Setting Up Retirement Annuity Offsets

This topic provides an overview of retirement annuity offsets, and describes steps for annuitant processing.

These terms are commonly used in annuitant processing:

|

Term |

Description |

|---|---|

|

Annuitant |

Federal retirees re-employed by the U.S. Federal Government, without the loss of their retirement benefits. |

|

Annuity Offset |

The difference between the employee’s position compensation and actual regular earnings. |

|

CSRS |

Civil Service Retirement System (U.S. Government, Office of Personnel Management) |

|

FEGLI |

Federal Employees Group Life Insurance (U.S. Government) |

|

Offset Rate |

The employee’s position compensation less the employee’s annuity. |

|

FERS |

Federal Employees Retirement System (U.S. Government, Office of Personnel Management) |

|

OPM |

Office of Personnel Management (U.S. Government) |

|

Pre-offset Rate |

The annuitant employee position compensation. |

|

RITS |

Retirement and Insurance Transfer System (U.S. Government Office of Personnel Management) |

|

SF-52 |

U.S. Standard Form- 52, Request for Personnel Action (U.S. Government Office of Personnel Management), which reports the Annuitant Indicator code and description in Box 28 . |

|

TSP |

Thrift Savings Plan (U.S. Government) |

An U.S. Federal Government annuitant employee is a government retiree who is re-hired into a federal position and reported on the U.S. form SF-52. In most cases, the annuitant keeps their full retirement annuity, however their new federal salary is reduced by the amount of the annuity.

When an employee receives a retirement annuity from the federal government, any current federal employer must offset the retirement calculation by the annuity amount. This difference must be reported on the RITS (Retirement and Insurance Transfer System) interface.

To ensure that the RITS interface picks up and reports the total annuity amounts, you must properly set up the earnings codes, employee pay data, and pay group table.

The hourly rate of the position is the pre-offset rate. Payroll calculation uses the pre-offset rate to pay premiums and to calculate benefits base rate for premiums/contributions.

Note: The system uses regular earnings at the pre-offset rate only for base benefits calculation. Regular earnings are not paid out at the pre-offset rate.

During payroll calculation, the system calculates and pays regular earnings at the offset rate, and uses the offset rate to pay all forms of regular pay.

You must enter the employee’s standard hours and offset rate in Additional Pay. During time entry, you must enter the premium earning codes on Addl Line Nbr 0 (additional line number 0; the line number does not appear) and regular earnings codes on Addl Line Nbr 1 (additional line number 1). When Pay Calculation creates paysheets, the pre-offset rate appears on Addl Line Nbr 0, and the offset rate appears on Addl Line Nbr 1.

The RITS (Retirement and Insurance Transfer System) is used to report retirement, military deposit, life insurance and health benefits premiums and contributions to the Office of Personnel Management (OPM) on a pay period basis. The RITS includes the annuitant offset amount in its reporting to OPM (Office of Personnel Management). The Payroll for North America RITS 2812/2812A Interface Summary Report (FGPY001.SQR) includes the annuitant offset amount in the Total Annuity Amount field by retirement plan.

Use the Employed Retired Annuitant component to view the total number of annuitants, new hires, separations and annuity offset for a pay period.

These are the setup steps to ensure proper calculation and interfacing of annuity offsets in annuitant processing:

Set up the annuity pre-offset earnings code.

Set up the annuity offset earnings code.

Set up an annuitant pay group.

Set up retirement contributions.

Set up the Thrift Savings Plan (TSP).

Set up the job record.

Set up the employee's additional pay.

Setting Up the Annuity Pre-Offset Earnings Code

Annuitant employees are paid using two hourly rates, pre-offset job rate and the offset annuitant rate. Two earning codes are used to create the paysheet with two paylines, one with each hourly rate.

The pre-offset job earnings code is configured to populate the paysheet with the job rate. The paysheet earnings line with the pre-offset rate is used to calculate and pay premium earnings.

An annuity pre-offset earnings code has the following characteristics:

Does not add to gross pay.

Is not subject to any taxes.

Is calculated before the off-set earnings code.

Adds to retirement and Thrift Savings Plan (TSP).

To set up the annuity pre-offset earnings code:

Add the earnings code to the Earnings Table.

Navigation:

On the General page, select the Either Hours or Amount OK in the Payment Type group box, and None in the Effect on FLSA group box.

