Chapter 127: Stored Value Card Authorization Reversal

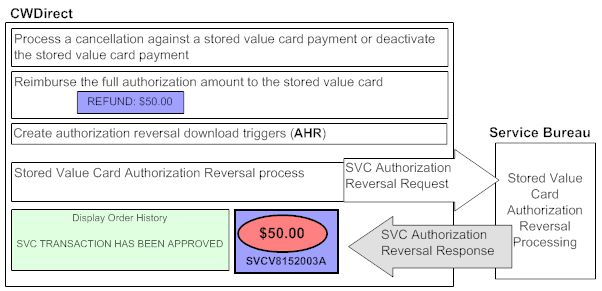

Overview: When you process a cancellation associated with a stored value card payment or deactivate a stored value card payment, the system reimburses the original authorization amount to the stored value card.

In addition, if the Perform Authorization Reversal during Deposit Processing (J20) system control value is set to Y, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.

In this chapter:

• Stored Value Card Authorization Reversal Process

• What Happens When the Authorization Reversal is Approved?

• What Happens When the Authorization Reversal is Declined?

• Authorization Reversal Process During Deposits

• SVC Authorization Reversal Request Message

• SVC Authorization Reversal Response Message

Stored Value Card Authorization Reversal Process

Purpose: The system reimburses a stored value card the original authorization amount associated with the card when you process a cancellation associated with a stored value card payment or deactivate the stored value card.

Note: If the Perform Authorization Reversal during Deposit Processing (J20) system control value is set to Y, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.

Stored Value Card Authorization Reversal Illustration:

1. You process a cancellation associated with a stored value card payment or deactivate the stored value card.

You can process a cancellation by:

• Entering 4 next to an order line or pressing F20 to cancel the entire order in order maintenance.

• Pressing F8 to void the pick slip and cancel the order at the Reprinting/Voiding Pick Slips by Order Screen.

• Pressing F15 to cancel a group of order lines based on the cancellation date or item in the Working with Backorders Pending Cancellation (WBPC) menu option.

• Processing soldout cancellations by submitting the job using the Processing Auto Soldout Cancellations (MASO) menu option or by entering 13 next to an order line in order maintenance.

• Submitting a job to cancel orders flagged for cancellation due to credit card decline using the Working with Credit Card Cancellations (WCCC) menu option.

• Submitting a job to cancel order lines for a given item and adding a substitute item to each order using the Processing Item Substitutions (PSUB) menu option.

• Cancelling an order line or order on the web storefront using the Maintenance E-Commerce Process.

You can deactivate a stored value card payment by entering 7 next to a stored value card payment at the Enter Payment Method Screen during order entry or order maintenance.

2. The system determines if the order is eligible for stored value card authorization reversal.

For an order to be eligible for stored value card authorization reversal, the order must:

• contain a stored value card payment method that is associated with a cancellation or deactivation. Stored value card payments have a Pay category of 2 (credit card) and a Card type of S (stored value card).

• have an open, unused authorization remaining for the stored value card.

An open, unused authorization is an authorization that is:

• in an A (authorized) or O (authorized, but not used) status

• not associated with an outstanding pick slip for the order

• not partially confirmed or deposited.

Authorizations in sent status: When you process a cancellation or deactivate a stored value card payment and the authorization is in an S (sent, but not received) status, the system does NOT create a SVC authorization reversal for the payment even if you later receive an approved authorization response.

Expired authorizations: If the original authorization for an order is expired and the order received a new authorization during pick slip generation, the system will create an authorization reversal against the expired authorization when you process deposits. However, the service bureau will reject this authorization reversal since they have already expired the authorization and reimbursed the stored value card.

Example 1: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

You cancel the order in order maintenance. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. |

Example 2: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

You cancel an order line in order maintenance for 4.00. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. The remaining items on the order will be resent to the service bureau for authorization during pick slip generation. |

Example 3: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 40.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 30.31. |

You generate a pick slip for an order line on the order for 6.00. |

The balance on the stored value card remains at 30.31. |

You cancel the remaining order line in order maintenance for 4.00. |

The system does not create an authorization reversal. The balance on the stored value card remains at 30.31. |

You ship and bill the order line for 6.00. |

The system updates the deposit amount for the authorization on the Authorization History Details screen to 6.00. The balance on the stored value card remains at 30.31. |

You deposit the order line for 6.00. |

The system creates a deposit record for 6.00 and updates the status of the authorization to voided. The balance on the stored value card is updated to 34.31. |

3. The system creates an authorization reversal for the original authorization amount, not the actual amount of the reversal.

4. The system creates a record in the Auth History SVC Reversal file for the authorization amount to reimburse.

Auth History SVC Reversal file:

Field |

Description |

Company |

The company where you processed the stored value card authorization reversal. |

Order # |

The order number associated with the stored value card authorization reversal. |

OPM Seq # |

The order payment method sequence number associated with the stored value card payment. |

AUH Seq # |

The authorization history sequence number associated with the stored value card payment. |

Seq# |

The Auth History SVC Reversal sequence number. |

Creation date |

The date, in CYYMMDD format, the stored value card authorization reversal was created. |

Creation time |

The time, in HHMMSS format, the stored value card authorization reversal was created. |

Approval date |

The date, in CYYMMDD format, the stored value card authorization reversal was approved by the service bureau. |

Approval time |

The time, in HHMMSS format, the stored value card authorization reversal was approved by the service bureau. |

Reversal amount |

The amount to reimburse to the stored value card. |

Response |

The response received from the service bureau, indicating if the authorization reversal was approved or declined. |

5. The system creates an authorization reversal download trigger for the stored value card authorization reversal.

You can view all download triggers in the IL Outbound Trigger file at the Work with Outbound Interface Transactions screen.

Each authorization reversal download trigger in the IL Outbound Trigger file contains a:

• File code: indicating the type of information to download and which IL process job processes the trigger. For authorization reversal download triggers, the File code is AHR.

• Key: indicating the specific record to download. For AHR download triggers, the Key identifies the specific company, order number, order payment method sequence number, authorization sequence number, and authorization reversal sequence number in the SVC Authorization Reversal file. For example, the Key 55500006794001001001 indicates the authorization reversal information is located in company 555 for order number 6794, order payment method sequence number 001, authorization sequence number 001, and authorization reversal sequence number 001.

• Capture type: indicating the type of activity performed against the record. AHR download triggers are always capture type A indicating the authorization reversal was created.

6. Looks at the Authorization service field defined for the stored value card payment to determine the service bureau used to process the authorization reversal.

7. The system looks for unprocessed AHR download triggers to process, based on the setting of the Use Stored Value Card Batch Processing (I50).

• If this system control value is set to Y, the system does not process the stored value card trigger records until you submit the batch process using the Transmitting Stored Value Card Transactions (SSVC) menu option or the SVCREV periodic function (program name PFR0077).

• If this system control value is set to N, the system monitors for stored value card download trigger records to process at defined intervals, based on the value defined in the Outbound delay time field.

Note: Immediate processing of stored value card activation and authorization reversal transactions is currently not implemented at this time with the CWIntegrate CWDirect/Paymentech integration; see the CWIntegrate CWDirect/Paymentech integration reference for additional information.

The system:

• looks for AHR download triggers with the File code AHR and a status of ready (R).

• determines which stored value card authorization reversal to download, based on the Key field for the authorization reversal download trigger.

8. for each authorization reversal download trigger, generates a Stored Value Card Authorization Reversal Message.

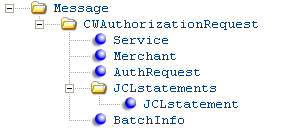

The system creates the Stored Value Card Authorization Reversal Message using the Generic Authorization Request Message in Batch mode. See SVC Authorization Reversal Request Message for a description of the attributes in the message that relate to stored value card authorization reversal.

9. The system sends the generated SVC Authorization Reversal Request Message to the service bureau and waits for a response.

