3 Setting Up Localizations for Argentina

This chapter contains the following topics:

-

Section 3.5, "Setting Up Corresponding Versions of Programs for Argentina"

-

Section 3.7, "Setting Up Localizations Additional Information for Argentina (Release 9.1 Update)"

-

Section 3.8, "Setting Up Print Authorization Codes for Argentine Suppliers"

-

Section 3.9, "Setting Up to Print Invoices and Shipment Notes for Argentina"

-

Section 3.10, "Setting Up the System to Generate the Text Payments File for Argentina"

-

Section 3.12, "Setting Up the System for Deferred Payments for Argentina"

-

Section 3.13, "Setting Processing Options for Additional A/B Information (P760101A)"

-

Section 3.15, "Entering Supplier Information for Small Contributors"

-

Section 3.17, "Specifying that Withholding Applies to a Small Contributor"

-

Section 3.18, "Setting Up Invoice Type M for Voucher Processing for Argentina"

-

Section 3.19, "Setting Up Credit Invoice Constants for Accounts Payable for Argentina"

-

Section 3.20, "Setting Up Tax Area Relationships for Credit Invoices for Argentina"

-

Section 3.21, "Setting Up Credit Invoice Status Rules for Argentina"

-

Section 3.22, "Setting Up Credit Invoice Constants for Accounts Receivable for Argentina"

-

Section 3.23, "Setting Up Payment Instruments for Credit Invoices for Argentina"

3.1 Setting Up UDCs for Argentina

Setting up Argentina-specific UDCs enables you to use Argentine functionality. You also set up some base software UDCs with Argentina-specific values.

Set up UDCs for:

-

Foreign suppliers and supplier withholding

-

Credit invoice processing

-

SICORE

-

Fixed assets and inventory management

-

Perception reports

-

Accounts receivable drafts

-

Tax processing

-

Accounts payable

-

Shipment notes

-

VAT Reports

3.1.1 Setting Up UDCs for Foreign Suppliers and Supplier Withholding for Argentina

Set up Argentina-specific values in the base software UDCs, and set up these Argentina-specific UDCs.

3.1.1.1 State & Province Codes (00/S)

The Administracion Federal de Ingresos Publicos (AFIP) has established a special codification for each state. You must set up the special codification in the Special Handling Code field of UDC 00/S as shown in this table:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| CF | Capital Federal | 0 |

| BA | Buenos Aires | 1 |

| CA | Catamarca | 2 |

| CO | Cordoba | 3 |

| COR | Corriente | 4 |

| ER | Entre Ríos | 5 |

| JY | Jujuy | 6 |

| MZ | Mendoza | 7 |

| LR | La Rioja | 8 |

| SA | Salta | 9 |

| SJ | San Juan | 10 |

| SL | San Luis | 11 |

| SF | Santa Fe | 12 |

| SE | Santiago del Estero | 13 |

| TU | Tucumán | 14 |

| CH | Chaco | 16 |

| CHU | Chubut | 17 |

| FOR | Formosa | 18 |

| MI | Misiones | 19 |

| NEU | Neuquen | 20 |

| LP | La Pampa | 21 |

| RN | Río Negro | 22 |

| SC | Santa Cruz | 23 |

| TF | Tierra del Fuego | 24 |

|

Note: Special Handling Code 15 does not exist. |

3.1.1.2 Tax Codes (70/TX)

This UDC table enables you to define regional tax codes, and it is used on generic objects. To work with RG 3164 withholding, you must set up the value VAT RG3164 in this UDC table.

3.1.1.3 ARG - G.I. Agreement Code (76/01)

You set up gross income agreement codes to identify agreement types. The system uses these values when you process gross income withholding for suppliers.

For example, you might set up these gross income agreement codes:

| Codes | Description |

|---|---|

| 00 | Multilateral |

| 01 | Unilateral |

| 02 | Multilateral Agreement |

| 03 | Not Registered |

| 04 | Exempt |

| 05 | Special Regime |

| 99 | Without Agreement |

3.1.1.4 ARG - VAT Withholding Concept (76/02)

Set up value-added tax (VAT) withholding concepts to identify groups of items according to their withholding percentages. The system uses these values when you process VAT withholding for suppliers.

You must set up a code for invoice type M for voucher processing.

For example, you might set up these VAT withholding concepts:

| Codes | Description |

|---|---|

| BIE | Goods |

| CER | Cereals |

| FLT | Shipment |

| NO | No concept |

| SER | Services |

| IVM | Invoice M - VAT |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

3.1.1.5 ARG - Profit WH Condition (76/03)

You set up profit withholding condition codes as provided by the AFIP to define different supplier conditions for profit withholding. The system uses these values when you process profit withholding for suppliers.

For small contributor profit withholding, the system uses the values in the Description 2 field to determine if the supplier is registered, not registered, or is a small contributor. These codes must exist in the Description 2 field for codes used for small contributors:

-

M (Monotributista [small contributor])

-

N (No inscripto [not registered])

-

I (Inscripto [registered])

You assign a value from this UDC table when you set up suppliers in the A/B Tag File Maintenance – ARG program (P760101A). The system calls the A/B Tag File Maintenance – ARG program from the Supplier Master program (P04012).

This table shows the AFIP condition codes that you use to set up the profit withholding condition codes. You associate the AFIP condition codes with the profit withholding codes by entering the AFIP code in the Special Handling Code field of the 76/03 UDC table:

| Code | Description 1 |

|---|---|

| 1 | Registered |

| 2 | Not Registered |

| 3 | Not Categorized |

| 6 | Hourly or Daily Contract |

| 7 | Monthly Contract |

| 8 | Included in the Grains Fiscal Regime |

| 9 | Not Included in the Grains Fiscal Regime |

| 10 | Other Subjects Registered |

| 11 | Gas Stations Registered VAT Withholding |

| 12 | Public Services |

| 13 | General Rate - Sales or Rent Movable Things |

| 14 | Reduced Rate - Sales or Rent Movable Things |

| 15 | Substitute Withholding |

This table shows example of how you might set up codes in this UDC table.

| Codes | Description 01 | Description 02 | Special Handling Code |

|---|---|---|---|

| . | |||

| INS | Registered | I | 1 |

| NOI | Not Registered | N | 2 |

| NOR | No Withholding | 3 | |

| MON | Small Contributor | M | 7 |

3.1.1.6 ARG - Profit WH Concept (76/04)

You set up profit withholding concepts to identify groups of items according to their profit withholding percentages. The system uses these values when you process withholding profits for suppliers.

You must set up a code for invoice type M.

For example, you might set up these codes:

| Codes | Description |

|---|---|

| 10 | Services |

| 20 | Rental income |

| 30 | Goods |

| 40 | Professional |

| 50 | Service location |

| 60 | Invoice type M - profit |

| 70 | Professional fees |

| 80 | Decentralized regime |

| 99 | No withholding |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

To meet the requirements of RG 830/00, you must set up UDC 76/04 to identify the concept that is used to withhold taxes for copyright, and set up the special handling code with the amount up to which no withholding will occur. According to RG 830, this amount is ten thousand pesos. For example, you might set up this concept code for RG 830/00:

| Codes | Description 01 | Description 02 | Special Handling Code |

|---|---|---|---|

| 60 | Derechos de Autor | NA | 10000 |

3.1.1.7 ARG - G.I. Concept - Source (76/05)

You set up gross income concept source codes to identify groups of items according to their gross income withholding percentages. The system uses the values in this UDC when you process gross income withholding for suppliers.

For example, you might set up these gross income concept source codes:

| Codes | Description |

|---|---|

| BIE | Goods |

| FLT | Shipment |

| NOR | No withholding |

| SER | Services |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

3.1.1.8 ARG - G.I. Concept - Destination (76/06)

You set up gross income concept destination codes to identify groups of items according to their gross income withholding percentages. The system uses the values in this UDC when you process gross income withholding for suppliers.

For example, you might set up these gross income concept destination codes:

| Codes | Description |

|---|---|

| BIE | Goods |

| FLT | Shipment |

| NOR | No withholding |

| SER | Services |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

3.1.1.9 ARG - Contract Concept (76/07)

You set up contract concept codes to identify groups of items according to their contract withholding percentages. Set up the values in this UDC before processing withholdings for contractors.

For example, you might set up these contract concept source codes:

| Codes | Description |

|---|---|

| ARC | Architecture |

| ENG | Engineering |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

3.1.1.10 ARG - G.I. State - Source (76/09)

You set up gross income state source codes to identify the states that are the source of gross income taxes. The system uses the values that you set up in this UDC when you process gross income withholding for suppliers.