On the Taxes page, because the code is not used to pay regular earnings, select only the Maintain Earnings Balances in the Earnings group box (deselect all other check boxes in that group box), and deselect all check boxes in the U.S. Only group box.

On the Calculation page, because the earnings is the first of the two to be calculated, enter an Earnings Calc Sequence that is lower than the sequence for the offset earnings codes, and enter a Multiplication Factor of 1.0000.

On the Special Process page, add special accumulator for Retirement and Thrift Savings Plan (TSP) earnings.

Setting Up the Annuity Offset Earnings Code

The offset earnings code populates the paysheet with the offset rate and is used to calculate and pay regular earnings.

An annuity offset earnings code has the following characteristics:

Does add to gross pay.

Is subject to taxes.

Is calculated after the pre-offset earnings code.

Adds to retirement and Thrift Savings Plan (TSP) special.

To set up the annuity offset earnings code:

Add the earnings code to the Earnings Table.

Navigation:

On the General page, select the Either Hours or Amount OK in the Payment Type group box, and None in the Effect on FLSA group box.

On the Taxes page, select the Add to Gross Pay, Maintain Earnings Balance, and Hours Only (Reduce from Regular Pay) check boxes in the Earnings group box, and select all check boxes in the U.S. Only group box.

On the Calculation page, enter an Earnings Calc Sequence that is higher than the sequence for the offset earnings codes, and enter a Multiplication Factor of 1.0000.

On the Special Process page, add special accumulator for Retirement and Thrift Savings Plan (TSP) earnings.

Setting Up an Annuitant Pay Group

To manage the unique features of annuitant employees, create a separate pay group.

An annuitant pay group has the following characteristics:

Employee type is Exception Hourly.

The regular earnings code (REG) that is used for employees, is not used for annuitants.

To set up an annuitant pay group:

Add the pay group code to the Pay Group Table.

Navigation:

On the Definition page, enter a description for the pay group, for example Annuitant Processing Group, and in the Employee Type Default field, enter Exception Hourly to create a paysheet with standard hours and the job hourly rate.

On the Process Control page, in the Employee Type(s) for Pay Group group box, enter the Employee Type of Excep Hrly (exception hourly) and deselect all check boxes.

On the Calc Parameters page, in the Earnings group box, enter the pre-offset earnings code in both the Regular Hours and Regular Earnings fields.

See PeopleSoft HCM Application Fundamentals, Setting Up Pay Groups.

Setting Up Retirement Contributions

Annuitant employees receiving benefits from FERS (Federal Employees Retirement System) must continue to make contributions while employed. Civil Service Retirement System (CSRS) annuitant employees have the option to contribute.

Retirement contributions have the following characteristics:

Retirement plans use a special accumulator to calculate eligible earnings. Both the pre-offset and offset earning codes add to the retirement special accumulator.

Annuitant employee withholdings and employer contributions are calculated on pre-offset earnings during payroll and reported on the Retirement and Insurance Transfer System (RITS).

To set up an retirement contributions:

Access the Base Benefits, Retirement Plan Table.

Navigation:

On the Retirement Plan Table page, in the Use Special Accumulator Instead of Gross field, enter the special accumulator code that defines earnings eligible for retirement contributions

See PeopleSoft Human Resources Manage Base Benefits, Setting Up Retirement Plans.

Setting Up the Thrift Savings Plan (TSP)

The Thrift Savings Plan (TSP) also uses a special accumulator to calculate eligible earnings.

TSP has the following characteristics:

Both the pre-offset and offset earning codes add to the special accumulator.

Annuitant employee withholdings and employer contributions are calculated on pre-offset earnings during payroll and reported on the TSP Interface.

To set up the TSP:

Access the Savings Plan Table component.

Navigation:

On the Employee Limit on Investments page, in the Use Special Accumulator field, enter the special accumulator that defines earnings eligible for TSP contributions.

See PeopleSoft Human Resources Manage Base Benefits, Setting Up Savings PlansEmployee Limit on Investments Page.

Setting Up the Job Record

An annuitant hire record has the following characteristics:

The Annuitant Indicator identifies the employee an annuitant.

The annuitant must be in an annuity pay group.

The employee type is Exception Hourly.

An annual annuity amount must be specified in the Annuity Offset Amount field on the Compensation Data page.

Expected pay base rates are reduced the annuity offset amount.

To set up the job record for an annuitant:

Access the annuitant’s job record in the HR Processing USF component (or Add Employment Instance USF component).

