PayPal Direct Connection Integration

Purpose: The PayPal Direct Connection integration enables you to use PayPal as a method of payment on web orders.

-

The web storefront sends the PayPal payment on the order directly to PayPal for authorization. The order must receive an approved authorization on the web storefront before it is sent to Order Administration for processing.

-

During pick slip generation, Order Administration verifies that the amount required to generate the pick slip is covered by the authorization received for the PayPal payment during web storefront processing. If the amount is not covered, the system places the order on Credit Card Decline hold and the PayPal payment on PayPal Decline hold.

-

During deposit processing, Order Administration sends the deposit transaction directly to PayPal for confirmation and settlement.

-

When an order is canceled or the PayPal payment method deactivated, Order Administration sends an authorization reversal request to PayPal.

PayPal is an e-commerce business that allows you to perform payment and money transfers securely over the Internet. PayPal’s service builds on the existing financial infrastructure of bank accounts and credit cards and utilizes fraud prevention systems to create a safe, global, real-time payment solution.

Note:

PayPal is a registered trademarkThe Order Administration PayPal Direct Connection integration allows you to use PayPal as a form of payment on web orders and send the deposit transactions directly to PayPal.

Note:

Because the PayPal Direct Connection Integration does not send authorization transactions between Order Administration and PayPal, web orders containing a PayPal payment must receive an approved authorization on the web storefront before being sent to Order Administration for processing. In addition, you can only use PayPal as a form of payment on web orders. The Order Administration PayPal Direct Connection integration does not support PayPal as a form of payment on non-web orders.

In this topic: This topic provides an overview of the PayPal Direct Connection integration and the required setup.

PayPal Direct Connection Integration Process

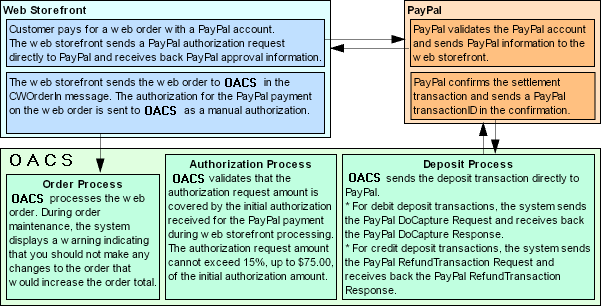

PayPal Direct Connection integration illustration:

Processing Orders Containing a PayPal Payment

When a customer places an order on the web storefront and pays for the order using a PayPal account:

-

The web storefront sends an authorization request for the PayPal payment directly to PayPal.

-

PayPal validates the PayPal account number that is passed in the authorization request and sends PayPal confirmation information back to the web storefront.

-

The web storefront completes the order and sends the order to Order Administration in the Inbound Order XML Message (CWORDERIN).

Web orders containing a PayPal payment that has been authorized by PayPal contain the following information in the Inbound Order XML Message (CWORDERIN). The authorization for the PayPal payment is sent to Order Administration as a manual authorization.

For more information see the Web Services Guide on My Oracle Support (ID 2953017.1).

-

Regular order information

-

PayPal pay type passed in the payment_type field

-

PayPal transaction ID passed in the cc_number field

-

Approved PayPal payment:

-

auth_amount

-

auth_number (this is the first 16 positions of the PayPal transaction ID)

-

auth_date (this is the date the PayPal payment was authorized with PayPal)

-

Validating a Web Order that Contains a PayPal Payment

Because the PayPal Direct Connection Integration does not send authorization transactions between Order Administration and PayPal, web orders containing a PayPal payment must receive an approved authorization on the web storefront before being sent to Order Administration for processing.

If Order Administration receives a web order that contains a PayPal payment that has not yet received an approved authorization, the system will accept the order; however, the PayPal payment will fail batch authorization and you will not be able to generate a pick slip for the order. See Processing Authorizations for a PayPal Order.

Maintaining a PayPal Order

When you advance to an order in order maintenance that contains a pay type with PPL (PayPal) defined as the authorization service and deposit service, the system displays the PayPal Warning Window indicating that you should not make any changes to the order that would increase the order total. When you generate a pick slip for an order that contains a PayPal payment, the system validates that the amount required to generate the pick slip does not exceed 15% or $75.00 of the initial authorization amount that was received from PayPal during web storefront processing.

Examples:

-

If the authorization received from PayPal during web storefront processing is $100.00, you can increase the order total up to $115.00 ($100.00 + 15% = $115.00) and still process the order without any problems. However, once you exceed $115.00, the PayPal payment will fail batch authorization and the system will not generate a pick slip or perform drop ship processing for the order.

-

If the authorization received from PayPal during web storefront processing is $600.00, you can increase the order total up to $675.00 and still process the order without any problems. However, once you exceed $675.00, the PayPal payment will fail batch authorization and the system will not generate a pick slip or perform drop ship processing for the order. Note: The system does not allow you to increase the order total by 15% ($600.00 + 15% = $690.00) because it would exceed $75.00 of the initial authorization amount that was received from PayPal during web storefront processing.

Reversals? The system submits a reversal to PayPal if:

-

The entire order is canceled or sold out, or;

-

The payment method is deactivated before any transactions are billed.

The system does not submit a reversal to PayPal for a partial amount, such as when:

-

A single item on a multi-line order is canceled or sold out.

-

A single unit on an order line is canceled or sold out.

-

Any items remaining on the order are canceled after a shipment has taken place.

Also, the reversal is not submitted if any of the order lines have been submitted to Order Orchestration for fulfillment.

For more information: See Stored Value Card Authorization Reversal.

Applying Refunds Across Multiple Capture Transaction IDs

PayPal cannot process a refund that exceeds the amount of the initial deposit. For example, if an order includes two deposits of $25.00, PayPal requires that any single refund processed not exceed $25.00.

In order to be able to reconcile refunds against the initial deposits, Order Administration stores the TRANSACTIONID provided by PayPal for each deposit as the Capture Transaction ID in the Credit Card Deposit History table for each successful deposit with PayPal, so that each refund amount applies to a deposit amount.

Example: You process an order in two shipments:

-

Shipment 1: $50.00

-

Shipment 2: $40.00

During deposit processing, the capture transaction ID for each shipment is stored in the Credit Card Deposit History table. This ID is not displayed on any screen.

If you then need to process one or more refunds against the order, Order Administration uses the capture transaction IDs to reconcile the refund amounts. It uses the capture transaction ID that matches the refund amount, if any; otherwise, it uses the capture transaction ID for the lowest total shipment that exceeds the refund amount. For example:

-

If the refund amount is $40.00: Use the capture transaction ID for shipment 2, because the amount matches this shipment.

-

If the refund amount is $50:00: Use the capture transaction ID for shipment 1, because the amount matches this shipment.

-

If the refund amount is $45:00: Use the capture transaction ID for shipment 1 (because $45.00 is more than the amount for shipment 2).

-

If the refund amount is $25.00: Use the capture transaction ID for shipment 1 (because $25.00 does not match the amount of either deposit).

-

If the refund amount is more than $50.00: Split the refund across both capture transaction IDs.

Sometimes multiple capture transaction ID are used for a refund deposit, because no single transaction is large enough to cover the refund. In these cases, the Display Order Payment History Screen indicates the number of deposits used for the total refund amount. For example, if you process a refund totaling $60.00 for an order with the two shipments, one for $50.00 and another for $25.00, the Display Order Payment History screen indicates:

-

Partial Deposit confirmed $50.00-

-

Partial Deposit confirmed $10.00-

-

Deposit split into 2 separate deposits.

-

Deposit confirmed $60.00-

Note:

These messages are not displayed at the Payment Method Details panel in Contact Center (Modern View Order Summary), although the purchase and deposit amounts are displayed.

In this situation, there is also an Order Transaction History message written, for example: Refund for inv# 1234 exceeds PayPal limit. Note that the message may be truncated based on the size of the invoice number.

Multiple refunds? Order Administration tracks the total returned amount for PayPal payment methods in order to ensure that subsequent refunds do not result in overusing any individual deposit amounts. For example, if there was a deposit for $50.00 and a deposit of $10.00, and there is already a refund amount of $40.00 applied to the first deposit, leaving $10.00 unrefunded, a subsequent refund of $15.00 would be split across the two deposits.

If the deposit fails: When the deposit is not initially processed successfully and you use Manage Rejected Deposits in Modern View instead, no capture transaction ID is recorded, so a refund cannot be applied to the deposit.

Note:

Deposits processed before update 20.0 will not have a capture transaction ID, so the process described above does not apply to these deposits.

Processing Authorizations for a PayPal Order

The system calls authorization processing when you generate a pick slip or perform drop ship processing for an order that contains a pay type with PPL (PayPal) defined as the authorization service. During authorization processing for an order that contains a PayPal pay type, the system validates that the required authorization amount is covered by the initial authorization received for the PayPal payment during web storefront processing.

Note:

Orders containing a PayPal payment should have received an authorization from PayPal on the web storefront before the order was received into Order Administration. The system does not send a PayPal payment to PayPal for authorization during pick slip generation or drop ship processing.

PayPal Authorization Processing

The system performs the following steps during PayPal authorization processing.

| # | Step |

|---|---|

|

1. |

The system determines if a manual authorization exists for the PayPal payment on the order. |

|

|

|

|

|

|

|

2. |

If this is the first time authorization processing was called for the PayPal payment on the order, the system:

|

Order history record for manual authorization: The system creates an order history record for the authorization that was received from PayPal on the web storefront. For example:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

7/28/09 |

AUTH |

MANUAL AUTH# DETECTED - O-AUTH_CODE |

100.00 |

AUTH |

Authorization history record for manual authorization: The system creates an approved authorization history record for the authorization that was received from PayPal on the web storefront. For example:

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

100.00 |

| # | Step |

|---|---|

|

3. |

The system determines if the initial authorization has expired. The system uses the following calculation to determine the expiration date: authorization date from Authorization History table + Reauthorization days from Pay Type table = authorization expiration date For example, if the initial authorization date is 7/01/09 and the Reauthorization days is 29, the initial authorization expires on 7/29/09 (7/01/09 + 29 = 7/29/09). If the initial authorization has expired, the system declines the authorization. See Declined PayPal Authorizations for the updates that the system performs. |

|

4. |

The system determines if the amount of the authorization request exceeds the manual authorization. The system allows the authorization request amount to be 15%, or up to $75.00, over the initial authorization amount. For example:

If the authorization request amount exceeds the initial authorization by 15% or $75.00, the system declines the authorization. See Declined PayPal Authorizations for the updates that the system performs. Orders that Contain a Catch-All Credit Card Pay Type If the order contains a catch-all credit card pay type in addition to the PayPal pay type, instead of declining the PayPal authorization, the system adds the amount that exceeds the manual authorization to the catch-all credit card pay type on the order. In this situation, the system approves the PayPal authorization for the manual authorization amount and applies the amount not covered by the manual authorization to the catch-all credit card. For example, if the manual authorization for the PayPal pay type is $100.00 and the order total is $124.00, the system approves the PayPal authorization request for $100.00 and applies $24.00 towards the catch-all credit card on the order. |

|

5. |

If the amount of the authorization request is covered by the manual authorization or exceeds the manual authorization but is within the 15% or $75.00 allowance, the system approves the authorization. If the approved authorization amount exceeds the manual authorization, the system creates a new authorization history record for the extra amount. This record indicates:

See Approved PayPal Authorizations for the updates that the system performs. |

Approved PayPal Authorizations

If the authorization received for the PayPal payment during web storefront processing covers the amount in the authorization request, the system:

-

Generates a pick slip or performs drop ship processing for the order.

-

Decreases the Amount available for the initial authorization history record by the authorization request amount. For example, if the initial authorization amount received on the web storefront is $100.00, and the authorization request amount is $28.00, the remaining amount available on the initial authorization is $72.00.

-

If the authorization request amount exceeds the manual authorization received for the PayPal payment, but is within the 15% or $75.00 allowance, the system creates a new authorization history record for the extra amount.

Updated authorization history record for manual authorization:

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

72.00 |

New authorization history record for the amount not covered by the manual authorization but within the 15% or $75.00 allowance:

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

12.00 |

.00 |

Example: Approved PayPal Authorization

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $100.00 and PayPal authorizes the payment for $100.00. The web storefront sends the order to Order Administration with a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-CC_NUMBER (this is the PayPal transaction ID)

-

auth_amount = 100.00

-

auth_number = O-AUTH_CODE (this is the first 16 positions of the PayPal transaction ID)

-

auth_date = 06262009

Order Administration receives and processes the order. Based on the Reauthorization days defined for the PayPal pay type, the PayPal payment does not expire until 29 days from the authorization date.

You generate a pick slip for the entire order. The authorization amount required to generate a pick slip for the order is $100.00. Because the unused authorization amount of $100.00 covers the amount required to generate a pick slip for the order, the system:

-

Generates the pick slip.

-

Creates an order history record:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/26/09 |

AUTH |

MANUAL AUTH# DETECTED - O-AUTH_CODE |

100.00 |

AUTH |

-

Creates an authorization history record for the PayPal payment on the order.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

100.00 |

.00 |

Example: Multiple Approved PayPal Authorizations

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $100.00 and PayPal approves the payment for $100.00. The web storefront sends the order to Order Administration with a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-AUTH_CODE (this is the PayPal transaction ID)

-

auth_amount = 100.00

-

auth_number = O-AUTH_CODE (this is the first 16 positions of the PayPal transaction ID)

-

auth_date = 06262009

Order Administration receives and processes the order. Based on the Reauthorization days defined for the PayPal pay type, the PayPal payment does not expire until 29 days from the authorization date.

You generate a pick slip for part of the order. The authorization amount required to generate a pick slip for the order is $42.00. Because the unused authorization amount of $100.00 covers the amount required to generate a pick slip for the order, the system:

-

Generates the pick slip.

-

Creates an order history record:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/26/09 |

AUTH |

MANUAL AUTH# DETECTED - O-AUTH_CODE |

100.00 |

AUTH |

Creates an authorization history record.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

100.00 |

58.00 |

You generate a pick slip for the remainder of the order. The authorization amount required to generate a pick slip for the order is $58.00. Because the unused authorization amount of $58.00 covers the amount required to generate a pick slip for the order, the system:

-

Generates the pick slip.

-

Updates the authorization history record.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

58.00 |

0.00 |

Example: Approved PayPal Authorization for Amount Within Allowed 15%

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $100.00 and PayPal approves the payment for $100.00. The web storefront sends the order to Order Administration with a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-AUTH_CODE (this is the PayPal transaction ID)

-

auth_amount = 100.00

-

auth_number = O-AUTH_CODE (this is the first 16 positions of the PayPal transaction ID)

-

auth_date = 06262009

Order Administration receives and processes the order. Based on the Reauthorization days defined for the PayPal pay type, the PayPal payment does not expire until 29 days from the authorization date.

You maintain the order and as a result the order total increases to $110.50.

You generate a pick slip for the entire order. The authorization amount required to generate a pick slip for the order is $110.50. Because the required authorization amount is within 15% of the unused authorization amount of $100.00, the system:

-

Generates the pick slip.

-

Creates an order history record:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/27/09 |

AUTH |

MANUAL AUTH# DETECTED - O-AUTH_CODE |

100.00 |

AUTH |

Creates authorization history records:

-

One authorization history record for the original authorization amount received from PayPal on the web storefront.

-

One authorization history record for the amount that was over the original authorization amount, but within 15% of the original authorization amount.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

100.00 |

0.00 |

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

10.50 |

0.00 |

Example: Approved PayPal Authorization and Credit Card Authorization

Declined PayPal Authorizations

If the authorization received for the PayPal payment during web storefront processing does not cover the authorization request amount, the system places the order on hold and does not generate a pick slip or perform drop ship processing for the order.

The system declines the PayPal authorization for the following reasons:

-

A manual authorization does not exist for the PayPal payment, or

-

The initial authorization received from PayPal on the web storefront has expired, or

-

The authorization request amount exceeds 15% of the initial authorization amount received from PayPal on the web storefront, or

-

The authorization request amount exceeds $75.00 of the initial authorization amount received from PayPal on the web storefront.

If the authorization received for the PayPal payment during web storefront processing cannot cover the authorization request amount, or a manual authorization for the PayPal payment does not exist, the system:

-

Does not generate a pick slip or perform drop ship processing for the order.

-

If the authorization was declined because the initial authorization has expired, the system updates the Amount available for the initial authorization history record to zero. For example:

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 EXPIRED |

100.00 |

.00 |

-

If the authorization was declined because the initial authorization amount cannot cover the authorization request amount, the system does not update the initial authorization history record. For example:

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/27/09 |

8/25/09 |

100.00 |

100.00 |

-

Creates an authorization history record for the declined authorization amount. For example:

| Status | Vendor Response | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|---|

|

Declined |

PPLDECLINE |

|

7/27/09 |

8/25/09 |

39.00 |

.00 |

-

Places the order on Declined Credit Card (AT) hold and the PayPal payment on the hold reason defined for the PPLDECLINE response code (typically PP PayPal Decline). Note:

-

If the PPLDECLINE response code has not been set up for the PPL service bureau, the system places the order on AV hold.

-

If the PPLDECLINE response code exists, but a hold reason is not defined for the response code, the system does not place the order on hold, but does not generate a pick slip for the order since the initial authorization for the PayPal payment is not valid.

-

Creates order history records indicating the authorization was declined and the order as put on hold. For example:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

7/27/09 |

PICKGEN |

ORDER FLAGGED FOR CREDITCARD CANCELLATIO |

|

USER |

|

7/27/09 |

HOLD |

SYS HLD - DECLINED CREDIT CARD |

39.00 |

USER |

Correcting PayPal authorization declines: If Order Administration declines the PayPal authorization request, you will need to correct the error by either:

-

Maintaining the order and reducing the order total so that it does not exceed 15% or $75.00 of the initial authorization amount received from PayPal on the web storefront.

-

Calling the customer on the order to ask for an additional form of payment to cover the amount that exceeds the initial authorization amount received from PayPal on the web storefront.

-

Canceling the order.

Note:

Before you run pick slip generation or perform drop ship processing for the order again, make sure to remove the order from hold.

Example: Declined PayPal Authorization for Amount Over 15%

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $100.00 and PayPal approves the payment for $100.00. The web storefront sends the order to Order Administration with a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-AUTH_CODE (this is the PayPal transaction ID)

-

auth_amount = 100.00

-

auth_number = O-AUTH_CODE (this is the first 16 positions of the PayPal transaction ID)

-

auth_date = 06262009

Order Administration receives and processes the order. Based on the Reauthorization days defined for the PayPal pay type, the PayPal payment does not expire until 29 days from the current date.

You maintain the order and as a result the order total increases to $122.50.

You generate a pick slip for the entire order. The authorization amount required to generate a pick slip for the order is $122.50. Because the unused authorization amount of $100.00 does not cover the amount required to generate a pick slip for the order, and the amount required exceeds 15% of the unused authorization, the system:

-

Does not generate a pick slip.

-

Declines the PayPal authorization.

-

Places the order on Credit Card Decline (AT) hold and the PayPal payment on the hold reason defined for the PPLDECLINE response code.

-

Creates order history records, indicating the PayPal authorization was declined:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/26/09 |

AUTH |

MANUAL AUTH# DETECTED - O-42693038SP2401 |

100.00 |

AUTH |

|

6/26/09 |

PICK GEN |

ORDER FLAGGED FOR CREDITCARD CANCELLATIO |

|

USER |

|

6/26/09 |

HOLD |

SYS HLD - DECLINED CREDIT CARD |

22.50 |

USER |

Creates authorization history records for the PayPal payment on the order, indicating the authorization was declined.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

100.00 |

100.00 |

|

Declined |

|

6/26/09 |

7/25/09 |

22.50 |

0.00 |

The system allows you to generate a pick slip for the order if:

-

You maintain the order and decrease the amount so that it does not exceed 15% of the unused PayPal authorization ($115.00), or

-

You maintain the order and apply the amount that exceeds 15% of the unused PayPal authorization towards another form of payment.

Example: Declined PayPal Authorization for Amount Over $75.00

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $600.00 and PayPal approves the payment for $600.00. The web storefront sends the order to Order Administration with a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-AUTH_CODE (this is the PayPal transaction ID)

-

auth_amount = 600.00

-

auth_number = O-AUTH_CODE (this is the first 16 positions of the PayPal transaction ID)

-

auth_date = 06262009

Order Administration receives and processes the order. Based on the Reauthorization days defined for the PayPal pay type, the PayPal payment does not expire until 29 days from the current date.

You maintain the order and as a result the order total increases to $680.00.

You generate a pick slip for the entire order. The authorization amount required to generate a pick slip for the order is $680.00. While $680.00 is within 15% of the unused PayPal authorization, it is greater than $75.00 of the unused authorization. Because the authorization amount required to generate a pick slip for the order ($680.00) is greater than $75.00 of the unused PayPal authorization ($600.00), the system:

-

Does not generate a pick slip.

-

Declines the PayPal authorization.

-

Places the order on Credit Card Decline (AT) hold and the PayPal payment on the hold reason defined for the PPLDECLINE response code.

-

Creates order history records, indicating the PayPal authorization was declined:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/26/09 |

AUTH |

MANUAL AUTH# DETECTED - O-42693038SP2401 |

600.00 |

AUTH |

|

6/26/09 |

PICK GEN |

ORDER FLAGGED FOR CREDITCARD CANCELLATIO |

|

USER |

|

6/26/09 |

HOLD |

SYS HLD - DECLINED CREDIT CARD |

80.00 |

USER |

Creates authorization history records for the PayPal payment on the order, indicating the authorization was declined.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

6/26/09 |

7/25/09 |

600.00 |

600.00 |

|

Declined |

|

6/26/09 |

7/25/09 |

80.00 |

0.00 |

The system allows you to generate a pick slip for the order if:

-

You maintain the order and decrease the amount so that it does not exceed $75.00 of the unused PayPal authorization ($675.00), or

-

You maintain the order and apply the amount that exceeds $75.00 of the unused PayPal authorization towards another form of payment.

Example: Initial PayPal Authorization Expired

A customer places an order on the web storefront and uses PayPal as the form of payment. The order total is $100.00. Due to communication problems, the web storefront cannot send the PayPal payment to PayPal for approval. The web storefront sends the order to Order Administration without a manual authorization for the PayPal payment:

-

cc_name = PAYPAL

-

cc_number = O-AUTH_CODE (this is the PayPal transaction ID)

Order Administration receives and processes the order.

You generate a pick slip for the entire order. The authorization amount required to generate a pick slip for the order is $100.00. Because a manual authorization does not exist for the PayPal payment on the order, the system:

-

Does not generate a pick slip.

-

Declines the PayPal authorization.

-

Places the order on Credit Card Decline (AT) hold and the PayPal payment on the hold reason defined for the PPLDECLINE response code.

-

Creates order history records, indicating the PayPal authorization was declined:

| Date | Type | Transaction Note | Amount | User |

|---|---|---|---|---|

|

6/26/09 |

PICK GEN |

ORDER FLAGGED FOR CREDITCARD CANCELLATIO |

|

USER |

|

6/26/09 |

HOLD |

SYS HLD - DECLINED CREDIT CARD |

100.00 |

USER |

Creates an authorization history record for the PayPal payment on the order, indicating the authorization was declined.

| Status | Auth # | Auth Date | Auth Expires | Amt Submitted | Amt Available |

|---|---|---|---|---|---|

|

Declined |

|

6/26/09 |

7/25/09 |

100.00 |

0.00 |

Processing Deposits for a PayPal Order

When you process deposits for an order that contains a pay type with PPL (PayPal) defined as the deposit service, the system sends the deposit transaction directly to PayPal via PayPal SOAP API architecture.

PayPal Deposit Processing

The system performs the following steps during PayPal deposit processing.

| # | Step |

|---|---|

|

1. |

Determines if the deposit is for a debit or credit transaction.

|

|

2. |

PayPal processes the deposit and sends the response back to Order Administration.

|

|

3. |

Order Administration receives the response and processes the deposit. |

Approved PayPal Deposits

If the deposit for the PayPal payment was approved, the system:

-

For debit transactions, updates the authorization history record with the deposit amount. For example:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Dep |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

28.00 |

-

Creates a deposit history record for the deposit transaction.

For debit transactions:

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

467 |

*PURCH |

7/28/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

For credit transactions:

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

479 |

*RETURN |

7/30/09 |

20.00- |

CONFIRMED |

*PROCESSED |

Return |

-

For debit transactions:

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response. However, if a transaction ID is already defined in the Authentication value field, the system replaces the transaction ID only if the deposit amount for the current deposit transaction is equal to or greater than the deposit amount for the previous deposit transaction. For example, If you process two deposit transactions for a PayPal order: the first deposit for $25.00 and the second deposit for $40.00, when you process the second deposit, the system updates the transaction ID defined in the Authentication value field with the transaction ID returned for the second deposit since the second deposit amount ($40.00) is greater than the first deposit amount ($25.00).

-

During deposit processing, updates the Credit Card Deposit History table with the transaction ID for each successful deposit, storing it as the capture transaction ID. The system then uses this capture transaction ID to tie refunds, if generated, to individual deposits; see Applying Refunds Across Multiple Capture Transaction IDs for more information. This ID is not displayed on any screen.

Example: Approved PayPal Deposit Across Multiple Authorizations

The PayPal payment on an order has the following authorization history records:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

.00 |

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

12.00 |

.00 |

.00 |

You submit a debit deposit transaction for the PayPal payment for $112.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history records with the deposit amount of $112.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

100.00 |

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

12.00 |

.00 |

12.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

469 |

*PURCH |

7/28/09 |

112.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response.

Example: Approved PayPal Deposit Across Multiple Deposits; Authentication Value Updated

The PayPal payment on an order has the following authorization history record:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

.00 |

You submit a debit deposit transaction for the PayPal payment for $28.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history record with the deposit amount of $28.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

28.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

469 |

*PURCH |

7/28/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response.

-

You submit a second debit deposit transaction for the PayPal payment for $28.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history record with the deposit amount of $28.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

56.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

469 |

*PURCH |

7/28/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

|

470 |

*PURCH |

7/28/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response. The system performs this update because the deposit amount for the current deposit transaction ($28.00) is equal to the deposit amount for the previous deposit transaction.

-

You submit a third debit deposit transaction for the PayPal payment for $44.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history record with the deposit amount of $44.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

44.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

469 |

*PURCH |

7/28/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

|

470 |

*PURCH |

7/29/09 |

28.00 |

CONFIRMED |

*PROCESSED |

Deposit |

|

471 |

*PURCH |

7/30/09 |

44.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response. The system performs this update because the deposit amount for the current deposit transaction ($44.00) is greater than the deposit amount for the previous deposit transaction ($28.00).

Example: Approved PayPal Deposit Across Multiple Deposits; Authentication Value Not Updated

The PayPal payment on an order has the following authorization history record:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

.00 |

You submit a debit deposit transaction for the PayPal payment for $56.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history record with the deposit amount of $56.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

56.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

472 |

*PURCH |

7/28/09 |

56.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response.

-

You submit a second debit deposit transaction for the PayPal payment for $44.00. Order Administration sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history record with the deposit amount of $44.00.

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

44.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

472 |

*PURCH |

7/28/09 |

56.00 |

CONFIRMED |

*PROCESSED |

Deposit |

|

473 |

*PURCH |

7/28/09 |

44.00 |

CONFIRMED |

*PROCESSED |

Deposit |

-

Does not update the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response. The system does not update this field because the deposit amount for the current deposit transaction ($44.00) is less than the deposit amount for the previous deposit transaction ($56.00).

Example: Approved PayPal Deposit and Catch-All Credit Card Deposit

The PayPal pay type on an order has the following authorization history record:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

.00 |

The catch-all credit card pay type on the order has the following authorization history record:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

AUTH_# |

7/28/09 |

8/26/09 |

24.00 |

.00 |

.00 |

You submit a debit deposit transaction for the order for $124.00. Order Administration:

-

Sends the deposit transaction for the credit card to the service bureau for deposit processing.

-

Sends the deposit transaction to PayPal in the PayPal DoCapture Request and receives the approved response in the PayPal DoCapture Response.

Order Administration:

-

Updates the authorization history records with the deposit amount of $124.00.

PayPal pay type:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/28/09 |

8/26/09 |

100.00 |

.00 |

124.00 |

Catch-all Credit Card pay type:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

AUTH_# |

7/28/09 |

8/26/09 |

24.00 |

.00 |

24.00 |

-

Creates a deposit history record for the deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action | Ser |

|---|---|---|---|---|---|---|---|

|

475 |

*PURCH |

7/28/09 |

100.00 |

CONFIRMED |

*PROCESSED |

Deposit |

PPL |

|

475 |

*PURCH |

7/28/09 |

24.00 |

CONFIRMED |

100 |

Deposit |

PMT |

-

Updates the Authentication value field in the Order Payment Method table with the transaction ID returned in the PayPal DoCapture Response.

Example: Approved PayPal Credit Deposit

The PayPal payment on an order has the following authorization history records:

| Status | Auth # | Auth Date | Auth Expires | Amt Submit | Amt Avail | Amt Deposit |

|---|---|---|---|---|---|---|

|

Authorized |

O-AUTH_CODE |

7/30/09 |

8/28/09 |

100.00 |

.00 |

100.00 |

|

Authorized |

O-AUTH_CODE |

7/30/09 |

8/28/09 |

14.19 |

.00 |

14.19 |

A debit deposit history record exists for the order:

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

480 |

*PURCH |

7/30/09 |

114.20 |

CONFIRMED |

*PROCESSED |

Deposit |

The customer returns part of the order for a credit of $22.00.

You submit a credit deposit transaction for the PayPal payment for $22.00. Order Administration sends the deposit transaction to PayPal in the PayPal RefundTransaction Request and receives the approved response in the PayPal RefundTransaction Response.

Order Administration creates a deposit history record for the credit deposit transaction.

| Inv# | Type | Date | Amt | Status | Response | Action |

|---|---|---|---|---|---|---|

|

481 |

*PURCH |

7/30/09 |

22.00- |

CONFIRMED |

*PROCESSED |

Return |

Failed PayPal Deposits

The deposit transaction will be rejected if:

-

Communication failures occur between Order Administration and PayPal.

-

A duplicate deposit transaction already exists on the PayPal system.

-

For debit deposit transactions:

-

The debit amount is greater than the associated authorization amount.

-

The transaction ID defined for the deposit does not match the associated authorization transaction.

-

-

For credit deposit transactions:

-

The transaction ID defined for the deposit does not match the associated debit deposit transaction.

-

The credit amount is greater than the deposit amount.

-

For example, the PayPal payment on an order receives an authorization for $100.00.

On 6/24, the system ships part of the order for $40.00.

On 6/30, the system ships the rest of the order for $60.00.

On 7/15, the system processes a return for the order for $75.00.

Because the return amount of $75.00 is greater than each deposit amount, PayPal fails the return deposit.

Correcting failed deposits: You can use the Submit Rejected Deposits (SRDP) menu option to cancel or resend failed deposits.

Purchase Deposit Transactions

Deposits for a debit (*PURCH) transaction use the PayPal DoCapture method to process the settlement. The system uses the API credentials (API User name, API Password, and API Signature) defined for the PPL service bureau as the credentials used to establish a direct connection to the PayPal system during deposit processing.

PayPal DoCapture Request

Order Administration sends the purchase deposit transaction to PayPal in the PayPal DoCapture Request transaction.

| Parameter | Description |

|---|---|

|

METHOD |

DoCapture. Transactions sent to PayPal for a purchase deposit use the PayPal DoCapture API. |

|

AUTHORIZATION ID |

The transaction ID from the Credit card # field in the Order Payment Method table. |

|

AMT |

The amount of the deposit transaction. PayPal will accept an amount that is up to 15% or $75.00 more than the original authorization amount. Note: This amount cannot exceed $10,000. |

|

CURRENCYCODE |

The PayPal currency code, from the ASC Currency code field in the Auth Service Currency table that corresponds to the Currency in the Order Header Extended table.

See the Work with Authorization Service Currency Screen to cross-reference the Order Administration currency code to the PayPal currency code. |

|

COMPLETETYPE |

NotComplete. This value indicates that there may be additional captures. |

|

INVNUM |

The company number and invoice number. Also includes the ecommerce order number if the Append Ecommerce Order # to PayPal Invoice ID (M40) system control value is selected. The company number and invoice number include leading zeros. Example: 006-0000467-EC12345, where 006 is the company number, 0000467 is the invoice number, and EC12345 is the ecommerce order number. |

|

NOTE |

The charge description from the Charge description field in the Authorization Service table, followed by the order number. A plus sign (+) displays for each space. Example: PAYPAL+DIRECT+COMMUNICATION+1845, where PAYPAL DIRECT COMMUNICATION is the charge description and 1845 is the order number. |

PayPal DoCapture Response

Order Administration receives the purchase deposit response transaction from PayPal in the PayPal DoCapture Response transaction.

| Parameter | Description |

|---|---|

|

AUTHORIZATION ID |

The transaction ID from the card number field in the Order Payment Method table. |

|

TRANSACTIONID |

The unique transaction ID assigned by PayPal to the deposit confirmation. Updates the Authentication value field in the Order Payment Method table. However, if a transaction ID is already defined in the Authentication value field, the system replaces the transaction ID only if the deposit amount for the current deposit transaction is equal to or greater than the deposit amount for the previous deposit transaction. Example: If you process two deposit transactions for a PayPal order: the first deposit for $25.00 and the second deposit for $40.00, when you process the second deposit, the system updates the transaction ID defined in the Authentication value field with the transaction ID returned for the second deposit since the second deposit amount ($40.00) is greater than the first deposit amount ($25.00). Capture transaction ID: During deposit processing, the system updates the Credit Card Deposit History table with this transaction ID for each successful deposit, storing it as the capture transaction ID. The system then uses this capture transaction ID to tie refunds, if generated, to individual deposits; see Applying Refunds Across Multiple Capture Transaction IDs for more information. This ID is not displayed on any screen. |

|

PARENT TRANSACTIONID |

|

|

PAYMENTTYPE |

Indicates whether the payment is instant or delayed. |

|

ORDERTIME |

The date and time when the payment was processed by PayPal. Example: 2009-07-24T17:23:15Z |

|

AMT |

The final amount charged, including any shipping and taxes from the Merchant Profile. |

|

FEEAMT |

The PayPal fee amount charged for the transaction. |

|

SETTLEAMT |

The amount deposited in the merchant’s PayPal account if there is a currency conversion. |

|

EXCHANGERATE |

The exchange rate if a currency conversion occurred. |

|

PAYMENTSTATUS |

Order Administration considers a deposit successful if the following status is received:

The system considers any other response a rejected deposit. Updates the Response field in the Deposit History table. |

Return Deposit Transactions

Deposits for a credit (*RETURN) transaction use the PayPal RefundTransaction method to process the settlement. The system uses the API credentials (API User name, API Password, and API Signature) defined for the PPL service bureau as the credentials used to establish a direct connection to the PayPal system during deposit processing.

PayPal RefundTransaction Request

Order Administration sends the return deposit request transaction to PayPal in the PayPal RefundTransaction Request transaction.

| Parameter | Description |

|---|---|

|

METHOD |

RefundTransaction. Transactions sent to PayPal for a return deposit use the PayPal RefundTransaction API. |

|

TRANSACTIONID |

The transaction ID from the Authentication value field in the Order Payment Method table for the record associated with the first non-deactivated PayPal pay type. This ID is also stored in the Credit Card Deposit History table as the capture transaction ID. The system uses this value to match a purchase deposit to the return deposit. When a refund is applied across multiple transactions, the system uses the capture transaction IDs to reconcile the refund amounts and submits each refund amount separately based on the originating capture transaction ID. See Applying Refunds Across Multiple Capture Transaction IDs for a discussion. If a transaction ID does not exist in the Authentication value, the system sends a blank Authorization ID field to PayPal. Because PayPal cannot match a purchase deposit to the return deposit, the system places the return deposit in a failed status. |

|

REFUNDTYPE |

The type of refund to make. Set to Partial. |

|

AMT |

The amount of the deposit (refund) transaction. Return Amount PayPal does not accept returns for an amount that is greater than the original deposit amount. For example, the PayPal payment on an order receives an authorization for $100.00.

