5 Working with Revenue Performance Obligations (Release 9.1 Update)

This chapter contains the following topics:

-

Section 5.1, "Understanding Revenue Performance Obligations in JD Edwards EnterpriseOne Job Cost"

-

Section 5.2, "Setting Up Revenue Performance Obligation AAIs"

-

Section 5.4, "Example: Revenue Performance Obligation and RPO AAI Setup: Review Resulting Accounts"

-

Section 5.5, "Updating Percent Complete at the Revenue Performance Obligation Level"

-

Section 5.6, "Generating Profit Recognition Data for Revenue Performance Obligations"

-

Section 5.7, "Revising Profit Recognition Records for Revenue Performance Obligations"

-

Section 5.8, "Creating Profit Recognition Journal Entries for Revenue Performance Obligations"

5.1 Understanding Revenue Performance Obligations in JD Edwards EnterpriseOne Job Cost

Business processes and financial standards outline when you can recognize revenue for the amounts you bill to customers. Per accounting standards, you cannot recognize revenue for billed amounts associated with the billing amount until the performance obligation to the customer is satisfied.

|

Note: To learn more about the revenue recognition process and requirements in JD Edwards EnterpriseOne, review the following information. |

When working in the JD Edwards EnterpriseOne Job Cost system specifically, the system enables you to manage and report on performance obligations at the project, job, subledger or revenue performance obligation level for any job. A revenue performance obligation (RPO) is a record that consists of a set of accounts used to track costs and revenue associated with specific tasks within a job.

Project managers can identify multiple revenue performance obligations within a single job, associate a range of accounts with a revenue performance obligation, update related percent complete, and make revenue and cost adjustments to the revenue performance obligations (similar to single job adjustments). You can accurately recognize revenue for multiple revenue performance obligations on a single job using the Revenue Performance Obligation Profit Recognition Process (with the resulting over and under billing adjustments), which is based on the existing Profit Recognition process.

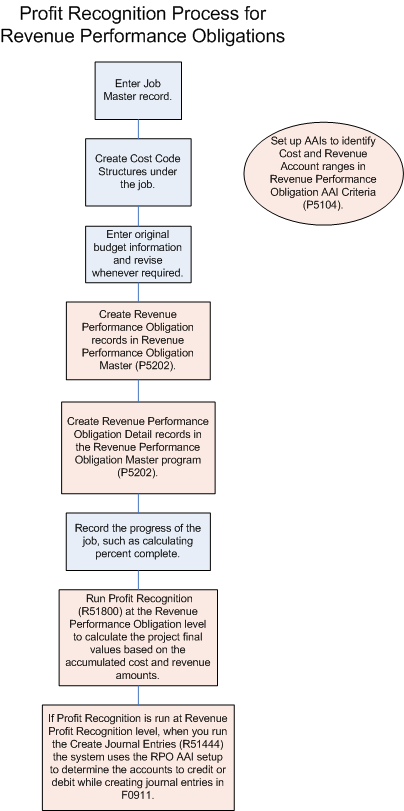

The following flowchart shows how the Profit Recognition Process has been updated to accommodate RPOs:

Figure 5-1 Profit Recognition Process for Revenue Performance Obligations

Description of ''Figure 5-1 Profit Recognition Process for Revenue Performance Obligations''

The following list outlines the steps of the Profit Recognition Process for revenue performance obligations and provides links as to where you can find additional information for each task:

-

Enter a job.

See Setting Up Jobs.

-

Create cost code structures under a job.

-

Set up RPO AAIs to identify cost and revenue account ranges.

-

Set up an RPO.

-

Select accounts for the RPO.

See Associating Accounts with a Revenue Performance Obligation.

-

Generate Profit Recognition Data for an RPO.

See Generating Profit Recognition Data for Revenue Performance Obligations.

-

Adjust revenue and cost amounts for an RPO.

See Revising Profit Recognition Records for Revenue Performance Obligations.

-

Create profit recognition journal entries at RPO level.

See Creating Profit Recognition Journal Entries for Revenue Performance Obligations.

-

Report on performance obligation status.

See Reviewing the Profit Recognition Job Status Report (R51445) for Revenue Performance Obligations.

5.2 Setting Up Revenue Performance Obligation AAIs

This section provides an overview of revenue performance obligation AAIs and discusses how to set up RPO AAIs.

5.2.1 Understanding Revenue Performance Obligation AAIs

During the life cycle of a project, various costs are incurred and there are rules that specify how the accounts are determined to record these costs. One rule is when working with revenue performance obligations (RPOs), you must set up RPO AAIs. RPO AAIs are similar to the AAIs that are set up at the job level, but the system uses RPO AAIs specifically when you run the Profit Recognition Build (R51800) at RPO level.

Use the Revenue Performance Obligation AAI Criteria program (P5104) to define RPO AAIs based on a match level and match value combination. During profit recognition at the RPO level, the system uses the AAI item number, match level, and match value to find the correct account to debit or credit.

When you set up cost and revenue AAI items, you have the option to specify a range of accounts. You can have more than one set of ranges per cost or revenue RPO AAI item, which means that you can have multiple rules (cost code/cost type ranges) with the same combination of values in the Match Level, Category Code, Match Value, and Effective Date fields.

For income statement and balance sheet AAI items, there can be only one rule (cost code/cost type ranges) for the same combination of values in the Match Level, Category Code, Match Value, Effective Date fields.

For AAI items other than cost account, revenue account, income statement and balance sheet, you can only define one rule for the same combination of values in the Match Level, Category Code, Match Value, and Effective Date fields.

When you add accounts to an RPO, there should not be any overlapping AAI definitions (date ranges) for same job, project, and RPO.

See Associating Accounts with a Revenue Performance Obligation

The system stores the RPO AAIs in the Revenue Performance Obligation AAI Criteria table (F5104).

To review how the system uses RPO AAI setup and the RPO record to select accounts, review the following example:

Example: Revenue Performance Obligation and RPO AAI Setup: Review Resulting Accounts

5.2.2 Forms Used to Set Up Revenue Performance Obligation AAIs

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Revenue Performance Obligation AAI Criteria | W5104A | Job Cost Setup menu (G5141), RPO AAI Criteria | Review and revise RPO AAIs. |

| Revenue Performance Obligation AAI Criteria - Revisions | W5104B | On the Work With Revenue Performance Obligation AAI Criteria form, click Add. | Set up RPO AAIs. |

5.2.3 Set Up Revenue Performance Obligation AAIs

Access the Revenue Performance Obligation AAI Criteria - Revisions form.

- AAI Item

-

Enter a value from UDC table 51/TY that defines an account or range of accounts used for a particular function in the system.

Values are:

001: Cost Account (JCST)

002: Revenue Account (JCCA)

003: Balance Sheet (BS)

004: Income Statement (IS)

005: Overbilling (JCBE)

006: Underbilling (JCCE)

007: Adj-Cost of Sales (JCBOUA)

008: Adj-Revenue (JCCOUA)

009: Loss (JCLOSS)

010: Offset-Loss (BSLOSS)

011: Accrued Cost (JCAPC)

012: Deferred Cost (JCSMJ)

013: Offset-Accrued Cost (JCAPO)

014: Offset-Deferred Cost (JCSMI)

015: Adj-Prj Final Cost (JCPFC)

016: Adj-Prj Final Profit (JCPFP)

016: Adj-Prj Final Profit (JCPFP)

017: Adj-Prj Final Revenue (JCPFR)

- Match Level

-

Enter a value from UDC table 51/TY that the system uses, in combination with the match value, to locate the required account details for the profit recognition process. The system uses the match level to specify the order in which the system searches for the RPO AAIs.

For match levels that correspond to category codes (match levels 2 and 4), you must also enter a value in the Category Code field. The system uses the category code to locate the required account details.

