Processing Credit Cards in PeopleSoft Receivables

This topic discusses the Receivables credit card process flow and how to create credit card payments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Credit Card Details Page |

AR_CRCARD_DETAILS |

View or modify the customer's credit card details and settle a credit card transaction. Note: This page differs in systems using the traditional credit card model or the hosted credit card model because of the location of stored credit card data. See Creating Credit Card Payments Using Item Inquiries. See also the Credit Card Details Page. |

|

Credit Card Worksheet Selection Page |

PAYMENT_IDENT_IC |

Create a new worksheet, modify an existing one, and select items to include in the worksheet. See Creating Credit Card Payments Using the Credit Card Worksheet. See also the Credit Card Worksheet Selection Page. |

|

Credit Card Worksheet Application Page |

PAYMENT_WS_IC |

Apply payments to selected items. See also the Credit Card Worksheet Application Page. |

|

Credit Card Worksheet Action Page |

PAYMENT_ACTION_IC |

Select posting options for the payment applied on the payment worksheet, including entry events and worksheets that the Payment Predictor process generated. See Creating Credit Card Payments Using the Credit Card Worksheet. See also the Credit Card Worksheet Action Page. |

|

Credit Card Scheduler Page |

AR_CRCARD_RQST |

Create credit card worksheets and settle credit card transactions automatically. See Creating Credit Card Payments in Batch. See also the Credit Card Scheduler Page. |

|

Credit Card Workbench Page |

AR_CRCARD_WORKBNCH |

Select credit card payments and perform mass actions on credit card payments. See Creating Credit Card Payments for Processing in Receivables. See the Credit Card Workbench Page. |

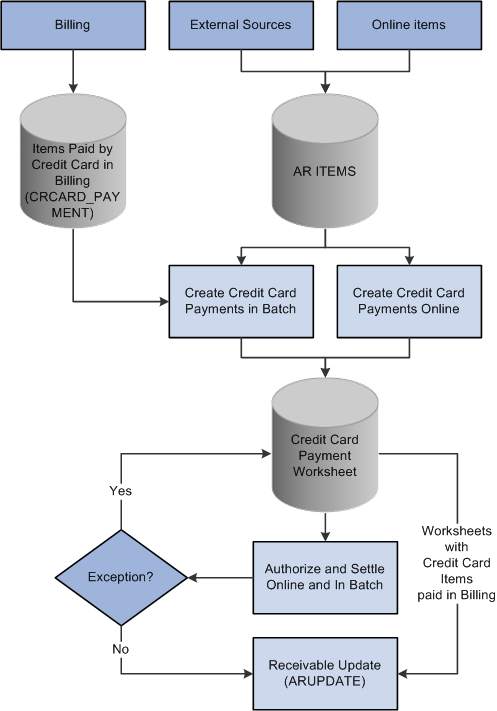

The following diagram illustrates how the PeopleSoft Credit Card process works in PeopleSoft Receivables:

PeopleSoft Receivables Credit Card Process Flow

You enter the same basic data for credit card payments, regardless of which PeopleSoft application you are using; the difference is where you enter it.

You can create credit card payments in several different ways:

Use the self-service eBill Payment component.

Use the Credit Card worksheet component.

Click the Pay by Credit Card link on a Receivables inquiry page.

Use credit card batch processing.

The Credit Card Workbench () enables you to manage credit card payments that have been created but not authorized or settled. You can also use this component to inquire on the transaction history for authorized and settled credit card payments. You do not use this component to create new credit card payments.

Note: After credit card numbers are entered, they are stored in an encrypted format. The encrypted card number does not appear on pages used to enter credit card information. Pages used to review the credit card information, such as the Customer Summary using Quick Customer Create, display the encrypted number.

You can create credit card payments on any of the following Receivables inquiry pages:

Account Overview - Balances page

Item List page

View/Update Item Details - Detail 1 page

Use any of these inquiry pages to access the Credit Card Details page (AR_CRCARD_DETAILS), where you can view or modify the customer's credit card details and settle a credit card transaction.

Navigation:

Click the Pay Balances by Credit Card link on the Account Overview - Balances page.

Select Pay by Credit Card in the Item Action field on the Item List page and click the Go button.

Click the Pay By Credit Card link on the View/Update Details - Detail 1 page.

Click the Pay By Credit Card link on the Worksheet Selection page.

Select Pay by Credit Card in the Item Action field on the Item tab of the Collections Workbench.

Click the Credit Card Details link on the Credit Card Worksheet Selection page.

Click the Pay by Credit Card link on the Credit Card Worksheet Action page.

