Understanding Multiple Currencies in PeopleSoft Payables

PeopleSoft offers a uniquely flexible structure that enables you to manage financial information in multiple currencies. You can use a ChartField to designate different currency codes within a ledger, or as required, you can store each currency in a different ledger.

PeopleSoft also provides specific input, processing, and reporting features that satisfy the most demanding requirements of multinational financial management. It supports the European Common Currency (Euro), as well as currency conversions, remeasurement, revaluation, and translation. It also provides a complete audit trail of all multicurrency processing.

This section discusses:

Multicurrency terminology in PeopleSoft Payables.

Voucher processing in a multicurrency environment.

Payment processing in a multicurrency environment.

PeopleSoft Payables Revaluation processing.

Multibook in PeopleSoft Payables.

Below are some key terms and concepts that you encounter when you use Oracle's PeopleSoft Financials multicurrency applications. Efforts have been made to use these terms consistently to coincide with generally accepted accounting terms and Financial Accounting Standards Board (FASB) rules.

Types of Currency

Currency refers to the denomination of a monetary transaction. PeopleSoft applications use a currency code to identify and track individual currencies. Though the system does not require it, it is suggested that you use the International Standards Organization (ISO) currency codes supplied with the application. You may use an unlimited number of currencies in PeopleSoft applications.

Term |

Definition |

|---|---|

Base Currency |

The base currency is the primary currency used for a business unit, and is sometimes referred to as the unit's book currency. A business unit can have one and only one base currency. This is generally the local currency for the organization; however, accounting rules or other circumstances might dictate otherwise. In PeopleSoft Payables, you assign a base currency to each business unit on the General Ledger Definition - Definition page. PeopleSoft Payables business units use the base currency of their associated general ledger business units. Once established, the base currency of a general ledger business unit cannot be changed. |

Transaction and Payment Currency |

Any currency with which a business unit interacts, other than its base currency, is a foreign currency. PeopleSoft Payables refers to a foreign currency as a transaction currency when describing the currency of the invoice, and as a payment currency when describing the currency in which payments are made. The system stores all distribution accounting data in three currencies: the base currency of the general ledger business unit on the distribution line, the PeopleSoft Payables business unit base currency, and the transaction currency. |

Currency Calculations

The system performs several calculations when it works with multicurrency transactions.

Term |

Definition |

|---|---|

Conversion |

Conversion is the exchange of one currency for another. In PeopleSoft Payables, this refers to expressing the value of foreign currency transactions in terms of the base currency. Conversion occurs in many places in your PeopleSoft Payables system. When receiving vouchers from a supplier, you can enter a transaction amount in a foreign currency. The system uses an exchange rate to convert the transaction amount to the PeopleSoft Payables business unit base currency and the general ledger business unit base currency. When you create payments in one currency for vouchers in a different currency, the system performs currency conversion as necessary to enable payment creation. It uses either the currency rate type, or override to convert the payment currency into the voucher's base currency, and the bank's general ledger base currency. During the revaluation of your current payables balance, the process revalues unpaid vouchers, based on business unit's base currency. |

Exchange Rate |

An exchange rate is the value of one currency expressed in terms of another. Actual exchange rates vary based on the currency rate type that you use. There are several recognized currency rate types, including spot (immediate), current, negotiated (discount and premium forward rates), average, and historical rates. The system supports any number of exchange rates. |

Unrealized Gains and Losses |

An unrealized gain or loss represents the difference between the amount that you would pay in your base currency if your outstanding foreign currency accounts liability balance were paid now and the amount that you would have paid if payment was made when the items were created. If the exchange rate is more favorable now than when items were created, you have an unrealized gain. If the exchange rate is less favorable now, you have an unrealized loss. |

Realized Gains and Losses |

Realized gains or losses represent the actual increase or decrease, due to exchange rate fluctuations, or rate type changes in the amount of money paid in the base currency. The system determines realized gain or loss only at payment time. |

Multicurrency affects voucher processing at all levels: entering and validating vouchers, scheduling payments, using control groups, and posting vouchers.

Entering Multicurrency Vouchers

Each voucher has a transaction currency denomination. The currency code for the transaction appears by default through the PeopleSoft Payables control hierarchy (business unit, voucher origin, control group, and supplier). If required, you can change the currency and rate type on the voucher. You can change the currency code for the voucher on the Voucher - Invoice Information page or on the Voucher - Attributes page, and you can change the rate type for the voucher on the Voucher - Attributes page.

