Configuring the GTAS ChartField Data

This topic discusses the steps involved in configuring GTAS ChartField data:

Verify setup of the General Ledger business units.

(Optional) Implement the Separate Debit/Credit feature.

Verify the GTAS ChartField attributes.

Set up or modify accounts for USSGL rollup and link associated attributes.

Set up GTAS Fund Codes, Budget References, or other ChartFields and link associated attributes.

You can use the FUND_CF component interface to load data into the tables for the Fund Code component and the ACCOUNT_CF component interface to load data into the tables for the Account component.

For information on how to use the Microsoft Excel Spreadsheet to PeopleSoft Components Interface to enter ChartField data into PeopleSoft databases, see PeopleTools: PeopleSoft Component Interfaces.

Note: If you plan to configure your ChartFields (activating, inactivating, or renaming ChartFields using the ChartField Configuration component) after establishing your GTAS ChartField data, you should analyze your GTAS setup to determine if there may be any impact to the ChartField Preferences setup, ChartField Attributes setup, or ChartField Exceptions setup. PeopleSoft delivers system data for GTAS attributes with standard ChartFields as default mapping. If you have renamed a ChartField, please check that the field name in the GTAS_ELEMENT_CF record is updated accordingly.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CF_ATTRIBUTES |

Enter the ChartField attributes and attribute values as required by the U.S. Treasury. |

|

|

GL_ACCOUNT |

Add the required accounts (or use the ACCOUNT_CF component interface to load all accounts at once.) |

|

|

FUND_DEFINITION |

Access the Fund Code ChartField that you want to associate with selected FUND_CODE ChartField attributes. |

|

|

BUDREF_PNL |

Access the Budget Reference ChartField that you want to associate with selected Budget Reference ChartField attributes.

|

|

|

CF_ATTRIB_VALUES |

Select ChartField attributes and attribute values to associate with the selected Fund Code, Account value, Budget Reference, or other ChartField value. |

Verify that all of the PeopleSoft General Ledger business units and corresponding subsystem business units are established before proceeding with GTAS setup. Also, verify the Ledgers For A Unit component for each Business Unit and Ledger Group combination that you will be using.

GTAS does not require the use of the Separate Debit/Credit feature; however, you can still use the feature with GTAS if your organization requires it for other regulatory reporting.

For more information, see Using Separate Debit and Credit.

Each required USSGL account must be associated with the attributes as defined by the U.S. Treasury. PeopleSoft delivers GTAS attributes in a sample data script as an attachment to My Oracle Support Article ID 1504697.1.

Note: : PeopleSoft does not support any changes made to the required GTAS attributes. The delivered sample data script contains the Treasury attributes as of the time of this publication. Treasury attributes can change over time and each agency is responsible for keeping up with those changes.

Use the ChartField Attribute page (CF_ATTRIBUTES) to add or modify the ChartField attributes and attribute values as required by the U.S. Treasury.

Navigation:

This example illustrates the fields and controls on the ChartField Attribute page.

Field or Control |

Description |

|---|---|

Field Name |

Select the ChartField to which the attribute should be assigned. |

Attribute |

Enter a meaningful name for the attribute. |

Description |

Enter a description of the attribute. You can also add a detailed description of the purpose of this attribute. |

Allow Multiple Values per Attr (allow multiple values per attribute) |

Select if multiple values for the attribute are allowed for a unique ChartField value. (This is deselected for most of the attributes). |

ChartField Attribute Value |

Enter the domain values for the attribute as defined by Treasury. |

Description |

Enter a description of the domain values. |

The ChartField Attributes table below designates how each attribute is defined in PeopleSoft (ChartField Attribute, Attribute Exception, Ledger Attribute, or Tree translation).:

You can use the delivered sample data scripts that PeopleSoft provides as a guide to set up your ChartField attributes and link them to your agency's accounts and fund codes.

Note: In the sample data, the GTAS Attributes are located under the FEDRL SetID.

The ChartField Attributes table below lists the ChartField attributes that are required for GTAS at the time of this publication:

|

ChartField |

Attribute (Attribute Name) |

Description |

Allow Multiple Values per Attr |

ChartField Attribute Value / Description |

|---|---|---|---|---|

|

ACCOUNT |

BUDG_PROP (Budgetary Proprietary) |

Indicates the type of USSGL account being reported. |

Note: This check box should NOT be selected. |

B -Budgetary P -Proprietary A - Both |

|

ACCOUNT |

BUDG_IMPACT (Budgetary Impact Indicator) |

Indicates whether there is a budgetary impact. |

Note: This check box should NOT be selected. |

D -Budgetary E - Non Budgetary |

|

ACCOUNT |

ANTICIPATED (Anticipated) |

Indicates that the transaction is anticipated to occur in the current fiscal year. |

Note: This check box should NOT be selected. |

Y - Yes N - No |

|

ACCOUNT |

BEGIN_END (Begin End Indicator) |

Indicates whether the balance or an USSGL account/attribute combination is at the start of the fiscal year or at the end of a period. |

