Creating Billing Business Units Using Business Unit Management

This topic discusses how to copy or modify Billing business units using the Business Unit Management feature.

The Business Unit Management feature allows you to create General Ledger business units. You can also create sub-ledger business units by copying existing sub-ledger business units and then modifying them per your requirements. After establishing a PeopleSoft General Ledger and Receivables business unit, you can establish a Billing business unit.

For more information about Business Unit Management, see Managing Business Units.

Use these pages to create Billing business units from the Business Unit Management tile.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_BI1_FL |

Copy a Billing business unit from an existing Billing business unit, or modify an existing Billing business unit. This process establishes a link with an existing General Ledger and Receivables business unit |

|

|

BUS_UNIT_BI2_FL |

Define tax control and contract liability options, and establish default debit and credit entry types and reasons. |

|

|

BUS_UNIT_BI3_FL |

Determine defaults for the Contract Asset process and document sequencing. |

|

|

BUS_UNIT_BI4_FL |

Enable PeopleSoft Billing business units for VAT, approvals, credit cards, and other features. |

Use the Billing Definition - Business Unit 1 page (BUS_UNIT_BI1_FL) to copy a Billing business unit from an existing Billing business unit, or modify an existing Billing business unit. This process establishes a link with an existing General Ledger and Receivables business unit.

Navigation:

Select the Business Unit Management tile. Add a new General Ledger business unit. Select Yes to Copy or modify a Billing Business Unit on the Questionnaire Page. Select Next. Select Next on the Questionnaire: Advances Features page. After entering required information, select Billing Definition on the Business Unit Management page.

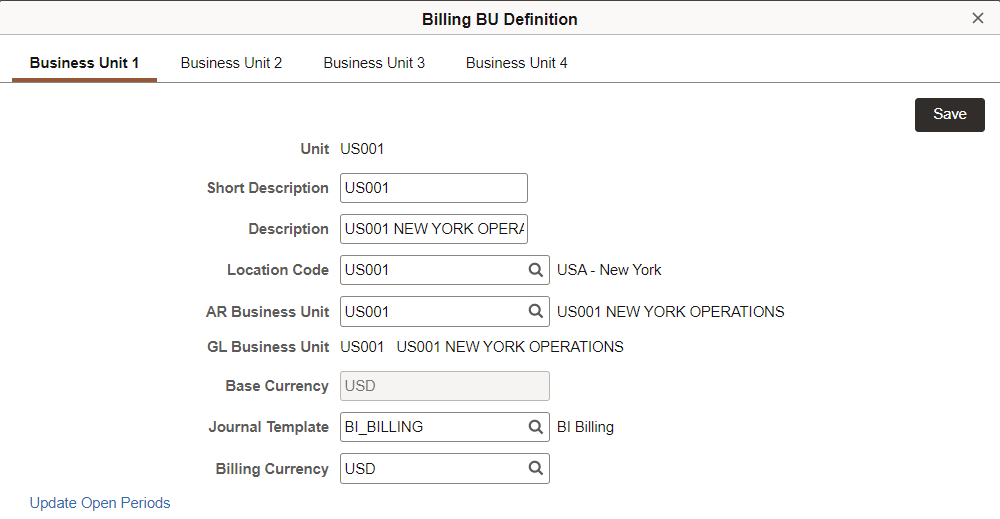

This example illustrates the fields and controls on the Billing Definition - Business Unit 1 page in Fluid.

