Understanding Credit Card Processing

Understanding Credit Card Processing

This chapter provides an overview of credit card processing, lists common elements, list prerequisites, and discusses how to:

Process credit cards for authorization only.

Process credit cards for immediate payment.

Process credits of deposit refunds.

Process credit cards in PeopleSoft Billing.

Process credit cards in PeopleSoft Receivables.

See Also

Changing Credit Card Encryption

Understanding Credit Card Processing

Understanding Credit Card Processing

This section discusses:

Credit card authorizations.

Immediate payments.

Deposit refunds.

Billing processes.

Receivables processes.

Card Verification Value (CVV) process.

You enter the same basic data for credit card payments, regardless of which PeopleSoft application you are using; the difference is where you enter it.

Note. After credit card numbers are entered, they are stored in an encrypted format. Once saved, only the last four digits of the card number appear on pages used to enter credit card information. Pages used to review the credit card information, such as the Customer Summary using Quick Customer Create, also display only the last four digits of the number.

Credit Card Authorizations in Order Management

Credit Card Authorizations in Order Management

This section describes how credit card data can be entered for an order and have only an authorization processed to the card. Card authorization and billing will be discussed later.

Enter an order with a payment method of credit card on the Order Entry Form page and click the Credit Card Data button to enter or modify the credit card information.

Authorize the credit card online while entering a sales order, or place the order on hold and run these two processes:

Load CC Interface process (OM_CRCARD).

CC Processing (OM_CRC000).

Note. For OM_CRCARD to load the pending credit card data to the interface table and OM_CRC000 to transmit for authorization or approval, a working third-party integration to the credit card application must be installed in the system.

Review failed credit card transactions in the Identify Pending Transactions component.

Review the credit card transaction history for the order on the Credit Card History page.

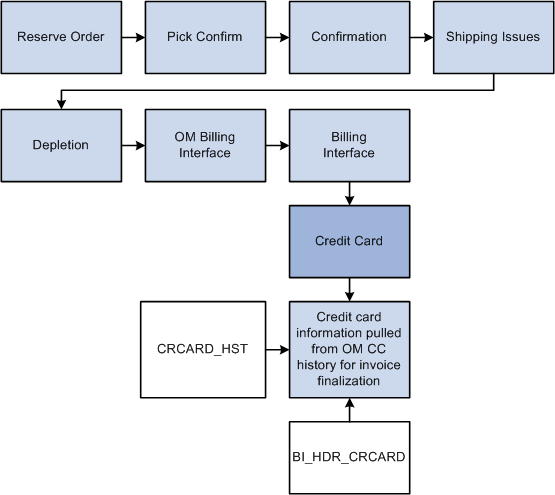

Run the OM Billing Interface process (OM_BILL).

After the authorization is successful or you changed the payment terms for the order, the order can be processed through the fulfillment cycle. Then run OM_BILL to pass the information to PeopleSoft Billing for the shipped orders. It populates the Billing Interface tables in PeopleSoft Billing, which the Billing Interface process (BIIF0001) uses to create invoices. If the amount increases, for example if shipping charges are added in PeopleSoft Inventory, Billing will reauthorize the amount when the invoice is finalized. If the authorization reversal feature is enabled, and the amount increases, Billing will issue an authorization reversal transaction to cancel the authorization performed in Order Management and release the money held on the customer's credit card.

Note. Authorizing credit cards in PeopleSoft Order Management is optional. If you are not performing authorizations, disable the hold associated with the credit card on the order.

