Generating China VAT Transactions

This feature requires the China Localization SuiteApp.

The following topics describe how to generate China VAT Transactions for the Golden Tax System:

Overview

NetSuite China Localization lets you generate VAT Transactions. The VAT transaction data generated is used to import your transactions to the Golden Tax System.

Follow the guidelines when generating VAT transactions. For more details, see Guidelines for Generating China VAT Transactions.

Use the exported text file to import transactions from NetSuite into the Golden Tax System. For more information, see Importing VAT Transactions from the China Golden Tax System.

Generating and exporting your VAT transactions updates the transaction status in NetSuite. For more information, see Viewing Transaction Status for Issuing VAT Invoices.

The Item Name and Item Model fields show the values set in their respective item records. The Item Name column derives the values from both the Item Name/Number and the Display Name/Code field in the item record. See Creating Item Records. For the Item Model column, see Setting Up China Item Models for Inventory Items

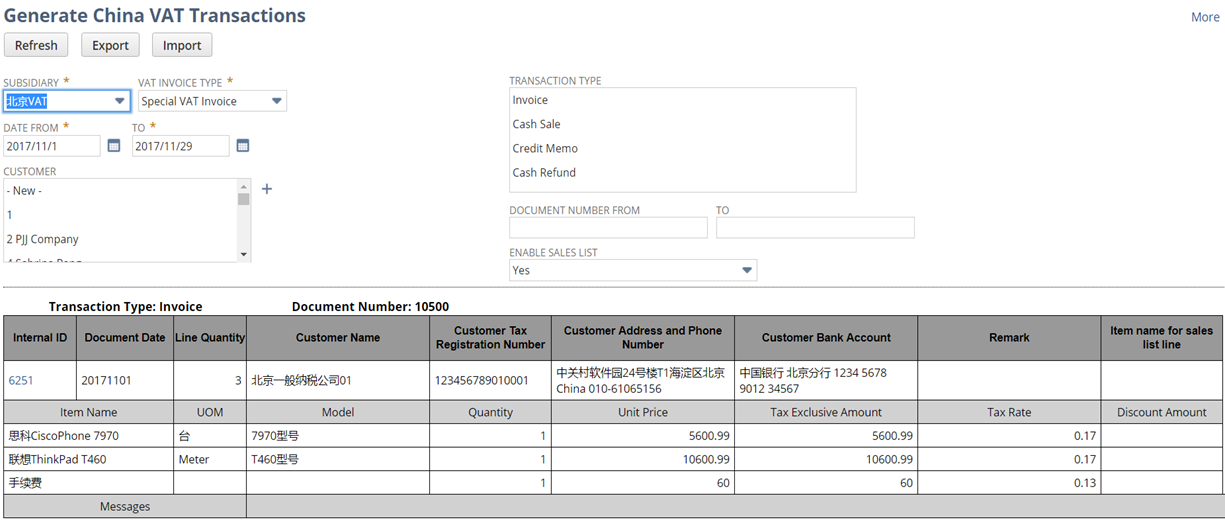

Generate China VAT Transactions

Follow these steps to generate China VAT Invoices:

To Generate China VAT Transactions:

-

Go to the Generate China VAT Transactions page.

-

In the Classic Center, go to Transactions > Sales >Generate China VAT Transactions.

-

In the Accounting Center, go to Customer > Sales > Generate China VAT Transactions .

-

In NetSuite OneWorld Accounts, select a subsidiary from the Subsidiary menu. You can select companies or subsidiaries located in China.

-

-

In the VAT Invoice Type field, select either Special VAT Invoice or Common VAT Invoice. For more information, see Setting China VAT Taxpayer Types.

-

In the Date From and To field, enter a date range.

-

In the Customer dropdown, select a customer.

-

In the Transaction Type list, select a transaction type.

-

(Optional) In the Document Number From and To fields, enter a range of document numbers to include in generating VAT Invoices. For more information, see Set Auto-Generated Numbers.

-

In the Enable Sales List field, select Yes or No. For more information about Sales Lists, see Using Sales Lists in China VAT Invoices.

-

Click Refresh.

-

(Optional) Click Internal ID to view the transaction associated with the transaction line.

-

In each invoice's Messages field, review any issues and correct them.

-

Blank messages indicate that the invoice has no errors and will be exported.

-

If there are messages for the transaction, it won't be exported.

-

-

Click Export.

-

(Optional) If your NetSuite account has a Golden Tax System Integration set up, click Issue Invoice. This action sends a request to the Golden Tax System Integration to issue an invoice. For more information, see Enabling and Configuring China Golden Tax System Integration.

-

(Optional) Click Merge to start merging transactions. For more information, see Merging China VAT Transactions.

-

Save the generated file.

Generate China VAT Transaction Example

Here's an example of generating China VAT Transactions: