Taxes

Use this feature to manage tax configurations for your organization.

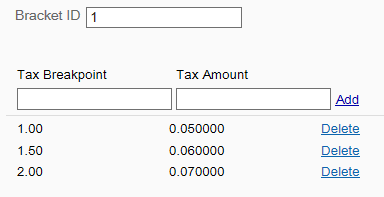

Figure 6-27 Data Manager - Taxes Page

-

To set up and manage Tax Authorities, Tax Locations, Tax Brackets, and Tax Groups used to create the tax rates, click Tax Elements. See Tax Elements below.

-

To set up and manage Tax Rates, click Tax Rates. See Tax Rates.

Note:

The Tax Elements must be set up before you can set up the Tax Rates.

Tax Elements

Set up the basic tax elements here before setting up the tax rate rules.

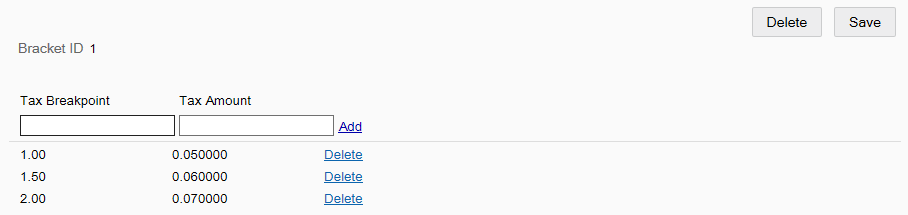

Figure 6-28 Tax Elements Page

-

Tax Authorities - Identifies the name of the authority that imposes the tax, and also supplies the rounding rules that are used in the calculation. See Tax Authorities.

-

Tax Locations - Defines the tax locations that can be assigned to individual stores. See Tax Locations

-

Tax Groups - Defines tax groups for items that are taxed according to the same rules. For example, certain food products may belong to the same tax group. After defining the tax groups, they may be assigned to individual items. See Tax Groups.

-

Tax Brackets - Defines the tax brackets used to calculate the sales tax for an item or transaction. See Tax Brackets.

Tax Authorities

If adding a new tax authority:

-

At the Tax Authorities Maintenance page, click Add New to create a new tax authority.

-

Complete the fields as required, then click Save.

If editing an existing tax authority:

-

At the Tax Authorities Maintenance page, select a tax authority from the list of tax authorities that are currently available for the targeted org node.

-

Edit the fields as required, then click Save. The following Tax Authority fields are available:

Table 6-24 Tax Authorities Fields

Field Description ID [REQUIRED]

Enter a unique identifier of a tax authority. The ID cannot be changed in edit mode.

Name [REQUIRED]

Enter the name of the tax authority.

Rounding Code

Select from the drop-down list of rounding codes. Codes indicate how tax is to be rounded when calculated. The list is populated using

TaxAuthorityUiContainer.Values:

Always round down

Always round up

Round ceiling

Round floor

Round half down

Round half even

Round half up

Rounding Digits

Enter the number of digits to which rounding is to be calculated.

Tax Locations

If adding a new tax location:

-

At the Tax Locations Maintenance page, click Add New to create a new tax location.

-

Complete the fields as required, then click Save.

If editing an existing tax location:

-

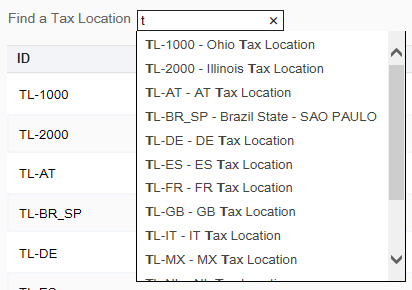

At the Tax Locations Maintenance page, select a tax location from the list.

-

Edit the fields as required, then click Save.

Note:

To search for a specific tax location, begin typing the tax location description in the Find a Tax Location field.

The following Tax Location fields are available:

Table 6-25 Tax Location Fields

Field Description ID [REQUIRED]

Enter a unique identifier of a tax location. The ID cannot be changed in edit mode.

Name [REQUIRED]

Enter the name of the tax location.

Description

Enter a text description of the tax location.

Note:

Any Tax Locations created here will be "pending deployment"; however, these locations will be available for use within the other areas of the Taxes feature.

Tax Groups

If adding a new tax group:

-

At the Tax Groups Maintenance page, click Add New to create a new tax group.

-

Complete the fields as required, then click Save.

If editing an existing tax group:

-

At the Tax Groups Maintenance page, select a tax group from the list.

-

Edit the fields as required, then click Save. The following Tax Group fields are available:

Table 6-26 Tax Group Fields

Field Description ID [REQUIRED]

Enter a unique identifier of a tax group. The ID cannot be changed in edit mode.

Name [REQUIRED]

Enter the name of the tax group.

Description

Enter a text description of the tax group.

Note:

Any Tax Groups created here will be "pending deployment"; however, these groups will be available for use within the other areas of the Taxes feature.

Tax Brackets

If adding a new tax bracket:

-

At the Tax Brackets Maintenance page, click Add to create a new tax bracket.

-

Complete the fields as required in step 3 below.

If editing an existing tax bracket:

-

At the Tax Brackets Maintenance page, select a tax bracket from the list.

-

Edit the fields as required in step 3 below.

-

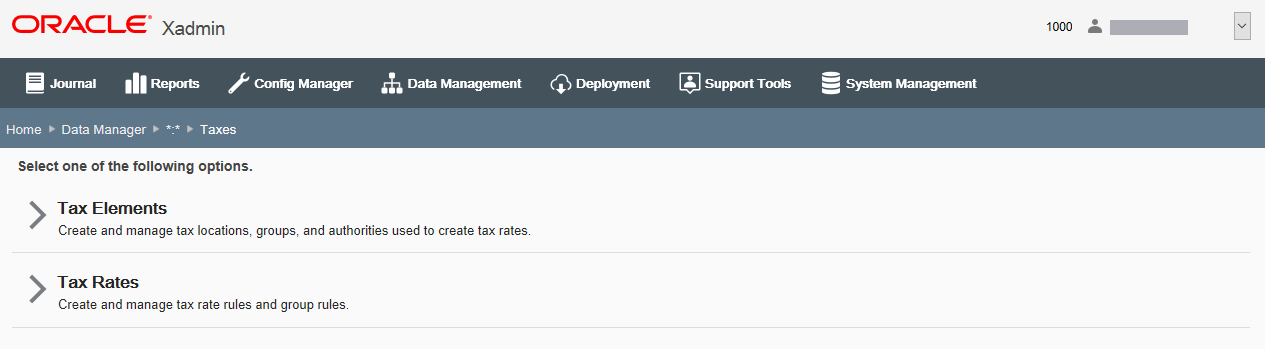

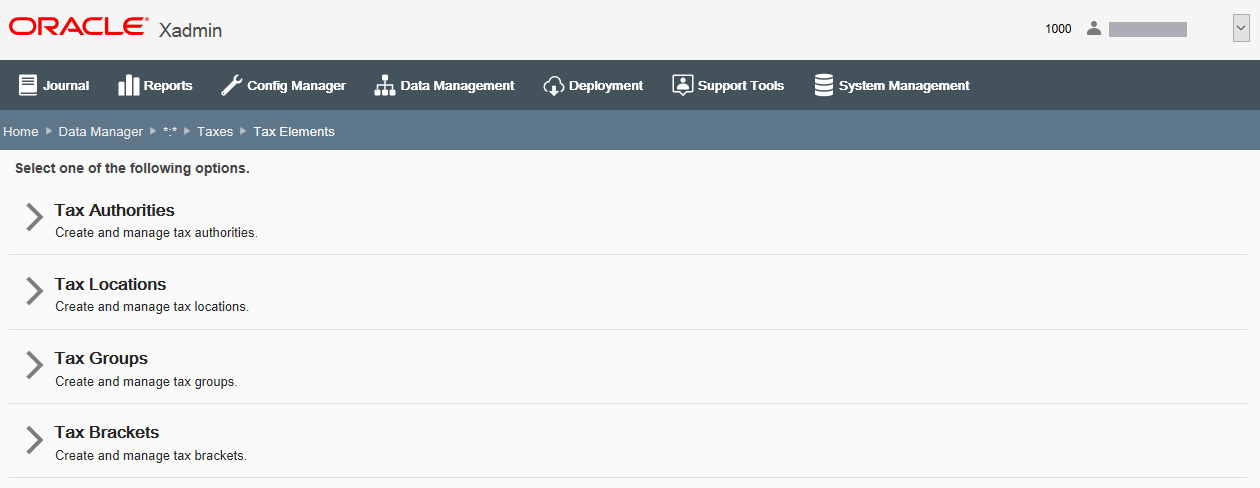

Complete the following Tax Bracket fields:

Table 6-27 Tax Bracket Fields

Field Description Bracket ID [REQUIRED]

Enter a unique identifier of a tax bracket. The ID cannot be changed in edit mode.