PeopleSoft Order Management Credit Card Process Flow

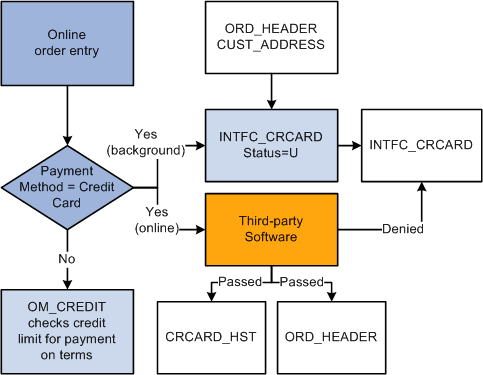

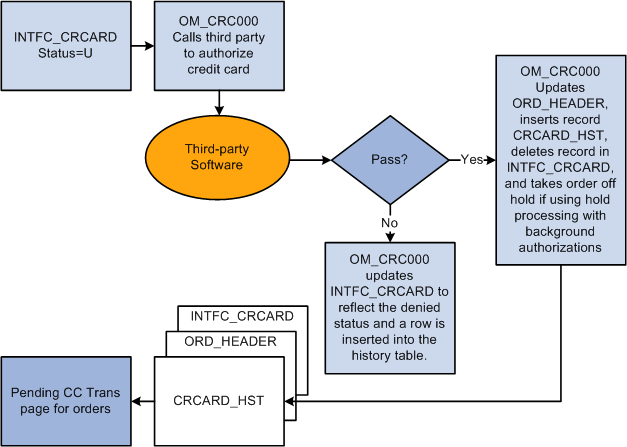

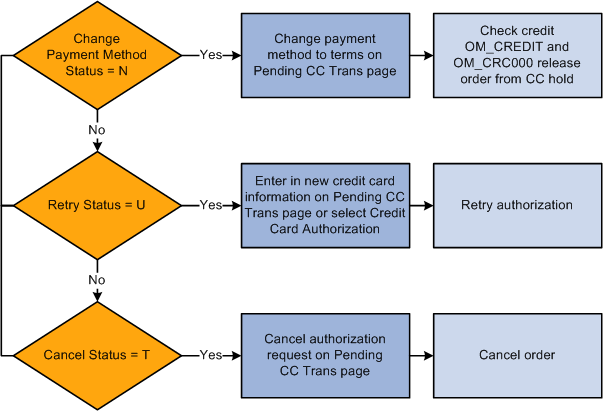

The next four diagrams illustrate the PeopleSoft Order Management credit card process flow:

Creating credit card charges during online order entry in PeopleSoft Order Management

Submitting credit cards for background processing in PeopleSoft Order Management

Processing failed credit card authorizations in PeopleSoft Order Management (1 of 2)

Processing failed credit card authorizations in PeopleSoft Order Management (2 of 2)

Credit Card Authorization Status Codes

The following table lists the authorization status codes that are used throughout credit card processing in PeopleSoft Order Management, Billing, and Receivables. The system either displays the status code or the description of the status.

|

Status Code |

Short Name, Long Name |

Comments |

Used In |

|

U |

Unproc/Ret Unprocessed/Retry |

The transaction has not been processed or a previous authorization has failed and is being resubmitted for inclusion in the next CC Processing run. |

OM, BI, AR |

|

A |

Auth Authorized |

The transaction is approved and funds are reserved. You can obtain approvals through batch or manual credit card processing. |

OM - batch and manual |

|

B |

Billed |

The transaction is complete. The funds are charged to the credit card. All bill transactions must be preceded by an authorization. The term Captured is also used. |

BI |

|

C |

Cred Credited |

A credit has been authorized and processed for the transaction. The funds are credited back to the specified card. |

BI, OM Refunds |

|

D |

Denied |

The transaction has failed credit card processing and has been declined, or disallowed, by the organization issuing the credit card. |

OM, BI, AR |

|

F |

Reversal Auth Reversal |

An authorization was canceled to free up funds on a credit card. |

OM, BI |

|

G |

Validated |

OM |

|

|

H |

Rev Denied Auth Reversal Denied |

The authorization reversal transmission was denied by the third party processor. |

OM |

|

J |

Reauth Reauthorize |

Issue another authorization request for authorizations that have become stale. |

OM |

|

P |

Auth/Bill Authorized and Billed |

The transaction was successfully authorized and billed. |

OM, BI, AR |

|

M |

Man Apprv Manually Approved/Settled |

The transaction received verbal approval. Enter manual approvals on the Review Pending Cred Card Trans - Credit Card Address page in PeopleSoft Billing. |

BI, AR |

|

N |

Chg to Trm Change to Terms |

The payment type for the transaction has been changed from Credit Card to Payment Terms. Changes to payment terms are made on the Pending CC Trans page in PeopleSoft Order Management and the Review Pending Cred Card Trans page in PeopleSoft Billing. The Process Credit Card Invoices process picks up the transaction the next time you run the process. |

OM, BI |

|

T |

Cancel Ord Cancel Order |

Indicates a canceled credit card order. The transaction is not subject to further processing. Cancellations are entered on the Pending Credit Card Trans page and on the sales Order Entry Form page. |

OM only |

|

E |

Validation Errors |

The credit card payment has failed PeopleSoft application validation edits and has not been processed by the third-party provider for authorization and settlement. Most errors are discovered when editing customer or credit card information. |

AR |

|

R |

Processing |

Indicates that the Credit Card Processor is working with the payment. |

AR |

|

V |

Pending Approval |

The credit card payment can not be sent to the third-party provider for authorization and settlement until a user manually reviews and submits the payment. |

AR |

|

K |

No Action |

A credit card payment worksheet has been created but is not ready to be submitted for authorization and settlement. |

OM, BI, AR |

|

W |

DelSettle Delete after Settlement |

A credit card payment that had been previously authorized and billed or manually approved/settled has been deleted. |

AR |

|

X |

Deleted |

A credit card payment worksheet has been created but has been deleted before authorization and settlement. |

AR |

|

Y |

Cancelled |

A credit card payment that has been ready for authorization and payment has been withdrawn for payment. The credit card payment worksheet has not been deleted but the credit card payment will not be attempted. |

AR |

|

Z |

Zero Dollar Payment |

A credit card payment worksheet has been created with a monetary value of 0. This status accommodates credit card payment worksheets that are created for maintenance purposes. For example, automated write off processing or in situations where the net credit and debit items selected on a credit card worksheet are 0. |

AR |

Immediate Payments

Immediate Payments

In PeopleSoft Order Management, a credit card can also be authorized and billed immediately. This method is used in a counter sale environment when payment is collected immediately at the time of the order. It is also used when accepting a deposit on unfulfilled goods. For immediate payments, complete these steps:

Enter a counter sale order, and then press the Record Payment button.

On the Record Payment page, select Credit Card, Procurement Card, or Debit Card as the payment method.

Enter an amount to be charged to the credit card in the Payment Tendered grid and click the Additional Information link next to the amount.

Complete the Card Data page and click the Process Card button to initiate an online authorization and bill of the card to the third-party credit card authorization and payment application. Results of the authorization and bill transmission appear immediately on the Card Data page.

Note. Credit card authorizations and bill transactions can also be initiated by clicking the Record Deposit button on the regular Order Entry component.

Deposit Refunds

Deposit Refunds

In PeopleSoft Order Management, a deposit that was taken for an order can be refunded back to a credit card. When doing this, a credit transaction is issued to the third-party credit card application. For deposit refunds, complete these steps:

On the Deposit Refund page, select Credit Card as the refund payment method and enter an amount to be refunded back to the card.

Click the Process Card button next to the refund amount.

Fill out the Card Data page and click the Process Card button to initiate an online credit of the card to the third-party credit card authorization and payment application. Results of the credit transmission appear immediately on the Card Data page.

Billing Processes

Billing Processes

After credit card data is entered in PeopleSoft Billing, you must:

Run the Pre-Process and Finalization process (BIIVC000). This populates the INTFC_CRCARD table with credit card transactions to be processed. There will be one row in this table for each credit card invoice to be processed.

Run the Process Credit Card Invoices process (BICRC000). This process reads from the INTFC_CRCARD table and submits each row to the credit card processing interface. Successfully processed transactions are then deleted from the INTFC_CRCARD table.

Note. For BICRC000 to process pending credit card transactions, a working third-party integration to the credit card application must be installed in the system.

Use the Review Pending Transactions (BI_INTFC_CRCARD1) page to review failed and pending credit card transactions.

Use the Review Pending Transactions - Edit Credit Card page to correct and resubmit the credit card for billing, authorize the card manually, or remove the transaction from further credit card processing by electing to pay using default payment terms.

PeopleSoft Billing Credit Card Process Flow

The next two diagrams illustrate the PeopleSoft Billing credit card process flow:

Authorizing and billing credit cards in PeopleSoft Billing

Processing failed credit card authorizations in PeopleSoft Billing

Authorization Reversals

Authorization Reversals

PeopleSoft Order Management and Billing supports the processing of authorization reversals. An authorization reversal comes into play when an order has been placed to be paid by credit card, for example 100 USD. The card is authorized in Order Management and a row is written to the history table for the authorization transaction as shown below:

|

Order Number |

Product |

Transaction Amount |

|

ORD-ABC |

OM |

Auth 100 USD |

Then, an amount is added to the order to cause the order total to increase, for example 50 USD, and the order total becomes 150 USD. Currently in Order Management, when the order total is increased, another authorization request would be processed for the new order total. A row for the new authorization is written to the history table as show below:

|

Order Number |

Product |

Transaction Amount |

|

ORD-ABC |

OM |

Auth 100 USD |

|

ORD-ABC |

OM |

Auth 150 USD |

Now the credit card is reserving a total of 250 USD of the card when actually it should be reserving 150 USD. The transaction for the 150 USD will eventually get freed up once the order is shipped and billed in Billing (Bill transaction). The transaction for the 100 USD auth will eventually expire and free up the money. But this can cause problems for customers who may have reached close to the maximum credit card limit.

When authorization reversals are enabled, and an order total is increased, the system will issue an authorization reversal transaction, which will cancel out the previous authorization. A new authorization for 150 USD will be issued for the order. When the order is shipped and billed, the card can be billed for 150 USD. In this scenario, the history table would be as shown below:

|

Order Number |

Product |

Transaction Amount |

|

ORD-ABC |

OM |

Auth 100 USD |

|

ORD-ABC |

OM |

Auth Reversal 100 USD |

|

ORD-ABC |

OM |

Auth 150 USD |

|

ORD-ABC |

BI |

Bill 150 USD |

It is also possible that after the invoice is created in PeopleSoft Billing, additional charges are added to the invoice, either manually or by the Billing Interface. For example, an invoice for 150 USD is created in Billing, but freight charges are added to the invoice for 20 USD. In Billing, if Authorization reversals are enabled, when the card is processed, the Auth for 150 USD will be reversed and a new Auth/Bill transaction for 170 USD will be processed. In this scenario, the history table would be as shown below:

|

Order Number |

Product |

Transaction Amount |

|

ORD-ABC |

OM |

Auth 100 USD |

|

ORD-ABC |

OM |

Auth Reversal 100 USD |

|

ORD-ABC |

OM |

Auth 150 USD |

|

ORD-ABC |

BI |

Auth Reversal 150 USD |

|

ORD-ABC |

BI |

Auth/Bill 170 USD |

Receivables Processes

Receivables Processes

You enter the same basic data for credit card payments, regardless of which PeopleSoft application you are using; the difference is where you enter it.

