7 Credit Card Disputes (Issued Through Reporting and Analytics)

View, accept, or reject chargebacks.

Required privilege: Search, View Disputes.

You can manage chargebacks made against accounts from the Disputes tab. Your main dashboard includes a tile with dispute details including disputes requiring action, defenses submitted, charged, and reversed.

Disputes happen when a customer challenges a charge and requests a chargeback. A chargeback is the return of funds to the guest's card. The chargeback is initiated by the bank that issued the payment. Then the chargeback appears in the Disputes tab and the dispute process begins.

-

Accept: you agree to transfer the funds back to the customer. See Accept a Chargeback for more details.

-

Defend: you disagree with the chargeback and you have supporting evidence that you can upload and submit along with a defense reason. You can defend disputes involving credit cards, but bank transfers can't be defended. See Defend a Chargeback for more details.

Note:

Some disputes are processed automatically and you do not have the option to accept or defend.-

Fraud

-

Consumer disputes

-

Processing errors

-

Authorization

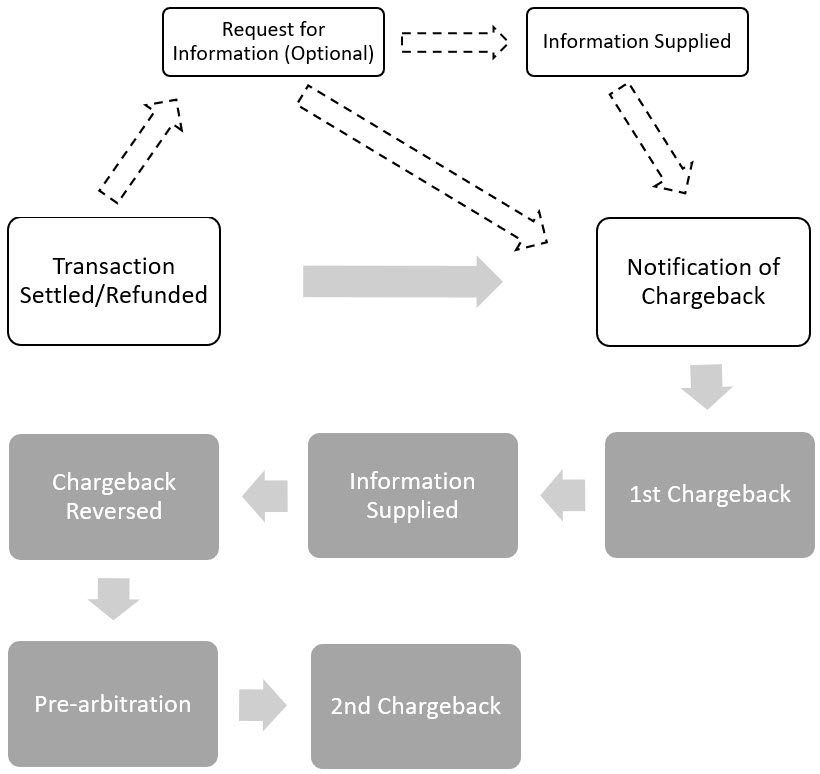

Lifecycle of a Dispute

-

Request for Information (optional): More information is requested about the transaction and money is not yet withdrawn from your account. If you do not respond with the requested transactional information, then a chargeback withdrawing money from your account my occur.

-

Notification of Chargeback: A chargeback was issued and you can defend it. This can occur after a Request for Information or it may occur immediately after the payment status is set to Settled or Refunded. A few days after you receive the Notification of Chargeback, the chargeback debit usually occurs.

-

1st Chargeback: The disputed amount is withdrawn from your account. If you accept the dispute or do not upload defense documents, then this is the final stage.

-

Information Supplied: Upload documents that support your defense against the chargeback. Once they are uploaded, you can't change the documents.

-

Chargeback Reversed: The disputed amount is transferred back to your account. During this stage, the issuer reviews the defense. If they accept the defense or if the issuer response timeframe expires, then this is the final stage.

-

Pre-arbitration: If the issuer declines your defense, they open pre-arbitration, which is then reviewed.

-

2nd Chargeback: If the issuer declines your defense or if their pre-arbitration case is accepted, then a second chargeback occurs. You can't upload defense documents. This is the final stage.

- Accept a Chargeback

Confirm a chargeback. - Defend a Chargeback

Provide defense reason and documents to reject a chargeback. - Fraud Alerts From Issuers