Navigation: (or

On the HR Processing USF, Job Data page, in the Position field, enter the position for which the annuitant was hired.

Click the FEGLI/Retirement/FICA link on the HR Processing USF, Job Data page, and then on the FEGLI/Retirement/FICA secondary page do the following: enter the FEGLI code to enroll the employee into FEGLI; enter the appropriate Retirement Plan; and select the appropriate Annuitant Indicator:

1 = Reempl Ann-CS

4 = Ret Off/Reempl Ann-CS

5 = Ret En/Reempl Ann-CS

A = Reempl Ann-FE

C = Ret Off/Reempl Ann-FE

E = Ret Enl/Reempl An-FE

On the Position Data page, assign the employee to the annuitant pay group and select the Employee Type of E (exception hourly).

On the Compensation Data page, enter the Annuity Offset Amount (which cannot be greater than the Base Pay amount).

Note: The Annuity Offset Amount field is available only after the annuitant job record has been saved with one of the Annuitant Indicator values: 1, 4, 5, A, C or E.

The full annual annuity amount is recorded. The Annuity Offset Amount will reduce the Expected Pay Base Pay values. When you click the Expected Pay link, the system may display a message showing the rates that have been changed. When you click OK, the Expected Pay secondary page appears, where you can view details of the annuitant’s expected pay. Base Pay amounts reflect the pay after being reduced by the annuity offset amount. The Locality/LEO Adjustment amounts are not reduced. Payroll uses this hourly rate.

See:

PeopleSoft Human Resources Administer Workforce, Adding an Employment Instance Add Employment Instance USF - Job Data Page.

PeopleSoft Human Resources Manage Base Benefits, (USF) Enrolling Employees in Benefit Programs and Plans, FEGLI/Retirement Data/FICA Page.

Setting Up the Employee's Additional Pay

To set up additional pay, you must identify the offset earnings code and hourly rate to use, and the pay periods to which they apply.

To set up additional pay:

Access the Employee Pay Data USF, Create Additional Pay component.

Navigation:

On the Create Additional Pay page, enter the offset earnings code in the Earnings Code field, enter the full pay period hours in the Hours field, and enter the offset rate in the Hourly Rate field.

The adjusted base pay, minus the annuity, divided by 2087 hours, equals the offset hourly rate to enter in Additional pay. For example, assume an adjusted base pay, including LEO/LOC, of $51,919.00, and annuity of $20,000. The adjusted base pay of $51,919.00, minus the annuity of $20,000.00, divided by 2087 hours, gives the annuitant an offset hourly rate of $15.29. This is the hourly rate to enter in Additional Pay.

See, Example: Annuitant Paycheck, Annuitant Earnings later in this topic.

Also on the Create Additional Pay page, select the OK to Pay check box, and select the check box for all of the pay periods to which additional pay applies in the Applies to Pay Periods group box.

When paysheets are processed, the system creates two paylines, Addl Line Nbr 0 and Addl Line Nbr 1 .

Addl Line Nbr 0 includes the regular standard hours and hourly rate from the Job Record. The hourly rate is the pre-offset rate and is used to pay premium earnings. All premium earnings must be entered on this earnings line.

Addl Line Nbr 1 includes the earnings code, hours and hourly rate from the Additional Pay page. The hourly rate Is the offset rate and is used to pay all regular earnings. All types of regular earnings must be entered on this earnings line.

This section describes an annuitant pay example and shows sample paysheet and paycheck information for the annuitant.

Annuitant

Mary is an annuitant. She is hired into a position that pays LEO/LOC (law enforcement officer percentage adjustment and locality pay).

Annuitant Earnings

The following earnings conditions apply to Mary:

Her base pay is $47,610.00.

She receives $20,000 annuity annually.

Her $47,610.00 base pay, minus her $20,000 annuity offset, divided by 2087, gives her a base pay hourly rate of $13.23.

Her LEO/LOC adjusted base pay is $51, 919.00, which divided by 2087, gives her a pre-offset hourly rate of $24.88.

Her $51,919.00 adjusted base pay, minus her $20,000 annuity offset, divided by 2087, gives her an offset hour rate of $15.29.

Her regular pay is calculated at her offset hourly rate of $15.29.

She worked 2 hours of overtime (FOV) in the pay period.

