Stored Value Card Integration

Topics in this part: The following topics describe the functions available for stored value card integration.

-

Stored Value Card Overview and Setup provides an overview of stored value card processing and required setup.

-

Stored Value Card Purchase and Activation describes the processing that occurs when a stored value card is purchased and activated.

-

Working with Physical Stored Value Card Assignment (WPSA) describes how to assign a number to a physical stored value card.

-

Stored Value Card Balance Inquiry (MSVB) describes the processing that occurs when you perform a stored value card balance inquiry.

-

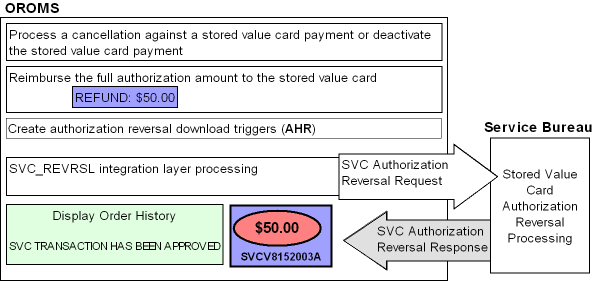

Stored Value Card Authorization Reversal describes the processing that occurs when you reimburse a stored value card payment a cancellation or deactivation amount.

-

Transmitting Activation and Reversal Transactions (SSVC) describes how to process stored value card download triggers and generate stored value card XML messages to send to the service bureau for processing.

-

Generating Stored Value Card Refunds describes how to generate a new stored value card to send to the sold to customer when you process a stored value card credit.

-

Customer Engagement Stored Value Card Integration describes the integration between Order Administration and the Oracle Retail Customer Engagement stored value card system.

Stored Value Card Overview and Setup

Overview: Stored value cards are gift cards assigned a pre-paid dollar amount that you can purchase and use as a form of payment. There are two types of stored value cards available in Order Administration: physical cards you ship to the recipient card holder and virtual cards you email to the recipient card holder.

In this topic:

For more information:

-

Stored Value Card Purchase and Activation: provides information on purchasing and activating a physical or virtual stored value card.

-

Working with Physical Stored Value Card Assignment (WPSA): provides information on assigning a number to a physical stored value card.

-

Stored Value Card Balance Inquiry (MSVB): provides information on inquiring on the remaining balance of a stored value card.

-

Stored Value Card Authorization Reversal: provides information on reimbursing a stored value card when you process a cancellation or deactivate the card and an open, unused authorization exists.

-

Transmitting Activation and Reversal Transactions (SSVC): provides information on processing stored value card download triggers to generate activation and authorization reversal messages to send to the service bureau for processing.

-

Generating Stored Value Card Refunds: provides information on generating a new stored value card for a refund amount.

-

Customer Engagement Stored Value Card Integration: provides information on the integration between Order Administration and the Oracle Retail Customer Engagement stored value card system.

Stored Value Card Overview

In Order Administration:

-

You can create an item identified as a physical or virtual stored value card.

-

Physical stored value cards are cards that you can stock in a warehouse or retail location. Physical cards are reserved on an order based on available inventory and printed on a separate pick slip from the other items on the order. Once the card is activated, the system delivers the physical card to the recipient card holder on the order.

-

Virtual stored value cards are cards that you do not stock. Virtual cards are automatically reserved on an order and express-billed during pick slip generation. Once the card is activated, an email is sent to the recipient card holder on the order, notifying the customer that a stored value card has been purchased and providing the stored value card number and dollar amount to use as a form of payment.

-

-

Customers can purchase the stored value card item on an order; see Stored Value Card Purchase and Activation.

-

Once you generate a pick slip for the order, you must assign a number to the physical stored value card before the card is shipped to the customer. The system automatically assigns a number to virtual stored value cards during pick slip generation.

-

Once the stored value card is billed, the card is sent to the service bureau for activation.

-

Once activated, the card is delivered to the recipient card holder on the order.

-

The customer can then use the stored value card as a form of payment on an order.

-

The service bureau authorizes and deposits the amount assigned to the stored value card payment.

-

The customer can inquire on the remaining balance on the stored value card; see Stored Value Card Balance Inquiry (MSVB).

-

In addition:

-

If the customer cancels an order or order line that is paid for by a stored value card payment with an open authorization or deactivates the stored value card payment, the system generates a stored value card authorization reversal to reimburse the stored value card the original authorization amount; see Stored Value Card Authorization Reversal.

-

If the customer returns a line that is paid for by a stored value card payment, the system generates a refund credit against the stored value card. When you deposit a refund credit against a stored value card, the service bureau sends back a new authorization number with the deposit response; because of this, the system creates a new authorization for the credit amount that is already updated to a deposit status. At this point, the credit amount is reimbursed to the stored value card.

-

You can define a stored value card credit as an alternate refund type; when you process stored value card credits, the system issues a new stored value card to the sold to customer for the refund amount; see Generating Stored Value Card Refunds.

-

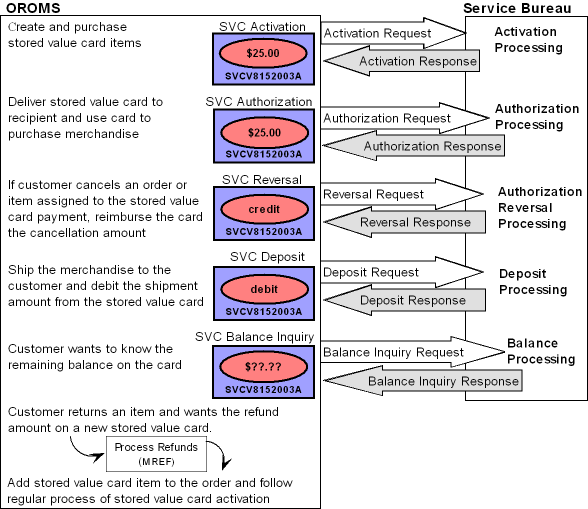

Stored value card process flow

Stored Value Card Setup

Purpose: Before you can use stored value cards, you must perform the necessary setup.

Required setup includes:

Creating a Stored Value Card Item

There are two types of stored value cards in Order Administration:

Physical stored value cards are physical cards that you can stock in a warehouse or retail location. Physical stored value cards are reserved on an order based on available inventory and printed on a separate pick slip from the other items on the order. You must assign a number to the physical card before the card can be billed. Once the card receives an approved activation from the service bureau, the system delivers the physical card to the recipient card holder on the order. In addition, an email may be sent to the recipient card holder, notifying the customer that the physical card is in the process of being delivered.

Virtual stored value cards are virtual (non-physical) cards that you do not stock. Virtual stored value cards are automatically reserved on an order and express-billed during pick slip generation. During pick slip generation, the system also assigns a number to the virtual card. Once the card receives an approved activation from the service bureau, an email is sent to the recipient card holder on the order, notifying the customer that a stored value card has been purchased and providing the stored value card number and dollar amount to use as a form of payment.

The SVC type field at the item level indicates if the stored value card is a physical or virtual card:

-

Physical Card indicates the stored value card is a physical card.

-

Physical Card/Early Notify indicates the stored value card is a physical card and, as soon as the stored value card is activated, the system sends an email notification to the recipient card holder on the order, notifying the customer that a stored value card has been purchased and is in the process of being delivered.

-

Virtual Card indicates the stored value card is a virtual (non-physical) card. Virtual cards automatically reserve when added to an order and are express-billed during pick slip generation, regardless of the Non-inventory flag. Once the stored value card is activated, the system sends an email notification to the recipient card holder on the order, notifying the customer that a stored value card has been purchased and the stored value card number to use when making a purchase.

Some things to note when creating a stored value card:

-

The offer price is used as the pre-defined amount assigned to the stored value card if the Stored Value Card Activation Pricing Method (I25) system control value is set to OFFER. This is important to note if you create a stored value card as a SKU item and each SKU represents a different dollar amount; make sure you create a SKU offer for each SKU instead of using the item offer; otherwise each SKU of the stored value card will be assigned the dollar amount defined at the item offer level.

-

It is recommended you create the stored value card as a regular SKU or non-SKU item. For example, do not create the stored value card as a membership item or with a kit type.

-

You can create the stored value card item as an inventory or non-inventory item. If you wish to track how many cards are available for pre-defined denominations, you should create the stored value card as an inventory item.

-

You cannot assign a specific group of numbers to a stored value card item. See Assigning a Stored Value Card Number.

Stored value card refund item: When you process stored value card refunds, the system adds a stored value card item to the order for the refund amount. You define the stored value card refund item in the Default SVC Refund Item Number (I73) system control value. This item must be a non-SKU item with the SVC type field set to P or E. See Generating Stored Value Card Refunds.

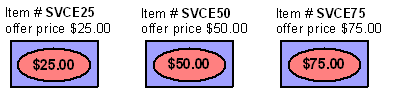

Stored Value Card example using non-SKU:

| Item Level | Item Offer Level |

|---|---|

|

Item #: SVCE25 SVC type: Physical Card/Early Notify |

Price: $25.00 |

|

Item #: SVCE50 SVC type: Physical Card/Early Notify |

Price: $50.00 |

|

Item #: SVCE75 SVC type: Physical Card/Early Notify |

Price: $75.00 |

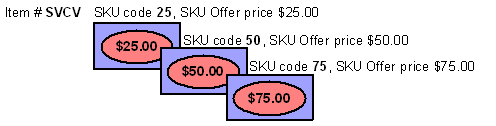

Stored Value Card example using SKU:

| Item Level | SKU Level | SKU Offer Level |

|---|---|---|

|

Item #: SVCV SVC type: V (virtual card) |

SKU: 25 |

Price: $25.00 |

|

Item #: SVCV SVC type: V (virtual card) |

SKU: 50 |

Price: $50.00 |

|

Item #: SVCV SVC type: V (virtual card) |

SKU: 75 |

Price: $75.00 |

System Control Values

The Stored Value Card Processing Values (I71) umbrella system control value contains the following values to control how stored value cards are processed.

| System Control Value | Description |

|---|---|

|

Select this field if you wish the system to send pick control records containing physical stored value cards to billing once you assign numbers to the physical cards; this assumes you never send pick control records containing physical stored value cards to a manifesting station to wand and bill the stored value card items. |

|

|

Enter the type of modulus check, if any, you wish to perform against the stored value card number. If you enter a modulus check, you can validate the stored value card number before sending the card to the service bureau for activation. |

|

|

Enter the price the system will assign to the stored value card as the card’s issue amount. You can select the offer price or order detail line price. |

|

|

Enter the code for the service bureau used to process stored value card activation requests. If you use the Customer Engagement Stored Value Card Integration, you must enter RLT. |

|

|

Enter the name of the program the system uses to generate a Stored Value Card Notification Email. You can send an email notification to the recipient card holder for virtual stored value cards and physical stored value cards set up with email notification, or generate the Outbound Email XML Message (CWEmailOut). For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1). The base program name is SVCNOTF. |

|

|

Select this field if you wish to process stored value card activation and authorization reversal transactions in batch mode. When you activate a stored value card or process a stored value card authorization reversal, the system generates a stored value card download trigger record.

|

|

|

Enter the stored value card item the system adds to an order when you process a stored value card refund. This item represents the new stored value card that is sent to the customer for the amount of the processed refund. The system adds this item to the order at no charge and defaults the Price Override Reason for SVC Refund Item (I74) to the order line. |

|

|

Enter the price override reason code the system defaults to the stored value card no charge order line that is added to an order when you process a stored value card refund. |

|

|

Default Pick Generation Template for SVC Refund Processing (I75) |

Enter the streamlined pick slip generation template (WSPS) the system uses to automatically generate a pick slip for the stored value card item that is added to an order when you process a stored value card refund. |

|

Select this field if you wish to perform a balance inquiry against a stored value card pay type before performing a batch authorization against the card. The system sends a balance inquiry request in batch format to the service bureau to determine the balance on the card.

See Batch Authorization Balance Inquiry for more information. If you are using the Customer Engagement Stored Value Card Integration, select this system control value. Oracle Retail Customer Engagement will approve an authorization for an amount that is less than the required authorization amount for an order. If you do not select this system control value, you must require another credit card payment on an order. |

|

|

Hold Reason for Stored Value Cards with Insufficient Funds (J18) |

Enter the hold reason code the system uses to place an order on hold when you Perform Balance Inquiry during Batch Authorizations (J19) and the balance remaining on a catch-all stored value card pay type is less than the amount to authorize. |

|

Perform Authorization Reversal during Deposit Processing (J20) |

Select this field if you wish to perform a stored value card authorization reversal during deposits processing if the authorization amount is greater than the deposit amount. Deselect this system control value if you are using the Customer Engagement Stored Value Card Integration. |

|

Retain Unused Stored Value Card Authorization After Deposit (J21) |

Select this field if you want the system to retain a stored value card authorization after it has been partially deposited. For example, if the authorization amount is 50.00 and the deposit amount is 40.00, the system retains the remaining 10.00 on the authorization. Leave this field unselected if you want the system to void the remaining balance against the authorization. For example, if the authorization amount is 50.00 and the deposit amount is 40.00, the system voids the remaining 10.00 on the authorization. If there are multiple authorizations for the order, the system does not void the other authorizations. Select this system control value if you are using the Customer Engagement Stored Value Card Integration. |

|

If selected, the system places an order on GC Gift Card order hold if it contains a stored value card item and a stored value card payment method. |

Periodic Function

| Periodic Function | Description |

|---|---|

|

Stored Value Card Unactivated Report (program name PFR0075) |

Create this periodic function to generate the Unactivated Stored Value Card Report. Use this report to review any stored value cards that require attention because:

|

|

Process Stored Value Card Activations (program name PFR0076) |

Create this periodic function to process stored value card activation trigger records that are in a ready (R) status. |

|

Process Stored Value Card Reversals (program name PFR0077) |

Create this periodic function to process stored value card authorization reversal trigger records that are in a ready (R) status. |

Menu Options

| Menu Option | Description |

|---|---|

|

Allows you to assign a number to a physical stored value card. See Assigning Numbers to Physical Stored Value Cards for more information. |

|

|

Activate the SV tickler event to generate a tickler when a stored value card item is billed without a number assignment. Activate the SD tickler event to generate a tickler when a stored value card activation request is declined by the service bureau. Note: To create ticklers, the Use Workflow Management (H96) system control value must be selected. |

|

|

Create a stored value card pay type. See Creating a Stored Value Card Pay Type for additional setup. Additionally, if you wish to always generate a stored value card refund for a particular pay type, enter a stored value card pay type as the alternate refund type. |

|

|

Stored Value Card Reversal: The SVC_REVRSL job creates a stored value card authorization reversal request for each unprocessed AHR download trigger in the IL Outbound Trigger table. If the Communication type field for the service bureau is Integration Layer, you must define:

Note: Order Administration is hard-coded to use the SVC_REVRSL job to process stored value card authorization reversals; you cannot create a new integration layer job with a different process name to process stored value card authorization reversals.Note: To avoid conflict, make sure you set up each integration layer process that sends messages to the external system with a unique queue so that the system can identify the different types of messages it is receiving. |

|

|

Create a service bureau for the service that you will use to process stored value cards. |

|

|

Allows you to process stored value card download triggers and generate stored value card XML messages to send to the service bureau for processing. |

|

|

Allows you to change a refund to a stored value card refund (refund type V) by entering a stored value card pay type in the Pay type field. |

|

|

Order Entry/Maintenance Balance Inquiry |

Allows you to inquire on the remaining amount available on a specified stored value card pay type and card number. |

Virtual Card Number Table (FLSVCA)

Use this table to automatically assign the next available number to a virtual stored value card during pick slip generation. Once the system assigns the number to a virtual stored value card, the number is removed from this table and the virtual stored value card is processed through billing.

Oracle Retail Customer Engagement stored value card integration: If you use the Customer Engagement Stored Value Card Integration, you do not need to populate this table; during pick slip generation for a virtual stored value card, Order Administration sends a Generate Card Request to Oracle Retail Customer Engagement and Oracle Retail Customer Engagement returns a Generate Card Response to Order Administration with the assigned virtual card number.

Note:

It is your responsibility to populate this table with stored value card numbers supplied by your service bureau. If this table does not contain an available number to assign to a virtual stored value card, the order for the stored value card will not be billed and the order will print on the Stored Value Card Assignment Errors Report.| Field | Description |

|---|---|

|

Company |

The company where the virtual stored value cards are processed. |

|

Card # |

A number to assign to a virtual stored value card, provided by the service bureau. |

|

ID # |

An ID number to assign to a virtual stored value card, provided by the service bureau. Note: Define an ID number only if your stored value card processor supports it. |

Virtual card numbers threshold: You can define a threshold for the system to notify you when the number of records in the Virtual Card Number table is below a specified number. When the actual number of records in the Virtual Card Number table falls below the threshold value, the system sends an email notification to the specified email address, providing you time to add records to this table before all of the virtual stored value card numbers are used.

If you do not already have the Virtual Card Number threshold created, the system automatically creates the threshold when you run the Batch Order Control job; however, you still need to define the threshold criteria; see Updating Threshold Actual Values.

Example: The threshold number you define is 25 with a less than comparison (the actual value must be less than the threshold value you define). Once the actual number of available virtual card number records is 24, the system sends an email to the specified email address.

| Threshold Code and Description | Comparison | Number Value | Actual Number | Email address |

|---|---|---|---|---|

|

VC: Virtual card numbers |

L (actual value is less than the threshold value) |

25 |

24 |

tbrown@example.com |

Sample email: A sample Threshold Monitor Breach email is displayed below.

From: htruman@CWIEX1.example.COM

To: eleanor.johnson@example.com

Subject: **ALERT** Threshold Monitor Breach

Virtual Card Numbers threshold exceeded.

Add numbers to the Virtual Card Number file (FLSVCA)

Co#: 555 Actual$: 000000024 > Thresh$: 000000025

Review screens and reports to monitor this breach.

For more information: See Working with Threshold Values (WTHR) for more information on defining threshold values.

Creating a Stored Value Card Pay Type

When creating a stored value card pay type in Working with Pay Types (WPAY), you must define the following information:

-

Pay category: enter Credit Card as the pay category.

-

Card type: enter Stored Value as the card type.

-

Authorization service: enter the authorization service that you will you to process stored value cards.

-

Deposit service: enter the deposit service that you will use to process stored value cards.

-

Reauthorization days: Enter the number of days before a stored value card authorization is set to expire. Enter 999 if you use the Customer Engagement Stored Value Card Integration.

-

Modulus check: enter a modulus check to verify the stored value card number is valid before sending the card to the service bureau for authorization.

In addition to creating a stored value card pay type:

-

Enter the stored value card pay type in the Alternate refund type field for each pay type for which you always wish to generate a stored value card refund.

-

Create a credit card number format if you do not want the full stored value card number to display on Order Administration screens and reports.

Notify Properties

In order to respond to Order Administration jobs that may require user intervention to proceed, you must set up the notify properties in Working with Admin Properties (CPRP).

Why would a job require user intervention?

-

An error occurred during processing

-

The job is used to send transactions to another system and communication failures occur before the transmission completes

Which types of job require user intervention?

-

Stored Value Card (activation, balance inquiry or authorization reversal) integration layer job

-

Authorization (batch only, for all card types) integration layer job

-

Deposit integration layer job

| Property Name | Description |

|---|---|

|

RESPONSE_RETRIES |

The number of times Order Administration looks for a response to a job that requires user intervention before using the default response in order to proceed with the job. For example, if this setting is 5, Order Administration will look for a user response five times, waiting 60 seconds between each time. |

|

RESPONSE_EMAILS |

The list of email addresses that receive the Response Required email when a job requires user intervention. Each email address entered must be separated by a semi-colon (;). For example: email1@add.com;email2@add.com. |

For more information: See Working with Required Responses (WREQ) for more information on the steps performed when a job requires user intervention.

Stored Value Card Purchase and Activation

Purpose: You can purchase a stored value card item on an order to deliver to the recipient card holder by mail or email. However, before the recipient card holder can use the stored value card as a form of payment, the card must be activated by the service bureau.

Activation processing: To activate a stored value card:

| # | Step |

|---|---|

|

1. |

A customer purchases a stored value card item on an order. If the stored value card is a virtual card, the system verifies that an email address is defined for the recipient card holder. See Purchasing a Stored Value Card. |

|

2. |

During pick slip preparation, the system creates a separate pre-generated pick for each physical stored value card.

