Setting Up Authorization Services

Topics in this part: The following topics describe the functions available to define the credit card authorization services that your company uses.

-

Reset Authorizations (RSAA) describes how to reset records in the Credit Card Authorization Transaction table from a *SENT status to a *RDY status so that they can be resent to the authorization service.

-

Defining Authorization Services (WASV) shows you how to define the authorization services that your company uses.

-

Defining Authorization Service Countries shows you how to cross-reference your country codes to the country codes used by the service bureau. You can also indicate whether the service bureau performs address verification for the country.

-

Defining Vendor Paytype Codes shows you how to cross-reference your payment codes to the payment codes used by the service bureau.

-

Defining Vendor Response Codes shows you how to define the codes your service bureau uses to identify whether a credit card is approved or declined, and how to have the system place orders on hold based upon the vendor response code.

-

Defining Merchant ID Overrides describes how to set up merchant ID overrides for different entities within your company.

-

Defining Authorization Service Currencies describes how to set up cross references for your company's currency codes and the codes used by a service bureau.

-

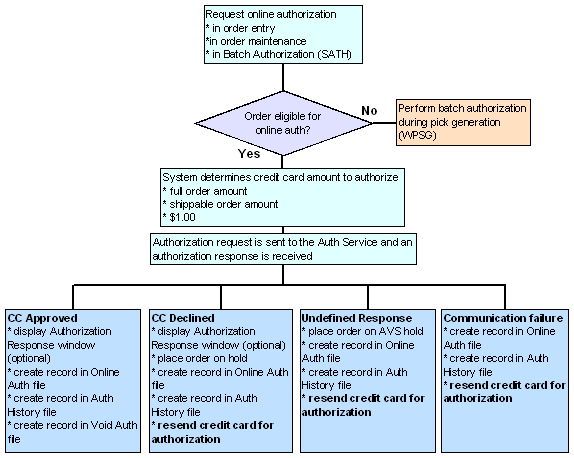

Performing Online Credit Card Authorizations provides an overview on online credit card authorization and required setup.

-

Performing Batch Authorization (SATH) describes how to send credit cards up for batch authorization by the associated ship via.

-

Printing the Online Credit Card Authorization List (PATL) describes how to print the Online Authorization Listing.

Defining Authorization Services (WASV)

Purpose: Use the Work with Authorization Services menu option to:

-

define the service bureaus that you use, such as:

-

Authorization services, to authorize charges against a credit card or stored value card.

-

Authorization/Deposit services, to authorize card charges and receive deposit amounts.

-

Deposit services, to provide settlement for card payments.

-

-

identify the type of service the service bureau performs

-

define the parameters that identify your company to the service bureau

-

define the information necessary to connect, transmit, and receive data to and from the service, such as:

-

country codes

-

valid pay types

-

response codes (vendor responses, AVS responses, and CID responses)

-

currency codes

-

merchant IDs for individual entities within your company

-

whether the order originated as an internet order

-

Some of the information required to establish a service bureau on your system is provided by the service bureau. For example, each service bureau will assign you a unique password.

You can use the same service bureau to process your authorizations and deposits, or you can use one service for authorizations and another for deposits.

Important:

Use the Payment Configurations option in Modern View to configure or work with any payment processing through EFTConnect. You would use Work with Authorization Services in Classic View only for other authorization services, such as for stored value cards (gift cards). You cannot create, change, or delete an authorization service that uses EFTConnect through the Work with Authorization Services option in Classic View.

In this topic:

Deferred/Installment Pay Plans

Deferred or installment pay plans allow you to process deposits against orders at various intervals after you bill the order shipment. For example, you could offer “no payment for 60 days” or “four easy payments” to your customers.

In order to set up deferred or installment pay plans, you must have the Deferred and Installment Billing (F51) system control value must be selected. See Deferred/Installment Billing Overview for more information on deferred and installment pay plans and how to set them up in Order Administration.

Identifying Internet Orders

An internet order is determined in one of two ways:

-

If using the E-Commerce Interface the system loads an I in the Internet field on the order header when the order is created in Order Administration.

-

An order is considered an internet order if the order type on the order matches the E-Commerce Order Type (G42) system control value.

-

Mail = Mail order.

-

Phone = Telephone order.

-

Internet = Web order.

To determine where the order originated, the system:

-

looks at the value in the Internet order field in the Order Header table. If this field is set to I, the order is a web order.

-

determines if the order type for the order matches the E-Commerce Order Type (G42) system control value. If the order type matches, the order is a web order.

-

looks at the Forecasting order category field in the Order Type table. If this value is 1, the order is a mail order. If this value is 2, the order is a phone order.

Work with Authorization Services Screen

How to display this screen: Enter WASV in the Fast path field at the top of any menu screen or select Work with Authorization Services from a menu.

| Field | Description |

|---|---|

|

Code |

The code to identify the service bureau. Enter a full or partial code and select OK to display service codes in alphanumeric order, starting with your entry. Alphanumeric, 3 positions; optional. |

|

Application |

The type of activity performed by the service bureau. Valid values are:

Optional. |

|

Description |

The name of the service bureau. Alphanumeric, 30 positions; optional. |

|

Merchant |

The account number assigned by the service bureau to identify transmissions to/from your company. This is the default ID number; you can also specify separate ID numbers for each entity in your company, and/or to use for orders using deferred or installment billing. Alphanumeric, 20 positions; optional. |

| Screen Option | Procedure |

|---|---|

|

Change an authorization service record |

Select Change for a service to advance to the Change Authorization Services Screen. At this screen you can change any information except the Service code. See the First Create Authorization Services Screen for field descriptions. Important: You cannot use this option to change an existing authorization service using EFTConnect. Use the Payment Configurations option in Modern View instead. |

|

Delete an authorization service record |

Select Delete for a service to delete it. Important: You cannot use this option to delete an existing authorization service using EFTConnect. Use the Payment Configurations option in Modern View instead. |

|

Display an authorization service record |

Select Display for a service to advance to the Display Authorization Services Screen. You cannot change any information at this screen. See the First Create Authorization Services Screen for field descriptions. |

|

Work with country codes |

Select Country for a service to add, change or delete the country codes recognized by the service bureau; see Defining Authorization Service Countries. |

|

Work with vendor paytype codes |

Select Paytypes for a service to add, change, delete or display the pay type codes recognized by the authorization service. See Defining Vendor Paytype Codes. |

|

Work with vendor responses |

Select Responses for a service to add, change, display or delete the response codes you receive from the service and the actions to take for each. See Defining Vendor Response Codes. |

|

Work with merchant ID overrides based on entity |

Select Merchant ID Override for a service to add, change, or delete merchant ID overrides by entity. See Defining Merchant ID Overrides. |

|

Work with currency codes |

Select Currency for a service to add, change, or delete cross-references between the currency codes used in your company and by the authorization service. See Defining Authorization Service Currencies. |

|

Work with external authorization service settings |

Select External Service to advance to the Work with External Authorization Service Screen. External Authorization Service Access (B25) authority is required. |

|

Create an authorization service |

Select Create to advance to the First Create Authorization Services Screen. Important: You cannot use this option to create an existing authorization service using EFTConnect. Use the Payment Configurations option in Modern View instead. |

First Create Authorization Services Screen

Purpose: Use this screen to define a service bureau on your system. The Authorization Service record contains information that identifies your company to the service bureau and the parameters that you must include in the transmission to the service bureau.