10. The service bureau receives the request, processes the authorization reversal request, and sends back a response indicating if the authorization reversal request was approved.

11. The system receives the Authorization Response Message and processes the response accordingly. See:

• What Happens When the Authorization Reversal is Approved?

• What Happens When the Authorization Reversal is Declined?

• When Communication Failures Occur

Note: Stored value card authorization reversal responses contain a Response code and Response date, but may not contain an Authorization code. In this case, if the Response code is 100, the system updates the Authorization code with a dummy authorization number so that the authorization reversal is approved.

What Happens When the Authorization Reversal is Approved?

An authorization reversal receives an approved reversal if the Authorization Reversal Response message contains an authorization number. In this case, the system:

• updates the associated record in the SVC Authorization Reversal file with the approval date, approval time, and reversal response.

• creates an order transaction history message indicating the authorization reversal was approved: SVC Reversal Has Been Approved.

• voids the authorization history record.

Note: If the stored value card authorization reversal response contains an amount, the system ignores the amount sent back and continues to use the amount defined in the Auth History SVC Reversal file.

You can review the stored value card authorization reversal at the Display Authorization Reversals Screen. The approved reversal will have a Response and an Approval date and time.

What Happens When the Authorization Reversal is Declined?

An authorization reversal receives a declined reversal if the Authorization Reversal Response Message does not contain an authorization number. In this case, the system creates an order transaction history message indicating the authorization reversal was declined: SVC Reversal Has Been Rejected.

You can review the declined stored value card authorization reversal at the Display Authorization Reversals Screen. The declined reversal will have a blank Response, Approval date and time. You cannot resend a SVC authorization reversal request to the service bureau.

Note:

• Except for the order transaction history message, there is no other indication that the stored value card authorization reversal request was declined.

• Because the cancellation or deactivation amount was not reimbursed to the stored value card, the customer will not be able to use that amount on future purchases paid for against the stored value card.

• The response received from the service bureau does not display in the Response field on the Display Authorization Reversals Screen unless it is set up as a vendor response for the service bureau in Work with Authorization Services (WASV).

When Communication Failures Occur

Communication failures can occur if the connection between CWDirect and the service bureau is down or the system times out before a response is received. If communication failures occur and you do not receive a response from the service bureau, the system:

• does not update the associated record in the SVC Authorization Reversal file.

• does not create an order transaction history message.

You cannot resend a SVC authorization reversal request to the service bureau.

Authorization Reversal Process During Deposits

Purpose: If the Perform Authorization Reversal during Deposit Processing (J20) system control value is set to Y, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference.

1. You process a deposit for an amount that is less than the original authorization amount.

2. The system looks at the service bureau settings to determine how to send the batch deposit request to the service bureau.

• If the service bureau uses a CWIntegrate site, the system sends the request to the integration layer process defined in the Deposit integration layer process field for the service bureau.

• If the service bureau uses data queues and Java programs, the system looks at the Provider Network Address field defined for the service bureau and the settings in the associated Properties file to communicate with the service bureau.

3. The system creates the Deposit Request XML Message (CWDepositRequest) in batch mode. See Deposit Request XML Message (CWDepositRequest) for a description of the attributes in the message.

• The depositAmount and depositAmountText tags contain the amount to deposit against the stored value card.

• The reversalAmount and reversalAmountText tags contain the amount to reimburse against the stored value card.

4. The system sends the generated Deposit Request XML Message (CWDepositRequest) to the service bureau and waits for a response.

5. The service bureau processes the deposit request and sends a response indicating if the deposit request was approved.

6. When the Deposit Response XML Message (CWDepositResponse) is received, the system:

• compares the merchantReference value in the Deposit Response XML Message (CWDepositResponse) against the Alpha order # field in the CC Deposit Transaction file to match a received deposit with a sent deposit record. When a match is found, the system updates the Credit Card Deposit Transaction file with the values in the deposit response message.

• updates the status of the Integration Layer Process Control record to CMP (complete).

• updates the Credit Card Deposit History file.

• completes auto deposit processing.

Examples:

Original authorization amount is equal to deposit amount |

||

Stored Value Card Activity |

SCV J20 = selected |

SCV J20 = unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

53.49 |

53.49 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

41.99 |

41.99 |

You ship the order and bill the order. The invoice amount is 11.50. You process deposits. The deposit amount (11.50) equals the original authorization amount (11.50). Deposit amount: |

11.50 |

11.50 |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

41.99 |

41.99 |

Original authorization amount is greater than deposit amount |

||

Stored Value Card Activity |

SCV J20 = selected |

SCV J20 = unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

88.49 |

88.49 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

76.99 |

76.99 |

You void one of the items from the pick slip. You partial ship the remaining items on the pick slip and bill the order for the shipment amount. The invoice amount is 6.25. You process deposits. The original authorization amount is greater than the deposit amount. Deposit amount: Reversal amount: |

6.25 5.25 |

6.25 blank |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

82.24 |

76.99 |

Original authorization amount is less than deposit amount |

||

Stored Value Card Activity |

SCV J20 = selected |

SCV J20 = unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

82.24 |

82.24 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

70.74 |

70.74 |

You add an item to the order for 5.25. You authorize the stored value card and generate a pick slip for the added item. Authorization amount: |

5.25 |

5.25 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

65.49 |

65.49 |

You ship the entire order and bill the order for the shipment amount. The invoice amount is 16.75. You process deposits. Deposit amount: |

16.75 |

16.75 |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

65.49 |

65.49 |

SVC Authorization Reversal Request Message

The stored value card authorization reversal request contains authorization reversal information to send from CWDirect to the service bureau for approval.

The system creates the SVC authorization reversal request using the Generic Authorization Request XML message in Batch mode; because of this, only the elements and attributes specific to SVC authorization reversal are explained below. See Authorization Request XML Message (CWAuthorizationRequest) for more information on the additional elements and attributes in this message.

Note: The SVC_REVRSL integration layer process uses the outbound XML version for the Stored Value Card Activation integration layer process defined for the service bureau, not the outbound XML version you define for the SVC_REVRSL process. For example, if you enter SVC_OUT in the SVC activation field for the service bureau, the system uses the outbound XML version defined for this process when generating the SVC Authorization Reversal Request Message.

Attribute Name |

Type |

Length |

Comments |

This element and its attributes display in the Header, Detail, Summary, Footer, Send, and Receive type messages. See Message for more information on the attributes for this element. |

|||

This element and its attributes display in the Header, Detail, Summary, Footer, Send, and Receive type messages. |

|||

mode |

alpha |

10 |

Indicates the mode of communication. Batch displays for SVC authorization reversal. |

type |

alpha |

10 |

Indicates the type of message in the batch. Each SVC authorization reversal request sends one message for each type: • Header • Detail (a separate detail message for each authorization reversal request) • Summary • Footer • Send • Receive |

This element and its attributes display in the Header, Detail, Summary, Footer, Send, and Receive type messages. |

|||

serviceID |

alpha |

3 |

Service bureau code. This is the service bureau code from the Authorization Service file. |

This element and its attributes display in the Header, Detail, Summary, Footer, Send, and Receive type messages. See Merchant for additional information on the attributes for this element. |

|||

JCLstatements |

This element and its attributes display in the Header type message. See JCLstatements for additional information on the attributes for this element. |

||

JCLstatement |

This element and its attributes display in the Header type message. This element and its attributes repeat for each JCL statement defined for the service bureau. See JCLstatement for additional information on the attributes for this element. |

||

This element and its attributes display in the Detail type message. |

|||

companyID |

alpha |

3 |

The company from where the SVC authorization reversal request was sent. |

createDate |

numeric |

8 |

The date (in MMDDYYYY format) the SVC authorization reversal request was sent to the service bureau. |

orderType |

alpha |

8 |

Indicates the type of order, for example phone order or mail order, where the stored value card payment requiring reversal is located. Mail indicates mail order. Phone indicates telephone order. Internet indicates web order. CWDirect: • looks at the value in the Internet order field in the Order Header file. If this field is set to I, the order is a web order. • determines if the order type for the order matches the order type defined in the E-Commerce Order Type (G42) system control value. If the order type matches, the order is a web order. • looks at the value defined in the Forecasting order category field in the Order Type file. If this value is 1, the order is a mail order. If this value is 2, the order is a phone order. |

transactionType |

alpha |

10 |

Indicates if the transaction is a debit or credit. Debit displays for SVC authorization reversal. |

merchantReference |

numeric |

20 |

A unique number made up of the CWDirect company code + order number + order payment method sequence number + authorization history sequence number. For example, 5550000695501001, where 555 is the company code, 00006955 is the order number, 01 is the order payment method sequence number; and 001 is the authorization history sequence number. |

transactionSeq Number |

numeric |

15 |

000000000000000 displays for SVC authorization reversal. |

numeric |

8 |

The order number where the stored value card payment that requires reversal is located. This is the order number from the Auth History SVC Reversal file. |

|

paymentID |

numeric |

2 |

The order payment method sequence number for the stored value card payment on the order. This is the order payment method sequence number from the Auth History SVC Reversal file. |

authID |

numeric |

3 |

The authorization history sequence number. |

payCategory |

numeric |

5 |

A description of the pay category associated with the SVC authorization reversal request. Credit card displays, indicating the stored value card is associated with the credit card pay category. This is the description associated with the pay category code defined for the stored value card pay type in the Pay Type file. |

vendorPayment Method |

alpha |

5 |

SV displays for SVC authorization reversal. |

cardType |

alpha |

30 |

Indicates the type of card being processed. Stored Value Card displays for SVC authorization reversal. |

actionCode |

alpha |

10 |

Indicates the action to take against the transaction being processed. Reversal displays for SVC authorization reversal. |

alpha |

20 |

The number assigned to the stored value card requesting reversal. If you use credit card encryption, the system decrypts the stored value card number before sending it to an external system. This is the stored value card number defined for the stored value card in the Stored Value Card file. |

|

expirationDate |

numeric |

4 |

Stored value card authorization reversals are sent without an expiration date. |

numeric |

10.2 |

The amount on the stored value card requiring reversal, including decimals. This is the reversal amount defined for the stored value card payment in the Auth History SVC Reversal file. |

|

authAmount |

numeric |

10 |

The amount on the stored value card requiring reversal, with implied decimals. This is the reversal amount defined for the stored value card payment in the Auth History SVC Reversal file. |

currencyCode |

alpha |

3 |

The currency code used by the authorization service to define a currency. Note: You can process stored value cards only in US currency. This is the authorization service currency code in the Authorization Service Currency file. |

ecommerceIndicator |

alpha |

3 |

Indicates if the order associated with the SVC authorization reversal request was placed on the web storefront. Valid values: YES = the order was placed over the web storefront. NO = the order was not placed over the web storefront. This is the e-commerce indicator (future use status 1 field) defined for the order in the Order Header file. |

alpha |

16 |

The authorization number used to authorize the card. This is the Auth # field defined for the stored value card pay type on the order in the Authorization History file. This field is populated only when performing a stored value card authorization reversal, indicating which authorization number to reverse. Available in XML version: 3.0 (version 9.5 of CWDirect). |

|

This element and its attributes display in the Summary, Footer, Send, and Receive type messages. |

|||

fileType |

alpha |

4 |

Indicates the type of request contained in the message. SVCR displays for SVC authorization reversal. |

merchantFileTrace |

alpha |

16 |

The next available number from the Batch Auth File Trace Number number assignment value. |

numeric |

8 |

The date (in MMDDYYYY format) the SVC authorization reversal request was sent to the service bureau. |

|

debitAmount |

numeric |

11.2 |

The total reversal amount for the batch of SVC authorization reversal requests, with implied decimals. This value displays for the summary and footer batch messages. |

debitCount |

numeric |

9 |

The total count of SVC authorization reversal records for this batch of requests. This value displays for the summary and footer batch messages. |

creditAmount |

numeric |

11.2 |

00 always displays for SVC authorization reversal. This value displays for the summary and footer batch messages. |

creditCount |

numeric |

9 |

0 always displays for SVC authorization reversal. This value displays for the summary and footer batch messages. |

totalAmount |

numeric |

11.2 |

The total reversal amount for the batch of stored value cards requesting reversal, with implied decimals. This value displays for the summary and footer batch messages. |

totalCount |

numeric |

9 |

The total count for this batch of SVC authorization reversal requests. This value displays for the summary and footer batch messages. |

testProductionFlag |

alpha |

4 |

Indicates whether the SVC authorization reversal request is processed in a live (production) environment or in a testing environment. TEST indicates a testing environment. PROD indicates a production environment. This is the test mode flag defined in the Authorization Service file. |

Sample SVC Authorization Reversal Request Message:

Header format message:

- <Message source="RDC" target="IL" type="CWAuthorizationRequest" resp_qmgr="CWIAS400" resp_q="CWDIRECT.FROM.PAYMENTECH.SVCREV.LOADRUNNER">

- <CWAuthorizationRequest mode="Batch" type="Header">

<Service serviceID="PMT" />

<Merchant companyID="555" merchantID="848481" merchantSubID="SUBCODE987" merchantName="PAYMENTECH AUTH/DEP" merchantDivision="778522" chargeDescription="PAYMENTECH AUTH/DEP" receivingCode="RECEIVECDE" startupInfo="STARTUP INFORMATIONX" signon="TEST987654" password="PASSWORDAZ" presentersID="192864" pidPassword="COMMERCI" submittersID="192864" sidPassword="COMMERCI" industryFormatCode="INDCD" addressVerificationFlag="YES" />

- <JCLstatements count="1">

<JCLstatement id="01">test this jcl statement</JCLstatement>

</JCLstatements>

<BatchInfo fileType="SVCR" merchantFileTrace="160" createDate="01272004" testProductionFlag="TEST" />

</CWAuthorizationRequest>

</Message>

Detail format message:

- <Message source="RDC" target="IL" type="CWAuthorizationRequest" resp_qmgr="CWIAS400" resp_q="CWDIRECT.FROM.PAYMENTECH.SVCREV.LOADRUNNER">

- <CWAuthorizationRequest mode="Batch" type="Detail">

<Service serviceID="PMT" />

<Merchant companyID="555" merchantID="848481" merchantSubID="SUBCODE987" merchantName="PAYMENTECH AUTH/DEP" merchantDivision="778522" chargeDescription="PAYMENTECH AUTH/DEP" receivingCode="RECEIVECDE" startupInfo="STARTUP INFORMATIONX" signon="TEST987654" password="PASSWORDAZ" presentersID="192864" pidPassword="COMMERCI" submittersID="192864" sidPassword="COMMERCI" industryFormatCode="INDCD" addressVerificationFlag="YES" />

<AuthRequest companyID="555" createDate="01272004" orderType="Mail" transactionType="Debit" merchantReference="5550000695501001" transactionSeqNumber="000000000000000" orderID="00006955" paymentID="01" authID="001" payCategory="Credit card" vendorPaymentMethod="SV" cardType="Stored Value Card" actionCode="Reversal" ccAccountNumber="6035718888880273249" expirationDate="" authAmountText="27.00" authAmount="2700" currencyCode="840" ecommerceIndicator="NO" firstName="BERNADETTE MIRA" initial="T" lastName="LETENDRE-BOTTGER" addressLine1="109 SAMPLE LANE" addressLine2="LOT 3" addressLine3="THIRD ADDRESS LINE" addressLine4="FOURTH ADDRESS LINE" city="TEMPLETON" state="MA" zip="01468" country="USA" phoneType="Evening/Home" phoneNumber="5082222222" email="BMIRANDA@EXAMPLE.COM" />

</CWAuthorizationRequest>

</Message>

Summary format message:

- <Message source="RDC" target="IL" type="CWAuthorizationRequest" resp_qmgr="CWIAS400" resp_q="CWDIRECT.FROM.PAYMENTECH.SVCREV.LOADRUNNER">

- <CWAuthorizationRequest mode="Batch" type="Summary">

<Service serviceID="PMT" />

<Merchant companyID="555" merchantID="848481" merchantSubID="SUBCODE987" merchantName="PAYMENTECH AUTH/DEP" merchantDivision="778522" chargeDescription="PAYMENTECH AUTH/DEP" receivingCode="RECEIVECDE" startupInfo="STARTUP INFORMATIONX" signon="TEST987654" password="PASSWORDAZ" presentersID="192864" pidPassword="COMMERCI" submittersID="192864" sidPassword="COMMERCI" industryFormatCode="INDCD" addressVerificationFlag="YES" />

<BatchInfo fileType="SVCR" merchantFileTrace="160" createDate="01272004" debitAmount="2700" debitCount="1" creditAmount="00" creditCount="0" totalAmount="2700" totalCount="3" testProductionFlag="TEST" />

</CWAuthorizationRequest>

</Message>

Footer format message:

- <Message source="RDC" target="IL" type="CWAuthorizationRequest" resp_qmgr="CWIAS400" resp_q="CWDIRECT.FROM.PAYMENTECH.SVCREV.LOADRUNNER">

- <CWAuthorizationRequest mode="Batch" type="Footer">

<Service serviceID="PMT" />

<Merchant companyID="555" merchantID="848481" merchantSubID="SUBCODE987" merchantName="PAYMENTECH AUTH/DEP" merchantDivision="778522" chargeDescription="PAYMENTECH AUTH/DEP" receivingCode="RECEIVECDE" startupInfo="STARTUP INFORMATIONX" signon="TEST987654" password="PASSWORDAZ" presentersID="192864" pidPassword="COMMERCI" submittersID="192864" sidPassword="COMMERCI" industryFormatCode="INDCD" addressVerificationFlag="YES" />

<BatchInfo fileType="SVCR" merchantFileTrace="160" createDate="01272004" debitAmount="2700" debitCount="1" creditAmount="00" creditCount="0" totalAmount="2700" totalCount="4" testProductionFlag="TEST" />

</CWAuthorizationRequest>

</Message>

Send format message:

- <Message source="RDC" target="IL" type="CWAuthorizationRequest" resp_qmgr="CWIAS400" resp_q="CWDIRECT.FROM.PAYMENTECH.SVCREV.LOADRUNNER">

- <CWAuthorizationRequest mode="Batch" type="Send">

<Service serviceID="PMT" />

<Merchant companyID="555" merchantID="848481" merchantSubID="SUBCODE987" merchantName="PAYMENTECH AUTH/DEP" merchantDivision="778522" chargeDescription="PAYMENTECH AUTH/DEP" receivingCode="RECEIVECDE" startupInfo="STARTUP INFORMATIONX" signon="TEST987654" password="PASSWORDAZ" presentersID="192864" pidPassword="COMMERCI" submittersID="192864" sidPassword="COMMERCI" industryFormatCode="INDCD" addressVerificationFlag="YES" />

<BatchInfo fileType="SVCR" merchantFileTrace="160" createDate="01272004" testProductionFlag="TEST" />

</CWAuthorizationRequest>

</Message>

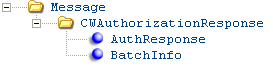

SVC Authorization Reversal Response Message

The SVC authorization reversal response indicates if the SVC authorization reversal request was approved or declined.

The system creates the SVC authorization reversal response using the Generic Authorization Response Message in Batch mode; because of this, only the elements and attributes specific to SVC authorization reversal are explained below. See Authorization Response XML Message (CWAuthorizationResponse) for more information on the additional elements and attributes in this message.

Attribute Name |

Type |

Length |

Comments |

This element and its attributes display for the send, receive, detail, and footer type messages. See Message for additional information on the attributes for this element. |

|||

This element and its attributes display for the send, receive, detail, and footer type messages. |

|||

mode |

alpha |

10 |

Indicates the mode of communication. Batch displays for SVC authorization reversal. |

type |

alpha |

10 |

Indicates the type of message in the batch. Each SVC authorization reversal response sends one message for each type: Header Detail (a separate message for each authorization reversal) Summary Footer Send Receive |

This element and its attributes display for the detail type message. |

|||

companyID |

alpha |

3 |

The company from which the SVC authorization reversal request was sent. |

merchantID |

numeric |

15 |

The account number assigned by the service bureau to identify transmissions. This is the merchant ID defined for the service bureau in the Authorization Service file. |

merchantReference |

numeric |

20 |

A unique number made up of the CWDirect company code + order number + order payment method sequence number + authorization history sequence number. For example, 5550000695501001, where 555 is the company code, 00006955 is the order number, 01 is the order payment method sequence number and 001 is the authorization history sequence number. The system uses this number to match the response to the appropriate record in the Auth History SVC Reversal file. |

orderID |

numeric |

8 |

The order number where the stored value card that requires reversal is located. |

paymentID |

numeric |

2 |

The order payment method sequence number associated with the stored value card authorization reversal. |

ccAccountNumber |

alpha |

20 |

The number assigned to the stored value card requesting reversal. If you use credit card encryption, the stored value card number is not encrypted since this message is received from an external system. However, the system encrypts the stored value card number in the CWDirect database. |

alpha |

7 |

If the vendorResponse1 XML tag is 100, the system loads a dummy authorization number for the SVC authorization reversal. |

|

authAmount |

numeric |

9 |

The amount reimbursed to the stored value card, with implied decimals. |

authDate |

numeric |

8 |

The date the stored value card amount was reversed, in MMDDYYYY format. CWDirect updates the activation date in the Stored Value Card file with this value. |

alpha |

10 |

The activation response for the stored value card. CWDirect updates the response code in the Stored Value Card file with this value. |

|

actionCode |

alpha |

10 |

Indicates the type of transaction. Reversal displays for stored value card authorization reversal. |

This element and its attributes display for the send, receive, and footer type messages. |

|||

Sample SVC Authorization Reversal Response Message:

Send format message:

- <Message>

- <CWAuthorizationResponse mode="Batch" type="Send" action="Sent">

<AuthResponse companyID="555" />

<BatchInfo merchantFileTrace="160" fileType="SVCR" rejectReason="Successful TCP Activity" />

</CWAuthorizationResponse>

</Message>

Receive format message:

- <Message source="CWIntegrate" target="CWDirect" type="CWAuthorizationResponse">

- <CWAuthorizationResponse mode="Batch" type="Receive" action="Receiving">

<BatchInfo fileType="AUTH" merchantFileTrace="160" />

</CWAuthorizationResponse>

</Message>

Detail format message:

- <Message source="CWIntegrate" target="CWDirect" type="CWAuthorizationResponse">

- <CWAuthorizationResponse mode="Batch" type="Detail" action="Response">

<AuthResponse companyID="555" merchantID="848481" merchantReference="5550000695501001" orderID="00006955" paymentID="01" ccAccountNumber="6035718888880273249" authNumber="" authAmount="2700" authDate="01272004" vendorResponse1="227" vendorResponse2="" actionCode="Reversal" />

</CWAuthorizationResponse>

</Message>

Footer format message:

- <Message source="CWIntegrate" target="CWDirect" type="CWAuthorizationResponse">

- <CWAuthorizationResponse mode="Batch" type="Footer" action="Complete">

<BatchInfo fileType="RESP" merchantFileTrace="160" />

</CWAuthorizationResponse>

</Message>

| Chapter 126: Stored Value Card Balance Inquiry | Contents | SCVs | Search | Glossary | Reports | XML | Index | Chapter 128: Transmitting Stored Value Card Transactions (SSVC) |

SO14_05 CWDirect 18.0 August 2015 OTN