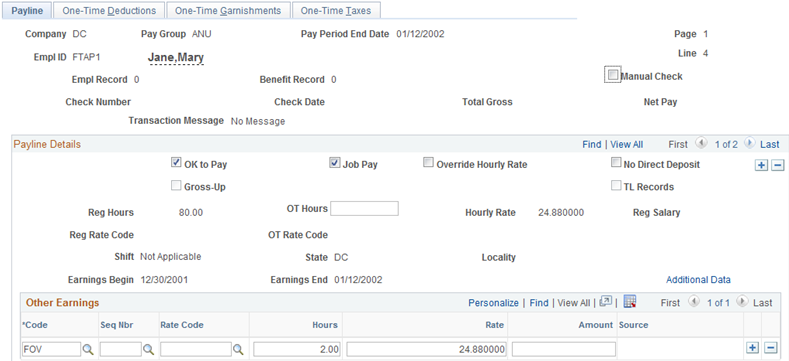

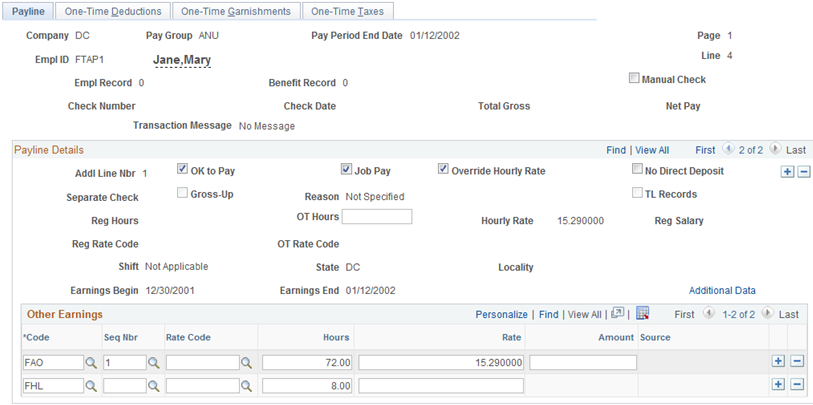

Annuitant Paylines

Based on Mary’s earnings conditions, the paylines on Mary’s paysheet are:

Addl Line Nbr 0 with 80 standard hours at the pre-offset hourly rate of $24.88, and 2 overtime hours based on the same hourly rate.

Addl Line Nbr 1 with an offset hourly rate of $15.29, earnings code FAO for 72 hours, and FHL (holiday) for 8 hours.

Payline details appear on the Update Paysheets, By Payline page.

Navigation:

This is an example of a Payline Page, annuitant Addl Line Nbr 0.

This is an example of a Payline Page, annuitant Addl Line Nbr 1.

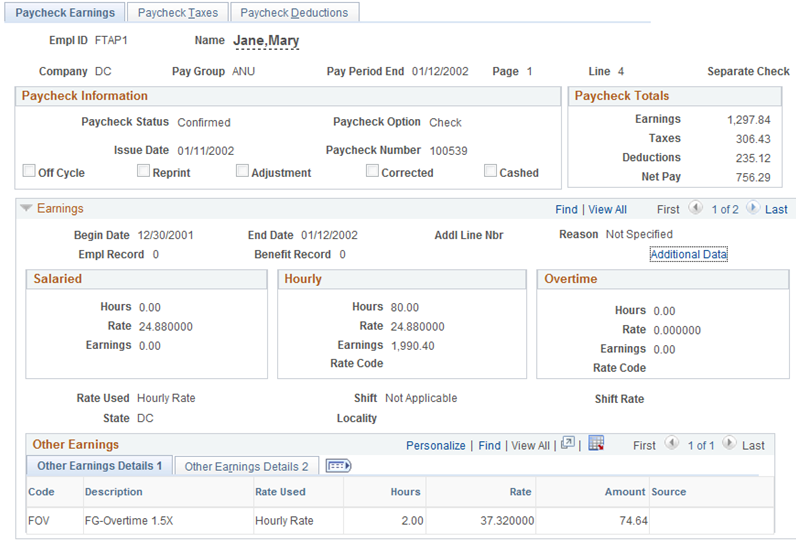

Annuitant Paycheck Earnings

The system calculates Mary’s paycheck earnings as shown in this table:

|

Earnings |

Hours |

Rate |

Dollars |

Paid |

|---|---|---|---|---|

|

Regular FPR |

80 |

24.88 |

1990.40 |

No |

|

Regular FAO |

(72) |

15.29 |

1100.88 |

Yes |

|

Regular FHL |

(8) |

15.29 |

122.32 |

Yes |

|

Total Regular |

80 |

15.29 |

1,223.20 |

Yes |

|

Overtime FOV |

2 |

74.64 |

Yes |

|

|

GROSS PAY |

1297.84 |

Yes |

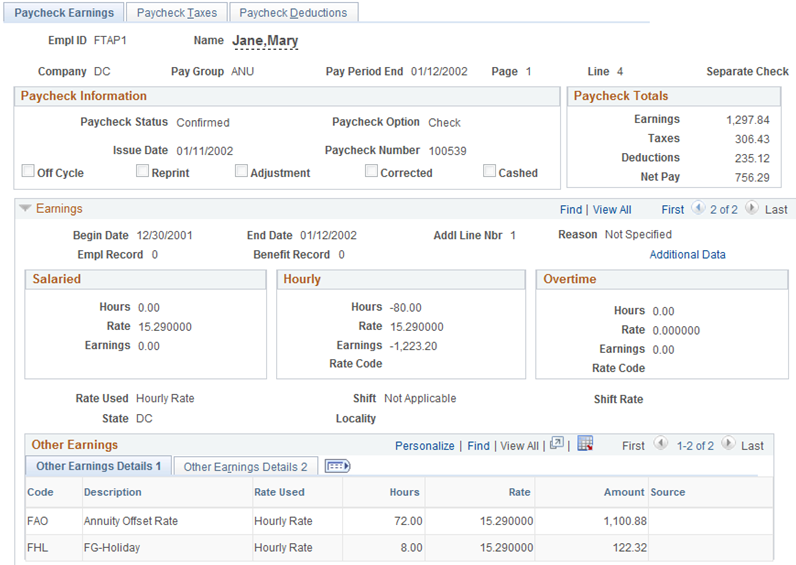

Paycheck earnings details appear on the Review Paycheck, Paycheck Earnings page.

Navigation:

This is an example of a Payline Page, annuitant Addl Line Nbr 0.

Note: For additional line number 0, Addl Line Nbr field in the Earnings group box is blank.

This is an example of a Payline Page, annuitant Addl Line Nbr 1.

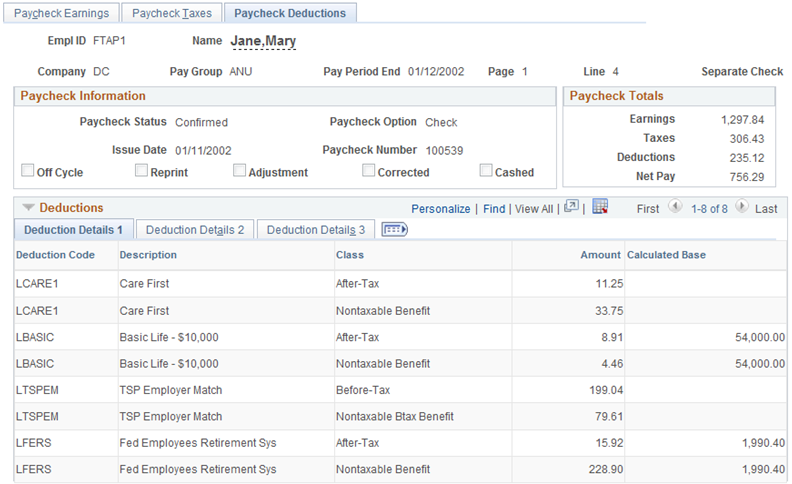

Annuitant Paycheck Deductions

Mary’s premium earnings and her retirement, TSP, and FEGLI contributions are calculated at her full job hourly rate of $24.88. Based on Mary’s earnings, her deductions are as follows:

Her before-tax TSP employer match is $199.04 (based on employee withholding of 10% of the special accumulator pre-offset earnings).

Her nontaxable TSP employer match is $79.61 (based on employer contribution).

Her after-tax retirement (FERS) is $15.92 (based on employee withholding of 0.8% of the special accumulator pre-offset earnings).

Her nontaxable retirement (FERS) is $228.90 (based on employer contribution of 11.5% of the special accumulator pre-offset earnings).

Her after tax FEGLI is $8.91.

Her nontaxable FEGLI is $4.46

Paycheck deduction details appear on the Review Paycheck, Paycheck Deductions page.

Navigation:

This is an example of a Paycheck Deductions page, showing annuitant retirement deductions.