Enrolling Participants in Benefit Programs and Plans

This section provides an overview of enrolling participants in Base Benefits and discusses how to enroll an employee in a benefit program and benefit plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BEN_PROG_PARTICPTN |

Enroll the employee in the appropriate benefit program. |

|

|

HEALTH_BENEFITS1 |

Enroll employees and dependents in health plan types: medical, dental, and vision. |

|

|

LIFE_ADD_BENEF1 |

Enroll participants in life plans and assign beneficiaries to those plans. |

|

|

BN_PERSON_EFFDT |

Enter Medicare information. |

|

|

BN_ANNL_BENEF_BASE |

Enter and maintain multiple ABBRs for an employee. |

|

|

Review ABBRs (review annual base benefit base rates) |

BN_ANN_BENBASE_INQ |

Review annual benefit base rate. |

|

DISABILITY_BENEFIT |

Enroll employees in disability benefit plans. |

|

|

SAVINGS_PLANS1 |

Enroll employees in savings benefit plans, assign beneficiaries, and identify investment elections. |

|

|

LEAVE_PLANS |

Enroll employees in leave plans. |

|

|

FSA_BENEFITS |

Enroll employees in FSA plans. |

|

|

RTRMNT_PLANS |

Enroll employees in Public Employees Retirement System (PERS) benefit plans. |

|

|

CAN-Pension Plans Page |

PENSION_PLAN1 |

Enroll employees in benefit plans. |

|

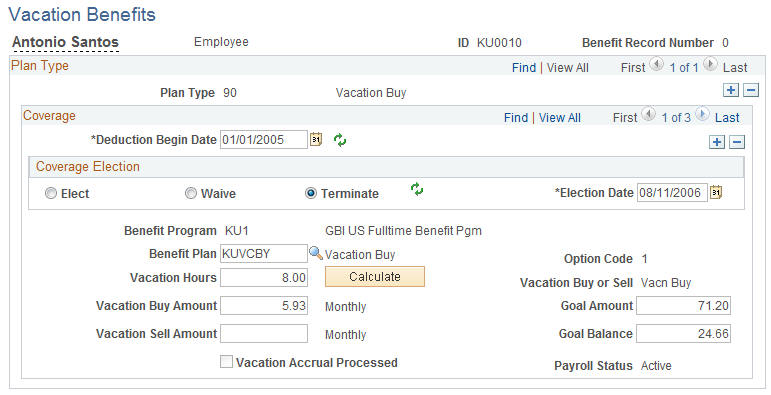

VACATION_BENEFIT |

Enroll employees in vacation buy and sell plans. |

|

|

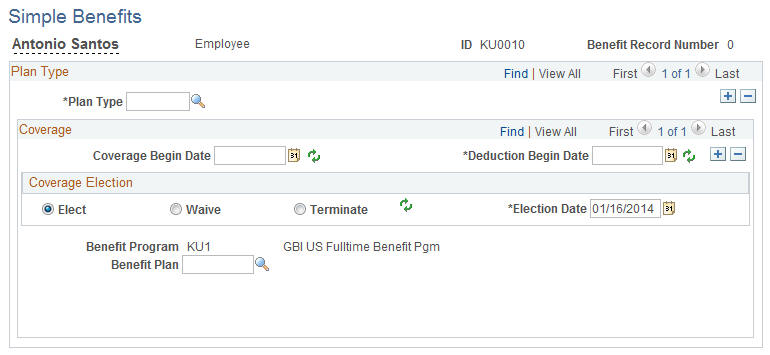

SIMPLE_BENEFIT |

Maintain employee enrollment in simple benefit plans. |

Using the Manage Base Benefits business process to enroll participants consists of two parts:

Enroll a participant in a benefit program.

Initially, an employee's benefit program assignment is assigned to the employee based on his or her employee pay group, but you can override this assignment at the employee level. Verify that the employee is enrolled in the correct benefit program, because you can enroll participants only in benefit plans that are associated with their assigned benefit program.

Using individual benefit pages, enroll the participant in all appropriate benefit plans within the benefit program.

When you enroll employees in health, life, savings, FSA (flexible spending account), and Canadian pension benefit plans, you also enroll dependents and assign beneficiaries.

Note: You should set up that data before you start enrollments. That way, for each dependent enrollment and beneficiary assignment, you can prompt for the data once rather than enter it several times.

