Vertex Interface

Purpose: The Vertex Interface provides a bridge between Order Administration and the Vertex Sales Tax system to calculate the tax information on your orders at strategic points, such as:

- order entry

- order maintenance

- pick slip preparation

- billing

Order Administration communicates with Vertex files to determine the appropriate tax rate at each stage of the order's life cycle. Vertex determines the appropriate tax rate based on the “ship-from” and “ship-to” addresses on the order.

The Vertex Sales Tax system stores the tax rates for each taxing jurisdiction in the United States and Canada, and provides the necessary reporting for each jurisdiction in which you sell or operate.

If you use the Vertex interface, you don't need to keep current with the tax rates and reporting requirements of each taxing jurisdiction, and you no longer have to maintain these rates on Order Administration. Also, the system does not consider any item tax exemptions set up through Working with Item Tax Exemptions (WITX) or Working with GST Tax Exemption Status (MGTX). Instead, you should use Vertex to set up any tax exemptions for items.

Note:

You cannot use both Vertex and tax-inclusive pricing (VAT) in the same company. See Tax Included in Price (E70) for more information on VAT.Compatibility:

- Order Management System version 19.2 or later, or Order Administration, is compatible with Vertex Indirect Tax O Series® On Demand 9.0, but continues to support integration with 7.0 and 8.0 using 7.0 messages.

- Order Management System version 15.1 or later, or Order Administration, is compatible with Vertex Indirect Tax O Series® On Demand 7.0 and 8.0. The 7.0 messages are used for both releases.

- Support for Vertex Indirect Tax O Series® On Demand 7.0 and 8.0 using 7.0 messages ends in September 2021.

For more information: See:

- Vertex Setup for information on setting up Order Administration to support communication with Vertex. Also, see your Vertex documentation for detailed information on setup requirements within Vertex.

- Vertex Troubleshooting

In this topic:

- Tax Calculation Processing Overview

- Tax Overrides, Customer Exemptions, and Item or Class Exceptions

Tax Calculation Processing Overview

Overview: The Vertex Interface passes order and tax information between Order Administration and Vertex at various points in the order cycle (from order entry to billing).

Vertex evaluates and calculates the tax amount on the order at each phase and updates transactions appropriately.

Communication between Order Administration and Vertex: When Order Administration needs tax information during order entry or maintenance, pick slip preparation, or billing, it sends a tax request message to Vertex using web services. The TAX_INT integration layer job defines the wsdl (Web Services Definition Language) file that controls the integration.

For troubleshooting purposes, Order Administration writes the tax request message to the Trace Log, masking the vertex user ID and password passed in the request. Additional processing is logged to the Application Log.

For more information: See Vertex Setup for more information on configuring the integration.

What is taxed? Based on its current data on tax rules for the shipping address on the order and the additional rules that you define for customer or item exceptions, Vertex indicates the tax amounts for merchandise, freight (order-level or line-level), handling charges, duty, shipper-item charges, and additional freight.

Tax Overrides, Customer Exemptions, and Item or Class Exceptions

Tax override: You can set the Tax override flag in the Order Detail table to Y when you create an order through the generic order API. If this flag is set to Y, Vertex does not calculate the tax amount for the item at any point in the order cycle and just uses the specified tax override amount; however, if there are any line-level freight, handling, or gift wrap charges, these charges may be subject to tax even if the order detail line has a tax override.

Similarly, you can override tax on freight through the order API

by specifying a freight_tax_amount and setting the freight_tax_override to Y.

Note:

- There is no way to set the Tax override flag through interactive order entry.

- The system does not set the Tax override flag in the Order Detail table unless there is a tax amount specified in the inbound order message. As a result, you cannot use this setting to create an order line with no tax amount in interactive order entry. The only way to exempt an order line from tax is to set up an item or product class exception in Vertex.

For more information: See the Send Tax to Tax Interface as Quote Not Invoice (L11) system control value for a discussion on how the system sends different request types to Vertex based on the setting of this system control value and whether the tax is overridden.

Customer tax exemptions: If a customer is flagged as tax exempt in Order Administration and has a tax identification number, the merchandise and charges on the customer’s orders are not taxable. Order Administration passes the exemption number to Vertex. Although Order Administration does not pass the customer’s tax exempt expiration date, order entry does not let you create an order flagged as tax-exempt if the customer’s expiration date has passed.

Item or item class exceptions: When you use Vertex, you need to set up item and product class exceptions in Vertex rather than in Order Administration. For example, if you have two item classes that are not normally taxable, you can map these item classes to product classes in Vertex. See Creating the Product Class under Vertex Setup for more information on mapping this information.

Note:

Even if an item on an order is not subject to tax, Vertex still calculates tax for any freight, handling charges, and gift wrap charges if the order is otherwise subject to tax.Vertex Setup

Overview: This document provides the steps needed to configure Order Administration to integrate with Vertex Indirect Tax O Series® On Demand so that Vertex calculates tax for orders during order entry, pick slip preparation, and billing.

Compatibility: Order Management System version 15.1 and later, or Order Administration, is compatible with Vertex Indirect Tax O Series® On Demand 7.0 8.0, and 9.0. For 8.0, Order Management System uses the 7.0 messages.

In this topic:

For more information: See Vertex Interface for an overview on the integration.

Before You Start: Taxability Considerations

Mapping Data from Order Administration to Vertex

Before you start the configuration steps described below, it is helpful to note the information in Order Administration that maps to corresponding values in Vertex.

| OROMS | Vertex | Notes |

|---|---|---|

|

company (WCMP) |

taxpayer |

Typically, the Order Administration company code matches the Vertex taxpayer code; however, if you specify a Company in the Default Values by Company XML File, it overrides the actual company code. You might define a company override if the Vertex taxpayer is already set up in Vertex and you need to configure Order Administration to map to the existing taxpayer. |

|

entity (WENT) |

taxpayer |

Typically, the Order Administration entity code matches the entity-level Vertex taxpayer code; however, if you specify an Entity in the Default Values by Company XML File, it overrides the actual entity code. You might define an entity override if the Vertex taxpayer is already set up in Vertex and you need to configure Order Administration to map to the existing taxpayer. Used if the Pass Entity Code to Tax Interface (F69) system control value is selected and you do not specify a company code and division code in the Default Values by Company XML File. Set up with the company taxpayer as the parent, and configure all required data at the entity-level taxpayer. The entity on an order is determined by the division assigned to the source code on the order header. If you specify a Company and a Division in the Default Values by Company XML File, the Division specified overrides the entity code. |

|

item class (WICL)/ long SKU department (WLSD)/ long SKU division (WLSV)/ long SKU class (WLSC) |

product class |

Assigned in Order Administration to the item/SKU (MITM). Used to map to the product class in Vertex in order to apply tax exceptions. See Creating the Product Class, below. |

|

customer class (WCCL) |

customer class |

Assigned in Order Administration to the customer. Maps to the customer class in Vertex to apply tax exemptions. Note:

|

Creating the Product Class

Purpose: In order to set up product classes for taxability purposes, you can map your company’s item class, long SKU department, long SKU division, and long SKU class combinations to product classes (taxability drivers) in Vertex. The particular categories mapped, and the order in which they are mapped, is user-defined, so that you can select the product class hierarchy that best matches the way you group and classify items.

Identified where? The Product_Class_Concatenation_Type in the Default Values by Company XML File identifies the sequence in which to concatenate the four product class code components, with leading zeros included.

What components can you include?

| Component | Identified as Element Number: |

|---|---|

|

item class (WICL) |

1 |

|

long SKU division (WLSV) |

2 |

|

long SKU department (WLSD) |

3 |

|

long SKU class (WLSC) |

4 |

The setting of the Product_Class_Concatenation_Type identifies the order in which to send these elements to Vertex in order to indicate an item or SKU’s product class.

Example:

You set the Product_Class_Concatenation_Type to 2341. This setting indicates to concatenate the product class elements as: long SKU division (2) + long SKU department (3) + long SKU class(4) + item class (1).