Values are:

1: Revenue Performance Obligation

2: Category Code of RPO

3: Job

4: Category Code of Job

5: Job Type

6: Project

7: Company

8: Default

- Category Code

-

Enter a value that indicates the category code that the system uses to define the RPO AAI setup. For match levels that correspond to category codes (match level values 2 and 4), the system uses this field, along with the Match Level field, to determine the values for the Match Value field.

Values are:

For Match Level 2 (RPO - Category Code): Any value between 1-10.

For Match Level 4 (JOB - Category Code): Any value between 1-50.

- Match Value

-

Enter a value that the system uses, in combination with the match level, to locate the required account details for the profit recognition process. The value that you enter in the Match Level field determines the available values in the Match Value field.

For example, if you enter match level 1 for revenue performance obligation, you must enter a valid revenue performance obligation number from the Revenue Performance Obligation Master table (F5102) in the Match Value field.

- Thru Cost Code

- From Cost Type

- Thru Cost Type

-

For AAIs that correspond to cost (001) and revenue (002) accounts, use these fields to define the cost code (subsidiary) and cost type (object) ranges.

- Resulting Business Unit

- Resulting Object

- Resulting Subsidiary

-

For AAIs that correspond to accounts other than cost (001) or revenue (002) accounts, use these fields to define a specific resulting account.

|

Note: For AAIs that correspond to balance sheet (003) and income statement (004) accounts: you can use the Thru Cost Code, From Cost Code, and Thru Cost Type fields, along with the Resulting Business Unit, Resulting Object, and Resulting Subsidiary to specify to which range of accounts the system uses the corresponding resulting accounts. |

5.3 Entering Revenue Performance Obligations

This section provides an overview of the revenue performance obligation setup, lists a prerequisite, and discusses how to:

-

Section 5.3.4, "Adding a Revenue Performance Obligation to a Job"

-

Section 5.3.5, "Associating Accounts with a Revenue Performance Obligation"

5.3.1 Understanding Revenue Performance Obligation Setup

A revenue performance obligation (RPO) is identified as a set of accounts that is associated with a job. You use an RPO to track specific costs and revenue for an obligation within a job.

An RPO has both master and detail information. Use the Revenue Performance Obligation Master program (P5102) to create a Revenue Performance Obligation (RPO) master record in the Revenue Performance Obligation Master table (F5102), similar to a job in Job Master Revision program (P51006).

After you set up the RPO master information, you add accounts to the RPO. The system stores these account details information in the Revenue Performance Obligation Detail table (F5103.) The system validates that any account (cost code and cost type combination) entered is not associated with another RPO. If you delete an RPO master record from the F5102 table, the system deletes the corresponding RPO detail records from the F5103 table.

You can copy the master information from an existing RPO to create a new RPO with unique detail information.

When working in the Job Cost Master Revisions program (P51006), you can quickly search for RPOs that are related to a specific job. Select a job and select RPO Master from the Row menu. The system displays the Work With Revenue Performance Obligation Master form with the selected job number populated in the QBE line of the grid.

To review how the system uses RPO AAI setup and the RPO record to select accounts, review the following example:

Example: Revenue Performance Obligation and RPO AAI Setup: Review Resulting Accounts

5.3.2 Prerequisites

Before you enter revenue performance obligations (RPOs), you must set up jobs in the Job Cost Master Revisions program (P51006).

See Setting Up Jobs.

5.3.3 Forms Used to Enter Revenue Performance Obligations

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Revenue Performance Obligation Master | W5102A | Job Cost Setup menu (G5141), RPO Master | Review and select revenue performance obligation records. |

| Revenue Performance Obligation Master Revisions | W5102B | On the Work With Revenue Performance Obligation Master form, select a record and click Select or click Add. | Add revenue performance obligations to a job. |

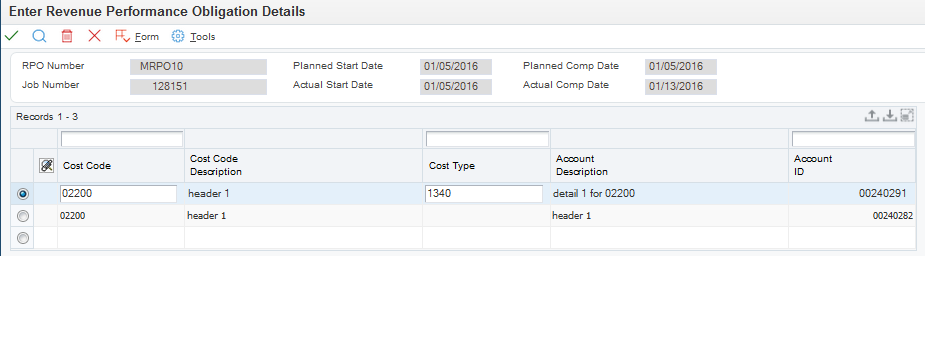

| Enter Revenue Performance Obligation Details | W5102D | On the Work With Revenue Performance Obligation Master form or the Revenue Performance Obligation Master Revisions form, select RPO Details from the Row menu. | Specify accounts to track costs associated with a revenue performance obligation. |

| Select Revenue Performance Obligation Accounts | W5102E | On the Enter Revenue Performance Obligation Details form, select Select RPO Accounts on the Form menu. | Search for and select one or more accounts to associate with an RPO. |

5.3.4 Adding a Revenue Performance Obligation to a Job

Access the Revenue Performance Obligation Master Revisions form.

- RPO Number

-

Enter an alphanumeric code that identifies a separate entity within a job for which you want to track costs independently of the entire job.

5.3.4.1 Revise Revenue Performance Obligation tab

- Description

-

Enter a unique name for the RPO.

- Job Number

-

Enter the job that the RPO is associated with.

5.3.4.2 More Detail tab

Use the Description Line 02, Description Line 03, and Description Line 04 fields to add additional descriptions to the RPO.

5.3.4.3 Cat Codes tab

Use the Cat Code 001 through Cat Code 010 fields to associate category codes with the RPO. Some examples of category codes for an RPO are territory, country, plant code, project supervisor, or RPO group code.

5.3.5 Associating Accounts with a Revenue Performance Obligation

Access the Enter Revenue Performance Obligation Details form.

- Cost Code

-

Enter a value that is the part of the account number that identifies a step, phase, or type of activity within a job, such as site work, earthwork, paving, or landscaping. The cost code is the subsidiary in a G/L account.

Note:

A subsidiary is optional for a G/L account. However, the cost code is required for each job cost account. - Cost Type

-

Enter a value that is the part of the account number that identifies a cost category within a cost code, such as labor, materials, equipment, and subcontracts. It can further divide a cost category into subcategories, such as regular time, premium time, and burden for labor. The cost type is the object account in a G/L account.

Note:

An object account is required for cost type accounts, but you do not use it for cost code headers.

If you do not know the values for the Cost Code or Cost Type fields, select RPO Accounts on the Form menu to access the Select Revenue Performance Obligation Accounts form. Use this form to search for and select one or more accounts to associate with an RPO.

5.4 Example: Revenue Performance Obligation and RPO AAI Setup: Review Resulting Accounts

This section provides an example of how the system determines resulting accounts when working with revenue performance obligations.

Review the following information for this example:

5.4.1 Example: Job Setup

Review the details of the job used in this example:

-

Job: J1

-

Job Type: JB

-

Project: 50

-

Company: 50

Review the RPO numbers listed under of the job J1:

-

RPO1

-

RPO2

-

RPO3

-

RPO4

Review the category codes used for job J1:

| Category Code Number (Description) | Value (Description) |

|---|---|

| 1 (Division) | 150 (New Construction) |

| 2 (Region) | 200 (Southwest) |

| 3 (Group) | 100 (John's Group) |

| 4 (Branch Office) | 150 (Denver) |

| 5 (Department Type) | 100 (Framing) |

5.4.2 Example: Revenue Performance Obligation Setup

Review the category code values for the following four RPOs in this example.

RPO Number: RPO1

Review the following category codes for RPO1:

| Category Code Number (Description) | Value |

|---|---|

| 1 (Territory) | 250 (Rolling Hills) |

| 2 (County) | 200 (Jefferson) |

| 3 (Facility) | CA (Canton) |

| 4 (Project Supervisor) | 100 (Erik Johnson) |

| 5 (RPO Group Code) | 100 (Priority) |

RPO Number: RPO2

Review the following category codes for RPO2:

| Category Code Number | Value |

|---|---|

| 1 (Territory) | 100 (Arrowhead) |

| 2 (County) | 500 (Denver) |

| 3 (Facility) | IN (Interstate) |

| 4 (Project Supervisor) | 100 (Erik Johnson) |

| 5 (RPO Group Code) | 100 (Priority) |

RPO Number: RPO3

Review the following category codes for RPO3:

| Category Code Number | Value |

|---|---|

| 1 (Territory) | 450 (Highlands) |

| 2 (County) | 500 (Denver) |

| 3 (Facility) | AR (Arista) |

| 4 (Project Supervisor) | 100 (Erik Johnson) |

| 5 (RPO Group Code) | 100 (Priority) |

RPO Number: RPO4

Review the following category codes for RPO4:

| Category Code Number | Value |

|---|---|

| 1 (Territory) | 250 (Rolling Hills) |

| 2 (Country) | 600 (Adams) |

| 3 (Facility) | US (Universal) |

| 4 (Project Supervisor) | 25 (Stephen Ward) |

| 5 (RPO Group Code) | 100 (Priority) |

5.4.3 Example: RPO AAI Setup

Review the following RPO AAI setup:

| RPO AAI Item | Match Level | Category Code Key Value | Match Value | From Cost Type | From Cost Code | To Cost Type | To Cost Code | Resulting BU | Resulting Object | Resulting Subsidiary |

|---|---|---|---|---|---|---|---|---|---|---|

| 001 | 1 | RPO1 | 1340 | 1350 | ||||||

| 001 | 1 | RPO1 | 1440 | 1450 | ||||||

| 001 | 3 | J1 | 1540 | 1550 | ||||||

| 002 | 1 | RPO2 | 1380 | 1390 | ||||||

| 002 | 1 | RPO3 | 1480 | 1490 | ||||||

| 002 | 5 | JB | 1580 | 1590 | ||||||

| 003 | 1 | RPO1 | 50 | 1392 | 9999 | |||||

| 003 | 2 | 1 | 100 | 50 | 1392 | 9800 | ||||

| 003 | 3 | J1 | 50 | 1392 | 9500 | |||||

| 004 | 1 | RPO2 | 50 | 6380 | 1000 | |||||

| 004 | 3 | J1 | 50 | 6380 | 2000 | |||||

| 004 | 2 | 2 | 200 | 50 | 6380 | 3000 | ||||

| 005 | 1 | RPO3 | 50 | 4165 | 99999 | |||||

| 005 | 6 | 50 | 50 | 4165 | 1000 | |||||

| 005 | 4 | 1 | 150 | 50 | 4165 | 1000 | ||||

| 006 | 1 | RPO1 | 50 | 1320 | 99999 | |||||

| 006 | 2 | 2 | 500 | 50 | 1320 | 99950 | ||||

| 006 | 5 | JB | 50 | 1320 | 99940 | |||||

| 007 | 2 | 3 | US | 50 | 6999 | 1000 | ||||

| 007 | 7 | 50 | 50 | 6999 | 2000 | |||||

| 008 | 1 | RPO1 | 50 | 5520 | 1000 | |||||

| 008 | 6 | 50 | 50 | 5520 | 2000 | |||||

| 009 | 1 | RPO1 | 50 | 6998 | 1000 | |||||

| 009 | 8 | 50 | 6998 | 2000 | ||||||

| 010 | 1 | RPO1 | 50 | 4166 | 1000 | |||||

| 010 | 5 | JB | 50 | 4166 | 2500 | |||||

| 011 | 5 | JB | 50 | 1371 | 1000 | |||||

| 012 | 7 | 50 | 50 | 1371 | 99999 | |||||

| 013 | 5 | WB | 50 | 4112 | 99999 | |||||

| 014 | 1 | RPO1 | 50 | 1330 | 99999 | |||||

| 015 | 8 | 50 | 1378 | 99999 | ||||||

| 016 | 1 | RPO1 | 50 | 1399 | 99999 | |||||

| 017 | 5 | JB | 50 | 1380 | 99999 | |||||

| 017 | 2 | 4 | 100 | 50 | 1380 | 99999 |

5.4.4 Example: Resulting Accounts

The following sections explain the resulting accounts.

