Purpose: Use this screen to define whether you process orders subject to VAT and tax-inclusive pricing.

Yes/no field: Select this field if you process orders to countries that are subject to Value Added Tax (VAT). On orders subject to VAT, tax does not accumulate in the Tax field; instead, the customer pays a tax-inclusive price for each item and the tax is “hidden” on the order detail line in the Hidden tax field.

The logic the system uses in determining the tax rate for both VAT and non-VAT orders differs, depending on the value in this field. See below for more information on how the system determines tax in either situation.

The customer sees only the tax-inclusive pricing on orders subject to VAT. However, system updates, such as order billing history, marketing reports, sales journals, etc. will display the price net of VAT; that is, the hidden tax amount is subtracted from the item price.

Example: The tax-inclusive price for an item is $10.00. A hidden tax amount of $1.50 is captured on the order detail line for the item. System updates record a sale of $8.50 ($10.00 - $1.50).

Note: You cannot use both a tax interface (Vertex or AvaTax) and tax-inclusive pricing (VAT) in the same company.

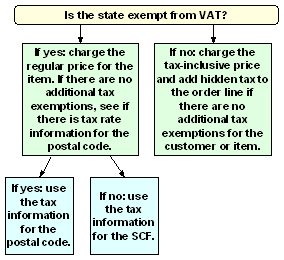

Calculation logic to determine the tax that applies to an order if this SCV is selected:

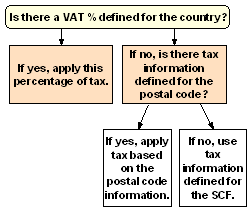

Calculation logic to determine the tax that applies to an order if this SCV is unselected:

Please note that in this scenario the system applies the VAT % for the country as a conventional tax rate.

Determining the Hidden Tax

The system checks these fields to determine the hidden tax amount or rate that applies to an item:

• Item percentage or amount: You can define either a VAT percentage or flat amount for each item or SKU. In the case of a percentage, the system calculates the hidden tax amount by multiplying the rate and the price the customer pays for the item. In the case of a flat amount, the system applies this amount regardless of the item price. If you process orders in multiple currencies based on offer (see Multi Currency by Offer (E03)) the system converts the hidden tax based on the conversion rate in effect for the customer's country if the hidden tax for the item is defined as an amount. For example, if the hidden tax amount for an item is set at $2.00, and the conversion rate for the customer's currency is currently 1.50, a hidden tax amount of $3.00 is added to the order detail line (2 * 1.5).

• VAT percentage: If there is no hidden tax amount or percentage defined for the item/SKU, the VAT percentage defined for the customer's country applies. If there is no hidden tax information for the item/SKU and no percentage defined for the country, there will be no hidden tax for the item.

You can review the hidden tax amount for an item by selecting Change for the item in order entry or order maintenance, or by selecting Display for the item in standard order inquiry. The amount that displays is the per unit amount, not the extended amount.

Tax Exemptions

An order or item may be exempt from either conventional tax or VAT based on:

• VAT exemption for a state (in states that are exempt from VAT, conventional tax applies)

• customer tax exemptions or overrides defined either through customer maintenance or order entry

• a VAT exemption for the item/SKU (this exemption also relieves the item from conventional tax)

• item tax exemptions and exceptions for U.S. states, or GST and PST item exemptions and exceptions for Canadian provinces

Reseller or nonprofit tax exemptions cause the order to be exempt from either VAT or conventional tax, whichever would apply. However, VAT exemptions defined for either the customer or item/SKU apply only to orders subject to VAT. When an order that is normally subject to VAT is tax exempt, the customer pays the regular (not the tax-inclusive) price, and no hidden tax is included in the order detail line.

Note:

• Customer VAT exemptions apply only if the customer's country is different from the country of your company address.

• VAT does not apply to an order unless a tax rate is specified for the SCF for the shipping address.

Determining the Tax-Inclusive Price

When an order is subject to tax-inclusive pricing and VAT, the system goes through the same pricing routine as it normally would, with the exception that it looks in each case for the item's tax-inclusive price rather than the conventional, tax-exclusive counterpart. If you have not set up the necessary tax-inclusive prices for an item, order entry displays an error message when a customer subject to VAT attempts to order the item.

VAT setup

Before beginning to process orders subject to VAT, you might need to set up information in your company:

• VAT percentage rates for countries and VAT exempt flags for states

• VAT exempt flags and hidden tax rates or amounts for items/SKUs

• VAT exempt numbers for customers

• tax-inclusive prices and associate prices for item or SKU offers, price tables, promotional prices, price codes, contract prices, etc.

• the Tax Inclusive Cutoff Date (E79) system control value

Other considerations: If you change information on an order that would affect whether the order is subject to VAT, you might need to clear or reenter certain information. For example, if you change the customer's shipping address in order entry, you should clear the tax code and resale/exempt certificate numbers from the order to see if the default information has changed.

The system reevaluates hidden tax for each item when any repricing applies in order entry (for example, with price tables). However, the system will not reprice any item with a price override reason code, even one added by the system (for example, an incentive item). If you change the tax status of an order in order entry by changing the shipping address or the customer's tax code, you should delete any item with a price override reason code and reenter it.

If you need to change the tax status of an order once you have accepted it, you should cancel the order and reenter it. Reevaluating the items in order maintenance is not supported.

The system may still add tax on freight or handling on orders subject to VAT, if the related system control values are selected and there is no override for the SCF or postal code.

Because it is the net price that is recorded in system updates, there may be situations where a sale will be recorded as credit if, for example, you define a hidden tax as a flat amount rather than a percentage, but sell the item at a reduced cost or give it to the customer free of charge. In other words, if you define the hidden tax as a percentage, when you give the item away free of charge the system calculates the percentage against a selling price of zero, which produces a hidden tax amount of zero. However, if you define the hidden tax as an amount, the system will subtract this amount from a selling price of zero, resulting in a credit.

For more information:

• Setting Up the Country Table (WCTY) and Setting Up the Zip/City/State (Postal Code) Table (WZIP) for information on countries and tax rates for postal codes

• Work with Contract Price Screen and Working with Customer Tax Statusfor information on customer tax exemptions and contract pricing

• Working with SCF Codes (WSCF)

• Working with Offers (WOFR) and Working with Special Pricing by Source Code (WSPP)for information on special pricing by source code

• Understanding Promotional Pricing for information on promotional pricing, price codes and price tables

• Performing Initial Item Entry (MITM) and Creating Item/SKU Offers (MISO) for information on setting up items and item/offers or SKU/offers

| Default Source for Internet Orders (E65) | Contents | SCVs | Search | Glossary | Reports | Solutions | XML | Index | Override Offer/Page/Alias on Order Detail (E72) |

IN03_02 OROMS 17.0 2018 OTN