Transactions in Foreign Currency

Transactions can have amounts in currencies other than the Philippine Peso (PHP). If a foreign currency is used, all Philippines documents that use foreign currency, printed or sent by email, include a Tax Summary that lists the tax calculation and corresponding currency amounts.

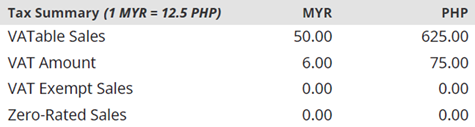

In the following sample of a tax summary:

-

The Tax Summary header displays the exchange rate in parenthesis ().

If a payment transaction includes two or more invoices, the exchange rate is hidden.

-

The first column lists the VAT details.

-

The second column has the amounts in transaction currency.

-

The third column has the amounts in base currency which is computed using the exchange rate.

If you're using a OneWorld account, the base currency is sourced from the customer's primary subsidiary. If you don't have a OneWorld account, the base currency depends on the company information.

The Exchange Rate field in the Accounting subtab indicates the exchange rate that each transaction applies. You can add foreign currencies in the Currencies record list.

For more information about printing and sending Philippines documents with foreign currency, see the following topics: