Managing Contributions for Employees on External Secondment

This section provides overviews of the contribution share calculation and secondment period modifications and lists prerequisites.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_FPA1100 |

Run the Calls for Entitlement SQR process (FPA1100) that identifies and calculates employee contributions. |

|

|

Payment Contribution Summary Table Page |

FPACNTRBTOT_PNL |

View the employees liable to contribute for civil pension for a given semester and indicate whether the contributions have been paid. |

|

RUNCTL_FPA1150 |

Edit call letters. |

The civil pension contribution share equals the rate multiplied by the contribution basis.

Contributions are based on the grade/step of the employee in the home organization and are then calculated by the home organization while the employee is sent on secondment to another organization.

The contribution basis is expressed by the following formula:

Contribution basis = Increased index x Point value x Proration ratio in host orgA secondment proration ratio is determined from the secondment work time percentage. It depends on civil service position and work time percentage.

If an employee is in a step, the contribution basis takes into account:

The increased index (deducted from gross index) in the home organization.

The point value in the home organization.

The secondment proration ratio.

If an employee is in a substep, the contribution basis takes into account:

The annual compensation associated with the scale-letter / substep in home organization.

The secondment proration ratio.

A semester can be divided into several periods. Within the semester, dates are limited by an event associated with one of the following elements:

|

Event Impact Type |

Events That Might Require Dividing the Semester |

|---|---|

|

Secondment start or end date. |

Modification of civil service position. |

|

Modification of the employer contribution rate. |

Modification of the employer rate value. |

|

Modification of the employee contribution rate. |

Modification of the employee rate value associated with a status. |

|

Modification of the contribution basis. |

|

Calculations are on a thirtieth pro rata basis and are rounded down to the nearest Euro.

The system determines the employee contribution amount for a semester by compiling the results of each semester elementary period. The results for each period and the total semester are stored.

Before you calculate secondment contributions, you must define the host organization, the status/population codes, the employer rate, and the secondment itself. You must leave the Job Leads to Civil Pension check box deselected and assign a title number on the Secondment Information page.

To set up secondment contributions:

Use the Type of Organization, Sub-types of Organization, and Organization pages to define host organization types and subtypes, and the organizations themselves.

Link contribution rates and statuses by associating an employee contribution rate code with each status on the Status/Population Codes page.

Define the employer rate contribution on the Employer Contribution Rate page.

Run the merge process between Manage French Public Sector (FPS) and HR data.

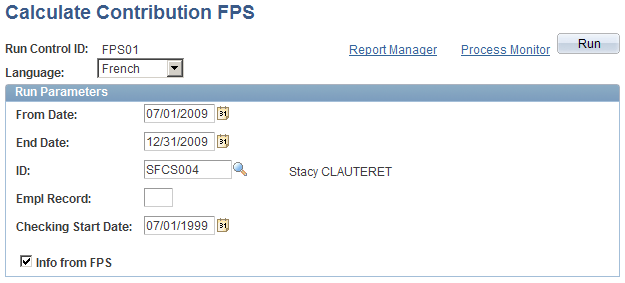

Use the Calculate Contribution FPS page (RUNCTL_FPA1100) to run the Calls for Entitlement SQR process (FPA1100) that identifies and calculates employee contributions.

Navigation

Image: Calculate Contribution FPS page

This example illustrates the fields and controls on the Calculate Contribution FPS page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| From Date and End Date |

The end date is automatically set to six months after the start date, but you can modify this date. |

| ID and Empl Rcd Nbr (employee record number) |

Enter one or both. When left blank, the system calculates all employees' contributions. |

| Checking Start Date |

The system checks that no retroactive modifications affect existing calculations between the check start date and the semester start date. By default, the period checked is 10 years. |

| Info From FPS |

Select to import required data from the home organization. |

Click Run. The system identifies employee deductions by employee ID, semester, title number, and sequence number.

After the calculation, you can review the contributions and access the Review Payment Cont FPS component to indicate whether the employee payment has been made.

Use the Contribution Call Letter FPS page (RUNCTL_FPA1150) to edit call letters.

Navigation

Call letters are those elements on the settlement/payment record that define the employer and employee contribution shares. Contribution call letters contain the employee's address and the contribution amounts. You must run the Calls for Entitlement process (FPA1100) before editing call letters.

To edit call letters:

Enter the employee ID and record number.

Enter the start and end dates. These dates define the edit period.

Run one of the following reports:

FPACNTR: edit call letters for the employee share.

FPACNTR2: edit call letters for the employer share.