Payments

In this section, we describe how to manage your taxpayer’s payments.

Contents

Financial Transactions On A Payment

Interfacing Payments From External Sources

A payment reduces how much an account owes. The topics in this section provide background information about a variety of payment topics.

Contents

A Payment Event Has Payments And Tenders

Multiple Tenders Used To Pay For Multiple Accounts

An Overview Of The Payment Event Creation & Allocation Process

Payments and Penalty and Interest

Payment Date and Effective Date for Payment Events

Distributing A Payment Amongst An Account's Obligations

Canceling A Tender Versus Canceling A Payment

Tender Management and Workstation Cashiering

Payment Financial Transaction Considerations

A Payment May Affect More Than Just Taxpayer Balances

Issuing A Payment Advice Instead Of Creating An Automatic Payment

A Payment Event Has Payments And Tenders

The explanation in The Financial Big Picture provides an accurate, but incomplete view of payments. The missing pieces concern payment events and tenders. The following diagram illustrates the difference between a payment event, its payment(s) and its tender(s).

The following concepts are illustrated above:

A payment event defines the event A payment event is required whenever any form of payment is received. The payment event defines the payment date and effective date (and that’s all).

A payment event has tender(s) A tender exists for every form of tender remitted as part of the payment event. A payment event must have at least one tender otherwise nothing was remitted. A payment event may have many tenders when multiple payment methods are associated with an event (e.g., paying with cash, a check, and a credit card).

A payment is allocated to account(s) The total amount of tenders under a payment event is distributed to one or more accounts.

A payment is distributed to obligations The system allocates an account’s payment amount amongst its obligations. The system creates a payment segment for each obligation that receives a portion of the payment.

Payor and payee are frequently the same The account remitting the tender (the payor) is frequently the same as the account to which the funds are allocated (the payee). The next illustration provides an example when this is not the case.

Multiple Tenders Used To Pay For Multiple Accounts

The following diagram illustrates a payment event with multiple tenders where the payor of the tender is not the same as the account(s) receiving the payment.

A payment event may have many tenders A single payment event may have many tenders. While the above example shows both tenders being paid by the same account, each tender may reference a different account.

Many accounts may be paid under 1 event The total amount of tenders under a payment event are distributed to one or more accounts.

Payor may differ from payee The account(s) remitting the tender may differ from the account(s) whose debt is relieved.

An Overview Of The Payment Event Creation & Allocation Process

When a payment event occurs, the system stores a tender for each form of remittance (e.g., cash, check, charge). It then allocates the sum of the tenders to one or more accounts.

By default, the system allocates the sum of the tenders to the account that remits the tenders. You may override this default and specify any number of accounts and their respective payment allocation amount. This is useful, for example, when a social service agency pays for many accounts. If applicable, you may also configure the system to use your own payment event distribution rule(s).

Refer to Distributing A Payment Event for more information.

The system distributes a payment amongst an account’s obligations based on the age of each obligation’s debt AND distribution priority. The system creates a payment segment for each obligation that receives part of the payment.

Refer to Distributing A Payment Amongst An Account’s Obligations for more information.

You may manually redistribute the payment amount amongst the account’s obligations before you commit the distribution. When the distribution is acceptable, you freeze the payment. Freezing a payment causes the system to create a financial transaction for each related payment segment. It is the financial transaction(s) that causes the obligations’ payoff and current balances to be reduced. The financial transaction also contains the journal details that debit “cash" and credit some other GL account.

And that’s it. The remaining topics in this section provide more information about the creation and allocation of payment events.

Batch and real-time payment event creation / allocation. There is only one payment event creation / allocation routine and therefore anything the batch payment process does for whole batches of payments, you can do to a payment on-line.

Payments and Penalty and Interest

If your organizations levy penalty and interest (P&I) charges for unpaid tax assessments, creating or canceling payments should recalculate penalty and interest.

The recalculation occurs when a payment is frozen or canceled assuming that the correct algorithm has been plugged in to the account's account type.

Payment Date and Effective Date for Payment Events

This section discusses the payment and effective dates used in payment events.

By default, the payment and effective dates are equal but the algorithm used to create the payment may calculate the dates differently based on business rules.

A payment event records a payment date and an effective date. The payment date should be the date that the payment was considered "received". This could be the system date or it could be a postmark date. The effective date is used to populate the effective date of the payment segment's financial transactions and is the date that the payment should affect penalty and interest.

The following examples illustrate when the effective date may differ from the payment date:

· Consider the following collections scenario. A collections notice is sent to a taxpayer with penalty and interest forecasted to a future date (for example, the 30th). If the payment is received (postmarked) on the 20th, this date is used as the payment date. However, your organization's business rules may dictate that for P&I purposes, the payment should be considered effective on the 30th (the date noted in the collection notice). In this case the distribution algorithm that directs this payment to a collection notice should set the payment effective date to the 30th. This ensures that penalty and interest will be calculated according to what was forecast.

· Consider an obligation whose filing period due date is April 15th, where the payment grace days on the obligation type is 3. If the taxpayer files and pays on April 17th, the payment distribution algorithm determines that this is within the grace days and sets the effective date to the 15th. In this case the payment date would still be the 17th.

Changing effective date. A BPA script Change Payment Effective Date is provided as an option on the payment event context menu. The script prompts you for a new effective date. It updates the payment event and its related FT and then causes penalty and interest to be recalculated.

Distributing A Payment Event

Warning! This section deals with the concept distributing a payment amount into payment(s). It does not discuss the distribution of a single payment into segments. For more information about payment distribution, refer to Distributing A Payment Amongst An Account’s Obligations.

The base-package, by default, creates a single payment for a payment event. Some business practices require potentially many payments to be created when payment events are added.

A few examples of when multiple payments may be necessary are:

· A payment amount needs to be distributed towards different distribution types:

· $50 in interest

· $60 in collection charges

· $70 in taxes

Each of the above distributions is realized as a separate payment identified by its own match type (i.e., there'll be one match type called Interest, another called Collection Charges, etc.).

In this example, the debt of a single obligation may be relieved by each of these payments.

· In a similar way, you may want to create a separate payment for an overpayment to differentiate it from regular payments (using yet another match type).

· In the case of a social service agency that pays for many accounts, a single payment event may be distributed amongst multiple accounts.

The method by which a payment amount is distributed to create payment(s) is contained in Create Payment algorithms plugged in on a distribution rule.

There is yet another aspect to having control over how payment events are created. The default method of creating payment events assumes knowledge of account IDs (of the payor and the payee) when making a payment. In cases where payments are made by and towards business entities other than accounts, knowledge of their corresponding account IDs may not be available at payment time. Consider the following examples:

· A payment is made for a taxpayer. The payment is applied to all of the taxpayer's accounts.

· A payment is made for a specific filing period.

· A court-ordered payment is made for a case. The payment is directed toward the assessments linked to the case, where assessments may cross tax roles, filing periods, etc

· A payment is made for a collections notice. The payment is directed toward specific assessments linked to the notice.

· A payment is made for a pay plan. The payment is applied to the specific obligations that are covered by the pay plan.

The method by which the tender account is determined by means of an alternate identifier is contained in Determine Tender Account algorithm plugged in on a distribution rule.

Refer to Making Payments Using Distribution Rules for information on how to configure your system to use this distribution method.

Distributing A Payment Amongst An Account's Obligations

Warning! This section deals with the concept of distributing a payment amongst an account’s obligations. It does not discuss how the sum of a payment event’s tenders is balanced out by payment allocations. For more information about payment event balance, refer to Unbalanced Payment Events.

A payment must be distributed to one or more obligations for its financial impact to be realized. When a payment satisfies an account’s entire debt, you don’t have to worry about how the system distributes the payment. The concept of payment distribution is only relevant when a partial or excess payment is distributed.

The first important point to understand is that the method of distributing a payment amongst an account’s obligations is contained in an algorithm that’s plugged in on to account type. This means that you can have different distribution algorithms for different account types.

Manual overrides. Most of the time, you’ll let the payment distribution algorithm distribute the payment amongst an account’s obligations. However, you may manually distribute a payment when a taxpayer directs a payment to specific obligation(s).

The following explanation describes one of the base package payment distribution algorithms (refer to Payment Distribution – Pay Priority and Debt Age for information about this algorithm). This algorithm distributes a payment based on:

· The age of each obligation’s debt.

· The payment distribution priority of each obligation’s obligation type.

The following diagram helps illustrate how the distribution algorithm works.

Important! There are other payment distribution algorithms in the base package. Click here to see the available algorithm types.

The above example shows three columns, one for each obligation linked to a hypothetical account. Notice that two of the obligations have the same distribution priority, the third has a lower priority. The numbers in the cells indicate the order in which the system distributes a partial payment.

Debt terminology. Before we can discuss the distribution algorithm, you must understand the terminology we use to categorize debt. Delinquent debt is associated with financial transactions that appear on overdue bills. Non-Delinquent debt is associated with financial transactions that appear on current bills. New Debits debt is associated with financial transactions that do not yet appear on a completed bill.

The following points describe the algorithm used to distribute the partial payment:

· The system pays off delinquent debt of the highest priority obligations first. In the above example, where multiple obligations have the same distribution priority, the system does NOT payoff one obligation before it starts on the next (which one would it pick?). Rather, it distributes the payment amongst the obligations based on the age of the respective debt on each obligation. In the above example, this is represented by steps 1 through 6 (notice how the distribution jumps between Obligation #1 and Obligation #2).

· After all delinquent debt has been relieved from the highest priority obligation(s), the system pays off the next priority until all delinquent debt is relieved. In the above example, this is represented by steps 7 through 9.

· The system next pays off non-delinquent debt using each obligation’s respective distribution priority. Note well, the payment distribution algorithm doesn’t associate an age with non-delinquent debt and therefore the distribution is based purely on the obligations’ respective distribution priority. In the above example, this is represented by steps 10 through 12.

· After all non-delinquent debt is relieved, the system next pays off “new debit” debt based on the obligations’ respective distribution priority. In the above example, this is represented by steps 13 through 15.

· Refer to Overpayment for a description of what happens if money still exists after the above distribution is complete.

Payment segments and financial transactions. A payment segment exists for each obligation that receives a portion of a payment. Linked to each payment segment is a financial transaction. It is the financial transaction that causes the obligation’s debt to be relieved and the general ledger to be impacted.

Refer to Payment Exception for more information about how the system handles errors detected during the payment distribution process.

Overriding the distribution algorithm for uploaded payments. The standard distribution algorithm is used for payments that are Interfaced From An External System unless you specify a MATCH_VALUE and MATCH_FLG on the Payment Staging row associated with the uploaded payment. These fields are used in conjunction to indicate that the distribution of the payment should be restricted in some way (i.e., the standard payment distribution algorithm should not be used). MATCH_FLG indicates how the payment should be distributed (e.g., only distribute to a specific obligation), MATCH_VALUE contains the ID of the restriction (e.g., the obligation ID).

Open item customers. For an open-item taxpayer, you MUST override the standard distribution algorithm because the payment is distributed as per the open items that it is relieving. Refer to Payments And Match Events for more information.

Overpayment

Overpayment refers to the situation where money is left over after a payment has been distributed to all eligible obligations, and all debt is relieved. Refer to Overpayment Obligations for a description on how to configure the system to handle your overpayment requirements.

Canceling A Tender Versus Canceling A Payment

A payment event has tender(s) and payment(s). You can cancel a tender when it’s not valid, e.g., when a check bounces. You can cancel a payment when the account should not have received the payment (e.g., a misdistribution or a canceled tender).

When you cancel a tender, the system automatically cancels ALL frozen payments. We do this because if the tender is canceled, there are no funds to distribute to accounts (unless there are other non-canceled tenders under the event). However, when you cancel a payment, the system does NOT cancel the tender(s) because we assume that, if the tenders were incorrect, you would have canceled them rather than the payment.

NSF Cancellations

When a tender is canceled, a cancellation reason must be supplied. If the cancellation reason indicates a NSF (non sufficient funds) charge should be levied, the system invokes the NSF charge algorithm specified on the tender’s account’s account type. Algorithms of this type will typically create an adjustment or billable charge to levy the NSF charge.

Besides calling this algorithm, an NSF cancellation may affect the tendering account's compliance rating. The cancellation reason indicates the extent to which the account’s ratings are affected.

Transferring A Payment

If the account on an event’s tender and payment are wrong, you can use the Transfer button on the Payment Event page to transfer the payment to another account.

If the account on the payment is wrong – but the tender is correct, you can use the Transfer button on the Payment page to transfer the payment only to another account.

Unbalanced Payment Events

The system, by default, distributes the sum of a payment event’s tenders to the account that remits the tender with a single payment. After distribution the sum of the tenders equals the sum of the payments when the event is first created. We refer to such an event as being balanced.

However, it is possible for an event’s tender amount to not equal the sum of the payment allocations (i.e., the event becomes unbalanced). How? Well, there are several ways this can happen:

· While the system DEFAULTS the payment amount to be the tender amount, you can override the payment amount and therefore make a previously balanced event unbalanced.

· While the system DEFAULTS the payment account to be the tender account, you can add additional accounts / amounts and therefore make a previously balanced event unbalanced.

· When you cancel a tender (e.g., because a check bounces), the system cancels ALL payments linked to the tender's payment event. If the payment event has multiple tenders, this will cause the event to become unbalanced. To correct this situation, you must add payment allocations to equal the amount of non-canceled tenders.

· If you cancel a payment and forget to add another payment for the same amount, the event becomes unbalanced. To correct this situation, you must add another payment (or cancel the tender).

· You may delete a tender from an event while its tender control is open. If you delete a tender and don’t do anything about the related payments, the event becomes unbalanced.

· You may add a tender to an event at any time. If you don’t allocate the tender amount to an account, the event becomes unbalanced.

Refer to Payment Event Exceptions for more information about how the system reminds you about unbalanced payment events.

Tender Management and Workstation Cashiering

When you add a tender, you must identify its Tender Source. For example,

· A specific cash drawer ID is the source of tenders remitted to a cashier.

· The notional lockbox ID is the source of tenders interfaced from a lockbox.

· The remittance processor is the source of tenders interfaced from a remittance processor.

For more information, refer to Setting Up Tender Sources.

A tender source’s tenders must be balanced against an expected total before they can be deposited at a bank. This periodic balancing requires all tenders to exist in respect of a Tender Control. Over time, a tender source may have many tender controls (one per balancing event).

An example of a cashier’s cash drawer will help clarify the tender control concept:

· When a cashier starts in the morning, s/he starts with a fresh cash drawer (i.e., one without tenders). Whenever a drawer starts afresh, a new Tender Control must be created because you balance the contents of a drawer.

· A cash drawer typically contains funds to make change. These funds are the tender control’s Opening Balance.

Default note. A tender control’s starting balance defaults from its tender source.

· During the day, taxpayers remit tenders to the cashier. Every tender put into the drawer is associated with the drawer’s tender control created at the start of the day.

· A tender control’s balance increases during the day as tenders are recorded. A cashier can view the balance at any time.

