Changing and Reviewing Item Information

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ITEM_MAINTAIN |

Change discount, payment, and draft options for an item. Put an item in dispute or collections, mark an item as a deduction, and assign item owners. Set the revaluation flag and make an item available for AR/AP netting. |

|

|

ITEM_MAINTAIN_2 |

Update item references and contact, shipping, and product information. Update information for the Treasury Report on Receivables (TROR). View and change the memo status for the U.S. government. |

|

|

AR Billing Inquiry Page |

AR_BI_INQUIRY_B |

Review details for an invoice in PeopleSoft Billing. The amounts are in the base currency. This page contains data only if you use PeopleSoft Billing. Use the Go To field to access a page in the Bill Inquiry component (BI_INQUIRY) in PeopleSoft Billing. See the View/Update Item Details - Detail 1 Page or the View/Update Item Details - Detail 2 Page. See also Understanding Pending Item Entry. |

|

AR BI Inq (EURO) (receivables billing inquiry) |

AR_BI_INQUIRY_E |

Review details for an invoice in PeopleSoft Billing. The amounts are in the euro currency. This page contains data only if you use PeopleSoft Billing. Use the Go To field to access a page in the Bill Inquiry component in PeopleSoft Billing. |

|

Bill Header - Note Page |

AR_BI_HDR_NOTE_INQ |

View notes attached to the bill header for an invoice by clicking the Bill Header Notes link on the AR Billing Inquiry page or the AR BI Inq (EURO) page. |

|

Bill Header - Bill To Address |

AR_BI_HDR_ADDR_INQ |

View address information for the customer and information about how the invoice was sent by clicking the Bill To Address link on the AR Billing Inquiry page or the AR BI Inq (EURO) page. |

|

Bill Header - Projects Information |

AR_BI_HDR_PC_INQ |

View the PeopleSoft Project Costing transaction information on the bill header associated with the item line, including the source PeopleSoft Contracts information, the purchase order reference information, reimbursable agreement ID for contracts, and the start and end dates for the project activity, by clicking the Bill Header - Project Info link on the AR Billing Inquiry page or the AR BI Inq (EURO) page. |

|

ITEM_MAINTAIN_3 |

Update user-defined fields. |

|

|

ITEM_DATA2 |

Review all activity records for an item. |

|

|

ITEM_SUB_GROUP |

View all matched items in a match group from the maintenance worksheet or the Automatic Maintenance Application Engine process (AR_AUTOMNT) as well as the amounts matched. |

|

|

ITEM_DATA_VAT |

Review the VAT lines for an item. This page is available only if the item has VAT lines. |

|

|

ITEM_DATA3 |

View the accounting entries for each item activity. |

|

|

ITEM_AUDIT |

View maintenance changes to items. |

|

|

ITM_GST_MNT_SEC |

Review item goods and sales tax details. (India) |

In PeopleSoft Receivables, maintenance items can be credit or debit memos, invoices, deductions, adjustments (generated when you process payments), on-account payments, or prepayments. After setting up component security, you can you set up and update the dispute check box, dispute reason code, dispute amount and dispute date for a selected customer. The PeopleSoft Receivables item maintenance feature enables you to change open or closed items once they have been posted and does not create a group of pending items or change the customer's balance. The changes take effect immediately. You do not need to run the Receivables Update Application Engine process (ARUPDATE).

The View/Update Item Details component (ITEM_MAINTAIN) provides a central point to change details for individual items and to review all activities, all accounting entries, and all VAT lines for an item. You can also view and assign actions to an item.

This documentation discusses how to:

Change discount, payment, and draft options and customer relationship information.

Update reference, contact, and shipping information.

Update user-defined information.

Review item activity.

Review item activity for a match group.

Review value-added tax (VAT) entries.

Review item accounting entries.

Review audit history for an item.

If you want to track and review changes to fields on items on the Item Audit History page, select the fields on the Audit Control page.

