Processing Outbound IPAC Transactions in Receivables

This topic discusses how to perform outbound IPAC processing.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AR_IPAC_SEC |

Enter information required by IPAC. |

|

|

IPAC Description Page |

AR_IPAC_DESCR_SEC |

Enter a detailed description for an IPAC transaction. See the Receivable IPAC Transactions Page. |

|

AR_IPAC_MISC_SEC |

Enter additional text to describe an IPAC transaction and additional sender and receiver information. |

|

|

Post SGL Comments Page |

AR_IPAC_SGLCMT_SBP |

Enter standard general ledger comments. See the Receivable IPAC Transactions Page. |

|

Override Options Page |

PRCSDEFNOVRD |

Enter override options for the Format EFT File process. See Entering Override Options for the Format EFT File Process. See the Override Options Page for more information. |

|

IPAC_EXP_RQST |

Run the Format EFT File process, which creates a file that can be uploaded to IPAC. |

The IPAC system transmits billing information electronically, using a formatted file, to the U.S. Department of Treasury specifications so that bills and payments can be applied to the correct account. If your organization requires that you use the IPAC system, you can use PeopleSoft Receivables to create an extract file with receivables data that you send to the U.S. Department of Treasury. Some types of data you send using IPAC processing are required. Others can be configured to be required in your system, depending on business cases your agency may have to make certain IPAC information required or to leave it as optional. You create a request to collect funds from customers that are federal agencies by creating a flat file in PeopleSoft Receivables and sending the file online or in a bulk file connection to the IPAC system. PeopleSoft Receivables supports IPAC Bulk File Formats for Federal Program Agencies, Version 3.0, which was issued to accommodate the implementation of the component TAS.

PeopleSoft Receivables supports four types of IPAC transactions:

Collection, which is associated with the 810 format.

Use this transaction type to collect funds from other agencies.

Adjustment, which is associated with the 812 format.

Use this transaction type to correct payment or collection information received by your agency, including the amount and the Standard General Ledger (SGL) account information. This transaction type is not available if you initiated the IPAC transaction.

Note: A credit item cannot be selected for refund processing until an IPAC adjustment transaction is entered. If an item that belongs to a customer, who requires IPAC processing, is selected for refund and the adjustment transaction is not created for the item, then an error message appears on the Maintenance Worksheet - Worksheet Application page.

Zero dollar, which is associated with the 835 format.

Use this transaction type to add or change collection information that you sent in an earlier transmission. This transaction type does not change the transaction amount or SGL account information.

Post SGL, which is associated with the 840 format.

Use this transaction type to add or change SGL account information for previously received or sent transactions. You can add or change the sender's information, the receiver's information, or both.

The system includes transactions in the file only if they are marked as Not Processed in the IPAC record.

PeopleSoft Financials supports the following requirements for IPAC transactions:

CGAC (Common Government-wide Accounting Classification) compliant Sender TAS for GWA reporters

CGAC-compliant Receiver TAS for GWA reporters

Sender BETC default

Receiver BETC default

The system also supports STAR string TAS for non-GWA Reporters.

Note: Receivables items submitted to U.S. Department of Treasury IPAC collection process for money transfer remain open after running the PeopleSoft AR IPAC outbound interface. The agency must confirm that the collection was actually executed in the Treasury IPAC system and then manually record a payment and apply to the Item.

For more information about Inbound IPAC in Receivables, see Processing Inbound IPAC Transactions in Receivables.

Before you export PeopleSoft Receivables transactions to IPAC:

(Optional) Determine business need for additional required IPAC fields for transaction processing, and define selected IPAC fields as required.

Enable the IPAC interface on the Installation Options - Receivables Page.

Assign an IPAC billing agency location code, sender DO (disbursing office), and IPAC subcategory to a SetID for each business unit using the Receivables Options - General 1 Page.

When defining customers, select the options for the IPAC interface and the customer agency location code.

Select a primary IPAC contact and at least one primary contact phone number for each customer.

PeopleSoft Receivables defaults TAS and BETC values as shown in the tables here on both the Receivable IPAC Transactions page and in the AR Posting program for items from an external billing system. The TAS and BETC fields must be set up on the Treasury Account Symbol Definition page and Business Event Type Code page for IPAC transaction processing. The Receivables Update multiprocess job (ARUPDATE) sets the AR_ERROR_CD field value to ISTAS, IRTAS, ISBET, or IRBET when required TAS or BETC values are missing. The payment group is marked in error and the message appears in the message log.

|

Agency Location Code |

GWA Type |

Consider Fund Code? |

TAS Format |

27th column |

TAS Field |

|---|---|---|---|---|---|

|

Sender ALC |

GWA Reporter |

Yes |

GWA TAS |

‘C’ |

Required |

|

Sender ALC |

Non-GWA Reporter |

Yes |

String TAS |

Optional |

|

|

Receiver ALC |

GWA Reporter |

No |

GWA TAS |

‘C’ |

Required |

|

Receiver ALC |

Non-GWA Reporter |

No |

String TAS |

Optional |

|

Agency Location Code |

GWA Type |

BETC Field |

BETC Defaulting Logic |

|

|---|---|---|---|---|

|

Number of BETC codes <=4 |

Number of BETC codes > 4 |

|||

|

Sender ALC |

GWA Reporter |

Required |

Yes – default BETC |

No Defaulting. User has to manually select the BETC code. |

|

Sender ALC |

Non-GWA Reporter |

Optional |

No |

No. |

|

Receiver ALC |

GWA Reporter |

Required |

Yes – default BETC |

No Defaulting. User has to manually select the BETC code. |

|

Receiver ALC |

Non-GWA Reporter |

Optional |

No |

No |

Note: For the Receiver TAS/BETC, there will be no edit in the AR Posting program to validate that the field is required for external items. There will only be an edit to validate the setup of the Receiver TAS/BETC on the definition pages. This is because external billing systems do not populate IPAC data on the records being sent to Receivables.

The SGL account information is now optional, however, if you want to automatically supply this information, you must perform these tasks:

Create entry event codes that include the WS-01 step for the ARUPDATE entry event process on the Entry Event Code Definition page.

Add two ChartField attributes for accounts to which IPAC processing applies on the ChartField Attributes page:

IPAC: Enter Y for the ChartField attribute value.

USSGL: Enter the four-character SGL account that you want to interface with the IPAC system for the ChartField attribute value.

When you run the Receivables Update process (ARUPDATE), the system compares the GL accounts in the entry event code definition to the Account ChartField attributes to determine whether IPAC processing applies. If IPAC processing applies, the system uses the four-character GL account that you enter for the USSGL attribute value to populate the SGL Account fields.

If invoices are entered directly in Receivables, ARUPDATE automatically creates the IPAC collection or adjustment transaction when the IPAC items are posted. You can view the transaction and enter manual adjustments on the Receivable IPAC Transactions page (click the Transfer to IPAC Transactions link on the View/Update Item Details - Detail 1 page).

If invoices are loaded from an external billing source, the IPAC interface option is selected on the Installation Options - Receivables page, and the IPAC interface option is selected for the customer who is associated with the invoice, then the Receivable Update process performs these edits:

Billing ALC - The pending item is marked in error if the ALC is not defined on the Receivables Business Unit options page.

Sender DO - The pending item is marked in error if the sender do is not defined on the Receivables Business Unit options page.

Customer ALC - The pending item is marked in error if the ALC is not defined on the Customer-General Options page.

Sender TAS - The pending item is marked in error if the TAS string is not defined and associated with the fund code on the item AR accounting line.

Unit Price - The pending item is marked in error if the item entry amount is zero.

SGL Account - The pending item is marked in error if the SGL Account is not defined and associated with an entry event code on the item.

Obligation Document and Purchase Order Id - Both fields default from the Purchase Order reference field. The pending item is marked in error if the purchase order reference is not populated.

The Receivables Update process also edits invoices from PeopleSoft Billing to check the configuration of IPAC fields as optional or required in the Agency Location Code component. If a field configured as required is left blank or the required setup is missing, the system uses AR_ERROR_CD, and the group is set to Error. You can view and correct the group in the Correct Posting Errors component.

See Correcting Posting Errors.

Processing IPAC for Federal Reimbursement Agreement Contracts

The IPAC processing for Federal Reimbursement Agreement Contracts is similar to processing for other invoices that come from Billing. However, Federal Reimbursement Agreement invoices, which are initiated in Contracts and sent to Billing, must have an IPAC Payment Type of Seller. The IPAC processing in Receivables uses the Receiver TAS from the Customer Funding information associated with the Contract line. More than one Receiver TAS can be defined on the Customer Funding page. In this case, for each Receiver TAS, the system creates an IPAC Detail record in Receivables. When multiple Receiver TAS values and percentages have been defined in Contracts, IPAC processing prorates the IPAC amount based on the percentage.