· The cashier can turn in funds to the head cashier during the day. Each turn in event can be recorded in the system. Note well, if the amount of funds in a tender control exceeds the maximum balance defined on the tender control’s tender source, a warning is issued to the cashier to remind him/her to turn in funds.

· At some point, the contents of the drawer must be balanced against the total tenders linked to the tender control. When balancing starts, no additional tenders may be put into the tender control. If the cashier receives additional tenders after balancing starts, a new tender control must be created (and the above process starts afresh).

· During the balancing process, some modifications may be made to the tenders associated with the tender control, but no additional tenders may be added. When the tender control is balanced, neither it nor its tenders may be modified.

For more information, refer to Managing Your Cash Drawers.

While the above explanation is true, it isn’t complete. In addition to the requirement that a tender must reference a tender control, the tender control must refer to a Deposit Control. Deposit controls give you administrative control over all of the tender controls whose contents will be deposited en masse. The following concepts will help explain the power of deposit controls:

· As explained above, when a cash drawer is started afresh, a new tender control must be created. The tender control “holds” all new tenders received by the cashier.

· Similarly, when a tender control is created, it must reference a deposit control. During the day, a deposit control’s tender controls are constantly changing. You can view the total impact of a deposit control’s tender controls at any time.

· At some point, you will want to deposit the tenders received during the day. To do this, you must indicate how much will be deposited at the bank. This deposit amount must equal the sum of the tender controls linked to the cash drawer. When this deposit balancing starts, no additional tender controls may be associated with the deposit control.

· When the deposit total equals the sum of the tender controls, the deposit control becomes balanced and no changes may be made to it, its tender controls, or its tender controls’ tenders.

For more information, refer to Managing Your Cash Drawers.

Background processes use the same concepts. Tenders that are interfaced from external sources (e.g., lockboxes and remittance processors) make use of the concepts describe above. For example, tenders interfaced from a remittance processor are linked to a tender control and this tender control is linked to a deposit control. The main difference is that the background processes require no human intervention; the system automatically creates tender and deposit controls and sets their states to balanced when the interface concludes successfully.

The ACH activation process also creates tender and deposit controls. Refer to Activating Automatic Payments for more information.

The topics in this section elaborate on the tender management concepts described above.

Contents

Managing Payments Interfaced From External Sources

Managing Your Cash Drawers

Warning! This section assumes you are familiar with the concepts described in The Lifecycle Of A Deposit Control and The Lifecycle Of A Tender Control.

There are many ways to handle the daily management of tenders received via cash drawers. It really depends on how your organization works. To help you understand the potential of the system, we’ll continue the example started above.

Assume that the cash drawers in your western office are balanced and deposited independently from those in your eastern office. We’ll assume that both offices follow the same daily routine:

· Load fresh drawers first thing in the morning. Each drawer contains a starting balance of $150.00. Note: the drawer’s tender control’s starting balance defaults from its tender source.

· At 10 am, the cashier turns in funds to the chief cashier and continues to receive additional tenders.

· At 12 noon, each drawer is pulled and balanced by a supervisor.

· By 12:30 pm, the tender controls are balanced.

· At 4 pm, the cashiering stations are closed. Each drawer is pulled and balanced by a supervisor.

· By 4:30 pm, the tender controls are balanced.

· At 5 pm, the deposit control is balanced and funds are ready to be deposited at the bank.

Given this, the following diagram illustrates the deposit controls and tender controls used by each office on a given day.

The following concepts are illustrated above:

· An Open deposit control must exist before you can create a tender control. And an Open tender control must exist before you can create a tender. From a business process standpoint, this means:

· A supervisor would create a deposit control at the start of the day (8 am in the above illustration).

· Each cashier would create a tender control when they start a drawer and reference the deposit control created by the supervisor.

· During the day, the cashier can turn-in moneys to the chief cashier. These turn-in events are recorded in the system as they play a part in the ultimate balancing of the drawer. Refer to Turn Ins for more information.

· At some point, the contents of a drawer can be pulled and balanced. If additional tenders can be received in a drawer, a new tender control must be created for the drawer. Refer to Balancing By Tender Type for more information.

· At the end of the day, the supervisor checks to make certain that all tender controls linked to the deposit control are Balanced. After this has been done, the supervisor indicates the deposit amount on the deposit control and changes it to Balanced. Notice that in the above illustration each deposit control references four tender controls.

· Typically, a cash drawer has one tender control Open at any point in time (meaning that the tenders being received are being linked to a specific tender control). However, this is not a hard rule. If you want, you may have multiple tender controls Open at any point for a specific cash drawer (for example, if multiple cashiers can work the same drawer during the day but take their drawer with them).

· Typically, a specific cashier puts tenders into a specific tender control. However, this is not a hard rule. On a tender control, you can define if it’s limited to a specific operator OR if any operator can link tenders to it.

· When you’re ready to balance a drawer, you change the tender control to Balancing in Progress. This prevents new tenders from being added to the tender control. If the cashier can continue to receive tenders, s/he must create another tender control. In the above example, all drawers are balanced at 12 noon by a supervisor while the cashier continues to take payments.

· When the tender control is balanced, you change its state to Balanced. This prevents any changes to the tender control or its tenders.

· All tender controls exist in respect of a deposit control (in fact, the deposit control must be created before the tender control). This way, a supervisor can check the state of the related drawers throughout the day. Notice that the state transition of a deposit control is identical to that of the tender control (refer to The Lifecycle Of A Deposit Control and The Lifecycle Of A Tender Control). There is only a temporal difference. Notice that the deposit control stays open throughout the day while any number of tender controls are being opened and balanced.

Multiple deposits in a day. While the above example illustrates a single deposit per office per day, it is quite possible to have multiple deposit controls on any given day.

Turns ins. The above example did not illustrate the fact that a cashier can turn-in moneys during the day without having to balance the drawer. Refer to Turn Ins for more information.

Turn Ins

A cashier may optionally turn-in funds received into a cash drawer to a head cashier. The turn-in process requires two steps:

· Each time a cashier turns-in funds, they add a turn-in event on the Tender Control – Turn Ins page. Note that a separate turn-in event is required for each type of tender that’s turned in. This is because the balancing of a tender control is performed for each tender type and therefore the system must know how much of each tender type has been removed from the drawer.

Turn in warning. If the amount of cash-like funds in a tender control exceeds the maximum balance defined on the tender control’s tender source, a warning is issued to the cashier to remind him/her to turn in funds.

· The head cashier (the person responsible for the deposit control associated with the various tender controls) approves the turn in using the Deposit Control – Turn Ins page.

All turn-ins must be approved for balancing to complete. A tender control cannot be balanced until the head cashier has approved all turn-in events.

Balancing By Tender Type

It should be noted that when it’s time to balance a tender control, the cashier must enter the amount of each tender type that is in the drawer in order to balance it. For example, assume the following takes place:

· A drawer is opened with a starting balance of $150.50 (tender type is Cash).

· During the day, the cashier receives $5,000 in Cash, and $1,000 in Checks.

· During the day, the cashier turns in $750 or the Checks and $4,000 of Cash.

At the end of the day, the following operator would have to enter the balances shown in the Ending Balance column.

|

Tender Type

|

Starting Balance |

Tenders Received |

Turn Ins

|

Ending Balance

|

|

Cash |

$150.50 |

$5,000 |

$4,000 |

$1150.50 |

|

Check |

- |

$1,000 |

$750 |

$250 |

Time saver. The system assists in the balancing effort by amalgamating the amount of tenders by tender type when the tender control’s status is changed from Open to Balancing In Progress. The cashier just needs to enter the Ending Balance. The system can then compare the cashier’s Ending Balance against the Expected Ending Balance. When these values are equal for all tender types, the tender control’s status can become Balanced.

Cash Back

When a payment is added, the user defines the following:

· The amount of debt to be relieved (i.e., the payment amount)

· The amount remitted (i.e., the tender amount)

· The form of the remittance (i.e., the tender type)

The payment amount typically equals the tender amount unless cash will be returned to the taxpayer. For example, if a taxpayer remits $100, but only wants to pay off $25 of debt, the tender amount will be $100 and the payment amount will be $25. The system will only allow a user to remit more than the payment amount if the tender type indicates "cash back" is allowed. For example, you may not allow cash to be returned if a check is remitted, but you may allow it to be returned if cash is remitted.

If cash back is allowed for the tender type, the system displays the amount of cash to be returned on the Payment Event. In addition, because the system enforces balancing the cash drawer by tender type, the system adjusts the payment event's tendered information as follows:

· When there is cash back, the payment event will have two tenders - one will be for the amount and type entered by the user, the other will be a negative amount with a tender type of cash (note, this tender type is retrieved from the Starting Balance Tender Type on the installation record). For example, if a taxpayer remits $100 in traveler's checks, but only wants to pay off $25 of debt, there will be two tenders: one for the $100 travelers check and the other for the -$25 of cash.

Multiple tenders and payment cancellation. If multiple tenders were created because of "cash back" processing, both tenders must be cancelled if the payment event needs to be cancelled.

When modifying an unfrozen payment on the Payment Event, if the payment becomes unbalanced, a button is displayed allowing the user to Recalculate Cash Back. If the user clicks this button, the system reassesses the cash back tender as follows:

· If there is now cash back, a new tender is created for the credit amount

· If the cash back amount has changed, the tender for the cash back is adjusted to the new amount

· If there is no longer cash back due, the tender for the cash back is removed.

Managing Payments Interfaced From External Sources

Just like a payment recorded on-line via a cash drawer, a payment interfaced from an external source (e.g., lock box or remittance processor) must reference a tender control and the tender controls, in turn, must reference a deposit control. The only real differences between these two types of payments are highlighted below:

· Whilst an operator must create and balance the tender and deposit controls for real-time payments, the system creates the tender and deposit controls associated with interfaced payments.

· It’s impossible for an invalid account to be referenced on a payment recorded real-time. However, it is quite possible for an interfaced payment to reference an unknown account. If an invalid account is referenced on an interfaced payment (using no distribution rules), the system links it to the suspense obligation referenced on the tender source control table.

Refer to Interfacing Payments From External Sources for more information.

Exceptions

The topics in this section describe exceptions that are detected when the system allocates a payment.

Contents

Resolving Exceptions Automatically

Payment Exceptions

When the system attempts to distribute a payment, there are a small number of situations where it can’t do its job. Some examples of classic errors:

· No obligation to hold a credit. For example, if an account overpays their debt and the account doesn’t have a single obligation that is allowed to hold a credit, a payment error is generated.

The system saves payments that are in error just as it saves payments that are error-free. This is done because payments are nothing more than a snapshot of the data that was used to distribute the payment. By saving the snapshot, you can see the information the system used when it detected the error and therefore more effectively correct it.

Every payment in error is written to the Payment Exception table. A To Do background process creates To Do entries for records in this table.

Payment Event Exceptions

It is possible for a payment event’s tenders to not equal its payments. Such events are classified as unbalanced. Refer to Unbalanced Payment Events for how this can happen.

For each unbalanced payment event, a record is written to the Payment Event Exception table. A To Do background process creates To Do entries for records in this table.

Resolving Exceptions Automatically

Some payment errors occur because master data was not fully set up prior to receiving a payment for the account. For these cases, the system will periodically check to see whether the master data problem has been resolved by attempting to distribute and freeze the payment in error.

A background process, Resolve Payments in Error – PY-RPE, exists for this purpose. This background process works as follows:

· It looks for payments in error where the error was caused by the lack of active obligations linked to the payment’s account.

· For each such payment, it attempts to re-distribute the payment. If obligations have been created in the meantime, this payment will distribute and freeze successfully.

Payment Financial Transaction Considerations

A payment segment exists for each obligation that receives a portion of a payment. Linked to every frozen payment segment is a financial transaction. This financial transaction affects an obligation’s payoff balance and/or current balance. It also contains the journal details that debt cash and credit some other account.

The topics in this section provide information about the financial impact of a payment segment.

Refer to The Financial Big Picture for more information about a payment’s place in the financial big picture.

Contents

Payment - Current Balance versus Payoff Balance

The Source Of GL Accounts On A Payment Financial Transaction

Payment - Current Balance versus Payoff Balance

Warning! If you do not understand the difference between payoff balance and current balance, refer to Current Amount versus Payoff Amount.

A payment segment financial transaction almost always affects payoff balance and current balance by the same amount (think of it like this - when a taxpayer pays, the amount they think they owe goes down by the amount they really owe). The only exception is a payment segment for a charitable contribution. These payment segments only affect current balance because the taxpayer was never assessed for the contribution in the first place.

Refer to Setting Up Payment Segment Types for more information about how payment segment type affects how a payment segment is produced and how its financial transaction is generated.

The Source Of GL Accounts On A Payment Financial Transaction

A payment segment’s financial transaction also contains the double-sided accounting entry that defines how the payment segment affects the general ledger.

Refer to The Source Of GL Accounts On Financial Transactions for a description of where the system extracts the distribution codes used to construct the GL accounts.

A Payment May Affect More Than Just Taxpayer Balances

The topics in this section provide information about obscure things that may happen when a payment is distributed and frozen.

Contents

Open Item Accounting and Match Events

Open Item Accounting and Match Events

Refer to Payments and Match Events for more information about how payments can create match events for open-item accounts.

FT Freeze Repercussions

Refer to Obscure Things That Can Happen for more information about things that can happen when an FT is frozen (and FT’s get frozen when a payment is frozen).

Automatic Payments

This section discusses how to set up and manage taxpayers who pay their bills automatically (via direct debit or credit card debits)

Contents

How To Set Up A Taxpayer To Pay Automatically

How And When Are Automatic Payments Created?

How To Implement Maximum Withdrawal Limits

How Are Automatic Payments Cancelled?

Match Events Are Created For Open-Item Customers When An Automatic Payment Is Created

Pay Plans and Automatic Payment

Downloading Automatic Payments and Interfacing Them To The GL

How To Set Up A Taxpayer To Pay Automatically

If a taxpayer wants to pay automatically, transfer to Account – Auto Pay and define the source of the funds and the taxpayer’s account or credit card number.

What Are Automatic Payments?

An automatic payment is just like any other payment (refer to A Payment Event Has Payments And Tenders for more information about payments in general). However, automatic payments have one special trait – they cause funds to be transferred into your company’s bank account. Refer to Downloading Automatic Payments and Interfacing Them To The GL for how this transference happens.

How And When Are Automatic Payments Created?

Automatic payments can be created in several ways:

· The system creates automatic payments for bills linked to accounts with an active auto pay option.

· At bill completion time, the bill is stamped with the automatic payment’s extract date and amount. The date is the automatic payment source’s extraction date (refer to Automatic Payment Dates for more information on how this date is calculated).

· The automatic payment background process (APAYCRET) creates the automatic payment on the extract date stamped on the bill.

An algorithm is used to create automatic payments. The logic used to create automatic payments is plugged in on the Installation Record. The base package includes two sample algorithms. APAY-CREATE creates each auto pay as one payment event with one tender and one payment. Use APAY-CREATE if you use standard payment distribution. C1-APAY-CRDR creates automatic payments using distribution rules. Use C1-APAY-CRDR if you use distribution rules.

· The automatic payment is NOT distributed and frozen when the automatic payment is initially created. A separate background process (APAYDSFR / C1-APYDF) distributes and freezes the automatic payment on the automatic payment GL distribution date (refer to Automatic Payment Dates for more information on how this date is calculated). This means that the taxpayer’s balance increases when the bill is completed and is only reduced when the automatic payment is marked for interface to the general ledger.

APAYDSFR uses standard payment distribution. This process assumes the automatic payment was created as: one payment event, one payment. Use this to distribute / freeze payments created by APAY-CREATE.

C1-APYDF uses distribution rules. This process assumes that the automatic payment was created using distribution rules. Use this to distribute / freeze payments created by C1-APAY-CRDR.

· Note that it is possible for automatic payments to be distributed and frozen after being extracted and interfaced to a financial institution. Please refer to Downloading Automatic Payments and Interfacing Them To The GL and The Nightly Processes.

An algorithm plugged in on the Installation Record calculates the payment amount whether the automatic payment is created at bill completion time or on the extract date. Please refer to APAM-DFLT for more information about how the algorithm that is supplied with the base package calculates this amount.

With balance forward accounting, automatic payments are not just for new charges. The base package algorithm includes prior balances when it creates a taxpayer’s first automatic payment. For example, if a taxpayer has an existing balance of $100 and then signs up for automatic payment, their next bill will cause an automatic payment of $100 plus any new charges to be created (assuming the $100 remains unpaid at the time the next bill is completed). Refer to Open Item Versus Balance Forward Accounting for information about balance forward accounting.

· If a taxpayer with an account that is set up for automatic payment has a pay plan that is not excluded from automatic payment, a background process (C1-PAYPA) creates an automatic payment on the scheduled payment dates. Please note, the automatic payment is NOT distributed and frozen when the automatic payment is initially created. Rather, a separate background process (APAYDSFR / C1-APYDF) distributes and freezes the automatic payment on the automatic payment GL distribution date (refer to Automatic Payment Dates for more information on how this date is calculated). Refer to The Big Picture of Pay Plans for more information about pay plans.

· A user can create an automatic payment by simply adding a payment tender with a tender type that indicates it is for automatic payment purposes. This would be a rather unusual thing to do, but you might do this if you want to immediately debit a taxpayer’s bank account after a large adjustment is added to the system (e.g., if they suddenly owe you a lot of money and you don’t want to wait until the next bill to collect it). Automatic payments created by this method must be distributed and frozen before they can be extracted.

Auto pay creation algorithm is not invoked for manually created automatic payments. Please note that this algorithm is not called when a user manually creates an automatic payment (by adding a payment tender with a tender type that indicates that it is for automatic payment purposes).

When an automatic payment is first created, it gets marked with a distribution date. The distribution date is the date on which the automatic payment’s FT’s GL details can be interfaced to the general ledger (via the standard GL interface). The distribution date is determined as follows:

· Every automatic payment references an auto-pay source.

· Every auto-pay source references an auto-pay route type.

· Every auto-pay route type contains an algorithm that is responsible for calculating the GL Distribution (Posting) date. On the GL distribution date, the automatic payment will be interfaced to the general ledger.

Automatic Payment Dates

As described in the previous section, an algorithm (that’s plugged in on Auto Pay Route Types) controls the date on which the automatic payment is interfaced to your general ledger. We refer to this date as the GL distribution date.

This algorithm also populates the following dates:

· The payment date that is stored on the payment.

· The date on which the automatic payment is interfaced to the financial institution.

The algorithm that is supplied with the base package provides many parameters that allow you to dictate how these dates are calculated. Please refer to APAY-DTCALC for the details.

How To Implement Maximum Withdrawal Limits

In some locales, taxpayers can define a “maximum withdrawal amount” to limit the amount of money that is automatically debited from their bank account. For example, a low-income taxpayer may want to prevent direct debits of more than $50 from being applied to their checking account.

You define a taxpayer’s maximum withdrawal amount when you setup their automatic payment information on Account – Auto Pay.

The following points describe how the system implements maximum withdrawal limits:

· When a bill is completed for a taxpayer who pays automatically the system calls the automatic payment creation algorithm that’s plugged in on the Installation Record. The base-package autopay creation algorithm checks if the amount of the automatic payment exceeds the taxpayer’s maximum withdrawal amount. If so, the autopay creation algorithm calls the automatic payment over limit algorithm that’s plugged in on the account’s account type. Algorithms of this type have the ability to reduce the amount of the autopay or to prevent the autopay from being created. Refer to APOL-RA for an example plug-in.

· When a user manually creates an automatic payment (by adding a tender with a tender type that indicates that it is for automatic payment purposes), the system issues a warning message when the tender amount exceeds the account’s maximum withdrawal amount.

Pay plans. Please note that automatic payments that are created as a result of pay plans are not subject to maximum withdrawal limits. This is because both of these options required taxpayer approval and therefore the taxpayer should be able to plan accordingly. Refer to How And When Are Automatic Payments Created for more information.

How Are Automatic Payments Cancelled?

There are two ways to cancel an automatic payment:

· The system will cancel an automatic payment behind-the-scenes if the related bill (if any) is reopened BEFORE the automatic payment is interfaced to the financial institution. When you recomplete the bill, the system will create a new automatic payment that reflects the new amount due (and the canceled automatic payment will net out the original automatic payment).

An operator can cancel an automatic payment (refer to How To Cancel A Tender) at any time. You would do this if the financial institution rejected the automatic payment.

Match Events Are Created For Open-Item Customers When An Automatic Payment Is Created

The system creates a match event when a bill is completed for open-item customers that pay automatically (i.e., direct debit taxpayers). The match event groups together the bill’s new charges against the automatic payment’s payment segments.

If the bill is subsequently re-opened, the match event will be cancelled when the automatic payment is cancelled.

Refer to Open Item Accounting for more information.

Pay Plans and Automatic Payment

If a taxpayer wants to pay their pay plan scheduled payments automatically, the account must be set up for automatic payment (as described under How To Set Up A Taxpayer To Pay Automatically). In addition, the pay plan must indicate that automatic payment is being used.

When this is done, a background process referred to as C1-PAYPA creates automatic payments on the scheduled payment date by calling the automatic payment creation algorithm plugged in on the installation record.

Downloading Automatic Payments and Interfacing Them To The GL

The following diagram illustrates the background processes that interface automatic payment out of the system:

These processes are described in the following topics.

Contents

ACTVTAPY - Activating Automatic Payments

APAYACH - Download Automatic Payments To The ACH (automated clearing house)

BALAPY - Creating Automatic Payment Tender Controls

ACTVTAPY - Activating Automatic Payments

When an automatic payment is first created, it gets marked with an extract date. The extract date is the date the automatic payment will be downloaded to the respective financial institution. The extract date is determined as follows:

· Every automatic payment references an auto-pay source.

· Every auto-pay source references an auto-pay route type.

· Every auto-pay route type contains an algorithm that calculates this date.

On the extract date, the automatic payment is “activated”. The automatic payment is activated is marked for download the next time its download process runs. An automatic payment’s download process is defined on its auto-pay source’s route type.

APAYACH - Download Automatic Payments To The ACH (automated clearing house)

This process reads all auto pay download staging records marked with a given batch control ID & run number and creates the flat file that’s passed to the ACH. Refer to ACH Record Layouts for the details of the record layouts.

You can rerun this process. You can reproduce the flat file at any time. Simply request this job and specify the run number associated with the historic run.

If you require a different flat file format, you must create additional versions of this program. Refer to Setting Up Automatic Payment Extracts for instructions describing how to add another process.

BALAPY - Creating Automatic Payment Tender Controls

This process creates a new tender control (with an associated deposit control) for each unique batch control and run number encountered in the extracted automatic payments (where its payment tender is not yet linked to a tender control). The payment tender of each of these automatic payments is then linked to the corresponding tender control. This process also balances the open tender control records afterwards.

ACH Record Layouts

The topics in this section describe the layout of the records created by APAYACH – Download Automatic Payments To The ACH (automated clearing house).

Contents

File Header Record

The ACH extract flat file must have one record of this type and it must be the first logical record on file.

|

Field Name |

Format |

Source/Value/Description |

|

RECORD-TYPE |

A1 |

“1” |

|

PRIORITY-CD |

A2 |

“01” |

|

RESERVED-01 |

A1 |

Spaces |

|

IMMEDIATE-DESTINATION |

A9 |

CI_BANK_ACCOUNT.DFI_ID_NUM |

|

COMPANY-ID |

A10 |

CI_BANK_ACCOUNT.ACCOUNT_NBR |

|

FILE-CRE-DT |

A6 |

YYMMDD. Current date |

|

FILE-CRE-TM |

A4 |

HHMM. Current time |

|

FILE-ID-MODIFIER |

A1 |

“A” |

|

RECORD-SIZE-CONST |

N3 |

“094” The “FILLER” at the end of all but the Entry Detail Record serves to bring the total length of each record up to this constant. |

|

BLOCKING-FACTOR |

N2 |

“10” |

|

FORMAT-CD |

A1 |

“1” |

|

ORIG-FIN-INST-NAME |

A23 |

CI_BANK_L.DESCR |

|

COMPANY-NAME |

A23 |

CI_BANK_ACCOUNT_L.DESCR |

|

REFERENCE-CD |

A8 |

Spaces |

Company Batch Header Record

The ACH extract flat file must have one record of this type and it must be the second logical record on file.

|

Field Name |

Format |

Source/Value/Description |

|

RECORD-TYPE |

A1 |

“5” |

|

SERVICE-CLASS-CD |

A3 |

“200” |

|

COMPANY-NAME |

A16 |

CI_BANK_ACCOUNT_L.DESCR |

|

COMPANY-DISCRETIONARY |

A20 |

Spaces |

|

COMPANY-ID |

A10 |

CI_BANK_ACCOUNT.ACCOUNT_NBR |

|

STD-ENTRY-CLASS |

A3 |

“PPD” |

|

CO-ENTRY-DESCR |

A10 |

“PAYMENT” |

|

COMPANY-DESCR-DT |

A6 |

Business process date |

|

EFF-ENTRY-DT |

A6 |

Business process date |

|

RESERVED-01 |

A3 |

Spaces |

|

ORIGINATOR-STAT-CD |

A1 |

“1” |

|

ORIGIN-DFI-ID |

A8 |

CI_BANK_ACCOUNT.DFI_ID_NUM |

|

BATCH-NBR |

N7 |

The batch number of this batch within the file. |

Entry Detail Record

The ACH extract flat file must have one record of this type for every direct debit record.

|

Field Name |

Format |

Source/Value/Description |

|

RECORD-TYPE |

A1 |

“6” |

|

TRANSACTION-CD |

A2 |

If the amount is a debit, this is set to CI_TENDER_TYPE.EXT_TYPE_FLG. If the amount is a credit, this is set based on the external type flag as follows: · If the value is Checking Withdrawal (27), this is set to 22 (Checking Deposit) · If the value is Savings Withdrawal (37), this is set to 32 (Savings Deposit) · If the value is Credit Card Withdrawal (47), this is set to 42 (Credit Card Deposit) |

|

TRANSIT-RTG-NBR |

A9 |

CI_APAY_SRC.EXT_SOURCE_ID |

|

DFI-ACCT-NBR |

A17 |

CI_APAY_CLR_STG.EXT_ACCT_ID |

|

AMOUNT |

N8.2 |

CI_PAY_TNDR.TENDER_AMT |

|

INDIVIDUAL-ID |

A15 |

CI_PAY_TNDR.PAYOR_ACCT_ID |

|

INDIVIDUAL-NAME |

A22 |

CI_APAY_CLR_STG.ENTITY_NAME |

|

DISCRETIONARY-DATA |

A2 |

Spaces |

|

ADDENDA-REC-IND |

A1 |

“0” |

|

TRACE-NBR |

N15 |

“000000000000000” |

External Account ID. The EXT_ACCT_ID field supports up to 50 characters. If the value entered in the field is longer than that supported by the record layout (17 characters), the value will be truncated.

Company Batch Control Record

The ACH extract flat file must have one record of this type and it must follow the Entry Detail records.

|

Field Name |

Format |

Source/Value/Description |

|

RECORD-TYPE |

A1 |

“8” |

|

SERVICE-CLASS-CD |

A3 |

“200” |

|

ENTRY-ADDENDA-CNT |

N6 |

The total number of entry detail records in this batch. |

|

ENTRY-HASH |

N10 |

The product of the first 8 digits of the external source id of the autopay source, multiplied by the number of entry detail records in the batch. |

|

TOTAL-DR-DOLLAR-AMT |

N10.2 |

Total tender amounts of the entry detail records. |

|

TOTAL-CR-DOLLAR-AMT |

N10.2 |

Zero. |

|

COMPANY-ID |

A10 |

CI_BANK_ACCOUNT.ACCOUNT_NBR |

|

RESERVED-01 |

A19 |

Spaces |

|

RESERVED-02 |

A6 |

Spaces |

|

ORIGIN-DFI-ID |

A8 |

CI_BANK_ACCOUNT.DFI_ID_NUM |

|

BATCH-NBR |

N7 |

The batch number of this batch within the file. |

File Control Record

The ACH extract flat file must have one record of this type and it must be the last logical record on file.

|

Field Name |

Format |

Source/Value/Description |

|

RECORD-TYPE |

A1 |

“9” |

|

BATCH-CNT |

N6 |

The number of batches in this file. |

|

BLOCK-CNT |

N6 |

Calculation of the total number of records in the file / 10.0 + 0.9 |

|

ENTRY-ADDENDA-CNT |

N8 |

The total number of entry detail records in this file. |

|

ENTRY-HASH |

N10 |

The sum of the entry hash values on all the batch control records in this file. |

|

TOTAL-DR-DOLLAR-AMT |

N10.2 |

Sum of the total debit entry dollar amounts of all the batches in this file. |

|

TOTAL-CR-DOLLAR-AMT |

N10.2 |

Sum of the total credit entry dollar amounts of all the batches in this file. |

|

RESERVED-01 |

A39 |

Spaces |

Issuing A Payment Advice Instead Of Creating An Automatic Payment

If the system is configured to send the taxpayer a payment advice (instead of initiating an electronic funds transfer) when a bill is completed, the automatic payment records – i.e. payment event, payment, tender and auto pay clearinghouse staging – are not created. Refer to Payment Advices for more information.

Contents

How To Set Up A Taxpayer To Receive Payment Advices

Payment Advice Option Is For Bill-Related Automatic Payments Only

How To Set Up A Taxpayer To Receive Payment Advices

Use Account – Auto Pay to capture the taxpayer’s bank details and indicate an auto pay method of Payment Advice.

Payment Advice Option Is For Bill-Related Automatic Payments Only

Payment advices can be printed for auto pays that result from completed bills.

An auto pay for a pay plan scheduled payment will not be created if the account’s effective auto pay option is set to Payment Advice. The Pay Plan Pay Plan Auto Pay (C1-PAYPA) batch process will log an error in this case.

Manually created automatic payments (i.e. auto pays created via payment event UI) are always processed as direct debit.

A payment event is used to record when moneys are remitted and how the moneys are allocated amongst accounts. The topics in this section describe how to maintain payment events.

The system creates most payment events behind-the-scenes. Most payment events are created by the system when it uploads payments and when it creates automatic payments. You should only have to access the payment event transaction if you need to correct a payment event or add a payment event real-time. For information about how the system creates payment events, refer to The Big Picture of Payments.

Contents

Payment Event - Main Information

Payment Lifecycles

The topics in this section describe the lifecycle of the various payment objects.

Contents

Payment Event Lifecycle

The following diagram shows the possible lifecycle of a payment event.

Warning! This diagram only makes sense in the context of the page used to maintain payment events. Refer to Payment Event - Main Information for the details.

The system, by default, distributes the sum of a payment event’s tenders to the account that remits the tenders. After distribution the sum of the tenders equals the sum of the payments (remember, the term payment is used to refer to an allocation of some/all of a payment event’s tenders to an account’s debt) when the event is first created. We refer to such an event as being Balanced.

It is possible via any of the methods described in Unbalanced Payment Events to make a balanced payment event Unbalanced.

Click ![]() to physically remove

a balanced or unbalanced payment event from the database. You may not delete a

payment event if: a) there are frozen or canceled payments linked to the event,

or b) if there are canceled tenders linked to the event, or c) if a tender

linked to the event is part of a balanced tender control. When the payment event is deleted, the

system also deletes its tenders, payments, and payment segments.

to physically remove

a balanced or unbalanced payment event from the database. You may not delete a

payment event if: a) there are frozen or canceled payments linked to the event,

or b) if there are canceled tenders linked to the event, or c) if a tender

linked to the event is part of a balanced tender control. When the payment event is deleted, the

system also deletes its tenders, payments, and payment segments.

Tender Lifecycle

The following diagram shows the possible lifecycle of a payment event.

Warning! This diagram only makes sense in the context of the page used to maintain tenders. Refer to Payment Event - Tenders for the details.

A tender is initially saved in the Valid state. It is possible via any of the methods described in Unbalanced Payment Events to make a balanced payment event Unbalanced.

If a tender is invalid, click ![]() to cancel the tender

AND ALL PAYMENTS LINKED TO THE EVENT.

to cancel the tender

AND ALL PAYMENTS LINKED TO THE EVENT.

Click the delete button to physically remove a tender from the database. You may not delete a tender if it is part of a balanced tender control.

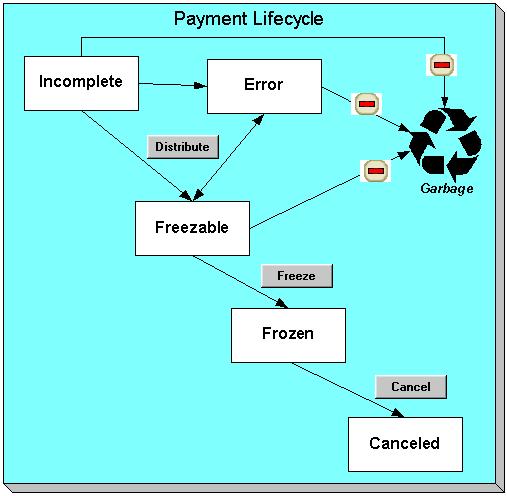

Payment Lifecycle

The following diagram shows the possible lifecycle of a payment.

Warning! This diagram only makes sense in the context of the page used to maintain a payment. Refer to Payment - Main for the details.

Payments are initially created in the Incomplete state. Payments in this state don’t have payment segments or financial transactions; they are simply a stub awaiting distribution.

Click ![]() to distribute a

payment amongst an account’s obligations.

to distribute a

payment amongst an account’s obligations.

· If the system cannot distribute the payment (for whatever reason), the payment is moved to the Error state. You may delete such a payment.

· If the system successfully distributes a payment, the payment becomes Freezable.

Click the - button to physically remove an Incomplete, Error or Freezable payment from the database.

Click ![]() to freeze a payment

and its financial transaction. Freezing

the payment causes the following to occur:

to freeze a payment

and its financial transaction. Freezing

the payment causes the following to occur:

· The system executes any payment freeze algorithms linked to the account’s account type and to the obligation’s obligation type.

· The payment’s state becomes Frozen and the payment may now appear on a taxpayer’s bill.

You may not change a payment once it is frozen. However, you may reverse the payment’s

financial effect by clicking ![]() button. Clicking this button will cause the

following to occur:

button. Clicking this button will cause the

following to occur:

· A new financial transaction is generated and linked to the payment. This financial transaction reverses the financial effects of the original payment.

· The system executes any payment cancellation algorithms linked to the account’s account type.

· If the payment has a related adjustment, this adjustment is also cancelled.

· The payment becomes Canceled.

Payment Event - Add Dialog

The Payment Event transaction features an unusual dialog that simplifies the addition of new payment events. This page appears if you open the Financial, Payment Event page in add mode from either the Account context menu or from the main menu (it also appears if you click the clear button when on the Payment Event page).

Note. If you have opted to always use the payment event distribution rules method as your default method, the Payment Event QuickAdd (Single Payment Event) page appears instead.

Description of Page

The Payor Account ID is the account that remitted the payment. We assume this account is both the tendering account and the account whose debt is being relieved by the payment. If this assumption is not correct, choose a Distribute Action of Do Not Distribute and then change the tendering or paying account when the Payment Event page appears (after you click OK).

Default note. If you have navigated to this page from account context menu, the Payor Account ID and Payment Amount are defaulted to this account.

The Payment Amount is the amount of the taxpayer’s debt to be relieved by the payment. Note, this amount is defaulted using an algorithm plugged in on the Installation Record. Please refer to APAM-DFLT for more information about how the algorithm that is supplied with the base package calculates this amount.

The payment tenders grid allows you to enter multiple tender types and amounts. Click + to add a new tender. For each tender specify the following fields:

· The Amount Tendered is the amount of moneys remitted for the tender type.

· Tender Type describes what was remitted (e.g., cash, check, …). Tender Type defaults from the Quick Add Tender Type that is defined on the installation record.

· If a check was tendered, use Check Number to specify the identity of the check.

Cash back causes an additional tender to be created. If cash should be returned to the taxpayer (because the taxpayer overpaid and the tender type’s cash back allowed switch is true and the tender type is not “like cash”), a negative tender for the cash back amount is created for the payment event. Refer to Cash Back for a description of how the system can recommend Cash Back amount if the taxpayer tendered more than they are paying.

Match Type and Match Value are used if either of the following conditions is true:

· This Payor Account belongs to an open item account type. In this situation, specify a Match Type to define how the payment should be matched to the taxpayer’s open-items and use Match Value to define the open-items covered by the payment. For example, if this payment is in respect of a bill, specify a match type of “bill id” and a match value of the bill id being paid.

Shortcut. If you enter a Match Type of “bill id” and leave the Match Value blank, the system assumes the taxpayer wants to pay the latest bill.

· The taxpayer wants to restrict the distribution of the payment to a specific obligation. In this situation, specify a Match Type of “obligation ID” and a Match Value of the respective obligation ID.

The Payment Date defaults to the current date.

If the Payor Account ID's account type is designated as non-tax agency payor (i.e., the person making the payment isn't a taxpayer), the following information appears in the above window:

Non Tax Agency Name is the name of the person remitting the payment.

Reference Number is the reference number of the item being paid (e.g., the property tax reference number).

Non Tax Agency Comments are used to describe anything unusual about the non tax agency payment.

Use Distribute Action to describe what you’d like to have happen when you click the OK button:

· Choose Distribute and Freeze if OK if this is a simple payment that should require no manual intervention. By “simple payment” we mean:

· The account is both the tendering account and the account whose debt is being relieved by the payment

· The payment date is the current date

· The payment should be distributed amongst the account’s obligations using standard distribution logic

If this option is selected, the system distributes the Payment Amount amongst the account’s obligations. If the distribution is successful, the system automatically freezes the payment. If the distribution is not successful, the payment will be in the Error or Incomplete state. When the Payment Event page appears, you can view the error and then correct it. After the cause of the error is corrected, you must distribute and freeze the payment manually (this can be done on several pages including Payment Event - Main and Payment - Main).

· Choose Manual Distribution if you need to manually distribute the payment amongst the account’s obligations. If this option is selected, the system creates a payment event, a tender and a payment and then transfers you to the Payment - Manual Distribution page where you can define the amount to be allocated to each of the account’s obligations. After you’ve distributed the payment, don’t forget to freeze it.

· Choose Do Not Distribute if you want to process the payment event manually (e.g., if you need to define multiple accounts whose debt is relieved by the payment). If this option is selected, the Payment Event – Main page opens with the information you entered defaulted accordingly. You can make any changes you want and then distribute and freeze the payment. Refer to How To Add A New Payment Event for more information.

Payment Event - Main Information

The Main page contains core payment event information. Open this page using Financial, Payment Event.

The Description of Page section that appears below simply describes the fields on this page. Refer to How To for a description of how to perform common payment event maintenance functions.

Description of Page

Pay Event Info contains a concatenation of the payment date, amount, and the name of the main taxpayer on the account that remits the tender. If multiple tenders exist, the taxpayer’s name is not displayed. If the payment event is associated with a single distribution detail, the rule name and the description of the rule value are displayed as well. If multiple distribution details exist, Multiple Distribution Details Exist is displayed instead. Pay Event Info is only displayed after the payment event has been added to the database.

Payment Event ID is the system-assigned unique identifier of the payment event.

The area under Pay Event Info provides warnings about the payment event. Possible warnings are Unfrozen Payments and The Payment Event is Unbalanced. A warning is also issued to the cashier to remind him/her to turn in funds – see Turn Ins.

If multiple distribution details are linked to the payment event, the distribution rule, value and amount for each distribution detail is displayed.

Payment Date is the business date associated with the payment event.

Warning! If you change the payment date and this event’s tender(s) are automatic payments, the extract date (i.e., the date the automatic payment is sent to the financial institution) will be changed to equal the payment date. Refer to Automatic Payments for more information.

Effective Date is populated by the algorithm that creates the payment and is used to populate the FT effective date. For example, an income tax return that the taxpayer files on April 1st that is due on April 15th has an effective date of April 15th.

Changing effective date. Refer to Payment Date and Effective Date for Payment Events for information about changing the effective date of a distributed payment event.

Payment(s) contains the total number and value of payments linked to the event.

Tender(s) contains the total number and value of tenders linked to the event.

Amount Tendered contains the amount that was tendered by the taxpayer.

The system displays a Cash Back Amount if the taxpayer tenders more than they are paying (refer to Cash Back for details).

If the payment event becomes unbalanced, a Recalculate Cash Back button appears. If this button is clicked, the system creates, deletes or recalculates the cash back tender. Refer to Cash Back for details.

While most payment events contain a single payment, the system allows many payments to exist under a payment event (when the payment event’s tender(s) are distributed amongst multiple accounts). If a payment event has a large number of payments, you can use the Account Filter to limit the payments that appear in the Payments grid. The following options are available:

· Account. Use this option if you only want to see the payment linked to an Account ID.

· All. Use this option to view all payments linked to the payment event.

· Person Name. Use this option to restrict payments linked to accounts whose main taxpayer has a primary name that matches Person Name.

The Payments grid contains the payment(s) linked to the payment event. The following points describe the attributes in this scroll; refer to How To for instructions describing how to perform common maintenance activities.

· If the payment is created via distribution details, the Distribution Sequence associated with this payment is displayed.

· Account ID references the payment’s account. The name of the account’s main taxpayer is displayed adjacent.

· Payment Amount is the amount of the account’s debt relieved by the payment. The adjacent context menu allows you to drill down to the details of the payment (this is where you can see the payment’s payment segments and where you can override the distribution of the payment).

· Payment Status is the payment’s status. If the payment’s status is Error, the error message is displayed adjacent. Refer to Payment Lifecycle for the potential values and how to handle a payment when it exists in a given state.

· Match Type and Match Value should only be used if either of the following conditions is true:

· This Account ID belongs to an open item account type. In this situation, specify a Match Type to define how the payment should be matched to the taxpayer’s open-items and use Match Value to define the open-items covered by the payment. For example, if this payment is in respect of a bill, specify a match type of “bill id” and a match value of the bill id being paid.

· The taxpayer wants to restrict the distribution of the payment to a specific obligation. In this situation, specify a Match Type of “obligation ID” and a Match Value of the respective obligation ID.

· The remaining columns are only used if the payment is linked to an Account ID that belongs to an account type that is used for non-CIS payments. Refer to Setting Up Account Types for more information. If such an account exists, the following fields must be defined.

· Non Tax Agency Name is the name of the person remitting the payment.

· Reference Number is the reference number of the item being paid (e.g., the property tax reference number).

· Non Tax Agency Comments are used to describe anything unusual about the non tax agency payment.

Note, you can also define a comment for a non tax agency payment. To define a comment, use the context menu adjacent to Payment Amount to drill to Payment - Main.

· Payment ID is the unique, system-assigned identifier of the payment. This value only appears after the payment has been added to the database.

Refer to Payment Actions and Payment Event Actions for information about the action buttons on this page. Refer to How To for a description of typical business processes that use these buttons.

Payment Event - Tenders

The Tenders page contains a scroll showing one row for every tender associated with the payment event. Open this page using Financial, Payment Event, Tenders.

The Description of Page section that appears below simply describes the fields on this page. Refer to How To for instructions describing how to perform common maintenance functions.

Description of Page

Pay Event Info contains a concatenation of the payment date, amount, and the name of the main taxpayer on the account that remits the tender. If multiple tenders exist, the taxpayer’s name is not displayed. If the payment event is associated with a single distribution detail, the rule name and the description of the rule value are displayed as well. If multiple distribution details exist, Multiple Distribution Details Exist is displayed instead. Pay Event Info is only displayed after the payment event has been added to the database.

Payment Event ID is the system-assigned unique identifier of the payment event.

Payment Date is the business date associated with the payment event.

Payment(s) contains the total number and value of payments linked to the event.

Tender(s) contains the total number and value of tenders linked to the event.

Amount Tendered contains the amount that was tendered by the taxpayer.

The system displays a Cash Back Amount if the taxpayer tenders more than they are paying (refer to Cash Back for details).

If the payment event becomes unbalanced, a Recalculate Cash Back button appears. If this button is clicked, the system creates, deletes or recalculates the cash back tender. Refer to Cash Back for details.

The Tenders scroll controls the display of the tenders linked to the payment event. The following simply describes the fields in this scroll; refer to How To for instructions describing how to perform common tender maintenance activities.

· Payor Account ID references the tendering account. The name of the account’s main taxpayer is displayed adjacent.

Warning! If you change the Payor Account ID and the tender has an associated automatic payment request, the automatic payment request will be removed. A new automatic payment request will be created for the new Payor Account ID. Refer to Automatic Payments for more information.

· Tender Amount is the amount of the tender.

· If a check was used, the Check Number contains the identity of the check.

· Pay Tender ID is the system-assigned unique identifier of the tender. This value appears after the tender has been added to the database.