For example, you might set up these gross income state source codes:

| Codes | Description |

|---|---|

| 01 | Cordoba |

| 02 | Mendoza |

| 03 | Catamarca |

| 04 | Neuguen |

| 05 | Santa Fe |

| 30 | Buenos Aires |

| 31 | Buenos Aires - Branch 0001 |

| 32 | Buenos Aires - Branch 0002 |

| 99 | No withholding |

3.1.1.11 ARG - G.I. State - Destination (76/10)

You set up gross income state destination codes to identify the states that are the destination of gross income taxes. The system uses these values when you process gross income withholding for suppliers.

For example, you might set up these gross income state destination codes:

| Codes | Description |

|---|---|

| 01 | Cordoba |

| 02 | Mendoza |

| 03 | Catamarca |

| 04 | Neuguen |

| 05 | Santa Fe |

| 30 | Buenos Aires |

| 31 | Buenos Aires - Branch 0001 |

| 32 | Buenos Aires - Branch 0002 |

| 99 | No withholding |

3.1.1.12 ARG - Eventual Concept (76/11)

Set up codes for eventual concepts. Enter 1 in the Special Handling Code field for cleaning services concepts. The system uses the values that you establish when you process withholding for sistema único de seguridad social (SUSS) and cleaning services.

For example, you might set up these values:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| (Blank) | (Blank) | N/A |

| ABC | Professional | N/A |

| DEF | Administrative | N/A |

| LIM | Cleaning Services | 1 |

| NOR | No withholding | 1 |

| SER | Servicios de Limpieza | 1 |

|

Note: You should include a value of blank so that you can assign that value to the records that are not subject to this withholding. |

3.1.1.13 Small Contributor Classific. (76/13)

You set up values in this UDC table to identify small-contributor suppliers as those providing goods or services. You assign a value from this UDC table when you set up suppliers in the A/B Tag File Maintenance – ARG program (P760101A). The system calls the A/B Tag File Maintenance – ARG program from the Supplier Master program (P04012). You also enter a value from this UDC table when you set up the small contributor limits in the Small Contributor Limits program (P76A050).

|

Note: You should include a value of blank so that you can assign that value to suppliers who are not classified as small contributors. |

Examples of values are:

| Codes | Description |

|---|---|

| (blank) | |

| BIE | Goods |

| SER | Services |

3.1.1.14 ARG-Item ABI-Allowed Values (76/A2)

Set up values in this UDC table to specify the base amount on which the system applies the withholding percentage. You assign these values in the Contract Services Withholding Percentages program (P760405A) and the system uses them during the Update process of the automatic payment process.

The codes in this UDC table are not hard-coded. However, the system assumes that UDC codes are set up as shown in this table:

| Codes | Description |

|---|---|

| 1 | Gross amount |

| 2 | Taxable amount |

| 3 | Taxable + Tax amount |

| 4 | Taxable + nontaxable amount |

3.1.1.15 ARG-DGI Transaction Doc. Type (76/DT)

You use the values in the ARG-DGI Transaction Doc. Type (76/DT) UDC to associate SICORE document types with AFIP legal document types by specifying the AFIP legal document type in the Codes field and the associated SICORE document type in the Special Handling Code field.

The SICORE data structure defines the special codes shown in this table for document types that generate withholding:

| Special Handling Code | Description |

|---|---|

| 1 | Voucher |

| 2 | Receipt |

| 3 | Credit Note |

| 4 | Debit Note |

| 5 | Other Document |

| 6 | Payment Order |

In this example for RG 1415, the SICORE document type 1, shown in the Special Handling Code column, corresponds to type A and B vouchers:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| 01 | Invoice A | 1 |

| 02 | Debit Note A | 4 |

| 03 | Credit Note A | 3 |

| 04 | Receipts A | 2 |

| 06 | Invoice B | 1 |

3.1.1.16 ARG-DGI Transaction Doc. Type (76/AF) (Release 9.1 Update)

You use the values in the ARG-DGI Transaction Doc. Type (76/AF) UDC to associate SICORE document types with AFIP legal document types by specifying the AFIP legal document type in the Codes field and the associated SICORE document type in the Special Handling Code field.

The SICORE data structure defines the special codes shown in this table for document types that generate withholding:

| Special Handling Code | Description |

|---|---|

| 1 | Voucher |

| 2 | Receipt |

| 3 | Credit Note |

| 4 | Debit Note |

| 5 | Other Document |

| 6 | Payment Order |

In this example for RG 1415, the SICORE document type 1, shown in the Special Handling Code column, corresponds to type A and B vouchers:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| 001 | Invoice A | 1 |

| 002 | Debit Note A | 4 |

| 003 | Credit Note A | 3 |

| 004 | Receipts A | 2 |

| 006 | Invoice B | 1 |

3.1.1.17 ARG - V.A.T. Legal Concept (76/L1)

Set up VAT legal concepts to identify different types of legal activities. VAT legal concept codes are defined by the Administración Federal de Ingresos Públicos (AFIP). The system uses these values when you process VAT withholding for suppliers.

You must set up code 499 for invoice type M.

For example, you might set up these VAT legal concepts:

| Codes | Description |

|---|---|

| 110 | Services |

| 12 | Goods |

| 250 | Shipment |

| 76 | Cereals |

| 499 | Invoice type M - VAT |

3.1.1.18 ARG - Gross Income Legal Conc. (76/L2)

Set up gross income legal concepts to identify different types of legal activities. Gross income legal concept codes are defined by the AFIP. The system uses the values in this UDC when you process gross income withholding for suppliers.

For example, you might set up these gross income legal concepts:

| Codes | Description |

|---|---|

| 25 | Goods |

| 55 | Shipment |

| 77 | Services |

3.1.1.19 ARG - Profit Legal Concept (76/L3)

Set up profit legal concept codes to identify types of legal activities. Profit legal concept codes are defined by the AFIP. The system uses these values when you process profit withholding for suppliers and when you print the SICORE reports.

For example, you might set up these codes:

| Codes | Description |

|---|---|

| 019 | Service location |

| 027 | Rental income |

| 110 | Services |

| 115 | Professionals |

| 116 | Professional fees |

| 128 | Goods |

3.1.1.20 ARG - Contract Legal Concept (76/L4)

Set up contract legal concepts to identify types of legal activities. Contract legal concept codes are defined by the AFIP. The system uses the values that you enter in this UDC when you process withholding for contractors.

3.1.1.21 ARG - Eventual Legal Concept (76/L5)

Set up eventual legal concepts to identify types of legal activities. Eventual legal concept codes are defined by the AFIP. The system uses the values that you establish when you process withholding for SUSS and cleaning services.

3.1.1.22 ARG - A/B Legal Document Type (76A/A0)

Set up legal document types to classify tax ID numbers, including foreign tax IDs.

This table shows the AFIP valid document types:

| Code | Description |

|---|---|

| 80 | C.U.I.T. |

| 86 | C.U.I.L. |

| 87 | C.D.I. |

| 83 | Foreign Tax ID |

| 84 | Foreign ID |

This table provides an example of how you might set up UDC 76A/A0:

| Codes | Description 01 | Special Handling Code | Hard Coded |

|---|---|---|---|

| 080 | CUIT | 1 | Y |

| 084 | CUIT prov del exterior | na | N |

| 085 | DNI | na | N |

|

Note: When you set up document type CUIT, you must enter 1 in the Special Handling Code field so that the system validates the CUIT (clave única de identificación tributaria) number when it is entered or modified. |

3.1.1.23 Unchangeable Pay Status (76A/EI)

You set unchangeable pay status codes to specify the pay statuses at which vouchers cannot be changed.

This table provides an example of how you could set up UDC 76A/EI:

| Codes | Description 01 |

|---|---|

| # | Payment Process |

| A | Approved |

| P | Paid |

3.1.1.24 Country CUIT (76A/FJ)

Set up the CUIT numbers for the country of origin of foreign suppliers.

This UDC code consists of the country of origin and the person/corporation code. Use the Description 01 field to set up the country CUIT, as shown in this example:

| Codes | Description 01 |

|---|---|

| FRC | 55-00000430-7 |

| FRP | 50-00000412-7 |

| USP | 50-0000301-5 |

3.1.1.25 Tax Codes (76A/TX)

The system uses this table to define tax codes for Argentina, and it is used in Argentina objects. To work with RG 3164 withholding, you must set up the value VAT RG3164 in this UDC table.

3.1.1.26 Withholding Minimum (76A/WM)

The system uses these values to determine whether to compare the minimum amount to the taxable amount or the withholding amount. Required values are:

| Codes | Description 01 |

|---|---|

| Blank | No minimum withholding. |

| 1 | Taxable amount is greater than or equal to the minimum amount. |

| 2 | Taxable amount is greater than the minimum amount. |

| 3 | Withholding amount is greater than or equal to the minimum amount. |

| 4 | Withholding amount is greater than the minimum amount. |

3.1.1.27 Excluded Document Types (76A/XD)

Set up values in this UDC table to identify the voucher document types that the system exempts from VAT and profit withholding validations. When you run the Create Payment Groups program (R04570) for Argentina or enter a manual payment in the Payment with Voucher Match program (P0413M), the system uses the values in this UDC table to exclude transactions from the determination of whether a transaction exceeds the limits established for a 12-month period.

