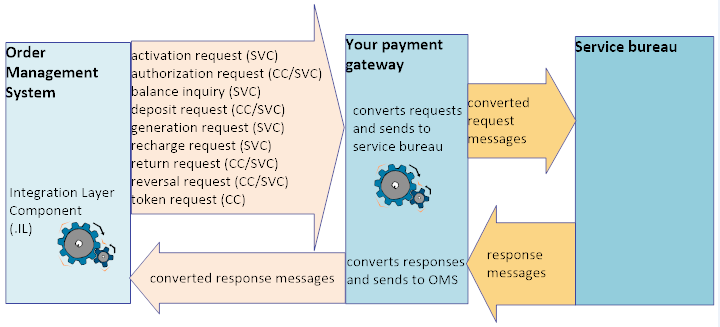

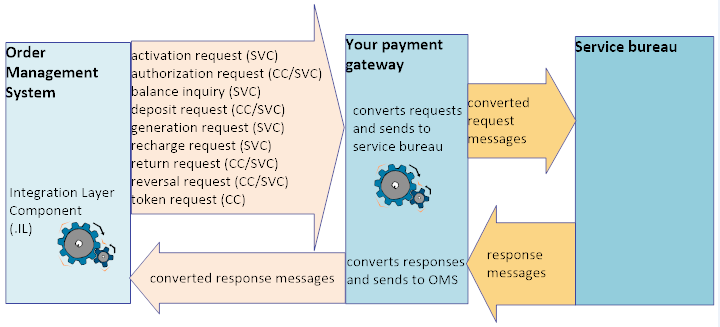

External payment service is a RESTful web service that provides an interface from Order Management System for sending credit card and stored value card transactions and receiving responses. Using this service, you can build a custom payment processor that maps to your payment provider.

This payment service needs to be configured to use the integration layer component of Order Management System, as this component controls payment service processing. When configuring the External Payment Service, the integration layer (.IL) must be defined as the primary authorization service.

Supported credit card transactions:

• authorization request

• deposit request

• return request

• reversal request

• token request

Supported stored value card transactions:

• activation request

• authorization request

• balance inquiry

• deposit request

• generation request

• recharge request

• return request

• reversal request

For more information: For background on credit card and stored value card authorization, see:

• Using the Credit Card Authorization Interface

• Defining Authorization Services (WASV)

In this topic:

• External Payment Service Setup

• Authorization Service Settings

• Work with Order Types (WOTY)

• Credit Card Authorization Reversal

• Stored Value Card Reversal Function

• Subsequent Authorization Requests through the External Payment Service

• Activation Request and Response (Stored Value Card)

• Authorization Request and Response

• Balance Request and Response (Stored Value Card)

• Deposit Request and Response

• Generate Request and Response (Stored Value Card)

• Recharge Request and Response (Stored Value Card)

• Reversal Request and Response (Stored Value Card)

External Payment Service Setup

The required setup for the External Payment Service is described below, and includes:

• Authorization Service Settings

• Work with Order Types (WOTY)

• Credit Card Authorization Reversal

Additional security requirements: For additional security-related setup requirements, including implementation of OAuth, see the External Payment Service Technical Reference Paper on My Oracle Support (2149144.1).

The External Authorization Service Access (B25) secured feature controls access to the Work with External Authorization Service Screen, where you can work with required settings for the External Payment Service. These settings are described briefly below under External Service Settings.

Use OAuth to authenticate the External Payment Service. See the Oracle Retail Omnichannel Web Service Authentication Guide on My Oracle Support (2728265.1) for more information.

Authorization Service Settings

Use Defining Authorization Services (WASV) to create a service bureau for the External Payment Service.

Settings for External Payment Service: The following table lists some of the required settings, in addition to the basic settings required for all service bureaus and any optional settings, to support the External Payment Service

Authorization Service Settings |

|

|---|---|

Fields at the first Create/Change/Display Authorization Services screen include: |

|

Typically set to EXT or EXC, but can be set to anything. |

|

Select Auth/Deposit. |

|

Select this field to perform credit card tokenization; otherwise, leave unselected. You can select this field only if the Use Credit Card Tokenization (L18) system control value is selected. |

|

Select this field to void any unused portion of a credit card or stored value card authorization at deposit time. Note: The Retain Unused Stored Value Card Authorization After Deposit (J21) system control value does not control stored value card deposit updates for the External Payment Layer. |

|

Select this field to perform a credit card authorization reversal when you process a cancellation associated with a credit card payment or deactivate a credit card payment. |

|

Fields at the second Create/Change/Display Authorization Services screen: |

|

Select Communication. |

|

Select Online or Batch. |

|

Must be selected. |

|

Must be set to .IL. See .IL Service Bureau Setup for required settings. |

|

Payment Link must be selected, to indicate messages sent the external payment layer are processed directly. |

|

Indicates the multiple to apply to the Response time to determine how long to wait for a response after a connection when you are using the External Payment Service. For example, if the Response check frequency is 6 and the Response time is 10,000, the system waits 60,000 milliseconds (60 seconds or 1 minute) for a response after connection. Note: If the total response interval is exceeded for an authorization record, the record goes into *RCVD status with a response type of SU, and is then removed from the Credit Card Authorization Transaction table (CCAT00). |

|

Indicates the number of milliseconds to wait for a connection to the service bureau when you are using the External Payment Service. For example, set this field to 10,000 milliseconds to wait 10 seconds for a connection. Note: Order Management System does not wait the entire response time if it is not necessary. To avoid potential timeout issues, Oracle recommends that you set the Response Time high enough for the authorization service to prevent issues that could potentially occur if the authorization process times out while processing multiple authorizations for an order. |

|

Country codes |

If needed, define a cross reference between your country code and the country code used by the service bureau. Note: This option also indicates whether a service bureau performs address verification processing for the country. |

Currency codes |

If needed, define a cross reference between your currency code and the currency code used by the service bureau; see Defining Authorization Service Currencies. |

Merchant ID Override |

If needed, define a merchant ID override for the different entities in your company; see Defining Merchant ID Overrides. |

Paytype codes |

If needed, define a cross reference between your pay type code and the pay type code used by the service bureau; see Defining Vendor Paytype Codes. |

Response codes |

Define the reasons that the service bureau approves (authorizes) or declines a transaction. The codes are assigned to each transaction by the service bureau when approving or declining the request; see Defining Vendor Response Codes. A response code of SU, indicating service unavailable, must be created. When there is a REJECT or ERROR response, the order goes on AT hold and the authorization is updated as declined when: • The reason code passed is not defined as an authorization response code, or • The reason code passed is defined as an authorization response code but also has a hold code defined, or • No reason code is passed. If no reason code is passed, a response code of SU is applied. |

The additional External Service Settings at the Work with External Authorization Service Screen are accessible only to users with External Authorization Service Access (B25) authority. All fields on the screen are required, with the exception of the External Service flag. Tracking changes to external service settings: Changes that users make to external service settings are tracked in the User Audit table, and listed on the User Authority Change report. See Tracking User, Authority, and Password Updates for more information. For more information: See the External Payment Layer RESTful Service technical reference on My Oracle Support for more information on updating these settings. |

|

External Service |

Select this field to have request messages generated for the External Payment Service. |