For each voucher, the system converts the transaction currency to the voucher base currency using the exchange rate and exchange rate type. By specifying the exchange rate source, you can enter a specific exchange rate or have the system determine the exchange rate from the exchange rate tables. If you select User as the source, enter the exchange rate yourself. If you select Tables as the source, the system uses the invoice date of the voucher and the exchange rate tables to determine the exchange rate to use.

The transaction currency code applies to all amounts entered onto the voucher. At save time, the system performs a conversion to the base currency defined for the business unit and to the PeopleSoft General Ledger base currency for the distribution line on interunit accounts.

Transaction balancing occurs on both the transaction and the base amounts. During voucher save, base amount rounding differences are added to the largest expense accounting lines for each voucher line.

Scheduling Payments for Multicurrency Vouchers

Payment scheduling creates scheduled payment records for each voucher. Each scheduled payment has a gross payment amount and a discount payment amount. The scheduled payment amounts are converted based upon the currency exchange rate of the voucher transaction currency. You can override the currency rate or rate type on the Holiday/Currency Options page selected from the Voucher - Payments page. When you enter a specific rate, the rate is used to convert the currency between the voucher transaction currency and the payment currency. When you override the rate type, the new rate type is used to convert from the transaction currency to the payment currency and from the payment currency to the bank's base currency and the voucher's base currency.

Note: If you use a rate type on the payment that is different from the rate type on the voucher, realized gain and loss may occur.

Multicurrency also affects payment processing at many levels.

Payment Selection

From a multicurrency perspective, PeopleSoft Payables determines the amount of a given currency required to pay a scheduled payment. The payment currency does not have to be the same as the voucher transaction currency. In fact, the payment currency can be in any currency that you have set up for the bank. You can either accept the default or select another valid currency code.

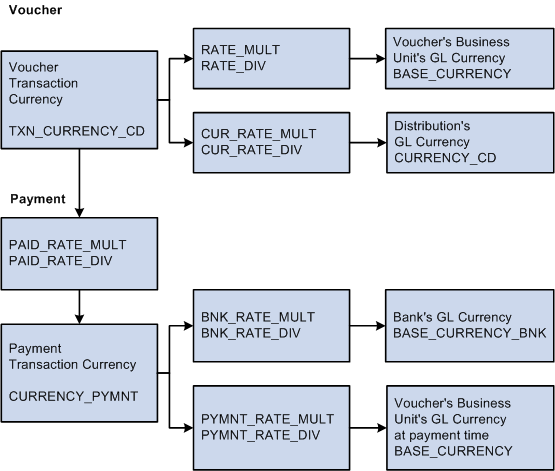

Payment Creation

During payment creation, the system converts the voucher transaction currency to the payment transaction currency for the payment. It converts the payment transaction currency to the voucher base currency and the bank base general ledger currency for posting. The amounts form the basis of realized gain and loss accounting entries created in payment posting.

PeopleSoft Payables supports checks, automated clearing house (ACH) payments, direct debits, wire transfers, electronic funds transfers (EFT), drafts, GIRO, letters of credit, and bank transfers. The Pay Cycle Application Engine process (AP_APY2015) consists of payment selection and payment creation. Output processes print checks and create files.

The payment creation process populates the payment amount and bank base amount of the payment. The payment table also holds the corresponding currency codes and rates. The check print process accesses the currency code table to access symbols and descriptive information to print on the check and remittance advice.

The Trial Payment Register, the Payment Register, and the Payment Forecast reports all reflect multicurrency payments.

Note: During payment creation, the system calculates the payment transaction currency from the voucher transaction currency.

This graphic shows the currency conversion process for vouchers and payments.

Payment Posting

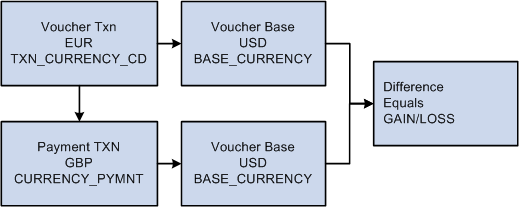

The Payment Posting Application Engine process (AP_PSTPYMNT) creates accounting entries that relieve liabilities and record payments, as well as discounts taken or lost, VAT, withholding and realized gains and losses. The Payment Posting process also creates accounting entries resulting from canceled payments (void and stop checks). The system calculates the exchange rate gain or loss by subtracting the BASE_CURRENCY at payment time from the BASE_CURRENCY at voucher entry time. However, if the voucher's transaction currency is different from the payment's transaction currency, the gain or loss is an overall gain or loss.

