20 Post to the General Ledger

This chapter contains these topics:

-

Section 20.3, "Reviewing the Posting Edit Report for Manufacturing,"

-

Section 20.5, "Reviewing the Item Ledger/Account Integrity Report,"

-

Section 20.6, "Reviewing World Writer Reports for Manufacturing Accounting,"

20.1 Posting to the General Ledger

Update your account balances with amounts from journal entries by posting the journal entries to the general ledger. After posting, the system provides several reports that you can use to view the journal entries that have been posted.

20.2 Posting Manufacturing Journal Entries

From Manufacturing Systems (G3), choose Manufacturing Accounting

From Manufacturing Accounting (G3116), choose Post General Journal

After you enter, review, and approve journal entries, use Post General Journal to post the journal entries to the general ledger.

You can only run one post at a time. You must ensure that all post menu selections are routed to the same job queue and that the job queue only allows one job to process at a time.

|

Caution: JD Edwards World strongly recommends that you do not customize the post program. |

The post is the third step of the JD Edwards World three-tier process. The post itself consists of two phases, the pre-post process and the post process.

20.2.1 Pre-Post Process

The pre-post process consists of several elements:

| Pre-Post Element | Description |

|---|---|

| Selection | The Post General Journal program selects unposted, approved transactions with a batch type 0 and other criteria specified in the processing options. These transactions come from the Account Ledger table (F0911). |

| Detail edit | The program edits each transaction to determine whether:

|

| Batch edit | The program edits each batch to ensure that it is approved and in balance. If the program finds any errors, it does not post the batch. |

| Posting Edit report | This report lists all batch errors that have occurred. It prints in batch sequence. |

| Error conditions | If any transaction in the batch is in error, the program places the entire batch in error, which prevents it from posting. |

|

Note: You should not make changes to the accounts, automatic accounting instructions (AAIs), intercompany settlements, general accounting constants, or processing options when you run the post. |

20.2.2 Post Process

The Post General Journal program only posts batches when no errors are found in the pre-post process. In general, the program:

-

Posts transactions to the Account Balances table (F0902) and marks each transaction and the batch header as posted in the Account Ledger table and the Batch Control table (F0011)

-

Changes the batch status for the Batch Control table to D

-

Marks each transaction with a status of P (posted)

-

Performs intercompany settlements for ledger types AA (actual amounts), XA, YA, CA, AZ, and ZA (detailed currency restatement amounts), if requested

-

Creates reversing entries, if requested

-

Generates two reports:

-

Posting Journal report, which lists the transactions posted to the Account Balances and the Account Ledger tables

-

Detailed Post Error report, which lists the detail transactions in a batch if there is a balancing error.

-

20.2.3 Before You Begin

-

Verify that the batch has an approved status. See Section 19.1, "Reviewing General Ledger Batches."

-

Verify that the post is submitted to a single-threaded job queue.

20.3 Reviewing the Posting Edit Report for Manufacturing

Each time you run Post General Journal, the program generates the Posting Edit Report. This report lists errors detected during the post. If the program finds errors, it does not post the batch. You must correct all errors in order for the batch to be posted.

20.3.1 Common Posting Errors

| Error | Description |

|---|---|

| Batch not approved for posting | This error message is caused by a batch with a pending or error status. |

| Account not set up in Account Master table (F0901) | Two situations can cause this error message:

|

| Batch journal entries out-of-balance | This error message occurs when debits do not equal credits. If the out-of-balance journal entry was entered in error, correct the error and post the batch again.

Other situations can cause a journal entry to be out-of-balance. For example:

|

20.4 Reviewing the Posting Journal Report

Each time you run Post General Journal, the program generates the Posting Journal report during the post process. This report lists the transactions posted to the Account Balances and Account Ledger tables.

20.5 Reviewing the Item Ledger/Account Integrity Report

From Inventory Reports (G41111), choose Inventory Integrity Reports

From Inventory Integrity Reports (G41113), choose Item Ledger/Account Integrity

The Item Ledger/Account Integrity report lists discrepancies between the Item Ledger and Account Ledger tables. If the data in the two files is in agreement, no lines print.

The lines that print are summary lines, that is, the amounts on a line represent the total for a specific document type, document number, and key company. No other total lines print. You can run this report as many times as needed because no tables are updated.

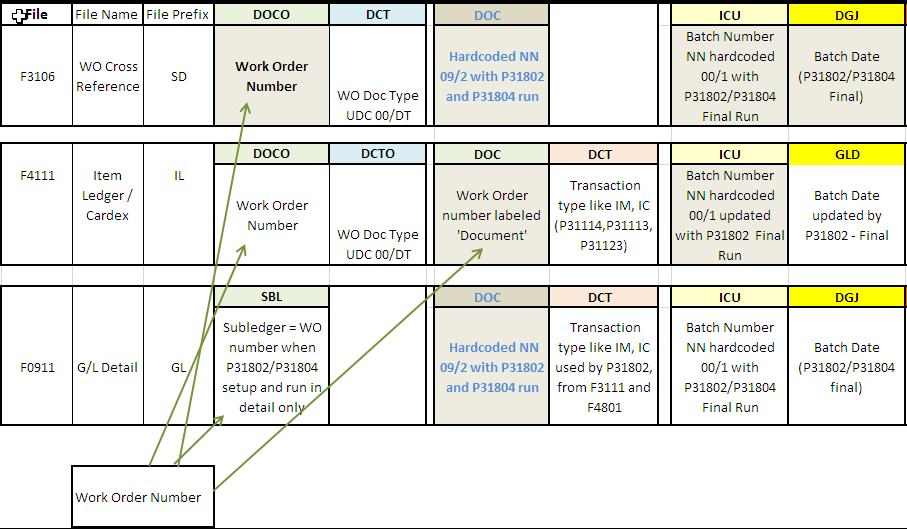

If you use summarized journal entries for work orders, the program uses the Work Order Cross-Reference table (F3106) to locate the material issue transactions (IM), completions (IC), and scrap transactions (IS) against those summarized work orders.

The system uses next numbering for the GL doc number rather than using the work order number. The system implements Work Order Cross-Reference (P3106) in order to cross-reference the work order number to the G/L document number. You can review this cross-reference on the Work Order Processing menu (G3116), using the GL Review by WO Number menu (option 22).

Following is a grid of the files and fields that are relevant to manufacturing work order cross-referencing:

Figure 20-5 Files and Fields for Work Order Cross-Referencing

Description of "Figure 20-5 Files and Fields for Work Order Cross-Referencing"

20.5.1 What You Should Know About

| Option | Explanation |

|---|---|

| Batch Number | Updated in field (ICU) in Cardex, Work Order Cross Ref and G/L Detail are generated with Next Number Product Code = 00, Use (positioned line) = 1. |

| Document Number | Updated in field (DOC) in Cardex and G/L Detail are generated with Next Numbers, Product Code =09, Use = 2. |

If you determine that there is not a true integrity issue between the F4111 and F0911 files, but the report is showing a discrepancy, do the following:

-

Determine which number (per the report) is inaccurate by reviewing the related Cardex transaction and journal entry.

-

If the Item Ledger (F4111) amount is wrong, check the data selection and sequencing. Try testing with the exact setup from the demo version.

-

If the Account Ledger (F0911) amount is wrong, check the UDC table 41/IN and the related AAI table setup.

20.5.2 Before You Begin

Figure 20-6 Item Ledger/Account Integrity report

Description of "Figure 20-6 Item Ledger/Account Integrity report"

|

See Also:

|

20.6 Reviewing World Writer Reports for Manufacturing Accounting

From Master Directory II (G1), choose World Writer Reporting

From World Writer Reporting (G82), choose Manufacturing

When you access the Manufacturing World Writer menu, locate the World Writer reports for Group Q31. You must manually enter Query Group Q31 as the default is Q30.

These reports help you review your production costs and variances. You might want to run them before you run Journal Entries for Variances, or you can run them after Journal Entries for Variances to verify the accuracy of the journal entries.

Complete the following tasks:

-

Review Work Order Activity (Amounts)

-

Review Work Order Activity (Units)

-

Review Engineering Variance

-

Review Planned Variance (to Current)

-

Review Planned Variance (to Standard)

-

Review Material Usage Variances

-

Review Efficiency Variances

-

Review Total/WIP and Other Variances

-

Review Open Work Order Valuation

-

Review Completed Work Order Valuation

-

Review Work Order Amount Variances

-

Review Variance Flag Exceptions

20.6.1 Reviewing Work Order Activity (Amounts)

This report lists standard, current, planned, actual, and completed amounts of work orders.

Figure 20-7 Work Order Activity (Amounts) report

Description of "Figure 20-7 Work Order Activity (Amounts) report"

20.6.2 Reviewing Work Order Activity (Units)

This report lists standard, current, planned, actual, and completed units of work orders.

Figure 20-8 Work Order Activity (Units) report

Description of "Figure 20-8 Work Order Activity (Units) report"

20.6.3 Reviewing Engineering Variance

This report lists work orders, their standard and current amounts, and their engineering variances.

20.6.4 Reviewing Planned Variance (to Current)

This report lists all work orders and their planned variances (current amounts compared to planned amounts). Journal entries for planned variances are calculated in the same way.

Figure 20-10 Planned Variance (to Current) report

Description of "Figure 20-10 Planned Variance (to Current) report"

20.6.5 Reviewing Planned Variance (to Standard)

This report lists work orders and their planned variances (standard amounts compared to planned amounts). These variances are informational only. Journal entries are not created from these amounts. Journal entries for planned variances come from comparing current amounts to planned amounts.

Figure 20-11 Planned Variance (to Standard) report

Description of "Figure 20-11 Planned Variance (to Standard) report"

20.6.6 Reviewing Material Usage Variances

This reports lists the planned and actual material (A1) quantities, extended by standard cost, and a total dollar variance for items on your work orders.

Figure 20-12 Material Usage Variances report

Description of "Figure 20-12 Material Usage Variances report"

20.6.7 Reviewing Efficiency Variances

This report shows planned and actual labor hours (all cost components except A1), extended by standard rates, and the dollar amount of variance by work order and item number.

20.6.8 Reviewing Total/WIP and Other Variances

This report shows the standard, actual, and completed amounts, and total and other variances by cost component and item for your work orders.

Figure 20-14 Total/WIP and Other Variances report

Description of "Figure 20-14 Total/WIP and Other Variances report"

20.6.9 Reviewing Open Work Order Valuation

This report shows the standard, actual, completed, and outstanding balance of amounts by cost component and item for your open work orders. The program calculates the total for each type of cost by work order and a grand total of each cost for all of the work orders listed.

Figure 20-15 Open Work Order Valuation report

Description of "Figure 20-15 Open Work Order Valuation report"

20.6.10 Reviewing Completed Work Order Valuation

This report shows the standard, actual, completed, and outstanding balance amounts by cost component and item for your completed work orders. The Journal Entries for Work in Process or Completions and Journal Entries for Variances programs have already been run for these work orders. The program calculates the total for each type of cost by work order and a grand total of each cost for all of the work orders listed.

Figure 20-16 Completed Work Order Valuation report

Description of "Figure 20-16 Completed Work Order Valuation report"

20.6.11 Reviewing Work Order Amount Variances

This report shows detailed production costs and variance amounts for your work orders.

Figure 20-17 Work Order Variances (Amounts) report

Description of "Figure 20-17 Work Order Variances (Amounts) report"

20.6.12 Reviewing Manufacturing Accounting Tables

This report lists the manufacturing AAIs used by your companies.

Figure 20-18 Manufacturing Accounting Tables report

Description of "Figure 20-18 Manufacturing Accounting Tables report"