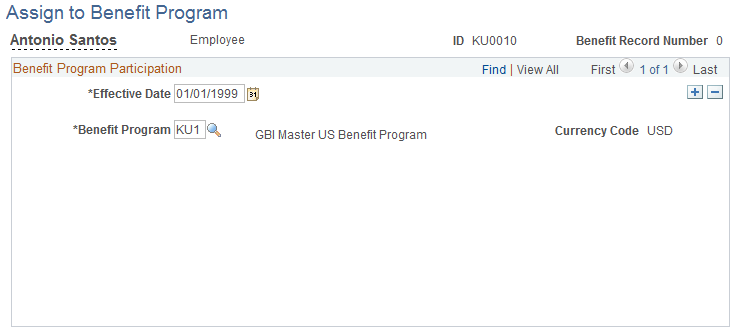

Use the Assign to Benefit Program page (BEN_PROG_PARTICPTN) to enroll the employee in the appropriate benefit program.

Navigation:

This example illustrates the fields and controls on the Assign to Benefit Program page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Benefit Program |

Enter the benefit program for the employee. Set up a default benefit program on the Pay Group table. If you run a payroll before you enter a benefit program, payroll cannot process the employee. You can override the default benefit programs with the correct benefit program. |

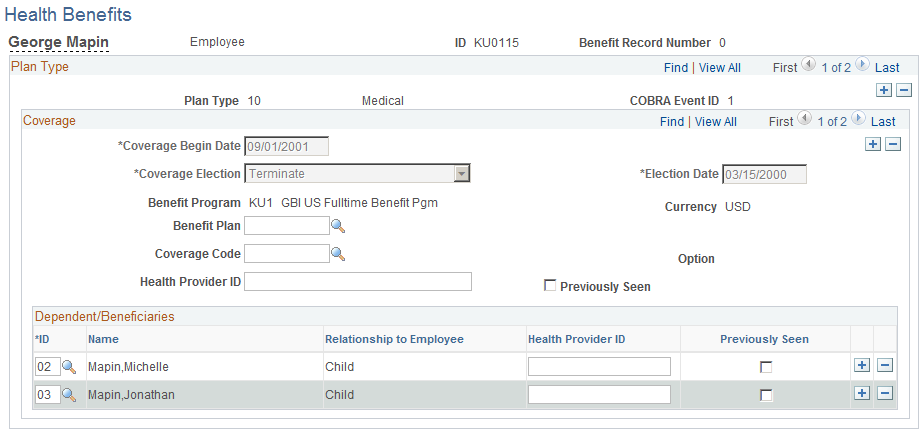

Use the Health Benefits page (HEALTH_BENEFITS1) to enroll employees and dependents in health plan types: medical, dental, and vision.

Navigation:

This example illustrates the fields and controls on the Health Benefits page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Health Provider ID |

Tracks the primary care physician information for the employee's health provider. Enter the name of the employee's doctor, an ID number, or any other format the health provider may require. |

Previously Seen |

Select to indicate that the employee is a current patient of the indicated physician. |

Other Covrg (other coverage) |

(USF) This check box indicates whether the dependent has another active insurance plan. |

