Statutory Chart of Accounts for Tax Audit Files

Statutory Chart of Accounts for Tax Audit Files is available only on OneWorld accounts.

Some countries require companies to submit a tax audit file with chart of account names and numbers in specific formats for compliance.

If your standard Chart of Accounts doesn't meet regulatory requirements for tax audit files, you'll need to use the Statutory Chart of Accounts.

The Statutory Chart of Accounts is included in the Tax Audit Files SuiteApp.

Use the Statutory Chart of Accounts if:

-

The standard chart of accounts is shared with other subsidiaries

-

The parent company requires a subsidiary to use account names and numbers that don't match the required format for that country.

This feature is only available for the Mexico Electronic Accounting File. For more information, see the help topic Mexico Electronic Accounting File (Mexico Compliance SuiteApp).

The Statutory Chart of Accounts mapping only works for primary accounting books.

To set up or update the Statutory Chart of Accounts:

-

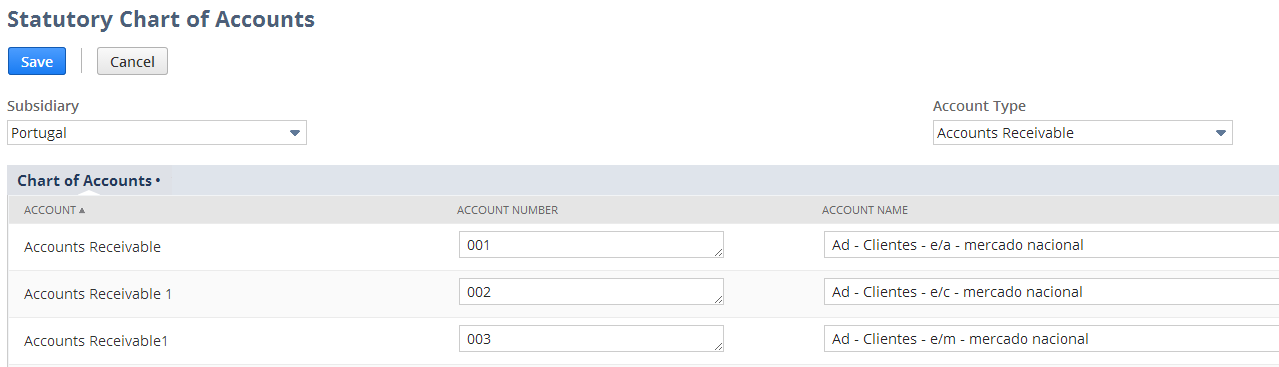

Go to Setup > Tax Audit Files > Statutory Chart of Accounts.

-

In the Subsidiary field, select a subsidiary.

Note:All active subsidiaries show up in the Subsidiary field, except for elimination subsidiaries.

-

In the Account Type field, select an account type.

Note:All active account types for the selected subsidiary show up in the Account Type field, except for nonposting accounts.

-

The Account column on the Statutory Chart of Accounts page shows the standard chart of account names and numbers for the selected subsidiary and account type. For each account that needs a statutory account name or number, do the following:

-

In the Account Number column, enter the statutory account number to use in the subsidiary's tax audit file.

-

In the Account Name column, enter the statutory account name to use in the subsidiary's tax audit file.

You can enter letters, numbers, and special characters.

If you don't provide a statutory account number or name, the standard account number or name will be used in the tax audit file.

Example:

The following table shows how the statutory chart of accounts data will be used in the tax audit file:

Standard Chart of Accounts

Statutory Chart of Accounts

What appears in the Tax Audit File

Number

Name

Number

Name

Number

Name

6022

Gas & Oil

60221

60221 - Combustibles

60221

60221 - Combustibles

6150

Office Expense

-

-

6150

Office Expense

-

-

Click Save to create a custom record for each account.

Note:You can only save 160 records at a time.

-

Repeat Steps 2 to 5 for other subsidiaries and account types.

Note:Remember to save any changes you made on the Statutory Chart of Accounts setup page before selecting a different account type or subsidiary. Otherwise, the data you entered will be lost.

You can also set up or update the Statutory Chart of Account records using CSV import.

To set up or update the Statutory Chart of Accounts using CSV import:

-

Prepare a CSV import file with your statutory chart of accounts data.

-

Create a saved search of the subsidiary's accounts. Go to Lists > Search > Saved Searches > New.

-

On the New Saved Search page, click the Account link.

-

On the Criteria subtab, set the filter for the subsidiary. Select which subsidiary will use the Statutory Chart of Accounts.

-

On the Results subtab, set it to only include the Subsidiary and Name columns.

Click Preview. On the results page, click Export - CSV and save the file.

-

-

Open the saved CSV file.

-

Add columns for the Statutory Chart of Accounts data. Use the following column headers for automatic field mapping during CSV import:

Column Header

Data

Subsidiary

Name of subsidiary that will use this statutory chart of account

Account

Account of the selected subsidiary

Name

Statutory chart of account name

Number

Statutory chart of account number

-

Save the CSV file with the Statutory Chart of Accounts data.

-

-

Import the saved CSV file to NetSuite. For information about how to import a CSV file, see Importing CSV Files with the Import Assistant. Select the following options for CSV import:

-

Import Type = Custom Records

-

Record Type = Statutory Chart of Accounts

-

Related Topics

- Tax Audit Files

- Prerequisites for Installing the Tax Audit Files SuiteApp

- Installing the Tax Audit Files SuiteApp

- Creating or Customizing Roles to Use Tax Audit Files

- Setting Up Tax Audit Files to Use Multiple Queues or Processors

- Setting Up Threshold Configuration on Tax Audit Files

- Setting Tax Audit Files Report Preferences

- Using Tax Audit Files

- Generating a Tax Audit File

- Troubleshooting Tax Audit File Generation Failures

- Downloading a Tax Audit File

- Deleting a Tax Audit File

- France Fichier d'Ecritures Comptables (FEC)

- Portugal Standard Audit File for Tax Purposes (PT SAF-T)

- Mexico Electronic Accounting File (Mexico Compliance SuiteApp)

- United Arab Emirates Tax Audit File