Reports

This chapter covers the following topics:

- Submitting Standard Reports, Programs, and Listings

- Programs

- Workflow

- Supplier Reports

- Income Tax Forms and Reports

- Invoice Reports

- Payment Reports

- Receivables and Payables Netting Reports

- Accounting and Reconciliation Reports

- Key Indicators Report

- Notices

- Listings

- Country-Specific Reports

- Subledger Accounting Reports

Submitting Standard Reports, Programs, and Listings

Payables provides reports, programs, listings, and notices (all referred to as requests) that you can use to:

-

review information about your suppliers, invoices, and payments.

-

analyze productivity and resolve exceptions

-

create reports that comply with tax authority reporting requirements

-

print notices

-

print listings

For information on submitting reports, listings, or request sets, see: Running Reports and Programs, Oracle Applications User's Guide.

You can see detailed information on the parameters in the Selected Report Parameters section of the request description, or in Common Report Parameters. See: Common Report Parameters.

If your request has output, you can see detailed information on it in the Selected Report Headings section of the request description, or in Common Report Headings. See: Common Report Headings.

Request Sets

A request set is a collection of requests that you group together. You can submit the requests in a single request set all at once using a single transaction. You submit request sets from the Request Set window.

Tip: Include the Concurrent Request Notification program as the last request in a request set. This program sends a designated recipient an e-mail notification confirming that all of the requests in the request set were submitted. This notification also provides concurrent request IDs so you can query and view request statuses in more detail in the Requests window. See: Concurrent Request Notification Program.

Listed below are the request sets that Payables predefines, and the requests that are included in the request set.

Listings

-

Bank Account Listing

-

Distribution Set Listing

-

Employee Listing

-

Payment Terms Listing

-

Payables Lookups Listing

-

Tax Codes Listing

-

Expense Report Template Listing

Period End

-

Accounts Payable Trial Balance

-

Posted Invoice Register

-

Posted Payment Register

-

Mass Additions Create Program

-

Mass Additions Create Report

-

Payables Open Interface Import

-

Payables Invoice Validation

-

Payables Accounting

-

Concurrent Request Notification

Automatic Reports

You can submit most requests from the Submit Request window. However, reports and listings in the following table print only if you submit the following programs:

| Program or Action | Report or Listing | Always Prints? |

|---|---|---|

| Invoice Validation Program | Invoice Validation Report | Yes |

| Payables Open Interface Import | Payables Open Interface Import Report | Yes |

| Purge | Preliminary Purged Listings | Yes |

| Final Purged Listings | Yes | |

| Rejected Purged Listings | No | |

| Final Purge Statistics Report | Yes | |

| Supplier Merge Program | Supplier Merge Report | Yes |

| Purchase Order Headers Report | Yes | |

| Unaccounted Transaction Sweep | Unaccounted Transaction Sweep Report | Yes |

| Update Matured Future Payment Status | Update Matured Future Payment Status Report | Yes |

Common Report Parameters

The following are report parameters common to many Payables reports:

Accounting Period. Accounting period for which you want to submit the request.

Batch. Name of invoice for which you want to submit the request. Payables displays N/A if you do not use invoice batches to enter invoices.

Currency. Currency of the invoice or payment.

-

Functional. Payables lists each amount converted into the currency you use for your ledger.

-

Original. Payables lists each amount in the currency in which you entered it.

Entered By. Name of the person who entered the data.

From/To Payment Date. Enter the first and last dates in a range for which you want Payables to submit the request.

From/To Date. Enter the date range for which you want to submit the request.

From/To Invoice Date. Enter the first and last invoice dates in a range for which you want Payables to submit the request.

From/To Period. Enter the period range for which you want to submit the request.

Functional Amount. Amount of the invoice or payment in your ledger currency. Your ledger currency is the currency you choose for your ledger. Payables uses the exchange rate to convert the invoice or payment into your ledger currency.

Income Tax Type. The income tax type for an invoice distribution. For U.S. reporting, your income tax type is also known as your 1099 type.

Invoice Amount. Original amount of the invoice.

Invoice Batch. The name of the batch in which the invoice was entered, if you have enabled the Allow Invoice Batches Payables option.

Invoice Number. Number of an invoice, assigned by you during invoice entry.

Invoice Type. Type of invoice (Standard, Prepayment, Credit Memo, Debit Memo, Interest, Mixed, Withholding Tax, and Expense Report).

Minimum Invoice Amount. Enter the minimum invoice amount you want to include in the report. The report will not include invoices below the minimum invoice amount you enter here.

Order By. Select from the list of values the criteria by which you want Payables to sort report output. For example, if Supplier Name is an option and you select it, Payables will sort the report alphabetically by supplier name.

Operating Unit. If you are using the multiple organization feature, select an operating unit from the list of values.

Note: The profile option MO: Operating Unit determines the operating units available for your responsibility.

Payment Batch. Payment batch in which the payment was created.

Payment Date. Date on payment document.

Payment Number. Document number for the payment. For example, check number.

Reporting Context: If you entered Ledger for the Reporting Level, the default is the ledger associated with your responsibility. If you entered Legal Entity for the Reporting Level, select a legal entity from the list of values. The profile option MO: Top Reporting Level determines which legal entities appear in the list of values. If this profile option is set to Ledger, you can choose any legal entity that posts to your ledger. If the profile option is set to Legal Entity, you can choose only the legal entity associated with the operating unit assigned to your responsibility.

If you entered Operating Unit for the Reporting Level parameter, select an operating unit from the list of values. The profile option MO: Top Reporting Level determines which operating units appear in the list of values. If the profile option is set to Ledger, you can choose any operating unit that posts to your ledger. If the profile option is set to Legal Entity, you can choose any operating unit within the legal entity associated with the operating unit assigned to your responsibility. If the profile is set to Operating Unit, you can select only the operating unit assigned to your responsibility.

Note: The profile option MO: Operating Unit determines the operating unit for your responsibility.

Reporting Level: Enter the reporting level for the report. Choose Ledger, Legal Entity, or Operating Unit. If you use Multiple Organization Support, the default is Operating Unit. If you do not use Multiple Organization Support, the default is Ledger.

Note: The profile option MO: Top Reporting Level determines the top reporting level for your responsibility.

Ledger Currency. Currency you want to use for the report output. The list of values for this parameter varies depending on the Reporting Level and Reporting Context parameter values. If your Reporting Level is Ledger, you can display the report only in your ledger currency. If the Reporting Level is Legal Entity or Operating Unit, the available values for this parameter are the reporting currencies of the ledger associated with the legal entity or operating unit selected in the Reporting Context parameter.

Site. Name of supplier site.

Supplier Name. Supplier name. For some reports you can leave this field blank to submit the request for all suppliers.

Supplier Number From/To: Enter the range of supplier numbers for which you want to submit the request. Payables includes all suppliers with numbers between and including the supplier numbers you enter.

Supplier Number. Supplier number.

Supplier Type. Type of supplier. You define supplier types in the Oracle Payables Lookups window, and enter a supplier type for a supplier in the Suppliers window.

Common Report Headings

Report headings at the top of each page provide you with general information about the contents of your report or listing, such as your ledger name, report title, date and time Payables runs your report, and page number.

In addition, Payables prints the parameters you specified when you submitted the report request. If you left a parameter blank, then the parameter will appear at the top of the report without a value.

Accounting Period. Accounting period in which you submitted the request.

Batch. Name of invoice batch or payment batch. Payables displays N/A if you do not use invoice batches to enter invoices.

Entered By. Name of the person who entered the data.

Document Number. Payment document number. For example, check number.

Functional Amount. Amount of the invoice or payment expressed in your ledger currency. Your ledger currency is the currency you choose for your ledger. Payables uses the exchange rate to convert the invoice or payment amount into your ledger currency.

Income Tax Type. The income tax type for an invoice distribution. You can default an income tax type from a supplier for each invoice distribution. For U.S. reporting, your income tax type is also known as your 1099 type.

Invoice Amount. Amount of the invoice.

Invoice Batch. If you have enabled the Allow Invoice Batches Payables option, the name of the batch in which the invoice was entered.

Invoice Currency. Currency in which the invoice was entered.

Invoice Number. Number of an invoice, assigned by you during invoice entry.

Invoice Type. Type of invoice (Standard, Prepayment, Credit Memo, Debit Memo, Withholding Tax, Interest, and Expense Reports).

Last Active Date. Last date in which a document was updated. Document entry or creation date, if it has not been updated.

Payment Batch. Payment batch in which the payment was created.

Payment Currency. Currency in which the payment was created.

Payment Date. Date on payment document.

Payment Number. Document number for the payment. For example, check number.

PO Number. Number of the purchase order.

PO Release. Purchase order release number.

PO Line. Purchase order line number.

Site. Name of supplier site.

Site Name. Name of supplier site.

Supplier Bank Account Num. Bank account number of your supplier. Used for electronic payments to your supplier.

Supplier Name. Supplier name. For some requests you can leave this parameter blank to submit the request for all suppliers.

Supplier Name From/To: Enter the alphabetical range of suppliers that you want to submit the request for. Payables includes all suppliers between and including the suppliers you enter.

Supplier Type. Type of supplier. You define supplier types in the Oracle Payables Lookups window, and enter a supplier type for a supplier in the Suppliers window.

Programs

Payables provides the following programs:

Create Procurement Card Issuer Invoice Program

Payables Open Interface Import Program

Procurement Card Transaction Validation Report

Payables Open Interface Purge Program

Unaccounted Transactions Sweep Program

Unapply Preupgrade Prepayments Program

Update Income Tax Details Utility and Report

Update Matured Future Payment Status Program

Mass Additions Create Program

Run the Mass Additions Create program to transfer capital invoice line distributions from Oracle Payables to Oracle Assets.

For foreign currency assets, Payables sends the invoice distribution amount in the converted ledger currency. The mass addition line appears in Oracle Assets with the ledger currency amount. Oracle Assets creates journal entries for the ledger currency amount, so you must clear the foreign currency amount in your general ledger manually.

After you create mass additions, you can review them in the Prepare Mass Additions window in Oracle Assets.

Note: Payables does not transfer invoice distributions to Oracle Assets for invoice items that are tracked by Enterprise Install Base and are depreciable.

Prerequisites

-

Set up your corporate book in Oracle Assets. See: Defining Depreciation Books, Oracle Assets User's Guide.

-

Set up your asset categories in Oracle Assets for the corporate book you want to use with mass additions. See: Setting Up Asset Categories, Oracle Assets User's Guide.

-

Set Up Post-Accounting Programs in Oracle Subledger Accounting. Define which accounting classes should be transferred for assets. Payables transfers all related distributions to Oracle Assets. See: Post-Accounting Programs, Oracle Subledger Accounting Implementation Guide

-

Enter invoices in Oracle Payables. See: Entering Basic Invoices in the Invoice Workbench.

-

Create accounting entries for the invoices. See: Creating Accounting Entries in Payables.

-

Transfer accounting entries to general ledger.

-

Ensure your invoice line distributions meet the necessary criteria to be imported from Payables to Oracle Assets. See: Create Mass Additions from Invoice Line Distributions in Oracle Payables, Oracle Assets User's Guide.

-

If you want to include the nonrecoverable tax amounts as part of the asset value, then enable the profile option: FA: Include Nonrecoverable Tax in Mass Addition.

To create mass additions for Oracle Assets:

-

Navigate to the Submit Request Set window.

-

Choose Mass Additions Create from the Request Set list of values.

-

Specify your parameters for the Mass Additions Create program.

GL Date: Payables creates mass additions from invoice distribution lines with GL dates that are on or before the date you enter in this field. You must enter a date on or before the current date.

Book: Enter the name of the Oracle Assets corporate book for which you want to create mass additions.

-

Specify the Book parameter for the Mass Additions Create report.

-

Choose Submit to submit the request set.

Payables creates the mass additions and runs the Mass Additions Create report so you can review a list of the mass additions created.

Related Topics

Submitting Standard Reports, Programs, and Listings

Mass Additions Create Report, Oracle Assets User's Guide

Concurrent Request Notification Program

Include this program as the last request in a request set. When the request set completes, this program sends an e-mail notification to a designated person stating that the requests in the request set were submitted. This notification also lists concurrent request IDs for each request in the request set. You use a concurrent request ID to find a request in the Requests window where you can view its status in detail.

Note: If you schedule single programs or reports to run automatically, create a scheduled request set with this program as the second request. Then the designated person will receive notification when all the requests in the request set are submitted.

Prerequisite

-

In the AP: Notification Recipient E-mail profile option, enter the e-mail address of the person who will receive the e-mail notification. See: Profile Options in Payables, Oracle Payables Implementation Guide.

Program Submission

This program should always be submitted as part of a request set. When you define a request set, list this as the last request in the request set. See: Request Set Windows, Oracle E-Business Suite User's Guide

Unaccounted Transactions Sweep Program

The Unaccounted Transactions Sweep Program transfers unaccounted transactions from one accounting period to another. The program redates all accounting dates of all unaccounted transactions to the first day of the open period you specify.

Because you cannot close a Payables period that has unaccounted transactions in it, if your accounting practices permit it, you might want to use this program to redate transaction accounting dates to another open period. You can then close the accounting period from which Payables moved the invoices and payments.

For example, you have invoices for which you cannot resolve holds before the close, and your accounting practices allow you to change invoice distribution GL dates. Submit the program to redate invoice distribution GL dates to the first day of another open period so you can close the current period.

The Unaccounted Transactions Sweep Program will not roll forward accounted transactions, but will roll forward transactions accounted with error.

When the Unaccounted Transactions Sweep Program completes, Payables automatically produces the Unaccounted Transactions Sweep Report, which lists transactions that were redated. The report displays the same data as the Unaccounted Transactions Report. For details on the report headings, see: Unaccounted Transactions Report.

When you try to close a period for the ledger and run the Sweep program, if you do not have access to all operating units for the ledger, and there are unaccounted transactions against the operating units that you do not have access to, then the Unaccounted Transaction Sweep program fails with an error.

Prerequisites

-

(Recommended) Confirm that your accounting practices permit you to redate accounting dates of transactions.

-

The period to sweep to is open. See: Controlling the Status of Payables Periods, Oracle Payables Implementation Guide.

-

The transaction does not have an accounted with error status. For transactions that are accounted with error, fix the problem that is causing the error, account for the transaction, and transfer the accounting entries to the general ledger.

-

The transaction is not accounted.

-

(Recommended) Submit the Period Close Exceptions Report. Review, for each organization, the Unaccounted Invoices and Unaccounted Payments sections of the report to review the transactions that the program will sweep to the next period. See: Period Close Exceptions Report.

Program Submission

To submit the Unaccounted Transactions Sweep Program:

-

In the Control Payables Periods window if you try to close a period that has exceptions then the system enables the Exceptions button.

-

Choose the Exceptions button in the Control Payables Periods window.

Payables opens a message window. From the window you can choose the following buttons:

-

Review (This submits the Period Close Exceptions Report.)

-

Sweep

-

-

Choose the Sweep button. Payables opens the Sweep to Period window. In the Sweep to Period field, Payables provides the next open period. You can accept this default or enter another open period.

-

Choose the Submit button to submit the Unaccounted Transactions Sweep Program. Payables automatically produces the Unaccounted Transactions Sweep report.

Update Income Tax Details Utility and Report

Submit this utility to report on or update the Income Tax Type and/or Income Tax Region fields on invoice distributions. These fields are required for all invoice distributions of United States Federally Reportable suppliers because the fields are necessary for 1099 reporting.

You can correct inaccurate or missing Income Tax Type or Income Tax Region fields for 1099 suppliers. First, ensure that the supplier has accurate 1099 information (Income Tax Type and Income Tax Region), then submit the utility.

Note: On Withholding Tax distributions, this utility updates only the Income Tax Region. It does not update the Income Tax Type. However, if you enable the Include Income Tax Type on Withholding Distributions Payables option, then the Update 1099 Withholding Tax Distributions program will update existing Withholding Tax distributions that have no values for income tax type or income tax region. See: Withholding Tax Payables Options, Oracle Payables Implementation Guide.

You can also use this utility to correct invoice distributions of non-1099 suppliers that have Income Tax Types assigned. If the supplier is a non-1099 supplier but you have inadvertently assigned Income Tax Types, first, ensure that the supplier is not federally reportable in the Suppliers window, and that the Income Tax Type field is blank. Then submit the Update Income Tax Details utility. If the supplier should be a 1099 supplier, update the supplier as Federally reportable in the Suppliers window. In this case, the invoice distributions are accurate, so you do not need to submit the Update Income Tax Utility. Payables will then include the invoices for the supplier in 1099 reports.

For more information about how this utility works, please refer to the Selected Report Parameters section for this utility and report.

The report is divided into two sections and ordered by supplier within each section:

-

Income Tax Type

The Income Tax Type section lists the supplier name and number of invoice distributions that do not have income tax types for your 1099 suppliers. It also lists the invoice distributions that have income tax types for non-1099 suppliers.

-

Income Tax Region

The Income Tax Region section lists the supplier name and number of invoice distributions with incorrect or missing income tax regions.

You can choose to run this utility in one of two modes. If you submit the utility in report mode, for each section, the report lists the number of distributions that will be updated when you submit the utility in update mode. If you run the utility in update mode, the report lists the number of distributions updated by the utility.

Prerequisites

-

Submit the 1099 Invoice Exceptions Report to review invoice distributions with inaccurate or missing income tax information for 1099 suppliers. (Optional) See: 1099 Invoice Exceptions Report.

-

Correct the Income Tax Type in the Tax region of the Suppliers window.

-

Update the Income Tax Region. Either correct the State field for the address of the supplier site you designate as the Reporting Site, or specify the correct value for this field in the Update Income Tax Region to parameter when you submit the utility.

-

Correct the Federally reportable status of a supplier in the Suppliers window, if applicable.

Note: To ensure correct Income Tax Region fields for the supplier site's future distributions, correct either the Payables Options Income Tax Region default value, if you have one, or correct the State field for the address of the supplier site you designate as the Reporting Site.

Utility and Report Submission

You submit this utility from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

Supplier Name. Supplier name, if you want to submit this program for a particular 1099 supplier's invoices. Leave the field blank if you want to submit the program for all 1099 suppliers. In this case, Payables either reports on or updates the 1099 information for all 1099 supplier invoices.

Start/End date. Range of invoices with 1099 invoice distribution exceptions that you want to update. Payables includes all invoices with payment dates on or between the Start Date and End Date.

Income Tax Type action. The action you want to perform on the income tax type for the invoice distributions for the suppliers you specify.

-

No Action. Payables does not update invoice distributions with incorrect or missing income tax types or print the Update Income Tax Details Report.

-

Report. Payables does not update invoice distributions, but prints the Update Income Tax Details Report, listing the number of invoice distributions with incorrect or missing income tax types for the suppliers you specify.

-

Update. Payables updates the income tax type for invoice distributions with incorrect or missing income tax types and prints the Update Income Tax Details Report.

The program updates the income tax type for each invoice distribution to the default income tax type for the supplier.

Income Tax Region action. The action you want to perform on the income tax region for the invoice distributions for the suppliers you specify. You can choose to take no action or you can choose to submit the utility in report or update mode.

-

No Action. Payables does not update invoice distributions with incorrect or missing income tax regions or print the Update Income Tax Details Report.

-

Report. Payables does not update invoice distributions, but prints the Update Income Tax Details Report, listing the number of invoice distributions with incorrect or missing income tax regions for the suppliers you specify.

-

Update. Payables updates the income tax region for invoice distributions with incorrect or missing income tax regions and prints the Update Income Tax Details Report. This report lists the number of invoice distributions updated by the program.

The program updates the income tax region for each invoice distribution depending upon your choice for the next parameter.

Update Income Tax Region to. The income tax region that you want to use to update 1099 invoice distributions that have incorrect or missing income tax regions.

-

Income Tax Reporting Site. Select this value from the list of values in the Update Income Tax Region To submission parameter to update 1099 invoice distributions that have incorrect or missing income tax regions.

-

No change. Choose this option if you select No Action or Report for the Income Tax Region action parameter.

-

Supplier Site Tax Region. Income tax region (state) in the address of the supplier site for the invoice.

Choose any tax region defined in the Income Tax Regions window. This option is available only if you have selected Update as the Income Tax Region action parameter.

Selected Report Headings (Income Tax Types and Income Tax Regions)

Supplier Income Tax Type. For invoice distributions with incorrect income tax regions, Payables prints the default income tax type for the supplier. You define a default income tax type for a 1099 supplier in the Suppliers window.

Distributions Eligible for Update. Total number of invoice distributions for a supplier site that are eligible for update. Payables only prints this information if you choose to submit the utility in report mode.

Number of Updated Distributions. Total number of updated invoice distributions for a supplier. Payables prints this information only if you choose to submit the utility in update mode.

Related Topics

Entering Supplier Information, Oracle iSupplier Portal Implementation Guide

1099 Invoice Exceptions Report

Income Tax Regions, Oracle Payables Implementation Guide

Workflow

Oracle Payables uses the following workflow processes:

-

Expenses Workflow. Used only if you install Oracle Internet Expenses. See: Defining Workflow Processes Oracle Internet Expenses Implementation and Administration Guide.

-

Payables Open Interface Workflow, Oracle Payables Implementation Guide

-

Process Payment Message Workflow, Oracle Payments Implementation Guide

-

Receive Payment Advice Message Workflow, Oracle Payments Implementation Guide

-

Receive Payment Instruction Error Workflow, Oracle Payments Implementation Guide

Related Topics

Oracle Workflow Guide, Oracle Workflow Guide

Oracle Workflow Guide, Oracle Workflow Administrator's Guide

Oracle Workflow Guide, Oracle Workflow Developer's Guide

Supplier Reports

Payables provides the following supplier reports:

Purchase Order Header Updates Report

Supplier Customer Netting Report

Supplier Paid Invoice History Report

Supplier Payment History Report

Supplier Mailing Labels

Use this report to create mailing labels for supplier sites. You can order your labels by supplier or by postal code. You can print mailing labels for any of your supplier's active sites.

Payables uses the same address order for all countries except Japan. If you select the Japanese address style in the Countries and Territories window, Payables prints labels in the Japanese address style.

When you submit the report you choose either Formatted or Unformatted for the output style parameter. If you choose Formatted, Payables creates output for Avery brand 1 1/3" x 4" labels. If you choose Unformatted, Payables creates a flat file with the report output. You can then use a custom program to format the file and print it on labels of another size.

Unformatted

If you use the Unformatted output style, the flat file lists the following information for each supplier site that matches the parameters you enter.

| Supplier Site Field | Information Printed on Label |

|---|---|

| Supplier: | supplier name |

| Address 1 | address line 1 |

| Address 2 | address line 2 |

| Address 3 | address line 3 |

| City | city |

| State/Province | state. Payables prints the province if state is null |

| Zip | zip code |

| Country | country name |

Each address segment is preceded by a descriptive tag. There is no top or left margin. Each descriptive tag has a length of 17 (including spaces before and after a colon mark) followed by the corresponding address segment value with a length of 63. There is one blank line between supplier sites.

Formatted

If you choose Formatted, Payables prints a label for each supplier site that matches the parameters you enter. The report generates output specifically for Avery 1 1/3" x 4" laser labels, part number 5162. On each page, Payables prints 2 labels across and 7 labels down. Payables can print 6 lines on each label, and Payables can print 34 characters on each line.

Payables uses the same 9 address segments listed above, and formats each address to fit as much information on the label as possible. Payables uses the same address order for all countries except Japan. If you select the Japanese address style in the Countries and Territories window, Payables prints labels in the Japanese address style.

Report Submission

You submit this report from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

Supplier Type. If you want to print labels for one type of supplier, enter the supplier type. Leave blank to print labels for all suppliers.

Order By. Enter the order in which you want Payables to sort the labels.

-

Supplier Name.

-

Postal Code.

Site Uses. Indicate for which sites you want to create labels:

-

Pay. Create labels for pay sites only.

-

Non-Pay. Create labels only for supplier sites that are not pay sites.

-

All/Null. Create labels for supplier sites regardless of the site type.

