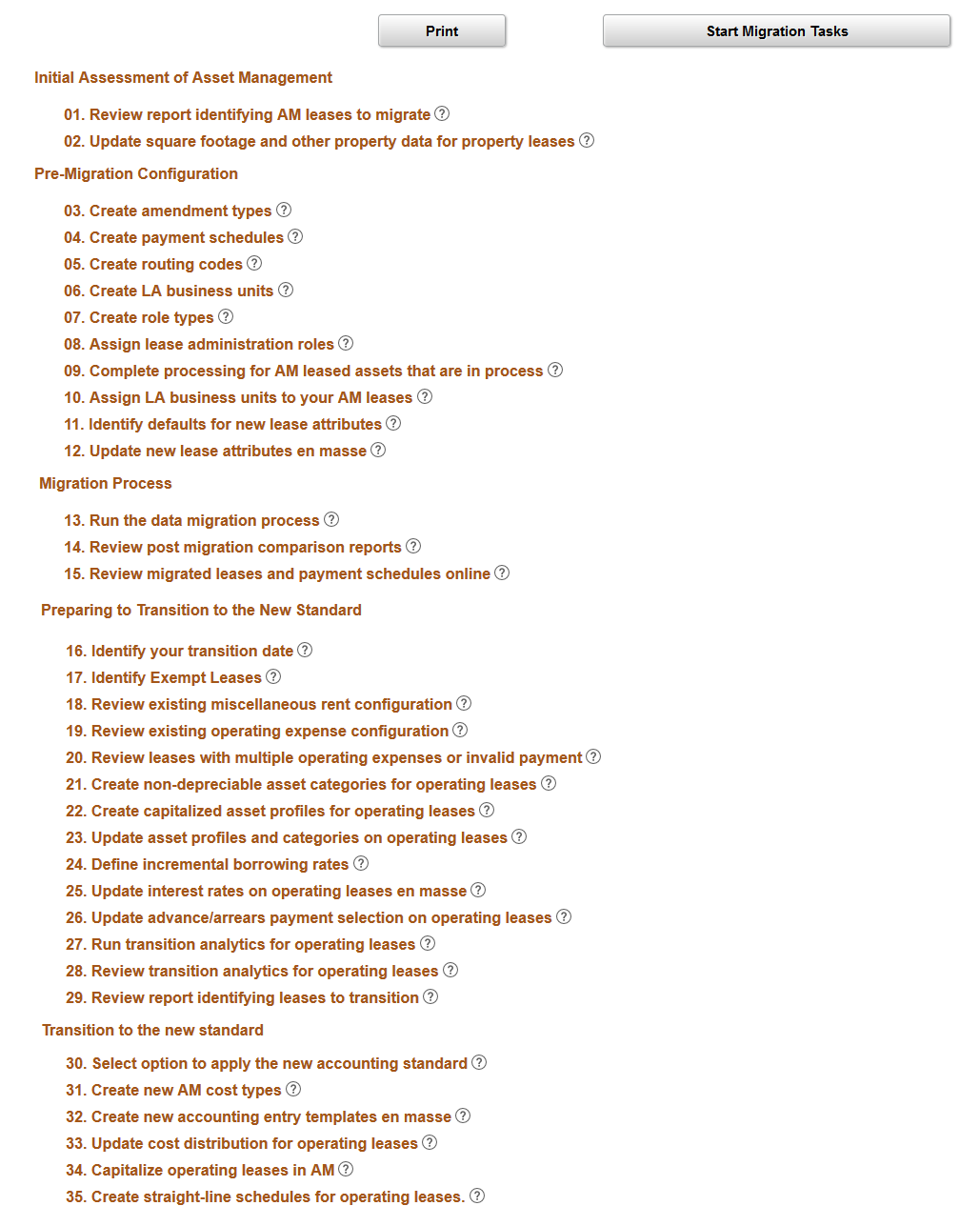

Using the Activity Guide

An activity guide is the central point where customers execute the tasks necessary to complete the data migration from Asset Management (AM) to Lease Administration (LA). The guide also includes tasks to transition your leases to the new accounting standard ASC 842, GASB 87, and IFRS 16. See Understanding the Data Migration and Transition Process.

There are five sections to the activity guide:

Initial Assessment of Asset Management — review your existing Asset Management leases and update certain information on your property leases.

Pre-Migration Configuration — configure Lease Administration to work with your leases being migrated from AM. You must complete shared product configuration in Lease Administration before leased assets from AM can be migrated into the LA data structure.

Migration Process — an online process is executed to migrate leased asset information in AM to the LA data structure. This includes both finance and operating leased assets.

Preparing to Transition to the New Standard— review and adjust configuration to prepare for the initial capitalization of operating leased assets.

Transition to the New Standard — review existing accounting configuration and add new accounting configuration to support processing under the new accounting standard. You will then capitalize your operating leased assets and run the straight-line accounting process creating the monthly amortization of your leased asset and lease liability.

Navigation from Lease Administration:

Navigation:

. Click the button Start Migration Tasks.

Navigation from Asset Management:

Navigation:

. Click the button Start Migration Tasks.

This example illustrates the fields and controls on the Migration Tasks page.

The migration process can be started by clicking the Start Migration Tasks button.

In this section you can review existing Asset Management leases and update certain information on your property leases. Only AM leases are impacted. Other tasks in the guide, particularly those in the transition section will apply to both AM leases and leases originating in LA (LA leases).

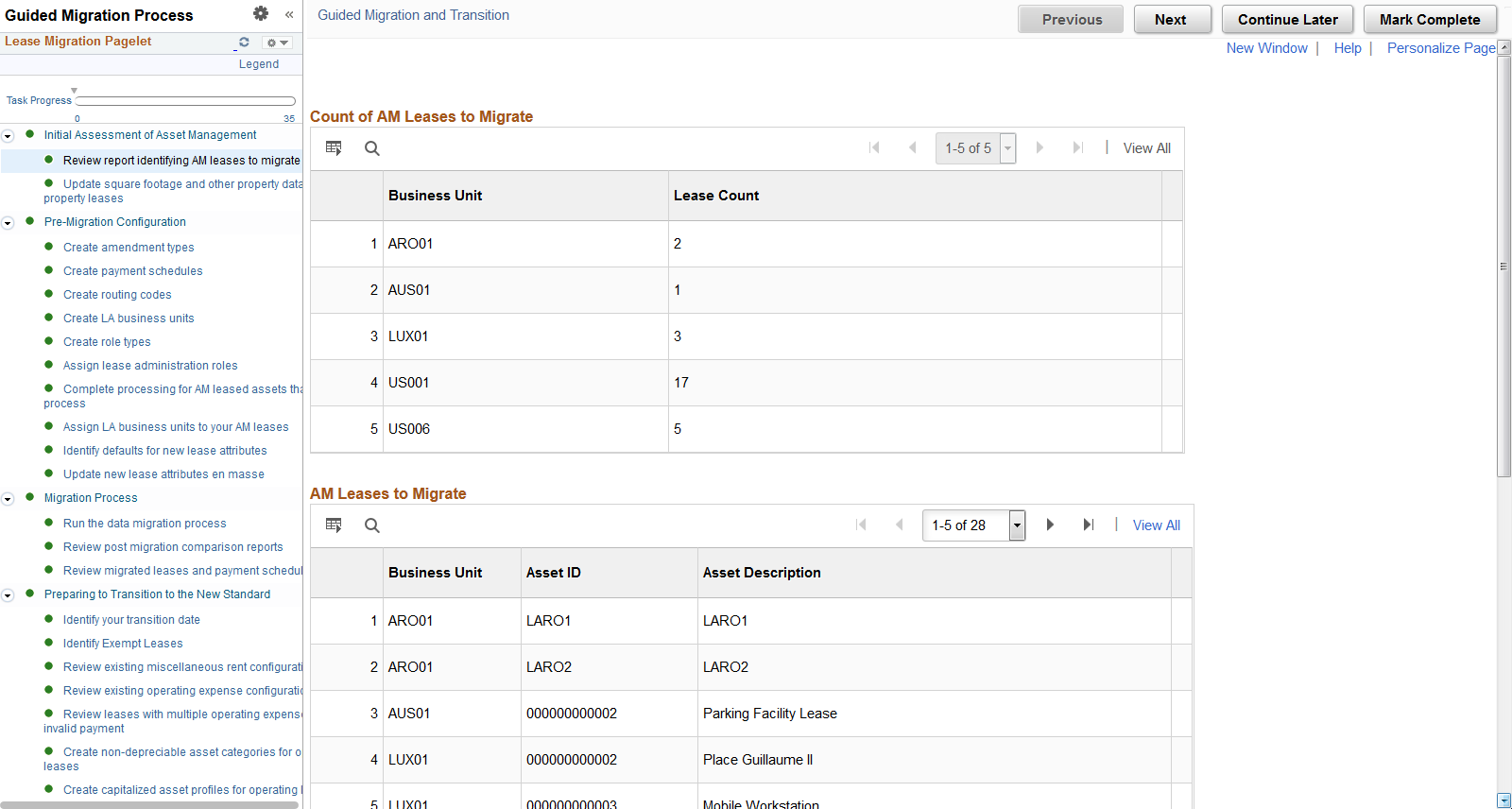

Review Report Identifying AM Leases to Migrate

Use this page to review a summarized count and detailed asset-by-asset listing of AM leases to migrate to LA. This report is applicable only for AM leases. ‘Partially Migrated AM Leases’ are included in this report and represent a subset of AM leases. A 'Partially Migrated' lease is an AM lease that has some of its data already stored in the LA data structure. Customers that own LA that have AM leases have had the ability to start entering data into the LA date structure since Update Image 10. From a technical perspective, the migration of these leases is slightly different since some of their lease data is already in the LA data structure.

This example illustrates the fields and controls on the Review report identifying AM leases to migrate page.

Update Square Footage and Other Property Data for Property Leases

Use this page to update AM property leases for square footage and other property related attributes required in LA.

The attributes include Total Area, Unit of Measure, Usable Area, Rentable Area and Occupancy Date. These fields were not available to AM customers, but are required in LA. This page should be used to update property related attributes before migrating the lease. Failure to do so will not prevent you from migrating the lease. However, if the information is not populated, users will receive errors after data migration when processing a lease amendment in LA.

This example illustrates the fields and controls on the Update Square Footage and Other Property Data for Property Leases page.

This section includes tasks to implement Asset Management's shared product functionality with the Lease Administration product. Certain tasks also apply to LA customers who have AM leases. These organizations will review and potentially adjust existing LA configuration to accept AM leases during migration.

Create Amendment Types

Use this page to create amendment types in LA. Lease Administration uses amendment processing to track changes to a lease after lease activation. This impacts AM customers configuring shared product functionality with LA for the first time. See Working with Amendments.

Create Payment Schedules

Use this page to create payment schedules in LA. New payment schedule configuration in LA will replace existing AM payment schedule configuration. This impacts AM customers configuring shared product functionality with LA for the first time.

Asset Management customers should configure the lease payment schedules that will be required after data migration.

Create Routing Codes

Use this page to create transaction routing codes. This impacts AM customers configuring shared product functionality with LA for the first time. See Defining Transaction Routing Codes.

Create LA Business Units

Use this page to create your LA business units. AM business units are mapped to LA business units. This page can also be used by LA customers to review configuration for their existing LA BUs. This task impacts both AM and LA customers. See Creating Lease Administration Business Units.

Create Role Types

Use this page to create role types in LA. This impacts AM customers configuring shared product functionality with LA for the first time. Role types are identified to role categories. You should create at least one role type for each Internal role category. See Defining Lease Administration Roles.

Assign Lease Administration Roles

Use this page to assign roles to users. This impacts AM customers configuring shared product functionality with LA for the first time. End users working in LA should be assigned roles. These roles identify whether the user can:

Approve (and adjust) lease payment transactions for payables processing.

Create manual fee transactions.

Create lease amendments.

Complete Processing for AM Leased Assets that are in Process

Use this page to review assets in the interface table. Links in the AM WorkCenter can be used to complete processing for AM leased assets that are in process. The AM WorkCenter can be used to review pending transactions and exceptions under My Work.