You enter an order for an item with the following assignments:

-

long SKU division: XYZ

-

long SKU department: 4

-

long SKU class: 6543

-

item class: FD

Vertex receives a product class assignment for the item of XYZ00046543FD. Note that leading zeroes are included (for example, the long SKU department of 4 is included as 0004).

Setup considerations: As a way to simplify the setup process, you can set the Product_Class_Concatenation_Type so that your most commonly used components are included first. For example, if you always use item class (1), sometimes use long SKU department (3) and never use long division (2)) or long SKU class (4), you can set the Product_Class_Concatenation_Type to 1324. Then when you set up product classes (taxability drivers) in Vertex, you only need to specify the item class (1) and long SKU department (3), as the integration concatenates those two values and leaves the rest of the product class blank.

Configuration Steps

Setup within Order Administration

System Control Values

-

Tax on Freight (B14): Must be selected.

-

Use Generic XML Tax Interface (J10): Must be set to VERTEX to have Order Administration communicate with Vertex.

-

Use Standard Tax Calculation if Tax Interface Fails (J13): Select this value to have Order Administration use the standard tax calculation if it does not receive a response from Vertex. If you select this value, you will need to set up tax rates at the SCF level (WSCF) and/or the postal code level (WZIP).

-

Pass Entity Code to Tax Interface (F69): Select this value to pass the entity associated with the source code on the order header to Vertex, provided you do not specify a Company and Division code in the Default Values by Company XML File. If you select this value, then you can set up product class or customer class tax exemptions at the entity level in Vertex.

-

Tax Included in Price (E70): Must be unselected if your company integrates with Vertex.

-

Send Tax to Vertex as Quote not Invoice (L11): Indicates whether billing should send a quotation or an invoice request message to Vertex when processing a shipment or a return.

Note:

When you change a system control value, stop and restart the background jobs (MBJC) and exit and re-enter Order Administration to have your changes take effect.

TAX_INT Integration Layer Job (IJCT)

For the TAX_INT job: Set the Communication type to Web Service and set the WSDL Document Name to:

-

CalculateTax90.wsdl for integration with Vertex 9.0

-

CalculateTax70.wsdl for integration with Vertex 7.0 or 8.0

See Vertex wsdl (Web Service Definition Language) File for more information.

Because the TAX_INT job is always in INTERACT status, you do not stop or restart the job for your change to take effect.

Note:

The TAX_INT job does not require a process queue.

Additional Setup in Order Administration

Create a customer class for exempt customers: Use Work with Customer Class (WCCL) to set up one or more classes of customers who are tax exempt, and then assign customers in Order Administration to the appropriate customer class. You can then set up the customer class(es) as tax exempt in Vertex. Similarly, set up product class exemptions and individual product (item) exemptions in Vertex. See Set up Data within Vertex for more information on setup steps in Vertex.

Note:

If the customer on an order is assigned to a customer class in Order Administration that does not correspond to a matching class in Vertex, Vertex calculates tax as if there is no customer class assignment.

Set up specific customer tax exemptions: Use Work with Customers (WCST) to set up specific customers as tax exempt, including specifying their Tax identification number and the Expiration date, or setting this information up for the customer in specific states or provinces. Order Administration passes this information to Vertex when a tax exempt customer places an order. It is not necessary to assign these customers to a particular customer class in order to flag them as tax exempt to Vertex.

Assign items and SKU’s to a product class hierarchy: Use Work with Items/SKU’s to assign items and SKU’s to the categories you use to identify product classes in Vertex, as described under Creating the Product Class.

Note:

It is not necessary to set up tax rates or other settings at the SCF level or the postal code level if you are using the generic tax integration with Vertex.

Set up Data within Vertex

Use the Sales Tax option within the Vertex Taxability Manager:

Set up company and entities as taxpayers in Vertex:

-

Set up a taxpayer for each company to integrate with Vertex. The taxpayer Code should match the company code and should be zero-filled (for example, company 3 in Order Administration = taxpayer Code 003 in Vertex). Assign the taxpayer to the appropriate jurisdictions, such as all U.S. states.

-

If you are sending entity information to Vertex, add a taxpayer for each entity for the related company, where the company taxpayer is the parent to the entity taxpayer. For example, if you are adding entity 100 for company 3, select taxpayer 003 in Vertex as the parent for taxpayer 100. Again, assign the taxpayer to the appropriate jurisdictions, such as all U.S. states.

-

If you would like to set up product class exceptions, use the Taxability Driver option in Vertex:

-

Input Field = Product Class

-

Code = the concatenated product class, as determined through Creating the Product Class

-

Taxpayer = your company and, optionally, entity

-

Taxability = Generally Taxable or 100% Exempt

-

Use the Taxability Mapping option to associate the taxability driver to predetermined taxability logic as defined by Vertex

-

-

Set up product classes for freight, additional charges, and handling and map them to the appropriate delivery charge categories:

Line Item Type Product Class OF

OF (Order Freight)

LD

LD (Line Duty)

LH

LH (line handling)

Note: If the S/H exclude tax? flag is selected for an additional charge code, then a line that uses this additional charge code for special handling is not subject to line handling (LH) tax. See Establishing Additional Charge Codes (WADC) for background.

AF

AF (additional freight and shipper item charges)

LF

LF (line freight)

Note:

If you use the integration with Vertex to calculate taxes, then the settings within Order Administration to control tax on freight and handling (such as system control values and settings at the SCF and postal code level) are not used.

-

Optionally, use the Customers option in Vertex to set up customer class exceptions:

-

Type = Customer Class

-

Code = customer class code

-

Taxpayer = your company and, optionally, entity

-

Taxability = set to 100% Exempt to indicate customers assigned to this customer class are exempt from tax

-

Note:

If the customer on an order is assigned to a customer class in Order Administration that does not correspond to a matching class in Vertex, Vertex calculates tax as if there is no customer class assignment.

Define a Tax Assist Rule for Canada:In order to tax Canadian orders, the deliveryTerm passed to Vertex must be set to SUP. You can define a tax assist rule in Vertex as follows:

If Destination.Country ="CA"

Set deliveryTerm="SUP"

Configuration Files

Use a text editor to edit the following files.

Important:

Make a backup copy of each of the files discussed below before making any changes. Also, it is important that you do not make any changes in these files beyond those outlined in these instructions.

Vertex wsdl (Web Service Definition Language) File

Purpose: The wsdl file controls web service communication and other settings between Order Administration and Vertex.

File location and name: The wsdl file you use for integration with Version 9.0 On Demand of Vertex is named CalculateTax90.wsdl, and is typically located on the application server at conf\cwdirectcpproperties\xslt\VertexWS\7.0 or conf\cwdirectcpproperties\xslt\VertexWS\9.0, based on the version of Vertex in use, where domain is the WebLogic domain directory for Order Administration.

Configuring the wsdl file:

-

Search for REPLACE_WITH_VERTEX_SERVER_NAME and replace any instance in the file with the name or IP address of the server running Vertex. For example, replace https://REPLACE_WITH_VERTEX_SERVER_NAME/vertex-ws/xsd/9.0/VertexInc_Envelope with https://SAMPLE_REPLACEMENT.vertexinc.com/vertex-ws/xsd/9.0/VertexInc_Envelope

-

Do not change anything else in the file.

Note:

After making any change to the wsdl, you need to restart Order Administration to have your changes take effect. See Restarting Order Administration for more information.

Vertex User ID and Password

Use the VERTEX_USERID and VERTEX_PASSWORD properties in Working with Customer Properties (PROP) to specify the user ID and password to use for connection to Vertex.

The user ID you specify should be assigned to the Vertex partition that includes the data that will be required by Order Administration.

The password entry here is encrypted. Also, the system masks the password for any transactions posted to the CWDirect Log or Trace Log.

Vertex URL

Use the VERTEX_SERVICE_ENDPOINT_URL in Working with Customer Properties (PROP) to define the URL used to communicate with Vertex. An example of the URL is https://partners1.ondemand.vertexinc.com/vertex-ws/services/CalculateTax90, if you integrate with release 9.0 of Vertex.

VertexWS XML File

Purpose: This file is required for the integration with Vertex and should not be changed.

File location: This file is typically located on the application server at /domain/conf/cwdirectcpproperties/VertexWS.xml, where domain is the WebLogic domain directory for Order Administration.

| Property Name | Description |

|---|---|

|

TAX_INT |

This setting indicates Order Administration communicates with Vertex. The setting for Vertex is: com.cwi.direct.interfaces.webservice.VertexWS |

Default Values by Company XML File

Purpose: Use this file to specify default values to send to Vertex for each company that will use the tax integration.

File location and name: A copy of this configuration XML file is required for each company that will use Vertex. The files are typically located on the application server at /domain/conf/cwdirectcpproperties/xslt/VertexWS/9.0, where domain is the WebLogic domain directory for Order Administration and 9.0 is the version of Vertex in use. The company number in the file name should be zero-filled; for example, the file name for company 49 is DefaultValues_049.xml.

Sample files: Your Order Administration installation includes a sample default values XML file for company 49 and for company 51. You can use these samples as starting points to build default values XML files for your companies.

Configuring the file: Each entry in the file is labeled by an ID, for which you enter the corresponding Value:

| Default Value ID | Value |

|---|---|

|

Company |

Optionally, use this field to enter an override company code to pass to Vertex that differs from the actual company number. See Configuring the Division and Company Codes for more information. |

|

Division |

Optionally, use this field to pass a division code to pass to Vertex. See Configuring the Division and Company Codes for more information. |

|

Product_Class_Concatenation_Type |

Indicates the sequence of the item class, long SKU department, long SKU division, and long SKU class to use when creating product classes (taxability drivers) for exceptions to default tax rules. See Creating the Product Class for setup considerations, and see Set up Data within Vertex for setup steps in Vertex. |

|

Call_Center_TaxAreaID |

The tax area ID to send to Vertex in order to identify your call center’s location. You can determine a location’s tax area ID in Vertex Central Home under Tools > Tax Area ID Lookup. |

|

Call_Center_Country |

This information is required by Vertex. |

|

Call_Center_City |

This information is required by Vertex. |

|

Call_Center_State |

This information is required by Vertex. |

|

Call_Center_PostalCode |

This information is required by Vertex. |

|

Call_Center_StreetAddress |

This information is required by Vertex. |

|

Default_Warehouse |

This information is required by Vertex. You also use the Warehouses XML File to indicate the tax area ID of each warehouse where you make shipments. |

|

Default_Warehouse_Country |

This information is required by Vertex. |

|

Default_Warehouse_City |

This information is required by Vertex. |

|

Default_Warehouse_State |

This information is required by Vertex. |

|

Default_Warehouse_PostalCode |

This information is required by Vertex. |

|

Default_Warehouse_StreetAddress |

This information is required by Vertex. |

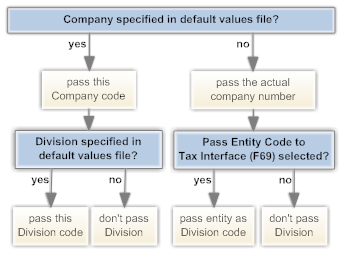

Configuring the Division and Company Codes

These fields in the Default Values by Company XML File enable you to override

the Company and Division specified in the QuotationRequest, InvoiceRequest, and DistributeTaxRequest messages that

Order Administration sends to Vertex.

Typically, the Order Administration company code and entity code matches the Vertex taxpayer code and entity level taxpayer code; however, if you specify a Company and/or Division in the Default Values by Company XML File, it overrides the actual company code and entity code. You might define an override if the Vertex taxpayer is already set up in Vertex and you need to configure Order Administration to map to the existing taxpayer.

-

If you do not specify a Company here: Regardless of whether you specify a Division here, Order Administration passes:

-

Company: The actual company code. -

Division: If the Pass Entity Code to Tax Interface (F69) system control value is selected, this is the entity code related to the source code on the order header. If the Pass Entity Code to Tax Interface (F69) system control value is not selected, no Division is passed.

-

-

If you specify a Company here but not a Division: Regardless of the setting of the Pass Entity Code to Tax Interface (F69) system control value, Order Administration passes:

-

Company: The Company code you enter here. -

Division: None.

-

-

If you specify both a Company and a Division here: Order Administration passes the

Companycode andDivisioncode you enter here.

Changes effective immediately: Changes you make to the default values by company file take place immediately. It is not necessary to stop and restart Order Administration.

Warehouses XML File

Purpose: This file provides the list of warehouses from which you ship merchandise, so that Vertex can apply the appropriate tax rules for the shipping location.

File location and name: Like the default values by company

XML file, a copy of this configuration file is required for each company

that will use Vertex. The files are typically located under /domain/conf/cwdirectcpproperties/xslt/VertexWS/9.0, where domain is the WebLogic domain directory for Order

Administration and 9.0 is the version of Vertex in use. The company

number in the file name should be zero-filled; for example, the file

name for company 6 is Warehouses_006.xml.

Sample files: Your Order Administration installation includes a sample warehouses XML file for company 49 and for company 51. You can use these samples as starting points to build warehouses XML files for your companies.

Information in this XML file

First WarehouseValue element: The first WarehouseValue element at the beginning of the file indicates that the file provides a list of warehouse ID’s and their corresponding tax area ID values:

<WarehouseValue>

<ID>Warehouse</ID>

<Value></Value>

</WarehouseValue>Do not change the default element.

Default warehouse tax area ID: The first warehouse entry

in the file should indicate a warehouse ID of 000 and your company’s default tax area ID. For example,

if the tax area ID is 220250100, the first entry

is:

<WarehouseValue>

<ID>000</ID>

<Value>220250100</Value>

</WarehouseValue>For each warehouse: For

each warehouse where you will be processing shipments, enter the ID that

identifies the warehouse code in Order Administration, and enter the

tax area ID of the warehouse. For example, if warehouse 3 has a tax

area ID of 140430510, enter:

<WarehouseValue>

<ID>003</ID>

<Value>140430510</Value>

</WarehouseValue>Example: The following example defines tax area ID’s for warehouses 1, 2, and 3:

<WarehouseValues>

<WarehouseValue>

<ID>Warehouse</ID>

<Value></Value>

</WarehouseValue>

<WarehouseValue>

<ID>000</ID>

<Value>220250100</Value>

</WarehouseValue>

<WarehouseValue>

<ID>001</ID>

<Value>700151420</Value>

</WarehouseValue>

<Wxml2zarehouseValue>

<ID>002</ID>

<Value>140430510</Value><

/WarehouseValue>

<WarehouseValue>

<ID>003</ID>

<Value>140430510</Value>

</WarehouseValue>

</WarehouseValues>Note:

Make sure that the Default Warehouse (A04) is one of the warehouses included in this file.

Changes effective immediately: Changes you make to the warehouse XML file take place immediately. It is not necessary to stop and restart Order Administration.

Vertex Troubleshooting

Purpose: Troubleshooting information includes:

Error in order entry: The message Error calling Tax Interface, check configuration in order

entry indicates that one or more of the required files were not found.

See Configuration Files for more information.

Processing Errors

Troubleshooting for the integration between Order Administration

and Vertex begins with checking the TRACE.log and CWDirect.log files.

- The

TRACE.logfile is typically located under/domain/conf/OMSFiles/Logs/TRACE/on your application server, wheredomainis the WebLogic domain directory for Order Administration. - The CWDirect.log file is typically located under

/domain/log/CWDirect.logon your application server, wheredomainis the WebLogic domain directory for Order Administration.

Note:

In addition to the errors written to log files, you will also see an error message in order entry if the extended order line price is over a million:Error occured on CALL to program Cwwebservice. Vertex does not support tax calculation for order line values that

high.

| Error in TRACE.log File | Explanation | How to Correct: |

|---|---|---|

|

Initial Configuration Issues |

||

|

ERROR TRACE - Class not found: ERROR TRACE - TAX_INT web service error: - null |

A required class was not installed during the initial installation process. |

Contact your Order Administration representative. |

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: User login failed: invalid_user. ; nested exception is: User login failed: invalid_user. |

Possible causes:

|

Check the contents of the Vertex User ID and Password and confirm that the user ID and password exist in Vertex and have authority to the correct partition in Vertex. See Set up Data within Vertex Vertex Setup and your Vertex documentation for more information. After you change the user ID and password in the Vertex User ID and Password, you need to stop and restart Order Administration. See Restarting Order Administration for more information. |