You can create credit card payments in several different ways:

Use the self-service eBill Payment component.

Use the Credit Card worksheet component.

Click the Pay by Credit Card link on a Receivables inquiry page.

Use credit card batch processing.

The credit card workbench enables you to manage credit card payments that have been created but have not been authorized or settled. You can also use this component to inquire on the transaction history for authorized and settled credit card payments. You do not use this component to create new credit card payments.

Note. After credit card numbers are entered, they are stored in an encrypted format. The encrypted card number does not appear on pages used to enter credit card information. Pages used to review the credit card information, such as the Customer Summary using Quick Customer Create, display the encrypted number.

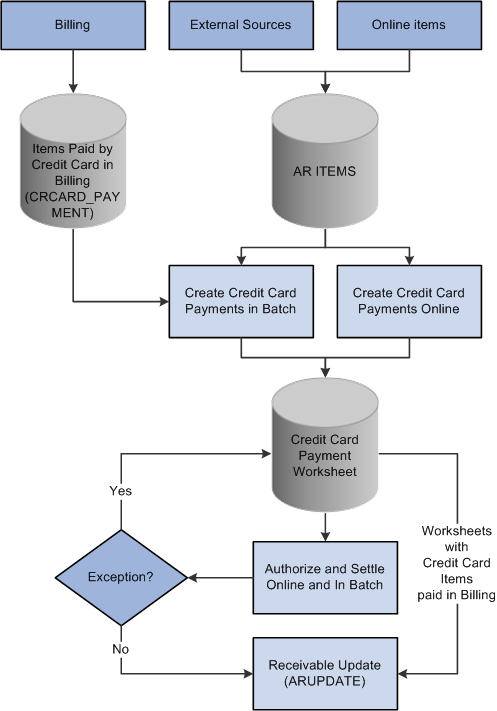

PeopleSoft Receivables Credit Card Process Flow

The following diagram illustrates how the PeopleSoft Credit Card process works in PeopleSoft Receivables:

PeopleSoft Receivables credit card process flow

See Also

Getting Started With PeopleSoft Enterprise Banks Setup and Processing

Defining Additional Processing Options

Security Code/ CVV Process

Security Code/ CVV ProcessCVV is an authentication procedure established to reduce card mishandling during internet transactions. A Security Code field is available on all credit card related pages to prompt for CVV number. A link next to the Security Code field enables the user to get additional information about the CVV number. Click the link to open a secondary page that explains what a security code is and how to find it on a credit card.

The CVV number is not permanently stored in the database. Also, the CVV number is not retained after a particular transaction is authorized or declined. A CVV number needs to be stored temporarily only in special cases, such as during batch processing of authorization transactions in Order Management and Billing. In such a scenario, the CVV number will be temporarily stored and discarded as soon as the batch transaction is processed.

The security code for credit cards needs to be enabled in the Credit Card Options page (Setup Financials/Supply Chain, Common Definitions, Credit Card, Credit Card Options). If the security code field is not enabled, the field will not be displayed on the credit card pages.

|

Enable Security Code |

Select to enable the display of or prompting for the security code value. |

|

Allow Security Codes to be Purged After |

Defines out-of-date security codes and allows them to be automatically purged when a process is run. A value of zero indicates that the security codes will not be purged. |

|

Currency Code |

Enter the currency code to be used for the Authorization Reversal tolerance amounts. |

|

Currency Exchange Rate Type |

Enter the exchange rate type to be used when converting authorization reversal tolerance amounts in comparison to transaction amounts when determining if an Authorization Reversal should be performed. |

|

Enable Authorization Reversals |

Select to enable the use of authorization reversals in Order Management and Billing. Authorization reversals are used when an order amount or an invoice amount is increased and a prior authorization was performed. |

|

Enable Authorization Reversals for Decrements |

Select to enable the use of authorization reversals for changes to a credit card amount. Authorization Reversals for decrements are used in PeopleSoft Order Management when an order amount is decreased after a credit card authorization is performed. |

|

Process Auth Reversals for Amounts Greater Than |

Enter a tolerance amount to be used when determining if an authorization reversal should be performed or not. This value prevents the system from processing reversals for minor amounts. |

|

Process Authorization Reversals for Decrements Greater Than |

Enter a minimum value below which Authorization Reversals are not performed. This value prevents the system from processing minor decrements. |

Common Elements Used in This Chapter

Common Elements Used in This Chapter

Prerequisites

Prerequisites

Before you begin accepting credit card charges from customers, you must set up this information:

The types of credit cards (Visa, Master Card, and so on) that you will accept for payment. Use the Credit Card Type page (Enterprise Components, Component Configurations, Credit Card Interface, Credit Card Type).

Credit card options (Set Up Financials/Supply Chain, Common Definitions, Credit Cards, Credit Card Options) and in PeopleSoft Order Management, if applicable.

An integration with a third party credit card processor.

Processing Credit Cards for Authorization

Only

Processing Credit Cards for Authorization

Only

This section discusses how to:

Enter credit card data and authorize credit card transactions online.

Submit credit card charges for background authorization only processing.

Change processing parameters for pending transactions.

Review and reauthorize pending credit card transactions.

Processing Replacement Orders created from a Returned Material Authorization

Replacement sales orders created from a sales order that is selected from the Customer Shipment History page will inherit credit card data from the original sales order or invoice. If the return has no sales order history and the replacement order has a Credit Card payment type, then the replacement sales order is created with default credit card information from the Credit Card Data page of the contact.

See Populating RMA Lines From the Shipment History.

See Using the Bill-By Identifier with the Billing Interface.

Pages Used to Process Credit Cards for Authorization

Only

Pages Used to Process Credit Cards for Authorization

Only

Entering Credit Card Data and Authorizing

Credit Card Transactions Online

Entering Credit Card Data and Authorizing

Credit Card Transactions Online

Access the Credit Card Data page (select the Credit Card payment method and then click the Credit Card Data link on the Order Entry Form page).

When modifying credit card information, note that:

The primary credit card information is the default information stored on the Contact Additional Info page. This page validates the credit card number and verifies that the required information is entered.

If you are using the credit card number validation set up on the Credit Card Type page, the system checks the length and prefix of the credit card number and performs a digit check to ensure that the credit card number is valid. The Valid Credit Card table stores the information for credit card number validations. If the credit card number passes validation, the order is submitted for processing. Otherwise, an error message appears requiring you to enter the credit card information again. You can change the credit card information, change the payment method, or cancel the order. Once the system validates the information, you can save and create the order in the PeopleSoft system.

Credit cards can be authorized online or in the background, depending on how you set up the PeopleSoft Order Management Business Unit definition. If you selected:

Online authorizations on the Order Entry Features page, click the Authorize Credit Card link to authorize the credit card during online entry. If the authorization fails, the customer service representative (CSR) can enter another credit card or change the payment terms.

Credit Card Hold on the Credit Processing page, the order is placed on hold until the credit card can be authorized by the CC Processing process (OM_CRC000).

Modify the credit card information on the Credit Card Data page; enter the required values for:

Note. Manual authorizations are not allowed in PeopleSoft Order Management. If you copy a sales order that was paid with a credit card, the Payment Type is copied but you need to select or enter new credit card information on this page.

See Also

Adding General Customer Information

Establishing Order Entry Features

Implementing PeopleSoft Order Management Options

Maintaining Order Header and Line Information

Processing Credit Cards in PeopleSoft Billing

Submitting Credit Card Charges for Background

Authorization Only Processing

Submitting Credit Card Charges for Background

Authorization Only Processing

When submitting credit card charges for third-party authorization and processing:

Access the Load Credit Card Interface page to initiate the Load CC Interface process.

This process loads the credit card information from the ORD_HEADER table and address information from the CUST_ADDRESS table into the INTFC_CRCARD, the main staging table for the credit card authorization interface program to the third-party credit card authorization and payment application.

Access the Credit Card Processing page to initiate the Credit Card Processing process.

The Credit Card Processing process takes the credit card information from the INTFC_CRCARD staging table and calls the Process Credit Card process. It also removes the hold that was applied when the order was created, assuming you have set up the PeopleSoft Order Management Business Unit to do that.

If reauthorization of stale transactions is enabled on the OM installation record, then a corresponding check box is appears on the Credit Card Processing page. You should schedule this process to run at least once per day with this check box selected on the run control.

Note. The Enable Authorization Reversals for Decrements option needs to be selected in the Installation Options for authorization reversals for decrements. The batch process will handle the reversals if necessary.

If purging of security codes is enabled on the installation record (indicated by a value greater than zero), then a Purge Security Codes check box appears on the Credit Card Processing page. The user should schedule this process to run at least once per day with All Business Units selected.

Changing Processing Parameters for Pending

Transactions

Changing Processing Parameters for Pending

Transactions

Access the Credit Status page (click the Credit Status link on the Pending CC Trans page). Select an option in the Actions group box to intercede in credit card processing:

|

Sets the authorization status to Unproc/Ret. You can reauthorize the same credit card or enter a different credit card number. The CC Processing process picks up the transaction the next time you run the process and resubmits the credit card amount for batch authorization. If using online authorization, you can click the Authorize Credit Card link to reauthorize the failed transaction. |

|

|

Removes the transaction from credit card processing. You can change the payment method from credit card to payment terms. Once you change the order to payment terms, the system checks the credit limit and Receivables balance before the order is released. |

|

|

The credit card amount for the order will not be reauthorized. The order must be canceled on the Order Entry Form page. |

See Also

Processing Credit Cards for Authorization Only

Reviewing and Reauthorizing Pending Credit

Card Transactions

Reviewing and Reauthorizing Pending Credit

Card Transactions

Access the Review Pending Transactions page (Billing, Generate Invoices, Process Credit Cards, Review Pending Transactions).

Use this page to:

Reauthorize credit card transactions, if using online authorization.

Review failed credit card transactions.

If the credit card authorization fails, the Process Credit Card Invoices process updates the CRCARD_HST table, and the entry remains in the INTFC_CRCARD staging table.

Note. Only errors found during a transmission are written to the history table. If the Process Credit Card Invoices process detects a data error before transmission, no processing transmission is attempted for this transaction and no log is created in the history table. Errors returned by a third-party credit card authorization and payment application are indicated by ICS in the return message. Failed credit card transaction messages that do not contain the ICS identifier indicate that the record was not transmitted because the system found data errors before transmission.

Review the authorization codes.

Transactions Tab

|

Actions |

The available options are: Change to Terms, Manual Charge, No Action, and Re-process. |

|

Auth Status(authorization status) |

Display the Authorization Status. |

|

Order Number |

Click the order numbers to display the Review Order Summary. |

|

Process All Pending Actions |

Click the button to initiate the order management credit card background process. Note. The Process All Pending Actions button saves the worksheet values and submits all worksheet rows except those with a Pending Action of None to the background process for authorization, cancellation, or a change to the terms payment method. |

|

Edit |

Click the Edit button on the worksheet to display a single page showing all three tabs in the Review Pending Transactions page as three group boxes. |

Card Information Tab

|

Card Type |

Displays the credit card type. |

|

Expiration Month |

Displays the credit card month of expiry. |

|

Expiration Year |

Displays the credit card year of expiry. |

Contact Information Tab and Messages Tab

|

Telephone |

Displays the telephone number. |

|

|

Displays the email ID. |

Processing Credit Cards for Immediate Payment

Processing Credit Cards for Immediate Payment

This section lists the page used to process credit cards for immediate payment of a sales order.

Page Used to Process Credit Cards for Immediate Payment

Page Used to Process Credit Cards for Immediate Payment

|

Page Name |

Definition Name |

Navigation |

Usage |

|

Additional Information - Card |

CDR_CARD_DATA |

Click the Additional Information link on the Record Payment page of the sales order. |

Record credit card data and process for immediate payment. See Entering Payments for Credit, Debit, and Procurement Cards. |

Processing Credits of Deposit Refunds

Processing Credits of Deposit Refunds

This section lists the page used to process credits of deposit refunds for a sales order.

Page Used to Credit Deposits

Page Used to Credit Deposits

|

Page Name |

Definition Name |

Navigation |

Usage |

|

Customer Deposits |

CUST_DEPOSIT |

Order Management, Quotes and Orders, Review Customer Information, Customer Deposits |

View and refund deposits. |

Processing Credit Cards in PeopleSoft Billing

Processing Credit Cards in PeopleSoft Billing

This section discusses how to:

Enter credit card data.

Submit credit card charges.

Review pending credit card transactions.

Change processing parameters for pending transactions.

View credit card transaction history.

Pages Used to Process Credit Cards in PeopleSoft

Billing

Pages Used to Process Credit Cards in PeopleSoft

Billing

Entering Credit Card Data

Entering Credit Card Data

When you enter a contact on a bill with a payment method of credit card on the Header Info 1 page, the system reads the customer's default payment method based on the bill-to customer ID. If the default payment method is credit card, the system marks this bill for credit card processing. If you do not want this bill charged to a credit card, change the payment method to a value other than credit card.

Access the Header Info 1 - Credit Card Information page and enter values for all required fields.

|

Click to access the Credit Card Address page to enter or edit customer credit card address information. |

|

|

Credit Card History |

Click to access the Credit Card History page to view the credit card history. |

See Also

Entering Bill Header Information

Submitting Credit Card Charges

Submitting Credit Card Charges

When submitting credit card charges for third-party authorization and processing:

Run the Pre-Process and Finalization process (BIIVC000).

The Pay Method field on the Standard Billing - Header - Info 1 page flags the invoice for credit card processing by the Bill Finalization process. This process changes the invoice status of credit card bills to FNL (final) and populates the INTFC_CRCARD table.

Run the Process Credit Card Invoices process (BICRC000). This process:

Picks up credit card bills with an authorization status of:

Unproc/Retry (unprocessed/retry) in INTFC_CRCARD and sends them to a third-party credit card authorization and payment application for credit card authorization or billing, as needed.

Manual Authorization and Change to Terms. For transactions in this status, the process will remove the pending transaction from INTFC_CRCARD, update BI_HDR_CRCARD, and insert a record into the credit card history table. For manual authorizations, BICRC000 inserts a record into the CRCARD_PAYMENT table.

Writes a record to the Credit Card Transaction History table (CRCARD_HST) for each transaction it passes to a third-party credit card authorization and payment application.

Checks the history table for an existing valid credit card authorization for the invoice. If the credit card authorization has expired or does not exist, the program authorizes and bills the credit card at the same time. If authorization reversals are enabled and the program finds an existing authorization that cannot be used, it will issue an authorization reversal to clear the authorization of the card. It will then issue a new authorization and bill for the transaction.

Updates records in INTFC_CRCARD for credit card payments that are denied for any reason.

If authorization is successful, the process:

Updates BI_HDR_CRCARD with the relevant information.