Each service bureau requires its own information. Not all fields are applicable for each service.

Important:

You cannot use this screen to create a new authorization service using EFTConnect. Use the Payment Configurations option in Modern View instead.

How to display this screen: Select Create at the Work with Authorization Services Screen.

| Field | Description |

|---|---|

|

The code to identify the service bureau. Foreign credit cards: In order to process foreign credit cards separately at billing, you must define a deposit service with a code of PRE, and then define PRE as the deposit service in the Pay Type table. See Processing Auto Deposits (SDEP) for more information on setting up a different process for foreign credit cards. Point-to-Point communication: If you are using point-to-point communication, the Service code must be a specific value for the integration:

Alphanumeric, 3 positions. Create screen: required. Change screen: display-only. |

|

|

The type of activity performed by the service bureau. Valid values are:

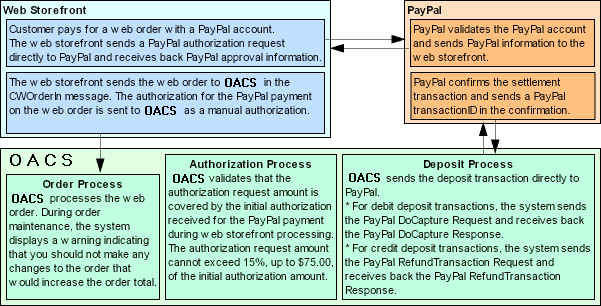

Note: PayPal should have the Application type set to Auth/Deposit. Required. |

|

|

The account number assigned by the service bureau to identify transmissions to/from your company. This ID is a default. You can also identify merchant IDs to use for depositing deferred or installment pay plans (as opposed to regular deposits) below. Similarly, you can set up overrides for different entities in your company, including deferred or installment overrides. See Defining Merchant ID Overrides. Note: You can enter upper and lower case letters in this field. Alphanumeric, 20 positions; optional. |

|

|

A description that identifies your company's product line or the type of service performed. Alphanumeric, 20 positions; optional. |

|

|

Deferred merchant ID |

The account number assigned by the service to identify transmission of deferred pay plan transactions for deposit. See Deferred/Installment Billing Overview for more information on deferred and installment billing, and see Processing Auto Deposits (SDEP) for more information on processing deposits. You can also set up overrides for different entities in your company, including deferred or installment overrides. See Defining Merchant ID Overrides. Alphanumeric, 20 positions; optional. |

|

Installment merchant ID |

The account number assigned by the service to identify transmission of installment pay plan transactions for deposit. See Deferred/Installment Billing Overview, and see Processing Auto Deposits (SDEP). You can also set up overrides for different entities in your company, including deferred or installment overrides. See Defining Merchant ID Overrides. Alphanumeric, 20 positions; optional. |

|

The service bureau assigns values to the following fields: |

|

|

Signon |

A code required to sign on to the service bureau. Case-sensitive. Alphanumeric, 10 positions; optional. |

|

Receiving code |

A code that identifies your company to the service bureau. Alphanumeric, 10 positions; optional. |

|

Password |

A password required by the service bureau. Case-sensitive. Alphanumeric, 10 positions; optional. |

|

Start up information |

Startup text that identifies your company to the service bureau. Alphanumeric, 10 positions; optional. |

|

A code required to sign on to the service bureau. Separate fields allow you to define a presenter’s ID for both batch authorization and deposit transactions; if you use the same port number for both batch authorization and deposit transactions, define the presenter’s ID in the first field. Alphanumeric, 10 positions; optional. |

|

|

PID password Auth / Deposit |

A password required to sign on to the service bureau. Separate fields allow you to define a PID password for both batch authorization and deposit transactions; if you use the same port number for both batch authorization and deposit transactions, define the PID password in the first field. Alphanumeric, 10 positions; optional. |

|

A code required to sign on to the service bureau. Separate fields allow you to define a submitter’s ID for both batch authorization and deposit transactions; if you use the same port number for both batch authorization and deposit transactions, define the submitter’s ID in the first field. Alphanumeric, 10 positions; optional. |

|

|

SID password Auth / Deposit |

A password required to sign on to the service bureau. Separate fields allow you to define a SID password for both batch authorization and deposit transactions; if you use the same port number for both batch authorization and deposit transactions, define the SID password in the first field. Alphanumeric, 10 positions; optional. |

|

Sub code |

A code required to sign on to the service bureau. Alphanumeric, 10 positions; optional. |

|

Exclude from FPO (Exclude from flexible payment option) |

Indicates whether to exclude orders associated with this service bureau from a deferred or installment pay plan. If an order includes any pay type whose authorization service has this field selected, the order is not eligible for a pay plan. Valid values are:

See Deferred/Installment Billing Overview for information on how the system determines whether an order is eligible for a pay plan in order entry. |

|

Defines whether any unused portion of an authorization should be voided at deposit time for:

Valid values are:

See Void Unused Authorization After Initial Deposit for processing details. Important: Your end payment processor must support split shipments for you to set this flag to N. Stored value card pay types when not using the External Payment Service: The setting of the Retain Unused Stored Value Card Authorization After Deposit (J21) system control value defines whether the system automatically voids a partially deposited stored value card authorization when the External Payment Service is not in use. See Stored Value Card Deposits for processing details. |

|

|

Defines whether the service bureau supports authorization reversals for credit card and stored value card payments. Valid values are:

Regardless of the setting of this field, you can still perform stored value card authorization reversals when the card is deactivated; see Stored Value Card Authorization Reversal. |

|

|

Indicates whether to resubmit failed authorization and deposit requests for credit cards through the External Payment Service. When the request is for authorization and deposit of a failed deposit request: CyberSource: The subsequentAuthReason in the authorization and deposit request is set to 1 if the Supports Auth Resubmission flag is selected; otherwise it is set to 3. Note: If the credit card number changes since the initial deposit request, then the subsequentAuthReason is set to 3, since it is not considered a subsequent authorization and deposit request. External Payment Service: The subsequentAuthReason is set to RESUBMIT; otherwise, if the Supports Auth Resubmission flag is not selected, the subsequentAuthReason is set to REAUTH. Important: Select this flag only if your payment processor supports merchant-initiated resubmission of failed deposits. |

Second Create Authorization Service Screen

Important:

You cannot use this screen to create a new existing authorization service using EFTConnect. Use the Payment Configurations option in Modern View instead.

