Understanding Voucher Processing and the Voucher Life Cycle

Understanding Voucher Processing and the Voucher Life Cycle

This chapter provides an overview of voucher processing and the voucher life cycle, lists prerequisites, and discusses how to:

Enter invoice information for online vouchers.

Copy source documents to create vouchers online.

Schedule and create voucher payments for online vouchers.

Complete voucher attributes.

View voucher summary information.

View related documents information.

View voucher error information.

View voucher approval summary information.

Run on-demand voucher processes as a batch request.

Note. Because the online voucher component is used to enter all voucher styles, but acts differently depending on the voucher style, this chapter provides sections that discuss how the Voucher (VCHR_EXPRESS) component works generally. Discussions about how to enter and update each voucher style specifically are provided in other chapters in this PeopleBook.

See Also

Entering and Processing Vouchers Online: Specific Voucher Styles

Entering and Importing Spreadsheet Vouchers

Understanding Voucher Processing and the Voucher Life Cycle

Understanding Voucher Processing and the Voucher Life Cycle

After you have set up all your control information, established your PeopleSoft Payables control hierarchy, and entered approved vendors in the system, you are ready to enter vouchers into the system.

This section discusses one method of entering vouchers into the system: using the online Voucher component. The pages in this component are the equivalent of electronic voucher forms on which you can record invoice information from your vendors in the PeopleSoft Payables database. You can also quickly copy line item information from purchase orders and receivers from PeopleSoft Purchasing tables.

We also provide the Voucher Build Application Engine (AP_VCHRBLD) process for creating vouchers. This process builds and edits voucher records from various sources, including the Quick Invoice Entry (VCHR_QUICK_PNL) component, the Summary Invoice Entry (VCHR_SUMM_PNL) component, and the Spreadsheet Voucher workbook. The Voucher Build process, the Quick Invoice Entry component, and the Spreadsheet Voucher feature are discussed elsewhere in this PeopleBook.

This section discusses:

Voucher process flow.

Voucher life cycle.

Voucher styles.

Voucher validation.

Voucher session defaults.

Processing that is initiated by the Voucher component.

(USA) Vouchers for Health Insurance Portability and Accountability Act of 1996 (HIPAA) payments.

See Also

Entering and Importing Spreadsheet Vouchers

Voucher Process Flow

Voucher Process Flow

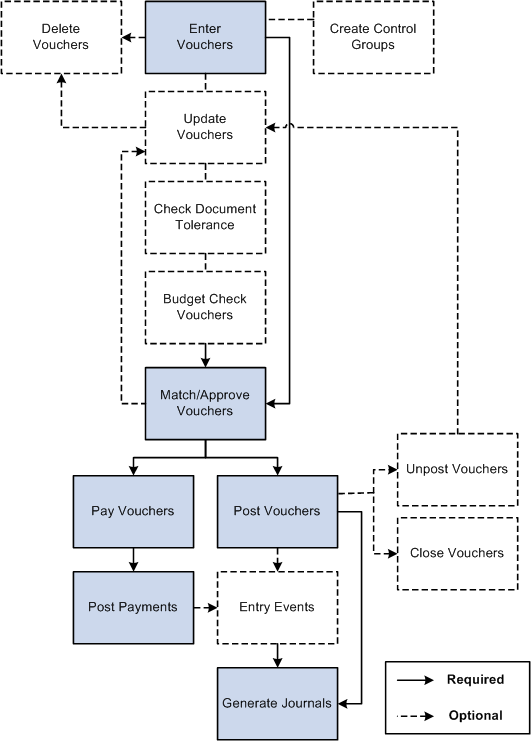

The following flowchart illustrates the processing routes that a voucher can follow. It includes optional stages of voucher processing, such as creating control groups and applying matching rules to approve a voucher:

Voucher processing flow

Voucher Life Cycle

Voucher Life Cycle

Vouchers go through several stages from initial entry to payment to posting. PeopleSoft Payables tracks these stages using various statuses for the following status types that relate to various actions and processes that can be run on a voucher:

Entry status.

Match status.

Approval status.

Budget status.

Document Tolerance status.

Post status.

Payment status.

Payment Post status.

This table illustrates the values for each voucher status, before and after processing:

|

Status Type |

Process |

Initial Status |

Post-Processing Statuses |

|

Entry Status |

Voucher Entry |

Open |

Deleted Recycle Postable |

|

Match Status |

Matching |

To Be Matched |

Exception Manually Overridden Manually Set to Credit Note Matched Match - Dispute No Match |

|

Approval Status |

Voucher Approval |

To Be Approved |

Pending Approval Approved Denied |

|

Budget Status |

Budget Processor (Budget checking) |

Not Checked |

Valid Error |

|

Document Tolerance Status |

Document Tolerance Checking |

Not Checked |

Valid Error |

|

Post Status |

Voucher Posting |

Not Posted |

Posted |

|

Payment Status |

Pay Cycle Payment Selection subprocess |

Not Selected |

Selected for Payment |

|

Payment Status |

Pay Cycle Payment Creation subprocess |

Selected for Payment |

Paid |

|

Payment Post Status |

Payment Posting |

Not posted |

Posted |

When you first enter a voucher into PeopleSoft Payables, it has an entry status of Open. When you save the voucher for the first time, the system validates the input with information that is provided by default from the control hierarchy to ensure correct entries. If the voucher passes all validations, it goes into a Postable state. The system generates accounting entries when the Voucher Posting Application Engine (AP_PSTVCHR) process selects the voucher for posting. At this time, the voucher is available for distribution to the general ledger using the Journal Generator Application Engine (FS_JGEN) process.

If one or more of the validations fail, a couple of events can happen. For some edits, the system does not allow you to save the voucher until the error condition is corrected. For example, if you do not enter a date on the voucher header, you cannot save the voucher.

For other edits, you can choose less restrictive error handling, such as Recycle, which lets you save the voucher. However, you cannot post or pay the voucher until you correct the error. You set these rules at the business unit level of the control hierarchy and can override them at other levels: voucher origin, control group, vendor, and voucher. With duplicate invoice checking, for example, you can choose recycle error handling, which means that the system accepts the suspect vouchers but does not enable them to be posted or paid. To post and pay these vouchers, you must update the voucher with correct information.

Until a voucher has been reviewed for approval, or unless it is preapproved, it has an approval status of Pending. After that, a voucher can be approved or denied. A voucher cannot be paid unless it has been approved. However, if your business unit definitions enable you to, you can post a voucher even though it has not been approved for payment.

When you post a voucher in PeopleSoft Payables, the system creates balanced accounting entries to record the liability and sets the post status to Posted. When a voucher is in a posted state, you can make only limited changes to it. Essentially, you can change only descriptive information that does not affect the numbers on the voucher. To change the numbers on a posted voucher, you must first unpost the voucher to create reversing entries. This action puts the voucher back into a postable state, as if it had never been posted. You can then change the necessary fields.

A voucher can have one or more payment records selected for payment based on their scheduled pay date and other parameters. The payment status is Unselected, Selected for Payment, or Paid.

Note. If you are using budget checking (through the Commitment Control feature), you cannot post or pay a voucher until it has successfully passed budget checking.

See Also

Defining Voucher Error-Handling Options

Budget-Checking PeopleSoft Payables Transactions Using Commitment Control

Processing Document Sequencing in PeopleSoft Payables

Running Voucher and Payment Posting

Voucher Styles

Voucher Styles

PeopleSoft Payables provides various voucher styles, each of which addresses a particular objective:

|

Adjustments |

Enter adjustment vouchers for credit or debit memos, or for relating one voucher to another. This style is also used for debit memo adjustment vouchers that are created by the Matching Application Engine process (AP_MATCH). |

|

Journal Voucher |

Enter vouchers for adjusting accounting entries. |

|

Prepaid Voucher |

Enter prepayments (down payments, progress payments, or deposits). |

|

Register Voucher |

Accrue an individual voucher for which the expense distribution is not known or not yet approved. |

|

Regular Voucher |

Enter standard vouchers (this is the default setting). This style is also used to enter purchase order vouchers and vouchers that require matching to purchase orders and receiving documents. |

|

Reversal voucher |

Create a new voucher with reversal accounting entries and back out encumbrances. |

|

Single Payment Voucher |

Enter a voucher for a one-time vendor without having to define the vendor in the system. |

|

Template Voucher |

Create a voucher that can be used as a template for generating regular vouchers that share voucher data. |

|

Third Party Voucher |

Enter vouchers for charges other than merchandise charges, for example, freight-only vouchers. |

This chapter describes the online voucher pages and how to enter regular vouchers online. The other methods of voucher entry and voucher styles are described in separate chapters of this PeopleBook.

See Also

Entering and Importing Spreadsheet Vouchers

Voucher Validation

Voucher Validation

When you save vouchers, many edits and processes occur automatically. Any problems that PeopleSoft Payables detects with a voucher are brought to your attention so that you can fix them immediately.

Other edits that are specific to particular voucher styles, payment terms, and other circumstances are discussed in the sections or chapters about those styles and circumstances.

This section discusses:

Voucher field validation.

Financial sanctions validation.

Voucher Field Validation

The system performs a series of validation checks to ensure that you have completed all the fields correctly. Some of the validations that occur are:

Duplicate invoice checking.

Verifying the existence of a vendor ID.

Verifying the existence of an invoice date and invoice ID.

Balancing header amounts against voucher line amounts for both transaction and base currency amounts.

Balancing voucher line amounts against distribution line amounts for both transaction and base currency amounts.

Ensuring that the user ID that is approving the voucher is the same as the user who is signed in.

Validating accounting distribution field values and combinations and error processing.

Where appropriate, validating the calculation and proration of nonmerchandise charges, such as sales and use taxes, value-added taxes (VAT), freight charges, and miscellaneous charges.

Validating the bank ID, bank account number, and DFI ID.

Financial Sanctions Validation

PeopleSoft provides validation of your vendors against financial sanctions lists (for example, the Specially Designated Nationals [SDN] list) at the vendor level, voucher level, and payment level. At the voucher level, if financial sanctions validation is enabled at the installation level, the invoicing vendor and remit vendor or vendors, if different from the invoicing vendor, are validated. If financial sanctions validation is enabled at the bank level, no validation of the vendor is done during voucher processing unless you specify a bank for the remit vendor and the bank requires financial sanctions validation. The system updates the vendor's financial sanctions status on the Vendor Information (VNDR_ID) component.

At the voucher level, the system validates your vendors upon:

Saving the voucher if financial sanctions validation is enabled at the installation level, or if financial sanctions validation is enabled at the bank level, you specify a bank for the remit vendor and the bank requires financial sanctions validation.

The system displays a warning message that the vendor is currently under financial sanctions review. You can proceed with saving the voucher; however, the system does not allow payments to vendors with a financial sanctions status of Review or Blocked.

At the time of voucher entry, if financial sanctions validation is enabled and the vendor that you entered has a financial sanctions status of Review or Blocked, the system displays a warning message that the vendor that is selected is currently under financial sanctions review. You can proceed with adding or updating the voucher for this vendor.

Note. You cannot record a manual payment on the Voucher

- Payments page if the vendor has a financial sanctions status of Review or Blocked. The

system does not allow you to select Record as the

payment action.

You cannot create an express payment on the Voucher - Payments page

if the vendor has a financial sanctions status of Review or Blocked. The

system does not allow you to click the Express Payment link.

Running the Financial Sanctions Validation Application Engine (AP_SDN_VAL) process.

You can schedule the Financial Sanctions Validation process to run on a predefined schedule using the Process Scheduler, or you can run it on an ad hoc basis.

See Understanding Financial Sanctions Validation.

Voucher Session Defaults

Voucher Session Defaults

You can define voucher defaults that automatically populate voucher fields for an entire session, and you can override those defaults for a particular voucher. These defaults override the defaults that the system applies using the PeopleSoft Payables control hierarchy. To set up voucher defaults, you can:

Predefine session defaults using the Session Defaults (AP_VCHR_DFLT_PG) page.

The system saves these defaults that you can apply to vouchers that you enter using the Voucher component or the Quick Invoice Entry component. You define session defaults for all users, for users with the same primary permission list, or for specific users.

Define ad hoc session defaults using the Session Defaults (AP_SESSN_DFLT_SEC) page within the Voucher and Quick Invoice Entry components.

The system does not save the defaults and only applies them during the current session.

Note. Session defaults can be applied only to vouchers with a voucher style of Journal Voucher, Regular Voucher, Single Payment Voucher, and Template Voucher.

Processing That Is Initiated by the Voucher Component

Processing That Is Initiated by the Voucher Component

Processing steps that occur when you save a voucher include:

Assigning a voucher ID for auto-numbered vouchers.

You can preassign voucher IDs on the add search page, as long as they are unique. In fact, if the auto-numbering option is disabled for the business unit, using the add search page is the only way to enter vouchers. Only the auto-numbered vouchers are assigned a voucher ID at save time.

Determining whether the status of the control group should be updated.

Setting one-time vendors to inactive status.

Calculating and prorating the discount amount, if any.

Prorating sales tax, use tax, freight, and miscellaneous charges, as applicable.

Calculating and prorating VAT and sales and use tax (SUT) amounts.

Converting the transaction amount to the base currency.

Determining payment net and discount due dates.

Determining the scheduled payment date.

Creating payment records.

Performing withholding processing, as applicable.

Creating payment records for manual payments that are recorded on the voucher.

Checking the voucher match status.

Validating your vendors if financial sanctions validation is enabled.

Voucher component-initiated processing that is specific to particular circumstances (such as integration with third-party tax applications or federal payment schedule processing) is discussed in the chapters that cover those circumstances.

(USA) Vouchers for HIPAA Payments

(USA) Vouchers for HIPAA Payments

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a set of regulations from the U.S. Department of Health and Human Services. One of the primary concerns of HIPAA is to restrict the use of individually identifiable health information to protect the privacy of healthcare consumers. In addition to the privacy rules, HIPAA includes regulations that establish national standards for the format and structure of electronic communications between covered entities.

PeopleSoft Payables generates HIPAA payments for only two transaction handling codes: Payment Only and Payment + Advice.

HIPAA entails communication protocol and standards for several business documents. PeopleSoft Payables supports Electronic Data Interchange (EDI) Format 820 (OUTBOUND), specifically designed for HIPAA required fields and values. To fully employ HIPAA functionality, you must use a third-party vendor to process the generated electronic funds transfer (EFT) file and transform it to the HIPAA 820 EDI format.

The HIPAA information that you define at the vendor level (in the HIPAA Information collapsible region on the Vendor Information - Payables Options page) appears by default on the HIPAA page in the Voucher component if the payment method for the voucher has an EFT layout of HIPAA. The system performs validation during online voucher entry and as part of the Voucher Build process, which checks for the HIPAA payment designation and marks such vouchers as Payment Separate.

See Also

(USA) Entering HIPAA Information

(USA) Defining HIPAA Information

Setting Up Files for Electronic Funds Transfers

Prerequisites

Prerequisites

Before entering vouchers into the system, you must:

Set up all control information.

Establish your PeopleSoft Payables control hierarchy.

Enter approved vendors in the system.

Specify user preferences for online voucher entry on the Define User Preferences - Payables Online Vouchering page.

See Also

Setting Up PeopleSoft Payables Business Units

PeopleSoft Enterprise Source-to-Settle Common Information 9.1 PeopleBook

Defining Payables User Preferences

Setting Up Draft, Payment, and Voucher Processing

Entering Invoice Information for Online Vouchers

Entering Invoice Information for Online Vouchers

This section provides an overview of voucher dependencies and balancing functionality and discusses how to:

Access the Voucher component.

Create vouchers online.

Define payment terms.

Enter nonmerchandise charge details.

Review nonmerchandise charges.

View purchase order and receiver references.

Associate receivers with voucher lines.

Associate receiver lines with voucher lines for matching.

Enter SUT summary information.

Enter voucher line tax information.

Enter session defaults.

Understanding Voucher Dependencies and Balancing Functionality

Understanding Voucher Dependencies and Balancing FunctionalityThis section discusses:

The dependencies of the Voucher component on voucher style and other factors.

Voucher balancing.

The Dependencies of the Voucher Component on Voucher Style and Other Factors

The Voucher component looks and acts differently for each voucher style. It also displays different fields and provides different processing depending on:

Tax environment (SUT, VAT, Indian excise and customs duty, installed third-party tax applications, and so forth).

Your installation options (such as whether you are a U.S. federal agency, for example).

Various processing and display options that you can select at each level of the PeopleSoft Payables control hierarchy.

For this reason, the description of the Voucher component that follows here includes page elements that you may not see or use for a particular voucher style or that you may not see or use in your implementation of PeopleSoft Payables. Whenever a page element has such dependencies, these are documented, except in the case of tax environment. The tax environment—whether VAT, SUT, Indian excise tax, sales tax, or customs duty—is usually reflected in the field labels themselves.

For discussions of specific voucher styles, see the chapters that discuss those styles.

The Voucher component has various functions that enable you to view and correct balance discrepancies. These include:

Displays of totals for separate voucher regions— lines, charges and taxes—enabling you to quickly identify the unbalanced area.

Calculate button: Located at the header level, this button enables you to perform on-demand balance calculations.

Highlighted fields: Displays out-of-balance information highlighted in red .

When the voucher is in balance, the system displays an amount of 0.00 in the Difference field .

We discuss three common out-of-balance scenarios:

The first scenario is a regular voucher with the header out of balance to the distribution lines.

In this example, a regular voucher has a header total of 1,500.00 USD, but distribution lines totaling 1,505.00 USD. The system displays discrepancies between the header and the lines in the Difference field at the header level.

The next scenario is a regular voucher with the distribution lines out of balance to the invoice line.

This regular voucher has a header total of 2,000.00 USD and an invoice line total of 2,000.00 USD, but the distribution lines total 2,002.00 USD. When the invoice lines and distribution lines are out of balance, the system displays the discrepancy in the Difference field.

The third scenario is a purchase order voucher with distributions that balance to the line, but the voucher has multiple lines that do not balance to the header.

The purchase order voucher has a header total of 2,100.00 USD, but the invoice line total and the distribution lines total 500.00 USD. The Difference field at the header level displays the 1,600.00 USD discrepancy between the header amount and the lines amount. The Difference field at the invoice and distribution line level displays a 0.00 USD discrepancy between the merchandise amount and the distributed amount, but it appears highlighted in red, because the voucher is out of balance.

See Also

Entering and Processing Vouchers Online: Specific Voucher Styles

Managing Voucher Line Tax Information with Taxware and Vertex

Processing Value Added Tax (VAT) in PeopleSoft Payables

(USF) Processing PeopleSoft Payables for U.S. Federal Agencies

Pages Used to Enter Invoice Information for Online Vouchers

Pages Used to Enter Invoice Information for Online Vouchers|

Page Name |

Definition Name |

Navigation |

Usage |

|

VCHR_EXPRESS1 |

Accounts Payable, Vouchers, Add/Update, Regular Entry, Invoice Information |

Enter or view invoice information, including invoice header information, nonmerchandise charges, and voucher line and distribution information. |

|

|

VNDR_LOOKUP_WRK |

Click the Advanced Vendor Search link on the Invoice Information page. |

Enter search criteria to retrieve vendor address information. Note. Selecting an address here does not automatically change the vendor location to any default location that is associated with the address. The system uses different defaults for the vendor location value. Change the default location value using the Location field on the Invoice Information page. |

|

|

VCHR_LN_CNTRCT_SEC |

Click the View Contract ID Line link on the Invoice Information page |

View contract ID, line and release number information for recurring vouchers. This link only appears for recurring vouchers. |

|

|

VCHR_COMMENTS_TXT |

Click the Comments link on the Invoice Information page. |

Enter internal voucher comments. |

|

|

VCHRHDR_ATT_SEC |

Click the Voucher link on the Invoice Information page. |

View or attach documents related to the voucher. |

|

|

VCHR_DT_CALC_SBP |

Click the Calc Basis Date link on the Invoice Information page. |

(USF) Define the date calculation basis for U.S. federal prompt payment due date requirements and enable enforcement of valid reimbursable periods for project-related vouchers. |

|

|

FS_AUDITLOG_SEARCH |

Click the View Audit Logs link on the Invoice Information page. |

Search for and view audit logs. |

|

|

VCHR_TERMS_EXP |

Click the Transfer to Pay Terms Detail button on the Invoice Information page. |

View or change the default payment and discount terms for the voucher. |

|

|

VCHR_FRGHT_SEC |

Enter a freight amount and click the Transfer to Freight Detail button on the Invoice Information page. |

Allocate the freight charges for the voucher at a more detailed level. |

|

|

VCHR_MISC_SEC |

Enter a miscellaneous charge amount and click the Transfer to Misc Chrgs Detail (transfer to miscellaneous charges detail) button on the Invoice Information page. |

Allocate the miscellaneous charges for the voucher at a more detailed level. |

|

|

VCHR_SALETX_SEC |

Enter a sales tax amount and click the Transfer to Sales Tax Detail button on the Invoice Information page. |

Allocate the sales tax amount at a more detailed level. |

|

|

VCHR_USETAX_SEC |

Click the Transfer to Use Tax Detail button on the Invoice Information page. |

Specify the use tax to apply to this voucher. |

|

|

VCHR_LINE_MISC_CHG |

Click the Non Merchandise Summary link on the Invoice Information page. |

View the miscellaneous amounts that are allocated to each voucher line. On this page, you can also change the allocation for a particular voucher. |

|

|

AP_SUT_SUMM_PG |

Click the Sales/Use Tax Summary link on the Invoice Information page. |

Review the sales and use tax information for all the voucher lines, and if applicable, modify tax information. |

|

|

AP_SESSN_DFLT_SEC |

Click the Session Defaults link on the Invoice Information page. |

Enter voucher defaults for an ad hoc session, or use an existing available session default. These defaults override the values that the system applies using the PeopleSoft Payables control hierarchy. |

|

|

VCHR_VAT_SM_EXP |

Click the VAT Summary link on the Invoice Information page. |

Review the VAT amounts summarized by VAT rate. This page provides a preliminary view of the VAT calculations based on the parameters that have been supplied by default (or have been manually updated), as well as the amounts that are entered. You can also link from this page to the VAT header, line, and distribution line defaults pages. |

|

|

VCHR_VAT_HD_EXP |

Click the VAT Summary link on the Invoice Information page. Click the Transfer to VAT Header link on the Invoice VAT Summary Information page. |

Review and, if applicable, override the voucher's VAT settings. |

|

|

VCHR_LINE_VAT_SEC1 |

Click the Invoice Line VAT link in the Distribution Lines scroll area on the Invoice Information page. |

Review and, if applicable, override VAT defaults for the distribution line. |

|

|

DISTRIB_LN_VAT_SEC |

Click the VAT link on the VAT tab in the Distribution Lines scroll area on the Invoice Information page. |

Review and, if applicable, override VAT defaults for the distribution line. |

|

|

VCHR_PO_INFO |

Click the Purchase Order & Receiver Info link in the Invoice Lines group box on the Invoice Information page. |

View references to purchase orders and receivers. View any comments that are associated with the purchase order or receiver header or line from which the voucher and voucher line information have been copied. |

|

|

VCHR_RECV_MTCH |

Click the Associate Receiver(s) link in the Invoice Lines group box on the Invoice Information page. |

Edit any of the receiver lines that are associated with the voucher line and delete a receiver line. |

|

|

RECEIVER_LOOKUP |

Click the Associate Receiver Lines link on the Associate Receiver page. |

Manually associate receiver lines with the voucher line for matching. |

|

|

VCHR_LINE_TAX |

Click the Sales/Use Tax link in the Invoice Lines group box on the Invoice Information page. |

Review and, if applicable, override tax settings for the voucher line. |

|

|

VCHR_LINE_TXGEO |

Click the Override Tax Location link on the Invoice Line Tax Information page. |

Define a new tax location for vouchers. (Taxware or Vertex users only.) |

Accessing the Voucher Component

Accessing the Voucher Component

The Voucher component in PeopleSoft Payables uses deferred processing. If you are adding a new voucher, you can use the fields on the add search page for the component to prepopulate the new voucher and reduce the amount of prompting and editing that you need to do on the new voucher. Note also that:

The voucher style that you select on the add search page determines how the system displays, edits, and processes the voucher.

The default voucher style is Regular Voucher.

The selected voucher style also determines what nonmerchandise and tax-exempt fields appear on the add search page. These fields are Miscellaneous Amount, Freight Amount, Sales Tax Amount, Tax Exempt, and VAT Amount. The selected business unit determines whether the latter three fields appear.

Important! When copying purchase order vouchers, do not enter gross, nonmerchandise, and tax-exempt amount information in the fields on the add search page. Be sure to use the Copy PO functionality on the Invoice Information page, which ensures that the system provides these amounts by default into the appropriate fields and creates the correct voucher lines.

The system prepopulates the control group on the add search page with the earliest assigned group for the business unit and user ID.

PeopleSoft Payables functionality performs duplicate invoice checking using the information that you add on the add search page.

If the system finds any vouchers that appear to be duplicates, it issues a warning before you enter the Invoice Information page. It also performs duplicate invoice checking when you save a voucher. However, the more information that you enter on the add search page, the more likely you will catch a duplicate invoice before you create another duplicate voucher.

PeopleSoft Payables uses default information from the voucher origin table and information from other default levels to determine how the system processes the voucher.

Each user who enters vouchers must be assigned to an active voucher origin. If the user is not assigned to a voucher origin or the voucher origin is inactive, the user cannot save the voucher. Also, you cannot change the voucher origin of a voucher after it is entered into the system.

The system automatically populates ChartField values that are defined at the vendor location level into the voucher distribution lines.

Entering the estimated number of invoice lines in the Estimated No. of Invoice Lines (estimated number of invoice lines) field enables you to enter lines on the Invoice Information page without repeatedly needing to click the Add button in the Invoice Lines scroll area.

Any lines that you leave blank are automatically deleted when you save.

When you enter gross amount and nonmerchandise amount values on the add search page, the system supplies the difference by default on the first voucher line and distribution line.

Note. If you are adding a voucher, the Invoice Information page appears when you have entered data on the add search page and clicked Add. If you are accessing a voucher that already exists in the system, then the Voucher - Summary page appears when you have entered the search information and clicked Search.

Creating Vouchers Online

Creating Vouchers Online

Access the Invoice Information page (Accounts Payable, Vouchers, Add/Update, Regular Entry, Invoice Information).

Note. If financial sanctions validation is enabled at the

installation level, the system validates the vendor against financial sanctions

lists upon saving the voucher. If financial sanctions validation is enabled

at the bank level, no validation of the vendor is done during voucher processing

unless you specify a bank for the remit vendor and the bank requires financial

sanctions validation. The system updates the vendor's financial sanctions

status on the Vendor Information component.

If the system determines that the vendor is a potential match to a financial

sanctions list, the system displays a warning message that the vendor is currently

under financial sanctions review. You can proceed with saving the voucher;

however, the system does not allow payments to vendors with a financial sanctions

status of Review or Blocked.

See Understanding Financial Sanctions Validation.

|

Related Content |

Click and choose a link to view information related to this vendor and business unit combination. The system displays information from today's date to one year prior, allowing you to see at a glance information in a graphical format. You can expand the viewing area by clicking on the box above the frame and dragging it up. You can also close the viewing area by clicking the X in the upper right corner of the viewing area. Information available for viewing is:

|

|

Invoice Number |

Enter the invoice number or some other control number from the voucher's supporting document. The system uses this number as a reference for duplicate invoice checking if you have selected it to be one of your match criteria. Note. For evaluated receipt settlement (ERS) vouchers that were built by the Voucher Build process, the invoice number is appended with the ERS invoice sequence number suffix. |

|

Invoice Date |

Enter the date that the invoice is entered into the system. It is usually the current date. |

|

Displays the accounting control date, which is based on the settings that are defined in the PeopleSoft Payables default hierarchy. You can override it here on the voucher. Changing this date also changes the VAT declaration date on the Invoice Header VAT Information page if the declaration point is Accounting Date. Note. If Current Date is selected as the accounting date option in the PeopleSoft Payables hierarchy, and the current date is not in an open PeopleSoft General Ledger period, the system uses the first available date in an open PeopleSoft General Ledger period as the accounting date. |

|

|

Tax Exempt |

Select if you want to override the default sales and use tax setup for this voucher and make it exempt from taxation. |

|

Print Invoice |

Click to create the invoice in a PDF file format. The system opens a new window where you can view and print the invoice. |

|

Calculate (calculate on-demand balancing) |

Click to perform on-demand balancing calculations and check whether the voucher is in or out of balance. The system displays an amount of 0.00 in the Difference field when the voucher is in balance. |

|

Vendor and Name |

Select the vendor by entering the vendor ID or short name. After you press Tab to exit either field, the system retrieves and populates the voucher with the full vendor name, primary address, default location information, and payment terms. In addition, the system uses default information from the vendor table in conjunction with information from other default levels (business unit, origin, and control group) to determine how the system processes this voucher. Note. If financial sanctions validation is enabled and the vendor has a financial sanctions status of Review or Blocked, the system displays a warning message that the vendor that is selected is currently under financial sanctions review. You can proceed with adding or updating the voucher for this vendor. |

|

Location |

Override the default location by selecting a new location. The vendor location controls much of the default voucher processing. |

|

Address |

Override the default address by selecting a new address. |

|

Advanced Vendor Search |

Click to search for vendors using partial names and wildcard symbols. Note. If you find that the referenced vendor does not exist on the vendor table and you want to add the vendor, you do not have to cancel the voucher on which you are working. Access the Vendor Search page by clicking the vendor link and then clicking the Add Vendor button. This takes you to the Vendor Information component, enabling you to add the vendor to the system. After saving the new vendor, close the newly opened browser session to return to the Vendor Search page. When you are back on the Vendor Search page, select the new vendor. |

|

Control Group |

Select a control group for the voucher if applicable. The default is the earliest assigned group for the business unit and user ID. If no groups are assigned for your user ID, the Group field does not appear. |

|

Miscellaneous Freight, and Sales Tax |

Enter any miscellaneous charge amount, freight amount, or sales tax amount. To allocate these charges at a more detailed level, click the icons next to these fields to access detail pages (the Miscellaneous Charges, Freight Charges, and Sales Tax Charges pages). You should enter any amounts on the voucher page first before accessing the detail page. When you save the voucher, the system allocates the charges that you enter to the voucher lines based on the defaults that you set in the Procurement Control (BUS_UNIT_INTFC2) component for the PeopleSoft Payables business unit. Note. If you override the default tax information on the Invoice Line Tax Information page and then change the sales tax amount in this field, the overridden tax information will revert to the default. Enter a tax amount here before you update any tax information on the Invoice Line Tax Information page. See Entering Nonmerchandise Charge Details. See (IND) Processing Excise Duty, Sales Tax, VAT, and Customs Duty for India in PeopleSoft Payables. |

|

|

Click to access the Miscellaneous Charges page and define miscellaneous charges. |

|

|

Click to access the Freight Charges page and define freight charges. |

|

|

Click to access the Sales Tax Charges page and define sales tax charges. |

|

Use Tax |

Displays the calculated use tax. The system calculates the use tax either from:

Click the Transfer to Use Tax Detail icon to access the Use Tax Charges page, where you can specify how to allocate the use tax charges. |

|

|

Click to access the Use Tax Charges page and define prorated or nonprorated use tax charges. |

|

|

Click to access the Invoice Header VAT Information page and define VAT default information for this voucher. |

|

Total and Currency |

Enter the full amount of the voucher, including merchandise and service amounts (entered on the voucher lines), freight, and tax. Enter the gross amount to ensure balancing between the voucher header and voucher lines. You can enter gross amounts only up to the limit that is specified on your PeopleSoft Payables user profile. |

|

Difference |

Displays the amount that you are currently out of balance. To arrive at this figure, the system compares the sum of the invoice lines plus the applicable charge amounts and the entered gross amount. |

|

Pay Terms |

Select the payment terms. These terms are supplied from the PeopleSoft Payables default hierarchy. Click the Transfer to Pay Terms Detail button to access the Payment Terms page, where you can override the defaults or change associated information. |

|

Basis Date Type |

Displays the basis date type which controls the basis date on which the payment terms are based. You can override the basis date type on the Payment Terms page. |

|

(USF) Pay Schedule |

Indicate a federal payment schedule type for this voucher. The system uses this information to group this voucher with others and assign it to the appropriate payment schedule. Select from:

See (USF) Processing PeopleSoft Payables for U.S. Federal Agencies. |

|

Non Merchandise Summary |

Click to access the Non Merchandise Charges Summary Information page, where you can view the miscellaneous amount that is allocated to each voucher line for each charge code. This page is useful only after you enter or copy voucher line information. |

|

Session Defaults |

Click to access the Session Defaults page, where you can select existing available session defaults or set ad hoc default values for all of the invoices that you enter in the current session. These defaults override the defaults that the system applies using the PeopleSoft Payables control hierarchy. |

|

(USF) Calc Basis Date |

Click to access the Date Calculation page, where you can enter information that enables you to schedule the payment for this voucher on a U.S. federal prompt payment basis. You can also use the Date Calculation page to enable enforcement of valid reimbursable periods for project-related vouchers. See Applying Prompt Payment Protocols. See Enforcing Valid Reimbursable Periods for Project-Related Vouchers. |

|

Attachments (n) |

Click to add or view attachments related to this voucher. The system displays the number of attachments attached to the voucher. If no attachment is attached, the system displays (0). If you have enabled the Approval Framework, you can decide if you want to allow approvers to view the attachments on this page. |

|

Comments (n) |

Click to enter comments for a voucher to explain payment schedules, issues with the vendor, or anything else that you need to document the invoice. Any comments that you enter in this field are meant for your reference only. You can enter up to 254 characters for a comment. If you exceed 254 characters, the system displays a warning message that it can save only 254 characters and truncates the message. The system displays the number of comments attached to the voucher. If no comment is attached, the system displays (0). Warning! For claim vouchers, the system populates this field with identification information that is necessary for processing. Do not edit or delete any existing information in this field. |

|

Approval History |

Click this link to access the Approval History page and view the approval history for the voucher. Note. This link is only available for vouchers that are submitted for approval in the Approval Framework. |

|

View Audit Logs |

Click to access the Search Audit Logs page and view audits associated with this voucher. Note. This link is only available if you enable audit logs. Information displayed depends on the events selected for auditing. |

|

Submit for Approval |

Click to submit the voucher for approval. Note. This button only appears if the voucher is enable for approvals in the Approval Framework. |

|

Sales/Use Tax Summary |

Click to access the Sales/Use Tax Summary page, where you can review and modify, if applicable, the SUT information for all the voucher lines. |

Invoice Information

|

Related Voucher |

Journal vouchers only. Use this field to associate the journal voucher with the voucher for which you are correcting accounting entries. |

|

Click the Finalize Document icon to finalize the predecessor PO. This icon also appears in the Invoice Lines group box as the Finalize Line icon, which you can click to finalize the predecessor PO line. |

|

|

|

Click the Undo Finalize icon to undo the finalization of the predecessor PO. This icon also appears in the Invoice Lines group box as the Undo Finalize Line icon, which you can click to undo finalization of the predecessor PO line. |

|

Dispatch Method |

Debit memo adjustment vouchers only. Select a dispatch method for this debit memo adjustment voucher. This field is available only if the voucher style is Adjustment and the voucher source is Match Adjustment. You can override the dispatch method that is defined in the Debit Memo Options collapsible region on the Vendor Information - Payables Options page. Values include Blank, EDI/XML, Email, Fax, Phone, and Print. |

|

VAT Amount (value-added tax amount) |

If this is a VAT-applicable voucher that is subject to exclusive VAT, enter the gross VAT amount. Click the Transfer to VAT Header icon to access the Invoice Header VAT Information page if you need to review and override the voucher's default VAT settings. When you click this icon, the system retrieves the VAT defaults based on your VAT setup and entered vendor and vendor location information. Note. If your voucher is in a VAT environment and you do not enter any of the VAT pages for your voucher before saving it, the process to retrieve the VAT defaults is triggered automatically at save time. |

When you have finished entering your voucher and saved it, you have three options for processing your voucher:

Perform budget-checking, matching, document tolerance checking, asset loading, posting, and journal generation on this and other vouchers in batch from the batch request pages for those processes.

Process the voucher on demand, directly from the Invoice Information page, using the Action field.

Process this and other vouchers in batch from the Voucher On-Demand Processes batch request page using on-demand process groups.

The first option is generally the most efficient, but the second option is useful when you must process a voucher immediately, on demand. The third option is convenient when you want to perform multiple sequential processes, such as matching, asset loading, voucher posting, and journal generation, on a batch of vouchers.

If you want to process a voucher on demand from the Invoice Information page:

Save the voucher.

Select an on-demand process group in the Action field.

Click Run to initiate processing.

While the voucher is being processed, the fields on the Voucher component are unavailable for entry. Click Refresh to view the processing status of the voucher on the Voucher Summary page.

The process groups that are available depend on whether you have on-demand processing enabled, your user ID, and whether your voucher requires the processing. If budget-checking isn't applicable to a voucher, for example, the Budget Checking process group will not be available. Process groups that may be available include:

Budget Checking (BUDGET_CHK).

Document Tolerance (DOC_TOL).

Matching (MATCHING).

Matching, Doc Tolerance, Budget Check (MTCH_DT_BC).

Voucher Post (PST_VCHR).

Journal Generate (PST_VCHRGL).

Voucher Post Load AM (POSTAPAM).

Journal Gen, Load AM (POSTAPGLAM).

See Setting Up On-Demand Processing.

See Running On-Demand Voucher Processes as a Batch Request.

Other Header Information

|

Document Sequencing |

Click to access the Document Sequence page, where you can view or override the document sequencing settings. This link appears only if you have implemented document sequencing. |

|

Withholding |

Click to access the Withholding Information page, where you can view or override the default withholding details for the voucher. This link appears only if the voucher is associated with a vendor that is set up for withholding. If you are adding a voucher and enter the vendor on this page rather than the add search page, the link appears when you press Tab to move out of the Vendor field. See Reviewing and Entering Withholding Information for Vouchers. |

|

VAT Summary |

Click to access the Invoice VAT Summary Information page, where you can view the calculated VAT totals for the invoice by VAT code. You can also link from the Invoice VAT Summary Information page to the VAT default pages if you need to review or override VAT defaults for the voucher. Note. If the voucher is in a VAT environment and you do not enter any of the VAT default pages for the voucher before you save it, the process to retrieve VAT defaults is triggered automatically at save time. |

If you are creating a prepayment voucher and you are a U.S. federal agency with Enable Federal Payment selected on the Installation Options - Payables page, the Advance Payment Option group box appears. When you select Use Advance Payment in that group box, you are required to associate the prepayment with a purchase order.

Note. The voucher component does not copy lines from the associated purchase order when you enter the PO number here.

See Handling Advances for Federal Agencies.

Use the following fields for copying from a source document. The voucher style determines which fields appear here:

|

PO Unit (PeopleSoft Purchasing business unit) and PO Number |

If you want to copy all of the lines from a purchase order into the voucher, enter the PeopleSoft Purchasing business unit and the PO ID for the purchase order that you want to copy. Then click the Copy PO (copy purchase order) button. This option is available only if you are creating a regular voucher, template voucher, or third-party voucher. Important! When copying a purchase order into a voucher, do not begin by entering nonmerchandise and tax-exempt information on the add search page. Use the Copy PO button to ensure that the system provides these amounts by default to the appropriate fields. |

|

Voucher ID |

If you want to copy all of the lines from another voucher into the voucher, enter the voucher ID number that you want to copy. Then click the Copy to Voucher button. To copy individual voucher lines, enter a vendor and click the Copy from Worksheet link. This option is available only if you are creating an adjustment or third-party voucher. |

|

Voucher to be Reversed |

If you want to reverse a voucher, select the voucher ID number of the voucher you want to reverse, and click the Copy to Voucher button. The system copies all information that is related to the selected voucher (such as voucher lines, distribution lines, freight, miscellaneous charges, and sales tax, and VAT information) into the reversal voucher. This option is available only if you are creating a reversal voucher. |

|

Reverse Remaining Vchr Balance (reverse remaining voucher balance) |

Select to reverse only the unpaid voucher balance. This option is available only if you are creating a reversal voucher. |

|

Adjust PO/Restore Encumbrance (adjust purchase order/restore encumbrance) |

Select to restore the encumbrance and to adjust the purchase order matched quantity or amount. This option is available only if you are creating a reversal voucher, and if the related purchase order has not been reconciled. If the related purchase order on the voucher line has been reconciled, this check box is deselected and unavailable for entry on the voucher line of the Invoice Information page. |

|

Copy From |

If you want to search for individual source documents to copy, to select a range of source documents, or to review individual source documents, select one of the values in this field to access the appropriate Copy Worksheet:

|

Use the Invoice Lines scroll area to enter information for each line on the invoice: the merchandise amount, unit price, quantity, and description. Initially, at least one line appears automatically; enter as many additional lines as needed. The system assigns a line number to each voucher line that you add to ensure that each voucher line is unique.

Note. Rebalancing and calculations are affected by deferred

processing.

You cannot enter or adjust voucher lines after a voucher has been payment

posted.

You cannot combine replacement type return-to-vendor (RTV) vouchers

with credit or exchange type RTV vouchers (vouchers having credit and replacement

type lines, or exchange and replacement type lines). Doing so causes match

exceptions, because these differing voucher types are created with dissimilar

statuses. The Voucher Build process builds replacement RTV debit memos with

a To Be Matched status so that the Matching process correctly

updates the matched amounts between the purchase order, the receiver, and

the voucher. However, the system receives credit and exchange RTV vouchers

that are already configured with a Matched status. They

do not need to be run through the Matching process as their totals do not

affect quantities that need to be matched.

|

Distribute by |

Select a distribution method: Amount: You must enter the merchandise extended amount for the voucher line. You can also enter the quantity, unit price, and unit of measure (UOM) on the voucher line and a quantity on the distribution line for informational purposes only. If you change the value in the merchandise Extended Amount field, the Unit Price field is recalculated. Note. Any changes in the extended amount will be reflected in the distribution. The system adjusts the distribution line that has the maximum distribution line number. If you reduce the amount below the original PO amount, then the only adjustment is to set the amount to zero on the distribution line that has the maximum distribution line number. In this case, you must still adjust the distribution amounts so that they tie back to the voucher line amount. In addition, any change to the merchandise amount will be accompanied by a corresponding change to unit price. If the original distribution method on the purchase order was quantity and you change the method to amount, then the distribution as well as the voucher line information remains unchanged. Even under the amount distribution method, the voucher line quantity should equal the sum of the distribution line quantity. If they are not equal, then an error message is issued. Quantity: The system calculates the merchandise amount on the invoice lines and distribution lines based on the quantity and unit price. You must enter the quantity, unit price, and UOM. The Extended Amount field is not available for entry. Select the Force Price option if you want to force the unit price based on the entered merchandise amount. This option is described subsequently. Note. If you change voucher line quantity, the system does not adjust the distribution lines in response. Therefore, if you change the voucher line quantity, you must adjust the corresponding distribution level quantity. A validation exists to check whether the voucher line quantity is equal to the sum of distribution quantities. In addition, if you change the quantity on the copy worksheet (either PO or receiver), then the changed quantity is copied onto the voucher line, whereas the distribution still retains the original PO quantity. You should manually adjust the distribution quantity such that the sum of the distribution quantity equals the voucher line quantity. If the original distribution method on the purchase order was amount and if you change the method to quantity, then the system recalculates the distribution amounts using the quantity on the distribution line and the unit price on the voucher line. An option also exists of forcing the price that is available under this method. Selecting this option will force the system to calculate the price based on the extended amount. When you select this option, the unit price field is not available. |

|

SpeedChart |

Enter a SpeedChart. When you press Tab to move out of the edit box, prorated amounts and distribution ChartFields appear on the voucher distribution lines. If the SpeedChart was defined with no proration percentages, you must enter the distribution amounts yourself. SpeedChart is not available on the reversal or prepaid voucher, as these voucher styles do not enable you to add voucher lines. See Defining SpeedCharts. |

|

Work Order Resources |

If the invoice line is for a Work Order Management external resource, use these fields to enter the actual resource procurement cost. You then transfer the information back to Work Order Management to help determine the actual cost. These fields appear only if your organization has installed the Work Order component in PeopleSoft Maintenance Management. If the system populates these fields with data that is copied from a purchase order, you cannot edit the information.