|

Field or Control |

Description |

|---|---|

|

Default SetID |

Select a new or existing SetID. |

|

Description |

Displays a description that PeopleSoft Billing uses throughout the system in prompt lists, reports, online inquiries, and other pages. PeopleSoft Billing uses the short description on pages and online inquiries with limited display space. If you establish a business unit with the same name as one that exists in PeopleSoft General Ledger or Receivables, the system uses the default description. |

|

Create BU (create business unit) |

Select to create a default relationship between the business unit and SetID. If you have already set up a PeopleSoft General Ledger business unit or a Receivables business unit with the same name, this button does not appear, and you do not need to provide a default SetID because it already exists for the business unit. After you select this button, the Default SetID field no longer appears. You can override this option for specific record groups at a later time. However, you should set the defaults at the highest level possible to avoid unnecessary work later. |

|

Save |

Select to save the relationship between the business unit and SetID. If you have already set up a PeopleSoft General Ledger business unit or a Receivables business unit with the same name, this button does not appear, and you do not need to provide a default SetID because it already exists for the business unit. After you select this button, the Default SetID field no longer appears. You can override this option for specific record groups at a later time. However, you should set the defaults at the highest level possible to avoid unnecessary work later. |

|

Location Code |

Select a code to represent the location of the billing business unit. The system uses this code for the default ship-from country and state, as well as the default seller's VAT country and state on VAT invoices. You define location codes on the Location - Location Definition page. |

|

AR Business Unit (accounts receivable business unit) |

Select a Receivables business unit to associate with the Billing business unit. |

|

GL Business Unit (general ledger business unit) |

When you select an accounts receivable business unit, the system populates this field with the General Ledger business unit that is associated with the Receivables business unit. The relationship between a Billing business unit and a General Ledger business unit is inherited from Receivables. If you do not have PeopleSoft Receivables installed, enter any value in these two fields; the system validates against tables. If the GL business unit is tied to a VAT entity, the system populates the identifier of that entity in the VAT Reporting Entity field on the Billing Definition - Business Unit 4 Page (Fluid), indicating that this is a VAT-enabled PeopleSoft Billing business unit. If this value is not tied to a VAT entity, the VAT fields on the Billing Definition - Business Unit 4 page are not displayed. |

|

Base Currency |

Displays the base currency of the General Ledger business unit if PeopleSoft Receivables or General Ledger is installed. The system uses this currency as the default billing currency for the business unit. You can select a different default billing currency, if appropriate. |

|

Journal Template |

Select a value to use when transferring balances to the General Ledger application. |

|

Billing Currency |

Displays the base currency of the General Ledger business unit. You can select a different value that the system uses as the default billing currency when the currency is not specified on the bill and the customer has no assigned currency. |

|

Update Open Periods |

Click to access the Open Period Update Page, where you can edit the parameters of an open period. |

Business Unit Level System Controls

On the Installation Options: Billing - General Options Page, if you defined certain options to be the defaults at the business unit level the system enables several fields in the Bus Unit Level System Controls (business unit level system controls) group box. The fields that the system displays depend on which options you select as the defaults. This table explains the fields or controls, and descriptions for the system controls:

|

Field or Control |

Description |

|---|---|

|

Invoice Number ID |

Enter the default value for this business unit. |

|

Consolidated Invoice Number ID |

Enter the consolidated invoice number ID. |

|

Page Series ID |

Enter a value to enable navigation through the same set of bill entry pages in the same order for any bill of this business unit. |

|

Accounting Display Template |

Select to control the display of ChartFields. |

General Ledger

Select one of the following general ledger levels for the business unit:

|

Field or Control |

Description |

|---|---|

|

AR Creates GL Acct Entries (accounts receivable creates general ledger accounting entries) |

Select to disable validation requirements for values defined for each revenue line of a bill when changing status to RDY (ready). PeopleSoft Receivables creates accounting entries. PeopleSoft Billing does not track accounting information. |

|

BI Creates GL Acct Entries (billing creates general ledger accounting entries) |

PeopleSoft Billing creates General Ledger accounting entries. |

|

No GL Acct Entries (no general ledger accounting entries) |

PeopleSoft Billing does not create General Ledger accounting entries. |

Accounts Receivable

Select one of the following accounts receivable levels as the default level for the business unit:

