VAT Reports - Philippines

The following VAT reports are provided by the International Tax Reports SuiteApp:

-

VAT RELIEF Reports - quarterly Summary List of Sales (SLS) and quarterly Summary List of Purchases (SLP)

Before you generate VAT reports for Philippines, read the following help topics:

Setting Roles and Permissions for Philippines VAT Reports

To enable custom roles to use the VAT reports, make sure that you give those roles the required permissions and access to scripts.

The international tax reporting features are accessible to the following standard NetSuite roles: Administrator, Accountant, Accountant Reviewer, and Chief Financial Officer. In addition, the following roles provided by the International Tax Reports SuiteApp have already been set up with all the required permissions, and can be used as templates for creating customized roles:

-

Tax Reporting Accountant

-

Tax Reporting Accountant Reviewer

-

Tax Reporting CFO

-

Tax Reporting Bookkeeper

The standard Bookkeeper role cannot access the reports in the International Tax Reports SuiteApp even if you add permissions and grant the role access to scripts and reports. You should use the Tax Reporting Bookkeeper role.

If you want to use your own customized roles to use the international tax reporting features, you should customize the Tax Reporting Accountant, Tax Reporting Accountant Reviewer, Tax Reporting CFO, or Tax Reporting Bookkeeper roles that are already included in the International Tax Reports SuiteApp.

You can add permissions and access to scripts to any new role or custom role. For more information, read the following topics:

Setting Up Tax Filing for the Philippines

If you want to use the DAT files of the SLS and SLP reports from NetSuite for online tax filing, you must complete the fields in the Tax Filing Setup page before you generate the reports.

To set up tax filing information for the Philippines:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

If you're using OneWorld, select the Philippines subsidiary.

-

Select the country form for the Philippines.

-

Click Setup and select Tax Filing.

-

On the Tax Filing Setup window, enter the following for each field:

-

VAT Registration No. - Enter the 9-digit VAT registration number.

If you want to display the VAT REG TIN header on Summary Listing of Sales (SLS) and Summary Listing of Purchases (SLP) reports, check the VAT Registered box.

If the box is clear, a NON-VAT REG TIN header is displayed.

-

RDO Code - Enter the RDO code.

-

Contact's First Name - Enter the first name of the contact person.

-

Contact's Last Name - Enter the last name of the contact person.

-

Contact's Middle Name - Enter the middle name of the contact person.

-

VAT Reporting Period - Select the applicable VAT reporting period.

-

-

Click Save.

Important Reminders:

Make sure that the data you entered on the Tax Filing Setup page and on customer and vendor records meet the requirements listed below. Non-compliance to these requirements could cause errors and invalidate the generated DAT file when it's validated using the BIR Relief Validation Module.

-

VAT Registration No. entered on the Tax Filing Setup page must have 9 digits and must not contain special characters, such as spaces and hyphens.

-

RDO Code must have 3 to 5 digits.

-

Contact Name fields in the Tax Filing Setup page must not contain special characters, such as apostrophe (') and ampersand (&). Addresses and names in the vendor and customer records must also not contain special characters.

-

For customer and vendor records, make sure that the Address and Tax Reg. Number fields are not empty. Tax Reg. Number must have at least 9 digits and must not contain special characters like spaces and hyphens.

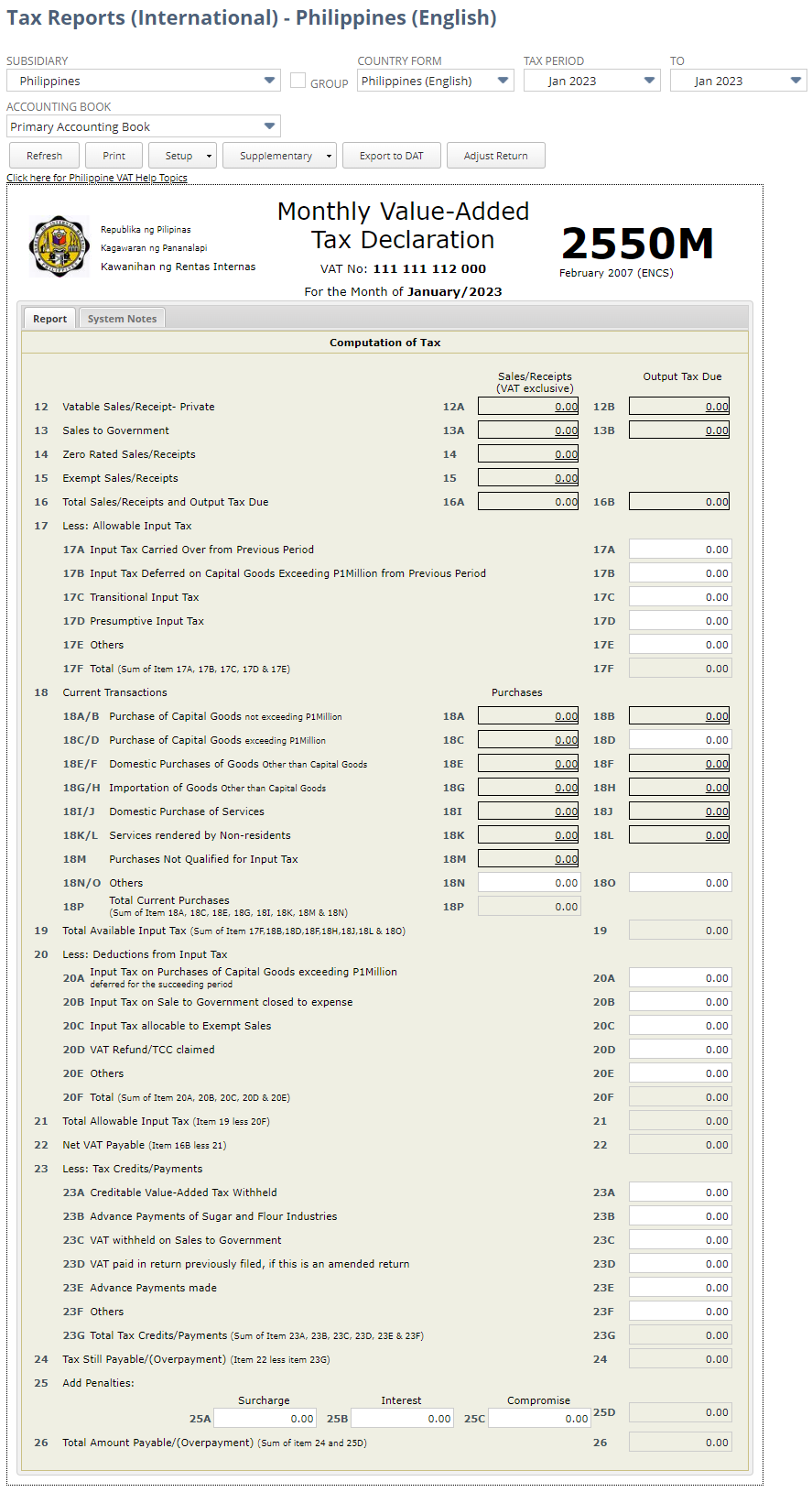

Monthly and Quarterly VAT Reports for the Philippines

The VAT Form 2550M and VAT Form 2550Q are the forms you submit to the Philippines Bureau of Internal Revenue (BIR) to report your tax liability or to claim a refund. You can filter the applicable tax period of the reports and NetSuite automatically calculates the amounts that appear in many of the boxes on the BIR VAT forms. The International Tax Reports SuiteApp provides both the monthly Form 2550M and the quarterly Form 2550Q.

To generate the VAT reports for the Philippines, use the new tax code properties provided by the International Tax Reports SuiteApp. See Philippines Tax Codes.

To generate a Philippines VAT return report:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

If you're using OneWorld, select the Philippines subsidiary.

-

Select the country form for the Philippines.

-

Select a tax period for the report.

-

If you select a period covering one month, the system displays the monthly VAT declaration form (Form 2550M).

-

If you select a period greater than one month, or a period covering one quarter, the system displays the quarterly VAT return (Form 2550Q).

-

-

Click Refresh to generate the report.

Each time you change the tax period, click Refresh.

-

Click Print to save a PDF file of the report.

Most of the boxes are automatically computed based on entered transactions with VAT. You can click these boxes to view a report of the individual transactions that make up the balance. However, some of the boxes such as report adjustments, amortizations, deferrals, and others, require manual calculation and input because the values cannot be automatically computed by the system. These boxes will show up as editable fields in the report.

You should review all the values in the report. You can click the values in the boxes of the VAT report to view drill down details. To understand how NetSuite uses the tax codes to get the values for the Monthly Value-Added Tax Declaration form 2550M, see What goes into each box - Philippines VAT report.

Any VAT return report produced by NetSuite is intended as a worksheet for record-keeping purposes only. For electronic or paper-based submission, you're required to transcribe the information contained on this form on to the official paper-based form or electronic submission facility provided by the tax agency. You should review all the values in the report prior to submission.

VAT RELIEF Reports

The VAT Reconciliation of Listings for Enforcement (RELIEF) reports are required attachments to the quarterly VAT returns in the Philippines. They are made up of the quarterly Summary List of Sales (SLS) and quarterly Summary List of Purchases (SLP). The Summary List of Imports is not included.

VAT RELIEF reports are used by the Bureau of Internal Revenue to match your transactions with those of other VAT taxpayers as declared in the quarterly Summary Lists of Sales and Purchases and the declarations and payments in the VAT returns.

You can generate the SLS and SLP in any of the following formats:

-

PDF

-

CSV

-

DAT

Online Tax Filing

The DAT file generated by NetSuite can be used for online filing and tax audits. The format of the DAT file generated by NetSuite complies with the specifications of the Bureau of Internal Revenue. For non-PHP currency transactions, NetSuite automatically converts the value of the supply and output tax into PHP, based on prevailing exchange rates.

The SLS and SLP reports produced by NetSuite are intended for record-keeping purposes only. For paper-based submission, you're required to use the official paper forms provided by the government. For electronic submission (online filing), you can submit the DAT file generated by NetSuite.

Make sure that your tax filing setup is correct before you generate the DAT file for online submission. See Setting Up Tax Filing for the Philippines. You should also review all the values in the report prior to submission. You can save the PDF file to review the content of the report before generating the DAT file.

To generate the SLS or SLP:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

If you're using NetSuite OneWorld, select a subsidiary. In the Country Form field, the Philippines report is automatically selected.

-

Choose a tax period for the report. The selected tax period should match the VAT reporting period specified in the tax filing setup.

Note:You can create SLS and SLP for a tax period covering one month or one quarter. For reference purposes, the BIR requires a report covering one quarter only.

-

Click Supplementary and select SLS or SLP to save the reports in any of the following formats:

-

PDF

-

CSV

Each time you change the tax period, click Refresh.

-

-

Click Export to DAT to generate SLS and SLP DAT files. A popup message appears to ask if you want to flag the transactions included in the report.

-

If you click Yes, the transactions are flagged. This flag indicates that the transactions have been reported (included in the VAT returns). This action cannot be undone.

-

If you click No, the file is exported but the transactions are not flagged.

For more information about flagging transactions, see Flagging Tax Periods in a VAT Return.

-

The System Notes subtab lists all the DAT files generated for the selected subsidiary. The list also shows the user name, date, reporting period, link to the DAT file for downloading, and a copy of the report generated for viewing or printing. For more information about VAT return submission history, see Viewing the VAT Return Submission History.

Other Tax Reports

You can also use customizable tax reports provided by the International Tax Reports SuiteApp to view both detail and summary reports for purchases or sales, grouped by tax code. Go to Reports > VAT/GST to access the following saved reports:

-

Purchase By Tax Code (Detail)

-

Purchase By Tax Code (Summary)

-

Sales By Tax Code (Detail)

-

Sales By Tax Code (Summary)

For more information, see Sales and Purchase Reports Grouped by Tax Code.

Related Topics

- Setting Tax Preferences

- Setting Tax Rounding Levels, Methods, and Precision Settings

- Managing Tax Codes

- Philippines Tax Codes

- Tax Accounting Overview

- Enabling and Setting Up Taxation Features

- Advanced Taxes

- Paying Tax Liabilities - Non-U.S. Editions and Nexuses

- International Tax Reports

- Generating VAT/GST Reports

- Flagging Tax Periods in a VAT Return

- Viewing the VAT Return Submission History