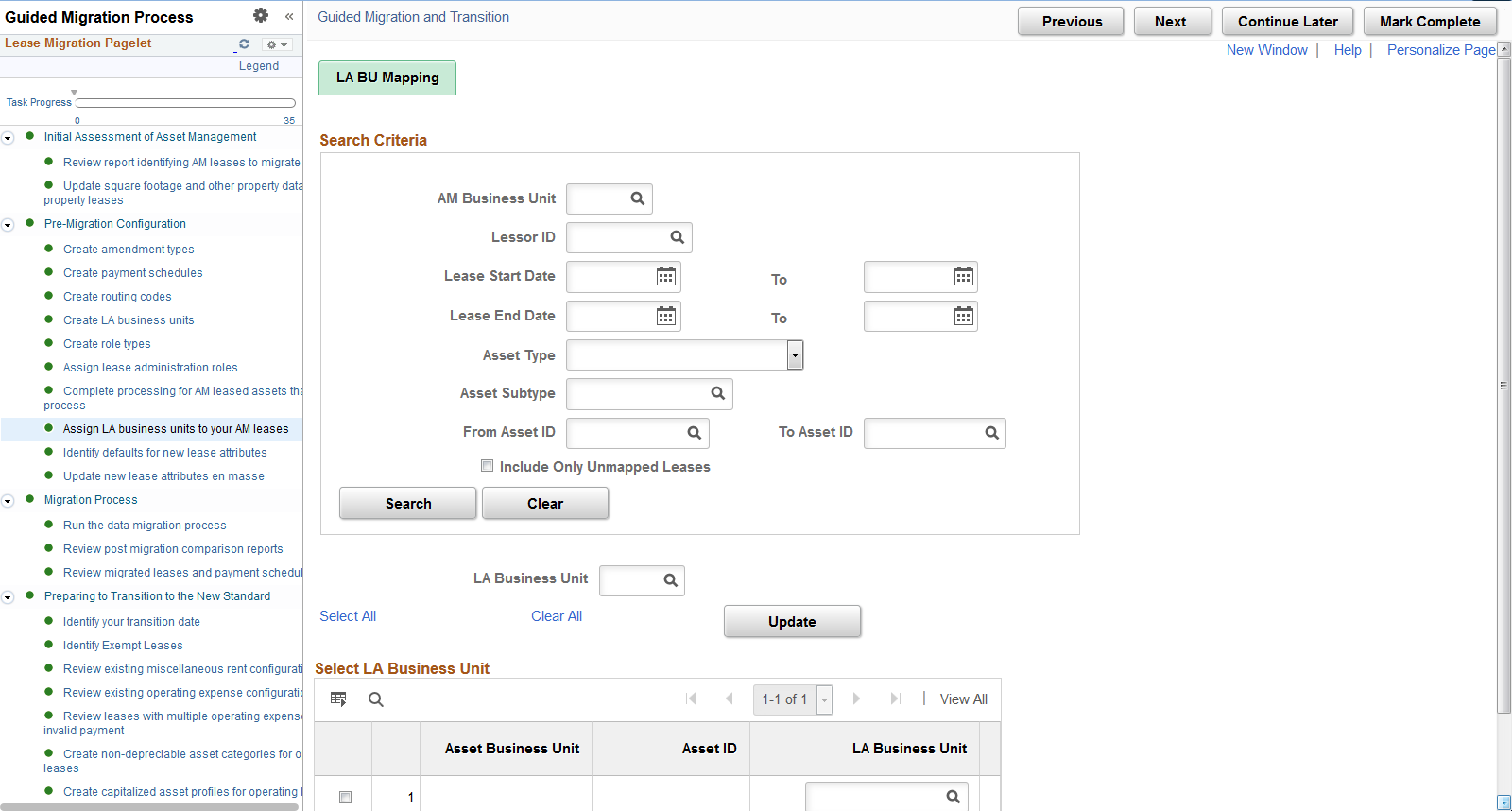

Assign LA Business Units to Your AM Leases

Use this page to review (and adjust if necessary) the LA Business Unit (LA BU) being assigned to your AM leases during migration. This task is important for a successful data migration.

The page shows a listing of your AM leases including the LA BU to which the lease will be mapped. More specifically, when you create an LA BU, you identify its related AM BU. This relationship determines the LA BU used for migration. In this task of the activity guide, the LA BU is populated and display only if the AM BU is mapped to only one LA BU. If the AM BU is mapped to multiple LA BU's, you must select a LA BU for the lease. In this scenario, the migration process does not know which LA BU the asset belongs in until you identify it on the page.

This example illustrates the fields and controls on the Assign LA Business Units to Your AM Leases page.

Identify Defaults for New Lease Attributes

Use this page to identify the default values for required fields on the lease. This impacts AM leases.

Asset Management is not tracking certain fields that are required once leases are migrated. This includes Lease Type, Region Code, Lease Administrator and Portfolio Manager. You should use this task to create your organization-specific values for these attributes and to assign a default value for each of the attributes. You must enter a default value for all the attributes on this page, else your AM leases cannot be migrated.

This example illustrates the fields and controls on the Identify Defaults for New Lease Attributes page.

Update New Lease Attributes en masse

Use this page to update new lease level identifiers en masse or individually. This impacts AM leases.

You can use this page to provide a more specific value for Lease Type, Region Code, Lease Administrator and Portfolio Manager for each of your leases. This is optional. If a lease is not updated here, on this task, then the defaults from the previous task will be used during data migration. Also, you must ensure that each lease has a lessor ID populated, else the lease cannot be migrated to LA. If you process lease payments through accounts payable, the supplier ID on the lease in AM will become the lessor on the lease in LA and this column is display only. You must identify a lessor before the lease can be migrated. To update information en masse, first select a LA Business Unit just below the search criteria. Next, select values for the fields being updated and select Update. Once complete, save the changes.

This example illustrates the fields and controls on the Update New Lease Attributes en masse page.

This section includes tasks related to running the Migration Process followed by tasks to review the results of the data migration online.

Run the Data Migration Process

Use this page to run the data migration process.

The data migration process is an application engine process run through the process scheduler. You can migrate one or many assets at once by selecting the check box next to the assets in the grid. The following validations will prevent a lease from being migrated:

No lease type, region code, lease administrator or portfolio manager for the lease.

No supplier/lessor for the lease.

No default value for AM interim rent.

No LA BU for the lease (note that leases without an assigned LA BU will be excluded from this page altogether).

After the lease is migrated to LA, you can access the lease through the pages shared with Lease Administration.

This example illustrates the fields and controls on the AM Leases Migration page.

This example illustrates the fields and controls on the AM Leases Migration page.

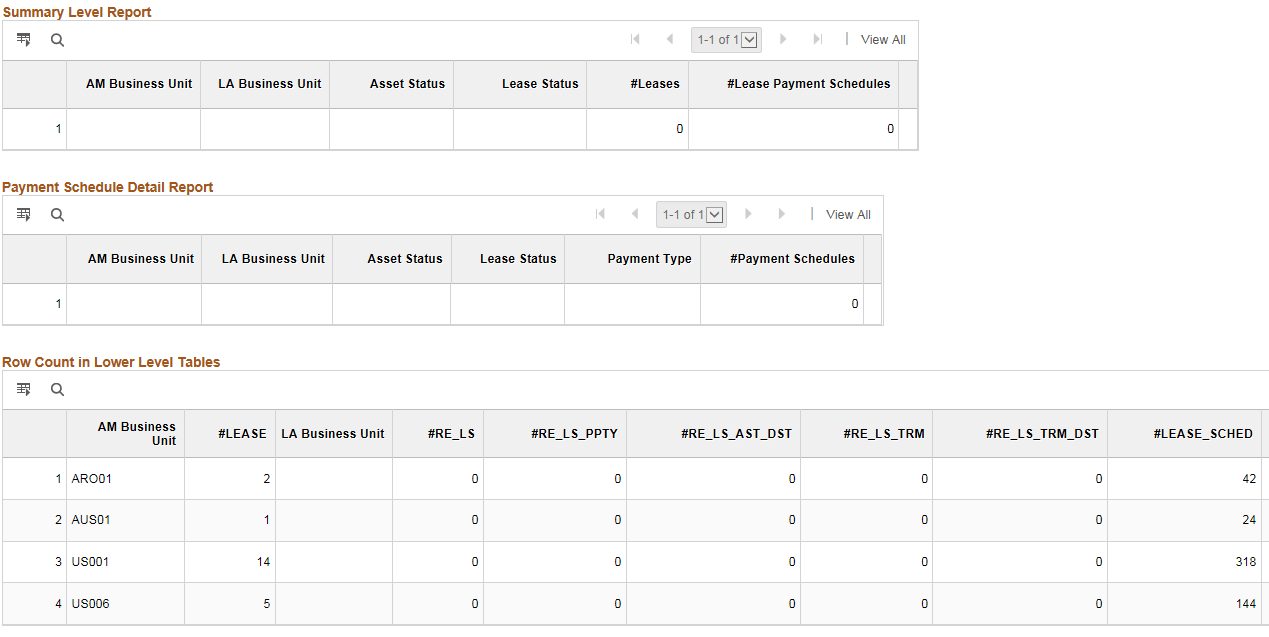

Review Post Migration Comparison Reports

Use this page to compare a count of leases in AM to a count of leases migrated to LA.