3.1.1.28 Excluded Tax Areas (76A/XT)

Set up values in this UDC table to identify the tax rate areas that the system exempts from VAT and profit withholding validations. When you run the Create Payment Groups program or enter a manual payment, the system uses the values in this UDC table to exclude transactions from the determination of whether a transaction exceeds the limits established for a 12-month period.

3.1.1.29 Legal Form Codes (76A/FC) (Release 9.1 Update)

Set up values in this UDC table to identify the legal form code that the system uses to process SUSS withholdings and profit withholdings for foreign beneficiaries. The legal form codes are assigned by the AFIP. When you run the S.U.S.S. TXT File - Withholding Information report (R76A4002) and the F2003 Profit Withholding to External Beneficiaries report (R76A4005), the system uses the values in this UDC table to identify the legal form for which the flat file is generated. For example, to process SUSS withholdings, create a code 2003, and to process profit withholdings for foreign beneficiaries, create a code 2004.

3.1.1.30 Legal Tax Code (76A/LC) (Release 9.1 Update)

Set up values in this UDC table to identify the legal tax code that the system uses to process SUSS withholdings and profit withholdings for foreign beneficiaries. The legal tax codes are assigned by the AFIP. When you run the S.U.S.S. TXT File - Withholding Information report (R76A4002) and the F2003 Profit Withholding to External Beneficiaries report (R76A4005), the system uses the values in this UDC table to identify the legal tax code for which the flat file is generated.

3.1.1.31 Legal Document Type (76A/DV) (Release 9.1 Update)

Set up values in this UDC table to identify the legal document type that the system uses to process SUSS withholdings and profit withholdings for foreign beneficiaries.

3.1.1.32 SIRE Countries (76A/PS) (Release 9.1 Update)

The system uses the values in this UDC table to determine the SIRE (Sistema Integrado Retenciones Electronicas) country code of the supplier when processing profit withholdings to external beneficiaries.

3.1.1.33 Aliquot With CDI (76A/WC) (Release 9.1 Update)

Set up values in this UDC table to determine the withholding rate when CDI is applicable to profit withholdings for foreign beneficiaries.

3.1.1.34 Aliquot Without CDI (76A/WD) (Release 9.1 Update)

Set up values in this UDC table to determine the withholding rate when CDI is not applicable to profit withholdings for foreign beneficiaries.

3.1.1.35 Profit Gross Up (76A/AC) (Release 9.1 Update)

Set up values in this UDC table to determine whether the profit withholdings are grossed up when you process profit withholdings for foreign beneficiaries.

3.1.2 Setting Up UDCs for Credit Invoice Processing for Argentina

Before you process credit invoices, set up these UDCs.

3.1.2.1 Document Type - Invoices Only (00/DI)

You must specify a value of 1 in the Special Handling Code field for the document types that might require credit invoices.

|

Note: You should set up one or more new document types for vouchers that have credit invoices attached. |

3.1.2.2 Document Type - Vouchers Only (00/DV)

You must specify a value of 1 in the Special Handling Code field for the document types that might require credit invoices.

|

Note: You should set up one or more new document types for vouchers that have credit invoices attached. |

The document type that is used for voucher acceptance (for example, FX) must be set up in the Document Type (00/DT) and the Document Type - Vouchers Only (00/DV) UDCs.

3.1.2.3 Address Book Category Codes (01/01 through 01/30)

You must define an address book category code to identify the suppliers and customers who issue or receive credit invoices.

You can use any category code, but you must specify the number of the category code that you are using in the General Constants program (P76A20).

You must set up a code for the category code that you specify. You can use any code. If the supplier or customer has a code other than blank in this category code, the system assumes that a credit invoice must be issued.

3.1.2.4 Credit Invoice Valid Status (76A/CS)

Credit invoice status codes represent the current status of a credit invoice and determine the event to be processed. For example, you might set up these credit invoice status codes:

| Code | Description 01 | Special Handling Code |

|---|---|---|

| (Blank) | (Blank) | N/A |

| 01 | Initial | N/A |

| 05 | To Accept | N/A |

| 10 | Accepted | A |

| 15 | Pay with Cash | N/A |

|

Note: The values in the Special Handling Code field do not apply to the JD Edwards EnterpriseOne Accounts Payable system; they are used by the JD Edwards EnterpriseOne Accounts Receivable and JD Edwards EnterpriseOne Sales Order Management systems, except in the case of a value of 1, which is used to specify a reclassification of losses. |

3.1.2.5 Credit Invoice A/P Events (76A/EV)

Events are the different points in the life cycle of a credit invoice. Use them to determine which valid status the invoice credit must have to pass through that event. JD Edwards EnterpriseOne software provides hard-coded values for this UDC.

3.1.2.6 Special Payment Instruments (76A/PY)

You use special payment instrument codes to identify the payment instruments (for example, X) that cancel the original voucher and automatically generate another voucher with the document type that is specified in this UDC (for example, FX) for the voucher amount less the withholding amount.

In the Description 02 field, specify the type of document to generate, followed by the credit invoice class and the payment term to assign to it. For example, you could specify FXACEPCDO in the Description 02 field, where:

-

FX is the credit invoice document type.

-

ACEP is the supplier classification that identifies the liability account for credit invoices.

You must set up the corresponding PCxxxx AAI.

-

CDO is the payment term of the acceptance voucher.

You would set up this special payment instrument code like this:

| Code | Description 01 | Description 02 |

|---|---|---|

| X | Credit invoice accepted | FXACEPCDO |

3.1.3 Setting Up UDCs for SICORE for Argentina

Set up these UDCs before you run the Step III - Self Withholdings program (R76A96).

3.1.3.1 ARG - Profit WH Concept (76/04)

You must enter 1 in the Description 02 field on UDC 76/04 to allow the columns to appear in the SICORE, as shown in this table:

| Codes | Description 01 | Description 02 |

|---|---|---|

| None | . | None |

| 10 | Services | 1 |

| 20 | Rental Income | 1 |

| 30 | Goods | 1 |

| 40 | Professional | 1 |

| 50 | Service Location | 1 |

| 70 | Professional Fees | 1 |

| 80 | Decentralized Regime | 1 |

| 99 | No Withholding | None |

3.1.3.2 ARG - Profit Legal Concept (76/L3)

Set up profit legal concept codes to identify types of legal activities. Profit legal concept codes are defined by the AFIP. The system uses these values when you process profit withholding for suppliers, and when you print the SICORE reports.

You must set up code 099 for invoice type M.

For example, you might set up these codes:

| Codes | Description |

|---|---|

| 019 | Service location |

| 027 | Rental income |

| 099 | Invoice M - profit |

| 110 | Services |

| 115 | Professionals |

| 116 | Professional fees |

| 128 | Goods |

3.1.4 Setting Up UDCs for Fixed Assets and Inventory Management for Argentina

Set up these UDCs before processing fixed assets and inventory adjustments.

3.1.4.1 G/L Reporting Code 15 (09/15)

You must use Chart of Accounts Category Code 15 to specify the Asset Type for each account that is used in the JD Edwards EnterpriseOne Fixed Assets system. The transactions from the Account Ledger table (F0911) are grouped, and Annex A is generated based on the Asset Type from Category Code 15. You must define asset types in UDC 09/15 before you set up accounts.

3.1.4.2 Anexo A Column Type (76A/12)

You use UDC 76A/12 to set up the relationship between document types and the column on the Annex A report in which they will be printed. You might set up this UDC as shown in this table:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| AD | Disposals | B |

| AT | Transfers | T |

3.1.5 Setting Up UDCs for the Perception Report for Argentina

Set up these UDCs that the system uses when you produce the Perception report:

-

ARG - Concept Code (76A/CI)

-

ARG - Concept Code (76A/CR)

-

Perception Code SICORE (76A/PE)

3.1.5.1 ARG-Concept Code (76A/CI)

Use UDC 76A/CI to set up tax category codes in conformity with General Resolution 738/99. The system uses these values when you run the Perception Report (R76A8050) program.

This table provides an example of how you might set up UDC 76A/CI:

| Codes | Description 01 |

|---|---|

| 217 | Impuesto a las ganancias |

| 767 | Impuesto al valor agregado |

3.1.5.2 ARG- Concept Code (76A/CR)

Use UDC 76A/CR to set up the activity codes under which the company can operate. Enter the codes and corresponding descriptions in conformity with General Resolution 738/99. The system uses these values when you run the Perception Report (R76A8050) program.

|

Important: This description is the concept of the perception certificate. |

This table provides an example of how you might set up UDC 76A/CR:

| Codes | Description 01 |

|---|---|

| 493 | Importaciones |

| 663 | Importacion de carnes |

3.1.5.3 Perception Code SICORE (76A/PE)

You must associate the tax codes from UDC 76A/TC with the perception activity codes from UDC 76A/CR and the tax categories from UDC 76A/CI. You set up this association in UDC 76A/PE. The system uses these values when you run the Perception Report (R76A8050) program.