Note: This check box should NOT be selected. |

B - Report Beginning Balance to Treasury E - Report Ending Balance to Treasury Y - Report both Beginning and Ending Balances to Treasury |

|

ACCOUNT |

AVAIL_TIME (Availability Time Indicator) |

Indicates whether a budgetary resource is available for new obligations in the current period, or in a subsequent period within the current fiscal year or after being reapportioned in a future fiscal year. |

Note: This check box should NOT be selected. |

A - Available in the current period S - Available in the subsequent period |

|

ACCOUNT |

EXCHANGE (Exchange Nonexchange Code) |

Indicates whether the gains or losses being reported are exchange revenue, nonexchange revenue, or exchange revenue with little or no associated costs. |

Note: This check box should NOT be selected. |

X - Exchange Rev T - Nonexchange Rev E - Exchange rev without associated costs |

|

ACCOUNT |

CUSTODIAL (Custodial Activity Indicator) |

Indicates whether the reported balance is custodial or noncustodial and reported by the agency in a Statement of Custodial Activity (SCA) or in a separate footnote. Noncustodial amounts are not reported on the SCA or on the custodial footnote. |

Note: This check box should NOT be selected. |

S - Custodial A - Noncustodial |

|

ACCOUNT |

PY_ADJUST (Prior Year Adjustment Code) |

Changes to obligated or unobligated balances that occurred in the previous fiscal year but were not recorded in the appropriate TAFS as of October 1 of the current fiscal year. Exclude upward and downward adjustments to current-year or prior-year obligations and most reclassifications from clearing accounts. |

Note: This check box should NOT be selected. |

B - Adjustments to prior-year reporting backdated in Treasury's Central Accounting system. P - Adjustments to prior-year reporting not backdated in Treasury's Central Accounting system. X - Not an adjustment to prior-year reporting. |

|

ACCOUNT |

AUTHORITY (Authority Type Code) |

Used to distinguish among the types of budgetary resources, where it is not possible to do so by the USSGL account number. For example, the USSGL rescission accounts (USSGL accounts 4392 and 4393) do not distinguish between rescissions of appropriations or contract authority. |

Note: This check box should NOT be selected. |

B - Borrowing Authority C - Contract Authority D - Advance Appropriation E - Appropriations available in prior period F - Appropriations available from subsequent years P - Appropriation excluding advance funding R - Re-appropropriation S -Spending from Offsetting Collections |

|

FUND_CODE Note: (See note 1 below) |

CATEGORY (Apportionment Category) |

Identifies OMB apportionments by quarters (Category A) or by other specified time periods, programs, activities, projects, objects, or combinations of these (Category B), or are not subject to apportionment (Category E). |

Note: This check box should NOT be selected. |

A - Category A, quarterly apportionments B - Category B, apportionments other than quarterly E - Category E -Exempt from apportionment |

|

FUND_CODE or BUDGET_REF (These are recommended ChartFields but not mandated) (See note 1 below) |

YEAR_OF_BA (Year of Budget Authority) |

Identifies whether outlays are from new budget authority (NEW) or from budgetary authority carried forward from the prior year (BAL). Used for expenditure TAS that are not credit financing TAS. |

Note: This check box should NOT be selected. |

BAL - Outlay from balances that are brought forward from previous year NEW - Outlays from new Budget Authority |

|

FUND_CODE (See note 1 below) |

BEA (Budget Enforcement Act) |

Indicates whether the Budget Enforcement Act (BEA) category is mandatory or discretionary. |

Note: This check box should NOT be selected. |

D - Discretionary M - Mandatory |

|

FUND_CODE (See note 1 below) |

BORROW (Fund Borrowing Source) |

Indicates whether borrowing took place from the public, Treasury, or a federal financing bank. Required if authority type code is B (borrowing). |

Note: This check box should NOT be selected. |

P - Public T - Treasury F - Federal Financing Bank |

|

FUND_CODE (See note 1 below) |

REIMBURSE (Reimbursable Indicator) |

Indicates whether amounts for goods or services and joint projects are financed by offsetting collections. |

Note: This check box should NOT be selected. |

D - Direct Authority R - Reimbursable Authority |

Note: 1 - Use a tree to determine the funds that require these values.

Ledger Attributes

This table lists the Ledger Attributes that are assigned at the transaction level for the ChartField that you select on the Attribute Assignment page.

|

ChartField |

Attribute (Attribute Name) |

Description |

Allow Multiple Values per Attr |

ChartField Attribute Value / Description |

|---|---|---|---|---|

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

COHORTYR (Credit Cohort Year) Note: Use a tree to translate ChartField value to Treasury value. |

Fiscal year when direct loans are obligated or guarantees committed by a program, even if disbursements occur in subsequent fiscal years. |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. Get value from Cohort Year field that is specified on the GTAS Ledger Attributes page. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

GTAS_CATB_CD (Apportionment Category B Program Code) Can share the same ChartField as Program Report Category (like Fed Non Fed, Trading Partner, and Main Account) |

Identifies the code representing the Category B program used on the apportionment. Apportionment Category B Program Code is a number from 00-99 that is required if Apportionment Category Code = B. Category B program is subject to the Anti-Deficiency Act. |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. Get value from Apportionment Category B Program Code field that is specified on the GTAS Ledger Attributes page. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

GTAS_PROG_CD (Program Report Category Code) |

Identifies a program report category that agencies use when reporting their obligations in detailed financial information. Agencies may use this code when reporting either Category A or Category B obligations. Unlike the Apportionment Category B Program Code, this code is NOT subject to the Anti-Deficiency Act. |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. Get value from Program Reporting Category field that is specified on the GTAS Ledger Attributes page. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

FED_NONFED (Federal Non Federal Code) |

Indicates the type of entity involved in transactions with the reporting entity: F - other Federal entities N - non-Federal entities such as private/local/state/tribal/foreign governments E - exceptions for other non-Federal partners |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

TRAD_PARTNER (Trading Partner Agency Identifier) |

Represents the agency identifier of the other department, agency, or establishment of the US government involved in transactions with the reporting entity. Required if the Fed/Non-Federal Indicator = F. |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

MAIN_ACCOUNT (Trading Partner Main Account Identifier) |

Represents the treasury main account code of the other department, agency, or establishment of the US government involved in transactions with the reporting entity. Required if the Fed/Non-Federal Indicator = F. |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. |

|

(Assign to ChartField on the Attribute Assignment page.) Note: See Note 2 below. |

GTAS_DEFC (Disaster Emergency Fund Code) |

Record and track funding under the Corona virus Aid, Relief, and Economic Security Act (CARES). |

Note: This check box should NOT be selected. |

Define as a Ledger Attribute. |

Note: 2 - Use a tree to translate the ledger value to the GTAS value.

Use the Account page (GL_ACCOUNT) to set up or modify accounts to use as required by the U. S. Treasury. You can access a complete listing of the accounts required for GTAS reporting along with their required attributes as defined by Treasury on the Treasury’s website.

PeopleSoft provides a translation account tree to enable agencies to record transactions using their agency GL accounts and report to GTAS using 6-digit GTAS USSGL accounts. Attributes are required for the accounts that are included in this tree for translation.

See Using Trees to Control Rollup of GTAS ChartField Data and Creating the GTAS Account Rollup Tree.

Navigation:

This example illustrates the fields and controls on the Account page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Attributes |

Click this link to associate the ChartField attributes that you set up for GTAS with the appropriate Account value (or Fund Code ChartField value on the Fund Code page or Budget Reference ChartField value on the Budget Reference page) that is required for GTAS reporting. |

See Adding and Mapping Accounts and Alternate Accounts.

For more information on setting up ChartFields (Accounts, Fund Codes, and so on), see Understanding PeopleSoft ChartFields.

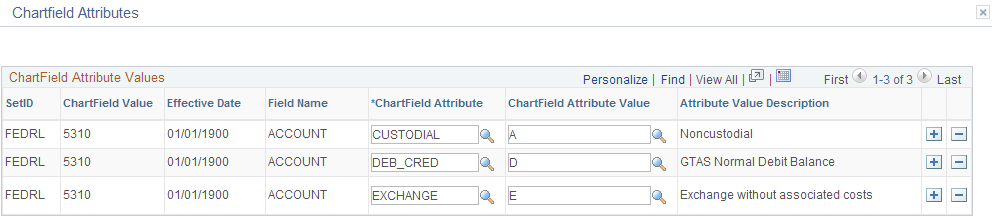

Use the ChartField Attributes page (CF_ATTRIB_VALUES) to select ChartField attributes and attribute values to associate with the selected Fund Code, Account value, Budget Reference, or other ChartField value.

Navigation:

From the Account page (or other ChartField entry page), click the Attributes link.

This example illustrates the fields and controls on the ChartField Attributes page.

After clicking the Attributes link from the Account page, you are directed to the ChartField Attributes page for this ChartField value (Account 5310 in this example). You can click the Attributes link from any ChartField value page (Fund Code, for example) and associate Attributes and Attribute values to the ChartField value.

Field or Control |

Description |

|---|---|

ChartField Attribute |

Select the appropriate ChartField attribute(s) for this ChartField Value. |

ChartField Attribute Value |

Select the ChartField attribute domain value to be associated with the ChartField. This value is the default and can be overridden by values on the GTAS Attribute Exceptions page. |

Note: If the attribute has values on the GTAS Attribute Exceptions page, the value specified on the ChartField Assignment page is a default and will be overridden for ChartField combinations that are specified on the Attribute Exceptions page.

Use the Fund Code page (FUND_DEFINITION) to define values for all types of funds. Associate the Funds Codes with selected ChartField attributes.

Navigation:

This example illustrates the fields and controls on the Fund Code page.

Add the necessary Fund Codes. Click the Attributes link to associate attributes and values with the Fund Code.

You can also use the FUND_CF component interface to load data into the tables for the Fund Code component

See Fund Code Page

For more information on setting up ChartFields (Accounts, Fund Codes, and so on), see Entering and Maintaining ChartField Values.