22 Balance Sheet Lessee Accounting (Release 9.1 Update)

This chapter discusses:

-

Section 22.1, "Understanding Balance Sheet Lessee Accounting"

-

Section 22.2, "Setting Up Balance Sheet Lessee Accounting Processing"

-

Section 22.3, "Processing Lease Commencement for Balance Sheet Lessee Accounting"

-

Section 22.4, "Processing Monthly Balance Sheet Lessee Accounting Journal Entries"

-

Section 22.5, "Changing Lease Terms After Schedule Creation"

-

Section 22.6, "Creating Alternate Ledger Journal Entries for Lessee Leases"

22.1 Understanding Balance Sheet Lessee Accounting

Current accounting standards for the lessees of property and non-property assets require that the leased asset might need to be accounted for on the company's balance sheet. These leased assets must be included on the balance sheet, and organizations must recognize the assets and the liabilities associated with the lease. These assets are called Right of Use (ROU) assets.

To accommodate these accounting standards, the JD Edwards EnterpriseOne Real Estate Management system includes features that enable users to:

-

Set up default lessee accounting values in the Real Estate Management constants. You can also use the constants to activate balance sheet lessee accounting once setup is complete.

-

Set up AAIs for balance sheet lessee accounting.

-

Set up lessee accounting information for bill codes to define their impact on lease liability and ROU asset calculations. You can then define recurring or manual billing information for the lease using these bill codes.

-

Manually or automatically create asset records for property units that will be included on a lessee lease.

-

Manually create asset records in the Fixed Asset system for non-property assets.

-

Create a lessee lease that includes property and non-property assets. Each leased asset on the lease references an asset in the Fixed Assets system.

-

Define lessee accounting information for the lease and the individual assets on the lease.

-

Process lease commencement activities, which includes:

-

Creating lease liability and ROU asset amortization schedules for leased assets.

The schedules are used when creating lease commencement journal entries, and during each calendar month to calculate lease liability and ROU asset journal entries. The values in the schedules are based on the lease term, borrowing rate, and the manual and recurring billing information.

-

Generating the appropriate lease commencement journal entries for the leased assets when the lease begins.

You can then review, approve, and post the journal entries.

-

-

Process monthly lessee accounting calculations to adjust the lease liability and ROU asset accounts associated with the leased assets.

You can then review, approve, and post the journal entries.

-

Easily identify when monthly accounting entries are overdue for processing.

Figure 22-1 Balance Sheet Lessee Accounting Process Overview

Description of ''Figure 22-1 Balance Sheet Lessee Accounting Process Overview''

Lease Simplification for Lessee Accounting

Numerous customized user defined objects (UDOs) have been created to help simplify lease entry and maintenance for lessee leases. These UDOs include:

-

Grid formats

-

Form layouts

-

Personal forms

-

Cafe One layouts

-

Watchlists

-

Advanced queries

A complete list can be found on the Lease Management page on LearnJDE.com.

Additional Resources for Lessee Accounting

|

> Additional Information on LearnJDE: Visit the Lease Management page on LearnJDE.com, where you can view additional information such as quick tours, video tutorials, learning paths, sample files for data import, and FAQ documents to assist you with the balance sheet lessee accounting features. |

22.2 Setting Up Balance Sheet Lessee Accounting Processing

Before you can process balance sheet lessee accounting information, you must ensure that the following tasks have been completed:

-

Define depreciation defaults.

Depreciation default accounts must be defined in the Depreciation Defaults program (P12002) for the company, object, and subsidiary combination for the asset account. Assets that are processed using lessee accounting must have Ledger Type = AA and Depreciation Method = 00 (no depreciation). The computation method is also required.

See Understanding Depreciation Default Values for additional information.

-

Accounts

Set up the accounts to support lessee accounting. The asset account used for leased assets. must exist in the Account Master table (F0901).

The Right of Use Asset accounts need to be in the FC range of AAIs, and the Accumulated Amortization accounts need to be in the FD range of accounts. Both accounts must be in the FX range of AAIs as well. This is required for the Asset Disposal process to work properly when your lease ends and you no longer have the asset.

See Setting Up Accounts for more information.

-

Set up Real Estate Management Constants.

The Real Estate Management Constants program (P1510) has been updated to enable you to set default values for the following lessee accounting options:

-

Lease Classification

-

Reasonably Certain to Exercise Option

-

Generate Unit Asset

-

Activate Balance Sheet Accounting

-

Populate Subledger

You can define the Lease Classification and Reasonably Certain to Exercise option values for Company 00000. You can define the Generate Unit Asset value for buildings and individual companies. When you create a lease, the system uses the default values from the constants on the lease. You can override the Lease Classification and Reasonably Certain to Exercise Option values on the lease.

If the Generate Unit Asset option is selected, the system will automatically create an asset record for the unit if the Unit Asset Number field is blank in the Unit Master. That asset number is then populated in the Unit Asset Number field on the Unit Master record (F1507).

Note: Balance sheet lessee accounting uses the value in the Unit Asset Number field to identify leased property assets. Therefore, when viewing asset information on leases, you will see the Unit Asset Number field populated for property assets, and the Asset Number field populated for non-property assets.

Finally, once your setup is complete, you can activate balance sheet lessee accounting.

See Section 2.1, "Setting Up Constants" for additional information.

-

-

Set up AAIs for lessee accounting.

Several new AAIs have been created to use when creating journal entries associated with lessee accounting.

See Section 2.3, "Setting Up Automatic Accounting Instructions" for additional information.

-

Set up bill codes.

When you set up bill code records, you can specify how those records will impact balance sheet lessee accounting processing. You can define the effect a bill code will have on the lease liability calculation, and on the ROU asset calculation. These values, once added to either manual or recurring billing setup on a lease, are used when calculating the amortization schedules and journal entries for a leased asset.

See Section 2.4, "Setting Up Bill Codes and Adjustment Reason Codes" for additional information.

-

Set up units and create associated unit asset records. (property assets only)

When you want to include property assets on a lease that will be included in the balance sheet lessee accounting process, you must create a unit and then associate each property unit with a unique asset number. The system has been updated to enable users to associate an asset with the unit master using these methods:

-

Manually enter an existing asset number in the Unit Asset Number field in the Unit Master record when you create the unit.

-

Set up the Real Estate Management Constants to automatically create the asset record for you if you leave the Unit Asset Number field blank when you add new unit records.

-

Use the Create Asset row menu option from the Work With Units form to create the asset and update the Unit Asset Number field.

-

Run the Create Assets from Unit Master Entries program (R15072) to create asset records and update The Unit Asset Number field for selected unit records.

See Section 3.4, "Setting Up Unit Information" for additional information.

-

-

Set up asset records for non-property assets in the Fixed Asset system, or create them during lease entry using the Create Non-Property Asset icon.

See Creating Asset Identification Information in the JD Edwards EnterpriseOne Applications Fixed Assets Implementation Guide or Section 4.2.5, "Understanding Lessee Lease Entry for Balance Sheet Accounting (Release 9.1 Update)".

|

Note: A new menu, Fixed Asset Setup (G15416), was added to the Real Estate Management system to enable users to easily access the Fixed Asset programs they will use to set up leased assets. |

After you have set up the system to use balance sheet lessee accounting, you can create leases that include leased property and non-property assets. You can update information about the leased assets, and set up manual and recurring billing information. Once you have entered all of the information needed to process the lease, you can then set the Lease Liability status for each asset line on the lease to 10 (Lease Terms Complete), which signifies that the line is ready for the lease commencement process.