How to display this screen: Select OK at the First Create Authorization Services Screen.

| Field | Description |

|---|---|

|

The method by which the data is transmitted to the service bureau. Valid value is Communication. Optional. |

|

|

A code that indicates whether transactions are transmitted to/received from the service bureau immediately (online) as each order is entered, or whether groups of transactions are transmitted to/received from the service bureau at predefined times during the day (in batch). Valid values are:

Optional. |

|

|

Active production system |

Indicates whether you are processing in a live environment (production) or in a testing environment. Valid values are:

|

|

Installment billing? |

Indicates if the service bureau supports installment billing of credit cards. Installment billing plans are typically established for high cost items. Note: This field is informational only and is not used to set up an installment pay plan in Order Administration. Valid values are:

|

|

Indicates whether a response from the service bureau is received immediately for each authorization transaction. Valid values are:

|

|

|

Immediate deposit |

Indicates whether the service bureau sends a detailed response to Order Administration. Valid values are:

|

|

Keep history information? |

Indicates whether transactions sent to the service bureau will be kept online. Typically, this feature is used in test environments. Valid values are:

|

|

Selected for deposit |

Indicates whether the service bureau is included in the next deposit run. By default, all service bureaus are selected for deposit; however, you can remove a service bureau from the next deposit run at the Select Auth Service for Deposit Screen in Processing Auto Deposits (SDEP). Once you submit the deposit run, the system reselects all service bureaus for the next deposit run. Valid values are:

Display-only. |

|

Address verification |

Indicates whether you will be using the Address Verification Service provided by the service bureau to verify the customer's address and credit card number. Valid values are:

|

|

Decline days |

The number of days to hold a declined credit card charge on the system before sending it for an authorization again. This field is not implemented. See Defining Vendor Response Codes for setup information. Numeric, 3 positions; optional. |

|

Industry format code |

A code that is assigned by the service bureau to identify your company type. Use this field to enter your DBA number. Alphanumeric, 5 positions; optional. |

|

The primary service bureau that the service bureau uses for its transmission setup. Orders sent to this service bureau are redirected to the primary service bureau defined in this field. If this field is left blank, the data created for this service bureau will be used. Alphanumeric, 3 positions; optional. |

|

|

Deposit phone # |

The telephone number associated with the deposit service bureau. Informational only. Numeric, 11 positions; optional. |

|

Authorization phone # |

The telephone number associated with the authorization service bureau. Informational only. Numeric, 11 positions; optional. |

|

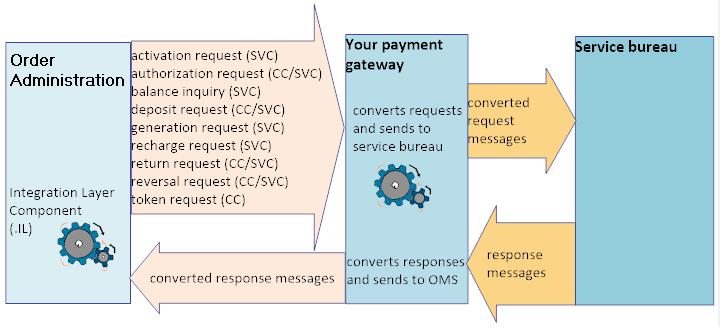

Indicates the method of communication used to transmit transactions between Order Administration and the service bureau. The only valid value is Payment Link, in which the system sends transactions to the service bureau using a point-to-point integration. You must define communication settings in Working with Customer Properties (PROP). The system also uses the Activation and Authorization Reversal integration layer jobs to process stored value card triggers. Optional. |

|

|

Indicates the multiple to apply to the Response time to determine how long to wait for a response after a connection when you are using an external payment service. For example, if the Response check frequency is 6 and the Response time is 10,000, the system waits 60,000 milliseconds (60 seconds or 1 minute) for a response after connection. Note: If the total response interval is exceeded for an authorization record, the record goes into *RCVD status with a response type of SU, and is then removed from the Credit Card Authorization Transaction table (CCAT00). To avoid potential timeout issues, Oracle recommends that you set the Response Time high enough for the authorization service to prevent issues that could potentially occur if the authorization process times out while processing multiple authorizations for an order. Numeric, 3 positions; optional. |

|

|

Test mode? |

Indicates whether you are transmitting in test mode. Valid values are:

This field is not implemented. |

|

Indicates the number of milliseconds to wait for a connection to the service bureau when you are using an external payment service. For example, set this field to 10,000 milliseconds to wait 10 seconds for a connection. Numeric, 5 positions; optional. |

|

|

Merchant division |

Assigned by the authorization service. Numeric, 5 positions; optional. |

|

Authorization service provider |

This field is not implemented. Alphanumeric, 10 positions; optional. |

|

The user name, provided by the service bureau, used to establish a direct connection to the service bureau. Alphanumeric, 64 positions; optional. |

|

|

The password, provided by the service bureau, used to establish a direct connection to the service bureau. Alphanumeric, 64 positions; optional. |

|

|

The encrypted signature, provided by the service bureau, used to establish a direct connection to the service bureau. You can also define API credential information at the entity level using the Create Merchant ID by Entity Screen. Alphanumeric, 128 positions; optional. |

|

|

Note: This field is available only for the CyberSource integration (if the Service Code is set to CYB). Indicates the value to pass as the reconciliationID in a debit deposit, credit deposit, or authorization and deposit request to CyberSource. Available settings are:

For more information see the Order Administration Web Services Guide on My Oracle Support (ID 2953017.1). If the reconciliationID in the request message does not specify an invoice number or alternate order number, then CyberSource assigns a reconciliationID as a reference number for the transaction, and passes it in the response message. Note:

|

Instructions:

-

At the First Create Authorization Services Screen, enter the Service Code, Application, Merchant ID, Charge description and any other information required by the service bureau.

-

Select OK to advance to the Second Create Authorization Service Screen.

-

Continue entering all necessary information to set up the service bureau on your system.

Work with External Authorization Service Screen

Purpose: Information will be provided by Oracle at a later date.

How to display this screen: Select External Service for an authorization service at the Work with Authorization Services Screen. External Authorization Service Access (B25) authority is required.

For more information: See the External Payment Layer RESTful Service reference on My Oracle Support for more information on updating these settings.

Note:

All fields are required, with the exception of the External Service flag.

| Field | Description |

|---|---|

|

External Service |

Select this field to have request messages generated for the External Payment Service. |

|

External URL Prefix |

The prefix that forms the beginning of the URL where messages are sent. Must begin with HTTPS. The message type defines the suffix that is appended to the prefix to create the entire URL. For example, for a credit card authorization request, the entire URL might be https://remote.auth.com:1234/authorization, where remote.auth.com is the remote server, 1234 is the port, and authorization identifies an authorization request. The following endpoints are supported:

Alphanumeric, 600 positions; required if the External Service flag is selected. |

|

Message Version |

Indicates which message version is supported with version 3.0 being the default version when creating a new authorization service. Previous versions have been removed. Version 3.0 no longer includes tags that pass the credit card number for an order and instead includes tags that pass the card token. It also allows an external merchant application to call for both Credit Cards and Stored Value Cards supported through the External Payment Service and EFTConnect. |

|

Authentication User |

The user ID for authentication of the messages to the external service. Alphanumeric, 256 positions; required if the External Service flag is selected. |

|

Authentication Password |

The password for authentication of the messages to the external service. Must be at least 6 positions long, include both numbers and letters, include a special character, and cannot end with a number. Alphanumeric, 256 positions; required if the External Service flag is selected. |

Defining Authorization Service Countries

Purpose: Each service bureau that your company uses may assign its own country codes to the various credit card payment methods. These country codes may differ from the country codes your company uses.

The Authorization Service Country function is used to cross reference the country codes your company uses with the country codes the authorization and deposit service uses. By cross referencing the country codes:

-

You can use your country codes when entering orders.

-

The country code the service bureau uses can be included in the Authorization and Deposit transactions that are transmitted to the service bureau.

-

When you create the country cross-reference, you can also indicate whether the service bureau performs address verification for the country.

Note:

Use this option if you are sending transactions to the service bureau using a point-to-point integration.

Authorization service country required for double-byte customer address: If the customer’s address uses a double-byte language, such as Chinese, you need to set up an authorization service country record to support address verification.

In this topic:

Work with Authorization Service Country Screen

Purpose: This screen displays the country cross references currently defined for the service bureau. Use this screen to create, change, or delete the country cross reference information.

The country codes your company uses are defined in the Country table; the country codes the service bureau uses are provided by the service bureau.

How to display this screen: At the Work with Authorization Service Country Screen, select Country for the service bureau.

| Field | Description |

|---|---|

|

Authorization service |

The code and description of the service bureau for which you are defining a country cross reference. Code: Alphanumeric, 3 positions; display-only. Description: Alphanumeric, 30 positions; display-only. |

|

Country |

A code you use to identify a country. Country codes are defined in and validated against the Country table; see Setting Up the Country Table (WCTY). Alphanumeric, 3 positions; optional. |

|

Authorization Service Country |

The code the service bureau uses to identify a country. Vendor country codes are provided by the service bureau. Alphanumeric, 3 positions; optional. |

|

AVS |

Defines whether the service bureau performs address verification for the country. N = The service bureau does not perform address verification for the country. Y = The service bureau performs address verification for the country. Alphanumeric, 1 position; display-only. |

| Option | Procedure |

|---|---|

|

Create a country cross reference |

Select Create to advance to the Create Authorization Service Country Screen. |

|

Change a country cross reference |

Select Change for the country cross reference to advance to the Change Authorization Service Country screen. At this screen you can change the Authorization service country and the Address verification setting. See the Create Authorization Service Country Screen for field descriptions. |

|

Delete a country cross reference |

Select Delete for the country cross reference to delete it. |

Create Authorization Service Country Screen

Purpose: Use this screen to cross reference the country codes your company uses with the codes the service bureau uses. For example, your company may use country code USA to identify the United States of America, whereas the service bureau may use country code US.

The country codes your company uses are defined in the Country table; the country codes the service bureau uses are provided by the service bureau.

How to display this screen: Select Create at the Work with Authorization Service Country Screen.

| Field | Description |

|---|---|

|

Authorization service |

The code and description of the service bureau for which you are defining a country cross reference. Code: Alphanumeric, 3 positions; display-only. Description: Alphanumeric, 30 positions; display-only. |

|

Country |

A code you use to identify a country. Country codes are defined in and validated against the Country table; see Setting Up the Country Table (WCTY). Alphanumeric, 3 positions. Create screen: required. Change screen: display-only. |

|

Authorization service country |

The code the service bureau uses to identify a country. Vendor country codes are provided by the service bureau. Alphanumeric, 3 positions; required. |

|

Address verification |

Defines whether the service bureau performs address verification for the country. Unselected = The service bureau does not perform address verification for the country. Selected = The service bureau performs address verification for the country. |

Defining Vendor Paytype Codes

Purpose: Each service bureau that your company uses may assign its own paytype codes to the various credit card payment methods. These paytype codes may differ from the paytype codes your company uses. For example, the service bureau may use paytype code 01 to represent payment by Visa, whereas, your company may use paytype code 04 to identify payment by Visa.

The Vendor Paytype Codes function is used to cross reference the paytype codes your company uses with the paytype codes the authorization service uses. By cross referencing the paytype codes:

-

you can use your paytype codes when entering orders

-

the paytype code the service bureau uses can be included in the Authorization and Deposit transactions that are transmitted to the service bureau.

In this topic:

Work with Paytype Cross Reference Screen

Purpose: This screen displays the pay type cross references currently defined for the service bureau. Use this screen to create, change, delete, or display the pay type cross reference information.

The pay type codes your company uses are defined in the Pay Type table; the pay type codes the service bureau uses are provided by the service bureau.

How to display this screen: At the Work with Authorization Services Screen, select Paytypes for the service bureau.

| Field | Description |

|---|---|

|

Pay type |

A code you use to identify a method of payment on an order. Pay type codes are defined in the Pay Type table; see Working with Pay Types (WPAY). Numeric, 2 positions; optional. |

|

Vendor pay code |

The code the authorization service uses to identify a method of payment. Vendor pay type codes are provided by the service bureau. Alphanumeric, 5 positions; optional. |

|

Authorization Merchant # |

The merchant number to use when sending authorization requests for this pay type code to the service bureau for approval. The merchant number is assigned to your company by the service bureau. Alphanumeric, 10 positions; optional. |

|

Deposit merchant # (Deposit merchant number) |

The merchant number to use when sending deposit requests for this pay type code to the service bureau for settlement. The merchant number is assigned to your company by the service bureau. Alphanumeric, 10 positions; optional. |

| Option | Procedure |

|---|---|

|

Create a paytype cross reference |

Select Create to advance to the Create CC Paytype Cross Reference Screen for the service bureau. |

|

Change a paytype cross reference |

Select Change for the pay type cross reference you want to change to advance to the Change Paytype Cross Reference Screen. At this screen you can change any information except the Authorization service and the Pay type code. See the Create CC Paytype Cross Reference Screen for field descriptions. |

|

Delete a paytype cross reference |

Select Delete for the pay type cross reference you want to delete. |

|

Display a paytype cross reference |

Select Display for the pay type cross reference you want to display to advance to the Display CC Paytype Cross Reference Screen. You cannot change any information at this screen. See the Create CC Paytype Cross Reference Screen for field descriptions. |

Create CC Paytype Cross Reference Screen

Purpose: Use this screen to cross reference the pay type codes your company uses with the codes the service bureau uses. For example, your company may use pay type code 4 to identify payment by Visa, whereas the service bureau may use pay type code 1.

The pay type codes your company uses are defined in the Pay Type table; the pay type codes the service bureau uses are provided by the service bureau.

How to display this screen: Select Create at the Work with Paytype Cross Reference Screen.

| Field | Description |

|---|---|

|

Pay type |

The code you use to identify a method of payment on an order. Pay type codes are defined in the Pay Type table; see Working with Pay Types (WPAY). Numeric, 2 positions. Create screen: required. Change screen: display-only. |

|

Vendor paytype/code |

The code the service bureau uses to identify a method of payment. Vendor pay type codes are provided by the service bureau. Alphanumeric, 5 positions; required. |

|

Authorization merchant # |

The merchant number to use when sending authorization requests for this pay type code to the service bureau for approval. The merchant number is assigned to your company by the service bureau. Alphanumeric, 10 positions; optional. |

|

Deposit merchant # |

The merchant number to use when sending deposit requests for this pay type code to the service bureau for settlement. The merchant number is assigned to your company by the service bureau. Alphanumeric, 10 positions; optional. |

Instructions:

-

Enter the pay type code you company uses to identify the payment method in the Pay type field.

-

Enter the corresponding pay type code the service bureau uses to identify the payment method in the Vendor pay code.

-

Optionally, enter the authorization and deposit merchant numbers assigned to your company by the service bureau in the Authorization Merchant # and the Deposit merchant # (Deposit merchant number) fields.

-

Your entries are cleared from the screen and a message similar to the following displays: CC Vendor Paytype Cross Reference (NAB - 5) created.

Defining Vendor Response Codes

Vendor response codes identify the reasons that the service bureau approves (authorizes) or declines a credit card charge or deposit. The codes are assigned to each transaction by the service bureau when approving or declining the request.

You should define each code for each service bureau you work with.

The system allows you to set up the following instructions for vendor response codes:

-

how many times to attempt authorization for this response

-

whether to put the order on hold and, if so, for how long

-

whether to flag the order for cancellation

Online credit card authorizations: If you are sending credit cards for authorization during order entry/maintenance (the On-line Authorizations (B89) system control value is selected), the system displays additional fields where you can enter a message indicating whether the credit card was approved or declined and if any action should be taken, such as asking the customer to repeat the credit card number or requesting a different credit card for authorization. If you define a message, the system displays the Select Authorization Response Option Window in order entry/maintenance when a response is received from the service bureau. This window displays the pop up window messages you defined for this vendor response. See Performing Online Credit Card Authorizations for an overview on online authorizations and the required setup.

Credit card decline email: If you specify a program in the Credit Card Decline Email Program (K53) system control value, the batch authorization process in pick slip generation generates an email to the customer when an order is placed on hold due to a credit card decline. See that system control value for more information.

In this topic:

Defining Vendor Response Codes

Entity Setup

Additionally, you can set up the following instructions for a vendor response code for each entity in your company:

-

Whether a dollar limit is applied to the ship via on the order. If the authorization amount is less than the ship via dollar limit, the system releases the order from any AVS hold. If the authorization amount is greater than the ship via dollar limit, the system places the order on hold using the hold reason defined for the ship via dollar limit. See Entity ship via dollar limits.

-

Whether a dollar limit to force an authorization is applied to a specific pay type. See Entity pay type dollar limits.

-

Whether a dollar limit is applied to the item class associated with an item on the order that requires authorization. If the authorization amount is less than the item class dollar limit, the system releases the order from any AVS hold. If the authorization is greater than the item class dollar limit, the system places the order on hold using the hold reason defined for the item class dollar limit. See Entity item class dollar limits.

-

Whether a dollar limit is applied to the postal code for the bill to or sold to customer on the order. If the authorization amount is less than the postal code dollar limit, the system releases the order from any AVS hold. If the authorization amount is greater than the postal code dollar limit, the system places the order on hold using the hold reason defined for the postal code dollar limit. See Entity postal code dollar limits.

Online authorization: If you are performing online authorization, the system does not evaluate the order for entity pay type dollar limit or entity ship via dollar limit; however, the system will evaluate the order for item class dollar limit and postal code dollar limit.

Entity dollar limit hierarchy: The system uses the following hierarchy when evaluating whether the order meets an entity dollar limit.

-

Evaluate the order for Entity pay type dollar limits.

-

If the order does not qualify for entity pay type dollar limits, evaluate the order for Entity ship via dollar limits.

-

If the order does not qualify for entity ship via dollar limits, evaluate the order for Entity item class dollar limits.

-

If the order does not qualify for entity item class dollar limits, evaluate the order for Entity postal code dollar limits.

If an order qualifies for more than one of the entity dollar limits, the system holds/releases the order using the last entity dollar limit that qualifies. For example, if the order qualifies for both entity ship via dollar limit and entity postal code dollar limit, the system holds or releases the order based on the entity postal code dollar limit setup.

Entity ship via dollar limits

You can set up a ship via dollar limit for an AVS response for each entity in your company. You can use the ship via dollar limit to reduce the amount of fraud. For example, a credit card may receive an AVS response of “all address matching,” but you may want to perform an additional check against the ship via assigned to the order and the dollar amount that requires authorization.

-

If the authorization amount is less than the ship via dollar limit, the system releases the order from any AVS hold.

-

If the authorization amount is greater than the ship via dollar limit and the sold to customer and ship to customer are different, the system places the order on hold using the hold reason defined for the ship via dollar limit.

The system checks the following information to determine if an order should go on hold due to a ship via dollar limit:

-

the service bureau code

-

the AVS response code received from the service bureau

-

the Entity associated with the order

-

the Ship via code on the order header

-

the $ limit to hold on the order

-

the sold to customer and ship to customer are different

-

The Use Credit Card Vendor Response Entity Ship Via Dollar Limits (F94) system control value is selected. If this system control value is not selected, the system does not perform an edit against the ship via dollar limit for an AVS response to determine if an order should go on hold.

The system does not evaluate the order for ship via dollar limit if:

-

The order does not pass authorization, regardless of whether the ship to customer is different than the sold to customer.

-

You are performing online authorization.

Entity ship via dollar limit summary:

| AVS response | Entity $ limit | Auth amount less than entity $ limit | Auth amount greater than or equal to entity $ limit |

|---|---|---|---|

|

hold reason |

no hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Entity Via $Limit. |

The system places the order on hold, using the hold reason defined for the AVS response. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

hold reason |

The system does not place the order on hold. |

The system places the order on hold, using the hold reason defined for the entity ship via dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

no hold reason |

The system does not place the order on hold. |

The system does not place the order on hold. |

|

hold reason |

hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Entity Via $Limit. |

The system places the order on hold, using the hold reason defined for the entity ship via dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

Ship via dollar limit example: The following is an example of how to set up a ship via dollar limit for an AVS response code.

| AVS Response | Description | Hold Reason Code |

|---|---|---|

|

I3 |

All Address Matching |

None |

The following is an example of how to set pu ship via dollar limit hold values:

| AVS Response | Entity | Ship Via | $ Limit | Hold Reason Code |

|---|---|---|---|---|

|

I3 |

555 |

1 |

$50.00 |

J3 |

|

I3 |

555 |

2 |

$75.00 |

J4 |

|

I3 |

555 |

3 |

$150.00 |

J5 |

Using the example, if an order passed AVS because it received an AVS response of I3, all address matching, the system would then perform an edit against the ship via dollar limit defined for the response.

If a ship via dollar limit was defined for the entity associated with the order, the ship via defined on the order, and the dollar amount on the order that required authorization was greater than the dollar limit defined for the AVS response, the order would then be placed on hold, using the hold reason code defined for the ship via dollar limit.

Using the example, the system would assign the hold reason code J3 to an order if the order was associated with entity 555, ship via code 1, and the dollar amount that required authorization was greater than $50.00.

Entity pay type dollar limits

You can set up a pay type dollar limit for a vendor response for each entity in your company. You can use the pay type dollar limit to force authorizations that have been declined.

Example: If a credit card received a vendor response of "credit card exceeds limit", you may want to force the authorization through anyway if the dollar amount that requires authorization is less than $50.00.

If you set up a pay type dollar limit, the order receives a forced authorization if:

-

the credit card on the order is declined, and

-

the dollar amount that requires authorization is greater than $1.00 and is less than the pay type dollar limit you have set up for the credit card pay type on the order. Note: If you wish to force authorizations for credit cards requiring authorizations less than $1.00, enter an authorization number in the Authorization Number for Authorizations Under $1.00 (I08) system control value.

In this situation, the order receives a forced authorization, and the system writes the Default Credit Card Authorization Number for Soft Declines (F93) to the Authorization number field on the Authorization History record. The system processes the authorization through Order Administration, as if the number that defaulted from the system control value was an actual authorization number. The order will be processed through pick slip generation and the system will produce pick slips for the order. The system also writes an order transaction history message indicating the authorization was forced.

If the Default Credit Card Authorization Number for Soft Declines (F93) system control value is blank, the order is placed on hold, using the vendor response hold reason code. If the hold reason code for the vendor response is blank, or a hold reason code has not been defined for the vendor response, the order is not placed on hold, and is processed through pick slip generation.

Note:

The system may still place the order on hold if it fails AVS authorization.

The system checks the following information to determine if an order should receive a forced authorization after it has been declined:

-

the service bureau code

-

the Vendor response code received from the service bureau

-

the Entity associated with the order

-

the credit card Pay type on the order that requires authorization

The system does not evaluate the order for pay type dollar limit if you are performing online authorization.

Note:

The system performs an edit against the pay type dollar limit defined for a vendor response before the number of authorization attempts logic. If the order passes the pay type dollar limit edit, the system does not perform the number of attempts edit against the order.

Entity pay type dollar limit summary:

| Vendor response | Auth amount less than entity $ limit to force auth | Auth amount greater than or equal to entity $ limit to force auth |

|---|---|---|

|

hold reason |

The system does not place the order on hold. Order transaction history message: System Forced CC Auth - Auth# 999999. |

The system places the order on hold, using the hold reason defined for the vendor response. Order transaction history message: SYS HLD - Declined Credit Card. |

Pay type dollar limit example: This example shows how to set up a pay type dollar limit for a vendor response code.

| Vendor Response | Description | Hold Reason Code |

|---|---|---|

|

Vendor Response Value: |

||

|

42 |

Declined, card over limit |

H4 |

| Vendor Response | Entity | Pay Type | Dollar Limit |

|---|---|---|---|

|

Pay Type Dollar Limit Values: |

|||

|

42 |

555 |

4 VISA |

$50.00 |

|

42 |

555 |

5 MASTERCARD |

$75.00 |

Using the example, if an order did not pass authorization because it received a vendor response of 42, declined card over limit, the system would then perform an edit against the pay type dollar limit defined for the response.

If a pay type dollar limit was defined for the entity associated with the order, the pay type defined on the order, and the dollar amount on the order that required authorization was less than the dollar limit defined for the vendor response, the order would receive a forced authorization, using the Default Credit Card Authorization Number for Soft Declines (F93).

Using the example, an order would receive a forced authorization if the pay type on the order was VISA and the dollar amount for the VISA card was under $50.00.

Entity item class dollar limits

You can set up an item class dollar limit for an AVS response for each entity in your company. You can use the item class dollar limit to reduce the amount of fraud. For example, a credit card may receive an AVS response of “all address matching”, but you may want to perform an additional check against the item class (such as high-theft items) assigned to one or more of the items on the order and the dollar amount that requires authorization.

-

If the authorization amount is less than the item class dollar limit, the system releases the order from any AVS hold.

-

If the authorization is greater than the item class dollar limit, the system places the order on hold using the hold reason defined for the item class dollar limit.

The system checks the following information to determine if an order should go on hold due to an item class dollar limit:

-

the service bureau code

-

the AVS response code received from the service bureau

-

the Entity associated with the order

-

the $ limit to hold on the order

-

the item class assigned to one or more of the items on the order requesting authorization

Note:

-

The item(s) assigned to the item class must be requesting authorization. For example, if the item assigned to the item class is on backorder, the other items on the order requesting authorization will not qualify for the item class dollar limit.

-

If more than one item class on the order qualifies for an item class dollar limit, the system uses the item class associated with the lowest order number. For example, if order line 1 is associated with item class PNT and order line 3 is associated with item class ELC and both qualify, the system uses the item class dollar limit defined for item class PNT.

The system does not evaluate the order for item class dollar limit if the order does not pass authorization.

Entity item class dollar limit summary:

| AVS response | Entity $ limit | Auth amount less than entity $ limit | Auth amount greater than or equal to entity $ limit |

|---|---|---|---|

|

hold reason |

no hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Item Class $Limit. |

The system places the order on hold, using the hold reason defined for the AVS response. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

hold reason |

The system does not place the order on hold. |

The system places the order on hold, using the hold reason defined for the entity item class dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

no hold reason |

The system does not place the order on hold. |

The system does not place the order on hold. |

|

hold reason |

hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Item Class $Limit. |

The system places the order on hold, using the hold reason defined for the entity item class dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

Item class dollar limit example: The following is an example of how to set up an item class dollar limit for an AVS response code.

| AVS Response | Description | Hold Reason Code |

|---|---|---|

|

I3 |

All Address Matching |

None |

Item class dollar limit to hold example:

| AVS Response | Entity | Item Class | Dollar Limit | Hold Reason Code |

|---|---|---|---|---|

|

I3 |

555 |

ELC |

$50.00 |

C1 |

|

I3 |

555 |

PNT |

$75.00 |

C2 |

|

I3 |

555 |

ZBA |

$150.00 |

C3 |

Using the example, if an order passed AVS because it received an AVS response of I3, all address matching, the system would then perform an edit against the item class dollar limit defined for the response.

If an item class dollar limit was defined for the entity associated with the order, the item class assigned to at least one of the items on the order requiring authorization, and the dollar amount on the order that required authorization is equal to or greater than the dollar limit defined for the AVS response, the order would then be placed on hold, using the hold reason code defined for the item class dollar limit.

Using the example, the system would assign the hold reason code C1 to an order if the order was associated with entity 555, item class ELC, and the dollar amount that required authorization was equal to or greater than $50.00.

Entity postal code dollar limits

You can set up a postal code dollar limit for an AVS response for each entity in your company. You can use the postal code dollar limit to reduce the amount of fraud. For example, a credit card may receive an AVS response of “All Address Match”, but you may want to perform an additional check against the postal code assigned to the bill to or sold to customer on the order and the dollar amount that requires authorization.

-

If the authorization amount is less than the postal code dollar limit, the system releases the order from any AVS hold.

-

If the authorization amount is greater than the postal code dollar limit, the system places the order on hold using the hold reason defined for the postal code dollar limit.

The system checks the following information to determine if an order should go on hold due to a postal code dollar limit:

-

the service bureau code

-

the AVS response code received from the service bureau

-

the Entity associated with the order

-

the postal code for the bill to customer on the order; if a bill to customer is not defined, the system validates the postal code for the sold to customer on the order

-

the $ limit to hold on the order

The system does not place the order on postal code dollar limit hold if the order does not pass authorization.

Entity postal code dollar limit summary:

| AVS response | Entity $ limit | Auth amount less than entity $ limit | Auth amount greater than or equal to entity $ limit |

|---|---|---|---|

|

hold reason |

no hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Postal Code $Limit. |

The system places the order on hold, using the hold reason defined for the AVS response. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

hold reason |

The system does not place the order on hold. |

The system places the order on hold, using the hold reason defined for the entity postal code dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

|

no hold reason |

no hold reason |

The system does not place the order on hold. |

The system does not place the order on hold. |

|

hold reason |

hold reason |

The system releases the order from AVS hold. Order transaction history message: AVS HLD Release - Postal Code $Limit. |

The system places the order on hold, using the hold reason defined for the entity postal code dollar limit. Order transaction history message: SYS HLD - Declined Credit Card. |

Postal code dollar limit example: The following is an example of how to set up a postal code dollar limit for an AVS response code.

| AVS Response | Description | Hold Reason Code |

|---|---|---|

|

I3 |

All Address Matching |

None |

Postal code dollar limit to hold example:

| AVS Response | Entity | Postal code | Dollar Limit | Hold Reason Code |

|---|---|---|---|---|

|

I3 |

555 |

01468 |

$50.00 |

P1 |

|

I3 |

555 |

01701 |

$75.00 |

P2 |

|

I3 |

555 |

02053 |

$150.00 |

P3 |

Using the example, if an order passed AVS because it received an AVS response of I3, all address matching, the system would then perform an edit against the postal code dollar limit defined for the response.