Removes the record from INTFC_CRCARD.

Inserts records into the CRCARD_PAYMENT table.

Changes the invoice status from FNL to IVC in the BI_HDR table.

Resume the PeopleSoft Billing business process flow of printing, currency conversion, pre-load, load to Receivables, and load to General Ledger for the invoice.

Note. For partial shipments, the first shipment is authorized at order entry. It can be billed without doing another authorization in PeopleSoft Billing as long as the authorized amount is greater than or equal to the billed amount. The second shipment requires another authorization for the amount of the second shipment.

See Also

Running the Pro Forma, Finalization, Print, and Reprint Processes

Entering Bill Header Information

Reviewing Pending Credit Card Transactions

Reviewing Pending Credit Card Transactions

Pending credit card transactions are created by the Pre-Process and Finalization process (BIIVC000) when you finalize credit card bills. The system sets the bill status of these transactions to FNL (final).

Access the Review Pending Transactions page to review the status of failed or pending credit card transactions (Billing, Generate Invoices, Process Credit Cards, Review Pending Transactions).

|

Click to access the Edit Credit Card page, where you can modify customer credit card information, enter credit card address information and change the authorization status of a transaction. |

|

|

Resets the status of selected transactions to the new status that you specify. |

Changing Processing Parameters for Pending

Transactions

Changing Processing Parameters for Pending

Transactions

You can change the processing parameters for pending transactions by changing the Action field in the grid of the Pending Transactions page. You can opt to change the action one transaction at a time, or in a mass update of selected rows in the grid. Use the Change Action To drop down field to select a new status to assign to selected row, then click on the Apply button to have the new status reflected in the grid.

Use the Edit button to bring up the Edit Credit Card page to update the credit card information.

Change the Action status as appropriate depending on the processing needed for a transaction. The Action status can be changed as described below:

|

Sets the authorization status to Unproc/Ret (unprocessed/retry). The Process Credit Card Invoices application engine process (BICRC000) picks up the transaction the next time you run the process and resubmits the credit card amount for authorization. |

|

|

Sets the authorization status to Man Appr (manual approval). You must enter an authorization code in the CrCdAuthCd field. Use this option for those instances when you obtain verbal authorization for a credit card charge. The Process Credit Card Invoices application engine process (BICRC000) picks up the transaction the next time you run the process, but it makes no call to the third-party processor. |

|

|

Removes the transaction from credit card processing. Select this option to change the payment method from credit card to payment terms. |

|

|

No Action |

Sets the authorization status to No Action. The Process Credit Card Invoices application engine process (BICRC000) will not pick up the transaction when the process is run. Instead it will leave the transaction in the pending table for processing later. |

Note. If you authorize the card manually or you change the invoice to terms to remove the transaction from further credit card processing, you still need to run BICRC000 to process the transaction.

Viewing Credit Card Transaction History

Viewing Credit Card Transaction History

Access the Review Transaction History page (Billing, Generate Invoices, Process Credit Cards, Review Transaction History).

If you obtained a manual authorization, the approval code you entered on the Review Pending Cred Card Trans - Credit Card Address page appears.

Processing Credit Cards in PeopleSoft Receivables

Processing Credit Cards in PeopleSoft Receivables

This section discusses how to:

Create credit card payments using item inquiries.

Create credit card payments using the Credit Card worksheet.

Create credit card payments in batch.

See Also

Changing Discount, Payment, and Draft Options and Customer Relationship Information

Pages Used to Process Credit Cards in PeopleSoft

Receivables

Pages Used to Process Credit Cards in PeopleSoft

Receivables

Creating Credit Card Payments Using Item Inquiries

Creating Credit Card Payments Using Item Inquiries

You can create credit card payments on any of the following Receivables inquiry pages:

Account Overview - Balances page

Item List page

View/Update Item Details - Detail 1 page

Use any of these inquiry pages to access the Credit Card Details page (click the Pay Balances by Credit Card link on the Account Overview - Balances page).

You can maintain credit card information on the Credit Card Details page and settle the payment immediately or settle the payment in a batch process.

For the credit card data to be authorized, you must enter data in all the fields required by the third-party authorizing authority.

Note. If you access this page from a Receivables inquiry page, the system displays a warning at the top of the page. If you want to leave the Credit Card Detail page without saving or processing the credit card transaction, you must use the indicated link to cancel the transaction. Leaving the page using another method, such as clicking the back button on your browser, creates a credit card worksheet based on the items you indicated on the inquiry page.

