Defining Asset Accounts and Values for Multiple Books

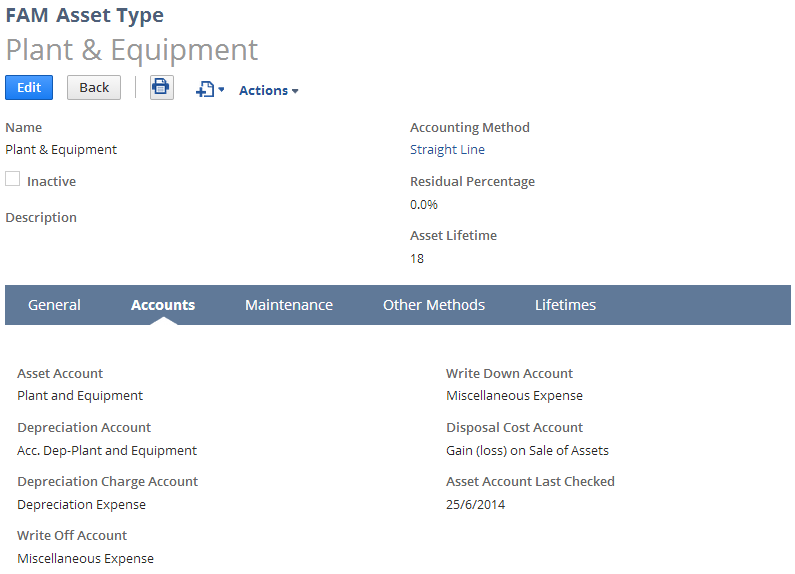

General ledger accounts on the Accounts tab of the Asset Type record store the primary book values. For more information about defining asset accounts, refer to Asset Type Accounts Subtab.

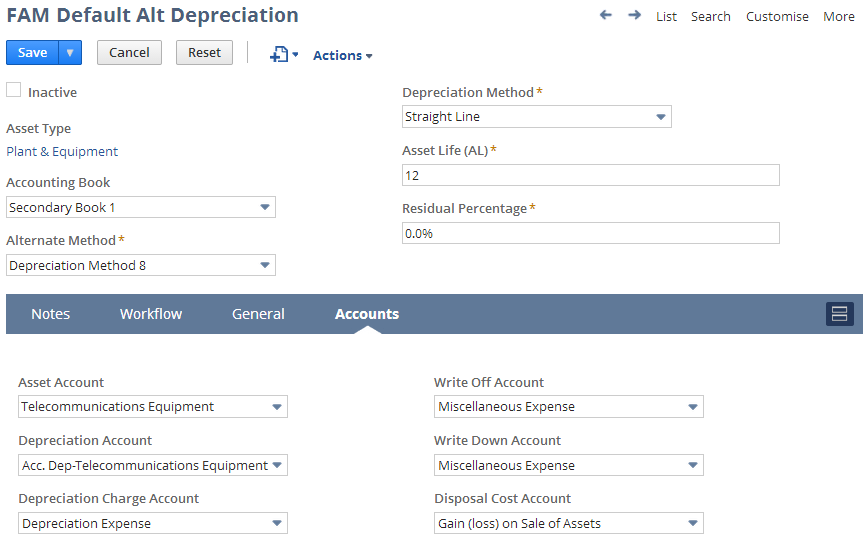

The Accounts subtab in the FAM Default Alternate Depreciation tab stores the secondary book general ledger accounts. You can link existing FAM default alternate depreciation to an accounting book by assigning a Book ID and populating other secondary book fields.

Changes to saved default alternate depreciation are prospective. Existing assets using the old default alternate depreciation won't be affected. You can override the alternate depreciation for default asset types in the Depreciation History subtab of the asset record. For more information, see Depreciation History Subtab.

The Other Methods subtab in the Asset Type record appears only after you save the record.

You can set different depreciation methods per accounting book.