5.4.4.1 RPO1

Review the resulting accounts for RPO1

Cost Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1340/1440 | 1350/1450 |

Revenue Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1580 | 1590 |

AAI accounts derived by the system due to the setup:

| RPO AAI Item (Description) | Resulting Business Unit | Resulting Object | Resulting Subsidiary |

|---|---|---|---|

| 003 (BS) | 50 | 1392 | 9999 |

| 004 (IS) | 50 | 6380 | 3000 |

| 005 (JCBE) | 50 | 4165 | 1000 |

| 006 (JCCE) | 50 | 1320 | 99999 |

| 007 (JCBOUA) | 50 | 6999 | 2000 |

| 008 (JCCOUA) | 50 | 5520’ | 1000 |

| 009 (JCLOSS) | 50 | 6998 | 1000 |

| 010 (BSLOSS) | 50 | 4166 | 1000 |

| 011 (JCAPC) | 50 | 1371 | 1000 |

| 012 (JCSMJ) | 50 | 1371 | 99999 |

| 013 (JCAPO) | **Not defined** | **Not defined** | **Not defined** |

| 014 (JCSMI) | 50 | 1330 | 99999 |

| 015 (JCPFC) | 50 | 1378 | 99999 |

| 016 (JCPFP) | 50 | 1399 | 99999 |

| 017 (JCPFR) | 50 | 1380 | 99999 |

5.4.4.2 RPO2

Review the resulting accounts for RPO2

Cost Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1540 | 1550 |

Revenue Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1380 | 1390 |

AAI accounts derived by the system due to the setup:

| RPO AAI Item (Description) | Resulting Business Unit | Resulting Object | Resulting Subsidiary |

|---|---|---|---|

| 003 (BS) | 50 | 1392 | 9800 |

| 004 (IS) | 50 | 6380 | 1000 |

| 005 (JCBE) | 50 | 4165 | 1000 |

| 006 (JCCE) | 50 | 1320 | 99950 |

| 007 (JCBOUA) | 50 | 6999 | 2000 |

| 008 (JCCOUA) | 50 | 5520 | 2000 |

| 009 (JCLOSS) | 50 | 6998 | 2000 |

| 010 (BSLOSS) | 50 | 4166 | 2500 |

| 011 (JCAPC) | 50 | 1371 | 1000 |

| 012 (JCSMJ) | 50 | 1371 | 99999 |

| 013 (JCAPO) | **Not defined** | **Not defined** | **Not defined** |

| 014 (JCSMI) | **Not defined** | **Not defined** | **Not defined** |

| 015 (JCPFC) | 50 | 1378 | 99999 |

| 016 (JCPFP) | **Not defined** | **Not defined** | **Not defined** |

| 017 (JCPFR) | 50 | 1380 | 99999 |

5.4.4.3 RPO3

Review the resulting accounts for RPO3

Cost Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1540 | 1550 |

Revenue Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1480 | 1490 |

AAI accounts derived by the system due to the setup:

| RPO AAI Item (Description) | Resulting Business Unit | Resulting Object | Resulting Subsidiary |