Summary Level Report — compares the number of leases in AM by business unit to the number of leases in LA by business unit. The report displays asset status and lease status.

Payment Schedule Detail Report — details the payment schedules created in LA by payment type. The payment schedule migration is an important part of the data migration. This report summarizes the types of payment schedules created in LA.

Row Count in Lower Level Tables — provides a count of the rows populated in the LA tables. This includes only the leases migrated from AM. Even after data migration this report will only include leases migrated from AM.

This example illustrates the fields and controls on the Review Post Migration Comparison Reports.

Review Migrated Leases and Payment Schedules Online

Use this page to perform an online review of the leases migrated from AM into LA. This page provides a detailed, asset-level view of the leases migrated from AM to LA.

Detail 1 — provides high-level view of the lease including BU, lease name and other lease attributes defined for the migration. Select the Lease Number link to view the lease.

Detail 2 — provides start and end date, lease administrator and other lease attributes defined for the migration.

Detail 3 — provides visibility into the types of lease payments created in LA and a link to view those lease payments on the Financial Terms page on the lease.

You can click the links for Base Rent, Purchase Option, Penalty Option and Interim Rent to view the payment schedules migrated from AM into LA. The link first opens the Financial Terms page on the lease. From the Financial Terms page, select the rent payment. After selecting the rent payment, you can review the start and end dates for the payment along with the payee. All payment information on this page are migrated from AM.

The data migration process does not populate values for Schedule, Frequency and Terms Calendar. When you open the page, the terms calendar defaults from the Lease Administration BU. The data migration process sets the Integrate with Accounts Payable selection to checked on base rent payments if the AM BU was set to process lease interface payments with AP. Purchase options and penalties migrated from AM were set to not integrate with accounts payable (unchecked) since these payments were not integrated with AP previously. You can update this selection through amendment processing. The data migration process does not generate a detailed payment schedule for one-time payments such as purchase options migrated from AM since there is only one payment. These amounts are included in the PVLP calculation.

This example illustrates the fields and controls on the Review Migrated Leases and Payment Schedules Online page.

This section details the steps required for successful transition to accounting standards ASC 842, IFRS 16, and GASB 87. This includes tasks to configure Asset Management to function under the new accounting standard such as the creation of new accounting entry templates. Other tasks prepare LA for the initial capitalization of operating leased assets such as the identification of interest rates used to calculate Present Value of Lease Payments (PVLP) calculations. Tasks in this section impact both AM operating leases migrated to LA and operating leases originating in LA (LA Operating Leases).

Note: The ‘Identify Exempt Leases’ step will not appear until you delete the existing activity guide template LA_MIG_TRA. For information about how to delete an activity guide template, see the task ‘Creating and Maintaining Activity Guide Templates’ in the PeopleTools: Portal Technology documentation.

If you have entered functional data into the activity guide, that data is not deleted. However, the progress icon to the left of each step indicating that you have started or completed a task is reset.

Identify Your Transition Date

Use this page to identify and update your organization's transition date. This should be the effective date your organization will adopt the new accounting standard. Payments made on or after this date will be included in the initial capitalization of your operating leases.

This example illustrates the fields and controls on the Identify Your Transition Date page.

Identify Exempt Leases

Use this page to identify leases that are exempt from recognition.

This example illustrates the fields and controls on the Identify Exempt Lease page.

Select the Exempt from Recognition option to identify exempt leases.

Exempt leases are automatically excluded from the following activity guide tasks:

Update Interest Rates on Operating Leases en Masse

Update Advance/Arrears Payment Selection on Operating Leases

Run Transition Analytics for Operating Leases

Review Transition Analytics for Operating Leases

Review Report Identifying Leases to Transition

Update Cost Distribution for Operating Leases

Capitalize Operating Leases in AM

Review Existing Miscellaneous Rent Configuration

Use this page to review and adjust the Include in Lease Payments selection on your miscellaneous rent payments.

A miscellaneous rent with the Include in Lease Payments box selected will be included in the initial capitalization of an operating leased asset. If an operating lease includes a misidentified miscellaneous rent, the initial capitalization of the asset will be incorrect. See Defining Miscellaneous Rent Types.

Review Existing Operating Expense Configuration

Use this page to review and adjust the Include in Lease Payments selection on your operating expenses. An operating expense with the Include in Lease Payments box selected will be included in the initial capitalization of an operating leased asset. See Establishing Operating Expenses for a Lease.

Review Leases with Multiple Operating Expenses and Invalid Payment

Use this page to review and resolve three exceptions/issues for leases. This applies primarily to leases originating in LA (LA leases), but also to AM leases that were modified after being migrated to LA. This step is critical to ensuring an accurate calculation of PVLP on your operating leases, the amount used for capitalizing your operating leased assets. The three exceptions are:

Operating Expenses with Multiple Expense Categories — for proper calculation of PVLP, an operating expense payment on a lease can be either included in lease payments or not included in lease payments, but not both. You must adjust the lease to break out the combined payment into two separate payments before capitalizing the lease.

Overlapping Payment Dates Within a Payment Group — this exception includes leases that have overlapping payment dates within a payment group. This exception applies to existing LA operating leases with multiple payments within a payment type. The payment group number must be different if the dates overlap with another payment. Note that overlapping payment dates are permitted across payment types. You must adjust the lease to correct this exception before capitalizing the lease.

Gaps in Payment Dates Within a Payment Group - this exception includes leases that have multiple payments within a payment group with gaps in payment start dates between the payments. Some of these gaps may be correct and should not be adjusted, however that determination must be made by the organization based on the following guidance:

The system calculates PVLP based on the start date for the individual payment which is not necessarily the start date on the lease. If the payment should be discounted back to the start date of the lease, then the start date for the individual payment should be the same as the start date on the lease.

The system will not validate if the Gaps in Payment Date exception has been cleared when the lease is capitalized since some of these may be correct. However, this exception has to be reviewed to ensure that the payment dates are setup correctly.

This example illustrates the fields and controls on the Review Leases with Multiple Operating Expenses or Invalid Payment page.

Create Non-Depreciable Asset Categories For Operating Leases

Use this page to modify your existing asset categories or create new asset categories for your operating leased assets. Categories used for operating leases must be identified as non-depreciable.

Under the new accounting standards, you amortize operating lease assets. You do not depreciate them. You should review your existing asset categories to determine which asset categories you are using for operating leased assets currently and verify they are setup as non-depreciable. You may also create new asset categories for your operating leased assets with a status of non-depreciable. Your asset categories used on finance lease assets should already be configured as depreciable and you should only need to identify a Related Lease Category. After transitioning to the new lease accounting standard, a lease modification may require the lease to be reclassified from operating to finance or vice versa. The Related Lease Category is used in the reclassification. See Categories Page.

For all asset categories assigned to your operating leased assets, you must select a status of non-depreciable, else you cannot capitalize the asset in AM.

Create Capitalized Asset Profiles for Operating Leases

Use this page to create new capitalized asset profiles for operating leases. New profiles should have an acquisition code of leased, set as capitalized asset, and have a non-depreciable status. In a subsequent task, you will update the asset profile and asset category for your operating leased assets individually or en masse using the profiles created on this task. See Setting Up Asset Profiles.

Update Asset Profiles and Categories on Operating Leases

Use this page to update the asset profile and asset category on your operating leases. You can do this individually on an asset-by-asset basis or en masse. This applies to LA leases primarily, but also to some AM leases particularly those that do not have an asset profile.

Asset profiles and categories are required on all operating leases before you can capitalize them in AM. The New Asset Category will default based on the asset profile configuration, but you can update it to another value. If you change the asset profile for a specific asset in the grid using the prompt, the system will default a new asset category based on the new asset profile.

Asset profiles provide a template for depreciation and tax information when you capitalize the asset in AM. Asset categories classify assets by type for accounting purposes.

This example illustrates the fields and controls on the Update Asset Profiles and Categories on Operating Leases page.

Define Incremental Borrowing Rates

Use this page to define your organization’s incremental borrowing rates. As part of your transition to the new accounting standard and capitalization of your operating leased assets, the system uses the incremental borrowing rate to calculate PVLP for your operating leases. In a subsequent task in the activity guide, you will update your leases to use the incremental borrowing rates entered here, on this task.

Organizations electing to restate their prior year reports should consider entering rates as follows:

You should enter one incremental borrowing rate with an ‘early’ effective date, for example 1/1/1901, a date earlier than the earliest start date on your operating leases. The system will apply this rate to leases starting before the earliest restatement date. This applies to AM and LA operating leases.

You should enter additional effective dated rows to identify rate changes DURING your restatement period. If your incremental borrowing rate changed during the restatement period, you should have an effective dated row with that rate. The system will apply these effective dated rates to leases starting during the restatement period.

To use a single rate for all of your leases as of your transition date, you would only need to enter one effective dated row. The row should have an 'early date' to include all of your leases. However, the rate entered for this effective dated row should be your organization's borrowing rate as of your transition date.

Update Interest Rates on Operating Leases en masse

Use this page to review and confirm the interest rates used to calculate initial cost (PVLP) on your operating leases.

You can review leases for an entire LA BU or AM BU, filter results for a specific lease or lease type or review leases with specific ranges for lease start date. The first time you open the page, the system will populate the Suggested Rate based on the way you have configured your incremental borrowing rate (the previous step in the guide), the start date of the lease and whether you report the lease under FASB or IASB. When you save the page the suggested interest rate is saved in the system. This applies to all leases displayed not just the leases selected with the check box. The check box on the grid is used to update leases en masse.

You might need to refresh the suggested rate if you had to go back and update your incremental borrowing rates after already reviewing and saving rates for your leases. To refresh the Suggested Interest Rate with the latest system generated information, first select the lease (or leases) by checking the box next to the lease. Then enter a value of 0 in the Suggested Rate field underneath the search criteria. Select the Update All button and you should see the suggested rate updated by the system. Save the changes.

This example illustrates the fields and controls on the Update Interest Rates on Operating Leases en masse page.

Note: Exempt leases do not appear on this page.

Update Advance/Arrears Payment Selection on Operating Leases

Use this page to update the payment type selection on your operating leases. The Advance/Arrears functionality was added to Lease Administration in a prior image and all leases were set to Arrears. Use this task in the activity guide to update the payment type on your lease payments to Advance where required.

This example illustrates the fields and controls on the Update Advance/Arrears Payment Selection on Operating Leases page.

Note: Exempt leases do not appear on this page.

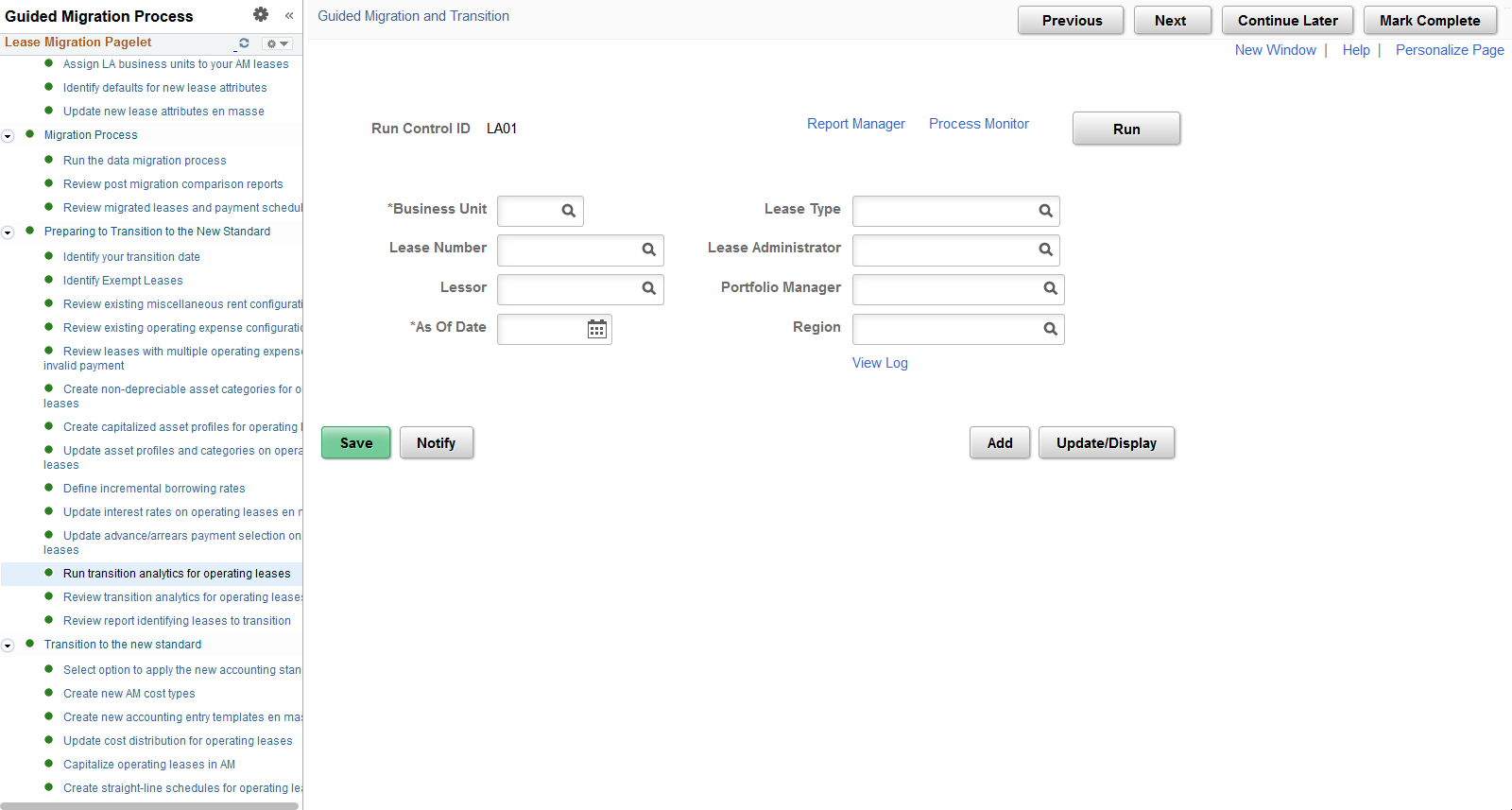

Run Transition Analytics for Operating Leases

Use this page to execute a process to summarize the lease payment data used to transition to the new accounting standard.

This task runs a process and populates a reporting table summarizing the remaining lease payments on your operating leases at points in time over the life of the lease. You can use the results of this process to review the initial cost amounts the system will capitalize as of your transition date. Only lease payments dated on or after the date on the run control are included in the process. If you would like to see payment information for earlier periods, enter an earlier date on the run control.

You must run the transition analytics process for your leases before you can transition them to the new accounting standard. In addition, this process is the only way to review the initial cost amounts the system will use to capitalize your assets in AM when you transition to the new accounting standard.

This example illustrates the fields and controls on the Run Transition Analytics for Operating Leases.

Note: Exempt leases do not appear on this page.

Review Transition Analytics for Operating Leases

Use this page to review a summary of remaining lease payments as of a specific date. You must enter a date and business unit on the prompt. The pivot grid summarizes the remaining payments as of the date entered. ‘Amount’ represents the full amount (or undiscounted amount) of the remaining payments. 'Obligation’ represents the discounted amount of your remaining payments and ‘Interest’ represents the interest portion of your remaining payments.

The pivot grid includes base rents as well as miscellaneous rents and operating expenses identified as ‘Included in Lease Payments’. It also includes guaranteed residual value amounts. You can export the results to Excel. To review a larger amount of data at one time you can run the query RE_TRANSITION_ANALYTICS, which is the basis for the numbers in the pivot grid.

Note that in the previous step of the guide, you ran the process to populate the pivot grid. This process summarized lease payments dated on or after the date on the run control. If you identify in the pivot grid that payments are missing, then you need to rerun the transition analytics process with an earlier date. To ensure accurate reporting, select an earlier date on the run control.

This example illustrates the fields and controls on the Review Transition Analytics for Operating Leases.

Note: Exempt leases do not appear on this page.

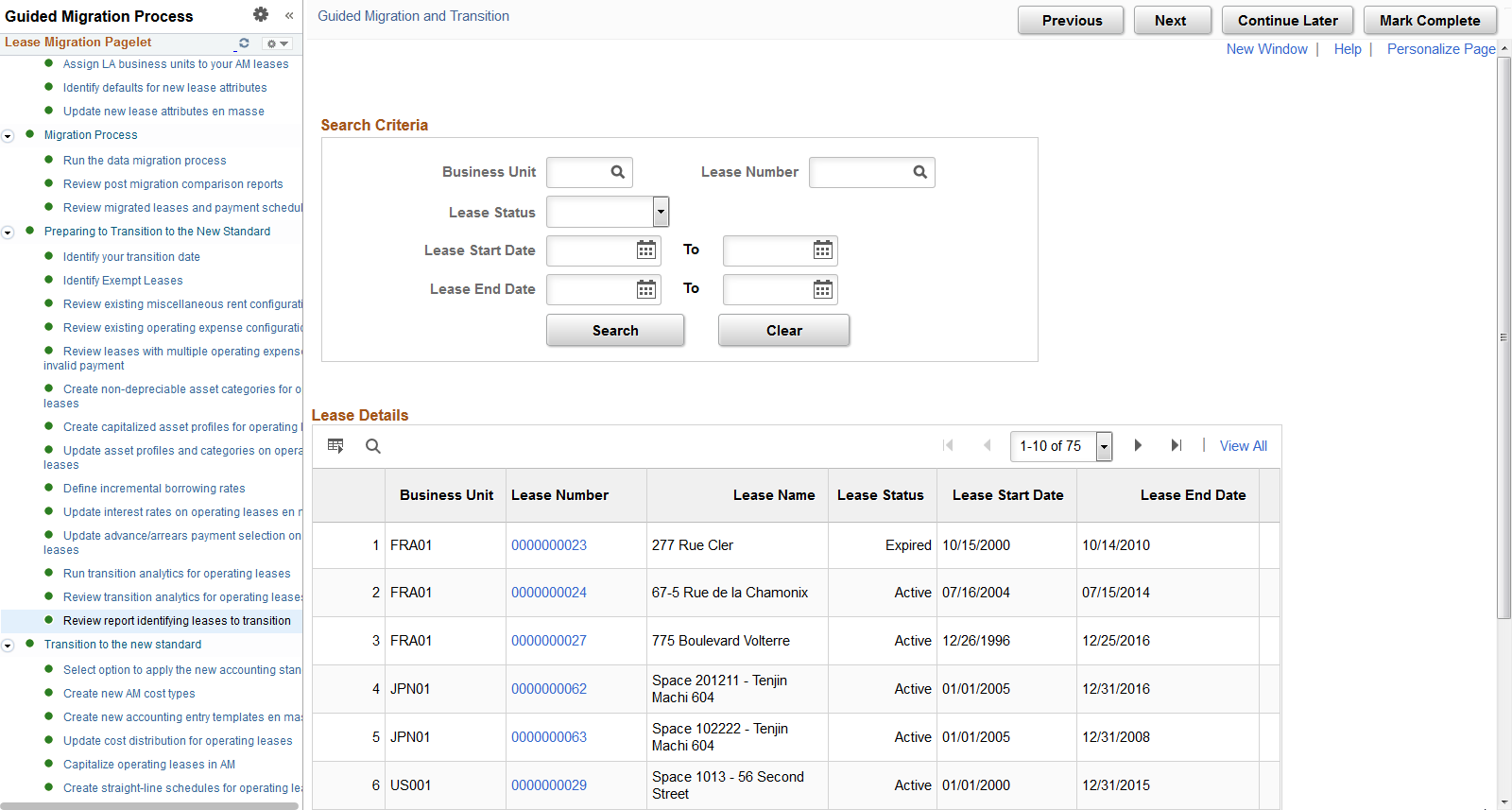

Review Report Identifying Leases to Transition

Use this page to review your operating leases before they transition to the new accounting standard. You will transition all operating leases to the new accounting standard including those originating in AM and others originating in LA.

This is the last task in the activity guide before you transition to the new accounting standard and begin applying ASC 842 and IFRS 16.

This example illustrates the fields and controls on the Review Report Identifying Leases to Transition page.

Note: Exempt leases do not appear on this page.

This section includes tasks to complete your transition to the new accounting standard. You will identify in the system that you are ready to apply the new accounting standard. After making this selection, you will review existing accounting configuration and add new accounting configuration to support processing under the new accounting standard. You will assign cost distributions and then run a process to capitalize your operating leases.

Tasks in this section apply to leases originating in AM and leases originating in LA.

Select Option to Apply the New Accounting Standard

Use this page to identify that you are now applying the new accounting standard, ASC 842, IFRS 16 and GASB 87. The data migration should be completed before you select the Apply ASC 842, GASB 87, and IFRS 16 Accounting option. Once this option is selected and the change saved, the new Lease Administration functionality shared with Asset Management will become active.

Note: You cannot change this selection after saving the page. You should make this selection only after you have completed your final processing under the old accounting standards.

This example illustrates the fields and controls on the Select Option to Apply the New Accounting Standard.

Create new AM cost types

Use this page to create three new cost types in Asset Management. You must create new cost types for Rent Expense, Lease Incentives and Lease Remeasurement. See Cost Types Page.

Create New Accounting Entry Templates en masse

Use this page to create new accounting entry templates (AETs) for use under the new accounting standard. You should create new accounting entry templates for Rent Expense, Rent Expense Contra, Accumulated Amortization, Lease Incentives and Lease Remeasurement. See Defining Accounting Entries.

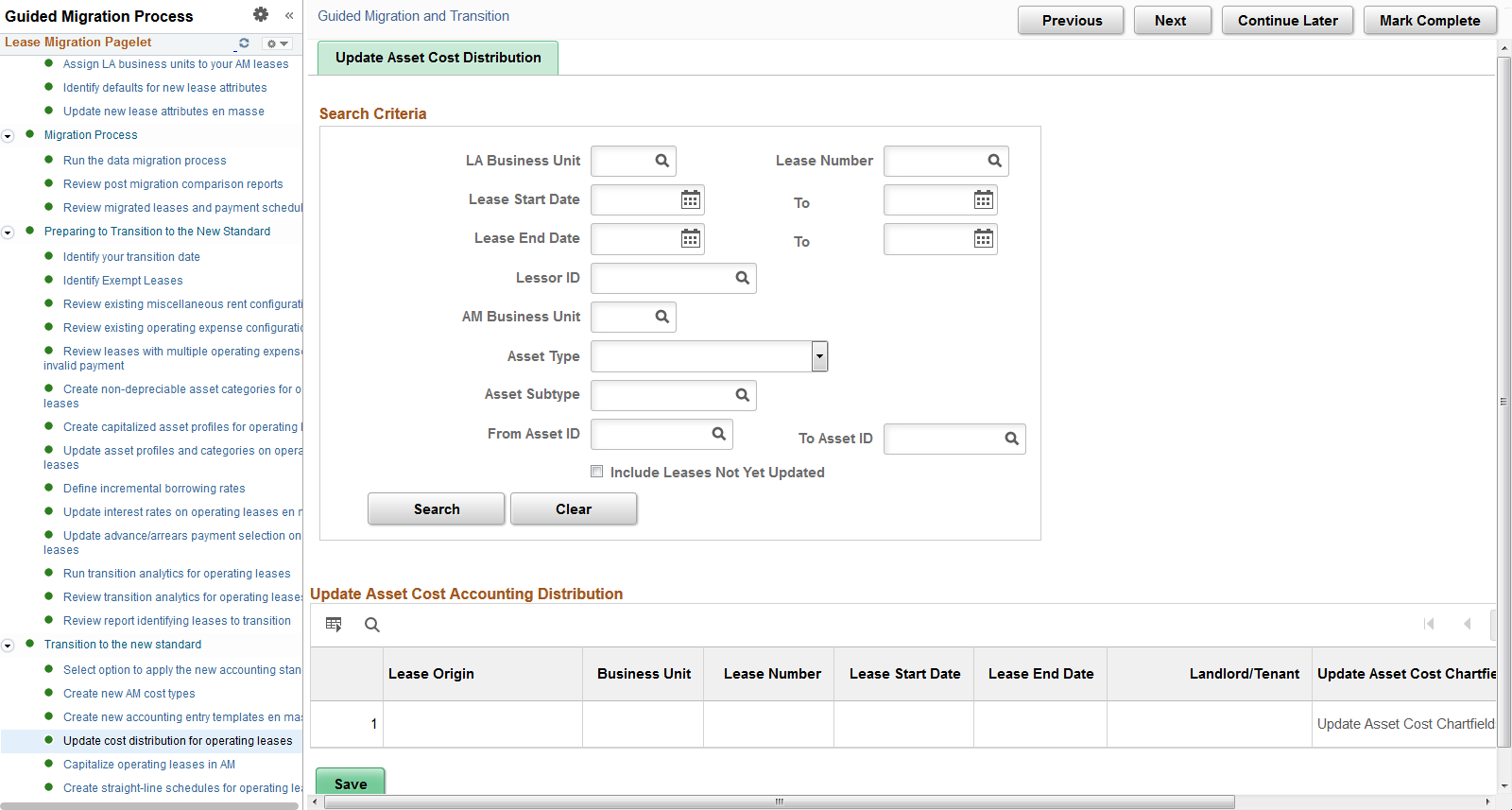

Update Cost Distribution for Operating Leases

Use this page to update the cost distribution for your operating leases. You can filter your search criteria to include only those leases not yet updated. You must update the asset's cost distribution before you can capitalize the asset in AM.

For AM leases, you will see the cost distribution from AM. However, you will need to open the cost distribution and confirm the accounts to use under the new accounting standard. These will default in from the AM Accounting Entry Templates, but you can override them. For LA leases, you will need to identify the detail general ledger ChartFields for the asset and the general ledger accounts. This task may take a significant amount of time particularly for your operating leases originating in LA, if you intend to update multiple ChartFields with information. This task cannot be started until after you select to apply ASC 842 and IFRS 16, and must be completed before you can capitalize your operating leases in AM. We recommend gathering the required information to complete this task earlier in the process, so you can complete the task quickly during your first closing cycle under the new accounting standard.

This example illustrates the fields and controls on the Update Cost Distribution for Operating Leases page.

Note: Exempt leases do not appear on this page.

Note: If you plan to capitalize a lease and update the cost distribution information, but later decide the lease is exempt, the asset cost distribution previously entered is deleted. The underlying asset in an exempt lease is not capitalized.