You specify the tax codes in the Codes field, the activity code in the Description 01 field, and the tax category in the Description 02 field, as shown in this example:

| Codes | Description 01 | Description 02 |

|---|---|---|

| FTIMP01 | 663 | 767 |

| IVA21PIA | 248 | 767 |

| IVAPERA | 248 | 767 |

| PER | 663 | 217 |

| PER1 | 265 | 767 |

| PER2 | 267 | 767 |

| PRU | 463 | 217 |

| REB-PER | 663 | 217 |

3.1.6 Setting Up UDCs for Tax Processing for Argentina

Set up these UDCs for standard tax processing and to meet the requirements of RG 1361 for sales and purchase transactions.

3.1.6.1 Foreign Currency Codes (00/CC)

Set up this UDC for the VAT Purchasing Ledger. You must add the currency code that AFIP requires in the Description 02 field of this UDC, as shown in this example:

| Codes | Description 01 | Description 02 |

|---|---|---|

| ARS | Argentine Peso | ARS |

| USD | U.S. Dollar | USD |

3.1.6.2 Document Type - Invoices Only (00/DI)

Set up this UDC for the for the Sales VAT Ledger. As established by general resolution, the fiscal authority (AFIP) states that the different invoices which are reported in the Sales VAT Ledger must have this codification:

-

Document types that correspond to exempt operations must be listed in UDC (00/DI) with Z, X, or E in the second position of the Special Handling Code field.

-

Document types that correspond to nontaxable operations must be listed in UDC (00/DI) with N in the second position of the Special Handling Code field.

This example shows a document type with Z in the second position of the Special Handling Code field:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| RI | Invoice | 1Z |

Document types of printed invoices that originated in the JD Edwards EnterpriseOne Sales Order Management system or the JD Edwards EnterpriseOne Accounts Receivable system and that have an exempt concept must be configured in this UDC. Documents with VAT must have a blank value in the second position of the Special Handling Code field.

If the same invoice has a combination of different concepts (for example, a VAT rate with exempt or nontaxable concepts) and this UDC contains a Z, X, E, or N in the Special Handling Code field for the document type, the system writes a blank in the Sales VAT Ledger magnetic file.

If the Special Handling Code field in the UDC contains an invalid value or is blank and the invoice concept is exempt, the program generates a warning message in the Work Center and writes an E in the Sales VAT Ledger magnetic file.

If the Special Handling Code field in the UDC contains an invalid value or is blank and the invoice concept is nontaxable, the program generates a warning message in the Work Center and writes an N in the Sales VAT Ledger magnetic file.

If the Special Handling Code field in the UDC contains an invalid value or is blank and the invoice has both exempt and nontaxable concepts, the program generates a warning message in the Work Center and writes an E in the Sales VAT Ledger magnetic file.

In addition, the fiscal authority requires that the program validate that the tax amount is less than the taxable amount and that the taxable amount must be less than the gross amount of the invoice. If these conditions are not met and the invoice has lines with tax explanation code VT, the program generates a message in the Work Center.

3.1.6.3 Responsible Type (01/xx)

Set up this UDC for the VAT Purchasing Ledger and the Sales VAT Ledger. For the VAT Purchasing Ledger, use an Address Book category code (01/xx) to list the VAT condition of subjects. Enter these AFIP codes in the Special Handling Code field:

| AFIP Code | Description |

|---|---|

| 01 | VAT inscript |

| 02 | Non-inscript VAT |

| 03 | Non responsible VAT |

| 05 | Final consumer |

This table is an example of UDC 01/24 for the VAT Purchasing Ledger:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| . | . | . |

| INS | Registered | 01 |

| NOI | Not registered | 02 |

| NOR | No withholding | 03 |

You specify the address book category code that you are using in the processing options of the V.A.T Purchasing Ledger program (R760499A).

For the Sales VAT Ledger, use an address book category code (01/xx) to list the responsible types. Enter the values that are defined by AFIP in the Special Handling Code field as shown:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| . | . | . |

| INS | Inscripto | 01 |

| NOI | No Inscripto | 02 |

| NOR | No retener | 03 |

You specify the address book category code that you are using in the processing options of the Sales VAT Tax Subsidiary program (R76A8060). The Sales VAT magnetic file lists the value from the Special Handling Code field for the responsible type.

3.1.6.4 ARG - Item ANAT Allowed Values (76/A3)

Set up this UDC table with values that you use to specify whether tax is calculated on tax. You use the values that you setup when you set up tax constants.

3.1.6.5 Item ASIB Allowed Values (76A/B3)

Use Item ASIB codes to specify the allowed values that define the invoice buckets for tax codes. The invoice bucket is the line on which the invoice tax will be printed. All tax codes with the same invoice bucket number appear on the same invoice line.

You assign invoice buckets to tax codes when you set up tax definitions.

3.1.6.6 ARG - Item ANAT Allowed Values (76A/B7)

Set up this UDC table with codes that you use when you specify a tax group in the tax constants.

3.1.6.7 Fiscal Controller (76A/CF)

Set up this UDC for the VAT Purchasing Ledger. Set up this hard-coded value in UDC 76A/CF:

| Codes | Description 01 | Hard Coded |

|---|---|---|

| (blank) | Default | N |

| C | Fiscal Controller | Y |

3.1.6.8 Destination Code (76A/DE)

Set up this UDC for the VAT Purchasing Ledger. Set up these hard-coded values in UDC 76A/DE:

| Codes | Description 01 | Hard Coded |

|---|---|---|

| (blank) | Default | N |

| CORI | Rpt Deposit Earning Correction | Y |

| DIS4 | Simplified Import Destination | Y |

| DIS5 | DAP Simplified Import Dest. | Y |

| EC01 | Export to Consumption | Y |

| EC02 | Expt to Consmptn w/DIT | Y |

| EC03 | Exp to consmptn/minerals conc | Y |

| EC09 | Exp to Cons w/DIT wo/trnsfrm | Y |

| IG01 | Imp to cons ige ops wo/trans | Y |

3.1.6.9 Country's CUIT (76A/FJ)

Set up this UDC for the Sales VAT Ledger. List the external CUITs that are defined by AFIP for foreign countries in UDC (76A/FJ):

| Codes | Description 01 |

|---|---|

| FRC | 55-00000430-7 |

| FRP | 50-00000412-7 |

| USP | 50-0000301-5 |

The system retrieves the CUIT from this UDC based on the Country and Person/Corporation Code of the supplier or customer in the JD Edwards EnterpriseOne Address Book system. For example, if the supplier's Country code is FR and the Person/Corporation Code is C, the system retrieves the CUIT for the FRC code in this UDC.

3.1.6.10 Operation Code (76A/OC)

Set up this UDC for the VAT Purchasing Ledger. Set up these hard-coded values in UDC (76A/OC):

| Codes | Description 01 | Hard Coded |

|---|---|---|

| (blank) | Default | N |

| E | Exempt Opt | Y |

| X | Foreign Export/Import | Y |

| Z | Export/Import Tax Free zone | Y |

3.1.7 Setting Up UDCs for Accounts Payable for Argentina

In addition to the standard software UDCs for accounts payables, set up these Argentina-specific UDCs and these base UDCs with Argentina-specific values.

3.1.7.1 Foreign Currency Codes (00/CC)

Set up this UDC before you generate the text payments file. You use this UDC when working with RG 1547 and RG 1361. RG 1547 uses the value in the Code and the Special Handling Code fields, while RG 1361 uses the value in the Code and the Description 02 fields. This example illustrates possible values for UDC 00/CC:

| Codes | Description 01 | Description 02 | Special Handling Code |

|---|---|---|---|

| ARA | Pesos Argentinos | ARS | 002 |

| ARS | Pesos | ARS | 123 |

| USD | Dolares | USD | 001 |

3.1.7.4 Payment Instruments (00/PY)

Set up UDC 00/PY to include the deferred check payment instrument (D), entering 1 in the first position of the Special Handling Code field as illustrated in this example:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| D | Draft by Invoice (A/R and A/P) | 1 |

The system uses these values when you process deferred payments.

In addition to setting up payment instruments for standard payment processing, specify that no withholding takes place if withholding vouchers are written off when payments are made in bonds.

The system stores unfulfilled withholding in a table so that you can generate a report showing these amounts when required by the fiscal authority.

You specify whether withholding is saved in permanent files or in unfulfilled withholding tables by completing the Special Handling Code field for the payment instrument in UDC 00/PY. This UDC does not affect withholding calculations.

The value in the Special Handling Code field consists of these parts:

| Position | Description |

|---|---|

| First Position | Specifies whether the payment is deferred. Values are:

|

| Second Position | Specifies whether VAT is withheld. Values are:

|

| Third Position | Specifies whether profit taxes are withheld. Values are:

|

| Fourth Position | Specifies whether taxable amounts and profit withholding is stored in the Profit Withholding - Payments Done table (F760406A). Values are:

|

| Fifth Position | Specifies whether the system applies withholding taxes for security services. Values are:

The system treats a blank value as a Y. |

| Sixth position | Specifies whether the system accumulates the withholding taxes in the F76A0456 table. Values are:

The system treats a blank value as a Y. |

This table lists the results of various special handling code combinations. The underlined character represents a blank space:

| Special Handling Code | Explanation |

|---|---|

| _YYYY | All withholding is made and the profits are accrued. This code is the same as leaving the Special Handling Code field blank. |

| _YYN | VAT is withheld, but profits are not accrued. |

| _YNY | VAT is withheld, but profits taxes are not withheld. The taxable amount is accrued for the unfulfilled withholding calculation. |

| _YNN | VAT is withheld, but profits taxes are not; profits are not accrued. |

| _NYY | VAT is not withheld; but profit taxes are withheld, and profits are accrued. |

| _NNN | No taxes are withheld. The VAT and profit tax withholding are saved in temporary files, and profits are not accrued. |

|

Note: If you include a 1 in the first position in any of the preceding combinations, the payment is considered to be a deferred payment. |

This table is an example of payment instruments for Lecops payments:

| Codes | Description 01 | Description 02 | Special Handling Code |

|---|---|---|---|

| J | Lecops | No retiene ni acumula RET | NNN |

| N | Cheque dif con Lecops | No RET si acumula Gcias | 1YNN |

3.1.7.5 Issue Place (76A/LE)

Use this UDC to identify the issue place of legal documents. For example, you might set up codes for each of your warehouses and for your main office.

3.1.7.6 Payment Types (76A/PT)

Set up this UDC before you generate the text payments file. You must set up these payment types:

| Codes | Description |

|---|---|

| 01 | Finance entities accounts deposits |

| 02 | Draft or bank transfers |

| 03 | Checks or cancellation checks |

| 04 | Credit cards |

| 05 | Credit invoice |

| 06 | Endorsable checks |

| 07 | Other |

3.1.7.7 Payment Terms Codes (76A/TP)

Set up this UDC before you generate the text payments file. You must set up two classifications of the operations:

-

01 - Cash

-

02 - Future Payment Term

The payment terms that are considered cash (01) must be listed in the UDC. Those that are not in the UDC are considered future payment terms (02).

3.1.8 Setting Up UDCs for Shipment Notes for Argentina

Set up standard software UDCs for sales order processing, and set up these Argentina-specific UDCs to print shipment notes.

3.1.8.1 ARG - Item ARGP-Allowed Values (76/B1)

Set up these values to work with shipment notes:

| Code | Description |

|---|---|

| R | Remito |

| X | Shipment note |

3.1.8.2 ARG-DGI Transaction Doc. Type (76/AF) (Release 9.1 Update)

Set up this value to work with shipment notes:

| Code | Description |

|---|---|

| 091 | Remito |

3.1.9 Setting Up UDCs for VAT Reports (Release 9.1 Update)

Set up the UDCs for standard tax processing and these UDC tables to meet the legal requirements for VAT reports.

3.1.9.1 Presentation Sequence (76A/SE)

When you work with VAT reports, you specify if the report that you are generating is the original version, or if it is an amendment. In case you need to submit amendments more than once, you must specify the sequence number of the current report.

You assign a value from the Presentation Sequence UDC table in the processing options for the RG 3685 Purchase and Sales Information program (R76A010) when you run the program to generate the header for the VAT reports that you want to submit to the fiscal authorities.

The JD Edwards EnterpriseOne system provides hard-coded values for this UDC table. Some valid values are:

| Codes | Description |

|---|---|

| 00 | Original |

| 01 | Amendment 1 |

| 02 | Amendment 2 |

You can add additional records to this UDC table if needed.

3.1.9.2 Relationship Tax AFIP (76A/AL)

The system uses this UDC table to establish relationships between the tax rates that your company uses and the codes that the fiscal authority sets for those rates.

When you generate VAT reports, the system checks if the VAT rate in the transaction is listed in this UDC, and reports the code published by AFIP in the output file.

The code is the four-digit value that the system uses when processing transactions, to identify the percentage that is calculated for a specific VAT rate, expressed without commas or periods. When you run VAT reports, the system searches for this code in the transaction record, automatically. If the value is listed in the Relationship Tax AFIP UDC table, the report displays the tax area for the transaction using the one-digit number assigned to the rate in this table. You can use the Description 01 field to enter a description for the code (the system does not use the information in this field). The data in the Description 02 field is the code listed in the catalog published by the government.

The JD Edwards EnterpriseOne system provides hard-coded values for this UDC table. Verify that the following codes are set up in your system:

| Codes | Description 01 | Description 02 |

|---|---|---|

| NOGR | Non taxable | 1 |

| EXEN | Exempt | 2 |

| 0000 | 0% | 3 |

| 1050 | 10,50% | 4 |

| 2100 | 21% | 5 |

| 2700 | 27% | 6 |

| 0500 | 5% | 8 |

| 0250 | 2,50% | 9 |

3.1.9.3 VAT Commission (76A/CM)

VAT Commission is a specific VAT rate applicable to companies that work with third parties as commission agents for specific economic activities. When you work with the VAT reports required by the RG 3685, the information about this rate must be specified in the text files generated.

Set up this UDC with the codes you use to identify the VAT Commission Tax Rate areas that your company uses. The tax area must exist in the Tax Areas (F4008) and the Additional Tax Areas - Arg (F764008A) tables.

For example, you might set up a record like this, where the Code field is the code for the Commission VAT tax rate:

| Codes | Description 01 |

|---|---|

| GRALCOM | Commission VAT Rate |

You can use the Description 01 field to enter a description for the code for your own references. The system does not use the information in this field.

3.1.9.4 Service Imports Document Types (76A/SI)

RG 3685 requires that you report the transactions that include service imports in a separate file. The transactions must also specify if the document for such transactions is a voucher, a contract or other type of document, according to a code system.

Set up the Service Imports Document Types UDC table with the document types that your company uses to identify service imports transactions. Use the Special Handling Code field to identify the document according to the following list:

-

1: Enter 1 for the document types that are vouchers. If you leave the SHC field blank, the system assumes the document is a voucher.

-

2: Enter 2 to specify that the document is a contract.

-

3: Enter 3 for all other document types.

The system uses this information when you work with the Service Import VAT report for RG 3685.

For example, you might set up a record like the following:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| FT | Service Imports | 3 |

In this example, the Code field is the internal document type, the Special Handling Code indicates that this is not a voucher or a contract, but "other" document, and the Description 01 is a description of that document.

The system only uses the information in the Description 01 field when the Special Handling Code is set to 3.

3.2 Setting Up AAIs for Argentina

This section discusses how to set up AAIs for:

-

Supplier withholding

-

Deferred payments

-

Credit invoice processing

-

Accounts receivable draft processing

-

Inventory inflation adjustment

|

See Also: |

3.2.1 AAIs for Supplier Withholding for Argentina

You must set up these AAIs for VAT, gross income, contract, cleaning, and eventuals withholding and associate them with the appropriate accounts:

-

$I: VAT withholding account

-

$G: Profit withholding account

-

$Bxx: Gross income withholding account

The variable xx in this AAI specifies the state.

-

$S: Contract withholding account

-

$A: Eventuals withholding account

As an alternative, you can set up $ADEF (eventual services including the withholding concept).

-

$L: Cleaning services

As an alternative, you can set up $LLIM (cleaning services including the withholding concept).

-

$Q: SUSS withholding

-

PC$I: VAT withholding control account

-

PC$G: Profit withholding control account

-

PC$L: Cleaning services control account

-

PC$Bxx: Gross income withholding control account

The variable xx in this AAI specifies the state.

-

PC$S: Contract withholding control account

-

PC$A: Eventuals withholding control account

When setting up $B and PC$B for gross income, you must append the state number to the suffix. For example, if the state number is 01, the AAI becomes $B01 and PC$B01.

For VAT, profits, eventuals, and contract accounts, the system can associate current accounts by concept. For example, you might set up $IEL. If the system does not find specific accounts, it uses the generic withholding codes ($I, $G, $A, and $S).

3.2.2 Setting Up AAIs for Deferred Payments

Set up AAI PD for the control account that will be charged for deferred checks, as illustrated in this example:

| Seq No. | Item. No. | Description | Co | Bus Unit | Obj Acct | Sub | Install System |

|---|---|---|---|---|---|---|---|

| 4.041 | PD | Deferred Checks Control Acct. | 00028 | 28 | 1115 | CTRL | 04 |

3.2.3 Setting Up AAIs for Credit Invoice Processing for Argentina

You must set up the PT and PC AAIs to process credit invoices.

3.2.3.1 PT + Offset (Tax)

You must create a PTxxxx AAI for the original tax area and one for the temporary tax area. The PTxxxx AAI for the original tax area must specify the tax fiscal credit account. The PTxxxx AAI for the temporary tax area must specify a temporary tax account.

When vouchers that require a credit invoice are posted, the offset of the temporary tax area is charged.

The reclassification process uses the Credit Invoice Tax Area Relationship (F76A25) table to cancel the temporary fiscal credit and charge the final one.

3.2.3.2 PC + Offset (Credit Invoice Accepted)

The PCxxxx AAI identifies the supplier class that corresponds to the debts from credit invoices that are represented by the voucher that is defined for credit invoices. This AAI must use a liability account.

This offset is charged during acceptance and then canceled when the accepted credit invoice is paid.

3.2.4 Setting Up AAIs for Draft Processing for Argentina

When you process accounts receivable drafts, you can use the government-issued Provincial Obligation Letters (Lecops) as the payment instrument.

Set up these AAIs for Lecops:

-

RDL (RD + payment instrument)

-

RD1L (RD1 + payment instrument)

-

RD2L (RD2 + payment instrument)

3.2.5 Setting Up AAIs for Inventory Inflation Adjustments

You must set up the following Distribution AAIs to process inflation inventory adjustment:

-

3910: Inventory Stock Valuation - Adjustment

Use this AAI to identify the inventory account for the inflation adjustment process.

-

3911: Expense or Cost of Goods Sold - Stock Valuation Adjustments

Use this AAI to identify the results account, which serves as the offset to the inventory adjustments account.

3.3 Setting Up Next Numbers for Argentina

This section discusses how to set up next numbering for withholding taxes and for profit withholding certificates (traceability codes).

You also set up next numbering for legal document numbering and VAT and profit withholding certificates.

3.3.1 Setting Up Next Numbers for Withholding Taxes

You must set up next numbers by company, fiscal year, or both, for the tax withholding document types $A, $G, $I, $L, and $S. The system uses this setup to obtain the numbering for supplier tax withholding certificates.

This table includes examples of next numbering setup:

| Document Company | Document Type | Description | Check Digit | Next Number Range |

|---|---|---|---|---|

| 00028 | $G | Profit Withholding | N/A | 115 |

| 00028 | $I | VAT Withholding | N/A | 111 |

| 00028 | $S | Contract Withholding | N | 5 |

| 00028 | $A | Eventuals Withholding | N | 26 |

| 0028 | $L | Cleaning Services Withholding | N | 40 |

|

Note: Next numbers for gross income withholding are assigned according to state specifications. Therefore, the only gross income document type for which you must set up next numbers is gross income rectifications. |

3.3.2 Setting Up Next Numbers for Withholding Certificates (Release 9.1 Update)

You set up temporary next numbers for traceability codes (for profit withholding certificates) in the standard software Next Numbers program (P0002). The system uses the temporary next numbers when you run the F2003 Profit Withholding to External Beneficiaries (R76A4005) and the S.U.S.S. TXT File- Withholding Information (R76A4002) programs.

After you submit the report to the fiscal authorities and receive the official traceability code in return, you use the Withholding Certificates Legal Number Maintenance - 76A program (P76A001) to relate the internal certificate number with the certificate number issued by the AFIP.

See Processing SIRE Withholding Reports (Release 9.1 Update)

3.3.2.1 Form Used to Set Up Withholding Certificate Numbers

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Set Up Next Numbers by System | W0002C | In the Fast Path field, enter nn.

On the Work With Next Numbers form, select system 76A. |

Set up next numbers for traceability codes in profit withholding certificates. |

3.3.2.2 Setting Up Next Numbers for Traceability Codes in Profit Withholding Certificates

Access the Set Up Next Numbers by System form.

- Use

-

In the sixth row, enter 76A.

- Next Number

-

For the sixth position under the Use column, enter a next number in the corresponding Next Number field. For example, enter 1.

- Check Digit Used

-

Do not select this check box for traceability codes.

3.4 Setting Up AAI Document Types for Argentina

You must set up the document types and the corresponding AAIs that are used in the process of adjusting works in progress for inflation. You adjust for inflation to manage your inventory.

This section discusses how to set up AAI document types.

3.4.1 Form Used to Set Up AAIs in Document Types for Inventory Inflation Adjustment

3.4.2 Set Up AAI Document Types

Access the Set Up AAI Document Type form.

Figure 3-1 Set Up AAI Document Type form

Description of ''Figure 3-1 Set Up AAI Document Type form''

- Document Type

-

Enter a value that exists in the Document Type (00/DT) UDC table.

- Order Type

-

Enter a value that exists in the Document Type (00/DT) UDC table.

- AAI Table Number

-

Enter a number used to specify sequence and retrieve accounting information.

3.5 Setting Up Corresponding Versions of Programs for Argentina

Some country-specific functionality requires that you create versions of the same name for a country-specific program and a base software program. For example, to have the system access the processing options for a country-specific voucher program, you might need to set up a version named XYZ for the country-specific voucher program and a version named XYZ of the Standard Voucher Entry (P0411) program.

Set up corresponding versions for these programs:

| Argentina Program | Base Software Program |

|---|---|

| AR SOP Print Credit Invoice (R76A0023) | Invoice Print (R03B505)

See Understanding How to Process Credit Invoices for Accounts Receivable and Sales Orders for Argentina. |

| PO - Update Receipt Register from Electronic Input (R76A551D) | Update Receipts Header (R03B551)

See Understanding How to Upload Automatic Receipts for Argentina. |

| PO Interest Invoice (R76A03B2) | Generate Delinquency Fees (R03B525) |

| PO - Invoice Print A/R (R76A03B5) | Invoice Print (R03B505)

See Understanding How to Process Credit Invoices for Accounts Receivable and Sales Orders for Argentina. |

| PO Invoice/Shipment Note Print (R76A565) | Invoice Print (R42565)

See Understanding How to Process Credit Invoices for Accounts Receivable and Sales Orders for Argentina. |

| Perception Report (R76A8050) | PO Invoice/Shipment Note Print (R76A565)

PO - Invoice Print A/R (R76A03B5) |

| F0411 Tag File Maintenance (P760411A) | Standard Voucher Entry (P0411)

Voucher Entry MBF Processing Options (P0400047) Note: The Standard Voucher Entry (P0411) program and the Voucher Entry MBF Processing Options (P0400047) program must also have identically named versions. |

| Additional A/B Information (P760101A) | Address Book Revisions (P01012) |

| PO Sales Order Entry (P76A4210) | Sales Order Entry (P4210) |

| A/P Auto Payment Register (R76A0476)

F0411 Tag File Maintenance (P760411A) See Understanding Credit Invoices for Accounts Payable for Argentina. |

Credit Invoice Acceptance (P04571) |

| Print PCG Detail - ARG (R760476A) | Work With Payment Groups (P04571) |

3.6 Setting Up Legal Numbering for Argentina

This section provides an overview of legal numbering, lists prerequisites, and discusses how to:

-

Establish relationships between document types.

-

Set up next numbers for legal numbering.

3.6.1 Understanding Legal Numbering

Legal numbering complies with the legal requirements that are stipulated in General Resolution 1415.

Legal numbering can be set up for invoices and shipment notices, and is assigned by issue place and DGI (Direccion General Impositiva) document type.

The legal number has these parts:

-

The document type assigned by the Administracion Federal de Ingresos Publicos (AFIP). For example, the document type might be 01-Invoice.

-

The invoice letter (A, B, C, E, and so on).

-

The issue place (where the voucher was issued).

-

A next number.

To set up legal numbering, you set up a relationship between document types and you set up next numbers.

3.6.1.1 AFIP Document Types

Set up AFIP document type relationships to cross-reference JD Edwards EnterpriseOne document types and legal invoice groups to legal document types. The AFIP defines both legal invoices groups and legal document types.

The JD Edwards EnterpriseOne document type and the legal invoice group (which is assigned based on the tax area that is used during voucher entry) determine the legal document type of the invoice by using the AFIP document type relationship that you set up.

3.6.2 Prerequisites

Before you complete the tasks in this section:

-

Set up the Document Types - All Documents in UDC (00/DT).

-

Set up the ARG-DGI Transaction Doc Type in UDC (76/AF).