IPAC Adjustments are created for Receivables credit items to refund money previously collected via IPAC. To create an IPAC Adjustment for the Receivables Outbound IPAC file, follow these steps:

Set up a vendor associated with a customer on the Identifying Information page (Suppliers, Supplier Information, Add/Update, Supplier, Identifying Information).

Create an AR credit item (Entry Type is CR) using the Pending Item 1 page (Accounts Receivable, Pending Items, Online Items, Group Entry, Pending Item 1).

Run Receivables Update (ARUPDATE) to post the item. Go to the Receivable Update Request page (Accounts Receivable, Receivables Update, Request Receivables Update, Receivable Update Request).

Review and update IPAC data for the item as necessary on the Receivable IPAC Transactions page (Accounts Receivable, Customer Accounts, Item Information, View/Update Item Details, Receivable IPAC Transactions).

The IPAC data is created during posting. The IPAC Type should be Adjustment.

Create and post a maintenance worksheet to refund the item using the refund a credit entry type. Go to the Worksheet Selection page (Accounts Receivable, Receivables Maintenance, Maintenance Worksheet, Create Worksheet, Worksheet Selection). Click the Build button.

On the Worksheet Application page, select the item and select the Entry Type of Refund A Credit. Click Save.

Click the Worksheet Action link. Select the Batch Standard action. Click OK.

Run Receivables Update (ARUPDATE), this time to post the updated item.

Review the posting request results on the Group Control page (Accounts Receivable, Receivables Update, Posting Results-Updated Items, All Items, Group Control). The Posting Status should be Complete.

Run the Receivables Refund process (AR_REFUND) for the customer. Go to the Refunds page (Accounts Receivable, Receivables Maintenance, Refunds, Request Refund Item).

On the Voucher Build page, verify that New Voucher Data is selected in the Voucher Sources field, and Receivables Customer Refunds is selected in the Voucher Build Interfaces field before running the Voucher Build process. Go to the Voucher Build page (Accounts Payable, Batch Processes, Vouchers, Voucher Build, Voucher Build).

Run the Voucher Build process (AP_VCHRBLD) to create a voucher from the staged rows in Payables, which builds a Receivables Customer Refund.

Review Voucher Build errors and fix as needed.

Review IPAC information on the payment page. Go to IPAC page (Accounts Payable, Batch Processes, Vouchers, Voucher Build, Regular Entry, IPAC).

Continue with the standard Payables processes: Voucher Budget Checking, Matching, and Document Tolerance Checking.

Run the Pay Cycle to create the Payables Outbound IPAC file. See Payables documentation, Processing Outbound IPAC Transactions.

The Pay Cycle process changes the status of all included IPAC vouchers to Processed on the IPAC page. After receiving notice that the U.S. Treasury has disbursed the payment, you can reconcile transactions by schedule ID.

Use the Receivable IPAC Transactions page (AR_IPAC_SEC) to enter information required by IPAC.

Navigation:

Click the Transfer to IPAC Transactions link on the View/Update Item Details - Detail 1 page.

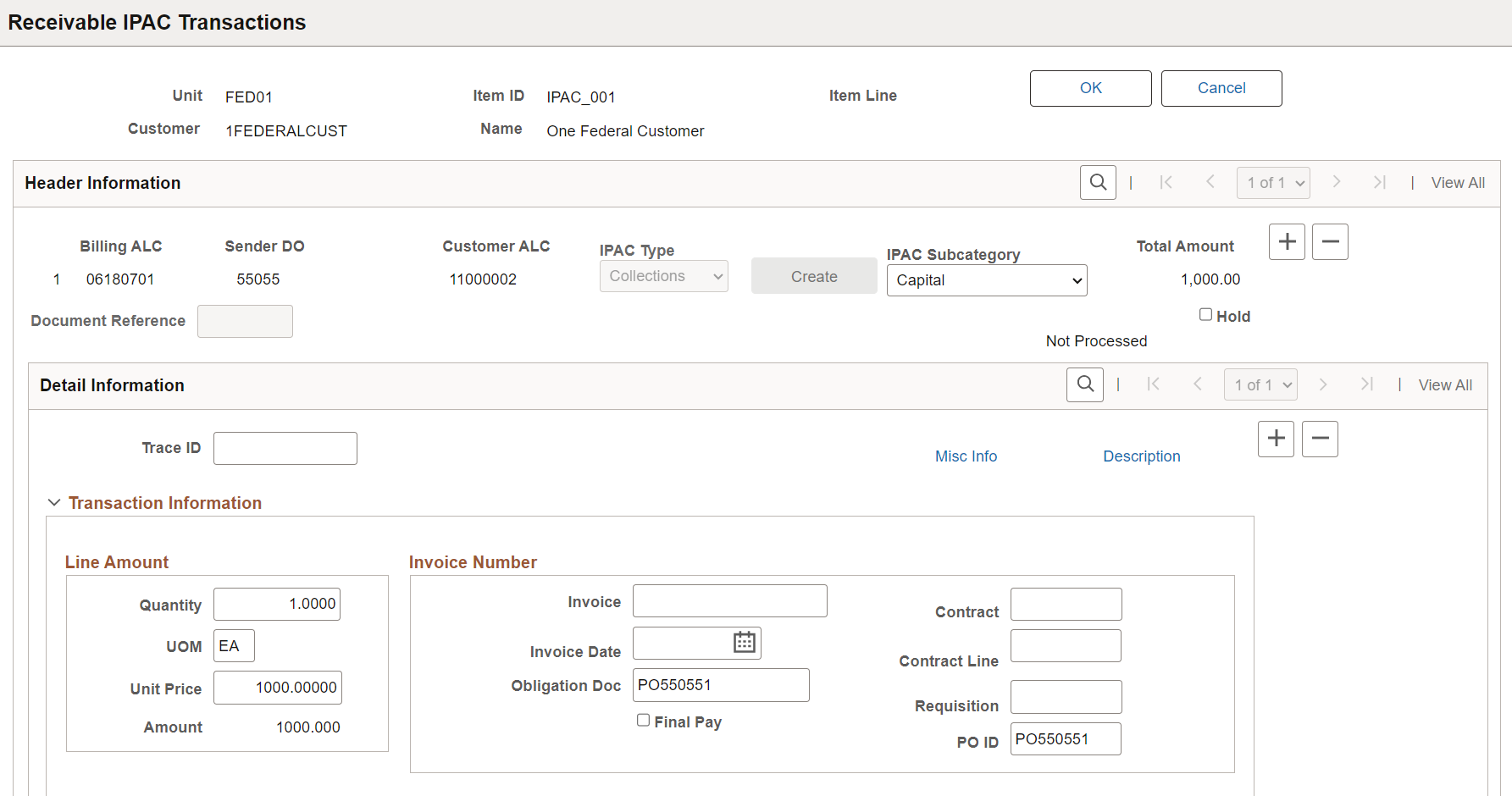

This example illustrates the fields and controls on the Receivable IPAC Transactions page (1 of 3). You can find definitions for the fields and controls later on this page.

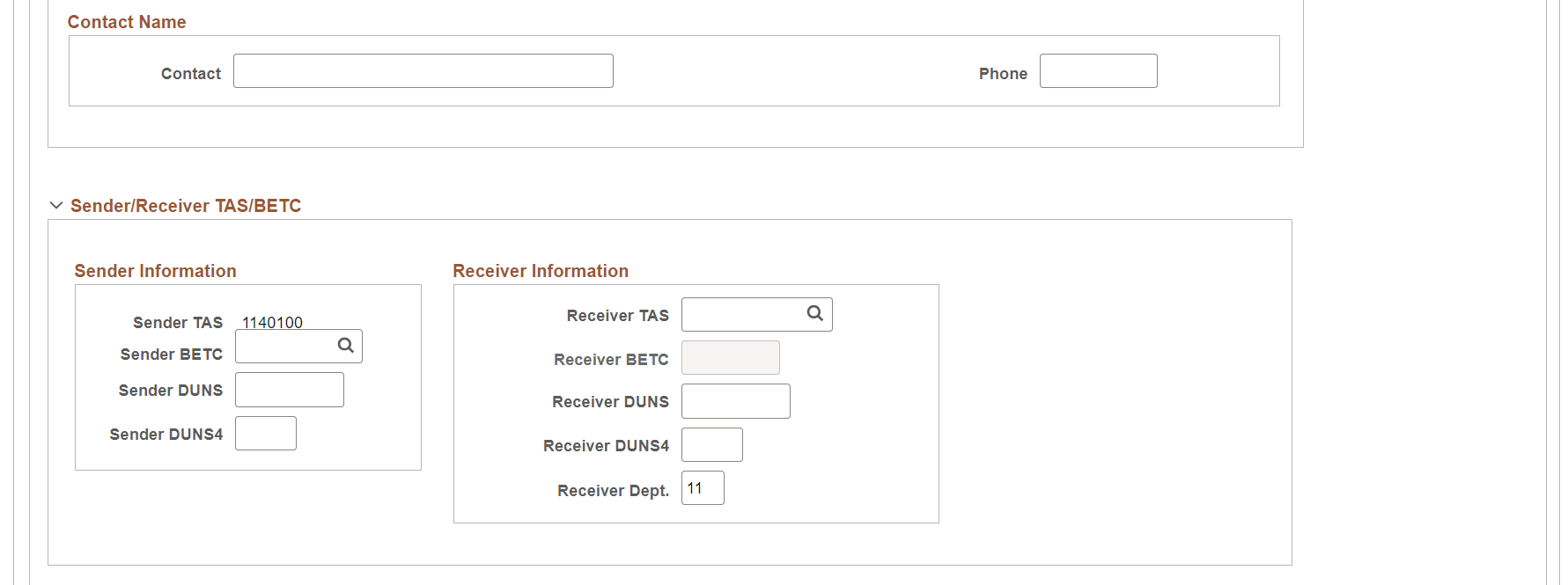

This example illustrates the fields and controls on the Receivable IPAC Transactions page (2 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Receivable IPAC Transactions page (3 of 3). You can find definitions for the fields and controls later on this page.

Some of the information displayed on this page comes from the default values for IPAC that you assigned to business units, customers, and contacts. You can override the default values as needed.

Header Information

Field or Control |

Description |

|---|---|

Billing ALC (billing agency location code) |

Displays the billing agency location code that you assigned to the SetID for the business unit. Override the code if needed. |

Sender DO (sender disbursing office) |

Displays the five-digit ID that you assigned to the SetID for the business unit. Override if needed. |

Customer ALC (customer agency location code) |

Displays the agency location code that you assigned to the customer associated with the item. Override if needed. |

IPAC Type |

Select an IPAC transaction type. Values are: Collection: Use for new transactions that you are sending to the IPAC system. Adjustment: Use for IPAC payment transactions received from another agency to add information and adjust the amount due. This option is not available if you initiated the transaction. Post SGL: Use to add or change the SGL account information for prior transactions that you sent for collection. Zero: Use for IPAC transactions that you have already sent to the IPAC system to change information other than the amount or the SGL account information. None: Use for information purposes only. No data is sent to the Department of Treasury. Note: The fields that require entry on the page vary based on the transaction type. |

|

Subcategory |

Displays the IPAC subcategory you defined on the Receivables Options - General 1 Page. Subcategory values can be:

|

Create |

Click to validate that no previous transactions exist for the item and to create IPAC transactions. Any previously entered transactions for the item must have a process status of Processed. After you click the Create button, the system enables data fields based on the IPAC record type selected. If you click the Create button after IPAC detail records have been created, the system issues a message warning that the existing IPAC detail records for this IPAC transaction will be re-created. You can proceed or cancel the action. Note: If you want to create additional IPAC transactions for an item that has prior transactions with a Processed status, you must insert a new record and IPAC type prior to clicking the Create button. |

Total Amount |

Displays the total amount of the IPAC transaction for all item lines. |

Detail Information

Only the Original Line Item Number field is available for adjustment types. No other fields are available.

Field or Control |

Description |

|---|---|

Trace ID |

Displays the user-assigned identification number to enable back-end systems to match transactions. |

Cross Ref Doc (cross-reference document) |

Displays the document reference number on the header of the original transaction. This field appears only for zero dollar transaction types. |

Original Line # (original line number) |

Displays the detail line number from the original transaction, which is used for adjustments only. |

Misc Info (miscellaneous information) |

Click to add additional information about the transaction. |

Description |

Click to add information about the IPAC description on the IPAC Description page (AR_IPAC_DESCR_SEC). |

Quantity |

Displays the quantity amount that can be used to verify that the amount on each IPAC detail record equals the quantity times unit price, except for the Zero Dollar record type. |

UOM (unit of measure) |

Displays the units by which goods and services are measured. This field is not available for adjustment type. |

Unit Price |

Displays the total amount of each IPAC unit, which is quantity multiplied by unit price. This field is required for payment and collection. |

Obligation Doc (obligation document) |

Displays the billing agency's internal accounting document associated with a specific bill. |

Final Pay |

Select to indicate whether a payment is final (F) or partial (P). |

Contract |

Displays a number that uniquely identifies a contract between two trading partners. |

Contract Line |

Displays a contract line item number. |

Requisition |

Displays whether a payment is from a requisition or a partial payment. |

PO ID (purchase order ID) |

Displays a purchase order number. This field is required for IPAC collections. |

Contact Name and Phone |

Displays information about the primary IPAC contact that you assigned to a customer. |

Sender/Receiver TAS/BETC

The fields that are available in this section vary based on the IPAC transaction type. This table shows the fields that are available based on the IPAC type:

|

IPAC Transaction Type |

Available Fields |

|---|---|

|

Collection |

All fields. |

|

Adjustment |

All fields except sender and receiver DUNS and DUNS4. |

|

Zero Dollar |

All fields except sender and receiver BETC. |

Field or Control |

Description |

|---|---|

TAS (Treasury Account Symbol) |

For the sender, select the account number assigned by the U.S. Department of Treasury to classify transactions. Indicates the agency that initiated the billing. For the receiver, select the account of the fund that will receive the payment. The following table summarizes the TAS format for Sender ALCs and Receiver ALCs, and field dependencies in PeopleSoft Receivables. |

|

Agency Location Code |

GWA Type |

Consider Fund Code? |

TAS Format |

27th column |

TAS Field |

|---|---|---|---|---|---|

|

Sender ALC |

GWA Reporter |

Yes |

GWA TAS |

‘C’ |

Required |

|

Sender ALC |

Non-GWA Reporter |

Yes |

String TAS |

Optional |

|

|

Receiver ALC |

GWA Reporter |

No |

GWA TAS |

‘C’ |

Required |

|

Receiver ALC |

Non-GWA Reporter |

No |

String TAS |

Optional |

Field or Control |

Description |

|---|---|

BETC (business event type code) |

Select the code used in the Governmentwide Accounting and Reporting Program (GWA) to indicate the type of activity being reported, such as payments, collections, and so on. This code must accompany the Treasury Account Symbol (TAS) and the dollar amounts to classify the transaction against the fund balance with the Treasury. The selected TAS determines the available BETC codes. Most TAS will have the following four BETC codes:

The following table summarizes the BETC requirements and selections for Sender ALCs and Receiver ALCs, and field dependencies in PeopleSoft Receivables. |

|

Agency Location Code |

GWA Type |

BETC Field |

BETC Defaulting Logic |

|

|---|---|---|---|---|

|

Number of BETC codes <=4 |

Number of BETC codes > 4 |

|||

|

Sender ALC |

GWA Reporter |

Required |

Yes – default BETC |

No Defaulting. User has to manually select the BETC code. |

|

Sender ALC |

Non-GWA Reporter |

Optional |

No |

No. |

|

Receiver ALC |

GWA Reporter |

Required |

Yes – default BETC |

No Defaulting. User has to manually select the BETC code. |

|

Receiver ALC |

Non-GWA Reporter |

Optional |

No |

No |

Field or Control |

Description |

|---|---|

DUNS and DUNS4 |

Enter the Dun & Bradstreet numbers used to identify the sender (your agency) or the receiver (the customer's agency). The Sender DUNS and Sender DUNS4 appears by default from the values defined on the Agency Location Code Page, if the DUNS fields were set up as required on the IPAC Fields Page. The Receiver DUNS and Receiver DUNS4 appear by default from the values defined on Customers - Additional General Information page. |

Department |

Displays the receiver department code of the customer. This field appears by default from the first two characters of the Receiver ALC. |

Entering SGL Information

If you entered an entry event code for the item in PeopleSoft Billing or during pending item entry on the Pending Item 1 page, the Receivables Update process populates the fields in the SGL Information grid. You can override the values if needed. If you did not enter an entry event code, you must enter SGL account information for Post SGL transaction types, and you can optionally enter SGL account information for the Collection and Adjustment transaction types. The SGL information fields are not available for zero dollar transaction types.

Field or Control |

Description |

|---|---|

SGL Comment (standard general ledger comments) |

Click to access the AR Post SGL Comments page (AR_IPAC_SGLCMT_SBP), where you can enter standard general ledger comments. This link is active only when Post SGL is selected in the IPAC Type field. |

SGL Account (standard general ledger account) |

Enter a chart of accounts used by the U.S. Department of Treasury for central agency reporting. |

Dr/Cr (debit/credit) |

Select a debit or credit, which determines the type of amount entered. When this value is saved, the system validates that the total debit amount is equal to the total credit amount. |

SGL Amount (standard general ledger amount) |

Enter an SGL amount. The Dr/Cr field determines the type of amount to enter. This value is used to verify that the total SGL debit amount is equal to the total SGL credit amount. It also verifies that the individual SGL amount is no greater than the amount on the IPAC detail record |

Sender/Receiver Flag |

Select a value to indicate whether the SGL account information for the line is for the sender (your agency) or the receiver (the customer's agency). |

Federal Flag |

Select a value to indicate whether the SGL account information for the line is Federal or Non-Fed (non-federal). |

SGL Action (standard general ledger action) |

Select a value that indicates the action for the line. Values are: Add: Indicates that this is a new line. Edit: Indicates that this is a changed line. For Post SGL transaction types, the action is Edit for existing lines and Add for new lines. For Adjustment transaction types, the action is Edit even though no existing rows exist. |

Use the IPAC Miscellaneous Description page (AR_IPAC_MISC_SEC) to enter additional text to describe an IPAC transaction and additional sender and receiver information.

Navigation:

Click the Misc Info (miscellaneous information) link on the Receivable IPAC Transactions page.

This example illustrates the fields and controls on the IPAC Miscellaneous Description page. You can find definitions for the fields and controls later on this page.

Enter comments about the collection request in the text box.

Field or Control |

Description |

|---|---|

Fiscal Year Obligation ID |

Select a value to indicate the fiscal year of the obligation. Values are Not Applicable, Current Fiscal Year, and Prior Fiscal Year. |

ACL/CD (account classification code) |

Displays a project code and is supplied to the billing agency by the customer on the original request for services. |

ACRN (account classification reference number) |

Appears for adjustment type only. |

Job |

Not available for adjustment type. |

JAS (job agency site) |

Displays a combination of job order number, accounting classification record number, and site ID. |

FSN (fiscal station number) |

Displays an 8-digit number identifying the subdivision of an agency location code. |

DoD (activity address code) |

Displays the activity address code. |

The fields that are available on this page vary based on the IPAC transaction type. This table shows the fields that are available based on the IPAC type:

|

IPAC Transaction Type |

Available Fields |

|---|---|

|

Collection |

All fields. |

|

Adjustment |

All fields. |

|

Zero Dollar |

All fields except Fiscal Year Obligation ID. |

|

Post SGL |

Only the text box. |

Use the Override Options page (PRCSDEFNOVRD) to enter override options for the Format EFT File process.

Navigation:

This example illustrates the fields and controls on the Override Options page for the Format EFT File process. You can find definitions for the fields and controls later on this page.

If you run PeopleSoft Receivables on a DB2 database on a Microsoft Windows or IBM OS390 server, you must manually insert an owner ID parameter in the list of parameters for the process definition before you can run the Format EFT Files process.

Field or Control |

Description |

|---|---|

Parameters List |

Enter Prepend. |

Parameters |

In the Parameters field next to the Parameters List field, enter %%OWNERID%% :EFT_WRK_PARM1 as shown in the preceding example. Note that a space is between the owner ID parameter (%%OWNERID%%) and :EFT_WRK_PARM1. |

Use the AR IPAC Run Request page (IPAC_EXP_RQST) to run the Format EFT File process, which creates a file that can be uploaded to IPAC.

Navigation:

Field or Control |

Description |

|---|---|

IPAC Interface Options |

Select an IPAC Interface option: Values are Generate for All Units, Generate for One Unit, Generate for One Customer, and Rerun for Previous Job. |