Insurance Name |

(USF) Enter the name of the other insurance plan. |

FEHB Ind (Federal Employee Health Benefits indicator) |

(USF) This check box indicates whether the dependent in enrolled in FEHB. |

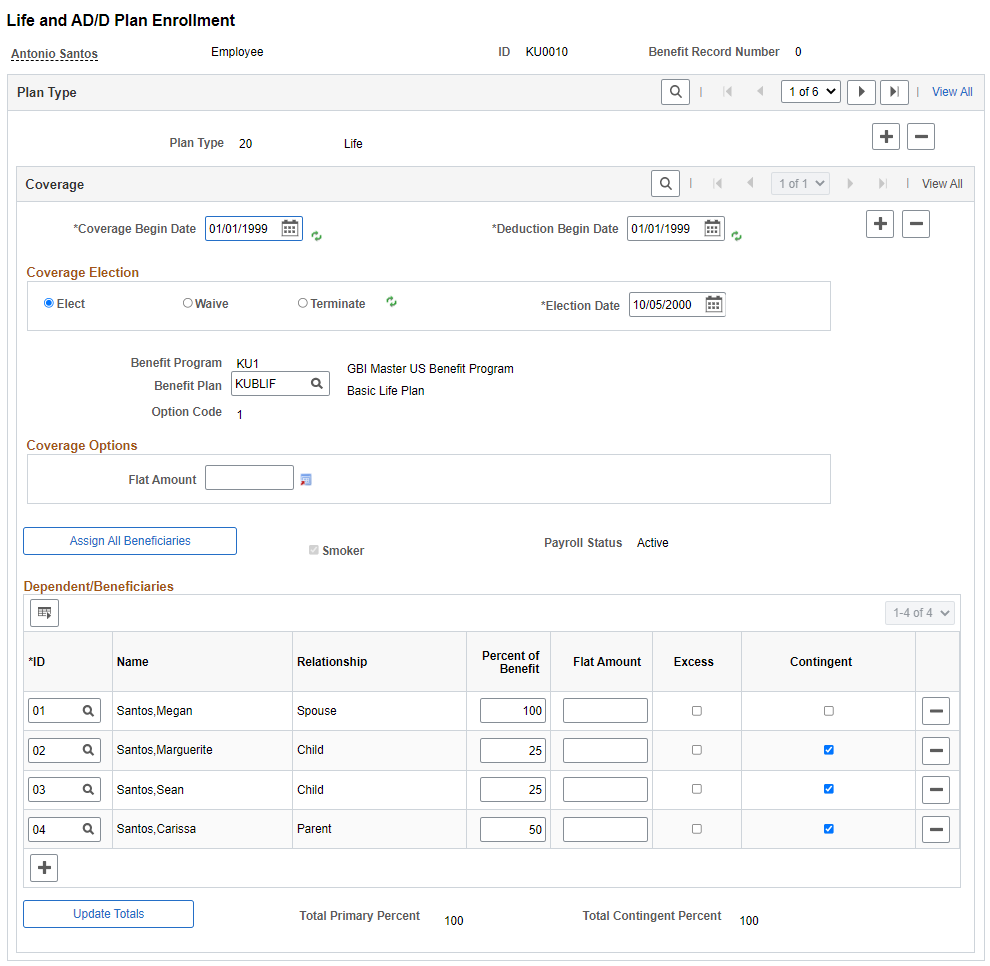

Use the Life and AD/D Plan Enrollment page (LIFE_ADD_BENEF1) to enroll participants in life plans and assign beneficiaries to those plans.

Navigation:

This example illustrates the fields and controls on the Life and AD/D Plan Enrollment page. You can find definitions for the fields and controls later on this page.

Coverage

Field or Control |

Description |

|---|---|

Smoker |

Smoker is selected if you have indicated that the dependent is a smoker in the Dependent/Beneficiary - Personal Profile page. On this page, the Smoker check box is a display-only field. When Smoker is selected, the system uses the age-graded rates that have been defined for smokers when calculating the employee's life benefit cost. |

Coverage Options

Use these group boxes to define plan coverage and the benefits base calculation rules.

These sections are active only if, in the Life and AD/D Plan Table page, you indicate that coverage should be Specified in Employee Record.

Field or Control |

Description |

|---|---|

Flat Amount |

Enter an amount. |

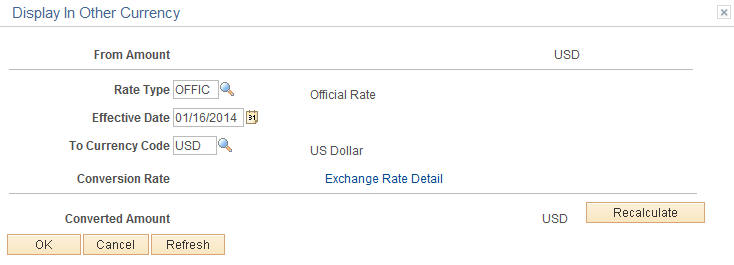

This example illustrates the fields and controls on the Flat Amount field opens to a Display in Other Currency page for the option of converting currency. You can find definitions for the fields and controls later on this page.

Dependent/Beneficiaries

Field or Control |

Description |

|---|---|

ID |

Select the beneficiary ID. The selection list includes all of the beneficiaries that you set up for the employee using the Dependent/Beneficiary Data pages. Only beneficiaries that you identified as Beneficiary or Both (beneficiary or dependent) can be selected. For more information on defining eligible beneficiaries, see Setting Up Life Insurance and Accidental Death Plans. To delete a dependent enrollment, position the cursor at the line for the dependent that you want to delete and click Delete. |

Percent of Benefit and Flat Amount |

Define the distribution benefit as a percent of benefit or a flat amount. If you enter a flat amount and more than one beneficiary, select one of the beneficiaries to receive any excess funds. Select the beneficiary by selecting the Excess check box. |

Contingent |

(Optional) Select to Indicate whether a beneficiary is primary or contingent (secondary to a primary beneficiary). If you set up a primary beneficiary to receive 100 percent of the benefit, all other beneficiaries have Contingent selected. |

Note: If you are working with a dependent life plan, add dependent IDs of eligible dependents that will be covered by the plan. In dependent life plans, the dependents are covered by life insurance, and the employee is the beneficiary.