Important! If you are creating a non-purchase order voucher

for items that are already entered in the Inventory application, do

not enter work order information here. Doing so creates a duplicate

charge situation, because PeopleSoft Payables and Inventory individually send

work order charges for the same item to Work Order Management. |

|

Maintenance Work Order |

Select the specific work order for the invoice line. |

|

Task Number |

Select a work order task for the invoice line. Available tasks depend on the selected maintenance work order. |

|

Resource Type |

Select Labor, Material, or Tools. |

|

Resource Line No (resource line number) |

Select a specific resource line number for this invoice line. Available resource line numbers depend on the selected resource type. |

|

Item |

Enter an item ID reference code and a line item description of up to 30 characters. If you also have PeopleSoft Purchasing installed, you can use an existing item from the PeopleSoft Purchasing item table. When you press Tab to move out of this field, the system populates the Description field with the associated description. |

|

Related Voucher |

For reversal and adjustment vouchers, displays the voucher ID of the voucher line that is being reversed or adjusted. |

|

Use One Asset ID |

Select to override all assets on the voucher line to use the same asset ID. Selecting this option causes the system to update all of the asset IDs for all asset-applicable distribution lines under the voucher line to NEXT, each sequence number to 1, and the profile ID to the profile ID of the first distribution line. You can override these values on individual distribution lines. |

|

Force Price |

Select if you want to force a change to the unit price to achieve the entered extended amount. Use when the sum of the merchandise amounts on the distribution lines does not match, usually because of rounding. Selecting Force Price enables you to change the extended amount and have the unit price recalculated to achieve that extended amount. Note. This check box is available only if you are distributing by quantity and copying from either a purchase order or a receiver. You must refresh the page to enable the Force Price check box. |

|

Override PO Pct (override purchase order percentage) |

Click this button to override the purchase order percentages. After clicking the button, the Percentage column becomes available for edit. The totals entered must equal 100. Once reallocated, click the Allocate by Pct button to reallocate the expenses. This button only appears for vouchers created from purchase orders or receipts. |

|

Allocate by Pct (allocate by percentage) |

Click this button to reallocate the voucher line's quantity and amount over the distributions by the percentage copied forward from the purchase order. This button only appears for vouchers created from purchase orders or receipts. |

|

Sales/Use Tax |

Click to access the Invoice Line Tax Information page, where you can override the default tax settings for the voucher line. |

|

Purchase Order & Receiver Info (purchase order and receiver information) |

Click to access the View Source PO/Receiver Information page, where you can view information about the source purchase order or receiver, including comments of various types, including header, line, and ship-to comments. This link appears only if you have PeopleSoft Purchasing installed on the same database. |

|

Associate Receiver(s) |

Click to access the Associate Receiver page and Associate Receiver Lines page, where you can manually associate individual receivers with the voucher line for three-way matching. This link is active only if you have copied purchase order or receiver information onto the voucher using the Copy Worksheet Option field and the purchase order requires matching, or if the vendor is set up for receipt-only matching. |

|

Invoice Line VAT or VAT and Intrastat |

Click to access the Invoice Line VAT Information page if you need to review and override the default VAT and Intrastat settings for the voucher line. The VAT and Intrastat link appears only on VAT-applicable adjustment vouchers. Note. If your voucher is in a VAT environment and you do not enter any of the VAT pages for your voucher before saving it, the VAT default process is triggered automatically at save time. |

|

View Contract ID Line |

Click to access the Contract Line Info page and view the contract ID, contract line and release number. Note. This link is only available for vouchers with a contract ID value. |

For each voucher line that you enter, you must also enter the distribution information in the Distribution Lines grid. Each voucher line must have one or more distribution lines. You can select the Copy Down check box on a distribution line to copy that line's general ledger business unit and ChartField values to new distribution lines.

Note. You cannot enter or adjust distribution lines after a voucher has been payment posted.

You can enter project information on distribution lines, and the project information that you capture on vouchers is available to PeopleSoft Project Costing. By entering multiple distribution lines, you can add multiple project lines for each voucher line to categorize project costs. If you have implemented PeopleSoft Project Costing during installation and add project information to a distribution line, you need at minimum to add the project business unit, project ID, activity ID, and resource type. The other fields are optional. If you have not installed PeopleSoft Project Costing, you are not required to enter a project business unit.

See Understanding Integration with PeopleSoft Payables.

Fields on this tab that are not documented here are optional ChartFields that are delivered with PeopleSoft Payables. They share the same validation error processing when you save the voucher as do the fields described here.

Important! ChartFields that appear here depend on how you configure options on the Standard Chartfield Configuration page.

See Completing the Standard ChartField Configuration Page.

|

Copy Down |

Select the check box on a distribution line and click the Insert Row button to copy that line's general ledger business unit and ChartField values to new distribution lines. If multiple distribution lines are selected, the system will issue a warning and arbitrarily select the ChartField values from one of the selected lines to populate the new lines. If no line is selected, only the default general ledger business unit will be populated. |

|

PO Percent |

This field appears only if the voucher was created by copying a purchase order into the voucher. |

|

Percent |

If the user removes distributions or reallocates the distribution amounts, the Percent column will update with the changes to reflect the actual percentage (Distribution Amount / Line Amount). Note. This field appears only if the voucher was created by copying a purchase order into the voucher. |

|

Merchandise Amt (merchandise amount) |

Enter the amount that you want to charge to the ChartField values that follow. The total of all amounts that you enter on the distribution lines for a voucher line must equal the merchandise amount on the parent voucher line. An error message appears if an imbalance occurs. |

|

Quantity |

Enter the number of units purchased that should be associated with the distribution line. This field is required if you are distributing by quantity. It is optional if you are distributing by amount. If you have entered a quantity on the voucher line, the total of all quantities entered on the distribution lines for that voucher line must equal the quantity on the parent voucher line. If you are entering a voucher line for a fixed asset that you will send to PeopleSoft Asset Management, you must enter a quantity for the asset. |

|

GL Unit (general ledger business unit) |

Identifies the general ledger business unit that will be charged with the expense that is coded on the distribution line. The default value is the general ledger business unit of the PeopleSoft Payables business unit under which the voucher is being entered. If you change the value to charge a different PeopleSoft General Ledger business unit, the system creates interunit accounting entries. This occurs during voucher and payment posting. In this case, ChartField validation occurs based on the ChartFields of the PeopleSoft General Ledger business unit. Note. When you enter interunit vouchers on the Invoice Information page, the value for the Budget Status field on the Voucher Summary page changes from Valid to Not Budget Checked. You must run the budget checking process to reset the status to Valid to make the voucher eligible for posting during voucher post. |

|

Entry Event |

Enter the entry event code for the voucher if applicable. The system displays this field if you have enabled entry events. See Processing Vouchers, Payments, and Cash Clearing Transactions with Entry Events. |

|

Account |

Enter an account. When you save the voucher, the system validates the account that you enter along with any other ChartField values. If the account that you select has been set up as a statistical account, the Amount and Quantity fields on the invoice line become inactive and any values that you may have already entered are deleted. If the Installation option is enabled, the Altacct (alternate account) field appears next to the Account field in the grid. |

|

OpenItem |

If the account that you enter has been set up as an OpenItem account, you must enter an open item reference. Select a reference by prompting. If you enter a reference for an account that is not an open item account, an error message appears when you attempt to save the voucher. You must remove the invalid reference before you can save the voucher. |

|

Project ID |

Enter a project identifier. This field appears if you do not have PeopleSoft Project Costing installed on your database. |

|

Budget Date |

Displays the budget date of the distribution line if the Commitment Control feature is enabled. You define which field the system uses for the budget date on a voucher in the Source Transactions component when you set up the Commitment Control feature in PeopleSoft General Ledger. You can also specify at the installation options whether the default budget date is the accounting date of the voucher or of the predecessor document (purchase order). |

|

Affiliate |

If the vendor is an interunit vendor, this field is not editable and the affiliate code appears by default. |

|

GL Unit (general ledger business unit) and Currency |

Identifies the general ledger business unit that is charged with the expense that is coded on the distribution line, as well as the currency in which it will be charged. |

|

Exchange Rate |

Appears automatically based on the default rate type from the market rate tables. You can override this value on the Voucher Attributes page. This field appears only when the distribution general ledger business unit is different from the voucher's general ledger business unit, or when the voucher is saved. |

This page displays statistical quantity information.

