25 Enter Additional Information for Sales Orders

This chapter contains these topics:

25.1 Entering Additional Information for Sales Orders for Brazil

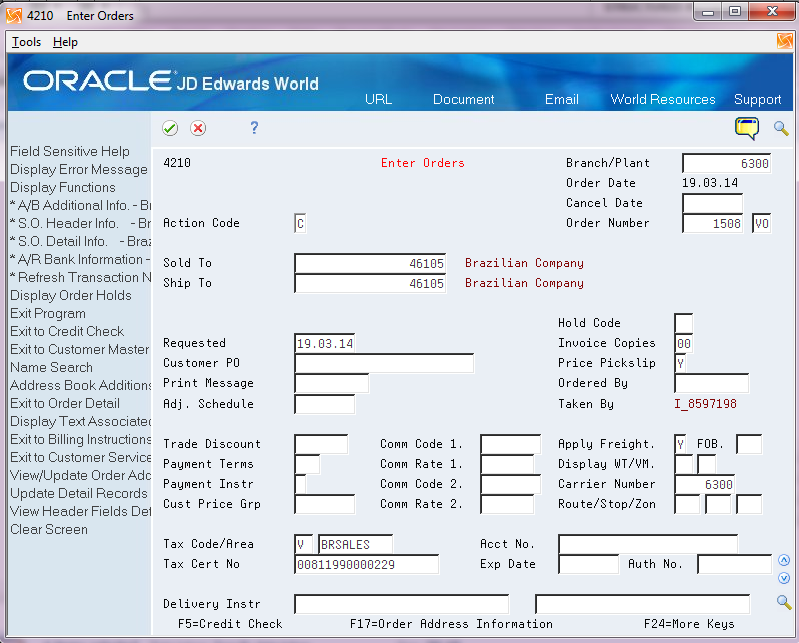

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Sales Order Processing

From Sales Order Processing - Brazil (G76B4211), choose Enter Orders or

From Sales Order Processing (G4211), choose Enter Orders (Page Mode)

You enter sales orders to input information about your customers and the items that they order. A sales order consists of two parts:

-

Header information, which is general information that relates to the entire order, such as the customer and order dates

-

Detail information, which is line-by-line details about the items or services you are selling, such as item numbers, quantities, and costs

You can enter header information and detail information separately. Depending on the volume of orders you have and the amount of header information you need to enter, you use menu options to choose one of the following methods to enter purchase orders:

-

Enter header information first, followed by detail information

-

Enter detail information only, the system then applies limited header information based on default values

In Brazil, the government requires companies to maintain additional information for sales orders for tax audit purposes. The information includes:

-

Transaction nature

-

Tax code

-

Fiscal classification

-

Whether the item is subject to a tax substitution mark-up

-

Origin of the item

-

Type of purchase

You must also enter the following additional information that describes the taxpayer in these fields:

-

Taxpayer Class

If you do not complete this field in the sales order, the system attempts to obtain the value from the address book record information in the Address Book additional Information Brazil file (F76011).

-

Presence Indicator Code

The system writes the values for the taxpayer information to the Sales Order Header Tag File (F76B4201).

25.1.1 Item Origin and Import Content Information in Sales Orders

If an item on a sales order includes imported content that exceeds a set threshold, you must complete additional information about the imported content. When you set up items in the Item Master Additional information (F76411/F76412) files, you specify the item origin by assigning a to the item a value from the 76/IO UDC table. If the first position in the Special Handling Code field for the value in the UDC table is 1, then the import information is required for the item.

When you access the S.O. Additional Info. - Brazil screen, the system retrieves the values for the Import Content Form - FCI and Import Content fields from the Item Location tag File Res 13 (F76B432). If the values for the fields do not exist in the F76B432 file, the system issues a warning message. You can enter and save the sales order, but you cannot generate the nota fiscal until the import information required is added to the F76B432 file and to the sales order.

25.1.2 Before You Begin

-

Verify that the processing options in the Sales Order Entry program are set up to display header information before the detail information. See Section 66.1, "Processing Options for Sales Order Entry (P4211)".

-

Verify that you have set up the processing options for P4211BR, Sales Order Additional Information - Brazil. See also the chapter, Chapter 10, "Set Up Transaction Nature Codes" in this guide.

-

Version names must match. If you run the Sales Order Brazil version (ZJDE0018) of the SO Entry program (P4211) to generate your sales orders, the system looks for an equivalent version of the Sales Order Entry - Detail program (P4211BR), ZJDE0018.

-

Verify that Brazil is the country that you have selected for your user display preferences.

-

Set up generic function keys to access the forms for additional sales order information. See Section 5.2, "Setting Up Generic Function Key Exits".

-

Every step in the order process must have a status code assigned in your order activity rules. If an order activity rule does not exist for a given document type and line type, the system defaults the Nota Fiscal status to '760.'

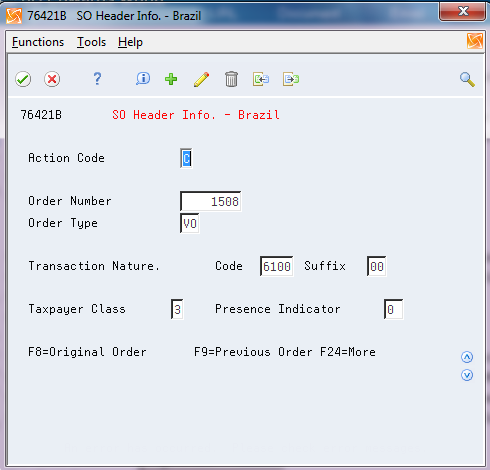

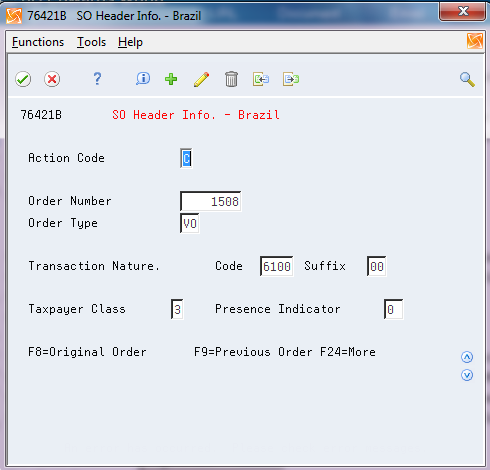

25.1.3 Entering Additional Header Information

To enter additional header information

-

To locate a sales order, complete the following field:

-

Order Number

-

-

Choose the S.O. Header Information - Brazil function key.

Figure 25-2 S.O. Header Information - Brazil screen

Description of "Figure 25-2 S.O. Header Information - Brazil screen"

-

Complete the following fields:

-

Order Number

-

Order Type

-

Transaction Nature Code

The first 3 digits of the Transaction Nature code are validated against F7615B; the fourth digit, which may default as 0, is not validated. For more information on the default values, see Section 10.1, "Setting up Transaction Nature Codes".

-

Suffix - Transaction Nature

-

Taxpayer Class

-

Presence Indicator

-

The system supplies default values for these fields. You can override these values.

| Field | Explanation |

|---|---|

| Transaction Nature | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY A value for X will default to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. |

| Suffix Transaction Nature | Complete this two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents a inventory change, or that a transaction is eligible for a certain type of tax.

Valid values might include: 01 - Bonus 02 - Demo 03 - Sample 04 - Return merchandise 05 - Back order 06 - Donation |

| Taxpayer Class | Enter a value from UDC 76/CC to indicate the type of taxpayer.

Values in UDC 76/CC are hard-coded. Use a value that includes 0 in the Special Handling Code field for general taxpayers/consumers. Use a value that includes 1 in the Special Handling Code field for final consumers. The system writes the value for this field to the Sales Order Header Tag File (F76B4201). |

| Presence Indicator | Enter a value from UDC 76B/PR to specify the presence of the person purchasing the goods or service, such as whether the order was received in person, via phone, or via the internet.

If you selected a value for the Taxpayer Class field that indicates the consumer is the final consumer (Special Handling Code field in 76/CC is 1), then you must select a code from UDC 76B/PR that also includes a 1 in the Special Handling Code field. If the value in the Taxpayer Class field indicates a general taxpayer/consumer, then you can select any value from UDC 76B/PR. The system writes the value for this field to the F76B4201 file. |

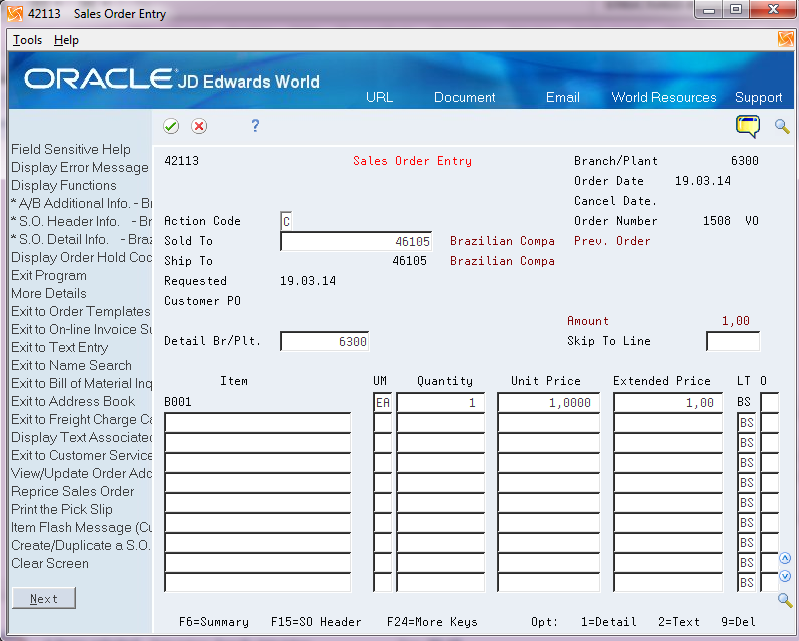

25.1.4 Entering Detail Lines

-

To locate a sales order, complete the following fields:

-

Order Number

-

Order Type

You do not need to complete these fields if you access the sales order detail screen from the sales order header screen.

-

-

Choose the S.O. Detail Info. - Brazil tag file function key.

-

If you need to enter item detail for items with imported content, press F4 to display the item import fields.

Figure 25-4 S.O Additional Info. - Brazil

Description of "Figure 25-4 S.O Additional Info. - Brazil"

-

To locate the sales order, complete the following fields:

-

Order Number

-

Order Type

-

-

For each item on the sales order, complete the following fields:

-

Transaction Nature (all 4 digits are validated against F7615B)

-

Transaction Nature Suffix

-

Tax Code

-

Fiscal Class

-

ICMS Substitution

-

Item Origin

-

Purchase Use

-

Import Content Form (FCI)

-

Import Content

-

| Field | Explanation |

|---|---|

| Tax Code

(UDC 76/CT) |

Use this auxiliary code to combine ICMS and IPI tax characteristics.

Examples of valid values might include: 01 - Taxed Domestic Goods (IPI and ICMS) 02 - Taxed Domestic Goods (ICMS taxed, IPI tax rate Zero) 03 - Exempt Products 04 - Export 05 - ICMS deferred, IPI suspended 06 - ICMS exempt, IPI taxed |

| Fiscal Classification | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| ICMS Substitution | Use this code to indicate whether a client or product is subject to tax substitution.

Valid values are: Y = Yes, use List Price Z = Yes, use Net Price N = No |

| Item Origin

(UDC 76/IO) |

Use the Item Origin code to specify the origin of a product. Values are hard coded.

Valid values are: 0: National, and does not meet requirements for codes 3, 4, 5, or 8. 1: Imported; foreign supplier 2: Imported; Brazilian supplier 3: National, where over 40% of the cost are from foreign components. 4: National, where the production is compliant with local production rules. 5: National, where under or 40% of the cost are from foreign components 6: Foreign, acquired abroad, does not have similar in the domestic market, and belongs to CAMEX list and natural gas. 7: Foreign, acquired on domestic market, does not have similar goods in the domestic market and belongs to CAMEX list and natural gas. 8: National, with imported content over 70%. |

| Purch Use

(UDC 76/PU) |

Use the Purchase Use code to identify the purpose for which the merchandise was purchased. You define purchase use codes on a user defined codes table (system 76, type PU).

When you define purchase use codes, use the special handling code to specify the following tax information: For ICMS tax: 0 - ICMS tax is non-recoverable 1 - ICMS tax is 100 percent recoverable. For IPI tax: 0 - IPI tax is non-recoverable; 1 - IPI tax is 50 or 100 percent recoverable, depending on the status of the ship-to and ship-from taxpayer You can define additional purchase use codes, if appropriate. |

| Import Content Form (FCI) | The system retrieves this value from the item setup if the item origin for the item indicates that the import content information is required. If it does not exist in the item setup, the system issues a warning message. You can complete the sales order, but you must add the import content information to the item record and update the sales order before you can generate the nota fiscal. |

| Import Content | The system retrieves this value from the item setup if the item origin for the item indicates that the import content information is required. If it does not exist in the item setup, the system issues a warning message. You can complete the sales order, but you must add the import content information to the item record and update the sales order before you can generate the nota fiscal. |

25.1.6 Processing Options

See Section 66.1, "Processing Options for Sales Order Entry (P4211)".

See Section 66.2, "Processing Options for Sales Order Entry - Brazil (P4211BR)".