Field or Control |

Description |

|---|---|

Add Conversation |

Click this link to access the Conversations page, where you can add a new conversation. The reference fields are populated based on the selected item. You can add new conversation entries by clicking the Add Conversation Entry button on the Conversation page. |

Customer |

Click the customer ID to access the General Info page for the customer. |

View/Update Conversations |

Click this link to access the Conversations page, where you can view and update existing conversations for the item. If there are multiple conversations, you can select the conversation you want to view or update on the View/Update Conversations search page. You can also add, delete, or edit existing conversation entries on the Conversations page. |

Item Attachments |

Click this link to access the Item Attachments page, where you can view and delete existing item attachments. Attachments are added when an item is created on the Pending Item 1 page. |

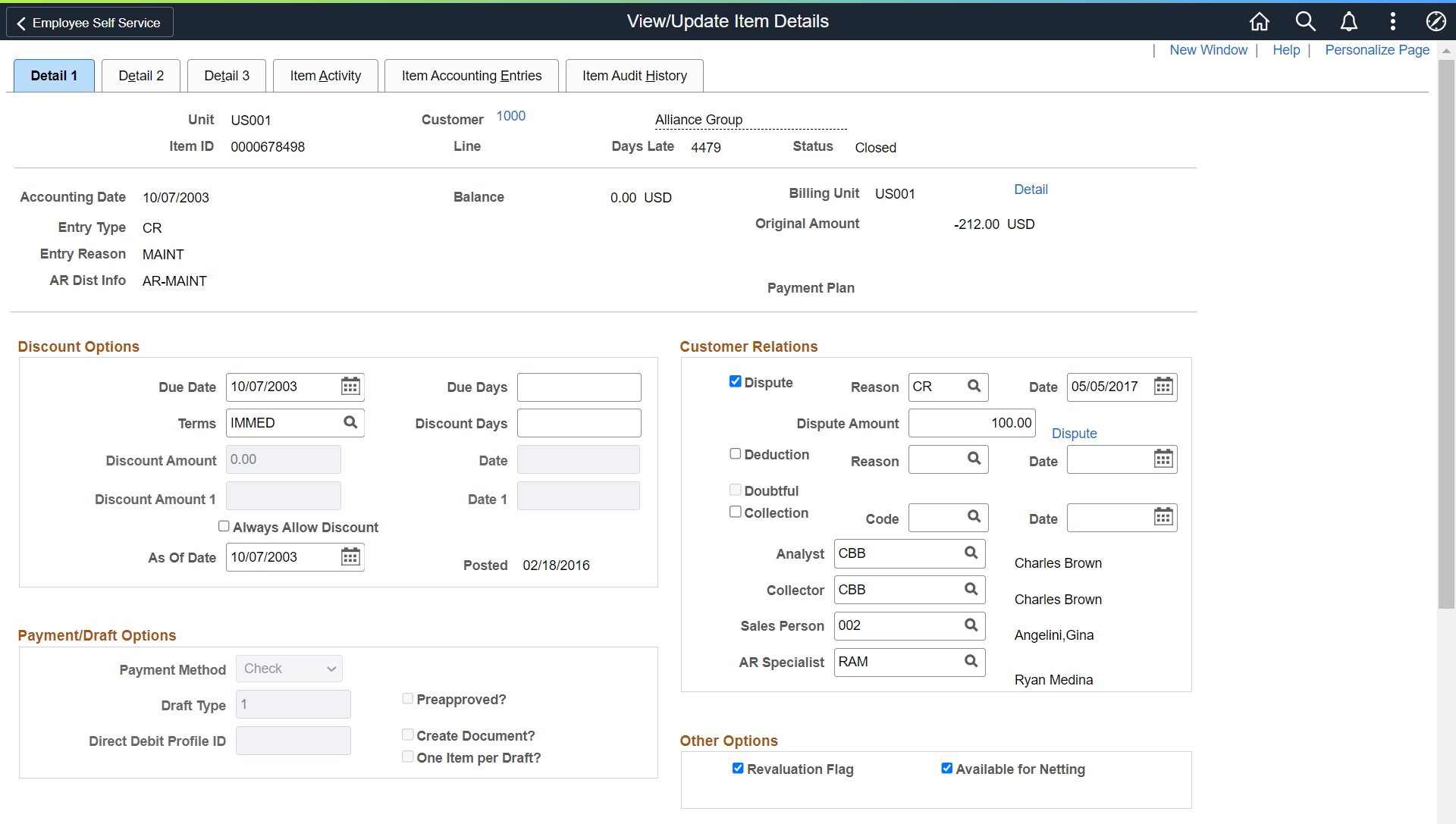

Use the View/Update Item Details - Detail 1 page (ITEM_MAINTAIN) to change discount, payment, and draft options for an item.

Put an item in dispute or collections, mark an item as a deduction, and assign item owners. Set the revaluation flag and make an item available for AR/AP netting.

Navigation:

You also access this page from several pages by clicking a button or link for an item.

This example illustrates the fields and controls on the View/Update Item Details - Detail 1 page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the View/Update Item Details - Detail 1 page (2 of 2). You can find definitions for the fields and controls later on this page.

You can change only field values that do not change the customer balance. The fields at the top of the page display information to identify the type of item and the item balance. If the item was entered in a currency that differs from the business unit base currency, the system displays the base currency amount and the rate type and exchange rate used for conversion.

Field or Control |

Description |

|---|---|

Balance and Base |

Displays the open amount for the item in the entry currency and the base currency. The base amount appears only if the balance differs from the base currency for the business unit. |

Detail |

Click to access the AR Billing Inquiry page, where you view the original invoice information. This link is available only if there is a valid PeopleSoft Billing business unit for the item which is associated with a valid invoice in PeopleSoft Billing. |

Exchange Rate Detail |

Click to view the information used in converting the item amount. |

Original Amount |

Displays the original amount of the item. The Original Amount field for an item signifies the actual (initial) amount of the item in the entry currency. This is the amount of the item before any payments, adjustments, splits, or other transactions are applied to the item. However, when a new item has multiple sequences in the same pending item group and all of the sequences have the same entry type, all amounts of the various sequences are summed up to determine the Original Amount. If the new item with multiple sequences in the same pending item group have different entry types, the amount corresponding to the first sequence is assigned to the Original Amount, as the subsequent sequences are considered adjustments. Also, if multiple sequences are part of different pending item groups, although posted together with the first group, the subsequent sequences are considered adjustments. |

|

Item Attachments |

Click the Item Attachments link to add, view, or delete attachments for the item. Similarly, click Pending Item Attachments link to view or delete pending attachments for the item. Note: If Authorize Delete Attachments check box is selected, on the Installation Options - Receivables Page, only users with the selected roles will be allowed to delete attachments along with the user who has originally attached the file. |

Discount Options

Field or Control |

Description |

|---|---|

Due Date |

Enter the date on which the item is due. |

Terms |

Select a payment term that defines the due date, discount days, and discount amount. If this field is blank, you can manually define the terms by entering values in the due and discount fields. If the item has payment terms, the Discount Amount and Date fields are unavailable. |

Due Days |

Enter the number of days beyond the due date during which the payment is still considered on time. |

Discount Days (discount days) |

Enter the number of days beyond the discount date during which the customer is still eligible to receive a discount. |

Field or Control |

Description |

|---|---|

Discount Amount, Date, Discount Amount 1, and Date 1 |

Enter user-defined amounts for discounts and dates from which to start counting the discount due date. The customer must pay by the discount due date to take an earned discount. |

Always Allow Discount |

Select to allow the discount on this item to be earned regardless of when the item is paid. |

As of Date |

Enter the date used to age the item. |

Payment/Draft Options

Field or Control |

Description |

|---|---|

Payment Method |

Select a payment method from these values:

If you select draft, the draft fields become available. If you select direct debit, the Profile ID field becomes available. If the payment method is direct debit, you cannot change the payment method if the item is selected on a direct debit worksheet, unless you do the following:

These payment methods identify a pending payment in PeopleSoft eBill Payment, and are not available for selection:

|

Pay by Credit Card |

Click to access the Credit Card Details page to begin credit card processing. |

Draft Type |

Select one of the draft types that you defined on the Draft Types page, which determines the draft processing options and what accounting entries to generate for the draft item. |

Preapproved? |

Select if the customer's drafts do not need to be sent to the customer for individual approval. |

Create Document? |

Select to include the item in the draft document prepared for the customer. |

One Item Per Draft? |

Select to have a separate draft for the item. |

Direct Debit Profile ID |

Enter the direct debit profile ID used to determine the direct debit processing rules for the item. The default value comes from the entry type for the item. |

Customer Relations

Field or Control |

Description |

|---|---|

Dispute (check box), Reason, Date, Dispute Amount, and Dispute (link) |

To put an item into dispute, select the Dispute check box and enter a dispute reason code, the date on which you put it in dispute, and the disputed amount. The default dispute date is the current date and the default amount is the item amount. Click the Dispute link to open the Dispute Status Tracking page (ITEM_DISP_T), where you can review the dispute status for the item (Active or Closed), timestamp for dispute status changes, and user ID. If the option to Resolve Dispute When Closed is selected on the Receivables Options – Payment Options page for the business unit SetID, the system automatically resolves the dispute when the item is closed. The dispute status change is recorded on the Dispute Status Tracking page and the dispute fields here (on the View/Update Item Details - Detail 1 page) are cleared. Note: To enable users to add, update, and delete dispute information on the payment worksheet, you must define component-level security in PeopleSoft Security for the View/Update Item Maintenance component. A user who can access the Item Maintenance Page can update dispute fields in the payment worksheet. The dispute fields are display-only for users without access to the View/Update Item Maintenance component. See Dispute Reason Page. See Dispute Processing. |

Deduction, Reason, and Date |

To mark an item as a deduction, select the Deduction check box and enter the deduction reason and the date that you marked it as a deduction. If you created a deduction, using the payment or draft worksheet, the Deduction check box is unavailable. Warning! If you mark an item as a deduction using the Deduction check box rather than creating a deduction (WS-08 item) using the payment worksheet, you do not generate any accounting entries or close the original item and create a new deduction item. Once you select this check box and save the page, you cannot deselect your selection. |

Doubtful |

This check box is selected if you transferred the item to a Doubtful Receivables account using the transfer worksheet. |

(USF) DMS Information (Debt Management Services information) |

Click to access the Debt Management Services Information page, where you enter information for the debt management system. |

Collection, Code, and Date |

To put an item into collection, select the Collection check box and enter a collection code and the date you put it in collection. To put the entire customer into collection, use the Credit Profile page for the customer. |

Analyst |

Select the credit analyst who you want to manage this item. If you set up conditions for collection and exception processing to assign items to the credit analyst, this person is notified of actions that he or she must perform. |

Collector |

Select the collector who you want to manage this item. If you set up conditions for collection and exception processing to assign items to the collector, this person is notified of actions that he or she must perform. |

Sales Person |

Select the primary salesperson for the item. Salespeople are support team members whose support team type is Sales. |

AR Specialist (receivables specialist) |

Select the individual responsible for managing deductions and items in dispute. If you select the Dispute or Deduction check box, the system automatically populates this value with the specialist assigned to either the customer, deduction or dispute reason, or business unit. |

Other Options

Field or Control |

Description |

|---|---|

Revaluation Flag |

Select to enable the Revaluation Application Engine process (AR_REVAL) to revalue the item. Deselect the check box if you do not want the item to be revalued. |

Available for Netting |

By default, all items are available for netting—a process that offsets open items and vouchers, if you have PeopleSoft Payables and PeopleSoft Cash Management on your system. You must set up a participant agreement between the suppliers and customers to net their items and vouchers. If you do not want an item to be selected in the netting process, deselect the check box. |

Transfer to IPAC Transactions |

Click to access the Receivable IPAC Transactions Page, where you enter information for the IPAC interface. |

Inbound IPAC |

Select this check box if you want to be able to select an item for Inbound IPAC processing after the item has been posted. This field is displayed only if the IPAC check box is selected in the AR installation options and the customer is identified as a federal customer. When you select this check box, you must also click the Transfer to IPAC Transactions link to delete the existing outbound transactions on the Receivable IPAC Transactions Page using the delete icon. |

Item Action |

Click this link at the bottom of the page to access the Item Action page, where you view or add all actions associated with the item, assign action owners, and drill down to perform the action. Note: The Item Action link does not appear for inactive customers. |

GST Details (India) |

Click this link to access the GST Details Page (India) and review item goods and sales tax details. |

Use the View/Update Item Details - Detail 2 page (ITEM_MAINTAIN_2) to update item references and contact, shipping, and product information.

Update information for the Treasury Report on Receivables (TROR).

View and change the memo status for the U.S. government.

Navigation:

This example illustrates the fields and controls on the View/Update Item Details - Detail 2 page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the View/Update Item Details - Detail 2 page (2 of 2). You can find definitions for the fields and controls later on this page.

Reference Information

Field or Control |

Description |

|---|---|

Related Unit, Related Invoice, and Related Invoice Date |

Enter the number of the related invoice associated with the item and the business unit associated with the invoice. Click Detail to access the AR Billing Inquiry page, where you view details about the invoice and PeopleSoft Project Costing Information. This link is available only if there is an invoice number in the Related Invoice field and the business unit and invoice number are a valid business unit and invoice in PeopleSoft Billing. If you enter a value that matches an existing item ID, the system automatically populates the following fields with values associated with the item when you save the page: Bill of Lading, Order Number, Purchase Order, Contract Number, Claim Number, Sold To, Ship To, and User. Note: The Related Invoice field for a deduction created on the payment or draft worksheet is blank if the value in the Document field does not match the item ID for another item in PeopleSoft Receivables. If it does match, it contains the item ID for the original item. |

Document |

Displays the document ID that you entered when you created the item. Override the value if needed. Note: If this is a deduction created using the payment or draft worksheet, it is the item ID of the original invoice for which the customer took the deduction. |

OM Business Unit and Order Number |

Enter the number of the sales order associated with the item and the business unit associated with the order. Click Detail to access the Order Summary page, where you view details about the order. This link is available only if there is an order number in the Order Number field and a business unit in the OM Unit field, and if you have installed PeopleSoft Order Management. |

Claim Date and Claim Number |

Enter the debit memo number that the customer sent you for a deduction and the date on which the customer created it. |

Purchase Order, Contracts BU, (contracts business unit) Contract, and Contract Line |

Enter the purchase order number, contracts business unit, contract number, and contract line that is associated with the original invoice. Click the Detail link for a contract to access the Contract Summary page, where you see summarized details for a contract and drill down to contract details. This link is available only if there is a valid contract number and you have installed PeopleSoft Contracts on your system. Note: If this is a deduction created on the payment or draft worksheet, it is the purchase order and contract number associated with the original invoice for which the customer took the deduction. You can change only the order number, purchase order number, and contract number for debit and credit (IT-01 and IT-02) items, if you enabled entry on the Receivables Options - General 2 page. |

Letter of Credit (letter of credit ID) |

Displays the letter of credit ID for the item. |

Reference Reason |

Enter an additional entry reason assigned for the item. The reason is used for custom reports and inquiries. It does not generate accounting entries. |

(USF) Receivable Type and Entity Code |

Select the information required for the Treasury Report on Receivables (TROR). See Setting Up the Treasury Report on Receivables and Treasury Report on Receivables (TROR) and Debt Collection Activities. |

(NLD) AG Number (acceptgiro reference number) |

Displays the acceptgiro reference number assigned to the item or invoice when you ran the Statements process (AR_STMTS) or the AR Dunning process (AR_DUNNING) for business units enabled for acceptgiro processing. It also displays the acceptgiro reference number assigned to the invoice when you printed the invoice in PeopleSoft Billing. Note: Each time that you run the Statements process or the AR Dunning process, the system overwrites the reference number if the item is included on a new statement or dunning letter. So, it is possible that the bank could pay for the item using a different reference number. |

Contacts and Shipping Information

Field or Control |

Description |

|---|---|

Sales Person 2 |

Enter the code for the secondary sales person associated with the item. |

Broker |

Enter the code for the customer broker to whom you assigned the broker role on the General Info page. |

Ship From Site |

Enter the original business unit for the sales order. If you have PeopleSoft Inventory, enter an inventory business unit. The business unit should represent a warehouse. |

Sold To Customer and Ship To Customer |

Enter the ship to and sold to customer IDs. |

Carrier ID |

Enter the unique identifier for the shipping carrier. Enter one of the values that you defined on the Carrier ID page. |

Proof of Delivery |

Enter a proof of delivery slip number. |

Bill of Lading |

Enter the bill of lading number for the shipment. |

(USF) Memo Status Code |

Click the Detail link to enter the current memo status or view historical status changes on the Memo Status Changes page. This option is available only if you enabled it on the Installation Options - Receivables page. |

Product Information

Field or Control |

Description |

|---|---|

Family |

Select an identifier that defines inventory items at a high level. Examples include computer items and office furniture. |

Class |

Enter a code for a group of customers in a trade, such as grocers or mass merchandisers. |

Trade |

Enter the type of industry market, such as groceries, hardware, or appliances. |

Division |

Enter a geographic area within an organization. |

Use the View/Update Item Details - Detail 3 page (ITEM_MAINTAIN_3) to update user-defined fields.

Navigation:

This example illustrates the fields and controls on the View/Update Item Details - Detail 3 page. You can find definitions for the fields and controls later on this page.

PeopleSoft Receivables provides 22 fields in the Item table (PS_ITEM) that you can use to track company- or industry-specific information that is not predefined in the Item table, such as shipment date. You define the value to use for each of the fields, and you can specify what to use for the field label.

Use the Item Activity page (ITEM_DATA2) to review all activity records for an item.

Navigation:

You can also access this page by clicking a link on several pages.

This example illustrates the fields and controls on the Item Activity page. You can find definitions for the fields and controls later on this page.

Each time that you perform an action to an item, such as transferring it to another customer, applying a payment, or unposting it, the Receivables Update process updates the Item Activity table (PS_ITEM_ACTIVITY). The Item Activities scroll area displays each activity record in the table.

Field or Control |

Description |

|---|---|

Refund Detail |

Click to access the Refund Status page, where you view information for a refund voucher that was created by PeopleSoft Payables. This field is not available if you have not refunded the item and created a voucher in PeopleSoft Payables. |

Entry Type and Reason |

Displays the type of activity. The system uses the entry type and reason to generate accounting entries. |

Worksheet Reason |

Displays an additional reason assigned to all items in a maintenance group to further identify the reason for the activity. This reason does not generate accounting entries. You define maintenance reasons on the Worksheet Reason page. |

Unpost Reason |

Displays the reason code that you specified for unposting the item's group. You define unpost reason codes on the Unpost Reason page. |

Group Unit and Group ID |

Displays the business unit for the group, the group ID, and the type of group—billing, payment, maintenance, transfer, overdue charge, unpost, direct debit, draft, vendor rebate, or claimback. Click the link for the group to open the Item Activity From A Group page, where you view the activities for all items in the group. |

Match Group ID |

Displays the identifier for a match group on the maintenance worksheet or that the Automatic Maintenance process assigned. A match group is a group of items that you are matching where the total of the debits equals the total of the credits. Click the link for the match group to open the Item Activity for a Match Group page, where you view all of the items in the match group associated with the item activity record. |

Deposit Unit, Deposit ID, and Payment ID |

Displays the identifier for a deposit and payment and the deposit business unit for a payment activity. Click the link for the payment to open the Item Activity for a Payment page, where you view items that were paid by a single payment after the payment was processed by the Receivables Update process. |

Payment Method |

Indicates the manner in which a payment was made, such as credit card, check, direct debit, and so forth. |

Draft Unit and Draft ID |

Displays the identifier for a draft and the draft business unit for a draft activity. |

Direct Debit Business Unit and Direct Debit ID |

Displays the identifier for a direct debit and the business unit for a direct debit activity. |

Use the Item Activity From a Match Group page (ITEM_SUB_GROUP) to view all matched items in a match group from the maintenance worksheet or the Automatic Maintenance Application Engine process (AR_AUTOMNT) as well as the amounts matched.

