Setting Up Source Tax Reports

This topic discusses how to set up source tax reports.

Global Payroll for Switzerland supports the legal source tax reporting requirements for all cantons. You need to manage the following setup to adjust the reporting to the local requirements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_SI_PROVDR |

Define provider for the GE and VD cantons only. See also Generating and Managing Dashboard XML. |

|

|

GPCH_TX_FAK |

Review values entered in the Withholding Tax on Commission field. |

|

|

GPCH_TX_FAK_STAX |

Define Tax Nbr, Use Premium separate, and Source Tax Language fields for monthly and quarterly reporting. |

|

|

GP_ACCUMULATOR |

Review accumulators and add customer earnings and deductions to the accumulators. |

Use the Providers page (GPCH_SI_PROVDR) to define provider for the GE and VD cantons only. See also Generating and Managing Dashboard XML.

Navigation:

Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Social Security/Insurance, Providers CHE

For more information on defining insurance providers refer to the chapter on Managing Social Insurance for Switzerland.

Use the FAK/Source Tax (System) CHE page (GPCH_TX_FAK) to review values entered in the Withholding Tax on Commission field.

Navigation:

Use this page to review values entered in the Withholding Tax on Commission field. For additional information on reviewing source tax percentages, refer to the Managing Source Tax chapter.

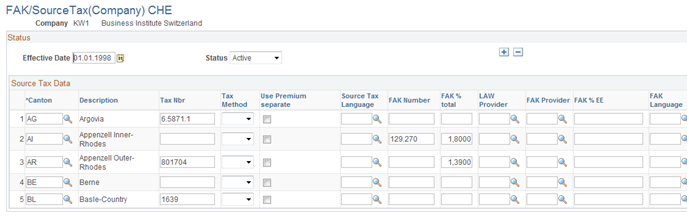

Use the FAK/Source Tax (Company) CHE page (GPCH_TX_FAK_STAX) to define Tax Nbr, Use Premium separate, and Source Tax Language fields for monthly and quarterly reporting.

Navigation:

FAK/Source Tax (Company) CHE page

Field or Control |

Description |

|---|---|

Tax Nbr (tax number) |

Enter Tax assigned to your company by tax administration. |

Tax Method |

Override tax method (e.g. for VS company may use VD method). |

Use Premium separate |

Reports earnings/deductions assigned to accumulator CH_TX_06 in separate column. |

Source Tax Language |

Select the language that you want to use for the canton. If the language on the run control page is blank, you need to select languages for specific cantons on this page, especially if you run one report that contains several cantons with different languages. Supported languages include English, French, German and Italian. |

Tax Month and Tax Quarter |

When running the report for several cantons in monthly or quarterly mode, the system includes only those cantons that qualify for monthly or quarterly mode. You can, however, select both modes, then the system will include the canton in both reports. |

Use the Accumulator Name page (GP_ACCUMULATOR) to review accumulators and add customer earnings and deductions to the accumulators.

Navigation:

Yearly Source Tax Report (GPCHTX01) – Cross Boarder Mode

|

Accumulator |

Description |

Custom Entry |

Comment |

|---|---|---|---|

|

CH_TX_GG1B |

Tax Gross Cross Boarder FRA |

CH_TX_CGG1B |

Only used when employees do not contribute through CH_00_0 or if the reported gross needs to be reversed as they contribute through CH_00_0. |

Defines the reported gross. This accumulator is calculated in payroll and stored in the GPCH_RP_0001 table. This is where the system gets the value from for the report.

Yearly Source Tax Report (GPCHTX01) – Geneva

|

Accumulator |

Description |

Custom Entry |

Comment |

|---|---|---|---|

|

CH_TX_GE31_YTD |

GE days worked |

CH_TX_CGE31 |

|

|

CH_TX_GE34_YTD |

GE indemnities depart |

CH_TX_CGE38 |

|

|

CH_TX_GE37 |

AQ GE prestations en capital |

CH_TX_CGE37 |

|

|

CH_TX_GE38 |

AQ GE indemnities pour frais |

CH_TX_CGE38 |

|

|

CH_TX_GE39 |

Unpaid days attestation quit. |

CH_TX_CGE39 |

These accumulators are calculated only within the report and saved into the XML file. Values are not stored in the GP_RSLT_ACUM table or in a write array.

Yearly Source Tax Report (GPCHTX01) – Ticinio

|

Accumulator |

Description |

Custom Entry |

Comment |

|---|---|---|---|

|

CH_TX_TI22 |

Source Tax TI unpaid days |

CH_TX_TI22 |

This accumulator is calculated within the payroll and stored in the GPCH_RP_0001 table. This is where the system gets the value from for the report.

Monthy/Quarterly Source Tax Report (GPCHTX02) – AI, AR, VD, ZH

|

Accumulator |

Description |

Custom Entry |

Comment |

|---|---|---|---|

|

CH_TX_06 |

QS Additional Premium (s. 2i) |

CH_TX_C06 |

Used with cantons other than AI, AR, GL, SG, VD, and ZH. |

|

CH_TX_06AI |

Source Tax Premium AI |

CH_TX_C06AI |

|

|

CH_TX_06AR |

Source Tax Premium AR |

CH_TX_C06AR |

Also used for GL and SG. |

|

CH_TX_06VD |

Source Tax Premium VD |

CH_TX_C06VD |

|

|

CH_TX_06ZH |

Source Tax Premium ZH |

CH_TX_C06ZH |

These accumulators are used to show bonus payments separately if the Use Premium flag for the canton is selected. The system calculates accumulators within the payroll. The value shown in the report is stored in the GPCH_RP_0001 table. This is where the system gets the value from for the report.