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: SAX processing failed on input stream SAX processing failed when attempting to create new element. (parent element=com.vertexinc.tps.xml.calc.parsegenerate.builder.ParticipantData, new element=null, local element name=PhysicalOrigin |

No physical origin is being passed. The physical origin is the address of the warehouse for the order detail line. Possible causes:

|

|

|

AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: SAX processing failed on input stream Non-fatal error detected during SAX parsing. Verify document against schema or contact document supplier. (URI=null, line number=30, error=cvc-datatype-valid.1.2.1: '' is not a valid value for 'integer'.) |

The Default Warehouse (A04) is not listed in the Warehouses XML File . |

Warehouses XML File: Confirm that the Default Warehouse (A04) is included in this file. |

|

Tax Calculation Failing After Initial Setup |

||

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: ; nested exception is: java.net.ConnectException: Connection refused: connect; nested exception is: java.net.ConnectException: Connection refused: connect |

Order Administration can no longer reach Vertex. |

Contact your Order Administration representative. |

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: An error occured during CalcEngine.calculateTax. This may be an incorrect use of the calculation engine. Please contact your software vendor. Error trying to calculate tax. Cannot find tax areas. Please verify that the address or tax area id provided for the location is correct and retry. |

The postal code passed in the tax request message from Order Administration is incorrect, or is associated with a city that does not exist in Vertex. To confirm, log onto Vertex and advance to the Tax Area Lookup Tool, then search for the shipping address that is causing the error. A message such as the following indicates that the postal code is incorrect:

|

Correct the postal code information in Order Administration. |

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: ; nested exception is: java.net.SocketException: No buffer space available (maximum connections reached?): connect |

The Order Administration server is out of memory. |

Reboot the Order Administration server. |

|

ERROR TRACE - AxisFault exception in invoke method of com.cwi.direct.interfaces.webservice.VertexWS: exception on AXIS invoke: (404)Not Found; nested exception is: (404)Not Found |

The URL specified for Vertex in the Vertex URL property is incorrect. |

See Restarting Order Administration for more information. |

|

Miscellaneous Log Messages |

||

|

WARN TRACE - WARNING: Responses for DISTRIBUTE not found in configuration xml. |

The log includes this message when Order Administration requests tax information for an order that includes a tax override. |

No need to correct; message is informational only. |

|

TRACE - message: com.sun.xml.ws.fault.ServerSOAPFaultException: Client received SOAP Fault from server: An unit based tax rule cannot be applied to a line item with a quantitiy of zero. Please ensure that the quantity is not zero and retry. Please see the server log to find more detail regarding exact cause of the failure. |

Certain states, such as Tennessee, require a quantity for tax calculation, and this error occurs when the quotation request includes a zero quantity for freight or additional freight charges. |

Add a new rule in Vertex to change the quantity to 1 for the related product classes. |

Tax Calculation Rules

| Situation | Explanation |

|---|---|

|

New settings in Vertex apply when you use the Vertex Transaction Tester, but not when Order Administration requests tax information |

If you have Vertex configured to cache information for improved performance, it might be retrieving tax rules from cached information when Order Administration requests tax information. Caching does not apply when you use the Transaction Tester. Consult your Vertex documentation for more information on configuring caching. |

|

An item on an order is not taxable based on its item or product class settings in Vertex, or on the Tax override flag for the order line; but there is still tax on the order |

Even if an item on an order is not taxable, freight, handling, gift wrap, additional freight, and duty can still be subject to tax. |

|

You receive an order that includes an item with a tax override through the generic order interface, but the order line is still taxed |

Even if the |

|

You make a change to the Vertex wsdl (Web Service Definition Language) File , but the changes do not take effect |

Before your changes take effect, you need to restart Order Administration. See Restarting Order Administration for more information. |

|

You change the user ID and password in the Vertex User ID and Password, but the changes do not take effect |

Before your changes take effect, you need to restart Order Administration. See Restarting Order Administration for more information. |