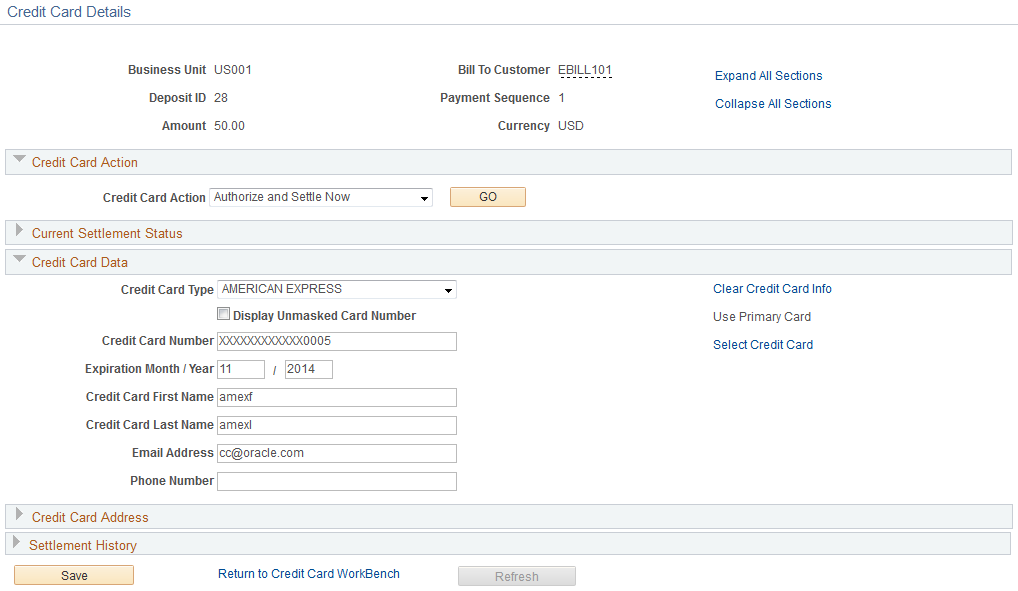

This example illustrates the fields and controls on the Credit Card Details page in Receivables (traditional credit card model), accessed through the Credit Card Workbench.

You can maintain credit card information on the Credit Card Details page in a system using the traditional credit card model and settle the payment immediately or settle the payment in a batch process.

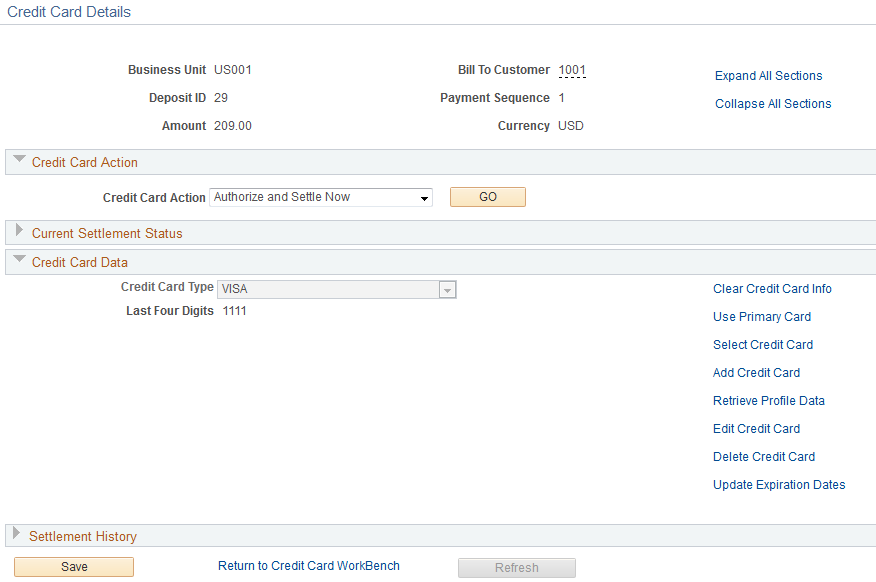

This example illustrates the fields and controls on the Credit Card Details page in Receivables (hosted credit card model), accessed through the Credit Card Workbench.

For the credit card data to be authorized in the hosted credit card model, you must enter data in all the fields required by the third-party authorizing authority.

Note: If you access this page from a Receivables inquiry page, the system displays a warning at the top of the page. If you want to leave the Credit Card Detail page without saving or processing the credit card transaction, you must use the indicated link to cancel the transaction. Leaving the page using another method, such as clicking the back button on your browser, creates a credit card worksheet based on the items you indicated on the inquiry page.

Note: Upon returning to the PeopleSoft application from the hosted credit card website, you must use menu navigation to return to the Finalize Worksheet page.

Field or Control |

Description |

|---|---|

Credit Card Action |

Select the settlement action for this credit card transaction. The values are: No Action: The system does not perform any settlement action on this transaction. Authorize and Settle Now: The system obtains an approval for the credit card transaction from the third-party authorizing authority and charges the amount of this transaction to the specified credit card. Authorize and Settle Later: The system processes the credit card transaction the next time the Credit Card Processor multiprocess job (ARCRCARD) is run. Manually Approved/Settled: The credit card payment has been processed outside of the PeopleSoft system. You can optionally enter the authorization code. This option is called a Manual Charge in Billing. Cancel Settlement Request: The settlement request is canceled. The history is retained for this transaction, but the status of the transaction is set to No Action. |

Authorization Code |

Displays the authorization code for the transaction. You can enter an authorization code if the Credit Card Action is Manually Approved and Settled. If the transaction has been settled through a third-party authorizing authority, the system populates the Authorization Code field. |

Credit Card Message 1, Credit Card Message 2, and Credit Card Message 3 |

Displays any processing messages. A message with a prefix of ICS indicates that the message is from a third-party credit card authorization and payment application. |

Clear Credit Card Data |

Click to clear the credit card information on the page. For more information about the credit card action links, see Managing Credit Card Data Using Action Links. |

Credit card worksheets enable you to select existing Receivables items and pay them by credit card. Credit card worksheets are created during credit card batch processing, when items are paid by credit card from inquiries, and when they are built directly through the credit card worksheet pages.

Important! If you click the Cancel button on the Credit Card Detail page or if credit card batch processing creates payments that are not authorized, the system still creates credit card worksheets for the selected items. If you do not create a credit card payment or delete these worksheets, the amount owed on the selected items may not be collected.

Once an item is scheduled for payment in eBill Payment, you cannot select the item for payment in the maintenance, payment, or credit card worksheets.

Credit card worksheets populate the same tables as payment worksheets.

The credit card worksheet components behave differently depending on whether or not the credit card payment has been authorized and settled. Before settlement, use the credit card worksheet to select items that make up the amount to be authorized and settled. After the credit card payment has been settled, unposting the payment enables you to use the credit card worksheet to apply the payment to items in the same way you would use a payment worksheet.

Working with a credit card worksheet consists of these high-level steps:

Use the Credit Card Worksheet Selection page to select the items that you want to work with and build the worksheet.

If you add items to an existing worksheet, the system adds the new items that you selected and does not delete any selected items that are already on the worksheet.

Use the Credit Card Worksheet Application page to select items to pay by credit card.

To use the credit card worksheet, follow these high-level steps:

Use the item display or sort controls to adjust the view.

Select the items to pay.

Handle underpayments and discounts.

Overpayments are not allowed on credit card worksheets that have not been authorized and settled.

Check the information in the Credit Card Payment group box to verify the amount of the credit card payment based on the selected items.

Use theCredit Card Worksheet Action Page to select a posting action for the worksheet or to create accounting entries online.

You can also delete the worksheet, that is, remove the items from the worksheet, or you can save your work and complete the worksheet later.

The Delete Worksheet button behaves in two ways. If the credit card payment has not been authorized and settled, clicking the Delete Worksheet button deletes the entire payment. If the credit card payment has been settled, clicking the Delete Worksheet button removes the items from the worksheet.

The Credit Card Processor multiprocess job (ARCRCARD) enables you to create credit card worksheets and settle credit card transactions automatically. The worksheet creation phase selects open items that are due with a payment method of credit card and builds credit card worksheets. A credit card profile is applied to limit the selection of open items and to apply rules for building and approving the worksheets. The authorization and settlement phase of the AR Credit Card process selects credit card worksheets that are ready for settlement.

Use the Credit Card Scheduler page (AR_CRCARD_RQST) to create credit card worksheets and settle credit card transactions automatically.

Navigation:

Field or Control |

Description |

|---|---|

From Due Date |

Specify the beginning due date to use when the Credit Card Processor selects items. |

Increment Due Dates By |

Enter the amount of time to increment the From Due Date and the To Due Date fields. Enter the numerical value and the time scale in days, weeks, or months that you want the due dates to change. These values are used when you click the Increment Now button or select the Automatic Increment Dates check box. |

Increment Now |

Click to increment the From Due Date and To Due Date based on the Increment Due Dates By fields. |

To Due Date |

Specify the last due date to use when the Credit Card Processor selects items. |

Automatic Increment Dates |

Select this check box so that the From Due Date and To Due Date fields automatically increment each time you run the Credit Card Processor. This functionality enables you to reuse a run control without having to change the dates. |

Include Items from eBill Payment |

Select to include items from PeopleSoft eBill Payment in this process run. eBill payment items will be selected based on the Payment Date that was set in eBill Payment. The process includes eBill Payment lines when the item is using the payment method CC. Even when the item was originally created with another payment method, eBill Payment changes it to CC when the external user selects this payment method in the Payment Cart, so that Credit Cart Processor can select this item. |

Deposit Unit |

Enter the deposit business unit. This value controls the bank account from which the credit card payment is made. The system processes each specified deposit unit separately. |

Create Credit Card Worksheets |

Select this check box to create credit card worksheets for the selected deposit business unit. Credit card worksheets are created from items that have a credit card payment method and a due date that falls within the specified range of due dates. The process selects all items in the selected business units that have the payment method set to credit card, as well as any items in the business unit that have originated in Billing and been paid by credit card. |

Authorize and Settle Worksheets |

Select this check box to enable credit card authorization and settlement for the specified deposit business unit. All credit card worksheets in the defined deposit business unit that have a credit card authorization status of Unprocessed/Retry are selected. |