|

Field or Control |

Description |

|---|---|

|

Header is AR Open Item (header is accounts receivable open item) |

PeopleSoft Billing creates a single open item for each bill. |

|

Bill Line is AR Open Item (bill line is accounts receivable open item) |

PeopleSoft Billing creates an open item entry for each bill line. |

|

No AR Open Items (no accounts receivable open items) |

Billing does not create Receivables open items. |

Select one of the following accounts receivable options as the default for the business unit:

|

Field or Control |

Description |

|---|---|

|

Use Header for Distribution |

The system sends item distribution to Receivables from the bill header. This option is valid only if you select Header is AR Open Item for the accounts receivable level. |

|

Use Line for Distribution |

The system sends item distribution to Receivables from the bill lines. This option is valid for both accounts receivable level options: Header is AR Open Item and Bill Line is AR Open Item. If you use this option with Header is AR Open Item, you can have one open item in Receivables and nevertheless use different Receivables account distribution for each bill line. |

InterUnit Accounts Payable

Select one of the following interunit accounts payable levels as the default for the business unit:

|

Field or Control |

Description |

|---|---|

|

Header is AP Voucher |

PeopleSoft Billing creates an AP Voucher header for an invoice. |

|

Bill Line is AP Voucher |

PeopleSoft Billing creates an AP Voucher header for each line on an invoice. |

|

No AP Voucher |

Billing does not create an AP Voucher. |

Use the Billing Definition - Business Unit 2 page (BUS_UNIT_BI2_FL) to define tax control and contract liability options, and establish default debit and credit entry types and reasons.

Navigation:

Select the Business Unit Management tile. Add a new General Ledger business unit. Select Yes to Copy or modify a Billing Business Unit on the Questionnaire Page. Select Next. Select Next on the Questionnaire: Advances Features page. After entering required information, select Billing Definition on the Business Unit Management page. Select the Business Unit 2 tab.

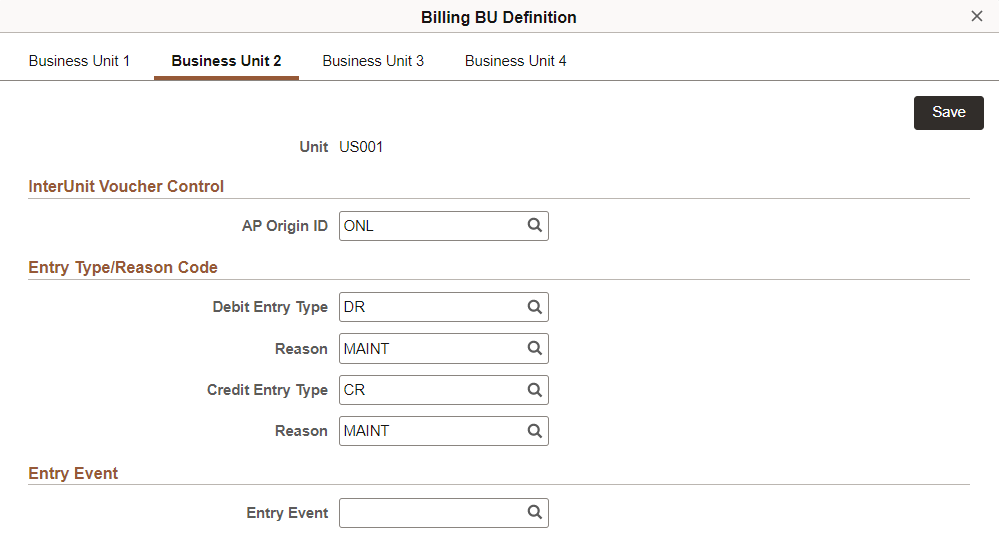

This example illustrates the fields and controls on the Billing Definition - Business Unit 2 page in Fluid.