For more information on defining eligible dependents, see Setting Up Life Insurance and Accidental Death Plans.

If you have defined the coverage method of the life or AD/D plan that you're working with to be the sum of dependent coverage in the Life and AD/D Plan Table, the Percent of Benefit field is not available for entry.

The totals for all beneficiaries must equal 100 percent. If they do not, the system displays an error message and does not allow you to save your entries. To correct the entry, change one or more of the percentages so that the totals are equal to 100 percent.

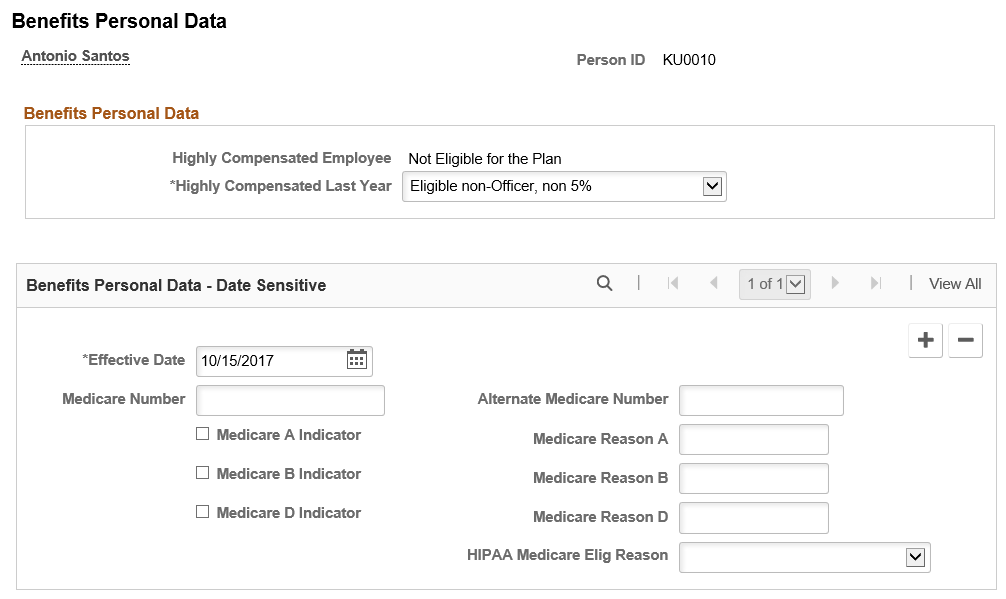

Use the Benefits Personal Data page (BN_PERSON_EFFDT) to enter Medicare information.

Navigation:

This example illustrates the fields and controls on the Benefits Personal Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Medicare Number and Alternate Medicare Number |

Enter the medicare number, for example Health Insurance Claim Number (HICN) or Medicare Beneficiary Identifier. |

Medicare A Indicator |

Select to indicate Enrollment in Medicare A. |

Medicare Reason A |

The administrator enters a description. |

Medicare B Indicator |

Select to indicate supplemental governmental insurance other than hospitalization costs |

Medicare Reason B |

The administrator enters a description. |

Medicare D Indicator |

Select to indicate enrollment in the Medicare D prescription drug plan. |

Medicare Reason D |

The administrator enters a description. |

HIPAA Medicare Elig Reason (HIPPA Medicare eligibility reason) |

Select the reason for a qualifying employee’s or dependent’s Medicare eligibility. Available values include: Age, Disability, and End Stage Renal Disease. This field is Situational. No eligibility code is generated in the HIPAA EDI 834 file if the HIPAA Medicare Eligibility Reason field is not entered for the Person ID here, and on the Dependent/Beneficiary - Personal Profile page. For information about Situational fields, see Sending HIPAA Data to Providers. |

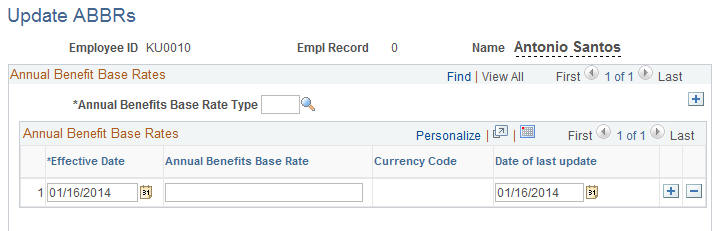

Use the Update ABBRs (update annual benefit base rates) page (BN_ANNL_BENEF_BASE) to enter and maintain multiple ABBRs for an employee.

