OFS MRMM enables banks to accurately measure, evaluate, monitor, and manage market risk. Additionally, it enables banks to proactively comply with the regulatory requirements of capital calculation as per the Internal Models Approach (IMA). This solution combines, OFSAA’s deep expertise with the Numerix analytics (Numerix Cross Asset Server and Numerix Oneview Enterprise Platform), to ensure that all the critical elements of a market risk program from pricing, valuations, risk assessment, monitoring and management, stress testing to data governance, data storage, and final regulatory submissions are fully addressed.

OFS MRMM enables banks and financial institutions to comply with the latest market risk capital regulations, such as the Fundamental Review of Trading Book (FRTB).

Topics:

The following image illustrates the process flow of the OFS MRMM solution.

Figure 1: MRMM Process Flow

Input Data Requirement: The following types of data are expected as input to the solution:

§ Trade Data: This is data of on-balance and off-balance sheet positions, settled and unsettled trades or deals belonging to trading book that you want to price and calculate risk measures. For example, data of bonds in which investment has been made, or swap transactions entered with the counterparty.

§ Reference Data: These are dimensions and attributes that describe the trade data. These are used to define business rules, and view reports. For example, Product, Legal Entity, Currency, Netting Agreement, and Credit Support Annex.

§ Market Data: These are price quotes, yield curves, volatility surface, and other forms for financial market data that are supplied by designated agencies such as Bloomberg, Reuters, and various exchanges, or market makers. For example, Interest Rate Curve, Equity prices, Foreign Exchange spot and forward rates, and so on.

· User Configurations (Processing): To process this data and achieve desired results, such as the price of a trade or capital requirement for the trading book, you must perform the following system configurations:

§ Dimension and Hierarchy Configuration: In this section, select the dimension that must be available for further configurations in MRMM, and specify the hierarchy for each selected dimension. The hierarchy must be pre-defined in Dimension Management. See Dimension Management section in the OFS Analytical Applications Infrastructure User Guide for details.

§ Default Configuration: In this section you need to define the default values used by various components of MRMM. It includes the following:

— Currency

— Currency Pair

— Model and Method

— Model Parameters

— Instrument Type Classification

— Liquidity Horizon

§ Library: In this section you must define the portfolios, configure rules for identification of modellable and non-modellable risk factors, and create market scenarios and pricing policies. It includes the following:

— Portfolio

— Risk Factor

— RFET

— Stress Scenarios

— Pricing policy

— Bucket definition

§ Instrument Valuation: In this section you must perform the valuation of instruments and positions in a trading book.

§ Historical Simulation: In this section you must measure the VaR, ES and other FRTB computations using the IMA approach for the Portfolio or Trading Desk.

§ Model Validation: In this section you must validate the models.

§ Monte Carlo Simulation: In this section you must compute the Monte Carlo VaR and other CVA measures for the counterparties.

· Output: MRMM has predefined reports to view and analyze data and results. The reports are presented in multiple dashboards which can be modified as per the specific requirements.

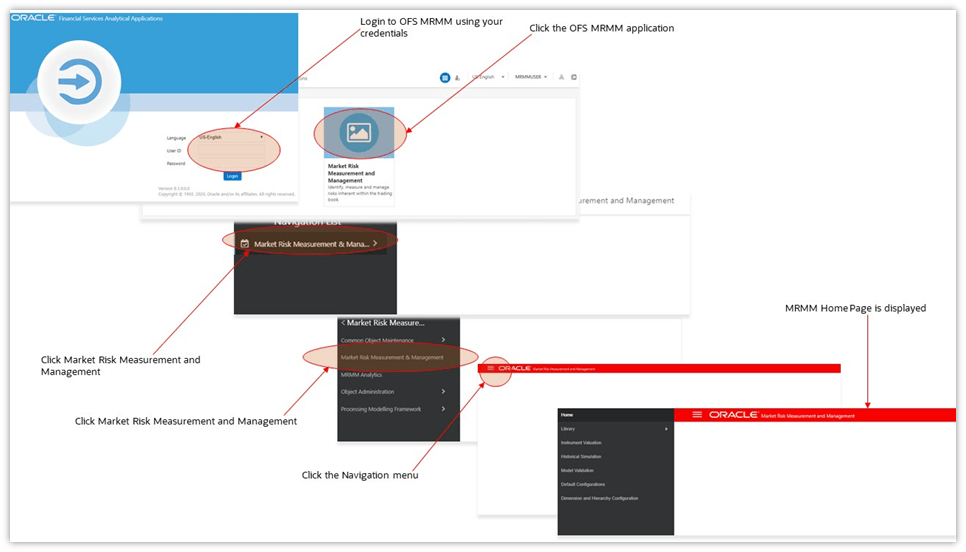

To log in to the OFS MRMM Application, follow these steps:

Figure 2: OFS MRMM Application Navigation

1. Access the OFS MRMM application using the login credentials (User ID and Password) provided and select the preferred language to navigate. The built-in security system ensures that you are only permitted to access the window and actions based on the authorization.

2. After logging in to OFSAA Home screen, the landing page is displayed.

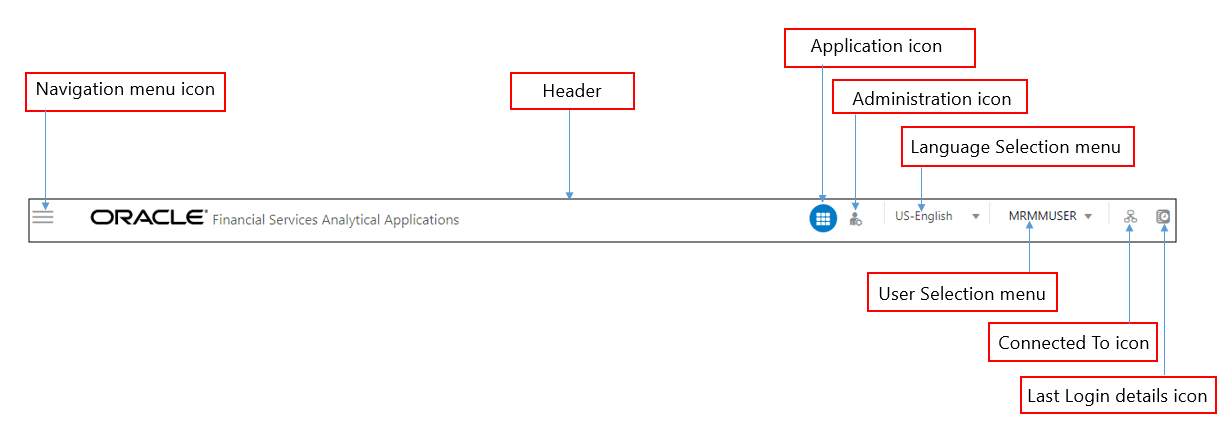

Figure 3: Illustration of the Icons in OFSAA Landing Page Header

Use the information provided in the following table to set the application preferences.

Field |

Description |

|---|---|

User Menu |

Click this drop-down to select the options: Preferences, About, Change Password, or Logout. |

Application Icon |

Click this icon to view all the applications installed in your environment. Click the icon and select Financial Services Market Risk Measurement and Management. |

Language Menu |

This menu displays the language you selected in the OFSAA Login Window. The language options displayed in the Language Menu are based on the language packs installed in your OFSAA instance. Using this menu, you can change the language at any point in time. |

Administration Icon |

Click this icon to navigate to the Administration window. The Administration window displays modules such as System Configuration, Identity Management, Database Details, Create New Application, Information Domain, Translation Tools, and Process Modelling Framework. |

Last Login Details |

Click this icon to view the details of the last login and last failed login. |

Object Administration |

Object Administration is an integral part of the infrastructure and facilitates system administrators to define the security framework. See the OFS Advanced Analytics Infrastructure User Guide for details. |

Common Object Maintenance |

Common Object Maintenance is an integral part of the infrastructure system and facilitates system administrators to define the security framework with the capacity to restrict access to the data and metadata in the warehouse, based on a flexible, fine-grained access control mechanism. See the OFS Advanced Analytics Infrastructure User Guide for details. |

Processing Modelling Framework |

This module facilitates built-in tooling for orchestration of human and automatic workflow interfaces. See the OFS Advanced Analytics Infrastructure User Guide for details. |

3. Select Market Risk Measurement and Management in the OFSAA landing page.

4. Select Market Risk Measurement and Management in the Left-Hand Side (LHS) pane. The Market Risk Measurement and Management landing page is displayed.

5. For ease of navigation, click the Navigation Menu  to view the following options:

to view the following options:

§ Library

§ Instrument Valuation

§ Historical Simulation

§ Model Validation

§ Default Configuration

§ Dimension and Hierarchy Configuration

This section provides an overview of the functionalities available in MRMM:

· Instrument Valuation

This component delivers the following functionalities:

§ Pricing of each trade in a portfolio or trading desk.

§ Calculation of Greeks for instruments.

§ Computation of sensitivities (such as Delta, Vega) as per the regulatory requirements for the Fundamental Review of the Trading Desk (FRTB) standardized approach.

See the Instrument Valuation section for details.

· Historical Simulation

This component delivers the following functionalities:

§ Risk factor reduced set identification and Liquidity Horizon, are available as a download.

§ Stress period identification as per the regulatory requirements for the FRTB Internal Models Approach (IMA).

§ Identification of Modellable and Non-Modellable risk factors is available through the RFET functionality.

§ Historical VaR and Expected Shortfall (ES) from a non-regulatory perspective.

§ Stress calibrated ES, as per the regulatory requirements for FRTB IMA.

§ Stressed capital add-on and Internal Modelled Capital Charge (IMCC), as per regulatory requirements for FRTB IMA.

See the Historical Simulation section for details.

· Model Validation

This component delivers the following functionalities:

§ VaR model backtesting.

§ Actual, Hypothetical and Risk-Theoretical Profit and Loss (P&L) are available as downloads.

§ Backtesting and P&L Attribution test, as per requirements for FRTB IMA.

§ Zone classification, as per requirements for FRTB IMA.

See the Model Validation section for details.

· Market Risk - Monte Carlo Simulation

This component delivers the following functionalities:

§ Credit Value Adjustment (CVA) measures (Trade and Group level)

§ Potential Future Exposure (PFE) measures (Trade and Group level)

§ Monte Carlo VaR (Group level)

See Market Risk - Monte Carlo Simulation for details.