3.6.3 Forms Used to Set Up Legal Numbering and Document Type Relationships

3.6.4 Establishing Relationships Between Document Types

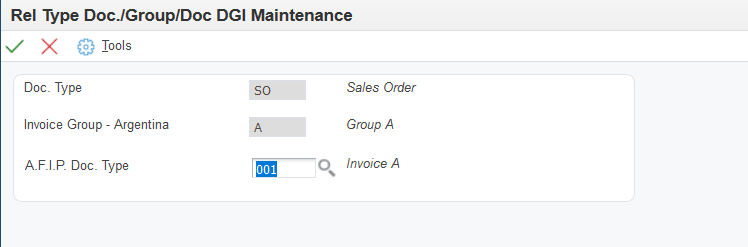

Access the Rel Type Doc./Group/Doc DGI Maintenance form.

- Doc. Type (document type)

-

Enter a user-defined code from 00/DT that identifies the origin and purpose of the transaction. The system reserves several prefixes for document types, such as vouchers, invoices, receipts, and time sheets. The reserved document type prefixes for codes are:

P: Accounts payable documents

R: Accounts receivable documents

T: Time and Pay documents

I: Inventory documents

O: Purchase order documents

S: Sales order documents

- Invoice Group - Argentina

-

Enter a code that identifies the invoice group. Values are:

A

B

C

- A.F.I.P. Doc. Type

-

Enter the legal document type given by DGI (Direccion General Impositiva) for documents.

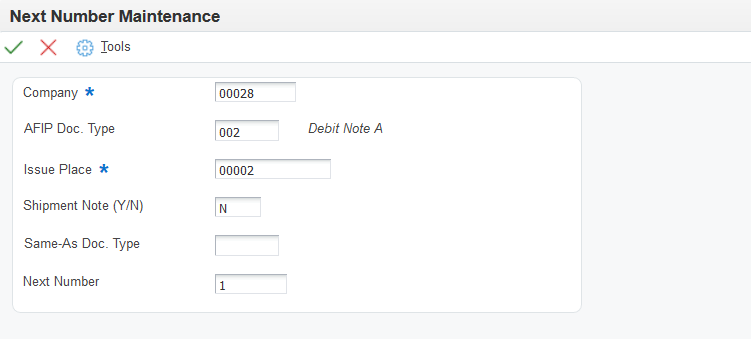

3.6.5 Setting Up Next Numbers for Legal Numbering

Access the Next Number Maintenance form.

- AFIP Doc. Type

-

Enter a value that exists in the ARG-DGI Transaction Doc. Type (76/AF) UDC table to specify the legal document type given by DGI for documents.

- Issue Place

-

Enter the location where the invoice or the shipment note is printed.

You must specify the issue place of the invoice or shipment note that you want to print in the Issue Place processing option of the PO - Invoice / Shipment Note Print program (R76A565) or in the PO - Invoice Entry (P03B11) - ARG - 03B program (P76A03B1).

- Shipment Note (Y/N) (shipment note [yes/no])

-

Enter Y (yes) to specify that the document is a shipment note. Enter N (no) to specify that the document is not a shipment note.

- Same-As Doc. Type (same-as document type)

-

Enter a value that exists in the Document Type - All Documents (76/AF) UDC table to specify a document type for which the system uses the same numbering scheme as the document type that you entered in the AFIP Doc Type field.

If you set up next numbers by company or by company and fiscal year, a document type can share the same next number sequence as another document type. Same As Document Type refers to the document type that controls the next number the system uses.

For example, you create a document with a document type of RR. The document that you create should use the same next number sequence as regular invoices or RI document types. In this case, define the RR document type setup record with a Same As Document Type of RI.

Note:

In Argentina, due to legal restrictions, you cannot use the Same As functionality with a different document ID. You must set up the document type that matches the AFIP doc type document ID. - Next Number

-

Enter the number that the system will assign next. The system can use next numbers for voucher numbers, invoice numbers, journal entry numbers, employee numbers, address numbers, contract numbers, and sequential W-2s. You must use the next number types already established unless you provide custom programming.

3.7 Setting Up Localizations Additional Information for Argentina (Release 9.1 Update)

This section provides an overview of localizations additional information setup, lists a prerequisite, and discusses how to:

-

Run the Additional Info Setup program.

-

Set processing options for Additional Info Setup program (R7000100).

3.7.1 Understanding Localizations Additional Information for Argentina

Localizations Additional Information is a tag-table methodology that captures and stores country-specific information. The system uses this information for different purposes.

Before you can start working with Localizations Additional Information, you must run the Additional Info Setup program (R7000100) to generate the required tables that store the additional data.

This setup also generates the forms where you enter the pre-defined information that is saved to the Localizations Additional Fields tables.

The system launches the Localizations Additional Information forms from the Regional Info row menu option from the specific programs that require additional data when your user profile country preference is set to AR (Argentina).

When you run the Additional Information Setup program, the system also generates all the additional fields required in the appropriate Regional Info forms. The forms for Localizations Additional Information, group the pre-defined data fields into the following tabs, according to the type of data that you enter:

-

String Data: The information that you enter in the pre-defined fields listed in this tab is a set of alpha-numeric characters.

-

Numeric Data: The information that you enter in the pre-defined fields listed in this tab is a set of numeric characters.

-

Date: The information that you enter in the pre-defined fields listed in this tab are dates.

-

Character: The information that you enter in the pre-defined fields listed in this tab are single characters.

For Argentina, the tables that the Additional Info Setup program (R7000100) generates to work with additional information are:

-

Header Localization Additional Data (F7000100)

-

Base Object / Tag Table Definition (F7000120)

-

Detail Localization Additional Data (F7000110)

-

Localizations Additional Fields Accounts Payable Ledger - 04 (F700411)

-

Localizations Additional Fields Tax Areas - 04 (F704008)

Every time you run the Additional Information Setup program, the system regenerates the tables required to work with the solution. You do not need to run this program multiple times but if you do, the existing data that you entered and that is saved in the Additional Information tables, is not affected.

3.7.2 Prerequisites

Before you complete the task in this section, verify that the Localization Country Code field in your user profile is set to AR (Argentina).

3.7.3 Running the Additional Info Setup Program (R7000100)

Select System Administration Tools (GH9011), Batch Versions.

Alternatively, enter BV in the Fast Path field.

In the Work With Batch Versions - Available Versions form, enter R7000100 in the Batch Application field to work with Additional Info Setup program.

3.8 Setting Up Print Authorization Codes for Argentine Suppliers

This section provides an overview of the Print Authorization Code (CAI) and discusses how to:

-

Enter the autoprinter company status.

-

Enter the CAI number.

3.8.1 Understanding Print Authorization Code (CAI)

General Resolution 100 (RG100) requires that a numerical Print Authorization Code (CAI) with an expiration date be printed on the bottom-right margin of type A and B vouchers that are issued by companies in the course of business. Type C vouchers are not affected by the regulation.

RG100 establishes that issuance of invoices or equivalent documents, as well as their printing by companies that are authorized to do so, is essential for tax purposes and also ensures the transparency of business principles. To work within RG100 parameters, you must indicate whether the company prints its own invoices.

Likewise, for taxpayers whose operations are significant in terms of volume and quality, the ability to print their own vouchers is beneficial because it helps facilitate their business operations and administrative tasks.

The CAI number is assigned by the AFIP, as stipulated in RG100. This number is assigned to all companies that print their own invoices. These companies must be registered and authorized by the fiscal authority to print their own invoices. Once registered and authorized, the company is given a CAI number, which must be printed on all legal invoices.

The CAI number is unique for each company.

3.8.2 Forms Used to Set Up Print Authorization Codes

3.8.3 Entering the Autoprinter Company Status

Access the RG 100 - Autoprinter Supplier Control form.

Figure 3-4 RG 100 - Autoprinter Supplier Control form

Description of ''Figure 3-4 RG 100 - Autoprinter Supplier Control form''

- Check for Autoprinter

-

Specify whether the system verifies if the supplier is set up as an autoprinter.

