Understanding Payday Reporting (PDR)

Payday Reporting is an initiative introduced by the New Zealand government to modernize and simplify the reporting to Inland Revenue Department (IRD). Employers are required to electronically report the employment income information to Inland Revenue Department (IRD) on a Payday basis.

Note: Payday Reporting is mandatory in New Zealand from 01 April 2019.

Peoplesoft Payroll for New Zealand supports Payday Reporting and generates the required files in CSV format as and when an employee is paid.

Once the files are generated, you can use the Inland Revenue’s Secure IR online service to transmit the files. The employment information application programming interface (API) lets employers send this information on each pay cycle.

Payday filing through the myIR file upload service lets employers upload:

Employment information: It includes employee's income and deductions for each pay cycle.

Note: Submit this information on or within the allowable due date from the payday.

New and departing employee’s information: It includes information such as the employee’s name, employment start and finish dates, tax code etc.

Note: Submit this information before or on the same day as their first employment information file.

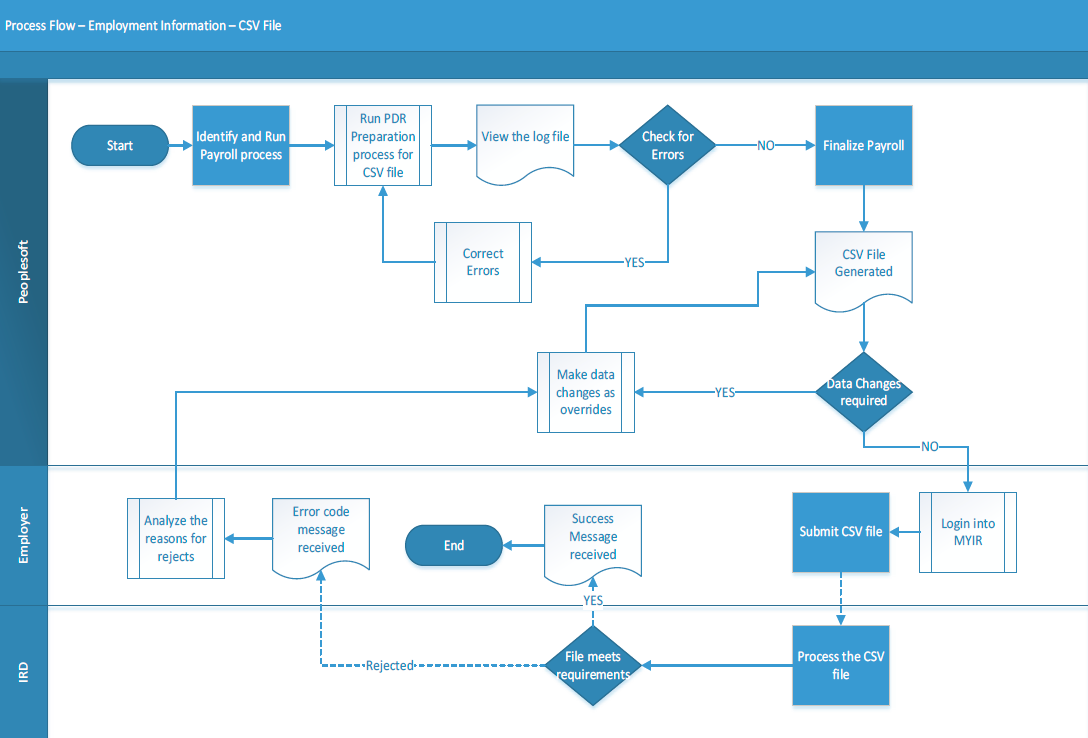

The following diagram illustrates the Payday Reporting process flow.