If you are distributing by quantity, you can distribute that quantity using a statistics code. The system converts the distribution line quantity from the distribution line UOM to the standard UOM that is associated with the Statistics Code field. The converted quantity is stored in the Statistic Amount field. The Statistic Amount and Unit of Measure fields are inactive.

If you enter a statistic account on a voucher line, you must refresh the page by clicking the Refresh button (access key: Alt+0) so that the merchandise amount and quantity fields on the invoice line are unavailable and blank. You must enter a statistic amount. You can enter the statistic amount in a UOM that is different from the standard UOM that is associated with the statistic account. After you enter the statistic amount, enter the corresponding UOM. The system converts the statistic amount that you enter back to the standard UOM that is associated with the statistic account. The Statistics Code field becomes unavailable for entry.

Whether you are using a statistic account or a statistics code, if the system cannot find a conversion formula between the two UOMs in the UOM conversion table, an error message appears. For example:

If you are using a statistic account, the system resets the UOM to the standard UOM for the account, and you must modify the Statistic Amount field manually so that it corresponds to the standard unit of measure.

If you are using a statistics code, the system does not calculate a statistic amount; you must delete the Statistic Code field value or enter another one.

|

Asset |

Select to enter asset information for the distribution line. All the fields on this tab become active when you select the Asset check box. |

|

Business Unit (PeopleSoft Asset Management business unit) and Profile ID |

Enter a business unit and a profile ID to indicate that the distribution line is related to an asset. These fields are required.

Note. You cannot assign the same asset ID to different profile

IDs. |

|

Asset ID |

Enter an asset ID. Otherwise, the field value NEXT appears by default. This value indicates that the next asset ID value in the PeopleSoft Asset Management system is assigned automatically. When you accept NEXT as the default, you can use the Sequence Number field to make more than one distribution line share the same automatically incremented asset ID. The system validates that a unique asset ID has only one profile ID associated with it for a given voucher line. Note. You cannot perform asset transfers in PeopleSoft Payables. You can make ChartField changes in PeopleSoft Payables, but you must also have your asset manager make a corresponding change in the appropriate PeopleSoft Asset Management page. |

|

Sequence Number |

If you have accepted the default asset ID value of NEXT, you can enter a sequence number to indicate an asset grouping of voucher distribution lines. If the asset ID is NEXT, you can enter any numeric value in this field. The unique combination of NEXT in the Asset ID field and the sequence number that you enter here cause a unique asset ID to be generated when the information is processed by PeopleSoft Asset Management. For example, if you have four distribution lines for assets that you want to assign to two separate asset IDs, you can specify an asset ID of NEXT and a sequence number of 1 for the first two lines and an asset ID of NEXT and a sequence number of 2 for the next two. Each group of two lines is assigned its own asset ID number. Leave this field blank if you entered a known asset ID. If the asset ID is NEXT and the Sequence Number field is blank, the system generates a unique number. If you selected the Use One Asset ID check box for the voucher line, the system populates the Asset ID field with NEXT and the Sequence Number field with 1 for each asset-applicable distribution line, and causes PeopleSoft Asset Management to assign all distribution lines to the same asset ID. |

|

Cost Type |

Select the cost type for the asset. Values are: A: Allowance for ADV depreciation. C: Cost type. G: Grant reimbursements. I: Impairment loss. M: Margin. P: Scrap on asset. R: Revaluation. S: Sale of assets. V: Reserve for ADV depreciation. W: Depreciation write-off. X: Revaluation reversal. Y: Impairment reversal. |

See Sending Information to PeopleSoft Asset Management.

VAT Tab

This page appears only for business units that are enabled for VAT.

Click the VAT link to access the Invoice Distribution Line VAT Information page if you need to review or update the VAT control settings for the distribution line.

Note. If your voucher is in a VAT environment and you do not enter any of the VAT pages for your voucher before saving it, the VAT default process is triggered automatically at save time.

See Reviewing and Overriding Voucher Distribution Line VAT Defaults.

The system automatically enters default values that are entered for miscellaneous charges, freight charges, VAT, and taxes on the add search page into the appropriate fields. You can edit these amounts.

In addition, field display in this group box varies depending on add search page values that are entered. For example, when you use a Prepaid voucher style, the system disables the Misc Charge Amount (miscellaneous charge amount), Freight Amount, and Sales Tax Amount fields. And if you select a VAT-applicable business unit, the system enables VAT fields on the voucher.

Note. The system acts differently when calculating VAT depending on whether you are in the Add mode or the Update/Display mode. When you enter a VAT amount using the add search page, the system supplies the VAT line amount on the Invoice Information page, and if the amount is edited, correctly recalculates this amount. However, when you modify an existing voucher VAT amount using the Update/Display mode, the system does not recalculate the VAT line amount. Instead, it displays the difference between the header and line amounts in the Difference Amount field.

Defining Payment Terms

Defining Payment Terms

Access the Payment Terms page (click the Transfer to Pay Terms Detail button on the Invoice Information page).

|

Payment Terms ID |

Controls how the voucher is paid, including the discount date and discount amount. PeopleSoft Payables supports both single and multipayment (installment) terms. You define payment terms on the Payment Terms - Multi Payment page or the Payment Terms - Single Payment page. The default setting on the voucher is based on the payment terms that are established for the vendor location for this voucher. Multipayment terms generate multiple scheduled payment records when you save the voucher by allocating the total payment amount for the voucher over these scheduled payments, according to the percentages that are established in the terms definition. With multipayment terms, you can also generate installment payment records (and review them and edit them, if necessary) in advance of committing them by saving the voucher. You can always edit the voucher immediately after saving, but this alternate method may offer more peace of mind. |

|

|

Click the Schedule Payments icon to generate payment records in advance of saving the voucher. For multipayment terms, this prepopulates multiple schedule payment records (installments). For single payment terms, this calculates and supplies the net due date, the discount amount, and the discount due date if the terms are discount-applicable. You can also do this by clicking the Schedule Payment button on the Payments page. |

|

Due Date Control |

Either accept the default due dates, or enter user-specified amounts. Select from: Terms: This is the default setting. When you select this value, the Basis Dt Type (basis date type) field is available for entry, but the Discount Due Date and Due Date fields are not. If the Due Date Control field is specified as Terms, then the scheduled due dates and net due dates are determined by the payment term specified. User: When you select this value, the Discount Due Date and Due Date fields are available for entry and you can modify them. The Basis Dt Type field is unavailable for entry. If the Due Date Control field is set to User, then the date is derived from the Due Date field. |

|

Enter the date for the system to use to calculate the discount due date and payment due date for the voucher. This field controls the basis date on which the payment terms are based. Values are: Acct Date (account date): The accounting date determines the payment basis date. Doc Date (document date): The date that the voucher is entered, which determines the payment basis date. If you select this value, the document date appears in the Basis Date field. Inv Date (invoice date): The invoice date determines the payment basis date. Recpt Date (receipt date): The receipt date determines the payment basis date. Ship Date: The ship date determines the payment basis date. User Date: The user-defined date that is entered in the Basis Date field determines the payment basis date. Note. Just because you can select an alternate basis date source does not necessarily guarantee that the particular date is currently available for the voucher. For example, the receipt date and ship date values would typically be available only if the invoice had first been matched to the purchase order, the receiver, or both. If you select a basis date value for which no corresponding date value is populated, a warning appears asking whether you want to use the invoice date as the override basis date. If you select Yes, you can save the voucher and generate scheduled payment data. Until a voucher is posted or paid, you can always update the voucher for the intended basis date if it becomes available. |

|

|

Basis Date |