Disposing an Asset in Multiple Books

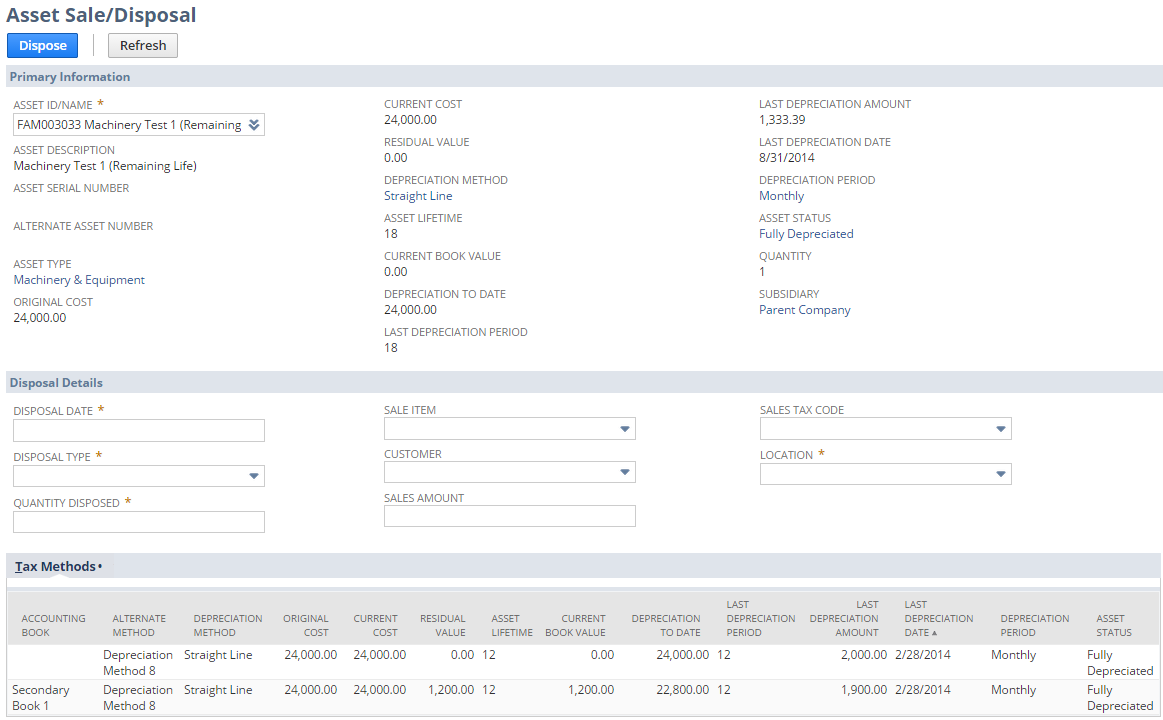

Upon disposal, the asset is disposed in all associated accounting books. The accounting and tax methods linked to the accounting books create depreciation histories.

When you write off an asset, a journal entry is created to write off the tax methods linked to the accounting books. Selling an asset creates a book-generic invoice that uses the primary book's residual value.

To dispose an asset, follow the procedure in Asset Disposal by Sale or Write-Off.