If a postal code dollar limit was defined for the entity associated with the order, the postal code assigned to the sold to, and the dollar amount on the order that required authorization is equal to or greater than the dollar limit defined for the AVS response, the order would then be placed on hold, using the hold reason code defined for the postal code dollar limit.

Using the example, the system would assign the hold reason code P1 to an order if the order was associated with entity 555, postal code 01468, and the dollar amount that required authorization was equal to or greater than $50.00.

Vendor Response Setup Examples

Examples of different vendor responses, and how you might set them up on the system for credit card authorization before shipment, are:

Stolen credit card:

-

do not reattempt authorization

-

put the order on CF (credit card fraud) hold

-

flag the order for cancellation

Over credit limit:

-

put the order on hold for 5 days before reattempting authorization

-

flag the order for cancellation after a number of declined authorizations

Transmission error:

-

do not put the order on hold; reattempt authorization immediately

Address verification failed:

-

do not reattempt authorization

-

put the order on AV (address verification) hold

Card security value should be on the credit card:

-

do not reattempt authorization

-

put the order on CF (credit card fraud) hold

Note:

A pick slip will not print if the authorization is declined or if the order is on hold.

Determining the maximum number of declines: The system counts the number of declines for each different vendor response code separately. For example, if an authorization is declined twice for a transmission error, and is then declined for exceeding a credit limit, the counter starts again at 1 the first time you receive the new vendor response code.

The Maximum Number of Retries on Credit Card Orders (E74) system control value specifies the maximum number of all declines (with any vendor response that represents a decline) an order can accumulate before being flagged for cancellation. This value overrides the limit you specify for an individual vendor response. Be sure to set this system control value high enough that you do not inadvertently flag on order for cancellation when it still might be eligible for authorization.

Releasing held orders: The Release Orders on Time Hold periodic function evaluates held credit card orders for release based on their hold dates. See Releasing Orders from Time Hold.

You can also use the Release Held Orders (ERHO) menu option to release orders one at a time..

Canceling orders: You can use the Working with Credit Card Cancellations (WCCC) menu option to cancel all orders flagged for cancellation automatically. You can also set up this function as part of your periodic process.

About Deposits

Response codes may be used both for credit card authorizations and deposit authorizations. Typically, you would need to authorize a deposit because the order is using deferred or installment billing, and so you would not have a current authorization for the amount of the deposit you are processing.

The system does not perform the same types of actions against the order for a deposit authorization as it does for other authorizations. Specifically, the system does not reference the following fields (defined at the Create Vendor Response Screen) when processing an authorization for a deposit:

-

Hold reason

-

of authorization attempts

-

of days between attempts

-

Cancel reason

-

Letter type

Similarly, the Maximum Number of Retries on Credit Card Orders (E74) system control value does not play a role in authorizing deposits.

Force deposit: You can set a vendor response code to “force deposit” in your company when you receive this response code from the deposit service. To do so, select the Force deposit for FPO flag for the response code. Forcing deposit means that you process all of the same updates in your company as if you had received an approval for the authorization.

Regular (non-payment plan) deposits are always forced.

Note:

You must make your own arrangements with the service bureau regarding how to deal with unconfirmed or rejected deposit transactions.

The system checks the setting of this "force deposit" flag only when:

-

you process a deposit for a deferred or installment pay plan

-

the service bureau supports force deposit

-

the authorization is declined (that is, the response code is not 100)

-

the system submitted the transaction with an action code of B (obtain both an authorization and deposit) rather than D (deposit only)

If you don't force: When a payment plan deposit fails authorization and is not forced, the deposit appears on the Unconfirmed Deposits Listing Report. You can use Manage Rejected Deposits in Modern view to work with these deposits. Additionally, the order is placed on hold, and any orders that match the sold to customer and/or the credit card number are placed on hold as well.

More information:

Work with Vendor Response Screen

Purpose: This screen displays the response codes currently defined for the service bureau. Use this screen to add, delete, or change a response code for the service bureau.

You must create a vendor response code for each code used by the service bureau. If the system receives a vendor response code it does not recognize, it puts the order on AVS hold.

How to display this screen: Select Responses for the service bureau at the Work with Authorization Services Screen

| Field | Description |

|---|---|

|

Response code |

The code assigned by the service bureau that identifies whether the credit card was authorized or declined, and the reason for the authorization or decline. Alphanumeric, 10 positions; optional. |

|

Description |

The description of the response code. Alphanumeric, up to 40 positions; optional. |

| Option | Procedure |

|---|---|

|

Change a vendor response code |

Select Change for a response code to advance to the Change Vendor Response Screen. At this screen you can change any information except the Authorization service code and the Response code. See the Create Vendor Response Screen for field descriptions. |

|

Delete a vendor response code |

Select Delete for a response code to delete it. |

|

Display a vendor response code |

Select Display for a response code to advance to the Display Vendor Response Screen. You cannot change any information at this screen. See the Create Vendor Response Screen for field descriptions. |

|

Work with ship via dollar limits and pay type dollar limits for a vendor response code |

Select Response/Entity Details for a response code to advance to the Work with Ship Via $ Limit to Hold Screen. |

|

Create a vendor response code |

Select Create to advance to the Create Vendor Response Screen. |

Create Vendor Response Screen

Purpose: Use this screen to define the response codes that the service bureau uses to indicate the disposition of the authorization, and how the system should then handle the order.

How to display this screen: Select Create at the Work with Vendor Response Screen

| Field | Description |

|---|---|

|

Response code |

The code assigned by the service bureau to identify whether the credit card was authorized or declined, and the reason for the authorization or decline. You should define each code used by the service bureau on the system. If the service bureau returns a response that the system does not recognize, the order appears on the Credit Card Authorization Listing as DECLINED (no description will appear) and is put on AVS hold; you must release the order through the Release Held Orders menu option, described in Selecting Held Orders (ERHO). Deposits: See About Deposits for an example of how response codes may be used during deposits processing. Note: The INSUFFICIENT_FUNDS response code for the RLT authorization service (WASV) must be assigned a hold reason code of SV. Alphanumeric, 10 positions. Create screen: required. Change screen: display-only. |

|

ORCE response |

The code assigned by the Oracle Retail Customer Engagement service bureau to identify whether the stored value card transaction was approved or declined. Use this field to map a response from Oracle Retail Customer Engagement to a vendor response code. This field displays only if the Authorization service code for the service bureau is RLT. See Customer Engagement Stored Value Card Integration. Alphanumeric, 60 positions. Create screen: optional. Change screen: display-only. |

|

Description 1 |

The description of the response code. You can use the description provided by the service bureau or you can use your own description. Both lines of the description appear on the Credit Card Authorization Listing. You can also review it in standard order inquiry at the Authorization History Details Window. Deposits: The first line only of the response code description displays on the Display Deposit History Detail Screen in standard order inquiry when the service bureau uses this response code for a deposit authorization. Alphanumeric, 100 positions; required. |

|

Description 2 |

An additional description for the response code. Alphanumeric, 100 positions; optional. |