For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1). See Assigning Numbers to Physical Stored Value Cards for additional details.

|

|

3. |

Once the stored value card is billed (see Billing a Stored Value Card), the system generates an SVC download trigger containing the information required to activate the card. |

|

4. |

The system sends a stored value card activation request to the service bureau for activation.

|

|

5. |

Once an approved stored value card activation is received from the service bureau, the system updates the stored value card and sends a Stored Value Card Notification Email to the customer, if defined, indicating the stored value card activation information. |

Stored Value Card Activation Process:

In this topic:

Purchasing a Stored Value Card

You purchase a stored value card as you would any item.

Physical stored value cards: When you purchase a physical stored value card (SVC type Physical Card or Physical Card/Early Notify), the system:

-

Reserves the item on the order, based on available inventory.

-

Does not require an email address, even if the stored value card is eligible for email notification. If you ordered a physical stored value card (with email notification) and an email address is not defined, the system still allows you to accept the order; however, the Stored Value Card Notification Email is not sent.

Note:

You can create a custom special handling template to capture stored value card information, such as the gift giver’s name, recipient’ name, and any gift message.Virtual stored value cards: When you purchase a virtual stored value card (SVC type Virtual Card), the system:

-

Automatically reserves the item on the order and express bills the item during pick slip generation.

-

Requires an email address to send the Stored Value Card Notification Email to the recipient card holder. An email address is required because the email notification is the only way the recipient of the virtual stored value card will receive the stored value card number associated with the order. If you order a virtual stored value card item and an email address is not defined or the opt in/out value is invalid, the system displays an error and does not allow you to accept the order:

Invalid e-mail address/opt in for order containing virtual SVC item.A similar error also displays when you process a web order. See Stored Value Card Email Hierarchy.

For more information: See Assigning a Stored Value Card Number for more information on how to assign a number to a stored value card.

Gift card hold: If the Use Gift Card Fraud Checking (L72) system control value is selected, the system places an order on GC Gift Card order hold if it contains a stored value card item and a stored value card payment method.

Stored Value Card Email Hierarchy

When a stored value card is activated and an email address is defined, the system sends a Stored Value Card Notification Email to the recipient of the stored value card.

The system uses the following hierarchy to determine the email address used to send a Stored Value Card Notification email to the recipient card holder. This email validation occurs in order entry and maintenance and during the generic order interface edit.

1. Send to ship to email address: Send the email to the email address defined for the ship to on the order.

-

Order ship to: Send the email to the email address defined for the order ship to. The system requires an email address for the order ship to if a stored value card item exists on the order:

Invalid email address/opt in for order containing virtual SVC item. -

Customer ship to: If an order ship to does not exist, send the email to the email address defined for the customer ship to. The system requires an email address for the customer ship to if a stored value card item exists on the order. In addition, the Opt in/opt out setting must allow for email delivery (codes O1 or O2):

Invalid email address/opt in for order containing virtual SVC item. -

Recipient (Sold To/Recipient): If an order ship to or customer ship to does not exist, send the email to the email address defined for the recipient customer. The system requires an email address for the recipient if a stored value card item exists on the order. In addition, the Opt in/opt out setting must allow for email delivery (codes O1 or O2):

Invalid email address/opt in for order containing virtual SVC item.

2. Send to customer sold to email address: If

a ship to does not exist on the order, send the email to the email

address defined for the customer sold to. The system requires an email

address for the customer sold to if a stored value card item exists

on the order. In addition, the Opt in/opt out setting

must allow for email delivery (codes O1 or O2): Invalid

email address/opt in for order containing virtual SVC item.

Note:

If the email address or opt in/opt out value changes after the order has been accepted and before the stored value card is activated, it is possible that a Stored Value Card Notification Email may not be generated.Assigning a Stored Value Card Number

Before you can activate a stored value card, you must first assign a number to the card. Assigning a number to a stored value card occurs during or after pick slip generation, depending on if the stored value card is a physical or virtual card.

Assigning Numbers to Physical Stored Value Cards

Follow these steps to assign a number to a physical stored value card (SVC type Physical Card or Physical Card/Early Notify):

1. Generate a pick slip for the order containing the physical stored value card.

When you generate a pick slip for an order containing a physical stored value card, the system:

-

prints a separate pick slip for each order line containing a physical stored value card. However, if you wish to print a separate pick slip for each unit of the stored value card item, set up the item as ship alone (Ship alone = Ship Alone).

-

creates a record in the Pick Stored Value Card Table for each unit of the stored value card item printed.

-

includes the stored value card item on the Pick Unit Report.

Pick Stored Value Card Table

This table contains a record for each physical stored value card item purchased whose pick control number has not yet been confirmed. Once you confirm the pick control number, the system deletes the stored value card record from this table. The system also uses this table to validate that a number has been assigned to the physical card before the card is shipped and confirmed.

| Field | Description |

|---|---|

|

Company |

The company where you created the pre-generated pick containing the stored value card item. |

|

PCH control # |

The pick control number assigned to the pick containing the stored value card item. |

|

Line # |

The pick control line number containing the stored value card item. |

|

Seq# |

The pick stored value card sequence number. |

|

Card # |

The number assigned to the stored value card. This field is blank when the record is created during pick slip preparation; you use the Working with Physical Stored Value Card Assignment (WPSA) menu option or the svc_card_nbr in the CWPickIn XML Message to assign a number to the physical stored value card after pick slip generation. For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1). |

If you void or reprint the pick slip: The system updates the Pick Stored Value Card table if you use the Reprinting and Voiding Pick Slips (WVRP or WSVP) menu option to void or reprint a pick slip and the pick control number containing the physical stored value card item has not yet been billed.

| In WVRP when you: | The system: |

|---|---|

|

Decrease the quantity allocated |

Deletes the last pick stored value card record(s) created for the order line. |

|

Void the pick slip |

Deletes the associated pick stored value card records. |

|

Reprint the pick slip |

Deletes the associated pick stored value card records referencing the old pick control number and creates new pick stored value card records for the new pick control number. |

|

Void and unreserve the pick slip |

Deletes the associated pick stored value card records. |

2. Assign a number to the physical stored value card.

-

Use Working with Physical Stored Value Card Assignment (WPSA) to assign a number to a physical stored value card by pick control number, OR

-

Use the svc_card_nbr tag in the CWPickIn XML Message to receive a card assignment from an external system.

For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1).

3. Bill the pick control number containing the stored value card item.

The Use Streamlined Stored Value Card Billing (I23) system control value determines when the physical stored value card is sent to billing.

-

If this system control value is selected, the system sends the pick control number assigned to the stored value card to billing immediately after you assign a number to the card.

-

If this system control value is unselected, the system sends the pick control number assigned to the stored value card to billing after you wand and bill the card at the manifesting station.

If you use the Manually Confirming Shipments (MCON) menu option to confirm a pick control number containing a stored

value card item, the system verifies that the stored value card is

assigned a number. If the stored value card is not assigned a number,

the system does not allow you to confirm the pick control number or

change the status of the pick slip to carryover and instead displays

an error message: All stored value card numbers must be entered

before accepting.

For more information: See Billing a Stored Value Card for more information on the processing the system performs when you bill a stored value card.

Assigning Numbers to Virtual Stored Value Cards

To assign a number to a virtual stored value card (SVC type V), generate a pick slip for the order containing the virtual stored value card.

When you generate a pick slip for an order containing a virtual stored value card, the system:

-

automatically assigns a stored value card number to the virtual card, using the next available number from the Virtual Card Number Table (FLSVCA) and deletes the record from the Virtual Card Number table.

Note:

Make sure a number is available in the Virtual Card Number table to assign to the virtual stored value card; if a number is not available to assign to the card, the entire order line containing the stored value card item will not be billed and the order will print on the Stored Value Card Assignment Errors Report.-

express bills the item and sends the pick control number containing the virtual stored value card to billing.

-

does not include the stored value card item on the Pick Unit Report.

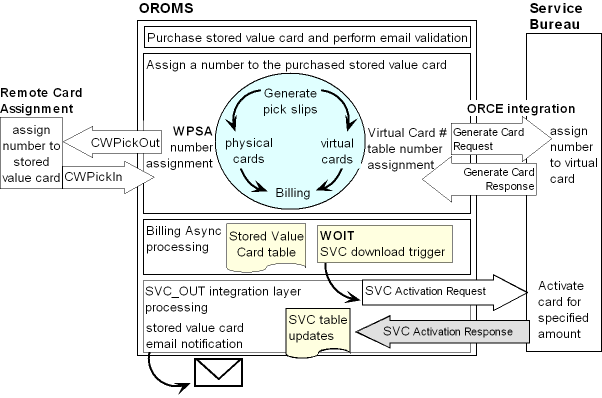

Oracle Retail Customer Engagement Stored Value Card integration: If you are using the Customer Engagement Stored Value Card Integration, the system does not assign a number to a virtual card from the Virtual Card Number table. Instead, the system:

-

generates a Customer Engagement Generate Card Request and sends the message to Oracle Retail Customer Engagement.

-

receives the Customer Engagement Generate Card Response from Oracle Retail Customer Engagement, containing the assigned card number.

-

express bills the item and sends the pick control number containing the virtual stored value card to billing.

-

does not include the stored value card item on the Pick Unit Report.

For more information: See Billing a Stored Value Card for more information on the processing the system performs when you bill a stored value card.

Billing a Stored Value Card

When a pick control record containing a stored value card item is billed, the system:

1. Deletes the associated record in the Pick Stored Value Card Table, if the stored value card is a physical card.

2. Determines the issue amount to apply to the stored value card.

The system control value determines the price the system uses as the amount to apply to the stored value card.

- Stored Value Card Activation Pricing Method (I25)

-

If this system control value is set to OFFER, the stored value card amount is the offer price. If the offer price is $0.00, the system uses the order line price.

-

If this system control value is set to ORDER or blank, the stored value card amount is the order line price. If the order line price is $0.00, the system uses the offer price.

If both the offer price and order line price are $0.00, the stored value card amount is $0.00.

3. Creates a record in the Stored Value Card Table for each unit of the stored value card item.

Stored Value Card Table

This table contains a record for each stored value card item that has been billed.

Once you receive an approved activation response from the service bureau, the system updates this table with the activation information. You can review the stored value card at the Display Stored Value Cards Screen.

Additionally, when you purge an order, the system deletes any associated records in this table.

| Field | Description |

|---|---|

|

Company |

The company where you processed the stored value card. |

|

Order # |

The order number where the stored value card was purchased. |

|

Ship to # |

The ship to number receiving the stored value card. |

|

Seq # |

The order line sequence number. |

|

Seq # |

The stored value card sequence number. |

|

Card # |

The stored value card number. If the Remove Stored Value Card Number After Activation (J22) system control value is selected, the words REMOVED BY SYSTEM display instead of the credit card number. |

|

Card type |

The type of stored value card.

|

|

Issue date |

The date the stored value card was billed. |

|

Issue amount |

The amount assigned to the stored value card. |

|

Activation date |

The date the stored value card was activated; this is the date the system received and processed the approved stored value card activation response. |

|

Activation time |

The time the stored value card was activated; this is the time the system received and processed the stored value card activation response. |

|

Email sent date |

The date a Stored Value Card Notification Email was sent to the customer. The system sends an email when an approved activation response is received from the service bureau. |

|

Auth service |

The service bureau where the stored value card was sent for activation. |

|

Response code |

The activation response received from the service bureau. The system does not update this field until the system receives a stored value card activation response from the service bureau. |

|

ID # |

The ID number assigned to the stored value card. |

4. Creates an SV tickler, if you Use Workflow Management (H96), for each stored value card item that was processed through billing without a number assignment.

A stored value card may be billed without a number assignment if you send the physical stored value card to the manifesting station without first using the Working with Physical Stored Value Card Assignment (WPSA) menu option to assign a number to the card. The system will not create a SVC download trigger for the stored value card until the card is assigned a number.

See SV (SVC Number Assignment) Event Processing for more information on how to resolve this tickler.

5. Creates an SVC download trigger in the Outbound Interface Transaction table for each stored value card that has been billed and is assigned a stored value card number.

You can review download triggers in the Working with Outbound Interface Transactions (WOIT) menu option. See Identifying SVC Download Triggers.

For more information: See Activating a Stored Value Card for more information on processing the SVC download triggers.

Activating a Stored Value Card

The system creates an SVC download trigger in the IL Outbound Trigger table when a stored value card item is billed (see Billing a Stored Value Card).

Identifying SVC Download Triggers

You can view all download triggers in the IL Outbound Trigger table at the Work with Outbound Interface Transactions Screen.

Each SVC download trigger in the IL Outbound Trigger table contains a:

-

File code: indicating the type of information to download and which IL process job processes the trigger. For SVC download triggers, the File code is SVC.

-

Key: indicating the specific record to download. For SVC download triggers, the Key identifies the specific company, order number, ship to number, order detail sequence number, and stored value card sequence number associated with the SVC download trigger. For example, the Key

555000066760010000100004indicates the stored value card information is located in company 555 for order number 6676, ship to number 1, order detail sequence number 1, and stored value card number 4. -

Capture type: indicating the type of activity performed against the record. SVC download triggers are always capture type A indicating the stored value card was created.

SVC download triggers in a ready status are processed by the SVC_OUT integration layer job.

| File code | Refers to table | Key | IL Process job |

|---|---|---|---|

|

SVC |

Stored Value Card |

|

SVC_OUT |

Generating the Stored Value Card Activation Request

To generate a stored value card activation request, the system:

| # | Step |

|---|---|

|

1. |

Creates an SVC download trigger when an order containing a stored value card item assigned a number is billed; see Identifying SVC Download Triggers. |

|

2. |

Looks for unprocessed SVC download triggers to process, based on the setting of the Use Activation / Reversal Batch Processing (I50) system control value.

The system:

|

|

3. |

Looks at the Stored Value Card Activation Authorization Service (I26) system control value to determine the service bureau used to activate stored value cards. |

|

4. |

Looks at the Communication type field for the service bureau to determine how transactions are processed between Order Administration and the service bureau.

Process Activations Using Payment Link Communication If the Communication type field for the service bureau is Payment Link:

|

|

5. |

Order Administration processes the activation response accordingly. See: |

What Happens When the Stored Value Card Activation is Approved?

A stored value card receives an approved activation if the activation response contains an authorization number. In this case, the system:

-

updates the associated record in the Integration Process Control table to CMP complete (if the Communication type field for the service bureau is Integration Layer).

-

updates the associated record in the Stored Value Card Table with the activation date, activation time, and activation response.

-

generates a Stored Value Card Notification Email and sends the email to the recipient card holder.

You can review the activated stored value card at the Display Stored Value Cards Screen. The activated stored value card number will have an Activation date, time, and response. Additionally, if a Stored Value Card Notification Email was sent, the Email sent field will display the date the email was sent to the customer.

Note:

If you receive a declined stored value card activation response after you have already received an approved response, the system does not deactivate the stored value card; the card remains activated and available to use as payment.If a customer returns a stored value card or reports the card stolen: If a customer returns a stored value card or reports the card stolen, you must call the service bureau to deactivate the card.

Stored Value Card Notification Email

The system sends a Stored Value Card Notification email or XML message to the recipient card holder when the SVC_OUT job processes an approved stored value card activation request and:

-

The SVC type field for the stored value card item is E (physical card with notification) or V (virtual card).

-

An email is defined for the recipient card holder. The system uses the Stored Value Card Email Hierarchy to determine the email address used to send a Stored Value Card Notification email to the stored value card recipient.

-

The Stored Value Card Email Notification Program (I30) system control value specifies a valid program name.

A separate email is sent for each unit of a stored value card item ordered. For example, if a customer purchases a stored value card for a quantity of 2 to send to a recipient customer, the recipient card holder receives 2 stored value card emails.

Order history message: The system writes

an order transaction history message, indicating a stored value card

notification was sent to the stored value card recipient customer: SVC Notice to acustomer@example.net.

For more information: See Working with E-Mail Notification Templates (WEMT) for more information on how the system generates email notifications, and see Stored Value Card Notification Sample and Contents for a sample email message. Also, see the Outbound Email API for information on when the system generates the Outbound Email XML Message (CWEmailOut) instead of an email, and the XML message layout.

For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1).

What Happens When the Stored Value Card Activation is Declined?

A stored value card receives a declined activation if the activation response does not contain an authorization number. In this case, the system:

-

updates the associated record in the Integration Process Control table to FLD error (if the Communication type field for the service bureau is Integration Layer).

-

creates a SD tickler if you Use Workflow Management (H96), indicating the stored value card activation request was declined. See SD (SVC Activation Decline) Event Processing for more information on how to resolve this tickler.

-

includes the order containing the declined stored value card on the Unactivated Stored Value Card Report. This report prints when you run the Unactivated Stored Value Cards periodic function (program name PFR0075).

-

does not send a Stored Value Card Notification Email to the customer, since the stored value card was not activated.

You can review the declined stored value card at the Display Stored Value Cards Screen. The declined stored value card number will have an Activation response, but a blank Activation date and time.

To activate a declined stored value card: You must call the service bureau to activate the card. You cannot re-send an activation request to the service bureau.

Reviewing Stored Value Card Activation Status

In standard Order Inquiry, you can review the stored value cards purchased on an order at the Display Stored Value Cards screen. This screen is also helpful if the customer purchased a virtual stored value card and forgot the number to use when making a purchase.

Note:

This screen is not available until the stored value card item has been assigned a number and processed through billing.Display Stored Value Cards Screen

This screen indicates:

-

the type of stored value card purchased

-

the issue amount applied to the stored value card

-

the card number

-

the date the card was processed through billing

-

the date and time the card was activated and the response received (if the card received a declined activation response, the system updates the Response field but does not update the Activation date and time)

-

the date a Stored Value Card Notification Email was sent to the customer

If the Remove Stored Value Card Number After Activation (J22) system control value is selected, the words REMOVED BY SYSTEM display instead of the credit card number.

How to display this screen: At the standard Order Inquiry detail screen, select SVC for an order line containing a stored value card that has been billed.

| Field | Description |

|---|---|

|

Order# |

The order number and ship to number where the stored value card item was purchased. Order#: Numeric, 8 positions; display-only. Ship to#: Numeric, 3 positions; display-only. |

|

Line# |

The order line number containing the stored value card item. Numeric, 3 positions; display-only. |

|

Card type |

Indicates the type of stored value card purchased.

Alphanumeric, 1 position; display-only. |

|

Issue amount |

The initial amount applied to the stored value card. This amount does not reflect the remaining balance on the card, if the card has already been used as payment for a purchase. Numeric, 13 positions with a 2-place decimal; display-only. |

|

Card# |

The number assigned to the stored value card. If the Remove Stored Value Card Number After Activation (J22) system control value is selected, the words REMOVED BY SYSTEM display instead of the credit card number. Alphanumeric, 20 positions; display-only. |

|

Issue date |

The date the stor ed value card was processed through billing. Numeric, 6 positions (user date format); display-only. |

|

Activation date |

The date the stored value card was activated; this is the date the SVC_OUT process received and processed the approved stored value card activation response. Numeric, 6 positions (user date format); display-only. |

|

Activation time |

The time the stored value card was activated; this is the time the SVC_OUT process received and processed the stored value card activation response. Numeric, 6 positions (user date format); display-only. |

|

Activation response |

The activation response received from the service bureau. Alphanumeric, 10 positions; display-only. |

|

Email sent |

The date a Stored Value Card Notification Email was sent to the customer. The system sends an email when an approved activation response is received from the service bureau. Numeric, 6 positions (user date format); display-only. |

Stored Value Card Authorization Reversal

Overview: When you process a cancellation associated with a stored value card payment or deactivate a stored value card payment, the system reimburses the original authorization amount to the stored value card.

In addition, if the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.

In this topic:

Purpose: The system reimburses a stored value card the original authorization amount associated with the card when you process a cancellation associated with a stored value card payment or deactivate the stored value card.