Because the return amount of $75.00 is greater than each deposit amount, PayPal fails the return deposit. |

|

NOTE |

The charge description from the Charge description field in the Authorization Service table, followed by the order number. A plus sign (+) displays for each space. Example: PAYPAL+DIRECT+COMMUNICATION+1845, where PAYPAL DIRECT COMMUNICATION is the charge description and 1845 is the order number. |

PayPal RefundTransaction Response

Order Administration receives the return deposit response transaction from PayPal in the PayPal RefundTransaction Response transaction.

| Parameter | Description |

|---|---|

|

REFUND TRANSACTIONID |

The unique transaction ID assigned by PayPal to the deposit confirmation. |

|

NETREFUNDAMT |

The amount subtracted from the PayPal balance of the original recipient of payment to make this refund. |

|

FEEREFUNDAMT |

The transaction fee refunded to the original recipient of payment. |

|

GROSSREFUND AMT |

The amount of money refunded to the original payer. |

PayPal Authorization Reversals

Authorization reversals use the PayPal DoVoid method to request the reversal. The system uses the API credentials (API User name, API Password, and API Signature) defined for the PPL service bureau as the credentials used to establish a direct connection to the PayPal system when processing a stored value card authorization trigger record (File/Key = AHR).

Sent when? The system creates authorization reversal triggers only if the Send reversal flag is selected for PayPal in Defining Authorization Services (WASV). Also, the system sends a DoVoid request for a reversal only if:

-

The entire order is canceled or sold out, or;

-

The payment method is deactivated before any transactions are billed.

The system does not submit a reversal to PayPal for a partial amount, such as when:

-

A single item on a multi-line order is canceled or sold out.

-

A single unit on an order line is canceled or sold out.

-

Any items remaining on the order are canceled after a shipment has taken place.

For more information: See:

-

Stored Value Card Authorization Reversal for background.

-

Working with Outbound Interface Transactions (WOIT) for information on creating and processing outbound interface triggers.

-

Defining Authorization Services (WASV) for information on setting up PayPal as an authorization service.

PayPal DoVoid Transaction Request

Order Administration sends the DoVoid request to PayPal to request an authorization reversal.

The DoVoid request specifies the stored value card number for the Order Payment Method as the AUTHORIZATIONID.

PayPal DoVoid Transaction Response

The DoVoid response confirms that the DoVoid request was successful and echoes the AUTHORIZATIONID.

PayPal Direct Connection Integration Restrictions

The Order Administration PayPal Direct Connection does not support the following.

-

Online or batch authorization processing in Order Administration. Web orders containing a PayPal payment must receive an approved authorization from PayPal on the web storefront before being sent to Order Administration for processing.

-

Additions to orders that contain a PayPal pay type in Order Maintenance that would exceed 15% or $75.00 of the initial authorization received for the PayPal payment. For example, if the authorization received for the PayPal payment is $100.00, you can apply up to $115.00 towards the PayPal authorization ($100.00 + 15% = $115.00).

-

Orders that contain multiple ship to customers.

-

Gift card payments.

-

Alias items.

-

Promotions applied to web orders in Order Administration. Final order amounts must be passed from the web storefront.

-

Authorization reversals are supported only for the full amount of the authorization when the entire order is canceled or sold out, when the payment method is deactivated.

-

Exchanges and returns performed through order entry are not recommended when the pay type on the order is PayPal; however, the system does not prevent either activity.

-

Exchanges are not supported if there is a charge on the exchanged item. In this scenario, you must create a separate order for the new charge with a different customer payment.

-

Returns/Refunds using the PayPal payment cannot be greater than the original deposit amount.

PayPal Direct Connection Integration Troubleshooting

If you have problems connecting to PayPal during deposit processing, use the following steps to help troubleshoot the issue.

PayPal service set up correctly? Verify that you have performed the required setup for the PayPal Direct Connection integration; see PayPal Direct Connection Integration Setup.

PayPal Log

When you process deposits for an order containing a PayPal pay type, the system sends the deposit transaction directly to PayPal and logs the transactional information in the PayPal log.

Information in log: The PayPal log includes a copy of the deposit information sent between Order Administration and PayPal. In addition, any errors that may occur during deposit transaction processing are captured in the log.

You can use this log to confirm that communication between Order Administration and PayPal is working correctly, to isolate communication problems, or the recover information.

Sample log information:

Successful deposit process generates IFO level messages, such as the following:

11:56:55,831 INFO PAYPAL - [Settlement] Transmitted deposit(*PURCH) Processed : AMT=20.94&INVNUM=I23-1754&NOTE=PAYPAL+1754&AUTHORIZATIONID=AUTH_ID&COMPLETETYPE=NotComplete&METHOD=DoCapture

Failure deposit process and errors during processing generates ERROR level messages, such as the following:

11:56:55,831 ERROR PAYPAL - [Settlement] Transmitted deposit(*PURCH) Failure : AMT=20.94=123-1234=PAYPAL+1754=AUTH_ID=NotComplete=DoCapture

11:57:06,581 ERROR PAYPAL - [Settlement] Timestamp : 2009-05-08T15:52:55Z

11:57:08,737 ERROR PAYPAL - [Settlement] CorrelationId : CORR_ID

11:57:10,284 ERROR PAYPAL - [Settlement] Error code : 10002

11:57:11,972 ERROR PAYPAL - [Settlement] Short message : Security error

11:57:15,018 ERROR PAYPAL - [Settlement] Long message : Security header is not valid

11:57:17,300 ERROR PAYPAL - [Settlement] Severity code : Error

11:57:20,297 INFO PAYPAL - [Settlement] Transmitted deposit(*RETURN)Failure : AMT=68.00=123-123456=PAYPALID+7042982=AUTH_ID=NotComplete=RefundTransactionThe time elapsed to receive a response is indicated in a DEBUG level message, such as the following:

12:19:13,481 DEBUG PAYPAL - message: [Settlement] Got response, elapsed time = 2 seconds

Errors reading the authorization service or authorization service extended generates ERROR level messages, such as the following:

11:31:04,471 ERROR PAYPAL - [Settlement] Defaults set. Do not process in PayPal 'live' environment

11:31:31,841 ERROR PAYPAL - [Settlement] Exception(s) encountered during Initialization. No Deposit processing performed.

PayPal Direct Connection Integration Setup

Purpose: Before you can use the PayPal - Direct Connection integration, you must perform the necessary setup.

If you are upgrading from 5.0: In 5.0, the PayPal credentials are stored in the System Properties (PPOP) menu option. When you upgrade from version 5.0, the PayPal credentials are stored in the Work with Authentication Services (WASV) menu option in the API user name, API password, and API signature fields. You will need to redefine your PayPal credentials as part of the upgrade process.

Type of PayPal integration: The PayPal Direct Connection integration uses PayPal’s Express Checkout to send deposit transactions between PayPal and Order Administration. Communication protocol is provided through the PayPal SOAP API Architecture, which uses a signed SOAP request over HTTPS. The PayPal API jar file, provided by PayPal and included with Order Administration, handles communication between PayPal and Order Administration.

In order to use the PayPal Direct Connection integration, your web storefront must support a direct connection to PayPal to perform authorizations.

Related system control value: In addition to the setup described below, you can use the Append Ecommerce Order # to PayPal Invoice ID (M40) to define whether to include the ecommerce order number in the INVNUM set to PayPal.

Creating the PayPal Decline Order Hold Reason

Use the Establishing Order Hold Reason Codes (WOHR) menu option to create the PP (PayPal Decline) order hold reason code. The system assigns this reason to the PayPal pay type on the order when it is declined during PayPal authorization processing at pick slip generation time.

At the Create Order Hold Reason Screen, enter the following information:

| Field | Description |

|---|---|

|

Reason |

Enter PP. |

|

Description |

Enter PAYPAL DECLINE. |

Creating the PPL (PayPal) Service Bureau

Use the Defining Authorization Services (WASV) menu option to create the PPL service bureau.

Multiple PayPal accounts: If you use multiple PayPal accounts, for example, each of your entities uses an individual PayPal account, you can:

-

Use the Work with Merchant ID Overrides Screen to set up overrides for the different entities in your company. In this situation, you can define unique API credentials to establish a connection to the PayPal system for each of your PayPal accounts at the Create Merchant ID by Entity Screen. You can create one PayPal pay type for all of your accounts; see Creating a PayPal Pay Type.

-

Use the Work with Authorization Service Currency Screen to set up a cross-reference between the Order Administration currency code and the PayPal currency code. When sending the PayPal DoCapture Request to PayPal, the system populates the CURRENCYCODE in the request with the ASC Currency code in the Auth Service Currency table that corresponds to the Currency in the Order Header Extended table.

-

If the Currency in the Order Header Extended table is blank, the system uses the currency code defined in the Local Currency Code (A55) system control value to determine which ASC Currency code in the Auth Service Currency table to use.

-

If a cross reference is not defined in Authorization Service Currency for the selected currency code, the system leaves the CURRENCYCODE in the PayPal DoCapture Request blank; PayPal treats a blank CURRENCYCODE as USD currency.

-

At the First Create Authorization Services Screen, enter the following information:

| Field | Description |

|---|---|

|

Service code |

Enter the name of the PayPal account; for example PPL. |

|

Application |

Select Auth/Deposit. |

|

Charge description |

Enter PAYPAL DIRECT CONNECTION. |

At the Second Create Authorization Service Screen, enter the following information:

| Field | Description |

|---|---|

|

Media type |

Select Communication. |

|

Batch/Online |

Select Batch. |

|

Active production system? |

Select this field to send transactions to PayPal. |

|

Primary authorization service |

Enter PPL. |

|

Test mode? |

Select this field if you are sending transactions to PayPal’s test “sandbox” environment. Deselect this field if you are sending transactions to PayPal’s production “live” environment. |

|

The following fields are used to establish a connection to the PayPal system when using the PayPal Direct Connection Integration. You can also define API credential information at the entity level using the Create Merchant ID by Entity Screen. |

|

|

API User name |

Enter the user name, provided by PayPal, used to establish a direct connection to the PayPal system during deposit processing. |

|

API Password |

Enter the password, provided by PayPal, used to establish a direct connection to the PayPal system during deposit processing. |

|

API Signature |

Enter the encrypted signature, provided by PayPal, used to establish a direct connection to the PayPal system during deposit processing. |

At the Create Vendor Response Screen, enter the following information:

| Field | Description |

|---|---|

|

Response code |

Enter PPLDECLINE. |

|

Description 1 |

Enter PAYPAL DECLINE. |

|

Hold reason |

Enter PP. If you do not enter PP as the hold reason, the system places the PayPal payment on AV hold. |

Creating a PayPal Pay Type

Use the Work with Pay Types (WPAY) menu option to create the PayPal pay type, making sure to define the following information.

| Field | Description |

|---|---|

|

Pay category |

Enter Credit Card (pay category 2). |

|

Card type |

Enter Credit (card type C). |

|

Authorization service |

Enter the name of the PayPal Direct Connection service bureau, for example, PPL. |

|

Deposit service |

Enter the name of the PayPal Direct Connection service bureau, for example, PPL. |

|

Reauthorization days |

Enter the number of days before PayPal payments expire. Make sure the number of days you enter matches the number of days defined in the PayPal system. Typically, PayPal payments are good for 29 days. |

|

Send reversal |

Select this field to enable sending reversals to PayPal when the value of the entire authorization amount is canceled or deactivated. See Stored Value Card Authorization Reversal for background. |