External URL Prefix |

The prefix that forms the beginning of the URL where messages are sent. Must begin with https. The message type defines the endpoint suffix that is appended to the prefix, creating the entire URL. For example, for a credit card authorization request, the entire URL might be https://remote.auth.com:1234/authorization, where remote.auth.com is the remote server, 1234 is the port, and authorization identifies an authorization request. The following endpoints are supported: • /balanceInquiry • /authorization • /reversal • /getToken • /generateGift • /activateGift • /rechargeGift • /deposit • /return |

Message Version |

Indicates which message version is supported: • Version 1.0: Messages include and support all tags as of Order Management System 19.5. • Version 2.0 (default when creating a new authorization service): Messages include and support all tags from Version 1.0, plus all tags introduced in Order Management System 20.0. Tags that are included in version 2.0 provide support for subsequent authorization requests through the External Payment Service. See Subsequent Authorization Requests through the External Payment Service for a discussion, and see Defining Authorization Services (WASV) for information on setting the Message Version. |

Authentication User |

The user ID for authentication of the messages to the external service. |

Authentication Password |

The password for authentication of the messages to the external service. Must be at least 6 positions long, include both numbers and letters, include a special character, and cannot end with a number. |

To send transactions through the External Payment Service, use Defining Authorization Services (WASV) to create a service bureau using the service code.IL and enter a value in the following fields:

• Application: ATDP (authorization and deposit)

• Merchant ID: INTEGRATION LAYER

• Charge description: Integration Layer

• Media type: C (communications)

No other fields are required.

Enter the .IL service bureau in the Primary authorization service field for the External Payment Service bureau.

Use Working with Pay Types (WPAY) to assign the authorization and deposit service to each credit card or stored value card pay type that uses the External Payment Service.

In order to perform online authorization on web orders, the Online Authorization setting for the order type on the web order must be set to Without Window. See Establishing Order Types (WOTY) for more information on setting up an order type.

Credit Card Authorization Reversal

The External Payment Service supports credit card authorization reversal. See Credit Card Authorization Reversal for an overview and processing details.

For the service bureau in Defining Authorization Services (WASV), select the Send reversal field to indicate the service bureau supports credit card authorization reversal if credit card authorization reversals need to be supported.

System control value for authorization reversal: Use Activation / Reversal Batch Processing (I50). See that system control value for more information.

The External Payment Service supports credit card tokenization using a 16 digit token. See Credit Card Tokenization in the Data Security and Encryption Guide on My Oracle Support (1988467.1) for an overview and processing details. The setup required for credit card tokenization is as follows.

In Defining Authorization Services (WASV), select the Request token field to indicate the service supports credit card tokenization. You can select this field only if the Use Credit Card Tokenization (L18) system control value is selected.

System control values for credit card tokenization:

System Control Value |

Description |

|---|---|

Select this system control value to replace the credit card number in the Order Management System database with a token provided by the external system. In addition, the number will be encrypted if you have credit card encryption enabled. |

|

Select this system control value to require a token for a credit card number. This ensures that credit card numbers are never stored in the Order Management System database and follows full PCI compliance and maximum security of sensitive data. If the Credit Card Tokenization Process is unable to replace the card number with a token, the system: • During Order Entry/Maintenance, Customer Memberships, and Change Invoice Payment Method: displays the Tokenization Warning window, requiring you to enter a different form of payment. • During web order processing: replaces the credit card number with the text TOKENIZATION FAILED and places the order in an error status with the reason Invalid Credit Card. You can correct the credit card payment method and resend the card for tokenization in batch order entry. Deselect this system control value to allow the system to accept a credit card number that has not been replaced with a token. The credit card number will be replaced by a token during authorization processing or when you use Work with Batch Tokenization (WBTK). Note: If you change the setting of this system control value, you must stop and restart the ORDER_IN integration layer job before your change takes effect for orders received through the Generic Order Interface (Order API). |

Stored Value Card Reversal Function

You can use a periodic function, described below, to submit stored value card reversal requests for closed or canceled orders.

REVXAHP (Program name = PFREVXAHP): Reverse Partial Auth for External Payment Service: Generates SVC reversal request messages for the External Payment Service within the specified company, provided that:

• A company is specified.

• The parameter specified for the function is a valid stored value card pay type code for the company.

• The pay type is assigned to an authorization service configured as the External Payment Service.

• The pay type does not match the Default Auth Code for CC Netting (M25) system control value.

For more information: See Stored Value Card Reversal with the External Payment Service for details, and see Stored Value Card Authorization Reversal for an overview of the authorization reversal process.

Subsequent Authorization Requests through the External Payment Service

About subsequent authorizations: Order Management System sends information through the External Payment Service indicating whether a transaction was initiated by the merchant, or by the customer. For example, when the customer initially places the order, this is a transaction initiated by the customer; an example of a merchant-initiated transaction is a subsequent authorization that is acquired by Order Management System when the initial authorization is expired.

Message version: Additional tags are available in version 2.0 of the messages to support passing information identifying a subsequent authorization that was not initiated by the customer. You need to have a version 2.0 selected for the External Payment Service to use the new tags. See External Service Settings for more information.

Term definitions:

• Merchant-Initiated Transactions (MIT): An authorization that the system initiates without the customer’s active participation.

• Cardholder-Initiated Transactions (CIT): An authorization that uses payment information provided by the customer.

• Credentials on File (COF): The cardholder payment information that is stored by the system. The credit card can be either tokenized or non-tokenized.

Types of subsequent authorizations: Brief descriptions of subsequent authorization types for credit cards include:

• Resubmission of a failed deposit: When the Supports Auth Resubmission flag is selected for the authorization service in Defining Authorization Services (WASV) and a previous deposit request for the credit card failed. A subsequent authorization and deposit request is generated, with the subsequentAuth tag set to Y and the subsequentAuthReason set to RESUBMIT. However, if the Supports Auth Resubmission flag is not selected, the subsequentAuthReason is set to REAUTH.

• Split shipment: When the order is not fulfilled in a single shipment. In this case, the request for the subsequent authorization includes a subsequentAuthReason set to REAUTH and passes the existing ci_transaction_id as the subsequentAuthTransactionID.

• Deferred or installment billing: When the order uses deferred or installment billing. The pay type’s Notify of installments setting indicates whether to send the subsequentAuthReason set to INSTALLMENT or REAUTH. See Deferred/Installment Billing Overview for background.

• Customer membership orders: When you generate orders for a customer membership that has been authorized. Authorization can take place either through the order originating the customer membership, or through a generated membership order. The CIT Transaction ID (customer-initiated transaction ID) and the original authorization amount for the credit card are stored on the customer membership, although this information is not displayed on any screen. For more information, see Subsequent Authorizations through the External Payment Service for Membership Orders.

Details on the tags in the authorization request message supporting subsequent authorization requests: See Subsequent Authorization Tags.

Sample External Payment Service Transactions

Overview: The sample request and response messages included in this help topic are:

• Activation Request and Response (Stored Value Card)

• Authorization Request and Response

• Balance Request and Response (Stored Value Card)

• Deposit Request and Response

• Generate Request and Response (Stored Value Card)

• Recharge Request and Response (Stored Value Card)

• Reversal Request and Response (Stored Value Card)

Depending on your configuration, these messages are typically logged in the INTEGRATIONORDER.log file, while errors are logged in the TRACE.log file. Personal data is not written to the logs.

Activation Request and Response (Stored Value Card)

Note: When the stored value card is a virtual card (the ccPassCode is set to V), the card is activated through a recharge request. See Recharge Request and Response (Stored Value Card).

{

"typeDescription":"ActivateRequest",

"requestType":"GiftCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"billToAuthServiceCountry":"US",

"cca":{

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"vendorResp":"",

"vendorResp2":" ",

"authNbr":" ",

"authDate":0,

"alphaOrderNbr":"00001234",

"merchantName":" ",

"authMerchantNbr":" ",

"oasisPayType":0,

"oasisPayCode":" ",

"oasisPayTypeCode":" ",

"companyDivision":" ",

"expireMonth":0,

"expireYear":0,

"AVSResp":" ",

"chargeDesc":"SVC",

"authAmt":25,

"custNbr":20110,

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":" ",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":" ",

"billtoCountry":"US",

"phoneNbr":0,

"phoneType":" ",

"ccPassCode":"P",

"ordNbr":12093,

"opmSeqNbr":0,

"auhSeqNbr":0,

"authService":"EXG",

"currCode":" ",

"lastModifiedPgm":" ",

"selected":false

},

"orderPaymentMethod":{

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXG"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT GC",

"merchantId":" ",

"password":" ",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":" ",

"submitterId":" ",

"SIDPassword":" ",

"presenterIdDep":" ",

"PIDPasswordDep":" ",

"submitterIdDep":" ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXG"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":5,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":90000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

}

{

"status":"ACCEPT",

"reasonCode":"77"

}

Authorization Request and Response

{

"typeDescription":"AuthorizationRequest",

"requestType":"CreditCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"billToAuthServiceCountry":"US",

"subsequentAuth":"N",

"subsequentAuthTransactionID":"",

"subsequentAuthReason":"",

"subsequentAuthOriginalAmount":"",

"subsequentAuthStoreCredential":"",

"cca":{

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"vendorResp":"",

"vendorResp2":"",

"authNbr":"",

"authDate":0,

"alphaOrderNbr":"00001234",

"expireMonth":12,

"expireYear":21,

"AVSResp":"",

"chargeDesc":"",

"authAmt":48.04,

"custNbr":20110,

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":" ",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":" ",

"billtoCountry":"US",

"phoneNbr":0,

"ordNbr":12091,

"opmSeqNbr":1,

"auhSeqNbr":1,

"authService":"EXC",

"currCode":"",

"lastModifiedPgm":" ",

"selected":false

},

"orderPaymentMethod":{

"id":{

"cmp":787,

"ordNbr":12091,

"seqNbr":1

},

"id_1":302185,

"amtToChg":0,

"amtAuth":0,

"amtBilled":0,

"amtCollected":0,

"amtCredited":0,

"authDate":0,

"authNbr":" ",

"manualAuthAmt":0,

"cashApplDate":0,

"cashCtrlNbr":0,

"chgSeq":3,

"expirationDate":1221,

"giftCertificateCpnNbr":0,

"payCategory":"2",

"cardSecurityVal":0,

"deferBill":"N",

"holdUntilDate":0,

"issuingBank":" ",

"nbrDaysForDeferral":0,

"fixDateForDeferral":0,

"nbrOfInstallments":0,

"installmentInterval":0,

"fixInstallmentBillDay":0,

"fpoExpirationDate":0,

"suppressDeposit":" ",

"suppressRefund":" ",

"checkingAct":" ",

"authVal":" ",

"ecommIndicator":" ",

"checkIntefaceDownload":0,

"cardStartDate":0,

"checkNbr":0,

"routingNbr":0,

"pinStorage":0,

"cardSecurityPresence":" ",

"cardIssueNbr":" ",

"payType":9,

"holdRsn":"CW",

"fpoPmtCode":" ",

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"ccLast4":"1111",

"tokenized":" ",

"verifiedToken":" ",

"bin":" ",

"lastModifiedPgm":"OrderPaymentMethodDAL.updateHoldReason",

"ciTransactionId":" ",

"ccNumberChange":" ",

"originalAmountAuthorized":0,

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXC"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT CC",

"merchantId":" ",

"password":" ",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":" ",

"submitterId":" ",

"SIDPassword":" ",

"presenterIdDep":" ",

"PIDPasswordDep":" ",

"submitterIdDep":" ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXC"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":1,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":9000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

},

"authorizationHistory":{

"id":{

"cmp":787,

"ordNbr":12091,

"ordPayMethodSeqNbr":1,

"seqNbr":1,

"selected":false

},

"authSts":"S",

"authAmt":48.04,

"depositAmt":0,

"authDate":0,

"sentDate":1210521,

"authNbr":" ",

"vendorResp":" ",

"vendorResp2":" ",

"AVSResp":" ",

"transactionId":" ",

"authTime":0,

"lastModifiedPgm":" ",

"captureSequence":0,

"captureCount":0,

"totalDeposited":0,

"captureVendorResp":" ",

"selected":false

}

}

{

"transactionId":"1234567890",

"approvedAmount":48.04,

"status":"ACCEPT",

"reasonCode":"100",

"authorizationCode":"123456789",

"ciTransactionId":"1234567890"

}

Balance Request and Response (Stored Value Card)

{

"typeDescription":"BalanceRequest",

"requestType":"GiftCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"billToAuthServiceCountry":"",

"cca":{

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"alphaOrderNbr":"00001234",

"oasisPayCode":"010",

"authAmt":0,

"phoneNbr":0,

"phoneType":"",

"ccPassCode":"",

"ordNbr":0,

"opmSeqNbr":0,

"auhSeqNbr":0,

"lastModifiedPgm":"",

"selected":false

},

"orderPaymentMethod":{

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXG"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT GC",

"merchantId":" ",

"password":" ",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":" ",

"submitterId":" ",

"SIDPassword":" ",

"presenterIdDep":" ",

"PIDPasswordDep":" ",

"submitterIdDep":" ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXG"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":5,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":90000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

}

}

{

"balance":100.00,

"status":"ACCEPT",

"reasonCode":"100",

}

{

"typeDescription":"DepositRequest",

"requestType":"CreditCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"requestAuth":"N",

"billToAuthServiceCountry":"",

"multipleCaptureSequence":1,

"finalCapture":"Y",

"ccd":{

"id":{

"cmp":787,

"ordNbr":12091,

"invNbr":32257,

"ordPayMethodSeqNbr":1,

"selected":false

},

"transType":"*PURCH",

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"transStatus":"*RDY",

"vendorResp":" ",

"vendorResp2":" ",

"authNbr":"1234567890",

"authDate":1210521,

"alphaOrderNbr":"00001234",

"merchantName":" ",

"oasisPayType":0,

"oasisPayCode":" ",

"companyDivision":" ",

"expireMonth":12,

"expireYear":21,

"AVSResp":" ",

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":" ",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":" ",

"billtoCountry":" ",

"transDate":1210521,

"transTime":193613,

"longInvoiceNbr":0,

"merchDollars":0,

"freightDollars":0,

"addlFreightDollars":0,

"totalTaxDollars":0,

"GSTTaxDollars":0,

"PSTTaxDollars":0,

"addlTaxDollars":0,

"handlingDollars":0,

"totalDollars":48.04,

"depositMerchantNbr":" ",

"flexPaymentType":" ",

"authService":"EXC",

"payType":9,

"currCode":" ",

"selected":false

},

"orderPaymentMethod":{

"id":{

"cmp":787,

"ordNbr":12091,

"seqNbr":1

},

"id_1":302185,

"amtToChg":0,

"amtAuth":48.04,

"amtBilled":48.04,

"amtCollected":48.04,

"amtCredited":0,

"authDate":0,

"authNbr":" ",

"manualAuthAmt":0,

"cashApplDate":0,

"cashCtrlNbr":0,

"chgSeq":3,

"expirationDate":1221,

"giftCertificateCpnNbr":0,

"payCategory":"2",

"cardSecurityVal":0,

"deferBill":"N",

"holdUntilDate":0,

"issuingBank":" ",

"nbrDaysForDeferral":0,

"fixDateForDeferral":0,

"nbrOfInstallments":0,

"installmentInterval":0,

"fixInstallmentBillDay":0,

"fpoExpirationDate":0,

"suppressDeposit":" ",

"suppressRefund":" ",

"checkingAct":" ",

"authVal":" ",

"ecommIndicator":" ",

"checkIntefaceDownload":0,

"cardStartDate":0,

"checkNbr":0,

"routingNbr":0,

"pinStorage":0,

"cardSecurityPresence":" ",

"cardIssueNbr":" ",

"payType":9,

"holdRsn":"CW",

"fpoPmtCode":" ",

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"ccLast4":"1111",

"tokenized":" ",

"verifiedToken":" ",

"bin":" ",

"lastModifiedPgm":"FLR0270",

"ciTransactionId":"1234567890",

"ccNumberChange":" ",

"originalAmountAuthorized":48.04,

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXC"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT CC",

"merchantId":" ",

"password":" ",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":" ",

"submitterId":" ",

"SIDPassword":" ",

"presenterIdDep":" ",

"PIDPasswordDep":" ",

"submitterIdDep":" ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXC"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":1,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":9000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

},

"authorizationHistory":{

"id":{

"cmp":787,

"ordNbr":12091,

"ordPayMethodSeqNbr":1,

"seqNbr":1,

"selected":false

},

"authSts":"A",

"authAmt":48.04,

"depositAmt":48.04,

"authDate":1210521,

"sentDate":1210521,

"authNbr":"1234567890",

"vendorResp":"100",

"vendorResp2":" ",

"AVSResp":" ",

"transactionId":"1234567890",

"authTime":192858,

"lastModifiedPgm":"AuthBO.changePreAuthPicksToPostAuth(2)",

"captureSequence":0,

"captureCount":0,

"totalDeposited":0,

"captureVendorResp":" ",

"selected":false

}

}

{

"status":"ACCEPT",

"reasonCode":"100",

"errorResponse":""

}

Generate Request and Response (Stored Value Card)

{

"typeDescription":"GenerateRequest",

"requestType":"GiftCard",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"billToAuthServiceCountry":"",

"cca":{

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"authAmt":0,

"phoneNbr":0,

"phoneType":"",

"ccPassCode":"",

"ordNbr":0,

"opmSeqNbr":0,

"auhSeqNbr":0,

"lastModifiedPgm":"",

"selected":false

},

"orderPaymentMethod":{

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXG"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT GC",

"merchantId":" ",

"password":"",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":"",

"submitterId":" ",

"SIDPassword":"",

"presenterIdDep":" ",

"PIDPasswordDep":"",

"submitterIdDep":" ",

"SIDPasswordDep":"",

"APIUsername":"",

"APIPassword":"",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXG"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":5,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":90000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

}

}

{

"cardNumber":"CARDNUMBER",

"status":"ACCEPT",

"reasonCode":"100",

"authenticationData":"1234",

"errorResponse":""

}

Recharge Request and Response (Stored Value Card)

{

"typeDescription":"RechargeRequest",

"requestType":"GiftCard",

"cardNumber":"CARD_NUMBER",

"authenticationData":"1234",

"emailAddress":"first.last@example.com",

"merchantId":"",

"compCurrency":"USD",

"vendCurrency":"",

"vendPaymentMethod":"",

"ecommerceIndicator":"false",

"useTokenization":"Y",

"billToAuthServiceCountry":"US",

"cca":{

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"vendorResp":"",

"vendorResp2":" ",

"authNbr":" ",

"authDate":0,

"alphaOrderNbr":"00001234",

"merchantName":" ",

"authMerchantNbr":" ",

"oasisPayType":0,

"oasisPayCode":" ",

"oasisPayTypeCode":" ",

"companyDivision":" ",

"expireMonth":0,

"expireYear":0,

"AVSResp":"4654",

"chargeDesc":"SVC",

"authAmt":25,

"custNbr":20110,

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":"",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":"",

"billtoCountry":"US",

"phoneNbr":0,

"phoneType":" ",

"ccPassCode":"V",

"ordNbr":12089,

"opmSeqNbr":0,

"auhSeqNbr":0,

"authService":"EXG",

"currCode":" ",

"lastModifiedPgm":" ",

"selected":false

},

"orderPaymentMethod":{

"ccNbr":[

],

"ccNbrAsBlob":{

"buf":[

],

"len":0,

"origLen":0

},

"selected":false

},

"authorizationService":{

"id":{

"cmp":787,

"authService":"EXG"

},

"application":"ATDP",

"batchOnline":"C",

"mediaType":"C",

"activeProductionSys":"N",

"addrVerification":"N",

"declineDays":0,

"selectForDeposit":"Y",

"immediateDeposit":"N",

"immediateResp":"N",

"industryFormat":" ",

"installmentBilling":"N",

"keepHist":"N",

"chgDesc":"EXT GC",

"merchantId":" ",

"password":"",

"receivingCode":" ",

"signon":" ",

"startUpInfo":" ",

"subCode":" ",

"fileSeqNbr":0,

"presenterId":" ",

"PIDPassword":"",

"submitterId":" ",

"SIDPassword":"",

"presenterIdDep":" ",

"PIDPasswordDep":"",

"submitterIdDep":" ",

"SIDPasswordDep":"",

"APIUsername":"",

"APIPassword":"",

"APISignature":" ",

"selected":false

},

"authorizationServiceExt":{

"id":{

"cmp":787,

"authService":"EXG"

},

"authPhoneNbr":0,

"depositPhoneNbr":0,

"communicationType":"P",

"respCheckFreq":5,

"testMode":"N",

"authSrvProvider":" ",

"merchDiv":0,

"providerNetworkAddr":" ",

"portNbr":0,

"respTime":90000,

"deferredMerchId":" ",

"installmentMerchId":" ",

"excludeFromFlexPay":"N",

"onLineILPProc":" ",

"batchILPProc":" ",

"depositILPProc":" ",

"svcActivationProc":" ",

"svcBalInqProc":" ",

"primaryAuthSrv":".IL",

"requestToken":"N",

"voidAuth":"N",

"allowReversal":"N",

"allowsResubmit":false,

"overrideReconciliationId":" ",

"selected":false

}

}

{

"transactionId":"TRANSID",

"approvedAmount":100.00,

"status":"ACCEPT",

"reasonCode":"100",

"errorResponse":""

}

{

"typeDescription": "ReturnRequest",

"requestType": "CreditCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId": "",

"compCurrency": "USD",

"vendCurrency": "",

"vendPaymentMethod": "",

"ecommerceIndicator": "false",

"useTokenization": "Y",

"billToAuthServiceCountry": "",

"ccd": {

"id": {

"cmp": 787,

"ordNbr": 12091,

"invNbr": 32258,

"ordPayMethodSeqNbr": 1,

"selected": false

},

"transType": "*RETURN",

"ccNbrAsBlob": {

"buf": [],

"len": 0,

"origLen": 0

},

"transStatus": "*RDY",

"vendorResp": " ",

"vendorResp2": " ",

"authNbr": " ",

"authDate": 0,

"alphaOrderNbr": "00001234",

"merchantName": " ",

"oasisPayType": 0,

"oasisPayCode": " ",

"companyDivision": " ",

"expireMonth": 12,

"expireYear": 21,

"AVSResp": " ",

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":" ",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":" ",

"billtoCountry":"US",

"transDate": 1210521,

"transTime": 200620,

"longInvoiceNbr": 0,

"merchDollars": 0,

"freightDollars": 0,

"addlFreightDollars": 0,

"totalTaxDollars": 0,

"GSTTaxDollars": 0,

"PSTTaxDollars": 0,

"addlTaxDollars": 0,

"handlingDollars": 0,

"totalDollars": 35,

"depositMerchantNbr": " ",

"flexPaymentType": " ",

"authService": "EXC",

"payType": 9,

"currCode": " ",

"selected": false

},

"orderPaymentMethod": {

"id": {

"cmp": 787,

"ordNbr": 12091,

"seqNbr": 1

},

"id_1": 302185,

"amtToChg": 0,

"amtAuth": 48.04,

"amtBilled": 48.04,

"amtCollected": 48.04,

"amtCredited": 35,

"authDate": 0,

"authNbr": " ",

"manualAuthAmt": 0,

"cashApplDate": 0,

"cashCtrlNbr": 0,

"chgSeq": 3,

"expirationDate": 1221,

"giftCertificateCpnNbr": 0,

"payCategory": "2",

"cardSecurityVal": 0,

"deferBill": "N",

"holdUntilDate": 0,

"issuingBank": " ",

"nbrDaysForDeferral": 0,

"fixDateForDeferral": 0,

"nbrOfInstallments": 0,

"installmentInterval": 0,

"fixInstallmentBillDay": 0,

"fpoExpirationDate": 0,

"suppressDeposit": " ",

"suppressRefund": " ",

"checkingAct": " ",

"authVal": " ",

"ecommIndicator": " ",

"checkIntefaceDownload": 0,

"cardStartDate": 0,

"checkNbr": 0,

"routingNbr": 0,

"pinStorage": 0,

"cardSecurityPresence": " ",

"cardIssueNbr": " ",

"payType": 9,

"holdRsn": "CW",

"fpoPmtCode": " ",

"ccNbr": [],

"ccNbrAsBlob": {

"buf": [],

"len": 0,

"origLen": 0

},

"ccLast4": "1111",

"tokenized": " ",

"verifiedToken": " ",

"bin": " ",

"lastModifiedPgm": "FLR0270",

"ciTransactionId": "1234567890",

"ccNumberChange": " ",

"originalAmountAuthorized": 48.04,

"selected": false

},

"authorizationService": {

"id": {

"cmp": 787,

"authService": "EXC"

},

"application": "ATDP",

"batchOnline": "C",

"mediaType": "C",

"activeProductionSys": "N",

"addrVerification": "N",

"declineDays": 0,

"selectForDeposit": "Y",

"immediateDeposit": "N",

"immediateResp": "N",

"industryFormat": " ",

"installmentBilling": "N",

"keepHist": "N",

"chgDesc": "EXT CC",

"merchantId": " ",

"password":"CHANGEDBYLOGGER",

"receivingCode": " ",

"signon": " ",

"startUpInfo": " ",

"subCode": " ",

"fileSeqNbr": 0,

"presenterId": " ",

"PIDPassword":" ",

"submitterId": " ",

"SIDPassword":" ",

"presenterIdDep": " ",

"PIDPasswordDep":" ",

"submitterIdDep": " ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature": " ",

"selected": false

},

"authorizationServiceExt": {

"id": {

"cmp": 787,

"authService": "EXC"

},

"authPhoneNbr": 0,

"depositPhoneNbr": 0,

"communicationType": "P",

"respCheckFreq": 1,

"testMode": "N",

"authSrvProvider": " ",

"merchDiv": 0,

"providerNetworkAddr": " ",

"portNbr": 0,

"respTime": 9000,

"deferredMerchId": " ",

"installmentMerchId": " ",

"excludeFromFlexPay": "N",

"onLineILPProc": " ",

"batchILPProc": " ",

"depositILPProc": " ",

"svcActivationProc": " ",

"svcBalInqProc": " ",

"primaryAuthSrv": ".IL",

"requestToken": "N",

"voidAuth": "N",

"allowReversal": "N",

"allowsResubmit": false,

"overrideReconciliationId": " ",

"selected": false

}

}

{

"status":"ACCEPT",

"reasonCode":"100",

"errorResponse":""

}

Reversal Request and Response (Stored Value Card)

{

"typeDescription": "ReversalRequest",

"requestType": "GiftCard",

"cardNumber":"CARD_NUMBER",

"emailAddress":"first.last@example.com",

"merchantId": "",

"compCurrency": "USD",

"vendCurrency": "",

"vendPaymentMethod": "",

"ecommerceIndicator": "true",

"useTokenization": "Y",

"billToAuthServiceCountry": "US",

"cca": {

"ccNbrAsBlob": {

"buf": [],

"len": 0,

"origLen": 0

},

"vendorResp": "",

"vendorResp2": " ",

"authNbr": "1234567890",

"authDate": 1210407,

"alphaOrderNbr": "00001234",

"merchantName": " ",

"authMerchantNbr": " ",

"oasisPayType": 0,

"oasisPayCode": " ",

"oasisPayTypeCode": " ",

"companyDivision": " ",

"expireMonth": 0,

"expireYear": 0,

"AVSResp": " ",

"chargeDesc": "SVC",

"authAmt": 12,

"custNbr": 20110,

"custLastName":"LAST",

"custFirstName":"FIRST",

"addrLine1":"123 EXAMPLE ST",

"addrLine2":" ",

"billtoCity":"CHICAGO",

"billtoState":"IL",

"billtoZip":"60625",

"billtoExtraZip":" ",

"billtoCountry":"US",

"phoneNbr": 0,

"phoneType": " ",

"ccPassCode": " ",

"ordNbr": 11775,

"opmSeqNbr": 1,

"auhSeqNbr": 1,

"authService": "EXG",

"currCode": " ",

"lastModifiedPgm": " ",

"selected": false

},

"orderPaymentMethod": {

"id": {

"cmp": 787,

"ordNbr": 11775,

"seqNbr": 1

},

"id_1": 301686,

"amtToChg": 0,

"amtAuth": 12,

"amtBilled": 22,

"amtCollected": 22,

"amtCredited": 0,

"authDate": 0,

"authNbr": " ",

"manualAuthAmt": 0,

"cashApplDate": 0,

"cashCtrlNbr": 0,

"chgSeq": 2,

"expirationDate": 1222,

"giftCertificateCpnNbr": 0,

"payCategory": "2",

"cardSecurityVal": 0,

"deferBill": "N",

"holdUntilDate": 0,

"issuingBank": " ",

"nbrDaysForDeferral": 0,

"fixDateForDeferral": 0,

"nbrOfInstallments": 0,

"installmentInterval": 0,

"fixInstallmentBillDay": 0,

"fpoExpirationDate": 0,

"suppressDeposit": " ",

"suppressRefund": " ",

"checkingAct": " ",

"authVal": " ",

"ecommIndicator": " ",

"checkIntefaceDownload": 0,

"cardStartDate": 0,

"checkNbr": 0,

"routingNbr": 0,

"pinStorage": 0,

"cardSecurityPresence": " ",

"cardIssueNbr": " ",

"payType": 10,

"holdRsn": "CW",

"fpoPmtCode": " ",

"ccNbr": [],

"ccNbrAsBlob": {

"buf": [],

"len": 0,

"origLen": 0

},

"ccLast4": "1111",

"tokenized": " ",

"verifiedToken": " ",

"bin": " ",

"lastModifiedPgm": "FLR0270",

"ciTransactionId": " ",

"ccNumberChange": " ",

"originalAmountAuthorized": 0,

"selected": false

},

"authorizationService": {

"id": {

"cmp": 787,

"authService": "EXG"

},

"application": "ATDP",

"batchOnline": "C",

"mediaType": "C",

"activeProductionSys": "N",

"addrVerification": "N",

"declineDays": 0,

"selectForDeposit": "Y",

"immediateDeposit": "N",

"immediateResp": "N",

"industryFormat": " ",

"installmentBilling": "N",

"keepHist": "N",

"chgDesc": "EXT GC",

"merchantId": " ",

"password":" ",

"receivingCode": " ",

"signon": " ",

"startUpInfo": " ",

"subCode": " ",

"fileSeqNbr": 0,

"presenterId": " ",

"PIDPassword":" ",

"submitterId": " ",

"SIDPassword":" ",

"presenterIdDep": " ",

"PIDPasswordDep":" ",

"submitterIdDep": " ",

"SIDPasswordDep":" ",

"APIUsername":" ",

"APIPassword":" ",

"APISignature": " ",

"selected": false

},

"authorizationServiceExt": {

"id": {

"cmp": 787,

"authService": "EXG"

},

"authPhoneNbr": 0,

"depositPhoneNbr": 0,

"communicationType": "P",

"respCheckFreq": 5,

"testMode": "N",

"authSrvProvider": " ",

"merchDiv": 0,

"providerNetworkAddr": " ",

"portNbr": 0,

"respTime": 90000,

"deferredMerchId": " ",

"installmentMerchId": " ",

"excludeFromFlexPay": "N",

"onLineILPProc": " ",

"batchILPProc": " ",

"depositILPProc": " ",

"svcActivationProc": " ",

"svcBalInqProc": " ",

"primaryAuthSrv": ".IL",

"requestToken": "N",

"voidAuth": "N",

"allowReversal": "N",

"allowsResubmit": false,

"overrideReconciliationId": " ",

"selected": false

},

"authorizationHistory": {

"id": {

"cmp": 787,

"ordNbr": 11775,

"ordPayMethodSeqNbr": 1,

"seqNbr": 1,

"selected": false

},

"authSts": "V",

"authAmt": 12,

"depositAmt": 0,

"authDate": 1210407,

"sentDate": 1210407,

"authNbr": "1234567890",

"vendorResp": "100",

"vendorResp2": " ",

"AVSResp": " ",

"transactionId": "1234567890",

"authTime": 145918,

"lastModifiedPgm": "ExternalServiceBO.createAuthReversal",

"totalDeposited": 0,

"captureVendorResp": " ",

"selected": false

}

}

{

"status":"ACCEPT",

"reasonCode":"100"

}

The information included in External Payment Service request messages is described below.

Note: All tags listed below were included in the initial version 1.0 of these messages, unless a later message version is indicated.

Tag |

Description |

|---|---|

ExternalPaymentServiceMessageRequest ExternalPaymentServiceMessageRequest{ "typeDescription": "AuthorizationRequest", "requestType": "CreditCard", "cardNumber": "", "emailAddress": "first.last@example.com", "merchantId": "MERCHANT", "compCurrency": "USD", "vendCurrency": "400 ", "vendPaymentMethod": "", "ecommerceIndicator": "false", "useTokenization": "Y", "billToAuthServiceCountry": "", "ciTransactionId":"1234567890" "multipleCaptureSequence":"1" "finalCapture":"Y" |

|

typeDescription |

Indicates the type of request. Credit card: Supported credit card request types are: • AuthorizationRequest: See Authorization Request and Response • DepositRequest: See Deposit Request and Response • ReturnRequest: See Return Request and Response • ReversalRequest: See Reversal Request and Response (Stored Value Card) • TokenRequest Stored value card: Supported stored value card request types are: • ActivateRequest: See Activation Request and Response (Stored Value Card) • AuthorizationRequest: See Authorization Request and Response • BalanceRequest: See Balance Request and Response (Stored Value Card) • DepositRequest: See Deposit Request and Response • GenerateRequest: See Generate Request and Response (Stored Value Card) • RechargeRequest: See Recharge Request and Response (Stored Value Card) • ReturnRequest: See Return Request and Response • ReversalRequest: See Reversal Request and Response (Stored Value Card) |

requestType |

Indicates whether the request is related to a credit card or a stored value card. Supported request types are: • GiftCard: The request is related to a stored value card. • CreditCard: The request is related to a credit card. |

cardNumber |

The credit card number, stored value card number, or token number, if any, related to the request. |

authenticationData |

The PIN, if any, assigned to a stored value card, or the CVV number for a credit card. |

emailAddress |

The email address for the customer. Not included for a stored value card generate request. |

merchantId |

The Merchant ID specified for the service bureau. Blank if no Merchant ID is specified. |

compCurrency |

The Currency code defined in the Local Currency Code (A55) system control value. |

vendCurrency |

The Authorization service currency specified for the Currency, as set up through the Work with Authorization Currency screen. May include trailing blanks. |

vendPaymentMethod |

The Vendor Pay Code specified for the pay type, as set up through the Work with Pay Type Cross Reference screen. |

ecommerceIndicator |

Indicates whether the order was placed on a web storefront. Valid values are: • true = The order was placed over the web storefront. This value is used if the order type matches the E-Commerce Order Type (G42). • false = The order was not placed over the web storefront. This value is used if the order type does not match the E-Commerce Order Type (G42). From the Ecomm Indic field in the Order Payment Method table. |

useTokenization |

Set to Y if tokenization is enabled; otherwise, set to N. Based on the setting of the Use Credit Card Tokenization (L18) system control value. |

requestAuth |

Indicates whether authorization is required for a stored value card or credit card deposit request, where Y indicates an authorization + deposit, while N indicates deposit only; otherwise, not used. |

billToAuthServiceCountry |

The authorization service country, as set up through Defining Authorization Service Countries. |

|

The following tags are available in version 2.0 of the message (Update 20.0 of Order Management System) and are included for the subsequent authorizations listed under Subsequent Authorization Requests through the External Payment Service. See Defining Authorization Services (WASV) for information on setting the Message Version. |

|

ciTransactionId |

The customer-initiated transaction ID, if known. This transaction ID could be from the CWOrderIn message that originated the order, or from the ciTransactionId passed in the authorization response message. See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

subsequentAuth |

Set to Y if this is a subsequent authorization request for a credit card, and the ci_transaction_id is stored on the Order Payment Method record. See the discussion of the subsequentAuthTransactionID, below, for more information. Set to N if this is the first authorization request for the credit card. This might occur if the order was initially created without the authorization, or if the credit card number was changed. Not passed if this is an authorization request for a stored value card. See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

subsequentAuthTransactionID |

The ci_transaction_id identifying the authorization. Passed when this is a subsequent authorization either from a previous message through the External Payment Service, through the ci_transaction_id received in the Inbound Order XML Message (CWORDERIN), or from the customer membership if this is a generated membership order. Otherwise, not passed. See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

subsequentAuthReason |

Passed only for a subsequent authorization request. Possible reasons: RESUBMIT: You need to obtain an authorization for a customer-initiated purpose. This situation can occur when the original authorization was declined for insufficient funds and the goods or services have already been delivered to the customer. This reason is passed only if the Supports Auth Resubmission flag is selected for the authorization service; otherwise, the reason passed is REAUTH. INSTALLMENT: This is a delayed charge related to deferred or installment billing. Used only if the pay type has Notify of installments selected; otherwise, this tag is set to REAUTH. REAUTH: One of the following is true: • The request is for a reauthorization for a split shipment or delayed shipment. A split or delayed shipment occurs when some of the goods that were ordered are not available for shipment at the time of purchase. When you ship goods after the authorization validity time limit set by Visa, you must perform a separate authorization to ensure that customer funds are available. • The request is for a delayed charge related to deferred or installment billing if the pay type has Notify of installments unselected. • The authorization request is for a generated membership order after the authorization was obtained for the customer membership. • You need to obtain an authorization for a custom-initiated purpose, as described above under RESUBMIT; however, the Supports Auth Resubmission flag is not selected for the authorization service. Note: Even if the order uses deferred and installment billing and Notify of installments is selected, the reason passed is still REAUTH if an authorization is required for other reasons, such as adding new items or the original authorization expiring. See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

subsequentAuthOriginalAmount |

The amount of the original approved authorization. This is the authorization amount from the oldest Auth History record, or from the customer membership if this is for a generated membership order. Passed only when the ci_transaction_id is stored on the Order Payment Method, either in a previous message through the External Payment Service, through the ci_transaction_id received in the Inbound Order XML Message (CWORDERIN). See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

subsequentAuthStoreCredential |

Set to Y if the authorization credentials are stored. Passed when this is a subsequent authorization and the ci_transaction_id is stored on the Order Payment Method, either in a previous message through the External Payment Service, through the ci_transaction_id received in the Inbound Order XML Message (CWORDERIN). See Subsequent Authorization Requests through the External Payment Service for a discussion. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

The following tags are always passed in a deposit request for both credit cards and stored value cards if the message version is 2.0. |

|

Indicates the sequence number of the deposit based on the number of deposits against the authorization. Set to: • 0 if Void auth at deposit is set to Y for the authorization service. • 1 if Void auth at deposit is set to N for the authorization service, and this is the first capture for the deposit. • 2 or higher if Void auth at deposit is set to N for the authorization service, and this is a subsequent authorization for the deposit. See Multiple Capture Sequence and Final Capture Sent to External Payment Service andVoid Unused Authorization After Initial Deposit for a discussion and examples. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

|

Indicates whether this is the final capture against the authorization. Set to: • empty if Void auth at deposit is set to Y for the authorization service. • Y if there are no additional shipments remaining against the authorization. • N if there are additional shipments remaining against the authorization. See Multiple Capture Sequence and Final Capture Sent to External Payment Service andVoid Unused Authorization After Initial Deposit for a discussion and examples. Available in: Version 2.0 of the message (Update 20.0 of Order Management System). |

|

cca: Included for: • Credit card: authorization, reversal, and token request • Stored value card: activation, authorization, balance, generate, recharge, and reversal request The fields in the cca container are primarily from the CC_Authorization_Trans table. Not all of these fields are used. "cca":{ "buf":[

], "len":0, "origLen":0 }, "vendorResp":"", |

|

ccd: Included for credit card and stored value card deposit and return requests. The fields in the ccd container are primarily from the CC_Deposit_Transaction table. Not all of these fields are used. "ccd":{ "buf":[

], "len":0, "origLen":0 }, "transStatus":"*RDY", |

|

The tags included in the cca or ccd container are described below. Because these containers contain many of the same tags, the listing is combined. The listing indicates tags that are included in only the cca or ccd container. |

|

cmp |

The code identifying the company originating a deposit or return request. Included in the ccd container. |

ordNbr |

The order number related to a credit card authorization, deposit, return, reversal, or token request, and a stored value card activation, authorization, deposit, generation, recharge, return, or reversal request. |

invNbr |

The invoice number related to a shipment or return related to a deposit or return request. Included in the ccd container. |

ordPayMethodSeqNbr |

The unique sequence number identifying the stored value card or credit card used on the order. Used for stored value card and credit card deposit and return requests. Included in the ccd container. |

ccNbrAsBlob |

Added automatically. Not mapped. |

LRAid |

May be included only in the ccd container for a credit card deposit request, but left blank. Not currently implemented. |

selected |

Set to false. Included in the ccd container. |

transType |

Set to: • PURCH: - Credit card requests: authorization request with token, deposit request, and reversal request - Stored value card requests: activation request, authorization request, recharge request, and reversal request • RETURN for a credit card return request or stored value card return request Otherwise, not included. |

creditCardNbr |

Always blank. |

transStatus |

Set to RDY for: • Credit card requests: authorization request with token, deposit request, return request, and reversal request • Stored value card requests: activation request, deposit request, recharge request, return request, and reversal request Otherwise, not included. |

vendorResp |

Not currently implemented. |

vendorResp2 |

Not currently implemented. |

authNbr |

The authorization number related to a credit card or stored value card deposit or reversal request. |

authDate |

The authorization date for a credit card or stored value card deposit or reversal request. |

alphaOrderNbr |

The Web Order number, if any, from the E-commerce order number from the Order Header Extended table. |

merchantName |

Not currently implemented. |

authMerchantNbr |

Not currently implemented. |

oasisPayType |

Not currently implemented. |

oasisPayCode |

Not currently implemented. |

oasisPayTypeCode |

Not currently implemented. |

companyDivision |

Not currently implemented. |

expireMonth |

From the first two positions of the Expiration date. The month when the credit card is no longer active. |

expireYear |

From the second two positions of the Expiration date. The year when the credit card is no longer active. |

AVSResp |

From the AVS response. A code representing the address verification response for the credit card authorization if AVS is used. If AVS is not used, this field is blank. The AVS response code is from the AVS response field in the Authorization History table. |

chargeDesc |

Set to SVC for a credit card reversal, and for a stored value card activation request, recharge request, or reversal request; otherwise, not used. Included in the cca container. |

authAmt |

The authorization amount requested for a credit card authorization request or reversal request, and for a stored value card activation request, recharge request, or reversal request; otherwise, not used. Included in the cca container. |

reauthCode |

May be included in the cca container. Not currently implemented. |

mailPhoneOther |

May be included in the cca container. Not currently implemented. |

oasisHoldRsn |

May be included in the cca container. Not currently implemented. |

vendHoldRsn |

May be included in the cca container. Not currently implemented. |

termPayCode |

May be included in the cca container. Not currently implemented. |

custNbr |

The customer number for a stored value card activation, authorization, recharge, or reversal request, and for a credit card authorization, reversal, or token request. Included in the cca container. |

custLastName |

The sold-to customer’s last name. Always included in the cca or ccd container. |

custFirstName |

The sold-to customer’s first name. Always included in the cca or ccd container. |

addrLine1 |

The first line of the sold-to customer’s address. Always included in the cca or ccd container. |

addrLine2 |

The second line of the sold-to customer’s address. Always included in the cca or ccd container. |

billtoCity |

The city of the sold-to customer’s address. Always included in the cca or ccd container. |

billtoState |

The state or province of the sold-to customer’s address. Always included in the cca or ccd container. |

billtoZip |

The zip or postal code of the sold-to customer’s address. Always included in the cca or ccd container. |

billtoExtraZip |

The additional positions of the zip or postal code of the sold-to customer’s address. |

billtoCountry |

The sold-to customer’s country code. Always included in the cca or ccd container. |

phoneNbr |

Not currently implemented. Included in the cca container. |

phoneType |

Included in the cca container. |

transDate |

The date of the transaction. |

transTime |

The time of the transaction. |

ccPassCode |

Set to P in a stored value card activation request, and set to V in a stored value card recharge request. (When the stored value card is a virtual card (the ccPassCode is set to V), the card is activated through a recharge request rather than an activation request.) Otherwise, not used. Included in the cca container. |

opmSeqNbr |

A unique sequence number to identify the payment method on the order. Populated for a stored value card authorization or reversal request, and for a credit card authorization, reversal, or token request. Included in the cca container. |

auhSeqNbr |

A unique sequence number to identify the authorization on the order. Populated for a stored value card activation, authorization, balance, recharge, or reversal request, and for a credit card authorization or token request. Included in the cca container. |

longInvoiceNbr |

The invoice number. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

merchDollars |

The total merchandise value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

freightDollars |

The total freight value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

addlFreightDollars |

The total additional freight value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

totalTaxDollars |

The total tax value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

GSTTaxDollars |

The total GST value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

PSTTaxDollars |

The total PST value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

addlTaxDollars |

The total additional tax value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

handlingDollars |

The total handling value. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

totalDollars |

The total value of the deposit or return. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

depositMerchantNbr |

The account number assigned by the service bureau to identify transmissions to and from your company. Populated for a stored value card deposit or return request, and for a credit card deposit or return request. Included in the ccd container. |

flexPaymentType |

Identifies whether a deposit is for an installment or deferred billing. Included in the ccd container. |

authService |

The 3-position alphanumeric code to identify the service bureau. |

payType |

From the Pay type. The pay type code associated with this order. Pay type codes are defined in and validated against the Pay Type table. See Working with Pay Types (WPAY). |

currCode |

The code identifying the currency used on the order, if different from the default. |

lastModifiedPgm |

Not currently implemented. |

selected |

Set to false. |

orderPaymentMethod Each tag is described briefly below. Details on order payment methods are available for review in order inquiry. See Reviewing Payment Methods for more information. "orderPaymentMethod":{

], "ccNbrAsBlob":{ "buf":[

], "len":0, "origLen":0 }, |

|

], "ciTransactionId":"124567890", "ccNumberChange":" ", "originalAmountAuthorized":12.34, |

|

id |

Includes identifying information about the service bureau. |

cmp |

The company where the service bureau was created. |

ordNbr |

The order associated with the order payment method. |

seqNbr |

An internal sequence number to identify the order payment record. |

LRAId |

May be included. Not currently implemented. |

creditCardNbr |

Always blank. |

selected |

Set to false. |

amtToChg |

From the Amount to charge. The total value charged to the payment method. If no value is specified, then this payment type serves as a “catch-all,” meaning any amount not assigned to another payment method applies to this one. |

amtAuth |

From the Amount authorized. The amount authorized for the credit card payment. |

amtBilled |

From the Amount billed. For credit card payments, this is the total amount billed to the credit card. The system updates this amount as soon as the card is billed even before you process deposits. If you are using deferred or installment billing, the total amount to charge the card displays, even if the total amount has not yet been billed. |

amtCollected |

From the Amount collected. An amount is collected when a shipment is billed using a credit card payment type. Note: This field is updated before you process deposits, and the update occurs regardless of whether the credit card uses a deferred or installment payment plan or is set up for immediate deposit. |

amtCredited |

From the Amount credited. The amount from this payment type that the customer has received as credit or refund, represented by the creation of a refund in the Refund table. This information is updated when the refund is processed. |

authDate |

From the Authorization date. The month, day, and year that your credit card authorization service confirmed or authorized the customer's credit card for the order, or you manually authorized the credit card. |

authNbr |

From the Authorization number. The number you used when you manually authorized the credit card, or the authorization service assigned when authorizing the credit card. The number can be overridden for manual or authorization service updates, and clears when the order is purged. For orders using a payment plan, the system retains the original authorization number from pick slip generation, even after you receive a full authorization for deposit. |

manualAuthAmt |

Not implemented in these messages. |

cashApplDate |

Not implemented in these messages. |

cashCtrlNbr |

Not implemented in these messages. |

chgSeq |

From the Charge sequence setting. A number that designates the order in which a payment method is used. |

expirationDate |

From the Expiration date. The date the credit card is no longer active. The expiration date may be zero, depending on the setting of the Require expiration date flag for the pay type. For example, a stored value card credit card type typically does not require an expiration date. |

giftCertificateCpnNbr |

Not implemented in these messages. |

payCategory |

Set to 2. |

cardSecurityVal |

The card security value, if any. See Credit Card Security Service (CID, CVV2, CVC2) for a discussion. |

deferBill |

Set to Y if the payment method is flagged for deferred billing; otherwise, set to N. |

holdUntilDate |

From the Hold until date. The date when the order is eligible for release through the Release Orders on Time Hold Periodic Function. You can assign a number of days for the system to add when calculating the hold date to each response code you receive from an authorization service. See Defining Vendor Response Codes for more information on setting up vendor responses for authorization services, and releasing orders from time hold. |

issuingBank |

Not implemented in these messages. |

nbrDaysForDeferral |

From the # days for deferral. The number of days the payment is deferred. This field is used with deferred payment plans only. |

fixDateForReferral |

From the Fix date for deferral. The day of the month when payment for this order is due. This field is used with deferred payment plans only. |

nbrOfInstallments |

From the # of installments. The number of installments for this order. This field is used with installment payment plans only. |

fixInstallmentBillDay |

From the Fixed installment date. The day of the month when each installment is due. This field is used with installment payment plans only. |

fpoExpirationDate |

From the Expiration date. The date when this payment plan expires. |

suppressDeposit |

From the Suppress deposit setting. Indicates whether the system will include this invoice payment method when you run Processing Auto Deposits (SDEP). |

suppressRefund |