Running Depreciation on an Accounting Book

Depreciation computation and journal entry creation in Multi-Book Accounting for Fixed Assets Management happens for each book. You can select the book that you want to depreciate, and the journal entries created will use the Book Specific Journal Entry form.

Note:

The system doesn't create a depreciation journal entry for depreciation history records that aren't linked to an accounting book. These records are depreciated when you run depreciation for any book.

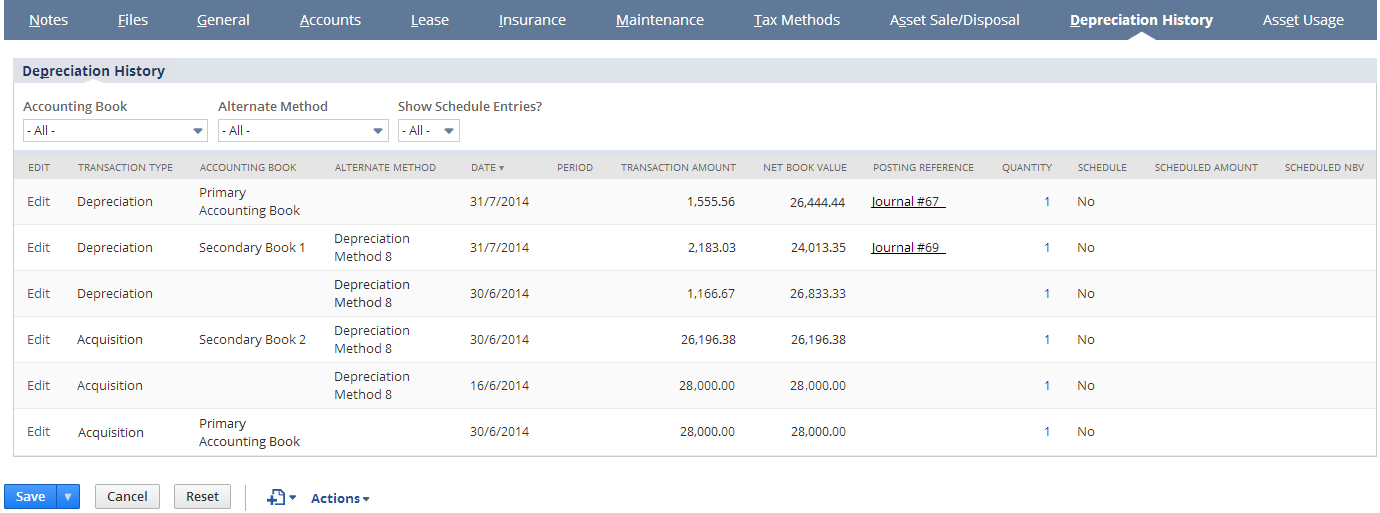

The Alternate Depreciation History subtab under the Tax Methods tab is combined with the Accounting Method Depreciation History in the Depreciation History tab. The combined subtab is named Depreciation History.

For more information about depreciating assets, see Asset Depreciation.