3.8.4 Entering the CAI Number

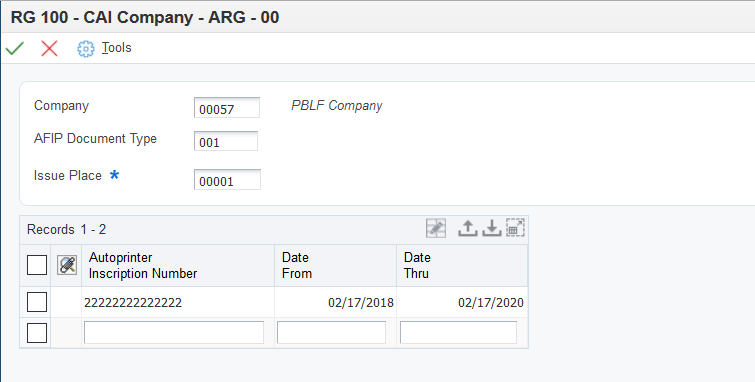

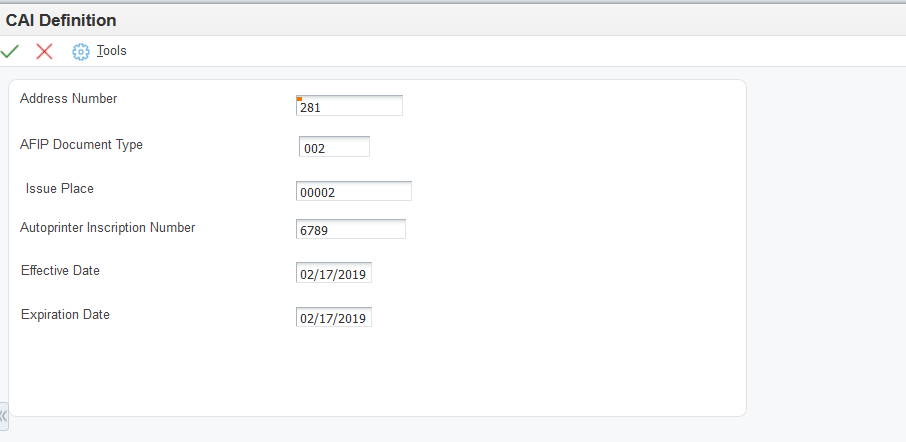

Access the RG 100 - CAI Company - ARG - 00 form.

- AFIP Document Type

-

Enter the legal document type given by DGI for documents.

- Issue Place

-

Enter the location where the invoice or the shipment note is printed.

- Autoprinter Inscription Number

-

Enter a number assigned to a supplier by legal authorities in Argentina, as stated in General Resolution 100. It is a unique ID given to all the companies that are autoprinters (that is, companies that print their own invoices).

These companies must be registered and authorized by legal authorities to print their invoices. Once they are registered and authorized, they are given a CAI (autoprinter inscription number), which they must print on every invoice.

- Date From and Date Thru

-

Enter the date when a transaction, contract, obligation, preference, or policy rule becomes effective or ceases to be in effect.

3.9 Setting Up to Print Invoices and Shipment Notes for Argentina

This section provides overviews of issue places and bar codes, lists prerequisites, and discusses how to:

-

Add the CIF code.

-

Add record type $C.

-

Relate issue places to address book records.

3.9.1 Understanding Issue Places

Article 11 of General Resolution 3434 stipulates that the commercial address that appears on the invoice or equivalent document must be the business or physical location where the invoice is issued.

In the case of shipment notes or equivalent documents, the location where goods are issued (warehouse or depot) must be the business address. The address of the place where goods are dispatched must be the same as the issue place address.

CIF codes relate the issue place with an address book record, which stores the address and other data about the issue place.

Setting up this relationship causes the invoice printing programs to retrieve the issue place address instead of the company address.

If this relationship is not defined, the business address is printed instead of the issue place address.

To set up the issue place relationship:

-

Add the CIF code.

-

Add record type $C.

-

Relate the issue place to the address book record.

3.9.2 Understanding Bar Codes for Argentina Invoices

When you generate a legal document with a document type of A, B, E, or M, you must print a bar code on the document. The bar code includes the:

-

C.U.I.T number

-

AFIP legal document type

-

Issue place

-

C.A.I. number

-

C.A.I. due date

-

Check digit

When you set up the ARG - Item ARGP - Allowed Values UDC (76/B1), you must specify Y in the Special Handling Code field for document types A, B, E, and M. A value of Y indicates that the document type requires the system to print the bar code information.

When you run the Print Invoices (R42565) program or the Invoice Print (R03B505) program, the system calls the Print Invoice / Shipment Note - ARG - 42 (R76A566) program. The Print Invoice / Shipment Note - ARG - 42 program calls the N76A510 (Bar Code String Generator) business function to print the bar code as well as the numeric equivalent of the bar code.

|

Note: You must install the Interleaved 2 of 5 ITF font for the bar code. JD Edwards EnterpriseOne software does not provide this font. |

3.9.2.1 Bar Code String Generator - ARG - 42 (N76A510)

The Bar Code String Generator - ARG - 42 business function obtains the data required for the bar code from these fields, and then generates a check digit:

-

C.U.I.T number (11 numeric characters obtained from data item TAX in the F76AUI20 table).

-

AFIP legal document type (three numeric characters obtained from the first three characters in data item VINV in the F76A09 table).

-

Issue place (five numeric characters obtained from data item ACEM1 in the F76AUI20 table).

-

C.A.I. number (14 numeric characters obtained from data item ACAI in the F76AUI20 table).

-

C.A.I. due date (eight numeric characters obtained from data item CXPJ in the F76AUI20 table).

The business function concatenates the values of the five data fields in the order listed and then adds the check digit to the end of the string to produce the numeric value of the bar code. To calculate the check digit, the system:

-

Sums the characters in the odd number positions (positions 1, 3, 5, and so on), beginning from the left of the string of characters.

-

Multiplies the sum obtained in the first step by 3.

-

Sums the characters in the even number positions (positions 2, 4, 6, and so on), beginning from the left of the string of characters.

-

Sums the values obtained in steps 2 and 3.

-

Determines the check digit to be the lowest number which, when added to the value that was determined in step 4, equals a multiple of 10.

3.9.2.2 Example: Generation of Numeric Bar Code

Suppose the values for the five data fields are:

-

C.U.I.T number: 23467812399

-

AFIP legal document type: 003

-

Issue place: 12222

-

C.A.I. number: 65432165432111

-

C.A.I. due date: 06062005

The business function concatenates the characters to produce this string: 23467812399003122226543216543211106062005

-

Sums the characters in the odd positions to produce a value of 69.

-

Multiplies 69 by 3 to equal 207.

-

Sums the characters in the even positions to produce a value of 58.

-

Sums 207 and 58 to equal 265.

-

Determines the check digit to be five because five is the lowest number, which when added to 265, returns a number which is divisible by 10.

-

Produces a numeric value for the bar code that is equal to the original string with the check digit of five added to the end of the string for a value of: 234678123990031222265432165432111060620055.

3.9.3 Prerequisites

Before you complete the tasks in this section:

-

Create a record for each issue place in the Address Book Revisions program (P01012).

-

Add issue place codes to the Issue Place (76A/LE) UDC table.

3.9.4 Forms Used to Set Up to Print Invoices and Shipment Notes

3.9.5 Adding the CIF Code

Access the Supplemental Database Setup form.

- Supplemental Database Code

-

Enter AB in this field to specify the JD Edwards EnterpriseOne Address Book system.

- Generic Alphanumeric Key 1

-

Select this option to use the data that you enter in the Generic Alphanumeric Key 1 field as a key field for supplemental data.

If you select this option, you must enter a valid data dictionary alias in the corresponding DD Alias (SAL1) field. Before you can use the data dictionary alias, you must set up the alias in UDC Valid Alphanumeric Aliases (00/S2).

When you select Generic Alphanumeric Key 1, and you enter a valid alias, the field appears with the data dictionary name as a key field on the Work With Supplemental Data form. If you enter data in the corresponding Row Description (SBD1) field, the data that you enter appears as the key field name on the Work With Supplemental Data form.

- DD Alias (data dictionary alias)

-

Enter AN8 in this field to specify the address number alias.

3.9.6 Adding Record Type $C

Access the Data Type Revisions form.

- Type Data

-

Enter $C in this field to group data by categories.

This is a required field for setting up any data type. You can use an existing data type, or you can create a new data type by entering one or two characters for the code.

- Product Code

-

Enter 76A (Argentina) in this field to identify the system for the UDC that is related to the data type. This field works with the Record Type field to identify the code type table that the system uses to verify the data type. When you leave both fields blank, the system does not verify the data type.

For example, a valid code for data type SKILL (skills) must exist in the table for system 08 and code type SK. If you enter a skill code that is not in the table, the system displays an error message.

This field applies only to the code format (C) data types.

- Record Type

-

Enter LE in this field.

The Record Type and Product Code fields work together to associate a UDC table to the UDC (alias GDC1) field. The system uses the UDC table to verify data that you enter in the UDC (alias KY) field on the General Description Entry form.

For example, if you enter 08 in the Product Code field and SK in the Record Type field, the data that you enter in the UDC (alias KY) field on the General Description Entry form must exist in UDC table 08/SK.

If you leave the Record Type and Product Code fields blank, you can enter any data in the data entry field for the UDC (alias KY) column on the General Description Entry form.

This is an optional field for setting up supplemental data types in code format.

3.9.7 Relating Issue Places to Address Book Records

Access the General Description Entry form.

- User Def Code (user defined code)

-