When the Voucher Transaction currency and the Payment Transaction currency are not equal, and you use the General Ledger Balance By All Currency, the Payment Posting process will automatically generate additional entries to balance by Foreign currency. The amounts will be posted to the RSAF (Rounding Suspense for Foreign) account and the system will use the ChartField values that were established on the Accounting Entry Template.

Exchange rate gain or loss process flow.

If a situation arises where the voucher is in currency A, the payment is in currency B, and the voucher's base is in currency C, you have a potential realized gain or loss. In this situation, the payment accounting entry foreign currency is the currency of the payment.

When rounding errors occur during the generation of accounting entries, the amounts are posted to the rounding suspense account. Rounding suspense account entries can be reclassified in PeopleSoft General Ledger for any ledgers.

Revaluation adjusts the domestic currency value of asset and liability account balances that are maintained in foreign currencies. It is necessary to reflect the actual value of these assets and liabilities in the domestic currency, because the exchange rates fluctuate between the domestic currency and the foreign currencies. Revaluation is generally performed at the end of each accounting period and results in a domestic currency adjustment to the account being revalued, with an offsetting entry being made to the revaluation gain or loss accounts. In PeopleSoft Payables, the PS/AP Revaluation process determines the revaluation adjustment required for the balance sheet account and creates a journal entry for this adjustment and its offsetting gain or loss amounts.

You might need to revalue your open payables for financial reporting purposes. PeopleSoft Payables enables you to create summarized revaluation accounting entries and input these entries into the Journal Generator. You can run the revaluation for one or many PeopleSoft Payables business units.

You revalue transactions as follows:

Run the PS/AP Revaluation process.

The PS/AP Revaluation process creates the unrealized gains and loss entries for selected PeopleSoft Payables business units for a given period. The PS/AP Revaluation process inspects the transaction tables and applies a specified exchange rate to each unpaid, scheduled payment which has a voucher transaction currency that is not in the business unit's base currency. It then applies the exchange rate to create a revaluation base amount, which it uses to create a revaluation accounting line.

Run the Journal Generator Application Engine process (FS_JGEN).

The Journal Generator process creates journals from the revaluation accounting lines. Make sure that you have set up an accounting definition to relate the revaluation accounting lines to journal lines. You also need a journal generator template specifying the creation of a reversing journal for revaluation.

If you run revaluation in PeopleSoft Payables, rather than in PeopleSoft General Ledger, the process happens at a specified level of detail. This provides more flexible results if your exchange rates are volatile. If you do run the process in PeopleSoft Payables for the accounts that you use here, you do not want to run the PeopleSoft General Ledger revaluation against the same account balances in PeopleSoft General Ledger, because you would be double counting.

Note: Vouchers must be posted before you can run revaluation.

The Multibook feature supports multiple base currencies, each in the form of a ledger, defined for a business unit. Optionally, you can post a single transaction to all base currencies (all ledgers) or to only one of those base currencies (individual ledgers).

With the Multibook feature, several ledgers are grouped together within a ledger group. Ledgers within the group share the same physical structure, but each ledger can have its own base currency. The ledger group controls how transactions post to all ledgers within the group or to an individual ledger. The system automatically converts transactions to the applicable base currency and then posts to the corresponding ledger. This gives you full, drill-down support and cross-currency comparisons at both the summary and transaction levels.

Enable the Multibook feature on the Installation Options - Overall page, by selecting the Create Multibook Accounting Entries in Subsystems check box. If this check box is selected, and if your ledger group is set up for secondary ledgers, the PeopleSoft Payables posting processes and revaluation process create the accounting entries for those ledgers. However, if this check box is not selected, the PeopleSoft Payables posting processes and revaluation process create only the primary ledger entries. The Journal Generator process creates the secondary and translate ledger entries.

Set up ledger groups on the Ledger Groups - Definition page.

The calculations for secondary ledgers are dependent upon whether you are using Translation or Non-Translation ledgers:

Term |

Definition |

|---|---|

Non-Translation ledgers |

The system creates accounting entries by converting from the transaction currency to the base currency. |

Translation ledgers |

The system creates accounting entries by converting from the primary ledger base currency to the translate ledger base currency. |

Use the Multibook feature to maintain the real-time balance of certain accounts in the ledger. You can track gain and loss for secondary ledgers more accurately (when they are non-translation ledgers).