See these topics for additional information about entering leases and setting up manual and recurring billing information:

22.3 Processing Lease Commencement for Balance Sheet Lessee Accounting

Once the lease terms are complete, you can then set the Lease Liability status for each asset line on the lease to 10 (Lease Terms Complete), which signifies that the line is ready for the lease commencement process. The lease commencement process includes:

-

Creating the lease liability and ROU asset amortization schedules for the assets that you want to process.

Amortization schedules show you the monetary amounts associated with each month of the lease term. The lease commencement date can be defined on each asset on the lease, or the system calculates the lease commencement date by determining when the recurring billing starts for the asset. Note that the lease commencement start date cannot be greater than the recurring billing start date.

If the payment method is In Advance, the lease commencement date is displayed in amortization schedule line 0 (zero). If the payment method is In Arrears, there is no date in line zero of the schedule. Line 0 (zero) includes the beginning balance, and no calculations are done in line 0. Amortization schedule line 1 uses the lease commencement date (whether entered on the lease, or calculated using recurring billing) as the begin date. Each subsequent line uses the first day of the month as the begin date.

Additionally, if you enter an ROUA End Date on the lease, the system uses this date to determine how many periods to create in the ROU asset schedule, and uses the recurring billing end date to determine how many periods to create for the lease liability schedule. If the ROUA End Date is greater than the recurring billing end date, it is possible that your ROU asset amortization schedule includes a greater number of periods than the lease liability amortization schedule.

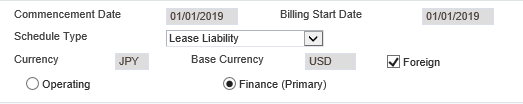

If you have a multicurrency lease, the amortization schedules are created in the currency of the lease. When reviewing the amortization schedules, the full schedule is shown as the foreign schedule. The domestic schedule is created as each month's transaction is created.

-

Generating lease commencement journal entries for those assets.

After schedules are created, you can generate lease commencement journals to debit the ROU asset account, and credit the lease liability account. The system uses the beginning balance from the lease liability amortization schedule for these journal entries.

Amortization schedules must be created before you can generate lease commencement journal entries. Depending on your business process, you can either create the schedules in one step, and then generate journal entries in a separate step, or you can process both steps at the same time.

You can create amortization schedules and generate journal entries using these programs:

-

Lease Information program (P1501)

You can use row exits to process lease commencement tasks by selected lease, or by selected asset.

-

Lease Commencement program (R15170)

Use this program to complete these tasks for a batch of leases or assets. You can set the processing options to create only the schedules, create only the journal entries, or to complete both steps in a single run.

-

Work With Amortization Schedules program (P15171)

You can create schedules and then generate commencement journal entries for selected assets.

If the schedules are created successfully, the system then updates the Lease Liability Status to 20 (Amortization Schedule Created) for each line on the lease for which amortization schedules were successfully created. If it does not complete successfully, the system either issues a pop-up error telling you that the schedules did not complete (if you are generating schedules interactively), or updates the status to 05 (Lease Terms Incomplete) if you are using the R15170 to create the schedules.

|

Note: If you are using the R15170 to create schedules and journal entries at the same time, the system first attempts to create the schedule. If it is successful, the status is updated to 20. If it is not, the status is updated to 05. The system then attempts to create journal entries for those assets at status 20.Review the Messages column on the report generated by the R15170 to determine if the lease commencement processes completed successfully for each included asset. Additionally, you can set up the R15170 to require the amortization schedules to be reviewed before lease commencement journal entries are processed. If you set up the program to require review, you cannot process both tasks at the same time. You must generate schedules, review them, and then manually change the status to 30 (Amortization Review Complete). You can then generate lease commencement journal entries. |

If there are issues with a schedule, you can delete the schedules for a selected lease and asset, update the lease terms, and then regenerate the schedule. When you delete schedules, the system deletes the associated records from the F1517, and updates the Lease Liability Status for the associated line on the lease to 10 (Lease Terms Complete). You can then make any necessary changes and regenerate the amortization schedules.

Alternatively, if you need to make changes to the lease terms after the schedule is created, you can use the change lease terms feature, and remeasure the lease as necessary. See Section 22.5, "Changing Lease Terms After Schedule Creation" for additional information.

If you want to review the schedules before generating commencement journal entries, you can use the Work With Amortization Schedules program (P15171) to complete your review. When you access the Work With Amortization Schedules form, the system displays all lessee accounting assets that have an Operating or Finance lease classification. You can narrow the number of records the system displays by using a query, specifying a lease classification status, or by selecting one of these options:

-

Display All Assets

-

Display Assets With Schedules

-

Display Assets Without Schedules

-

Display Assets With Alternate Schedules

-

Display Assets Without Alternate Schedules

Understanding Amortization Schedule Calculations

This section provides details on how the system calculates the present value of lease payments (PVLP) and the other amounts on the amortization schedules.

PVLP Calculation

This is the equation for calculating PVLP:

PVLP = p/(1+r)^n, where:

-

p: Monthly payment from recurring billing, adjusted for billing frequency.

Recurring lease payments are defined in recurring billing.

-

r: Monthly interest rate.

This is the lease borrowing rate divided by 12.

-

n: Monthly payment number.

This value increments each month. In the first month, the value is 1. In the second month, the value is 2, and so on.

The system performs this calculation for each month of the lease term, and totals the amounts to get PVLP. The number of payments in the lease term is the number of months from the begin date through the ending date in recurring billing.

Note that if you are generating payments in advance, the system does not use this formula to calculate PVLP for the first period of the amortization schedule. In this case, PVLP during the first period is equal to p, the monthly payment from recurring billing, adjusted for billing frequency, since no interest is calculated during the first period. All other periods use the formula.

ROUA Calculation

This is the calculation for the right of use asset (ROUA):

ROUA = PVLP + lp + idc + li, where:

-

lp: Lease payments made to the lessor at or before lease commencement.

-

idc: Initial direct costs

-

li: Lease incentives

Lease payments, initial direct costs, and lease incentives are defined in manual billing.

ROUA Expense Calculation

The calculation for ROUA expense differs, depending on the type of lease.

-

Operating Lease ROUA Expense Calculation:

topp / nom, where:-

topp: Total amount of all payments, which include future recurring billing payments and current manual billing payments for initial lease payment, initial direct cost, lease incentives.

-

nom: Number of months, which is determined from lease commencement date through the ROUA ending date, which could be greater than the recurring billing ending date.

-

-

Finance Lease ROUA Expense Calculation:

ROUA / nom

In addition to these standard calculations, there are other scenarios that can impact the calculations, and the amounts and information on the amortization schedule. These include:

-

Remaining Balance Adjustment Limits

When creating amortization schedules, the system makes slight rounding adjustments (if needed) on each monthly calculation to ensure that the journal entries for that month balance correctly.

Due to these small rounding amounts, it is common to end up with one of these scenarios occurring on the last line of the schedule:

-

If no GRV billing record exists for the asset, you might end up with a small remainder on the last line of both the lease liability and ROU asset schedules. For example, you might end up with a remaining balance of $2.58 USD.

-

If there is a GRV billing record set up for the asset, you might end up with a small remainder on the lease liability schedule, and a small remainder plus the amount of the GRV billing record on the ROU asset schedule. For example, if the GRV amount is $15,000, you might end up with a remaining balance of $2.58 on the lease liability schedule, and $15, 002.58 on the ROU asset schedule.

A processing option on the R15170 controls how the system handles these amounts. You can define an acceptable adjustment limit, and have the system automatically adjust remaining balances in the last record of the amortization schedules if they fall within the acceptable limit.

If the absolute value of the remaining balance (less any GRV amount on an ROU asset schedule) is within the specified limit, the system adds the remaining lease liability balance to the interest amount on a lease liability amortization schedule, and adds the remaining right of use asset balance to the ROUA expense on an ROUA amortization schedule to ensure the remaining balance is zero on the lease liability schedule, and only the GRV amount (if one exists) on the ROU asset schedule. For example, if you enter 5.00 in this option, and the remaining balance is equal to, or within the range of -5.00 to 5.00, the system automatically adjusts the balance.

If the remaining balance is outside of the defined limit, the system leaves the remaining balance as is. You can also leave the processing option blank if you do not want the system to make automatic adjustments.

If you do not choose to automatically adjust the remaining balance, or that balance falls outside of the defined limit, at the end of a lease term you can manually create journal entries to clear the remaining lease liability and ROUA balances.

You can also define the adjustment limit and whether you want the system to automatically create the adjustment journal entries in the processing options of the R15180. The system then uses that information, along with the accounts for L4 and L5 AAIs, when generating journal entries for the final line on the amortization schedule.

-

-

Free Rent

If your lease begins with a period of free rent, you can enter a date in the Lease Commencement Date on the lease detail for that asset. The period between the lease commencement date, and when recurring billing for that asset begins, is the period of free rent. When the system generates the amortization schedules, the Free Rent Included message appears at the top of the schedule to notify you that your setup for this asset includes a period of free rent.

For example, if you begin your lease on January 1, and you are given 3 months of free rent, you would enter January 1 in the Lease Commencement Date for that asset on the lease. Your recurring billing start date would then be April 1. The amortization schedule would begin on January 1, but no payment is displayed until April.

Note:

If you are paying rent in arrears, (Payment Method is set to In Arrears), the amortization schedule includes the payment in the schedule periods covered by the payment. For example, if billing is quarterly in arrears, and the recurring billing start date is entered as April, February and March are included and a full payment for the quarter is displayed in April. There may be periods at the end of the schedule that are blank, however, these periods are not considered free rent. -

Fixed Stepped Payments

In some leases, the payment amount changes as the lease progresses. For example, the monthly lease amount in year 1 is 10,000, the amount in year 2 is 11,000, and year 3 is 12,000. In these cases, the actual payment amount is reflected on the amortization schedule, and will show the amounts for each month of the 3-year lease term, meaning months in year 1 of the lease will show a 10,000 payment, year 2 will show 11,000 payments, and year 3 will show 12,000 payments. The stepped payments are set up in recurring billing.

Note that each set of payments for each step can have a different billing frequency. For example, in year one, you might pay monthly, but in year 2 and 3, you might pay quarterly.

Also, when using payment steps, any period of the schedule can be based on prorated amounts. This occurs when the recurring billing start date is not the first day of the month or the end date is not the last day of the month. The system prorates the amounts based on the monthly amount for each step and then accumulates the amounts from both steps.

See Section 7.3.3, "Understanding Recurring Billing for Balance Sheet Lessee Accounting (Release 9.1 Update)" for additional information.

-

Suspending Recurring Billing Lines

See Section 22.5, "Changing Lease Terms After Schedule Creation" for additional information about remeasuring a lease.

Processing a Multicurrency Lease

Multicurrency leases are contracts in which assets are leased to a company with a currency that is different from the lessor's currency. A US company leasing equipment from a Canadian company is an example of a multicurrency lease. The financial reporting for the lease will be done in the US dollar whereas the lease payments will be made in Canadian dollar. In this case, the recurring and manual billing for the lease will be in Canadian dollar. As the accounting for the lease is based on the amortization schedules that are based on the recurring and manual billing entries, currency processing is required for the lease.

According to lease accounting standards, the lease liability account is considered a monetary account because it is tied to the lease payments. This account is subject to currency gains and losses due to fluctuation in exchange rates. The right of use asset account is not a monetary account and is not subject to currency gains and losses. However, a material shift in the exchange rate may trigger a revaluation of the right of use asset based on the exchange rate difference.

A processing option on R15170 allows you to retrieve the exchange rate from the lease header, use the system date to retrieve the exchange rate from the Currency Exchange Rates table (F0015), or enter a specified date to use for the retrieval of the exchange rate.'

Use the following steps to process a multicurrency lease:

-

Create Amortization Schedules

-

Use the foreign currency amounts from recurring billing and manual billing to create an amortization schedule.

The system creates a foreign lease liability schedule and a right of use asset schedule.

-

-

Process Lease Commencement

-

Create journal entries using the currency of the lease and the exchange rate to be used for the lease.

The system creates the AA and CA ledger records. The CA amounts are available in the foreign schedule and the AA amounts are calculated using the specified exchange rate.

-

Select the exchange rate from one of the following:

-

The override exchange rate in the lease header.

-

The exchange date effective on the system date when the commencement is executed.

-

The exchange rate effective on the date specified by the user.

-

-

Add a line to the domestic lease liability and right of use schedules to include the domestic amounts that are calculated during journal entry creation.

Lease commencement processing establishes the historic exchange rate that is used in the calculation of right of use asset amounts for the AA ledger.

-

-

Process Monthly Journal Entries

-

Lease Liability

-

Specify the exchange rate in the same way it is specified for lease commencement processing.

The system calculates a currency gain or loss for the lease liability if the exchange rate varies from the rates used in the previous transactions.

-

Create monthly journal entries based on the amounts in the foreign amortization schedule and the exchange rate used during journal entry creation.

The system creates the AA and CA ledger records. The CA amounts are available in the foreign schedule and the AA amounts are calculated using the specified exchange rate.

-

Add a line to the domestic lease liability schedule to include the domestic amounts and any gain or loss amounts that are calculated during journal entry creation.

-

-

Right of Use Asset

-

Use the current historic exchange rate as the exchange rate.

-

Create monthly journal entries based on the amounts in the foreign amortization schedule and the historic exchange rate used during journal entry creation.

The system creates the AA and CA ledger records. The CA amounts are on the foreign schedule and the AA amounts are calculated using the historic exchange rate.

-

Add a line to the domestic right of use asset schedule to include the domestic amounts that were calculated during journal entry creation.

-

-

-

Remeasurement

-

Lease Liability

-

Specify the exchange rate in the same way it is specified for lease commencement processing.

The system calculates a currency gain or loss for the lease liability if the exchange rate varies from the rates used in the previous transactions.

-

Create remeasurement journal entries based on the amounts in the foreign amortization schedule and the exchange rate used during journal entry creation.

The system creates the AA and CA ledger records. The CA amounts are available in the foreign schedule and the AA amounts are calculated using the specified exchange rate.

-

When the next monthly journal entry is created, add a line to the domestic lease liability schedule to include the domestic amounts and any gain or loss amounts that are calculated during journal entry creation.

-

-

Right of Use Asset

-

Use the current historic exchange rate as the exchange rate.

-

Create remeasurement journal entries based on the amounts in the foreign amortization schedule and the historic exchange rate used during journal entry creation.

The system creates the AA and CA ledger records. The CA amounts are on the foreign schedule and the AA amounts are calculated using the historic exchange rate.

-

When the next journal entry is created, add a line to the domestic right of use asset schedule to include the domestic amounts that were calculated during journal entry creation.

Note:

When running a remeasurement, the system does an automatic revaluation of the right of use asset and establishes a new historic exchange rate. These values will be used when monthly journals are run for the start remeasurement period.

-

-

-

Revaluation

-

Right of Use Asset

The system retrieves the exchange rate from the Revaluation of Right of Use Asset table (F15173).

-

Create revaluation journal entries based on the amounts in the foreign amortization schedule and the historic exchange rate used during journal entry creation.

The system creates the AA ledger records and deletes any journal entry lines for CA ledger records that have a zero amount.

-

When you create the next monthly journal entry, add a line to the domestic ROU asset schedule to include the domestic amounts that were calculated during revaluation journal entry creation.

The system displays the revalued amount and the new historic exchange rate from the ROU asset schedule for the domestic currency.

-

-

Existing multicurrency leases that are used for balance sheet lessee accounting must be set up appropriately to avoid integrity issues. For recurring billing records having an effect on lease liability and manual billing records having an effect on ROUA, the Lessee Accounting Multicurrency Integrity program will detect and report the following issues:

-

Any lease in which the currency code is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

-

Any lease in which the exchange rate is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

Apart from the above issues, the program also reports if an amortization schedule exists and if manual or recurring billing has been processed for the lease.

See Section 25.6, "Validating Lessee Accounting Multicurrency Integrity (Release 9.1 Update)" for additional information.

Lease Commencement Journal Entry Processing

When you complete the review of the schedules, you can then update the Lease Liability Status to 30 (Amortization Review Complete) before creating the lease commencement journal entries.

|

Note: Whether amortization schedule review is required before running lease commencement is controlled by a processing option in the R15170. If you set this program to require amortization review, you must manually update the status of the lease lines to 30 before creating lease commencement journal entries. If the review is not required, you can create lease commencement journal entries for records at status 20 or 30. |

The batch and associated journal entries have the following values:

-

Batch Type: LA

-

Document Type: LA

-

Ledger Type: AA

-

Subledger: Asset number

-

Subledger Type: E

-

Purchase Order: Lease number

|

Note: If the Populate Subledger checkbox in P1510 is checked, journal entries are created with subledger type E and subledger with the asset number left filled with zeros. If Populate Subledger is unselected, the journal entries are created with subledger type and subledger blank. |

To create the lease commencement journal entries, the B1501380 function uses the value in the Beginning Balance field on the first line of the lease liability amortization schedule to generate a debit entry for the ROU asset account, and a credit entry to the lease liability account. The system uses the LR AAI to determine the account number for the debit entry, and LL AAI to determine the account number for the credit entry.

If the lease commencement journal entries are successfully created, the system updates the Lease Liability Status to 40 (Lease Commencement Complete). Once a lease line is at status 40 or higher, you can no longer delete or change a schedule. You must change the lease terms and run the remeasurement or early termination process if you want to make changes to the schedule.

See Section 22.5, "Changing Lease Terms After Schedule Creation" for additional information.

A processing option determines whether the system automatically approves the batch if there are no errors, or if the system uses the G/A Constants to determine whether the batch of journal entries is approved. If there are errors when creating the amortization schedule, the system updates the status to 05 (Lease Terms Incomplete). If there are errors generating commencement journals, the system updates the status to 35 (Commencement Error). The system also prints a report that lists the errors. You can set the program to print in summary or detail mode, or just to print the errors. If you select detail mode, the system lists the errors in the detail, but also lists all of the errors together at the end of the report to facilitate identifying them.

After the lease commencement journal entries are created, you can then use the Balance Sheet Lessee Accounting Batch Review program (P150911) to review, approve, delete, and post these batches. Use the processing options on the P150911 to specify the versions of the Journal Entry program (P0911) and the General Ledger Post program (R09801) to use. The system uses default version ZJDE0046 to process lessee accounting journal entries if you leave that option blank.

The Journal Entry form is read-only, and does not allow you to change the journal entries. If there are issues or errors, you can delete the batch if it has not yet been posted, or void the batch if it has already been posted, fix the issue, and regenerate the journals. If you attempt to delete a batch after it has been posted, the system voids the batch instead of deleting it. Note that while you can review these batches of journal entries in other journal batch review programs, such as the P0911, you can only delete or void these batches using the P150911. The system issues an error if you attempt to void or delete LA batch types from other journal review programs.

See Working with Batches and Posting Financial Transaction in the JD Edwards EnterpriseOne Applications Financial Management Fundamentals Implementation Guide for additional information.

Transitioning Existing Leases to the Balance Sheet Lessee Accounting Standard

You can process lease commencement activities to create amortization schedules and journal entries for a lease that is already in progress before you begin using the balance sheet lessee accounting standard.

To do this, you must first update the lease to include lessee accounting information. When you have entered all pertinent lessee information, you can then update the Lease Liability Status to 10 (Lease Terms Complete).

You then update the processing options of the R15170 with the following information:

-

Enter an as-of balance date.

This is the date on which you want to begin using the new lessee accounting standard.

-

Specify whether to use the beginning or the end balance for the period associated with the as-of balance date.

-

Specify whether you want the system to create ROUA adjustment entries if the balances on the ROUA and lease liability schedules are different.

Note that the schedules will be different if there are manual billing records that have an effect on ROUA. The system can create adjustment journal entries to account for the difference between the balances on the ROUA schedule and the lease liability schedule.

After you have set the processing options, generate amortization schedules and commencement journal entries.

When you create commencement journal entries using an As-Of Balance Date, the system populates the Batch Number, Document Number, G/L Date, and Document Company fields, and selects the As-Of Balance option for each month on the amortization schedules that occurs before the date specified (if set to use the beginning balance) or the As of Balance option for each month on the amortization schedules that occurs up to and including the date specified (if set to use the ending balance) in the As-Of Balance Date processing option. Because these fields are populated for these periods, they will be excluded from monthly lessee accounting journal entry processing in the future.

The system also generates all necessary balance sheet lessee accounting journal entries.

Using an Alternate Ledger for Retrospective and Other Reporting

You use the Lessee Alternate Ledger Journals program (R15181) to write journal entries for lessee assets, for a specified period of time, to an alternate ledger. You can then use these journal entries to meet the accounting standard requirement for retrospective and historical reporting of lease liability and ROU Asset balances. By putting these balances in an alternate ledger, you can easily identify these balances when creating retrospective financial statements.

The R15181 processes leased assets with a Lease Liability Status of 20 or greater. The amortization schedules must exist for the asset before you run the R15181. The program generates journal entries using the specified alternate ledger for lines on the amortization schedule that fall within the date range specified in the from and through month and year, as defined in the processing options.

You also use the processing options to specify general ledger information, such as GL date and versions to use when creating and posting the journal entries. The version of the G/L MBF (P0900049) that you specify must have a value of Blank in the Zero Amounts processing option on the Zero Amounts tab.

|

Note: Using the R15181 to create journal entries in an alternate ledger is different than using the Lessee Alternate Schedule Journals program (R15182) to create journal entries in an alternate ledger.The R15181 is typically run once for each leased asset that had a lease that was in progress when you converted to the new standard, and the journal entries for that asset need to be included in retrospective reporting. You typically run the R15181 one time after the amortization schedules are created, and before the lease commencement journals are created. The R15182 is typically run on a monthly basis using the same or similar schedule as creating monthly balance sheet accounting journal entries. The R15182 is intended to maintain the alternate ledgers on an ongoing basis as the lease is processed, and can be run over the alternate schedule, or over the primary schedule if no alternate schedule exists. See Section 22.6, "Creating Alternate Ledger Journal Entries for Lessee Leases" for additional information. |

22.3.1 Running the Lease Commencement Program (R15170)

From the Balance Sheet Lessee Accounting menu (G15201), select Lease Commencement.

Use this program to create lease amortization schedules and to create lease commencement journal entries.

|

Note: This program is hard coded to exclude any lease detail lines (F15017) with a lease liability status of 99, Schedules Not Required. This status is automatically updated on the lease line if the lease classification is set to Not On the Balance Sheet. |

Before you begin, review and set the processing options to determine:

-

Whether to create the amortization schedules only, processes lease commencement journals only, or create schedules and process journals during a single run of the program.

-

Whether amortization schedule review is required before creating journal entries. Note that if you require review, you cannot process both of these steps in a single run. You must first create schedules, then review the schedules and update the lease liability status to 30, then rerun the program to create journal entries.

-

The date to use if you are transitioning existing leases to the balance sheet lessee accounting standard.

-

Whether to run this program in proof or final mode.

-

Whether to continue processing if warnings or errors are encountered.

-

Specify the program versions to use when processing lessee information.

-

Define settings for journal batch approval.

-

Adjustment limits for remaining balance adjustments.

-

Whether to create right of use asset as-of balance adjustment entries.

This program produces a report that lists the errors and warnings.

22.3.2 Creating Amortization Schedules Using the Lease Information Program (P1501)

Use one of the following methods to create amortization schedules for assets on a lease.

To create amortization schedules for all lessee accounting lines for a selected lease:

-

From the Tenant & Lease Information menu (G1511), select Lease Information.

-

From the Work With Leases form, select a lease, and then select Create Amort Sched from the row menu.

-

The system creates amortization schedules for all of the lines on the lease that have a Lease Liability Status of 10, and have a Lease Classification value of Operating Lease or Finance Lease.

If any of the lines are not successfully processed, the system updates the status to 05, and continues processing the other lines.

To create amortization schedules for individual lines on a lease:

-

From the Tenant & Lease Information menu (G1511), select Lease Information.

-

From the Work With Leases form, select a lease, and then click Select.

-

On the Lease Master Revisions form, select the lines for which you want to create schedules, and then select Create Amort Sched from the row menu.

-

The system creates amortization schedules for all of the selected lines that have a Lease Liability Status of 10, and have a Lease Classification value of Operating Lease or Finance Lease.

For additional information about the Lease Information program, see Section 4.2, "Setting Up Lease Information".

22.3.3 Creating Amortization Schedules Using the Work With Amortization Schedules Program (P15171)

-

From the Balance Sheet Lessee Accounting menu (G15201), select Amortization Schedules.

-

On the Work With Amortization Schedules form, search for and select the lease and asset for which you want to create schedules.

-

From the row menu, select Create Amort Sched. Note that this option is available only if the Lease Liability Status is 10.

22.3.4 Reviewing and Deleting Lease Amortization Schedules

-

From the Balance Sheet Lessee Accounting menu (G15201), select Amortization Schedules.

-

On the Work With Amortization Schedules form, search for and select the lease and asset for which you want to review or delete schedules.

-

To delete the amortization schedules, select a row and then click Delete. Note that the Delete button appears only if schedules exist for the selected row, and the Lease Liability Status is less than 40.

-

To review the lease liability amortization schedule, select a row and then click Select. The system brings you to the Lease Liability Amortization Schedule form.

-

To review the ROU asset schedule, complete one of these steps:

-

From the Work With Amortization Schedules form, select Amortization Sched from the Row menu, and then select Right of Use Asset.

-

From the Lease Liability Amortization Schedule form, select Right of Use Asset from the Amortization Schedule Type field in the header.

-

-

Review the schedules and then update the Lease Liability Status for the associated assets to 30 (Schedule Review Complete) before creating lease commencement journal entries.

22.3.5 Creating Lease Commencement Journal Entries Using the Lease Information Program (P1501)

Before you begin, verify that amortization schedules have been created, and if necessary, approved, for the selected assets. Then use one of the following methods to create lease commencement journal entries for assets on a lease.

To create commencement journals for all assets on a selected lessee accounting lease:

-

From the Tenant & Lease Information menu (G1511), select Lease Information.

-

From the Work With Leases form, select a lease, and then select Create Commencement JEs from the row menu.

-

The system creates a batch of journals for each of the lines on the lease that have a Lease Liability Status of 20 (if review is not required) or 30, and have a Lease Classification value of Operating Lease or Finance Lease.

If any of the lines are not successfully processed, the system updates the status to 35 (Commencement Error), and continues processing the other lines.

To create commencement journals for individual lines on a lease:

-

From the Tenant & Lease Information menu (G1511), select Lease Information.

-

From the Work With Leases form, select a lease, and then click Select.

-

On the Lease Master Revisions form, select the lines for which you want to create journal entries, and then select Create Commencement JEs from the row menu.

Note that this option is only available if the Lease Liability Status of all selected lines is at an appropriate status to create journal entries.

-

From the Lease Commencement Options dialog box, enter a value in the following fields:

-

G/L Date

-

Exchange Rate Method

-

Exchange Rate Date (if the Exchange Rate Method is set as User Defined Date)

-

-

The system creates a batch of journal entries for each of the selected lines.

If any of the lines are not successfully processed, the system displays an error message and does not update the status of the records.

For additional information about the Lease Information program, see Section 4.2, "Setting Up Lease Information".

22.3.6 Creating Lease Commencement Journal Entries Using the Work With Amortization Schedules Program (P15171)

-

From the Balance Sheet Lessee Accounting menu (G15201), select Amortization Schedules.

-

On the Work With Amortization Schedules form, search for the lease and asset for which you want to create journal entries, and select the row.

Note that the schedule must already exist for the selected row, and the lease liability status must be 20 (if no schedule review is required) or 30 (if schedule review is required).

-

From the row menu, select Create Commence JEs.

-

From the Lease Commencement Options dialog box, enter a value in the following fields:

-

G/L Date

-

Exchange Rate Method

-

Exchange Rate Date (if the Exchange Rate Method is set as User Defined Date)

-

22.3.7 Reviewing, Approving and Posting Lease Commencement Journal Entries

-

From the Balance Sheet Lessee Accounting menu (G15201), select Balance Sheet Lessee Accounting Batch Review.

-

On the Work With Balance Sheet Lessee Accounting Batches form, search for the batch you want to work with. You can use the options on the form to narrow your search to posted or unposted batches.

-

From the row menu, select one of these options, depending on the action you want to take:

-

JE Review

On the Journal Entries form, review the selected batch of journal entries. Click Close to return to the previous form.

-

Batch Approval

On the Batch Approval window, select the appropriate approval status and then click OK.

-

Void JE

On the Void Journal Entry form, enter the G/L Date for the void and then click OK.

-

Post By Batch

This option runs the version of the General Ledger Post program (R09801) that is specified in the processing options.

-

Amortization Sched

Select this option if you want to view information on the associated amortization schedules.

