How Is An Account's Debt Monitored?

| Contract's Debt Class | Account's Collection Class | |

|---|---|---|

| Commercial Customer | Residential Customer | |

| Regulated | N/A - there is no regulated, large customer debt |

Highest Priority: If > $5 in arrears by more than 50 days, create the accelerated collection process for residential customers. Lower Priority: If > $25 in arrears by more than 25 days, create the courtesy reminder collection process for residential customers. |

| Unregulated |

Highest Priority: If > $10 in arrears by more than 50 days, create the accelerated collection process for commercial customers. Lower Priority: If > $1000 in arrears by more than 25 days, create the normal collection process for commercial customers. |

Highest Priority: If > $10 in arrears by more than 25 days, create the normal collection process for residential customers. |

This matrix contains the information used by the Account Debt Monitor.

This matrix can be overwhelming when viewed as a whole. So let's consider how to use it for a specific account's debt and things will become clearer.

First, because an account belongs to a unique collection class, we only have to worry about a single column in the matrix when monitoring an account's debt.

Next, we accumulate the total amount of aged debt for each unique debt class associated with the account's contracts.

Next, we subject the accumulated aged debt to the override aged debt algorithm (plugged in on the debt class). This algorithm can cause aged debt to be reduced. This is an optional algorithm and is only used if you set up promise to pay for customers. Refer to How Promise To Pay Affect The ADM for more information.

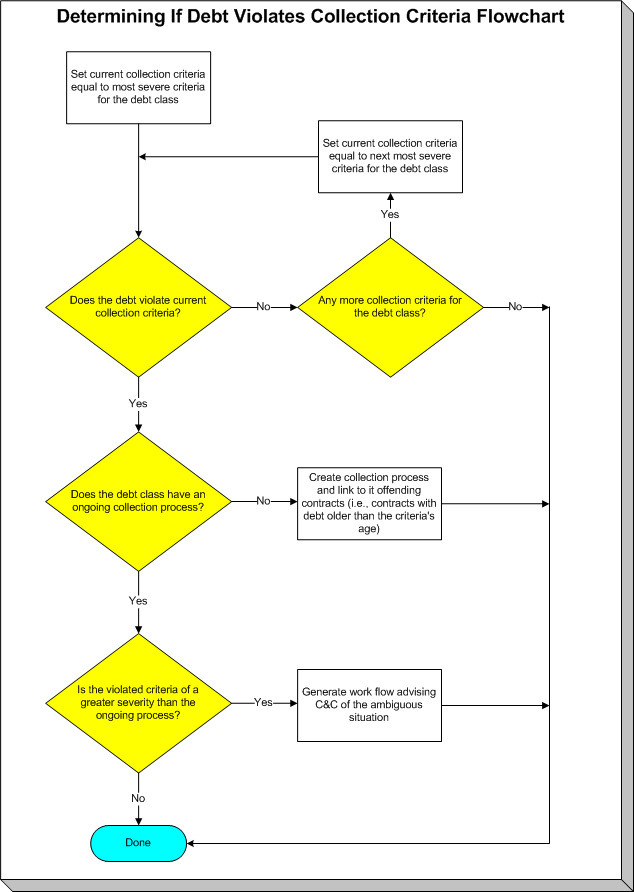

Next, we determine if the debt for the debt class violates the collection criteria in the respective matrix element. If so, we kick off a collection process and link the offending contracts to it. The logic associated with the determination of whether to kick off a collection process is rather sophisticated. The following flowchart explains the exact details.