Using Wine Equalization Tax (WET)

The wine equalization tax (WET) is a value-based tax applied to wine consumed in Australia. It applies to wholesale sales, untaxed retail sales and applications to own use. For more information about WET, visit the Australian Taxation Office web site.

To apply WET to your transactions in NetSuite, use a tax group that combines WET and GST. For guidance on creating tax groups, see Creating a Tax Group (All Countries Except US and Canada).

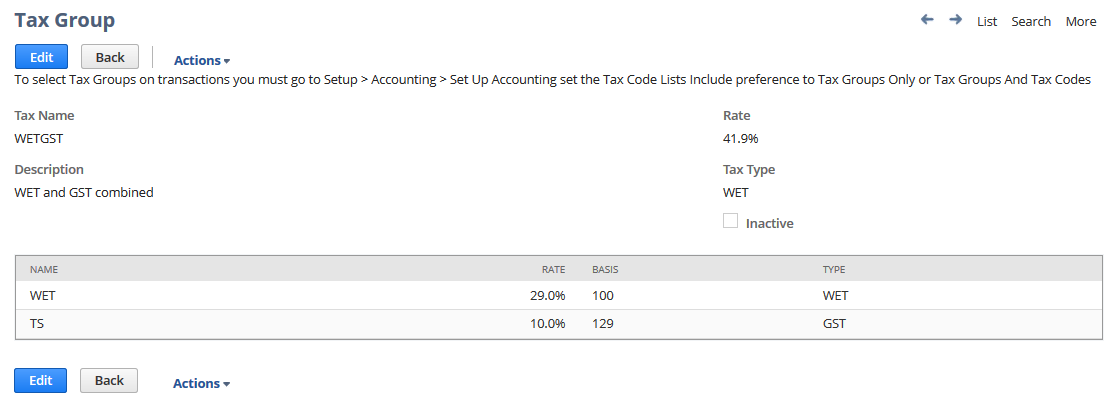

-

Create a tax group for Australia that has the following information:

Tax Code

Rate

Basis

Type

WET

29%

100

WET

TS

10%

129

GST

In this example, the tax group is named WETGST, and the TS tax code is used for the GST. To calculate the correct tax amounts, the basis for TS must be set to 129. The total rate becomes 41.9%.

-

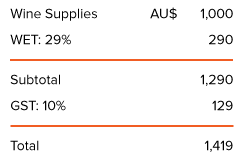

WET is applied at 29% of the value of the wine at the last wholesale sale before adding GST.

-

GST is applied after WET has been added to the price of the wine.

To make this tax group available for selection on transactions, make sure that on the Set Up Taxes page for Australia, the Tax Code Lists Include field shows Tax Groups and Tax Codes.

-

-

When you sell or import wine for consumption in Australia, select this tax group in the Tax Code column of the transaction.

The following example shows the tax amounts for each tax type:

-

To see the accounts to which the amounts are posted, hover over Actions, and click GL Impact.

Example

Account

Amount (Debit)

Amount (Credit)

Accounts Receivable

1,419

GST Collected

129

WET Collected

290

-

To display the WET and GST amounts on the printed invoice, make sure that on the Set Up Taxes page for Australia, the Print Tax Code Summary on Sales Forms box is checked.

-

On your Business Activity Statement setup, make sure that the WET tax code is included in the Wine Equalisation Tax (1C) box.

Additional Information

Related Topics

- Setting Tax Preferences for Australia

- Creating Tax Codes - Australia

- Australia Tax Codes

- Accounting for Goods and Services Tax (GST) - Australia

- Setting Up Your Business Activity Statement

- Viewing Australian Goods and Services Tax (GST) Reports

- Australia Tax Topics

- Australia Payment Formats

- Shipping Integration with Australia Post

- Setting Up Australia-specific Preferences

- Australia Account Setup