-

22.3.8 Running the Lessee Alternate Ledger Journals Program (R15181)

From the Balance Sheet Lessee Accounting menu (G15201), select Lessee Alternate Ledger Journals (R15181). After running this program, you can then review, approve, and post the journal entries using the same process that you use to review, approve and post lease commencement journal entries.

|

Note: This program is intended to be ran one time per asset, to assist with retrospective reporting from an alternate ledger. To generate alternate ledger journal entries on an ongoing basis, use the R15182 program. See Section 22.6.2, "Running the Lessee Alternate Schedules Journal Program (R15182)" for instructions. |

22.4 Processing Monthly Balance Sheet Lessee Accounting Journal Entries

Once you have completed all of the lease commencement tasks, you can then begin processing the monthly journal entries to update the balance sheet for leased assets. You use the Balance Sheet Lessee Accounting Journals program (R15180) to generate monthly balance sheet lessee accounting journal entries for assets that are at a lease liability status of 40 (Commencement Complete).

You use the processing options to specify general ledger information, such as the GL date, and versions to use when creating and posting the journal entries. The version of the G/L MBF (P0900049) that you specify must have a value of Blank in the Zero Amounts processing option on the Zero Amounts tab.

The R15180 generates journal entries using the information from the amortization schedules and the balance sheet lessee accounting AAIs.

This table outlines the typical journal entries that are created for leased assets on an operating lease in arrears:

| Process | Account | AAI | Source from the Amortization Schedules | Debit or Credit |

|---|---|---|---|---|

| Monthly Journals | Lease Liability | LL | Lease Liability Reduction | Debit |

| Monthly Journals | Lease Liability | LL | Lease Liability Gain/Loss | Debit |

| Monthly Journals | Accumulated Amortization | LC | ROUA Reduction | Credit |

| Monthly Journals | Lease Expense | L1 | Accum Amortization - Lease Liability Reduction | Credit |

| Monthly Journals | Lease Liability Gain/Loss | LG | Lease Liability Gain/Loss | Credit |

| Recurring Billing | Lease Expense | L1 | Lease Payment | Debit |

| Recurring Billing | A/P Trade | PC | Lease Payment | Credit |

This table outlines the typical journal entries that are created for leased assets on an operating lease in advance

| Process | Account | AAI | Source from the Amortization Schedules | Debit or Credit |

|---|---|---|---|---|

| Monthly Journals | Lease Liability | LL | Lease Liability Reduction | Debit |

| Monthly Journals | Lease Liability | LL | Lease Liability Gain/Loss | Debit |

| Monthly Journals | Accumulated Amortization | LC | ROUA Reduction | Credit |

| Monthly Journals | Lease Expense | L1 | Accumulated Amortization - Lease Liability Reduction | Credit |

| Monthly Journals | Lease Expense | L1 | Lease Payment | Debit |

| Monthly Journals | Lease Liability Gain/Loss | LG | Lease Liability Gain/Loss | Credit |

| Monthly Journals | Pre-paid Rent | L0 | Lease Payment | Credit |

| Recurring Billing | Pre-paid Rent | L0 | Lease Payment | Debit |

| Recurring Billing | A/P Trade | PC | Lease Payment | Credit |

This table outlines the typical journal entries that are created for leased assets on a finance lease in arrears:

| Process | Account | AAI | Source from the Amortization Schedules | Debit or Credit |

|---|---|---|---|---|

| Monthly Journals | Lease Liability | LL | Lease Liability Interest Paid | Debit |

| Monthly Journals | Lease Liability | LL | Lease Liability Gain/Loss | Debit |

| Monthly Journals | Accumulated Amortization | LC | ROUA Expense | Credit |

| Monthly Journals | Lease Liability Gain/Loss | LG | Lease Liability Gain/Loss | Credit |

| Monthly Journals | Amortization Expense | L3 | ROUA Expense | Debit |

| Monthly Journals | Internet Expense | L2 | Lease Liability Interest Paid | Debit |

| Recurring Billing | Lease Liability | LL | Lease Payment | Debit |

| Recurring Billing | A/P Trade | PC | Lease Payment | Credit |

This table outlines the typical journal entries that are created for leased assets on a finance lease in advance:

| Process | Account | AAI | Source from the Amortization Schedules | Debit or Credit |

|---|---|---|---|---|

| Monthly Journals | Lease Liability | LL | Lease Payment | Debit |

| Monthly Journals | Lease Liability | LL | Lease Liability Interest Paid | Debit |

| Monthly Journals | Lease Liability | LL | Lease Liability Loss/Gain | Debit |

| Monthly Journals | Accumulated Amortization | LC | ROUA Expense | Credit |

| Monthly Journals | Lease Liability Gain/Loss | LG | Lease Liability Gain/Loss | Credit |

| Monthly Journals | Pre-paid Rent | L0 | Lease Payment | Credit |

| Monthly Journals | Amortization Expense | L3 | ROUA Expense | Debit |

| Monthly Journals | Internet Expense | L2 | Lease Liability Interest Paid | Debit |

| Recurring Billing | Pre-paid Rent | L0 | Lease Payment | Debit |

| Recurring Billing | A/P Trade | PC | Lease Payment | Credit |

When you run the R15180, the system creates a batch of journal entries using the Create Lessee Accounting Journal Entries business function (B1501420). The system also updates each processed row in the amortization schedules for the associated assets with the G/L Date, Document Number, and an indicator appears in the Lessee Journals Exist field.

When you run the R15180, the system creates a batch of journal entries using the Create Lessee Accounting Journal Entries business function (B1501420). The system also updates each processed row in the amortization schedules for the associated assets with the G/L Date, Document Number, and an indicator appears in the Lessee Journals Exist field.

When you run the R15180, you can specify the through month and year in the processing options. If you do not specify a through month and year, the system date is used. The system processes all months for the selected assets that do not have values in the Document Number field, up to the through month and year. This enables you to process multiple months at once, ensuring that journal entries for months that were already processed are not created again. The program also updates the Lease Master Detail table (F15017) with the schedule date of the last month processed.

|

Note: If you have made lease term changes for a leased asset, the system updates the Recalculate Lease Liability field on the lease, indicating that the lease must be remeasured before you can continue processing. If you attempt to run the R15180 for assets that have the Recalculate Lease Liability flag set to 1 (Remeasure Only) or 2 (Early Termination Option), you will receive an error. You must recalculate the amortization schedules using the appropriate option, or clear the Recalculate Lease Liability flag before you can process monthly balance sheet accounting journal entries. See Section 22.5, "Changing Lease Terms After Schedule Creation" for additional information. |

Once the journal entries have been created, you can then review, approve, delete, and post them using the same method as you do with the lease commencement journal entries. See Section 22.3.7, "Reviewing, Approving and Posting Lease Commencement Journal Entries" for additional information.

Throughout the lease cycle of an asset, you can use the Work With Amortization Schedules program to view detailed information about which months have been processed, and to access additional balance sheet lessee accounting information. This program displays icons to identify the following conditions:

-

Journal entries for the month have been created. (Green icon on the amortization schedule detail.)

-

As-of balance records for the month have been created. (Yellow icon on the amortization schedule detail)

-

Journal entries for the month have not been processed in the last 30 days, and are likely overdue. (Red icon on the Work With Amortization Schedules form, and all journal entry fields are blank.)

-

Termination processing has been completed for this asset, and termination journal entries exist for this period. (Red icon on the amortization schedule detail, and journal entry fields are populated in the amortization table but are displayed as blank in the program.)

When you process the R15180 for the last month of a leased asset, the system updates the lease liability status on the lease detail line to 50 (Schedules Completed). Note that in some instances, the ROU asset schedule is longer than the lease liability schedule. The system does not update the status to 50 until both schedules are complete.

22.5 Changing Lease Terms After Schedule Creation

After a lessee lease reaches Lease Liability Status 20 (Schedules Complete), it might be necessary to make changes to the lease terms or billing records. For example, a lease might be extended, terminated early, or the amounts associated with the leased asset might change.

Depending on the type of change you need to make to the lease terms, you use one of the following programs:

-

Lease Information program (P1501)

You can update the borrowing rate, or enter a date in the ROUA End Date field that is greater than the latest recurring billing end date. These are the only lease term changes you can make from the Lease Master Information program.

-

Recurring Billing Information (P1502)

Any change that impacts the billing records for the lease must be made using this program. This includes changing the dates of the lease term, as those changes impact the billing records.

Also note that you can use a global update program to update recurring billing records. However, processing options associated with the global update process determine whether that process is available for use on recurring billing records associated with leased assets for which amortization schedules exist. See Section 24.6, "Updating Recurring Billing Records (Release 9.1 Update)" for additional information.

Depending on the changes you make, and the status of the lease, the system updates the Recalculate Lease Liability field on the lease with one of these values:

-

1: Remeasure

The changes you made require a remeasurement of the lease, and do not include an early termination.

-

2: Terminate or Remeasure

The changes you made require you to run either the remeasurement or the early termination process.

The Recalculate Lease Liability value, along with the lease liability status, determine which of these actions you can take:

-

Remeasurement

This action is available when you make any change to a leased asset that impacts the amortization schedules, and your lease is at a status 20 or greater. When you select this option, the system recalculates amortization schedules based on your changes, and if necessary, creates remeasurement journal entries to adjust previously reported amounts.

Note that if your lease is at a Lease Liability Status of 20 (Schedules Created) or 30 (Schedule Review Complete), the system will delete your existing schedules and recreate schedules based on your changes without creating remeasurement journal entries. If your lease is at a status 40 (Commencement Complete), the system updates your existing schedules based on the changes, and creates remeasurement journal entries to adjust any journal entries that were previously created. The system also updates the Remeasurement Flag on the amortization schedule with 2 (Remeasurement Complete) in the period during which the remeasurement took place.

-

Early termination

This action is available when the only change you make to a lease is to change the recurring billing end date to be earlier than the existing date, and your lease is at a lease liability status of 40. When you select this option, the system creates termination journal entries based on the lease term changes and the processing option settings in the P15171, and does not update the amounts on the amortization schedule.

The system also updates the Journals Exist field with a red square in the period when the termination is scheduled to occur, selects the Early Termination Flag option, creates a batch of termination journal entries, and updates the batch information fields in the period where the termination occurs, and every period after, through the end of the schedule, which excludes those periods from being included in monthly processing.

If you make changes that cause the system to update the Recalculate Lease Liability field, the system assumes that you will then run either the remeasurment or early termination process to update the amortization schedules, create journal entries (if necessary), and to clear the recalculation flag. Until the recalculation flag is cleared, you cannot continue monthly lease processing.

If you have entered lease term changes incorrectly, you can use the Clear Recalc Flag feature to reset the Recalculate Lease Liability field to 0 (No action required).

|

Note: The Clear Recalc Flag option only clears the Recalculate Lease Liability field, and does not undo any changes you made to the lease or recurring billing records. If you are clearing this flag because you entered incorrect lease term changes, you must correct the lease term changes. The system then updates the Recalculate Lease Liability flag again when you save your changes.This option should be used with care. |

This table lists several lease term change scenarios, and describes the method you might use to make the changes:

| Lease Term Change Scenario | Method for Entering and Processing Change |

|---|---|

| The lease is at status 10 (Lease Terms Complete) and the monthly lease payment amount must be changed. | Because the schedules have not yet been generated, you can make changes to the lease and the recurring billing records without running any remeasurement processes. |

| The lease is at status 20 (Schedules Created) or 30 (Schedule Review Complete) and the monthly lease payment amount must be changed. | You can make these changes using either of these methods:

|

| The lease is at status 40 (Commencement Complete) and the monthly lease payment amount must be changed. | Because schedules and journal entries already exist for this lease, you must make these changes using the Change Lease Terms feature in the Recurring Billing program. After you update the amount in the billing records, you then run the remeasurement process to update the amortization schedules and create remeasurement journal entries. |

| The lease is at status 10 (Lease Terms Complete) and lease ending date is now 1 year earlier than initially expected. | Because the schedules and journal entries have not yet been generated, you can make changes to the lease and the recurring billing records without running any remeasurement processes. |

| The lease is at status 20 (Schedules Created) or 30 (Schedule Review Complete) and lease ending date is now 1 year earlier than initially expected. | You can make these changes using either of these methods:

|

| The lease is at status 40 (Commencement Complete) and lease ending date is now 1 year earlier than initially expected. | Because schedules and journal entries already exist for this lease, you can make these changes using the Change Lease Terms feature in the Recurring Billing program.

Note that if the end of period journals have been run for the selected grid row and you only wish to process an early termination, you must change the Ending Date in the Recurring Billing Revisions form. After you update the date in the billing records, you then run the remeasurement or the early termination process to update the amortization schedules and create remeasurement or termination journal entries. Alternatively, you can use the Change Lease Terms feature to enter an early termination date. |

|

Note: Be aware that manual billing changes will not trigger lease remeasurement processing. It is assumed that all manual billing records are created before initial amortization schedules are created, and processed on or before lease commencement. If manual billing records are added after lease commencement, and they have an effect on ROUA, the system will not update the Recalculate Lease Liability flag. However, the updates will be processed if the lease is remeasured for any other reason.Additionally, suspending a recurring billing line does not impact amortization schedules, or initiate an update of the Recalculate Lease Liability flag. If you want a billing suspension to be reflected in the lease liability calculation, you must use the change lease terms feature. |

After you process a remeasurement or an early termination, you can review and post the journal entries using the same method you use to review and post commencement and monthly journal entries. See Section 22.3.7, "Reviewing, Approving and Posting Lease Commencement Journal Entries" for information and instructions.

If you delete a batch of termination or remeasurement journal entries, the system resets the Recalculate Lease Liability status to the value it was before you ran the remeasurement or early termination process. You must then rerun the process to regenerate journal entries.

22.5.1 Changing Lessee Lease Terms Using Recurring Billing

In many cases, the amounts or dates associated with leased assets can change during the course of a lease. These changes are called lease term changes, and they can impact the amortization schedules and journal entries associated with the balance sheet lessee accounting process.

To make lease term changes to your recurring billing records, your leased asset must be at a Lease Liability Status of 20 (Amortization Schedules Created) or greater. This status indicates that schedules exist for the associated asset.

You have two methods for entering lease term changes in your recurring billing records. From the Recurring Billing Revisions form:

-

Select a billing record and then select Change Lease Terms from the Row menu.

This option is only available if the selected row has existing amortization schedules, and the effect on lease liability is set to Yes. When you use this option, you select one billing record and make your changes. The system automatically updates all of your existing records (for the selected asset and for the same payment step), and creates new records as needed, based on your changes. You can then make any additional updates in the detail area of the form.

-

Enter changes directly in the detail area of the form.

When you use this option, you must manually update all lines that require changes, and create any new lines that are needed. You must use this option to make changes to billing lines with the effect on lease liability set to No or GRV.