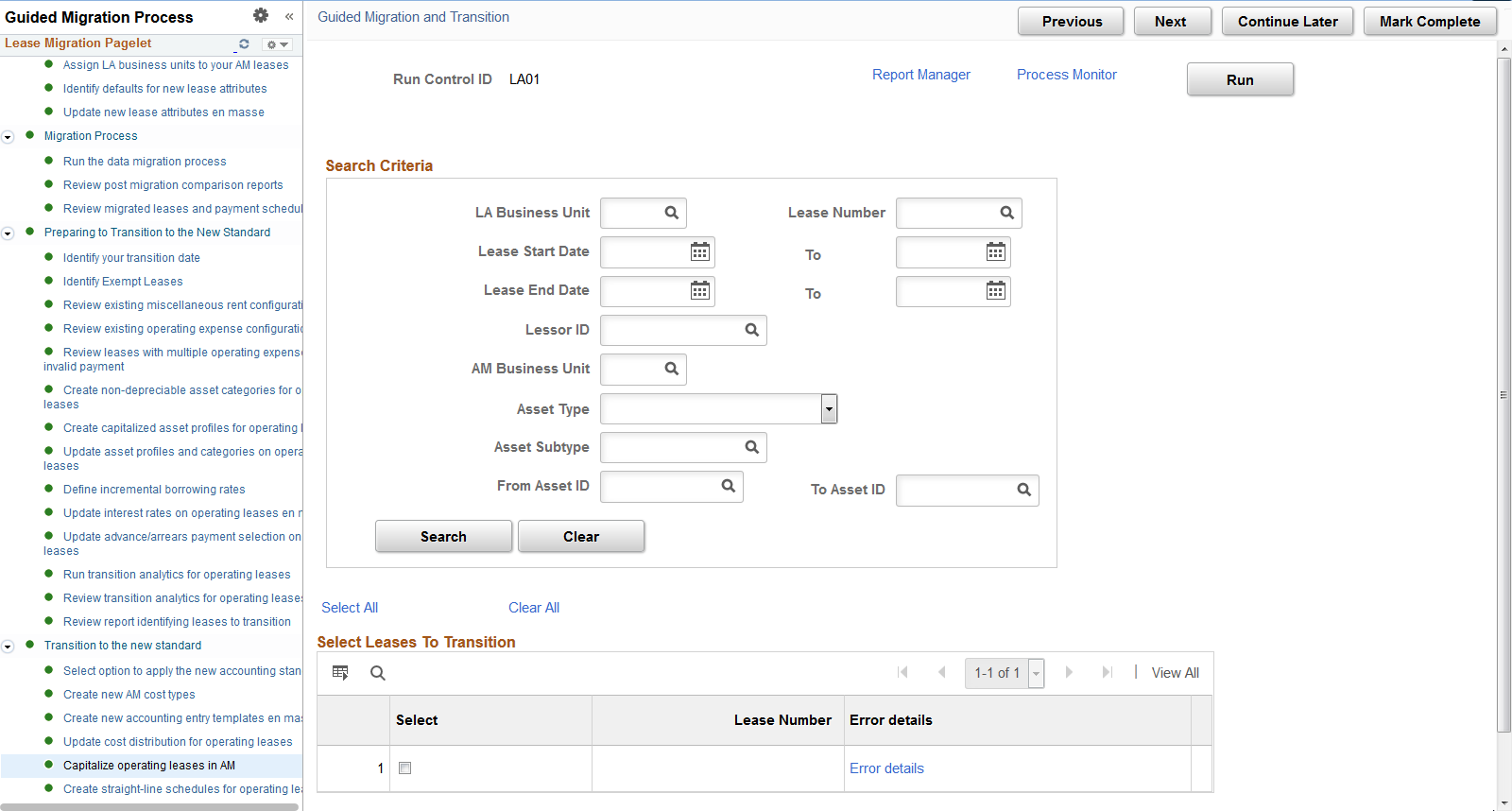

Capitalize Operating Leases in AM

Use this page to capitalize your operating leases in AM. The page will display all operating leases that you have not already capitalized regardless of end date. You should run the capitalization process for all leases including those that have ended even though the capitalization process may result in a zero cost value.

The capitalization process updates many data fields in AM and LA with the following being most notable:

Creates a capitalized asset in AM.

Sets the lease classification on the lease header as ‘Capital’ in LA. With new functionality, you classify individual assets on the lease as finance or operating and the lease header classification is hidden.

After running the process, you can return to this page to see if the process capitalized the asset successfully. If the asset appears on the page, then the process did not capitalize the asset and you should select the Error Details link to review the reasons.

This example illustrates the fields and controls on the Capitalize Operating Leases in AM page.

Note: Exempt leases do not appear on this page.

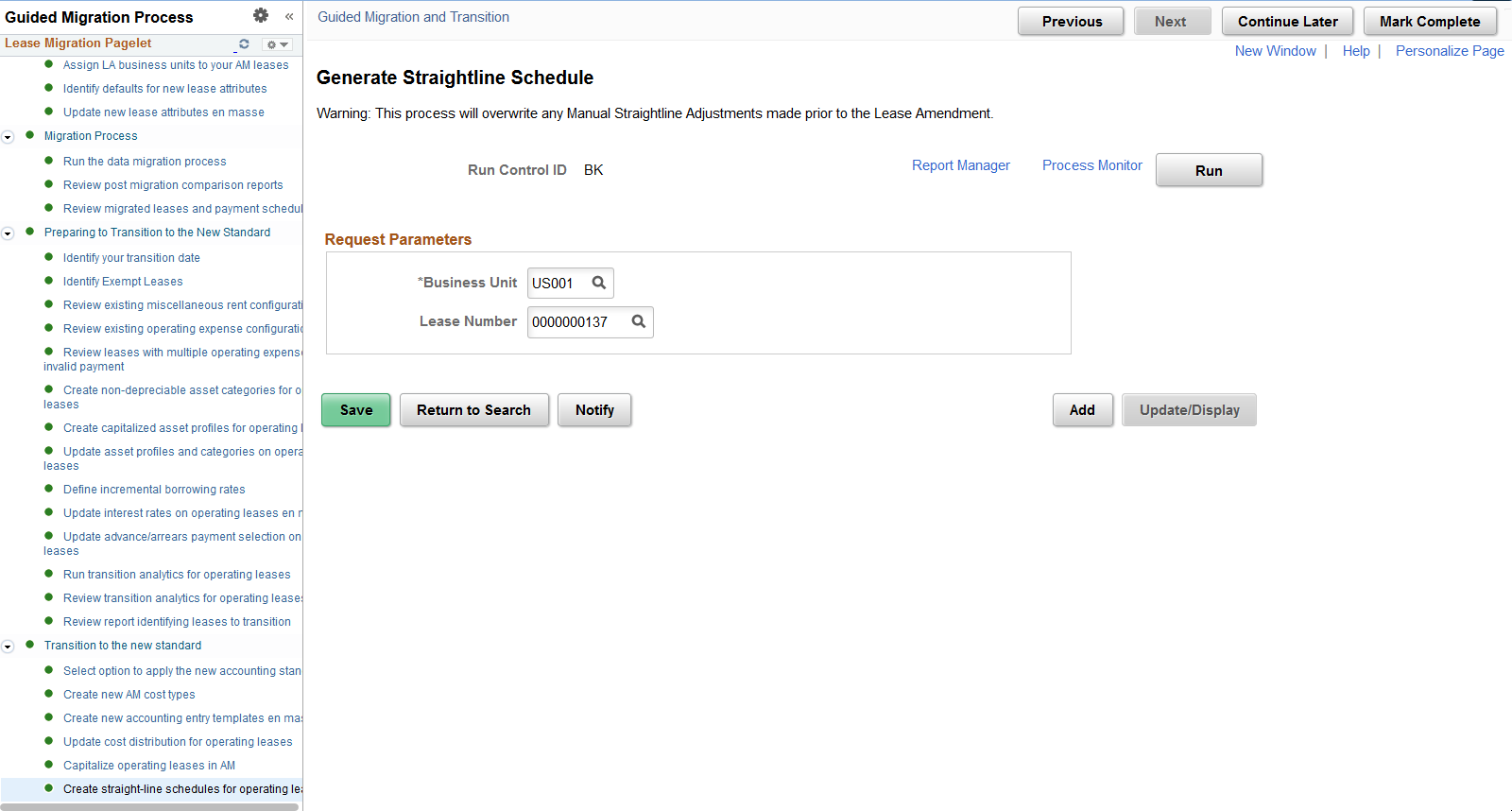

Create Straight-Line Schedules for Operating Leases

Use this page to create straight-line amortization schedules for your operating leases. Under the new accounting standard, you amortize the cost of the operating leased asset on a straight-line basis over the shorter of the asset’s useful life or lease term.

You must run this process to create the monthly expense amounts for your operating leased assets. You can run the process for a specific lease or an entire business unit.

Note: Oracle recommends consulting your accounting department for clarity on whether straightline accounting applies to your exempt leases. The process will exclude certain costs on these leases such as prepaids, initial direct cost, and lease incentives since these costs should be expensed when paid.

This example illustrates the fields and controls on the Create Straight-Line Schedules for Operating Leases page.