Tax Breakpoint [REQUIRED]

Enter the tax breakpoint, up to 6 decimal places.

Tax Amount

[REQUIRED]

Enter the tax amount, up to 6 decimal places.

-

Click Add to add the tax breakpoint and tax amount to the Tax Bracket.

Continue adding all tax breakpoints and tax amounts for the Tax Bracket, and click Add after each addition to add the values to the Tax Bracket. The entered values are sorted in ascending order based on the breakpoint as they are added.

-

Click Save to save the Tax Bracket.

Note:

Any Tax Brackets created here will be "pending deployment"; however, these brackets will be available for use within the other areas of the Taxes feature.

Tax Rates

After setting up the basic tax elements (see Tax Elements), perform the following steps to set up and manage tax rate rules and group rules.

-

Select Tax Rates at the Taxes page (Figure 6-27), then enter/select a Tax Location and click Next.

-

Add a new tax rate, or edit an existing tax rate for the selected tax location:

If adding a new Tax Group Rule:

-

At the Tax Location Group Rules page, click Add New to create a new Tax Group Rule for the selected tax location.

-

Complete the fields as required, then click Save.

If editing an existing Tax Group Rule:

-

At the Tax Location Group Rules page, select a Tax Location Group Rule from the list.

-

Edit the fields as required, then click Save. The following Tax Group Rule fields are available:

Table 6-28 Tax Group Rule Fields

Field Description Tax Group [REQUIRED]

Select the ID assigned to the tax group. The ID cannot be changed in edit mode.

Name [REQUIRED]

Enter the name assigned to the tax group.

Tax Authority [REQUIRED]

Select the Tax Authority.

Tax Type [REQUIRED]

Select the Tax Type.

Transaction Level check box

Select this check box to use this group rule at the transaction level.

Compound Tax check box

Select this check box to compound this group rule.

A compound tax is a special kind of tax that is calculated by applying it to a previously taxed item. The value of the compound tax is based on the sum of an item's price plus the tax that was previously applied to it.

Fiscal Tax ID

[Country Pack ONLY]

Add the tax authority specific fiscal tax ID to the selected tax group rule.

Note: This field is only available for country packs. For more information on country packs, see the Xstore Suite Configuration Accelerator Guide.

If adding or editing a Tax Rate Rule:

-

At the Tax Location Group Rules page, click Edit Rates.

-

Do one of the following:

-

To create a new Tax Rate Rule, click Add New.

-

To edit an existing Tax Rate Rule, select it in the list.

-

-

-

Complete the following Tax Rate Rules fields:

Table 6-29 Tax Rate Rules Fields

Field Description Minimum Taxable Amt

Specify the starting value amount at which the tax rate rule is first applied if the tax rate rule is applied at different thresholds.

Maximum Taxable Amt

Specify the highest value amount at which the tax rate rule is applied if the tax rate rule is applied at different thresholds.

Tax Rate [REQUIRED]

Select the tax rate and enter the amount, percent, or select a tax bracket.

Effective Date

Enter the date on which the tax rate rule becomes operative.

Expiration Date

Enter the date on which the tax rate rule is no longer operative.

Breakpoint

Select the breakpoint from the list.

This value determines if the tax rate rule is applied to the entire value of the transaction or only to a portion of it, if the rule has threshold values defined.

Note:

The Seq. Number determines the order in which a tax is applied in a transaction. The rule with sequence number "1" is first, "2" is second, and so on.

-

Click Save.

To delete a Tax Rate Rule:

-

Click the Delete icon associated with the Tax Rate Rule.

-

When prompted, click Yes to confirm the deletion.

If adding or editing a Tax Rate Rule Override:

See If adding or editing a Tax Rate Rule. The process for Tax Rate Rule Overrides is the same as the process for Tax Rate Rules.

-