Note:

If the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.Stored Value Card Authorization Reversal Process:

| # | Step |

|---|---|

|

1. |

You process a cancellation associated with a stored value card payment or deactivate the stored value card. You can process a cancellation by:

You can deactivate a stored value card payment by selecting Deactivate for a stored value card payment at the Enter Payment Method Screen. |

|

2. |

The system determines if the order is eligible for stored value card authorization reversal. For an order to be eligible for stored value card authorization reversal, the order must:

An open, unused authorization is an authorization that is:

Also, a reversal is not submitted when any lines on the order are submitted to Order Orchestration for fulfillment. Multiple payment methods: If the order contains one or more stored value card and/or credit card payments, the system performs authorization reversal for each eligible payment method. Authorizations in sent status: When you process a cancellation or deactivate a stored value card payment and the authorization is in an S (sent, but not received) status, the system does NOT create a SVC authorization reversal for the payment even if you later receive an approved authorization response. Expired authorizations: If the original authorization for an order is expired and the order received a new authorization during pick slip generation, the system will create an authorization reversal against the expired authorization when you process deposits. However, the service bureau will reject this authorization reversal since they have already expired the authorization and reimbursed the stored value card. Note: When the Send reversal flag is not selected for the authorization service, the system does not create an authorization reversal trigger record, described below, unless the reversal is created because the stored value card payment method is deactivated. |

Example 1: The following transactions are applied against a stored value card payment on an order.

| Order Activity | Result |

|---|---|

|

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

|

You cancel the order in order maintenance. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. |

Example 2: The following transactions are applied against a stored value card payment on an order.

| Order Activity | Result |

|---|---|

|

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

|

You cancel an order line in order maintenance for 4.00. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. The remaining items on the order will be resent to the service bureau for authorization during pick slip generation. |

Example 3: The following transactions are applied against a stored value card payment on an order.

| Order Activity | Result |

|---|---|

|

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 40.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 30.31. |

|

You generate a pick slip for an order line on the order for 6.00. |

The balance on the stored value card remains at 30.31. |

|

You cancel the remaining order line in order maintenance for 4.00. |

The system does not create an authorization reversal. The balance on the stored value card remains at 30.31. |

|

You ship and bill the order line for 6.00. |

The system updates the deposit amount for the authorization on the Authorization History Details screen to 6.00. The balance on the stored value card remains at 30.31. |

|

You deposit the order line for 6.00. |

The system creates a deposit record for 6.00 and updates the status of the authorization to voided. The balance on the stored value card is updated to 34.31. |

| # | Step |

|---|---|

|

3. |

The system creates an authorization reversal for the original authorization amount, not the actual amount of the reversal. |

|

4. |

The system creates a record in the Auth History SVC Reversal table for the authorization amount to reimburse. |

Auth History SVC Reversal table:

| Field | Description |

|---|---|

|

Company |

The company where you processed the stored value card authorization reversal. |

|

Order # |

The order number associated with the stored value card authorization reversal. |

|

OPM Seq # |

The order payment method sequence number associated with the stored value card payment. |

|

AUH Seq # |

The authorization history sequence number associated with the stored value card payment. |

|

Seq# |

The Auth History SVC Reversal sequence number. |

|

Creation date |

The date, in CYYMMDD format, the stored value card authorization reversal was created. |

|

Creation time |

The time, in HHMMSS format, the stored value card authorization reversal was created. |

|

Approval date |

The date, in CYYMMDD format, the stored value card authorization reversal was approved by the service bureau. |

|

Approval time |

The time, in HHMMSS format, the stored value card authorization reversal was approved by the service bureau. |

|

Reversal amount |

The amount to reimburse to the stored value card. In the case of PayPal, this is the original authorization amount. |

|

Response |

The response received from the service bureau, indicating if the authorization reversal was approved or declined. |

| # | Step |

|---|---|

|

5. |

The system creates an authorization reversal download trigger for the stored value card authorization reversal. You can view all download triggers in the IL Outbound Trigger table at the Work with Outbound Interface Transactions screen. Each authorization reversal download trigger in the IL Outbound Trigger table contains a:

|

|

6. |

Looks at the Authorization service field defined for the stored value card payment to determine the service bureau used to process the authorization reversal. Note: When the Send reversal flag is not selected for the authorization service, the system does not create an authorization reversal trigger record unless the reversal is created because the stored value card payment method is deactivated. |

|

7. |

The system looks for unprocessed AHR download triggers to process, based on the setting of the Use Activation / Reversal Batch Processing (I50) system control value.

The system:

|

|

8. |

For each authorization reversal download trigger, the system generates a Stored Value Card Authorization Reversal Request. |

|

9. |

The system looks at the Communication type field for the service bureau to determine how transactions are processed between Order Administration and the service bureau.

If the Communication type field for the service bureau is Payment Link:

|

|

10. |

Order Administration processes the authorization reversal response accordingly. See: Note: Stored value card authorization reversal responses contain a Response code and Response date, but may not contain an Authorization code. In this case, if the Response code is 100, the system updates the Authorization code with a dummy authorization number so that the authorization reversal is approved. |

An authorization reversal is approved if the Authorization Reversal Response message contains an authorization number. In this case, the system:

-

updates the associated record in the Integration Process Control table to CMP complete (if the Communication type field for the service bureau is Integration Layer).

-

updates the associated record in the SVC Authorization Reversal table with the approval date, approval time, and reversal response.

-

creates an order transaction history message indicating the authorization reversal was approved:

Reversal Has Been Approved. -

voids the authorization history record.

Note:

If the stored value card authorization reversal response contains an amount, the system ignores the amount sent back and continues to use the amount from the Auth History SVC Reversal table.You can review the stored value card authorization reversal at the Display Authorization Reversals Screen. The approved reversal will have a Response and an Approval date and time.

An authorization reversal receives a declined reversal if the Authorization

Reversal Response Message does not contain an authorization number.

In this case, the system creates an order transaction history message

indicating the authorization reversal was declined: Reversal

Has Been Rejected.

You can review the declined stored value card authorization reversal at the Display Authorization Reversals Screen. The declined reversal will have a blank Response, Approval date and time. You cannot resend a SVC authorization reversal request to the service bureau.

Note:

-

Except for the order transaction history message, there is no other indication that the stored value card authorization reversal request was declined.

-

Because the cancellation or deactivation amount was not reimbursed to the stored value card, the customer will not be able to use that amount on future purchases paid for against the stored value card.

-

The response received from the service bureau does not display in the Response field on the Display Authorization Reversals Screen unless it is set up as a vendor response for the service bureau in Work with Authorization Services (WASV).

Communication failures can occur if the SVC_REVRSL job is inactive, the connection between Order Administration and the service bureau is down, or the system times out before a response is received. If communication failures occur and you do not receive a response from the service bureau, the system:

-

updates the associated record in the Integration Process Control table to FLD error (if the Communication type field for the service bureau is Integration Layer).

-

does not update the associated record in the SVC Authorization Reversal table.

-

does not create an order transaction history message.

You cannot resend a stored value card authorization reversal request to the service bureau.

Purpose: If the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference.

| # | Step |

|---|---|

|

1. |

You process a deposit for an amount that is less than the original authorization amount. |

|

2. |

The system looks at the Communication type field for the service bureau to determine how transactions are processed between Order Administration and the service bureau.