Access the Credit Card Details page (click the Pay Balances by Credit Card link on the Account Overview - Balances page).

|

Credit Card Action |

Select the settlement action for this credit card transaction. The values are: No Action: The system does not perform any settlement action on this transaction. Authorize and Settle Now:The system obtains an approval for the credit card transaction from the third-party authorizing authority and charges the amount of this transaction to the specified credit card. Authorize and Settle Later: The system processes the credit card transaction the next time the Credit Card Processor multiprocess job (ARCRCARD) is run. Manually Approved/Settled: The credit card payment has been processed outside of the PeopleSoft system. You can optionally enter the authorization code. This option is called a Manual Charge in Billing. Cancel Settlement Request: The settlement request is cancelled. The history is retained for this transaction but the status of the transaction is set to No Action. |

|

Authorization Code |

Displays the authorization code for the transaction. You can enter an authorization code if the Credit Card Action is Manually Approved and Settled. If the transaction has been settled through a third-party authorizing authority, the system populates Authorization Code field. |

|

Credit Card Message 1, Credit Card Message 2, and Credit Card Message 3 |

Displays any processing messages. A message with a prefix of ICS indicates that the message is from a third-party credit card authorization and payment application. |

|

Clear Credit Card Data |

Click to clear the credit card information on the page |

See Also

Creating Credit Card Payments Using Item Inquiries

Changing Discount, Payment, and Draft Options and Customer Relationship Information

Creating Credit Card Payments Using the Credit Card Worksheet

Creating Credit Card Payments Using the Credit Card Worksheet

Credit card worksheets enable you to select existing Receivables items and pay them by credit card. Credit card worksheets are created during credit card batch processing, when items are paid by credit card from inquiries, and when they are built directly through the credit card worksheet pages.

Important! If you click the Cancel button on the Credit Card Detail page or if credit card batch processing creates payments that are not authorized, the system still creates credit card worksheets for the selected items. If you do not create a credit card payment or delete these worksheets, the amount owed on the selected items may not be collected.

Credit card worksheets populate the same tables as payment worksheets.

The credit card worksheet components behave differently depending on whether or not the credit card payment has been authorized and settled. Before settlement, use the credit card worksheet to select items that make up the amount to be authorized and settled. After the credit card payment has been settled, unposting the payment enables you to use the credit card worksheet to apply the payment to items in the same way you would use a payment worksheet.

Working with a credit card worksheet consists of these high-level steps:

Use the Credit Card Worksheet Selection page to select the items that you want to work with and build the worksheet.

If you add items to an existing worksheet, the system adds the new items that you selected and does not delete any selected items that are already on the worksheet.

Use the Credit Card Worksheet Application page to select items to pay by credit card.

To use the credit card worksheet, follow these high-level steps:

Use the item display or sort controls to adjust the view.

Select the items to pay.

Handle underpayments and discounts.

Overpayments are not allowed on credit card worksheets that have not been authorized and settled.

Check the information in the Credit Card Payment group box to verify the amount of the credit card payment based on the selected items.

Use the Credit Card Worksheet Action page to select a posting action for the worksheet or to create accounting entries online.

You can also delete the worksheet, that is, remove the items from the worksheet, or you can save your work and complete the worksheet later.

The Delete Worksheet button behaves in two ways. If the credit card payment has not been authorized and settled, clicking the Delete Worksheet button deletes the entire payment. If the credit card payment has been settled, clicking the Delete Worksheet button removes the items from the worksheet.

See Also

Creating Credit Card Payments Using the Credit Card Worksheet

Applying Payments Using Payment Worksheets

Creating Credit Card Payments in Batch

Creating Credit Card Payments in Batch

The Credit Card Processor multiprocess job (ARCRCARD) enables you to create credit card worksheets and settle credit card transactions automatically. The worksheet creation phase selects open items that are due with a payment method of credit card and builds credit card worksheets. A credit card profile is applied to limit the selection of open items and to apply rules for building and approving the worksheets. The authorization and settlement phase of the AR Credit Card process selects credit card worksheets that are ready for settlement.

Access the Credit Card Scheduler page (Accounts Receivable, Credit Cards, Process Credit Cards).

|

From Due Date |

Specify the beginning due date to use when the Credit Card Processor selects items. |

|

Increment Due Dates By |

Enter the amount of time to increment the From Due Date and the To Due Date fields. Enter the numerical value and the time scale in days, weeks, or months that you want the due dates to change. These values are used when you click the Increment Now button or select the Automatic Increment Dates check box. |

|

Increment Now |

Click to increment the From Due Date and To Due Date based on the Increment Due Dates By fields. |

|

To Due Date |

Specify the last due date to use when the Credit Card Processor selects items. |

|

Automatic Increment Dates |

Select this check box so that the From Due Date and To Due Date fields automatically increment each time you run the Credit Card Processor. This functionality enables you to reuse a run control without having to change the dates. |

|

Deposit Unit |

Enter the deposit business unit. This value controls the bank account from which the credit card payment is made. The system processes each specified deposit unit separately. |

|

Create Credit Card Worksheets |

Select this check box to create credit card worksheets for the selected deposit business unit. Credit card worksheets are created from items that have a credit card payment method and a due date that falls within the specified range of due dates. The process selects all items in the selected business units that have the payment method set to credit card, as well as any items in the business unit that have originated in Billing and been paid by credit card. |

|

Authorize and Settle Worksheets |

Select this check box to enable credit card authorization and settlement for the specified deposit business unit. All credit card worksheets in the defined deposit business unit that have a credit card authorization status of Unprocessed/Retry are selected. |