|

Hold reason |

The hold code to use for orders receiving this response. This a paytype-level hold; the order will be put on AT hold. The hold reason you enter here displays on the Credit Card Order Cancellation List when you process cancellations, so you can use this field as a description of the vendor response for that report. No pick slip prints if the order is placed on hold. If you assign a Hold date to the order (by completing the # of days between attempts field) you can release the order through the Release Orders on Time Hold periodic function. If not, you must use the Release Held Orders or Manual Credit Card Authorization function to release the order. Leave the Hold field blank if orders with this response code should not be placed on hold. Hold reason codes are defined in and validated against the Order Hold Reason table; see Establishing Order Hold Reason Codes (WOHR). Deposits: The system does not reference this field when processing an authorization for a deposit. See About Deposits. Alphanumeric, 2 positions; optional. |

|

# authorization attempts (Number of authorization attempts) |

The number of times to attempt to authorize an order before flagging it for cancellation. This field defines the number of attempts for this response code only; if the vendor returns a different response code, the count begins again at one. Enter 1 in this field if you want to flag an order for cancellation immediately. If this value is set to more than one, the system will continue to resubmit the order for authorization until the value is reached, provided the order is not held. The Maximum Number of Retries on Credit Card Orders (E74) system control value overrides this limit if it is lower than the maximum specified for a given response code. This system control value will also override the limit for a response code if the combined total authorization attempts for all responses on an order meets the maximum defined in the System Control table. Leave this field blank if you want to the system to continue to attempt authorization indefinitely (however, the system control value described above will override a blank value). Deposits: The system does not reference this field when processing an authorization for a deposit. See About Deposits. Online credit card authorization: The system does not reference this field when processing an online credit card authorizations. Numeric, 2 positions; optional. |

|

# of days between attempts |

The number of days to add to the current date when calculating a Hold until date for an order. Example: If the current date is 7/15, and this field is set to 5, the system assigns a Hold until date of 7/20. If you leave this field blank and:

The Release Orders on Time Hold periodic function releases an order from hold once the Hold date is reached. See Releasing Orders from Time Hold. Deposits: The system does not reference this field when processing an authorization for a deposit. See About Deposits. Online credit card authorization: The system does not reference this field when processing an online credit card authorization. Numeric, 2 positions; optional. |

|

Cancel reason |

The cancel reason to use when an order has reached the # authorization attempts (Number of authorization attempts), or in the number in the system control value (whichever is lower). As part of this process, the order is flagged for cancellation; you use the Working with Credit Card Cancellations (WCCC) option to cancel such orders. You can also set this function up as part of your periodic processing. If an order becomes eligible for cancellation because its total number of authorization attempts meet the maximum defined in the System Control table, the system uses the cancellation code associated with the most recently received vendor response. Cancel reason codes are defined in and validated against the Cancel Reason Code table; see Establishing Cancel Reason Codes (WCNR). Deposits: The system does not reference this field when processing an authorization for a deposit. See About Deposits. Online credit card authorization: The system does not reference this field when processing an online credit card authorization. Numeric, 2 positions; optional (required if you enter a value in the # authorization attempts field). |

|

Force deposit for FPO |

Indicates whether to process all the usual updates for a deposit when you receive this response code from the service bureau, even though this response code actually represents a decline. Selected = force deposit Unselected (default) = Do not force deposit About Deposits |

|

Pop up window messages (online authorization messages) |

Four additional fields where you can enter a message indicating whether the credit card is approved or declined and if any action should be taken, such as asking the customer to repeat the credit card number or requesting a different credit card for authorization. Note: These fields only display if the On-line Authorizations (B89) system control value is selected and the Batch/online field for the service bureau is set to I (online authorization only) or C (online and batch authorization). If you are sending credit cards for authorization during order entry (the On-line Authorizations (B89) system control value is selected), the system displays the Select Authorization Response Option Window in order entry when a response is received from the service bureau. This window displays the pop up window messages you defined for this vendor response. See Performing Online Credit Card Authorizations for an overview on online authorizations and the required setup. Alphanumeric, four 40-positions fields; optional. |

Select Entity for Vendor Response Details Screen

Purpose: Use this screen to define more information for a vendor response for each entity in your company. At this screen you can:

-

define a ship via dollar limit for an AVS response code to perform an additional edit against the authorization amount if the ship via on the order matches a ship via dollar limit and the sold to customer and ship to customer are different.

-

define a pay type dollar limit to force an authorization for a declined vendor response code.

-

define an item class dollar limit for an AVS response code to perform an additional edit against the authorization amount if one or more item(s) on the order requiring authorization has an item class that matches an item class dollar limit.

-

define a postal code dollar limit for an AVS response code to perform an additional edit against the authorization amount if the postal code for the sold to on the order matches a postal code dollar limit.

How to display this screen: On the Work with Vendor Response Screen screen, select Response/Entity Details for a vendor response

| Field | Description |

|---|---|

|

Authorization service |

The code and description to identify the service bureau for which you are working with vendor response details. This is the service bureau you selected at the Work with Authorization Services Screen. Authorization code: Alphanumeric, 3 positions; display-only. Authorization description: Alphanumeric, 30 positions; display-only. |

|

Response code |

The code and description assigned by the service bureau that identifies whether the credit card was authorized or declined, and the reason for the authorization or decline. This is the vendor response you selected on the Work with Vendor Response Screen. For ship via dollar limit, postal code dollar limit, and item class dollar limit, this must be an AVS response code. Pay type dollar limit applies to a vendor response code. Vendor response code: Alphanumeric, 10 positions; display-only. Vendor response description: Alphanumeric, 40 positions; display-only. |

|

Entity |

A code for the entity for which you wish to create vendor response details. An entity is a component of the sales reporting hierarchy. An entity can represent the business units in your company, for example, mail order, retail, wholesale). A list of all the valid entity records set up for the company you are currently in displays. Entity codes are defined in and validated against the Entity table. See Working with Entities (WENT). Numeric, 3 positions; optional. |

|

Description |

A description of the entity. Alphanumeric, 25 positions; optional. |

| Screen Option | Procedure |

|---|---|

|

Define ship via dollar limits for a specific entity |

Select Ship Via $ Limit for an entity to advance to the Work with Ship Via $ Limit to Hold Screen. |

|

Define pay type dollar limits for a specific entity |

Select Pay Type $ Limit for an entity to advance to the Work with Pay Type $ Limit to Force Authorization Screen. |

|

Define item class dollar limits for a specific entity |

Select Item Class $ Limit for an entity to advance to the Work with Item Class $ Limit to Hold Screen. |

|

Define postal code dollar limits for a specific entity |

Select Postal Code $ Limit for an entity to advance to the Work with Postal Code $ Limit to Hold Screen. |

Work with Ship Via $ Limit to Hold Screen

Purpose: Use this screen to create and maintain ship via dollar limits for a specific entity, AVS response, and service bureau.

Ship via dollar limit defines whether a dollar limit is applied to the ship via on the order.

-

If the authorization amount is less than the ship via dollar limit, the system releases the order from any AVS hold.

-

If the authorization amount is greater than the ship via dollar limit, the system places the order on hold using the hold reason defined for the ship via dollar limit.

You might use this if you want to keep a careful check for stolen credit cards. For example, you can place an order on hold if the order is associated with a Federal Express ship via and the dollar amount required for authorization is greater than $200.00.