If the Communication type field for the service bureau is Payment Link:

|

|

3. |

When a deposit response is received, Order Administration:

|

Examples:

Original authorization amount is equal to deposit amount

| Stored Value Card Activity | SCV J20 selected | SCV J20 unselected |

|---|---|---|

|

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

53.49 |

53.49 |

|

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

|

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

41.99 |

41.99 |

|

You ship the order and bill the order. The invoice amount is 11.50. You process deposits. The deposit amount (11.50) equals the original authorization amount (11.50). Deposit amount: |

11.50 |

11.50 |

|

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

41.99 |

41.99 |

Original authorization amount is greater than deposit amount

Note:

The following example does not apply to PayPal reversals.| Stored Value Card Activity | SCV J20 selected | SCV J20 unselected |

|---|---|---|

|

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

88.49 |

88.49 |

|

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

|

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

76.99 |

76.99 |

|

You void one of the items from the pick slip. You partial ship the remaining items on the pick slip and bill the order for the shipment amount. The invoice amount is 6.25. You process deposits. The original authorization amount is greater than the deposit amount. Deposit amount: Reversal amount: |

6.25 5.25 |

6.25 blank |

|

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

82.24 |

76.99 |

Original authorization amount is less than deposit amount

Note:

The following example does not apply to PayPal reversals.| Stored Value Card Activity | SCV J20 selected | SCV J20 unselected |

|---|---|---|

|

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

82.24 |

82.24 |

|

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

|

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

70.74 |

70.74 |

|

You add an item to the order for 5.25. You authorize the stored value card and generate a pick slip for the added item. Authorization amount: |

5.25 |

5.25 |

|

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

65.49 |

65.49 |

|

You ship the entire order and bill the order for the shipment amount. The invoice amount is 16.75. You process deposits. Deposit amount: |

16.75 |

16.75 |

|

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

65.49 |

65.49 |

Generating Stored Value Card Refunds

Stored value card refunds allow you to generate a credit card credit against the original stored value card on the order or generate a new stored value card for the amount of the refund to send to the customer when you process a refund.

In this topic:

For more information: See:

-

overview and setup: Stored Value Card Overview and Setup

-

activating the new stored value card for the refund amount: Stored Value Card Purchase and Activation

Stored Value Card Refunds: Credit Card Credit

If you process a return against a stored value card pay type that does not have an alternate pay type or alternate refund category defined, the system generates a credit card credit refund against the original stored value card pay type, allowing you to reimburse the refund amount to the original stored value card instead of sending a new stored value card to the customer.

Stored Value Card Refunds: New Stored Value Card

If you process a return against a stored value card pay type that has an alternate pay type or alternate refund category of stored value card defined, the system generates a new stored value card to send to the customer when you process a refund. The card is issued for the refund amount. When you process stored value card refunds, the system adds a stored value card item to the order at no charge and performs pick slip preparation. You can then follow the normal process of generating a pick slip for the stored value card item so that the card can be picked, activated, billed, and shipped to the customer.

You may wish to generate a new stored value card for the refund amount if:

-

The sold to customer paid for the order using a stored value card, but has since thrown the card away. Instead of reimbursing the original stored value card on the order the refund amount, the customer has requested a new stored value card.

-

The sold to customer paid for the order using multiple pay types. Instead of refunding each separate pay type on the order, the customer has requested the refund amount in the form of a stored value card.

Changing the Type of Stored Value Card Refund Generated

You can use Working with Refunds, Writeoffs and Balances Due (WREF) to change the type of refund that is generated for a stored value card pay type.

Credit card credit refund: If the original pay category and current pay category associated with the refund is a stored value card pay type (pay category Credit Card and Card type Stored Value), the system allows you to change the refund by entering a different refund type in the Type field on the Change Refund Screen. You can only change the refund type to a credit card credit refund (C) or stored value card refund (V). If you change the refund type to a credit card credit refund, the system adds the refund amount to the original stored value card on the order.

Stored value card refund: The system allows you to change any refund to a stored value card refund by entering a stored value card pay type in the Pay type field on the Change Refund Screen.

In addition, if the original pay category and current pay category associated with the refund is a stored value card pay type (pay category Credit Card and Card type Stored Value), the system allows you to change the refund by entering a different refund type in the Type field on the Change Refund Screen. You can only change the refund type to a credit card credit refund (C) or stored value card refund (V). If you change the refund type to a stored value card refund, the system generates a new stored value card for the refund amount.

When is a New Stored Value Card Generated for a Refund?

If the pay type associated with the refund is set up to generate a stored value card refund, the system generates a refund for refund type V (stored value card).

The system generates a stored value card refund when:

-

The alternate refund type defined for a pay type is a stored value card.

-

You process a return outside the Return Grace Period (B52) and the Alternate Pay Type (B51) is a stored value card pay type.

-

You change a refund to a stored value card refund (refund type V) in Working with Refunds, Writeoffs and Balances Due (WREF).

Alternate currency and stored value card refunds: The system can process stored value cards in the US currency only. If the order is for a currency other than US, you should change the refund to a refund type other than stored value card.

Consolidating New Stored Value Cards Generated for Refunds by Order

The system consolidates open stored value card refunds that are for the same pay type on the same order.

Example: The following activity occurs for an order. The pay type on the order has an alternate refund type of stored value card.

| Activity | Results |

|---|---|

|

You return order line 1 for 50.00 |

The system creates a stored value card refund for 50.00. |

|

You return order line 2 for 25.00 |

The system updates the existing refund to 75.00. |

|

You process stored value card refunds |

The system generates a stored value card for a refund amount of 75.00. |

|

You return order line 3 for 30.00 |

Since the first stored value card refund for the order has been processed, the system creates a new stored value card refund for 30.00. |

Multiple pay types on the same order: If the system generates a stored value card refund for different pay types on the same order, the system will not consolidate the stored value card refunds.

Example: The following activity occurs for an order. The order contains 2 pay types: cash/check for 50.00 and credit card for 55.00. Both pay types have an alternate refund type of stored value card.

| Activity | Results |

|---|---|

|

You return order line 1 for 50.00 |

The system creates a stored value card refund for 50.00. The current pay category assigned to the refund is credit card; the original pay category assigned to the refund is cash/check. |

|

You return order line 2 for 25.00 |

The system creates a stored value card refund for 25.00. The current pay category assigned to the refund is credit card; the original pay category assigned to the refund is credit card. |

|

You process stored value card refunds |

The system generates 2 stored value cards: 1 for a refund amount of 50.00 and the other for a refund amount of 25.00. |

Note:

In Working with Refunds, Writeoffs and Balances Due (WREF), if you change existing refunds for an order to stored value card refunds (by entering a stored value card pay type in the Pay type field at the Change Refund Screen), the system will not consolidate the stored value card refunds. For example, if 2 refunds exist for an order and you change both refunds to stored value card, the system will not consolidate the 2 refunds.Processing New Stored Value Cards Generated for Refunds

To generate stored value card refunds, select a Bank, select the Generate SVC credits field and optionally, specify the Amount to generate at the Process Refunds Screen.

Note:

If multiple stored value card refunds exist for an order and the first stored value card refund processed places the order on hold (due to credit checking), the system will not process the subsequent stored value card refunds since the order is now on hold.When you process stored value card refunds, the system:

-

Produces the Stored Value Card Credit Register; this report displays each order and sold to customer associated with a stored value card refund and the amount of the refund.

-

Writes an order transaction history message:

F Stored Value Card refund created. -

Adds the Default SVC Refund Item Number (I73) to the order and performs pick slip preparation. This item represents the new stored value card that is sent to the customer for the amount of the processed refund. The system adds this item to the order at no charge and defaults the Price Override Reason for SVC Refund Item (I74) to the order line.

Note: