17 Enter Additional Item Master Information

This chapter contains these topics:

-

Section 17.2, "Entering Additional Item Master Information for Brazil"

-

Section 17.3, "Enter Additional Branch/Plant Information for Brazil"

-

Section 17.4, "Setting Up Category Code for Transaction Nature Retrieval"

17.1 About Items with Imported Content

When imported products are subject to industrial processing according to Resolution 13 of 2012, you complete these additional fields to capture information about the percentage of imported materials:

-

Item Origin

-

Import Content

-

Value of the Portion From Abroad

-

Total Value of the Interstate Outbound

The system uses the values in these fields when it processes ICMS tax. See Section 12.1, "Setting Up ICMS Tax Rates"

If the imported items are not subject to industrial processing, you do not complete the import fields.

The system uses the special handling code value associated with the item origin code to determine if imported content information is required. If you enter a code from UDC 76/IO (Item Origin) that includes 1 in the Special Handling Code field, you must complete the Import Content, Value of the Portion From Abroad, and Total Value of the Interstate Outbound fields. Item Origin codes 3, 5, and 8 include 1 in the Special Handling Code field of the UDC.

The Item Master Info -Brazil and Item Branch Additional Info screens also include a field for the Import Content Form - FCI. You do not need to complete this field when you enter item information. However, the field must be populated before you can process purchase order receipts or notas fiscais that include items with imported content.

The system does not validate the FCI number in the item or item/branch files when you enter the number in the item records. Instead, the system validates the number when you process sales orders, notas fiscais, purchase orders, and purchase order receipts. When you work with sales order, purchase orders, and nota fiscal processing, the system displays an error message if the item origin and special handling code value indicate that imported content information exists in the record for the item and the information does not exist.

When you save item records, the system writes import information to the Item Master Tag File Res. 13 file (F76B431) if you complete the fields for the import information on the Item Master Info -Brazil screen, and write import information to the Item Location Tag File Res 13. (F76B432) if you complete the fields for import information on the Item Branch Additional Info screen. The system reads the data in these files when you generate the TXT file to request FCI numbers from the fiscal authority.

17.2 Entering Additional Item Master Information for Brazil

From Localizations - Brazil (G76B), choose Inventory Management

From Inventory Management - Brazil (G76B41), choose Item Master under the Inventory Master Information heading

You must enter general information for all stock and nonstock items. The system uses this information to identify and process each item in the distribution and manufacturing systems.

In Brazil, the government requires companies to maintain additional information for each item, including:

-

Fiscal classification

-

Tax code (IPI or ICMS)

-

Whether the item is subject to tax substitution mark-up

-

Item origin

-

Purchase use

-

Messages to print

You can access the additional information for an item from the Item Master Information screen when you add a new item to the system or change the information for an existing item. You can also access the additional information screen from a generic function key or directly from the Inventory Master - Brazil menu.

When you enter additional information for an item, the system creates a record for the item in the Item Master Tag File (F76411). For transactions with ICMS, the system also writes import information to the Item Master Tag File Res. 13 file (F76B431) if you complete the fields for the import information.

17.2.1 Before You Begin

-

Verify that Brazil is the country that you have selected for your user display preferences.

To enter additional item master information

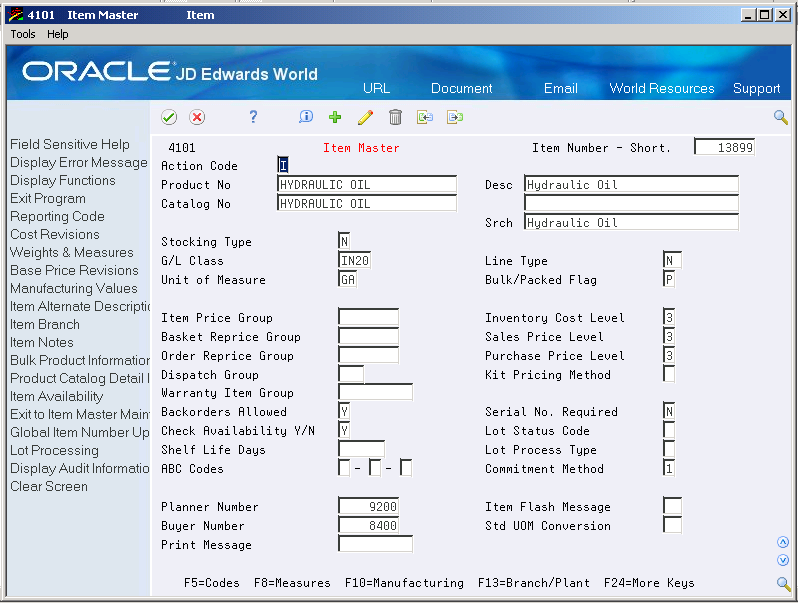

To add a new item, complete the following fields:

-

Product No

-

Desc

-

Catalog No (optional)

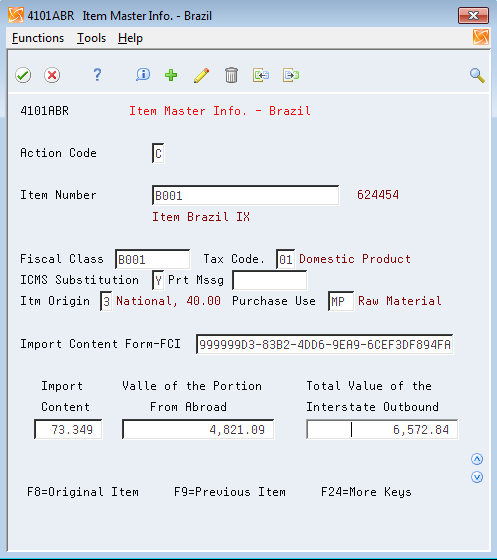

Figure 17-2 Item Master Info. - Brazil screen

Description of "Figure 17-2 Item Master Info. - Brazil screen"

On Item Master Info -Brazil screen, complete the following fields:

-

Fiscal Class

-

Tax Code

-

Item Origin

-

ICMS Substitution

-

Print Message

-

Purchase Use

-

Import Content Form - FCI

-

Import Content

-

Value of the Portion From Abroad

-

Total Value of the Interstate Outbound

| Field | Explanation |

|---|---|

| Fiscal Class (Fiscal Classification) | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| Tax Code

(UDC 76/CT) |

Use this auxiliary code to combine ICMS and IPI tax characteristics.

Examples of valid values might include: 01 - Taxed Domestic Goods (IPI and ICMS) 02 - Taxed Domestic Goods (ICMS taxed, IPI tax rate Zero) 03 - Exempt Products 04 - Export 05 - ICMS deferred, IPI suspended 06 - ICMS exempt, IPI taxed |

| Item Origin

(UDC 76/IO) |

Use the Item Origin code to specify the origin of a product. Values are hard coded.

If you enter a code from UDC 76/IO that includes 1 in the Special Handling Code field, you must complete the Import Content, Value of the Portion From Abroad, and Total Value of the Interstate Outbound fields. Item Origin codes 3, 5, and 8 include 1 in the Special Handling Code field of the UDC. Valid values are: 0: National, and does not meet requirements for codes 3, 4, 5, or 8. 1: Imported; foreign supplier 2: Imported; Brazilian supplier 3: National, where over 40% of the cost are from foreign components. 4: National, where the production is compliant with local production rules. 5: National, where under or 40% of the cost are from foreign components 6: Foreign, acquired abroad, does not have similar in the domestic market, and belongs to CAMEX list and natural gas. 7: Foreign, acquired on domestic market, does not have similar goods in the domestic market and belongs to CAMEX list and natural gas. 8: National, with imported content over 70%. |

| ICMS Substitution | Use this code to indicate whether a client or product is subject to tax substitution.

Valid values are: Y = Yes, Use List Price Z = Yes, Use Net Price N = No |

| Print Message

(UDC 40 / PM) |

A user defined code (system 40, type PM) that you assign to each Fiscal print message that appears on the Nota Fiscal. |

| Purchase Use

(UDC 76/PU) |

Use the Purchase Use code to identify the purpose for which the merchandise was purchased. You define purchase use codes on a user defined codes table (system 76, type PU).

When you define purchase use codes, use the special handling code to specify the following tax information: For ICMS tax: 0 - ICMS tax is non-recoverable 1 - ICMS tax is 100 percent recoverable. For IPI tax: 0 - IPI tax is non-recoverable; 1 - IPI tax is 50 or 100 percent recoverable, depending on the status of the ship-to and ship-from taxpayer You can define additional purchase use codes, if appropriate. |

| Import Content Form - FCI | This number is sent by Fiscal SEFAZ together with protocol to Authorization of use. The FCI number is included in the exit fiscal document (NF-e) so that the taxpayers acquiring the product after importation and individual processing may also know about it. When the imported products are not subject to industrial processing, it is not necessary to generate the FCI.

This field should be completed with the 36-character value that SEFAZ returns to you after you submit the FCI form. The system does not require you to complete this field when you enter additional item information. However, it must be completed before you process notas fiscais and purchase order receipts for items for which import information is required according to Resolution 13 of 2012. |

| Import Content | Import Content is the percentage corresponding to the ratio between the value of the imported portion coming from abroad (data item BVPA) and the total value of the exit interstate transaction (data item BVIO) of goods or property subject to the industrialization process. The formula is: (BVPA / BVIO) x 100 = Import Content.

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

| Value of the Portion From Abroad | The monetary amount of the portion of imported materials. The system uses the value that you enter when you generate the import content form (FCI).

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

| Total Value of the Interstate Outbound | The total monetary amount of the goods, including taxes. The amount that you enter is included in the NF-e.

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

17.2.2 What You Should Know About

17.3 Enter Additional Branch/Plant Information for Brazil

From Localizations - Brazil (G76B), choose Inventory Management

From Inventory Management - Brazil (G76B41), choose Item Branch/Plant under the Additional Detail - Brazil heading

Information about an item might be different from warehouse to warehouse. For example, taxes might be applicable to an item in one warehouse, but not in another. You might also have different quantity requirements for each item based on the warehouse.

After you enter master information for an item, you can assign the item to different warehouses or branch/plants. You can then customize the item information for each branch/plant. You can also specify the locations in the branch/plant in which the item is stored.

Every JD Edwards World system that retrieves item information searches for the item branch/plant information before using the item master information.

In Brazil, companies are required to maintain additional branch/plant information for each item. Companies can choose to override the Item Master information they enter for specific lot locations. The information companies should maintain include the following:

-

Fiscal classification

-

Tax code (IPI or ICMS)

-

Whether the price of the item is controlled by the government

-

Whether the item is subject to tax substitution mark-up

-

Item origin

-

Purchase use

-

Messages to be printed

-

Import content

You access the additional information from the Item Branch Plant screen when you add a new item to the system or change the information for an existing item. You can access the additional information screen by using a generic function key or directly from the Inventory Master - Brazil menu (G76B41, choose 15).

When you enter additional branch/plant information for an item, the system creates a record for the item in the Item Location Tag File (F76412). If you enter import information, the system saves that information to the Item Location Tag File Res 13. (F76B432).

You can prevent the Item Branch Additional Info window from displaying during work order entry and other programs. To run P76412B in blind mode, change the option on the user's menu so that the App Override field is set to blank or 76.

For example, P4114, Inventory Adjustments, is delivered on menu 9/G4111 with the App Override field set to 41. The Item Branch Additional Info window, V76412B, will display. It can be prevented from displaying if the App Override field for 9/G4111 is changed to 76.

17.3.1 Before You Begin

-

Verify that Brazil is the country that you have selected for your user display preferences.

To enter additional branch/plant information for items

On Item Branch Additional Info.

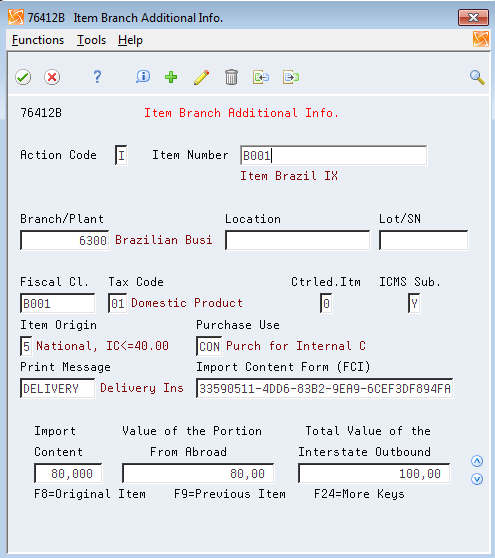

Figure 17-3 Item Branch Additional Info. screen

Description of "Figure 17-3 Item Branch Additional Info. screen"

-

To locate an item at a specific branch or plant, complete the following fields:

-

Item Number

-

Branch/Plant

-

Location

-

Lot/SN

-

-

Complete the following fields:

-

Fiscal Class

-

Tax Code

-

Controlled Item

-

ICMS Substitution

-

Item Origin

-

Purchase Use

-

Print Message

-

-

If the item includes imported materials and is subject to Regulation 13, complete these fields:

-

Import Content Form - FCI

-

Import Content

-

Value of the Portion From Abroad

-

Total Value of the Interstate Outbound

-

| Field | Explanation |

|---|---|

| Item Number | A number that the system assigns to an item. It can be in short, long, or 3rd item number format. |

| Branch/Plant | An alphanumeric field that identifies a separate entity within a business for which you want to track costs. For example, a business unit might be a warehouse location, job, project, work center, or branch/plant.

You can assign a business unit to a voucher, invoice, fixed asset, employee, and so on, for purposes of responsibility reporting. For example, the system provides reports of open accounts payable and accounts receivable by business units to track equipment by responsible department. Security for this field can prevent you from locating business units for which you have no authority. Note: The system uses this value for Journal Entries if you do not enter a value in the AAI table. |

| Location | The storage location from which goods will be moved. |

| Lot/SN | A number that identifies a lot or a serial number. A lot is a group of items with similar characteristics. |

| Fiscal Classification | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| Tax Code

(UDC 76 / CT) |

Use this auxiliary code to combine ICMS and IPI tax characteristics.

Examples of valid values might include: 01 - Taxed Domestic Goods (IPI and ICMS) 02 - Taxed Domestic Goods (ICMS taxed, IPI tax rate Zero) 03 - Exempt Products 04 - Export 05 - ICMS deferred, IPI suspended 06 - ICMS exempt, IPI taxed |

| Controlled Item | Use this code to indicate whether the price of an item is controlled by the government.

Valid values are: 1 - Yes 0 - No |

| ICMS Tax Substitution Mark-up | Use this code to indicate whether a client or product is subject to tax substitution.

Valid values are: Y = Yes, Use List Price Z = Yes, Use Net Price N = No |

| Item Origin

(UDC 76/IO) |

Use the Item Origin code to specify the origin of a product. Values are hard coded.

Valid values are: 0: National, and does not meet requirements for codes 3, 4, 5, or 8. 1: Imported; foreign supplier 2: Imported; Brazilian supplier 3: National, where over 40% of the cost are from foreign components. 4: National, where the production is compliant with local production rules. 5: National, where under or 40% of the cost are from foreign components 6: Foreign, acquired abroad, does not have similar in the domestic market, and belongs to CAMEX list and natural gas. 7: Foreign, acquired on domestic market, does not have similar goods in the domestic market and belongs to CAMEX list and natural gas. 8: National, with imported content over 70%. |

| Purchase Use

(UDC 76/PU) |

Use the Purchase Use code to identify the purpose for which the merchandise was purchased. You define purchase use codes on a user defined codes table (system 76, type PU).

When you define purchase use codes, use the special handling code to specify the following tax information: For ICMS tax: 0 - ICMS tax is non-recoverable 1 - ICMS tax is 100 percent recoverable. For IPI tax: 0 - IPI tax is non-recoverable; 1 - IPI tax is 50 or 100 percent recoverable, depending on the status of the ship-to and ship-from taxpayer You can define additional purchase use codes, if appropriate. |

| Print Message

(UDC 40 / PM) |

A user defined code (system 40, type PM) that you assign to each Fiscal print message that appears on the Nota Fiscal. |

| Import Content Form - FCI | This number is sent by Fiscal SEFAZ together with protocol to Authorization of use. The FCI number needs to be included in the exit fiscal document (NF-e) so that the taxpayers acquiring the product after importation and individual processing may also know about it. When the imported products are not subject to industrial processing, it is not necessary to generate the FCI.

This field should be completed with the 36-character value that SEFAZ returns to you after you submit the FCI form. |

| Import Content | Import Content is the percentage corresponding to the ratio between the value of the imported portion coming from abroad (data item BVPA) and the total value of the exit interstate transaction (data item BVIO) of goods or property subject to the industrialization process. The formula is: (BVPA / BVIO) x 100 = Import Content.

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

| Value of the Portion From Abroad | The monetary amount of the portion of imported materials. The system uses the value that you enter when you generate the import content form (FCI).

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

| Total Value of the Interstate Outbound | The total monetary amount of the goods, including taxes. The amount that you enter is included in the NF-e.

You complete this field only when the item requires import information according to Resolution 13 of 2012 and you use an Item Origin code that includes 1 in the Special Handling Code field. |

17.4 Setting Up Category Code for Transaction Nature Retrieval

You may set up an Item Category Code value to default to the 4th digit of Transaction Nature (BNOP).

-

Review Category Code Name/Code (76/CN) Category Code associated with NATUR (default value SRP6)

-

Populate Sales Category Code 6 (SRP6) in:

-

Classification Codes (P41011)

-

Item Branch Class Codes (P41025)

17.5 Setting Up SPED Fiscal Information

SPED Fiscal programs are automatically called when an item is added and/or changed.

See Additional Item Master Info (P704101) and Additional Item Branch Info (P704102).

When you add a new item or change the Item Description-1 (DSC1) Description-2 (DSC2) values, Item Master Information - Update Tag File F76B4101 (X76B4101) is automatically called and Item Description by Date (F76B4101) is updated. The information in this file is used by SPED Fiscal report.