Before using this option, be sure that you have a complete understanding of the rules associated with recurring billing records for balance sheet lessee accounting, including stepped payments, suspended lines, and multiple lease versions. See Section 7.3.3, "Understanding Recurring Billing for Balance Sheet Lessee Accounting (Release 9.1 Update)" for additional information.

When you select the Change Lease Terms option, the system displays the Change Lease Terms window. The Lease Term Change row option is available only for rows having the same lease version as the default lease version in the header. The window includes header information for the lease line, and enables you to make changes to these fields:

-

Early Termination

Use this field to specify the Term Change End Date that represents an early termination. If the early termination check box is checked, all other fields are disabled except for the Term Change End Date.

-

Term Change As Of Date

This field is required, and reflects the date on which you want your changes to be effective.

-

Gross Amount

This field represents the changed amount for the billing record. The system also displays the current amount for your reference. If you leave the field blank, the existing value is used.

-

Term Change End Date

This date reflects the date on which your changes end. This date must be greater than the last day of the month of the date in the Lessee Accounting JE Thru Date field in the header of the form, and must also be greater than or equal to the Term Change As Of Date you enter. If you are using stepped payments, the end date can only be extended on the last step.

-

Effect on Lease Liability

This field is editable only if the Term Change As Of Date is greater than the date in the Lessee Accounting JE Thru Date field.

|

Note: If the Early Termination check box is selected, the system will update the ending dates for the selected asset but will not create additional recurring billing lines. The system issues a message to indicate the start termination date if the Term Change End Date is greater than the date through which the month journal has already been run. |

After you enter your changes, you click OK. The system returns you to the Recurring Billing Revisions form, and enters an ending date in all existing billing rows that is one day prior to the date you entered in the Term Change As Of Date field. The system then creates new rows for all necessary records using the new start and end dates that you entered. If you did not enter a new ending date, the end date of the selected record is used as the end date on the new records.

You can then make any additional changes to the new records directly in the grid. When you are finished, click OK to save your changes.

|

Important Note: The system does not save the changed lease lines and the new lease lines that are created when you click OK on the Change Lease Terms window until you click OK on the Recurring Billing Revisions form. If you exit out of this form before clicking OK, your changes will be lost. |

When you save your changes, the system updates the Recalculate Lease Liability field on the lease as follows:

-

1: Remeasure

You must run the remeasurement process on the lease to continue with balance sheet lessee accounting processing. This action is available when you make any change to a leased asset that impacts the existing amortization schedules.

-

2: Terminate or Remeasure

You must run either the early termination or the remeasurement process on the lease to continue with balance sheet lessee accounting processing. This option is available when the only change to the lease is that the recurring billing end date is changed to a date earlier than the original end date, and the lease is at a lease liability status of 40 (Commencement Complete).

Run the remeasurement process to recalculate amortization schedules based on your changes, and if necessary, create remeasurement journal entries to adjust previously reported amounts.

Run the early termination process to end the lease earlier than planned, keep the original amortization schedules, and if necessary, create termination journal entries at the end of the lease. This process is available only if the Recalculate Lease Liability field is set to 2.

22.5.1.1 Entering Lease Term Changes in Recurring Billing

To enter lease term changes in recurring billing:

-

From the Recurring Billing menu (G1521), select Recurring Billing Information.

-

On the Recurring Billing Revisions form, search for and select the record you want to update, and then select Change Lease Terms from the Row menu.

This option is available only if amortization schedules exist and the Effect on Lease Liability is set to Yes for the selected line.

-

On the Change Lease Terms form, complete these fields, as needed, and then click OK:

-

Term Change As Of Date

-

Gross Amount

-

Term Change End Date

-

Effect on Lease Liability

-

-

On the Recurring Billing Revisions form, make any additional updates to the records in the detail area, and then click OK. Note that your changes are not saved until you click OK on this form.

22.5.2 Changing Lessee Lease Terms Using the Lease Master

Once a lease is at lease liability status 20 (Amortization Schedules Created) or greater, you can use the Lease Master Information program (P1501) to make the following changes to the lease terms:

-

Update the borrowing rate.

-

Update the ROUA End Date to a date greater than the existing recurring billing end date.

You can make these changes directly in the lease detail lines, or you can select a lease line you want to update, and use the Change Lease Terms Row menu option.

When you make either of these changes, the system updates the Recalculate Lease Liability field with a 1 (Remeasure), indicating that the lease must be remeasured.

You can then run the remeasurement process to recalculate amortization schedules based on your changes, and if necessary, create remeasurement journal entries to adjust previously reported amounts. This action is available when you make any change to a leased asset that impacts the existing amortization schedules.

22.5.2.1 Entering Lease Term Changes in the Lease Master

To enter lease term changes in the Lease Master:

-

From the Tenant & Lease Information menu (G1511), select Lease Information.

-

On the Work With Leases form, search for and select the lease you want to update.

-

On the Lease Master Revisions form, select the row you want to update, and then select Change Lease Terms from the Row menu.

-

On the Change Lease Terms form, complete one or more of these fields, and then click OK:

-

Borrowing Rate

-

ROUA End Date

You must enter a date greater than the date that is displayed in the Recurring Billing End Date field.

-

-

On the Lease Master Revisions form, make any additional updates to the records in the detail area, and then click OK. Note that your changes are not saved until you click OK on this form.

22.5.3 Remeasuring a Lessee Lease

To run the remeasurement process on a leased asset:

-

From the Balance Sheet Lessee Accounting menu (G15201), select Amortization Schedules.

-

On the Work With Amortization Schedules form, search for the leased asset you want to remeasure.

-

Review the Recalculate Lease Liability field, which must contain a 1 (Remeasure) or 2 (Terminate or remeasure).

-

Select the row you want to remeasure, and then select Remeasure from the Row menu.

-

Specify the G/L date and the exchange rate method in the Remeasurement Options dialog box and click OK.

-

The system runs the remeasurement process, and completes one of these sets of steps, based on the lease liability status of the asset:

-

If the status is 20 or 30, the system deletes the existing schedules, recreates new schedules using the updated lease terms, and resets the Recalculate Lease Liability field to 0 (Do Not Remeasure).

-

If the status is 40, the system updates the amounts in the amortization schedules starting in the next unprocessed month, creates a batch of remeasurement journal entries, and resets the Recalculate Lease Liability field to 0 (No action required).

-

-

If necessary, you can now review, approve, and post your remeasurement journal entries. See Section 22.3.7, "Reviewing, Approving and Posting Lease Commencement Journal Entries" for instructions.

22.5.4 Revaluing a Lessee Lease

Before running the revaluation process, review and set the processing options in ROUA Revaluation batch program (R15183). The processing options are used to run R15183 as a batch job and are not relevant when using the row exit from Work with Amortization Schedules form to run the revaluation process.

Alternatively, you can run the revaluation process on a leased asset interactively:

-

From the Balance Sheet Lessee Accounting menu (G15201), select Amortization Schedules.

-

On the Work with Amortization Schedules form, search for the leased asset you want to revaluated.

-

Select the row you want to revaluate, and then select Revaluate ROUA from the Row menu.

-

Specify the G/L date and the revaluation name in the Revaluation Options dialog box and click OK.

-

The system runs the revaluation process and processes revaluation of journal entries in for the month after the last end of period.

22.5.5 Terminating a Lessee Lease Early