Navigation:

Click the link for the match group ID on the Item Activity page.

The Item Activities grid displays all of the items in the match group for a specific maintenance activity.

Field or Control |

Description |

|---|---|

Display Amount Switch |

Specify whether you want to view amounts in the entry currency or the base currency. |

Item ID |

Click the link to access the View/Update Item Details component, where you view detailed information about the item. |

Entry Type and Entry Reason |

Identifies the type of activity and reason associated with each item. These determine the accounting entries that were generated. The entry types are always MT (maintenance), MD (new debit), MC (new credit), WO (write-off debit), or WOC (write-off credit). |

Entry Amount and Entry Currency |

Displays the amount and currency of the item that was matched. |

Use the Item VAT Entries page (ITEM_DATA_VAT) to review the VAT lines for an item.

This page is available only if the item has VAT lines.

Navigation:

This example illustrates the fields and controls on the Item VAT Entries page. You can find definitions for the fields and controls later on this page.

The Item Activity scroll area displays the VAT information for the item for each activity. The Entry Type field identifies the type of activity. The VAT Lines grid displays the VAT information for each item line.

Field or Control |

Description |

|---|---|

Intermediate VAT |

Displays the VAT amounts for a future declaration point. These amounts are not reported to the government. |

Final VAT |

Displays the VAT amounts ready to be reported to the government. |

VAT Basis |

Displays the amount of the item on which the VAT is calculated. |

Error Flag |

Appears if the discrepancy between the invoice and the amount the system calculates exceeds the tolerance level defined by the Percent and VAT amount. |

Domestic Reverse Charge Goods |

This check box is selected if the country requires the use of the domestic reverse charge provision. |

Customer VAT Code |

Displays the customer VAT code used to calculate a domestic reverse charge VAT amount. When the Domestic Reverse Charge Goods check box has been selected, the regular VAT code is replaced by a zero-rate VAT code and the customer VAT code is used instead. |

Customer VAT Rate |

Displays the rate from the customer VAT code. |

Customer Amount |

Displays the customer VAT amount for domestic reverse charges that are calculated using the Customer VAT Code. |

Use the Item Accounting Entries page (ITEM_DATA3) to view the accounting entries for each item activity.

Navigation:

This example illustrates the fields and controls on the Item Accounting Entries page. You can find definitions for the fields and controls later on this page.

The Item Activity scroll area displays all of the accounting entries for each activity for the item. The Entry Type field identifies the type of activity. The Accounting Lines grid displays the ChartField values for each line.

Field or Control |

Description |

|---|---|

Accounting Line Display |

Specify which accounting entries to display, and then click Display. Values are: Standard, Supplemental (Entry Event), or Both. Supplemental accounting entries are available only if you entered an entry event code for the pending item, payment item, or maintenance item. These options are available only if you enable the entry event feature for PeopleSoft Receivables on the Installation Options - Entry Event page. |

Debit Amount and Credit Amount |

The item amount appears unless you enabled the Display Separate Debit/Credit in Subsystem option on the User Preferences - Overall page. Otherwise, the debit and credit amount and currency appear for each accounting line. |

Use the Item Audit History page (ITEM_AUDIT) to view maintenance changes to items.

Navigation:

This example illustrates the fields and controls on the Item Audit History page. You can find definitions for the fields and controls later on this page.

The page displays one row for each change to the item.

Field or Control |

Description |

|---|---|

Field Changed, Previous Value, and Updated Value |

Displays the name of the field, the original value, and the new value after the change. |

User ID |

Displays the individual who made the change. If the Mass Change Application Engine process (AR_MASS_CHANGE) made the change, the field displays the user ID of the person who created the run control request. |

Source of Change |

Displays the source of the change. Values are: Item Maintenance: A change entered using the View/Update Item Details component. Multi-item Update: A change entered online using the Multi-item Update option on the Item List page. Batch Mass Change: A change generated by the Mass Change process. |

Use the GST Details page (ITM_GST_MNT_SEC) to review item GST details.

Navigation:

Click the GST Details link on the View/Update Item Details - Detail 1 page.

This example illustrates the fields and controls on the GST Details page.