Navigation:

This example illustrates the fields and controls on the Update ABBRs page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Annual Benefits Base Rate Type |

Select the ABBR type. ABBR types are defined on the Annl Benef Base Rt Type Tbl page. |

Annual Benefits Base Rate |

Enter the amount of the ABBR. Note: The Primary ABBR can be set only in the Job component. |

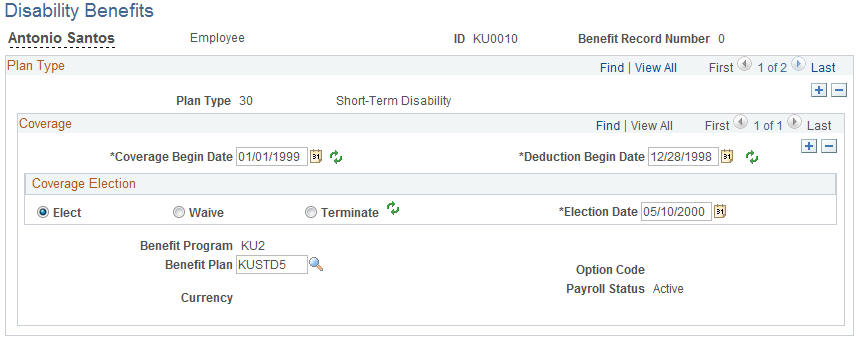

Use the Disability Plan Enrollment page (DISABILITY_BENEFIT) to enroll employees in disability benefit plans.

Navigation:

This example illustrates the fields and controls on the Disability Plan Enrollment page. You can find definitions for the fields and controls later on this page.

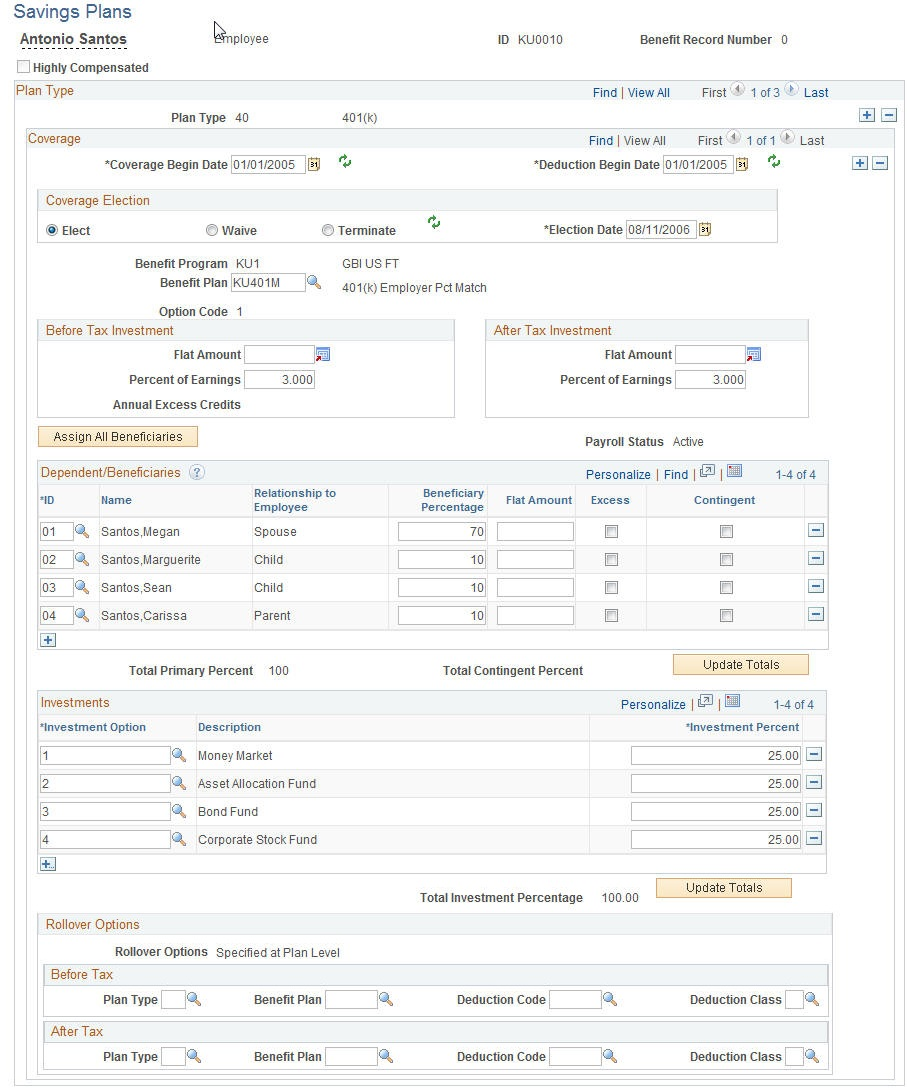

Use the Savings Plans page (SAVINGS_PLANS1) to enroll employees in savings benefit plans, assign beneficiaries, and identify investment elections.

Navigation:

This example illustrates the fields and controls on the Savings Plans page. You can find definitions for the fields and controls later on this page.

Before Tax Investment and After Tax Investment

Field or Control |

Description |

|---|---|

Flat Amount and Percent of Earnings |

Define investment contributions as a flat amount or percent of earnings. The system compares the percent of earnings to the percent of gross limits for employee before-tax and after-tax investment values. The system also verifies that the sum of the before-tax and after-tax investment values does not exceed the overall investment limit percentage that you defined for the savings benefit plan on the Savings Plan Table. |

Dependent/Beneficiaries

Field or Control |

Description |

|---|---|

ID |

Select the beneficiary ID. The selection list includes the beneficiaries that you set up for the employee using the Dependent/Beneficiary Information component. To delete a beneficiary, position the cursor at the line for the beneficiary that you want to delete and click the Delete icon. |

Beneficiary Percentage |

Enter the percent of benefit for each beneficiary. |

Note: The total for all beneficiaries must equal 100 percent. If it does not, the system displays an error message and does not allow you to save your entry. To correct the entry, change one or more of the percentages so that the total equals 100 percent.

Investments

Field or Control |

Description |

|---|---|

Investment Option |

Select an investment option and allocate an investment percentage. Investment percentages must total 100 percent before they can be saved in the system. If more than one investment option is associated with the chosen employee's savings plan, add more rows. |

Rollover Options

You can enter rollover options only if Specified at Employee Level is selected on the Savings Plan Table - Rollover of Funds page.

Enter the plan type, benefit plan, deduction, and deduction class values for before tax and after tax rollovers.

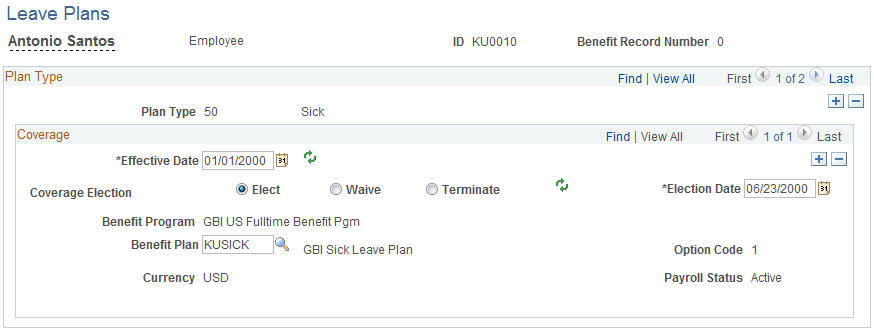

Use the Benefits Leave Plans page (LEAVE_PLANS) to enroll employees in leave plans.

Navigation:

This example illustrates the fields and controls on the Benefits Leave Plans page. You can find definitions for the fields and controls later on this page.

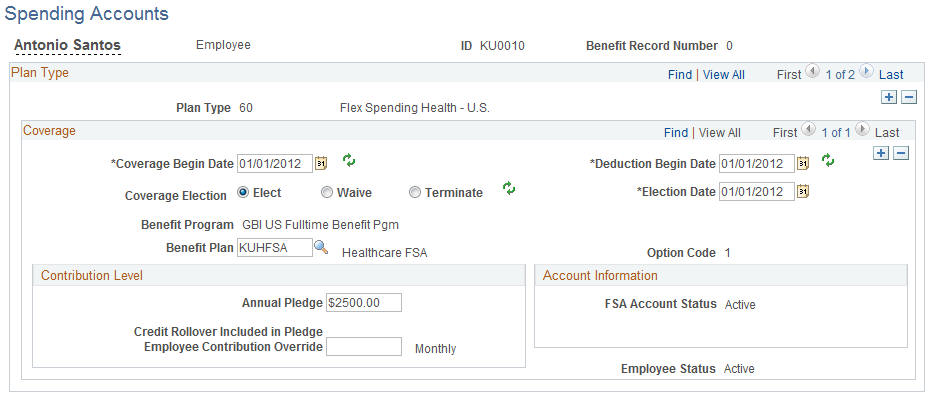

Use the Spending Accounts page (FSA_BENEFITS) to enroll employees in FSA plans.

Navigation:

This example illustrates the fields and controls on the Spending Accounts page. You can find definitions for the fields and controls later on this page.

Note: The FSA Benefits (CAN) page is essentially the same as the page for U.S. users with two exceptions: It offers a choice between Canadian Health Care and Canadian Retirement Counseling plan types (plan types 65 and 66) instead of Health and Dependent Care plan types (plan types 60 and 61), and it displays a Carryforward option of either Claim or Credit, if applicable.

Contribution Level

Field or Control |

Description |

|---|---|

Annual Pledge |

Enter the employee's annual pledge amount. |

Credit Rollover Included in Pledge |

(Used by Benefits Administration) Displays the amount of the excess benefits credits that have been assigned to an FSA plan at the end of a plan year. The PeopleSoft Benefits Administration system automatically provides the credit rollover included in pledge from the previous year if you have designated that excess credits should be assigned to FSA plans in the Benefit Program Table. |

Field or Control |

Description |

|---|---|

Empl Contribution Override (employee contribution override) |

If you do not implement PeopleSoft Payroll for North America or Payroll Interface, this is optional. Enter a value to have the system use this amount to calculate the employee's spending account contribution. Leave the field blank to have the system use the annual pledge amount to calculate the employee's spending account contribution. |

Account Information

The system reflects the FSA account status of the employee's FSA plan, as well as the employee's FSA contributions IT'D (contributions year-to-date).

Employees cannot transfer FSA funds from one account to another. As a rule, unused funds in an account at the end of a plan year are transferred to the employer.

Carryforward

This value appears for Canadian pension plans and is automatically set to the value that you entered for the employer carryforward choice in the FSA Benefits Table (Canada).

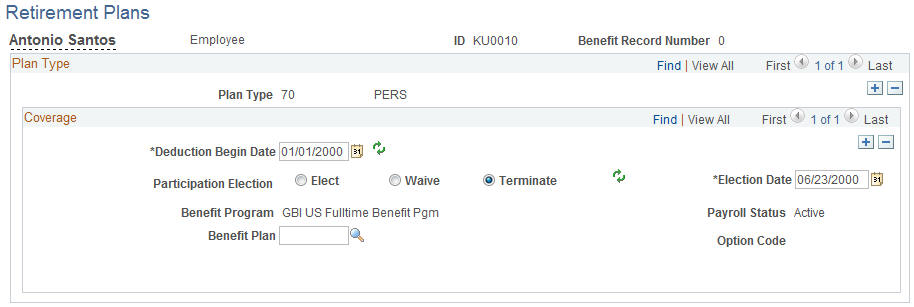

Use the Retirement Plans page (RTRMNT_PLANS) to enroll employees in Public Employees Retirement System (PERS) benefit plans.

Navigation:

This example illustrates the fields and controls on the Retirement Plans page. You can find definitions for the fields and controls later on this page.

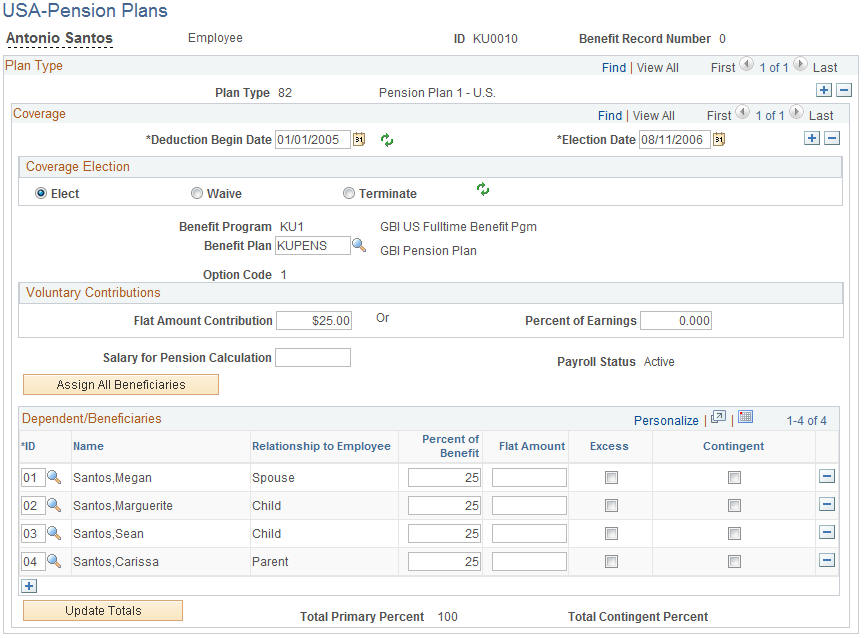

Use the Pension Plans USA page (PENSION_PLAN1) to enroll employees in benefit plans.

Navigation:

For Canadian users, the plan types are 80 and 81. For U.S. users, the plan types are 82 through 87.

This example illustrates the fields and controls on the Pension Plans USA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Voluntary Contributions |

Enter an amount that the employee voluntarily contributes to the pension plan. This is an amount over the amount that you define in the Pension Plan Table. Enter a flat amount or a percent of earnings. |

Salary for Pension Calculation |

Use to calculate the pension using a salary other than the employee pay rate. |

Dependent/Beneficiaries

Field or Control |

Description |

|---|---|

ID |

Select the beneficiary ID. The selection list includes the beneficiaries that you set up for the employee using the dependent and beneficiary data pages. To delete a beneficiary, position the cursor at the line for the beneficiary that you want to delete and click Delete. |

Percent of Benefit and Flat Amount |

Define the distribution benefit as a percent of benefit or a flat amount. If you enter a flat amount and more than one beneficiary, select one of the beneficiaries to receive any excess funds. Select the beneficiary by selecting the Excess check box. |

Note: The total for all beneficiaries must equal 100 percent. If it does not, the system displays an error message and does not allow you to save your entry. To correct the entry, change one or more of the percentages so that the total equals 100 percent.

Use the Vacation Benefits page (VACATION_BENEFIT) to enroll employees in vacation buy and sell plans.

Navigation:

This example illustrates the fields and controls on the Vacation Benefits page. You can find definitions for the fields and controls later on this page.

When you define vacation buy or sell benefit plans with the Vacation Buy/Sell Table, you define increments for the vacation hours and minimum and maximum amounts that an employee can buy or sell.

Field or Control |

Description |

|---|---|

Vacation Hours |

The number of hours that an employee buys or sells for the full plan year (a 12-month period). The vacation hours that you enter must be at least the minimum and not more than the maximum numbers of vacation hours that are defined in the Vacation Buy/Sell Table. In addition, they must be entered in the increment specified in the Vacation Buy/Sell Table. |

Goal Balance |

Updated by payroll. The system automatically stops deductions when the current goal balance equals the goal balance. |

Vacation Accrual Processed |

During the first payroll processing cycle of the plan year, PeopleSoft Payroll calculates bought and sold vacation earnings for each participant. The system automatically selects this check box. You will not see the buy or sell transactions reflected in employee leave balances until after you perform leave accrual processing, at which time the system deselects the check box. |

Note: If you change employee job data after the system performs vacation buy and sell processing, it does not update its calculations based on the new job data. For example, an employee is hired on September 1 and is paid monthly, at a rate of $20.00 per hour. The employee wants to buy 40 hours of vacation. The system assumes a 12-month period in which to spread the deduction. It calculates the goal amount as $800.00 (40 hours × $20 an hour), and calculated the pay period deduction as $66.67 (40 hours × $20 an hour/12 monthly periods per year). However, the company wanted the vacation amount based on the hire date. Because 4 months remained in the year, September through December, the company manually calculated and entered $200, or $800 divided by 4.

Use the Simple Benefits page (SIMPLE_BENEFIT) to maintain employee enrollment in simple benefit plans.

Navigation:

This example illustrates the fields and controls on the Simple Benefits page. You can find definitions for the fields and controls later on this page.

No attributes are required for creating a simple benefit plan and costs are calculated from the Benefit Rate table.