Print Home Country. If you want Payables to suppress the country name in the address for suppliers that are in your home country, enter No. You define your home country when you enter the Default Country profile option. If you do not enter a Default Country profile option, your default home country is the United States.

Output Style. Choose the format in which you want Payables to create the output.

-

Formatted. Create output for 1 1/3" x 4" labels, 2 labels across and 7 labels down per page.

-

Unformatted. Create a flat file that you will process with a custom program.

Troubleshooting this report

If you are having problems running the Supplier Mailing Labels report, your system administrator may not have performed the required installation steps. See: Setting Up Print Styles and Drivers for the Supplier Mailing Labels Report, Oracle Payables Implementation Guide

Related Topics

Countries and Territories, Oracle Payables Implementation Guide

Supplier Paid Invoice History Report

You can submit the Supplier Paid Invoice History Report by supplier or supplier type to review payment history, discounts taken, and frequency of partial payments.

The report lists invoices alphabetically by supplier and site. Payables separates invoice amounts paid in foreign currencies from invoice amounts paid in your ledger currency by printing a subtotal of the paid invoices by currency.

Report Submission

You submit this report from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

The report output depends on the values selected for the Summarize Invoices by Site parameter.

Summarize Invoices by Site? Enter Yes to summarize all paid or partially paid invoices by supplier site.

When the Summarize Invoices by Site is set to No, the report shows detailed supplier-wise invoices information. It also shows Invoice amount total for each payment currency code.

The following columns display when the Summarize Invoices by Site option is set No:

-

Invoice Number, displays the Invoice Number

-

Date, displays the Invoice Date

-

Description, displays the Invoice Description

Minimum Invoice Amount. The minimum invoice amount you want to include in the report.

Invoice Order.

-

Ascending. List invoices by increasing value.

-

Descending. List invoices by decreasing value.

Selected Report Headings

Amount Paid. The amount of an invoice that you have paid.

Discount Taken. Total amount of discount you have taken on the invoice.

Amount Remaining. Amount you have remaining to pay on an invoice.

Description. Invoice description.

Related Topics

Supplier Payment History Report

Use the Supplier Payment History Report to review the payment history for a supplier, or a group of suppliers with the same supplier type. You can submit this report by supplier or supplier type to review the payments you made during a time range you specify.

This report provides totals for the payments made to each supplier site, each supplier, and all suppliers included in the report. If you choose to include the invoice details, Payables displays the paid invoice's invoice number, date, invoice amount, and amount paid by the payment. This report also displays the void payments for a supplier site, but does not include the amount of the void payment in the payment total for that supplier site.

The report lists supplier payments alphabetically by supplier and site. You can additionally order the report by Payment Amount, Payment Date, or Payment Number. All amounts are displayed in the payment currency.

Report Submission

You submit this report from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

Invoice Detail. Enter Yes to include invoice details for each payment.

Selected Report Headings

Address. Address to which payment was sent.

Account Name. Bank account used for the payment.

Gross Amount. Invoice amount, displayed in the payment currency.

Payment Number. Payment document number. For example, check number.

Payment Amount. Payment amount in the currency in which it was paid.

Ledger Amount. Payment amount in ledger currency. If you void a payment, Payables displays 0.00 in the Functional Amount column and does not include the payment in the payment total.

Void Date. Void date if you void a payment. If you void a payment, Payables displays 0.00 in the Functional Amount column and does not include the payment in the payment total. You enter a void date when you void a payment.

Amount Paid. Amount of an invoice that you have paid, displayed in your ledger currency. Payables displays this only if you choose the Invoice Detail option.

Suppliers Report

Use the Suppliers Report to review detailed information about your supplier records. You can use this report to verify the accuracy of your current supplier information and to help manage your master listing of supplier records. Payables provides detailed information for each supplier, and optionally, supplier site, including the user who created the supplier/site, creation date, pay group, payment terms, bank information, and other supplier or site information.

You can sort the report by suppliers in alphabetical order, by supplier number, by the user who last updated the supplier record, or by the user who created the supplier record.

Selected Report Parameters

Supplier For This Organization Only. Limit the report to suppliers with sites in a specific operating unit.

Order By.

-

Created By. Sort report alphabetically by the userid of the person who created the supplier record.

-

Last Updated By. Sort report alphabetically by the userid of the person who last updated the supplier record.

-

Supplier Name. Sort report alphabetically by supplier name.

-

Supplier Number. Sort report numerically by supplier number.

Income Tax Reportable Suppliers.

-

Yes. Limit the report to income tax reportable suppliers. This parameter allows you to easily review suppliers for which you will generate 1099 reporting.

-

No. Limit the report to nonincome tax reportable suppliers.

-

All. Submit report for all suppliers, regardless of income tax reportable status.

From/To Creation Date. If you want to limit the report to suppliers, supplier sites, or Bank Accounts that were created within a date range, then enter the range.

From/To Update Date. If you want to limit the report to suppliers, supplier sites, or bank Accounts that were last updated within a date range, then enter the range.

Note: If you enter values in the From/To Creation Date parameters and the From/To Update Date parameters, then the report will display only suppliers created within the Creation Date range specified, as well as last updated in the Update Date range specified.

If you choose to display Bank Account information and enter a date range The report will also display the associated Supplier and Site information in order to provide proper context even if the Creation/Update Dates for the supplier and site are outside of the entered date range.

Created By. If you want to limit the report to suppliers or supplier sites that were entered by a particular person, then enter the person's userid.

Updated By. If you want to limit the report to suppliers or supplier sites that were last updated by a particular person, then enter the person's userid.

Note: If you enter values for both the Created By and Updated By parameters, then only suppliers and sites that meet both these criteria will appear on the report.

Include All/Active Suppliers.

-

Active. Limit the report to active suppliers.

-

All. Submit the report for active and inactive suppliers.

Include Site Information.

-

Yes. List supplier site information for all sites for a supplier.

-

No. Do not list any supplier site information.

Include All/Active Sites. Note: This option is available only if the Include Site Information parameter is Yes.

-

Active. Limit the report to active supplier sites.

-

All. Submit the report for all supplier sites, regardless of status.

Include Home Country. To suppress the country name in the address for suppliers that are in your home country, enter No. You define your home country when you enter the Default Country profile option.

Site Pay Group. To list only sites that have the specified pay group, enter a pay group.

Include Contact Information.

-

Yes. List supplier site contact information.

-

No. Do not list any supplier site contact information.

Include All/Active Contacts. Note: This option is available only if the Include Contact Information parameter is Yes.

-

Active. List only active contacts.

-

All. List active and inactive contacts.

Include Bank Account Information.

-

Yes. List bank account information.

-

No. Do not list any bank account information.

Include All/Active Accounts. Note: This option is available only if the Include Bank Account Information parameter is Yes.

-

Active. List only active bank accounts.

-

All. List active and inactive bank accounts.

Selected Report Headings

The Suppliers Report displays information you have entered for your suppliers in the Suppliers and Supplier Sites windows. For more detailed descriptions of these supplier attributes, see: Suppliers Pages Reference.

Supplier Header Information

One Time. Payables displays Yes if you have enabled the One Time option in the Classification region of the Suppliers window.

PO Hold. Payables displays Yes if you have enabled the Purchase Order Hold option in the Purchasing region of the Suppliers window.

Taxpayer ID. Supplier's Tax Identification Number (TIN).

Tax Registration Num. Tax registration number, for example, a supplier's value-added tax (VAT) registration number. You enter a tax registration number for a supplier if it is required to pay or report on Value-Added Taxes (VAT).

Income Tax Reportable. Payables displays Yes if you have enabled the Federal Reportable option in the Tax Reporting region of the Suppliers window.

State Reportable. Payables displays Yes if you have enabled the State Reportable option in the Tax Reporting region of the Suppliers window.

Income Tax Type. Income tax type specified in the Tax Reporting region of the Suppliers window.

Status. Payables displays Active if the supplier has no inactive date or if the inactive date is after the Suppliers Report submission date.

Creation Date. Date the supplier record was entered.

Created By. Userid of the person who entered the supplier record.

Update Date. Date the supplier record was last updated.

Updated By. Userid of the person who last updated the supplier record.

Site Uses. Payables displays the site uses specified in the General region of the Supplier Sites window.

Supplier Site Information

Site Name. Supplier site name.

Address. Supplier site address.

Status. Payables displays Active if the supplier site has no inactive date or if the inactive date is after the Suppliers Report submission date.

Creation Date. Date the supplier site record was entered.

Created By. Userid of the person who entered the supplier site record.

Update Date. Date the supplier site record was last updated.

Updated By. Userid of the person who last updated the supplier site record information.

Site Uses. Payables displays the site uses specified in the General region of the Supplier Sites window.

Payment Terms. Payment terms assigned to this supplier site.

Pay Group. Pay group assigned to this supplier site.

Payment Priority. Payment priority assigned to this supplier site.

Payment Method. Payment method assigned to this supplier site.

Pay Alone. Payables displays Yes if you have enabled the Pay Alone option in the Payment region of the Supplier Sites window.

Invoice Tolerances. Payables displays the invoice tolerance assigned to the supplier site.

Hold Unmatched Invoices. Payables displays Yes if you have enabled the Hold Unmatched Invoices option in the Control region of the Supplier Sites window.

Hold Unvalidated Invoices. Payables displays Yes if you have enabled the Hold Unvalidated Invoices option in the Control region of the Supplier Sites window.

Hold All Payments. Payables displays Yes if you have enabled the Hold All Payments option in the Control region of the Supplier Sites window.

Supplier Contact Information

Contact Name. Name of contact.

Position. Job title of contact.

Telephone. Telephone number of contact.

Status. Payables displays Active if the contact has no inactive date or if the inactive date is after the Suppliers Report submission date.

Supplier Bank Account Information

Bank Account Name. Name that you use to refer to the supplier site bank account.

Number. Supplier site bank account number that is used to receive electronic payments.

Curr. Currency of the supplier site bank account.

Primary. Payables displays Yes if this is the designated supplier site bank account for receiving electronic payments in the specified currency.

Effective Dates. A date range indicates that this bank account is designated as the primary supplier site bank account for the period specified.

Related Topics

Entering Supplier Information, Oracle iSupplier Portal Implementation Guide

Income Tax Forms and Reports

Payables provides the following income tax forms and reports:

1099 Invoice Exceptions Report

1099 Supplier Exceptions Report

Tax Information Verification Letter

Withholding Tax By Invoice Report

Withholding Tax By Payment Report

Withholding Tax By Tax Authority Report

Withholding Tax By Supplier Report

Withholding Tax Certificate Listing

1099 Reporting Overview

In the United States, you must report to the Internal Revenue Service certain types of payments you make to 1099 reportable suppliers. In the supplier window, you can designate suppliers as federally reportable. When you enter invoices for the supplier, you classify invoice distributions by 1099 MISC type using the Income Tax Type field. At year end, you can then report, in standard formats, your accumulated 1099 payment information to the Internal Revenue Service (IRS), other tax agencies, and your suppliers.

The IRS Form 1099 is a standard form, which summarizes the annual payments made to your suppliers for services performed in the United States. The IRS requires that 1099 information be sent to the IRS for each 1099 supplier and a copy of the form sent to the respective supplier at year-end.

When payment is made to vendor more than $ 600.00 in a financial year, it is mandatory to report to IRS about the payment and also to vendor. The reporting document is named as 1099.

If payment is made to employee, then it is reported as W-2.

In the Suppliers window, you can designate suppliers as 1099 reportable. When you enter invoices for that supplier, you can classify invoice distributions by 1099-MISC type using the Income Tax Type field. At year-end, you can then report, in standard formats, your accumulated 1099 payment information to the IRS, other tax agencies, and your suppliers.

There may be changes to the legal requirements of IRS related to 1099 reporting every year. For all windows, Payment Year, has been increased to four digit-reporting year (2008 to 2009), unless reporting prior year data.

For each reporting entity, you assign one or more balancing segment values. When you submit 1099 reports for a tax entity, Payables sums up the paid invoice distributions that have these company balancing segment values in their accounts.

Validation of Income Tax Type has been modified. You can use NA to indicate that the type 1099 value is not applicable for the invoice line. When NA is used the Payables Open Interface Import program will not consider the value as invalid. Instead, a null is populated as type 1099. When the Payables Open Interface Import is run, the income tax type is default from the supplier setup

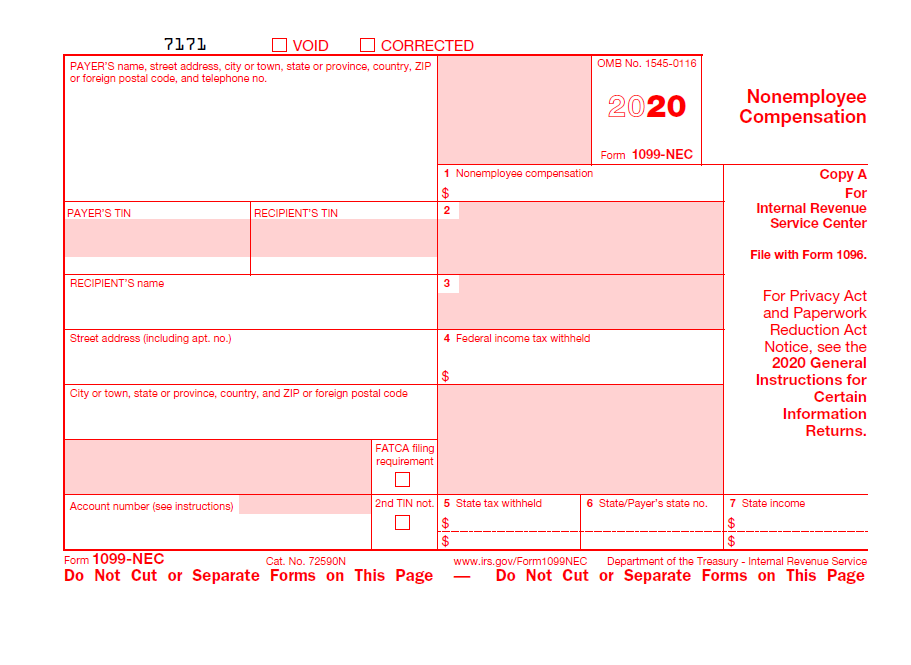

Changes to 1099 Tax Reports for the Reporting Year 2020

The US Tax form, Form 1099-MISC, is used for reporting payments such as Rent, Royalties, Medical and healthcare payments. The Non-Employee Compensation (NEC) was reported in Box 7 of Form 1099-MISC till the Tax Year 2019. Beginning from the Tax Year 2020, the Non-Employee Compensation must be reported in the Form 1099-NEC. This allows taxpayers to adhere to separate deadlines for NEC and other payments in Form 1099-MISC.

This required creation of new Form 1099-NEC, and revise the existing Form 1099-MISC and rearrange the boxes for reporting certain income.

Oracle Payables has been modified to support the US Tax changes, as follows:

-

Generate two separate reports, 1099-NEC for Non-Employee Compensation reporting and 1099-MISC, to submit to Internal Revenue Service (IRS).

-

Non-Employee Compensation (Box 7 in current report) is moved to a new report, 1099 NEC.

-

1099 MISC report has been revised with boxes rearranged for the rest of the categories.

-

1099 Forms - Comma Delimited Format report has been revised to include a new column for Withholding on NEC.

-

Generate 1099 Electronic Media report separately for 1099-MISC and 1099-NEC.

To create and report on 1099 supplier payments:

-

Set up Payables for 1099 reporting:

-

If you want to use combined federal and state 1099 filing, and want to produce K-Records and B-Records, enable the Combined Filing Program Payables option. See: Tax Reporting Payables Options, Oracle Payables Implementation Guide.

-

Set the Include Income Tax Type on Withholding Distributions Payables option. If this option is enabled, then when Payables automatically creates Withholding Tax distributions it automatically enters MISC4 for the Income Tax Type, and enters the Income Tax Region value if you use combined filing. See: Withholding Tax Payables Options, Oracle Payables Implementation Guide.

-

If you use combined federal and state filing, define your tax regions. See: Income Tax Regions, Oracle Payables Implementation Guide.

-

Define your tax reporting entities. See: Reporting Entities, Oracle Payables Implementation Guide.

-

Ask your system administrator to set the value of the Query Driver hidden parameter. See: Setting the Query Driver Parameter for 1099 Reporting, Oracle Payables Implementation Guide.

-

-

Enter 1099 details for suppliers:

-

See: Suppliers subject to income tax reporting requirements and Define Tax Information for Suppliers, Oracle iSupplier Portal Implementation Guide

-

-

Enter and pay 1099 invoices:

-

When you enter invoices for 1099 suppliers, enter an Income Tax Type and Income Tax Region for appropriate invoice distributions, or accept the default from the supplier. See: Entering Invoices for Suppliers Subject to Income Tax Reporting Requirements.

-

Pay invoices.

-

-

Identify and resolve 1099 exceptions:

-

Submit for each reporting entity the 1099 Invoice Exceptions Report to identify the following exceptions:

-

1099 invoice distributions with no Income Tax Type

-

1099 invoice distributions with invalid or missing income tax regions

-

non-1099 invoice distributions with an Income Tax Type

-

1099 suppliers with a negative Income Tax Type total

-

1099 suppliers with positive MISC4 totals

Resolve exceptions for each invoice distribution. See Adjusting Invoice Distributions or Update Income Tax Details Utility and Report.

-

-

Submit the 1099 Supplier Exceptions Report to identify and resolve exceptions including the following:

-

suppliers with null or invalid state abbreviations

-

suppliers that will be flagged as foreign in the 1099 Electronic Media report

-

suppliers with missing or non-standard Tax Identification Numbers

Resolve any exceptions in the Suppliers window.

-

-

Generate a Tax Information Verification Letter for each supplier who has not yet furnished or confirmed its tax identification number or tax reporting region. See: Tax Information Verification Letter. After a supplier provides this information, update the Supplier Verification Date in the Tax Region of the Suppliers window.

-

-

Optionally withhold tax from suppliers if they have a missing or invalid Tax Identification Number (TIN) and if you have not met the legal requirements of requesting a valid TIN from them. See: Automatic Withholding Tax Overview.

-

Update 1099 Payment Information.

-

Adjust Invoice Distributions manually in the Invoice Workbench, or use the Update Income Tax Details Utility. See: Adjusting Invoice Distributions, or Update Income Tax Details Utility and Report.

-

-

Generate 1099 Reports.

-

1099 Forms. Submit to the Internal Revenue Service for each 1099 supplier, and send a copy to the supplier. See: 1099 Forms.

-

1096 Form. Submit to the Internal Revenue Service for each 1099 MISC type paid during the calendar year. See: 1096 Form.

-

1099 Electronic Media. If you submit 250 or more 1099 forms, the Internal Revenue Service requires you to file your 1099 payment information on magnetic media or electronically. See: 1099 Electronic Media.

-

Form 941. Send this form to the Internal Revenue Service to report total supplier withholding for a quarter. Your Accounts Payable department should create a manual payment for the total amount withheld, and you should remit this amount and the 1096 Form to the Internal Revenue Service.

-

1099 Payments Report. Run this report for your reference to review 1099 payments by supplier or MISC type. See: 1099 Payments Report.

-

Related Topics

Entering Invoices for Suppliers Subject to Income Tax Reporting Requirements

Define Tax Information for Suppliers, Oracle iSupplier Portal Implementation Guide

Automatic Withholding Tax Overview

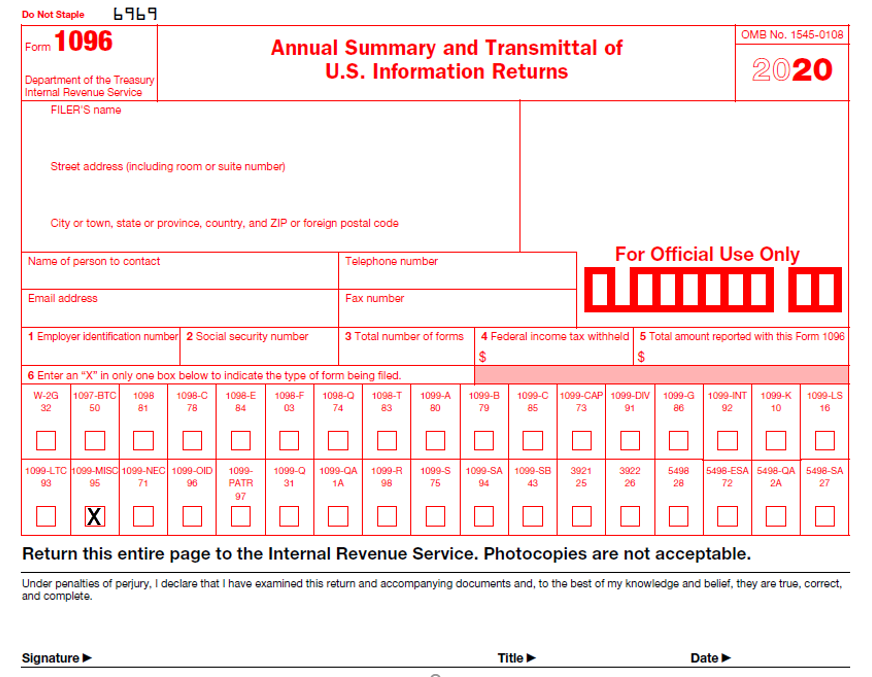

1096 Form

The United States Internal Revenue Service requires that you send a 1096 form as a summary of each 1099 form type you transmit on paper. Payables generates the report on a preformatted form from the Internal Revenue Service.

When you run the 1099 Forms report, Payables summarizes all payments of 1099 MISC reportable invoice distributions and populates a table for 1096 information. You can then submit the 1096 Form report to run off this data. You can generate a 1096 form for each of your tax reporting entities.

Prerequisites

-

Run the 1099 Forms report.

-

Insert and align the 1096 forms in your printer.

Report Submission

You submit this report from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

Tax Reporting Entity. The name of the reporting entity for which you want to submit the 1096 Form report.

Payer Name Source. The source from which Payables obtains the payer name for the report.

-

Address. Address line 1 for the address entered in the Location window.

-

Location. Location Name entered in the Location window.

-

Tax Entity. Entity Name entered in the Reporting Entity window.

-

Return Type. Select the type of return to generate, MISC or NEC. To generate summary for the Form 1099-MISC, select MISC. To generate summary for the Form 1099-NEC, select NEC. Depending on whether you select the MISC and NEC return type, the report generates the total amount of 1099-MISC or 1099-NEC.

Selected Form Headings

FILER'S name, street address, city, state, and ZIP code. The name and address of your tax reporting entity. You can define the name and location of your tax reporting entity in the Location form. You then assign the location to your tax reporting entity in the Reporting Entity window. Payables prints the name according to the Payer Name Source parameter you choose.

1 Employer identification number. The tax identification number of the tax reporting entity. You enter this tax identification number when you define your tax reporting entities.

2 Total number of forms. The total number of 1099 MISC forms that you created for 1099 suppliers.

3 Federal income tax withheld. The total amount of Federal income tax withheld for all 1099 suppliers. This is the sum of all paid distributions for all 1099 suppliers that have an income tax type value of MISC4.

4 Total amount reported with this Form 1096. Total amount of 1099 MISC payments.

Payables prints an X in the 1099-MISC box to indicate the form type being filed.

Form 1096 with 2020 Tax Reporting Modification

Related Topics

Site Locations, Oracle Human Resources User's Guide

Reporting Entities, Oracle Payables Implementation Guide

1099 Electronic Media

Submit the 1099 Electronic Media report to generate your summarized 1099 information in electronic format as required by the Internal Revenue Service. You can create this file in a format to either send electronically or store on a diskette or magnetic tape to send to the Internal Revenue Service. The IRS requires electronic filing in one of these formats if you need to submit 250 or more records for your 1099 reporting. You must report 1099 information for each tax reporting entity you define for your organization, so the 250 record requirement is applicable to each tax reporting entity.

If you enable the Combined Filing Payables option, Payables produces K records for all tax regions (or states) participating in the Combined Filing Program that have qualifying payments. Payables also produces B records for suppliers with 1099 payment amounts which equal or exceed the tax region's reporting limit in qualifying states. Payables produces these records when you submit the 1099 Electronic Media report.

Refer to federal or state tax publications to obtain information regarding the 1099 reporting requirements for each participating tax region. For example, you may need to enter the reporting limits for each income tax region in the Income Tax Regions window.

Payables provides a total for the payments in the B record for each payee.

If this report encounters any of the following exceptions it will stop and report the error on the output:

-

Non-Standard TIN

-

Null Address Element

-

Null Foreign Address

-

Null State

-

Null TIN

If the report encounters a Negative MISC Total then it will stop and report this in the log file.

Be sure to review the 1099 Supplier Exceptions report and 1099 Invoice Exceptions report to identify and fix all errors before you submit the 1099 Electronic Media.

Prerequisite

-

The Tax Reporting Entity must have a nine digit TIN or the program will fail. You assign a TIN to a tax entity in the Reporting Entities window. See: Reporting Entities, Oracle Payables Implementation Guide.

-

Submit the 1099 Invoice Exceptions report and the 1099 Supplier Exceptions report. Review the report output and make any necessary corrections. See: 1099 Invoice Exceptions Report, and 1099 Supplier Exceptions Report.

Report Submission

You submit this report from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Electronic Filing of Forms 1099-MISC and 1099-NEC for Tax Year 2020

From the US tax year 2020, Non-Employee Compensation must be filed separately in 1099-NEC instead of 1099-MISC. The 1099 Electronic Media report generates two files, one for 1099-MISC and other for 1099-NEC to be submitted separately to IRS. The 1099-NEC must be submitted by the end of January, while the 1099-MISC can be submitted by the end of February.

When the 1099 Electronic Media report is run for the year 2020 or later, 1099-MISC and 1099-NEC files are generated separately:

-

Non-employee compensation and the withheld taxes on those payments are reported in 1099-NEC. The 1099-MISC report includes all other categories.

-

A, B and C records are generated for 1099-NEC as per the new specifications. This is applicable only for tax year 2020. For prior years, 1099-NEC return should not be generated.

-

The record structure for A, B, C, and K in 1099-MISC are updated, the Amount code 7 is not used in 1099-MISC and the corresponding amount is reported as zero.

-

There are no K records (state-level reporting) for 1099-NEC.

-

In the Combined filing, position 6 contains a blank since combined filing is not applicable for NEC.

Selected Report Parameters

Control Name. Enter your Payer Name Control. You can obtain the 4-character Payer Name Control from the mail label on the Package 1099 that is mailed to most payers on record each December. It is typically the first 4 characters of your tax reporting entity name.

Control Code. Enter your 5-digit Transmitter Control Code (TCC). You can file form 4419 to receive a control code from the Internal Revenue Service.

From Payment Date. Enter or select the date range with the start date of the payment transaction for which the report is to run.

To Payment Date. Enter or select the date range with the end date of the payment transaction for which the report is to run.

Tax Reporting Entity. The name of the tax reporting entity for which you want to submit the 1099 Electronic Media report.

Media Type.

-

3 1/2" Diskette. Payables formats your 1099 data so that you can record it on a diskette.

-

Electronic File. Payables formats your 1099 data so that you can transmit an electronic file to the IRS.

-

Magnetic Tape. Payables formats your 1099 data so that you can record it on magnetic tape.

Test Submission. Enter Yes if you are submitting a test 1099 Electronic Media report to the Internal Revenue Service.

Foreign Corporation. Enter Yes if your organization is a foreign tax reporting entity as recognized by the Internal Revenue Service.

Last Year Filing. Enter Yes if due to merger, bankruptcy, etc., this will be the last year that this tax reporting entity will be filing.

Payer Name Source. The source from which Payables obtains the payer name for 1099 payments displayed on this report.

-

Address. Address line 1 for the address entered in the Location window.

-

Location. Location Name entered in the Location window.

-

Tax Entity. Entity Name entered in the Reporting Entity window.

Contact Telephone Number. The telephone number that will be included in the 1099 Electronic Media report.

Contact Name. The Contact name to include on the 1099 Electronic Media report.

Contact E-mail. Complete e-mail address of the person in your enterprise to contact regarding electronic or magnetic files sent to the Internal Revenue Service. This will be included on the 1099 Electronic Media report.

File Indicator. Choose one of the following file indicators that will be included in the 1099 Electronic Media report:

-

C. Correction file

-

O. Original file

-

R. Replacement file

Original File. If you are submitting a replacement file, you must select one of the following options:

-

M. Original file was on magnetic media

-

E. Original file was electronic

Replacement Alpha Character. Enter a value only if the IRS/MCC returned your file due to processing problems and you are generating a replacement file. Enter the alphanumeric character that appears immediately following the TCC number on the Media Tracking Slip (Form 9267) that the IRS/MCC sent with your returned media.

You must enter a value if your File Indicator is R (Replacement) and if the Original File and Media Type are not both Electronic.

Electronic File Name. If this is a replacement file then enter the file name that was assigned by the IRS electronic FIRE system (for example, 12345p01.DAT). If this is an original or correction file, enter blanks.

Federal Reporting Limit. The minimum amount for which you want to report 1099 payments to your suppliers.

Return Type. Select the type of return to generate, MISC or NEC. To generate and file the 1099-MISC electronically, select MISC. To generate and file the 1099-NEC electronically, select NEC.

Related Topics

Site Locations, Oracle Human Resources User's Guide

Reporting Entities, Oracle Payables Implementation Guide

Special Calendar, Oracle Payables Implementation Guide

1099 Forms

1099 forms report on the total 1099 MISC payments for a particular 1099 supplier. Generate 1099 forms for each tax reporting entity in your organization.

Important: Voided checks are not included in 1099 payment totals, regardless of when the void occurred.

You can use either of the 1099 Forms reports in Payables:

-

The 1099 Forms report prints on preformatted forms from the Internal Revenue Service. You can generate two separate reports, Non-Employee Compensation 1099 NEC and 1099-MISC, to submit to IRS.

-

As shown in the image, the 1099 MISC form has been modified to print the calendar year of the filing dynamically.

-

1099 Forms -- Comma Delimited Format report generates the output in a comma delimited format that you can use with third-party software to print both the 1099 forms and data.

-

1099 Forms PDF Format generates the 1099 Forms both MISC and NEC in the PDF format using the new template.

In accordance with the Internal Revenue Service rules, Payables does not generate a 1099 form for a supplier unless you paid the supplier at least $600 USD for the calendar year. However, Payables generates a 1099 form for the supplier if you do any of the following:

-

Pay a 1099 supplier at least $10 in Royalties (Box 2)

-

Substitute payments in lieu of dividends or interest (Box 8)

-

Pay any fishing boat proceeds (Box 5)

-

FATCA filing requirement (Box 13)

-

Pay excess golden parachute payments (Box 14)

-

Pay gross proceeds to an attorney for legal services (Box 15)

Payables reports on a payment only if the payment pays a distribution that uses one of the following 1099 MISC types in the Income Tax Type field: MISC types 1-14, except MISC9, MISC11 and MISC12.

You can order the output alphabetically either by state code or by the supplier's reporting name.

If this report encounters any of the following exceptions it will stop and report the error on the output:

-

Non-Standard TIN

-

Null Address Element

-

Null Foreign Address

-

Null State

-

Null TIN

If the report encounters a Negative MISC Total then it will stop and report this in the log file.

Be sure to first review the 1099 Supplier Exceptions report and 1099 Invoice Exceptions report to identify and fix all errors before you submit the 1099 Forms.

Prerequisites

-

Submit the 1099 Invoice Exceptions report and the 1099 Supplier Exceptions report. Review the report output and make any necessary corrections. See: 1099 Invoice Exceptions Report, and 1099 Supplier Exceptions Report.

-

If you are using the 1099 Forms report to print on 1099 forms, then insert and align the forms in your printer.

-

If you are generating the report in comma-delimited format, then install the third-party software

Report Submission

You submit these reports from the Submit Request window. See: Submitting Standard Reports, Programs, and Listings.

Selected Report Parameters

From Payment Date. Enter or select the date range with the start date of the payment transaction for which the report is to run.

To Payment Date. Enter or select the date range with the end date of the payment transaction for which the report is to run.

Tax Reporting Entity. The name of the tax reporting entity for which you want to submit the 1099 forms report.

Payer Name Source. The source from which Payables obtains the payer name for the report.

-

Address. Address line 1 for the address entered in the Location window.

-

Location. Location Name entered in the Location window.

-

Tax Entity. Entity Name entered in the Reporting Entity window.

Telephone Number of Payer. Enter the telephone number that you want Payables to use for the name and address of payer. This is the telephone number of the person in your organization whom the payee should call if there are questions regarding the 1099 form.

Supplier Name. If you want to submit the report for a single supplier, enter the supplier name. Leave this parameter blank to submit the report for all suppliers.

Query Driver. Defaults the query driver.

Federal Reporting Limit. The minimum amount for which you want to report 1099 payments to your suppliers.

Order By. Choose whether you want the report ordered alphabetically by state code or by the supplier's reporting name.

Return Type. Select the type of return to generate, MISC or NEC. To generate and file the 1099-MISC electronically, select MISC. To generate and file the 1099-NEC electronically, select NEC.

Form Headings: 1099 Forms Report

As shown in the image, the 1099 MISC form has been modified to print the calendar year of the filing dynamically.

PAYER'S name, street address, city, state and ZIP code. The name and address of your tax reporting entity. You can define the name and location of your tax reporting entity in the Locations window. You then assign the location to your tax reporting entity in the Reporting Entity window. Payables identifies the name according to the Payer Name Source parameter you choose.

PAYER'S Federal identification number. The tax identification number of the tax reporting entity. You enter this tax identification number when you define your tax reporting entities.

RECIPIENT's identification number. The tax identification number of the 1099 supplier.

RECIPIENT's name. The 1099 supplier's name.

Street address. The supplier's street address.

Note: If you are using the 1099 Forms report to print directly on the IRS 1099 forms: You can enter up to three address lines when you enter a supplier but the 1099 form only provides space for one address line. Payables uses the first supplier address line from the Suppliers window and adds as much of the second and third address lines if there is available space in the 1099 Form. The 1099 Forms report prints a maximum of thirty characters in the address field of the 1099 form.

City, state, and ZIP code. Supplier's city, state, and postal code.

Account number (optional). Not supported.

2nd TIN Not. If the Internal Revenue Service (IRS) has notified you twice in three years that a 1099 supplier has provided you with incorrect tax information, you can enter an X in this box to fulfill your reporting obligations to the IRS.

Federal income tax withheld. The total amount of Federal income tax withheld for the 1099 supplier. This is the sum of all paid distributions for a 1099 supplier that have an income tax type of MISC4. Also, reported in the Form 1099-NEC for the tax reporting year 2020.

Nonemployee compensation. Reported in the Form 1099-NEC for the tax reporting year 2020. The total amount of nonemployee compensation payments to a 1099 supplier during a calendar year.

Payments in lieu of dividend or interest Reported in Box 8.

Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale. Not Supported.

Crop Insurance Proceeds not capitalized under sections 278,263A or 447. Reported in Box 9 for the tax reporting year.

State Income Tax Withheld. Not supported. The total amount withheld as state income tax from a 1099 supplier during a calendar year. This field need not be completed for the IRS and is for your convenience only.

State/Payer's State Number. Not supported. The abbreviated name of the state and the payer's state identification number, assigned by the state. The IRS does not require this field, it is for your reference only.

Excess Golden Parachute Payments. Excess golden parachute payments.

Payments to Attorneys. Gross proceeds paid to an attorney for legal services. Reported in Box 10 for the tax reporting year 2020.

Section 409A non-taxable deferrals Reported in Box 12 for the tax reporting year.

Section 409A taxable deferrals Reported in Box 12 for the tax reporting year.

FATCA filing requirement Reported in Box 13.

Section 409A income Reported in Box 15 for the tax reporting year.

Modified Form 1099-MISC

New Form 1099-NEC Non-Employee Compensation Form

Generating 1099 Forms PDF Format

Oracle Payables includes a new template for Form 1099-NEC for the US Tax reporting year 2020. The 1099-MISC Form has been rearranged to accommodate the move of MISC 7 column to 1099-NEC Report for the tax year 2020.

Selected Report Parameters

From Payment Date. Enter or select the date range with the start date of the payment transaction for which the report is to run.

To Payment Date. Enter or select the date range with the end date of the payment transaction for which the report is to run.

Tax Reporting Entity. The name of the tax reporting entity for which you want to submit the 1099 forms report.

SOB. Indicates and defaults the set of books.

Payer Name Source. The source from which Payables obtains the payer name for the report.

-

Address. Address line 1 for the address entered in the Location window.

-

Location. Location Name entered in the Location window.

-

Tax Entity. Entity Name entered in the Reporting Entity window.

Telephone Number of Payer. Enter the telephone number that you want Payables to use for the name and address of payer. This is the telephone number of the person in your organization whom the payee should call if there are questions regarding the 1099 form.

Supplier Name. If you want to submit the report for a single supplier, enter the supplier name. Leave this parameter blank to submit the report for all suppliers.

Query Driver. Defaults the query driver.

Federal Reporting Limit. The minimum amount for which you want to report 1099 payments to your suppliers.

Order By. Choose whether you want the report ordered alphabetically by state code or by the supplier's reporting name.

Return Type. Select the type of return to generate, MISC or NEC. To generate and file the 1099-MISC electronically, select MISC. To generate and file the 1099-NEC electronically, select NEC. Depending on MISC or NEC you select, choose the corresponding Template Layout to use.

-

Select the Layout by clicking the Options button, on the Submit Request window in the Upon Completion region.

Select 1099-MISC PDF Layout Template

Upon Completion window displays.

-

Click the Template Name and select the corresponding template to print the PDF using that format. Valid values are, Form 1099-MISC and Form 1099-NEC. If you selected NEC as the Return Type, then select Form 1099-NEC template to use.

New Template Form 1099-NEC

-

Submit the report.

Report Output: 1099 Forms -- Comma Delimited Format Report

The report output of the 1099 Forms -- Comma Delimited Format report provides the following information. For each supplier (also known as recipient), the report provides values for the data elements listed below. The values are a continuous string separated by commas. The strings of values for each supplier are separated by hard returns.

The following table shows the data elements and the order in which they are presented. For elements that are not supported, the output provides a space instead of a value.

| Data Element | Supported? |

|---|---|

| payer's name | |

| payer's address line 2 | |

| payer's address line 3 | |

| payer's city | |

| payer's state | |

| payer's postal code | |

| payer's telephone number | |

| payer's federal ID number | |

| recipient's federal ID number | |

| supplier name or tax reporting name | |

| supplier's address line | |

| supplier's city | |

| supplier's state | |

| supplier's postal code | |

| account number | No |

| second TIN box | No |

| MISC1 | |

| MISC2 | |

| MISC3 | |

| MISC4 | Reported in the Form 1099-NEC for the tax reporting year 2020. |

| MISC5 | |

| MISC6 | |

| MISC7 | Reported in the Form 1099-NEC for the tax reporting year 2020. |

| MISC8 | |

| MISC9 | No |

| MISC10 | |

| Reserved | No |

| Reserved | No |

| MISC13 | |

| MISC14 | |

| Reserved | No |

| Reserved | No |

| Reserved | No |

| Reserved | No |

| MISC4 for NEC | Taxes withheld on NEC. Reported in Box 4 of Form 1099-NEC |

For example:

For the following data elements: payer's name, payer's address line 2, payer's address line 3, payer's city, payer's state, payer's zip code, payer's telephone number, . . ., the report provides the following string of values: Acme Corporation,90 Fifth Avenue,New York,NY,10022-3422,5057775588, . . .

For the 1099 Forms Comma Delimited Format Report to format correctly, you must exclude commas in the following fields:

-

Supplier Name field in the header region of the Suppliers window

-

Address fields in the Supplier Sites window

-

Location field in the Reporting Entity window

Note: The Location field is unique because you set up a location in Oracle HRMS then assign this location to a reporting entity while in Oracle Payables.

Related Topics