Business Unit Tax Controls

Select one of the following tax provider options:

|

Field or Control |

Description |

|---|---|

|

Use Tax Provider |

Select to associate the business unit with the tax provider that you define on the Installation Options - Overall/GL (installation options - overall and general ledger) page. You select this option to indicate that third-party tax provider software calculates taxes for billing transactions in this business unit. Note: This field is disabled if the Billing business unit is associated with a VAT entity. If you do not select the Use Tax Provider option, no additional controls appear in the Bus Unit Tax Controls (business unit tax controls) group box. |

|

Company |

Enter the company code that you set up for this business unit in the tax provider system. This code will be associated with all bills you create in this business unit. The system reports the taxes calculated in this business unit under the selected company code in the tax provider's system. |

|

Division |

Enter the division code setup for this business unit, if applicable. Set up division codes in the tax provider system. |

|

Ord Accept (order acceptance) and Ord Origin (order origin) |

Enter the bill line default order-acceptance and order-origin locations to be used in third-party software tax calculations for bills that you create in this business unit. |

|

Calc Use Tax on Free Items (calculate use tax on free items) |

Select the check box to specify whether use taxes should be accrued for free items. |

Tax Liability Account

|

Field or Control |

Description |

|---|---|

|

Sales/Use |

Provide the distribution code for the sales tax liability account. |

|

(CND) GST (goods and services tax) |

Provide the distribution code for the Canadian goods and services tax liability account. The GST control is only displayed for a business unit using Canadian dollars as its billing currency. Note: To calculate Canadian taxes through a third-party tax provider, do not associate the Billing business unit with a GL unit linked to a VAT entity. |

|

Use Tax Dist (use tax distribution code) |

Provide the distribution code for the accrued use tax. |

|

Use Tax Offset |

Provide the distribution code for use tax offset. Note: The Use Tax Offset account may be an accounts payable distribution code. |

Note: The controls in the Tax Liability Account group box are displayed only when using a third-party tax solution.

Contract Liability Options

The fields in this group box appear only if you set the GL Options (General Ledger options) to Business Unit on the Installation Options - Billing - Integration Options page.

|

Field or Control |

Description |

|---|---|

|

Enable Contract Liability |

Before you can generate deferred accounting entries, select this option, and define the future period accounting dates. These definitions tell the system whether it can generate contract liability entries and which accounting date to use for future-dated accounting entries. Set these definitions at the same level that you set the general ledger options. In other words, if the general ledger options are set at the business unit level, set this option and the future period accounting dates at the business unit level. |

The proration method is the calculation method used to divide and distribute contract liability across accounting periods. Select from the options listed in this table:

|

Code |

Field Value |

Function |

|---|---|---|

|

1 |

By Days Within Range |

The system divides the number of revenue days in the period by the number of days in the range. |

|

2 |

Evenly Using All Pds (evenly using all periods) |

The system divides the total invoice line amount by the number of periods in the range. Revenue is recognized in equal portions for each accounting period, regardless of the number of days in each period. |

|

3 |

Evenly Using Mid-period Rule |

The system divides the total invoice line amount by the number of recognizable periods in the range. The number of recognizable periods is derived from applying rules to start and end days and the mid-period day to determine whether the first and the last periods are recognizable or excluded from the calculations. The Mid-Period # of Days field becomes available for entry. Enter the day in an accounting period that determines whether the accounting period is fully recognizable or not recognizable at all. Specify the mid-period day here, or enable the system to assign the date. The system defines the mid-period day by dividing the number of days in the accounting period by two and rounding to the nearest whole number. |

|

4 |

Evenly/Partial by Days |

Revenue is recognized in steps. The system prorates first and last periods by dividing the total number of days in the period by the total number of days in the range. The revenue recognized for these partial periods is deducted from the total. The remainder revenue is divided equally between the total number of fully recognizable periods. |