|---|---|---|---|

| 003 (BS) | 50 | 1392 | 9500 |

| 004 (IS) | 50 | 6380 | 2000 |

| 005 (JCBE) | 50 | 4165 | 99999 |

| 006 (JCCE) | 50 | 1320 | 99950 |

| 007 (JCBOUA) | 50 | 6999 | 2000 |

| 008 (JCCOUA) | 50 | 5520 | 2000 |

| 009 (JCLOSS) | 50 | 6998 | 2000 |

| 010 (BSLOSS) | 50 | 4166 | 2500 |

| 011 (JCAPC) | 50 | 1371 | 1000 |

| 012 (JCSMJ) | 50 | 1371 | 99999 |

| 013 (JCAPO) | **Not defined** | **Not defined** | **Not defined** |

| 014 (JCSMI) | **Not defined** | **Not defined** | **Not defined** |

| 015 (JCPFC) | 50 | 1378 | 99999 |

| 016 (JCPFP) | **Not defined** | **Not defined** | **Not defined** |

| 017 (JCPFR) | 50 | 1380 | 99999 |

5.4.4.4 RPO4

Review the resulting accounts for RPO4

Cost Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1540 | 1550 |

Revenue Account Range:

| From Cost Type | To Cost Type |

|---|---|

| 1580 | 1590 |

AAI accounts derived by the system due to the setup:

| RPO AAI Item (Description) | Resulting Business Unit | Resulting Object | Resulting Subsidiary |

|---|---|---|---|

| 003 (BS) | 50 | 1392 | 9500 |

| 004 (IS) | 50 | 6380 | 2000 |

| 005 (JCBE) | 50 | 4165 | 1000 |

| 006 (JCCE) | 50 | 1320 | 99940 |

| 007 (JCBOUA) | 50 | 6999 | 1000 |

| 008 (JCCOUA) | 50 | 5520’ | 2000 |

| 009 (JCLOSS) | 50 | 6998 | 2000 |

| 010 (BSLOSS) | 50 | 4166 | 2500 |

| 011 (JCAPC) | 50 | 1371 | 1000 |

| 012 (JCSMJ) | 50 | 1371 | 99999 |

| 013 (JCAPO) | **Not defined** | **Not defined** | **Not defined** |

| 014 (JCSMI) | **Not defined** | **Not defined** | **Not defined** |

| 015 (JCPFC) | 50 | 1378 | 99999 |

| 016 (JCPFP) | **Not defined** | **Not defined** | **Not defined** |

| 017 (JCPFR) | 50 | 1380 | 98999 |

5.5 Updating Percent Complete at the Revenue Performance Obligation Level

To update the percent complete at the RPO level, the process is the same as when you update the percent complete for a job. Access the Update Percent Complete program (P511112) by navigating to the Job Cost Master Revisions program (P51006), selecting a job, and selecting Update % Complete from the Row menu.

On the Update Percent Complete form, enter P in the Subledger Type field to search on the Revenue Performance Obligation subledger type. When you enter P in the Subledger Type field, use the Subledger Value field to search on all RPOs for the job or enter a specific RPO from the Revenue Performance Obligation Master table (F5102).

To review additional information on updating the percent complete, review the following section:

Updating the Percent Complete for a Job (Release 9.1 Update)

5.6 Generating Profit Recognition Data for Revenue Performance Obligations

Run the Profit Recognition Build report (R51800) to calculate actual and budget amounts, projected final values, and percent complete. In final mode, the system also generates records in the Profit Recognition table (F5144) and Profit Recognition Account Balance table (F5145). To run P51800 at RPO level, you must enter 4 (Revenue Performance Obligation level) in the Summarization Level processing option.

See Setting Processing Options for Profit Recognition Build (R51800) (Release 9.1 Update)

The system compares the value in the Threshold processing option with the percent complete of each RPO separately and validates the Recognition Threshold Percent for an RPO, which controls when to start recognizing profit for this RPO. To review when the system starts recognizing profit for an RPO, review the following section:

Generating Profit Recognition Data (Release 9.1 Update)

The system uses the Subledger and Subledger Type fields to store the RPO number in the F5144 and F5145 tables. Subledger type P refers to the RPO number. The system reviews whether the adjustments for revenue, cost, and percent complete were made at the job level or at the RPO level, and accordingly posts profit recognition records to either the accounts at the job level or to the accounts at the RPO level.

|

Caution: If you have a job that is being worked on before the FASB/IASB Revenue Recognition 2014 standard goes into effect, you can run Profit Recognition at the job or project level for this job. If, when the new standard goes into effect, the job is still active and you need to recognize revenue at a different summarization level (which could be by project, job, RPO or subledger), you can run the R51800 report at the new level.In order to rerun the R51800 report at a different summarization level, you must first mark the existing records as obsolete. To do so, you run the Obsolete Profit Recognition Records report (R51446). Generally, there is a constraint in place that prevents this, but in the transitory time between standards you may want to change the way you run Profit Recognition. There may also be times after the FASB/IASB Revenue Recognition 2014 standard goes into effect that you may also need to change the level of summarization because of changes in a contract(s) and identified performance obligations with your customer(s). |

You can regenerate profit information for closed periods when adjustments are needed. The system displays an error message when re-opening of prior closed fiscal periods, after the journal entries have been created for that fiscal period for the given RPO. The system displays this error to specify that the records need to be regenerated so that RPO-to-date balances are correct in the F5144 table.

The system stores a history version of the information in Profit Recognition History File (F5144) with the same generation date and financial information stored at RPO level.

5.7 Revising Profit Recognition Records for Revenue Performance Obligations

Use the Single Job Adjustments program (P51440) to select individual revenue performance obligations (RPOs) for a job and make adjustments at the RPO level. You cannot add or delete profit recognition information in the P51440 program.

To select an RPO in order to make an adjustment, enter P (Revenue Performance Obligation) in the Subledger Type field on the Work with Profit Recognition Versions form. Click Select to access the Single Job Adjustments form, where you can select Account Adjustment from the Form menu to access the Account Adjustment form.

Use the Account Adjustment form to review and revise amounts for individual accounts in the profit recognition record. You can update projected final amounts for a selected RPO, and when you do so, the system recalculates the rest of the fields based on the recognition method (percentage of cost / percentage of revenue). When you adjust the cost amount using the Accrual/Deferral field in the header on the Single Job Adjustments form, the system adjusts the Actual Cost to Date amount and recalculates the profit data.

For additional information on reviewing profit recognition records and revising the accounts in the profit recognition records, review the following section:

5.8 Creating Profit Recognition Journal Entries for Revenue Performance Obligations

To generate the journal entries for the accounts that are used in the profit recognition process, you must run the Create Journal Entries program (R51444). The system uses the records in the Profit Recognition table (F5144) to determine whether to create journal entries for RPO-level records or for other level records. The system creates the records in the F5144 table at different levels based on the value in the Summarization processing option in the Profit Recognition Build (R51800).

See Creating Profit Recognition Journal Entries for Revenue Performance Obligations

See Setting Processing Options for Profit Recognition Build (R51800) (Release 9.1 Update)

When you run the Create Journal Entries program (R51444) for RPOs, the system uses the RPO AAIs to determine the accounts to use for the debit and credit journal entries. You set up RPO AAIs in the Revenue Performance Obligation AAI Criteria program (P5104).

See Setting Up Revenue Performance Obligation AAIs

When creating journal entries for RPOs, the system uses records from the Revenue Performance Obligation Master table (F5102) and the Revenue Performance Obligation Detail table (F5103).

The system validates the history profit recognition journal entries in the F0911 table before posting in order to include only the incremental change in profit for a given RPO. This is important if you try to change the estimated profits for an RPO when profit has already been recognized.

5.9 Reviewing the Profit Recognition Job Status Report (R51445) for Revenue Performance Obligations

You can run the Profit Recognition Job Status report (R51445) for RPOs to review the following information:

-

Actual amounts

-

Budget amounts

-

Projected final amounts

To run the R51445 report for RPOs, use data selection to specify that the system selects profit records that correspond to the RPO summarization level. For profit records at the RPO summarization level, the system uses a section layout that is specific for RPOs. In addition to the grand total, the report totals RPO level profit recognition records at job level as well.

See R51445 Profit Recognition Job Status (Release 9.1 Update)