|

5 |

User Defined Proration Method |

This option is available to create a configured proration method. |

InterUnit Voucher Control

|

Field or Control |

Description |

|---|---|

|

AP Origin ID (accounts payable origin ID) |

If you use a third-party tax provider in PeopleSoft Billing, no tax codes are available to pass to PeopleSoft Payables. Therefore, you need voucher entry intervention to enter the tax information. Set up a unique ID to identify vouchers that require manual intervention. If you do not have PeopleSoft Payables installed, you cannot take advantage of voucher functionality, and the Generate AP Voucher (generate accounts payable voucher) option on the System Transaction Map - Transaction Options page is unavailable. If you do not select the Generate AP Voucher option, you must provide payables distribution information for the InterUnit pair. This enables the Load GL Interface (load general ledger interface) process to generate accounting entries for the InterUnit payables and expense entries. Configure the system to extract data from the PeopleSoft Billing tables to create vouchers. |

Entry Type/Reason Code

|

Field or Control |

Description |

|---|---|

|

Debit Entry Type , Reason (debit entry reason), Credit Entry Type , and Reason (credit entry reason) |

Assign values to these fields to define the default accounting entries for debit and credit activity generated by this business unit. Only those values predefined in PeopleSoft Receivables appear. To add accounts receivable entry types and entry reasons, access the Entry Type page and Entry Reason page. You are required to assign both at the business unit level because these fields are optional at all other levels. Providing them at the business unit level (the top of the default hierarchy) ensures that the Load AR Pending Items (load accounts receivable pending items) process always has an entry type and reason values to pass to PeopleSoft Receivables. Passing an entry type and reason is required by the PeopleSoft Receivables system for further processing of pending items. |

Entry Event

|

Field or Control |

Description |

|---|---|

|

Entry Event |

Define the default entry event code for the corresponding business unit. Options include only those values identified with the Receivables Update process (ARUPDATE). This field appears only if entry events are defined as Required or Optional in the Billing field on the Installation Options - Entry Event page. |

Use the Billing Definition - Business Unit 3 page (BUS_UNIT_BI3_FL) to determine defaults for the Contract Asset process and document sequencing.

Navigation:

Select the Business Unit Management tile. Add a new General Ledger business unit. Select Yes to Copy or modify a Billing Business Unit on the Questionnaire Page. Select Next. Select Next on the Questionnaire: Advances Features page. After entering required information, select Billing Definition on the Business Unit Management page. Select the Business Unit 3 tab.

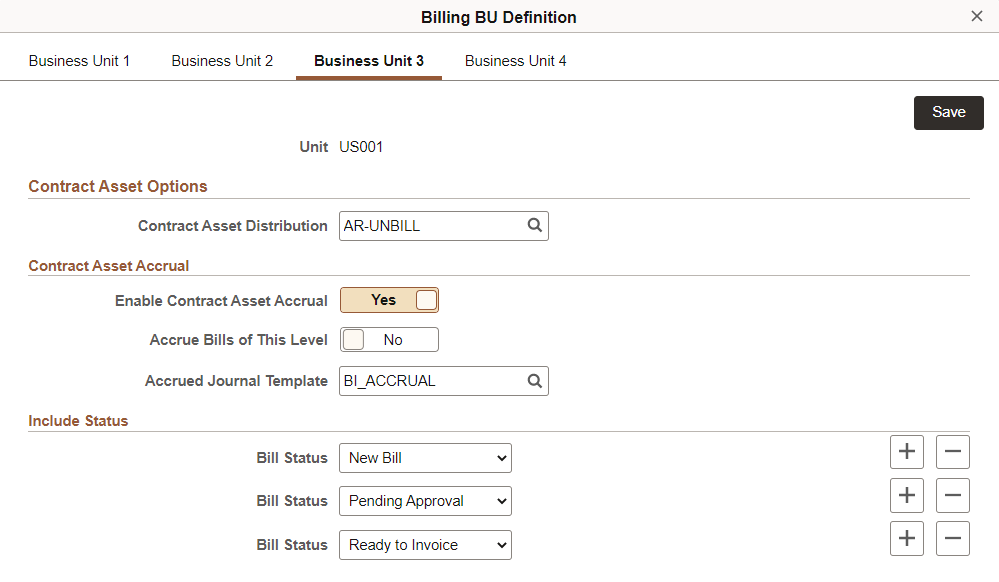

This example illustrates the fields and controls on the Billing Definition - Business Unit 3 page in Fluid.

|

Field or Control |

Description |

|---|---|

|

Contract Asset Distribution |

Select a distribution code that is used as the default when the Enable Contract Asset Accrual option is Yes. |

|

Enable Contract Asset Accrual |

Select to enable accrual processing for the business unit. When you select this option, define a default contract asset distribution code and an accrued journal template. Only journal templates that are set up to auto-reverse are available for selection. |

|

Accrue Bills of This Level |

Select Yes to accrue bills by business unit. Select No to enable unbilled revenue accrual at the business unit level for certain bill types only. When this option is selected, set up unbilled revenue accrual for the bill type on the Bill Type 3 Page. |

|

Accrued Journal Template |

Select a journal template that is defined to auto-reverse. This option is available when the Enable Contract Asset Accrual is Yes. |

|

Include Status |

Define which bill statuses to include in the accrual. You can define multiple statuses by inserting a row for each additional status. The following statuses are eligible for accrual: Finalized, Hold, New Bill, Pend Apprv (pending approval), and Ready. |

|

Document Sequencing Defaults |

Enter the document type that you want to associate with the invoice types listed. The journal code that you associate with the document type on the Document Type Page becomes the default code. |

Use the Billing Definition - Business Unit 4 page (BUS_UNIT_BI4_FL) to enable PeopleSoft Billing business units for VAT, approvals, credit cards, and other features.

Navigation:

Select the Business Unit Management tile. Add a new General Ledger business unit. Select Yes to Copy or modify a Billing Business Unit on the Questionnaire Page. Select Next. Select Next on the Questionnaire: Advances Features page. After entering required information, select Billing Definition on the Business Unit Management page. Select the Business Unit 4 tab.

This example illustrates the fields and controls on the Billing Definition - Business Unit 4 page in Fluid.

VAT Information

The fields in this section are display -only and can only be changed using the Billing Definition - Business Unit 4 Page in Classic.

|

Field or Control |

Description |

|---|---|

|

VAT Reporting Entity |

Displays if you link the PeopleSoft Billing business unit to a General Ledger business unit, that is already associated with a VAT entity, on the Billing Definition - Business Unit 1 Page (Fluid). This is required for VAT Billing business units. If this field is blank, the business unit is not set up for VAT. |

|

Physical Nature |

Indicates whether a VAT billing business unit is for goods or services. Physical nature is required for billing business units that are tied to a VAT entity. This field appears only when the billing business unit's associated general ledger business unit is associated with a VAT entity. |

|

Where Service Performed |

Indicates the location where the service is physically performed. Where Service Performed is required for billing business units that are tied to a VAT entity. Options are: Buyer's Location, Ship From Location, ship-to Location, or Supplier's Location. This field appears only when the billing business unit's associated general ledger business unit is associated with a VAT entity. |

|

(NLD) Acceptgiro Type |

Displays the acceptgiro contract type. The Acceptgiro Type field will be displayed only if an acceptgiro contract is set for the Receivables business unit associated with the Billing business unit. If no contract type is displayed, the business unit will not be able to generate acceptgiro invoices. |

Note: The VAT Defaults Setup and Services VAT Treatment Drivers Setup pages are described in detail in the PeopleSoft Global Options and Reports.

See Understanding VAT in PeopleSoft Billing, and Setting Up VAT Entities.

Warning! If the General Ledger business unit is linked to a VAT entity after the Billing business unit is created, the VAT status of the Billing unit is not automatically updated. To update the Billing business unit VAT status, you must change the AR Business Unit setting on the Billing Definition - Business Unit 1 page to another, temporary value, and then change it back to the correct Receivables business unit. This change causes the system to determine whether the General Ledger business unit is linked to a VAT entity. After the link between the General Ledger business unit and the VAT entity is verified, the Billing business unit becomes a VAT Billing business unit, and the VAT entity identification is copied onto the Billing Definition - Business Unit 4 page.

Invoice Approval Options

|

Field or Control |

Description |

|---|---|

|

Enable Invoice Approvals |

Select to enable the approval process for the business unit. |

|

Only Submit Credits for Approval |

Select Yes when bills that have a negative invoice amount, or at least one negative line amount, are to be submitted for approvals. |

|

Enable Worksheet Approval |

Select Yes to have the system process worksheets through approvals. This option is only available when Enable Invoice Approvals is Yes. |

|

Process ID |

Select a process ID to be used in the approval process. The process ID defines the criteria and rules for your approval process. PeopleSoft Billing uses the Enterprise Components Approval framework to process invoice approvals. The process can be customized to meet your company's business needs. Process IDs are defined in Enterprise Components using the Setup Process Definitions Page. |

Details

|

Field or Control |

Description |

|---|---|

|

Financial Sanctions Screening |

Select Yes to indicate that the bills that are associated with this billing business unit are processed through the Financial Sanctions Screening (FSS) check during the Screen for Denied Parties process or the Bill Finalization process. This option is activated when you selectEnable at Business Unit in the Order To Cash field on the Overall Installation Options - Financial Sanctions Options Page. |

|

Attach Invoice Image Option |

Select this option to retain an image of the invoice that is generated when the invoice is printed. If the invoice format is BI publisher and the invoice has been finalized, the print program can be run and the PDF output of the invoice is attached to the invoice header. |

Credit Cards

Use this section to determine a Default Credit Card Group for the business unit. This group can be used to limit or control what credit card types and third-party processors are available for transactions.

For additional information about Credit Card options and groups, see Setting Up Credit Card Options and Groups.

Threshold

Use this section to establish a threshold amount for the Finalization process. When the Threshold option is Yes, the Threshold Amount field appears.

Invoices below the Threshold Amount are not selected for the Finalization process.

Invoices that are equal to or greater than the Threshold Amount are selected for the Finalization process.

Credit invoices that have negative invoice amounts, or invoice amounts that are negative, are selected for processing.

When accessing the Common Elements - Invoices Not Finalized page, if multiple invoices are selected and the Finalize and Print (or Single Action Job) action is selected, and some invoices are below the threshold amount, a message is displayed notifying you that invoices below the threshold amount will not be finalized. A similar message is displayed for consolidated invoices. For consolidated invoices, the invoice amount on the consolidated header is used to compare to the threshold amount.

For more information about the Finalization process (BIIVC000), see Preprocessing Steps.

For more information about Billing WorkCenters, see Understanding the PeopleSoft Fluid Billing WorkCenter.

Invoice Email Option

|

Field or Control |

Description |

|---|---|

|

From Email Address |

Enter an email address for invoices that are emailed to your customers. When this business unit is used on an invoice, and you email the invoice to a customer using the Invoice Bursting (XMLPBURST) process, this email address appears in the From Email field. This value can be overridden at the bill type level, which is established on the Bill Type 2 Page. |

|

Express Bill Entry Template |

Select a template from the list of options. The template allows you to select the configurable bill entry fields that you want to display on the Express Billing - Line List page. Access the Express Bill Entry Template page (Set Up Financials/Supply Chain, Product Related, Billing, Defined Preferences, Express Bill Entry Template) to create or edit the template. Only the express billing fields that can be hidden appear on this page. To display a field in the Express Billing - Line List page, select the corresponding check boxes. The Bill Entry Template value can be specified at various levels; Installation, Business Unit, Bill Type or Bill Source. Based on the Billing defaulting hierarchy, a Template ID is populated and associated with the Express Bill Entry page. For more information about Express Billing, see Adding New Bills in Express Billing. |