Additional Setup Requirements for Singapore

If you have installed the NetSuite Tax Audit Files SuiteApp to generate the IRAS Audit File (IAF), you must complete the following setup steps:

For more information about what you must do to make the generated IAF compliant with IRAS requirements, see Singapore Tax Audit File.

-

Go to Setup > Accounting > Taxes > Set Up Taxes and set up tax preferences for Singapore.

-

Enter your company's VAT/GST Registration No. and Unique Entity Number (UEN) on the company information (if you do not have a OneWorld account) or Singapore subsidiary record (if you have a OneWorld account). If you do not have a OneWorld account, go to Setup > Company > Company Information. If you have a OneWorld account, go to Setup > Company > Subsidiaries and select the Singapore subsidiary.

-

Go to Go to Setup > Company > Setup Tasks > Auto-Generated Numbers and set up subsidiary numbering for transactions. For more information, see Set Auto-Generated Numbers.

-

Go to Go to Setup > Accounting > Preferences > Set Up Accounting and check the Use Account Numbers box. Also, make sure that each posting account has a unique account number in the Chart of Accounts setup. For more information, see Chart of Account Numbering.

-

Make sure the tax types and tax codes are set up as described in the following topics:

-

Fill in the UEN field on vendor records, partner records, and customer records. For details, see Tracking the Unique Entity Number.

-

Mark the Reference No. field on the Vendor Bill, and the Check # field on Checks as required fields. To do so, an account administrator must complete the following configuration tasks:

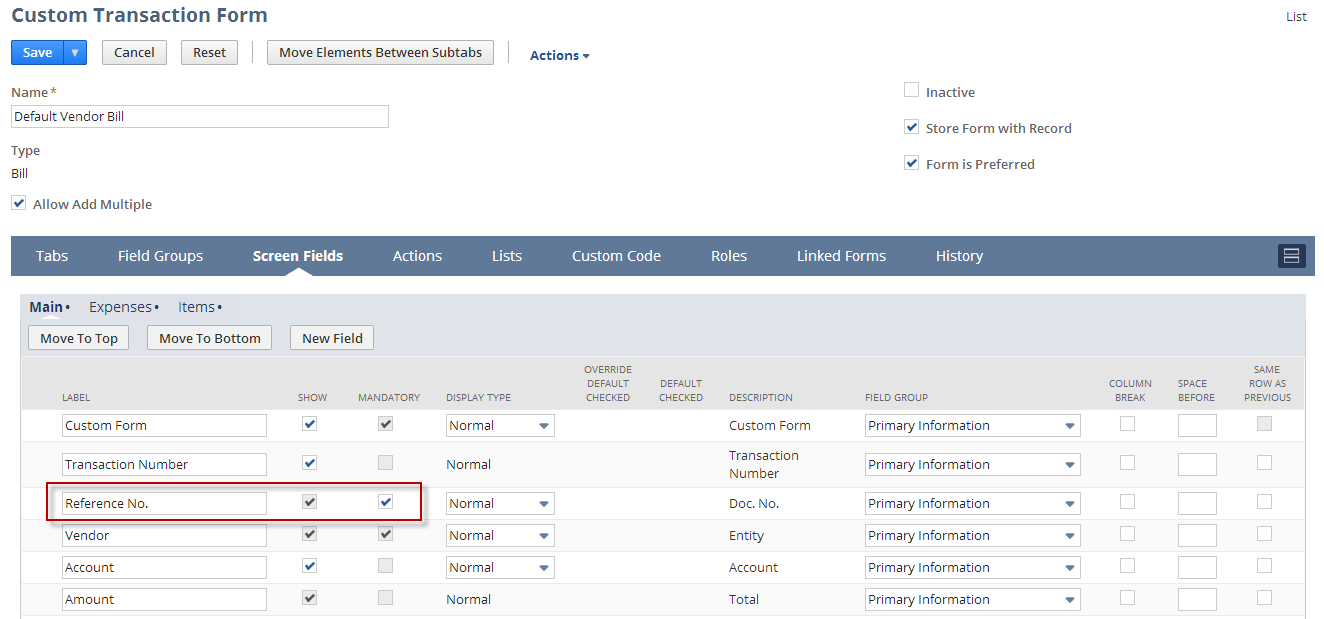

Vendor Bills

-

Create a custom vendor bill transaction form. Do one of the following to select the form to customize.

-

Go to Transactions > Payables > Enter Bills and click Customize.

-

Click Customize or Edit next to the form name at Customization > Transaction Forms. For example, click the Customize link of the Standard Vendor Bill.

-

-

Enter a name for the custom form. For example, Default Vendor Bill.

-

Check the Form is Preferred box to make this the default form that displays when a user creates a vendor bill.

-

On the Screen Fields subtab, in the Mandatory column, check the box next to Reference No. to mark the field as required on the custom form.

-

Click Save.

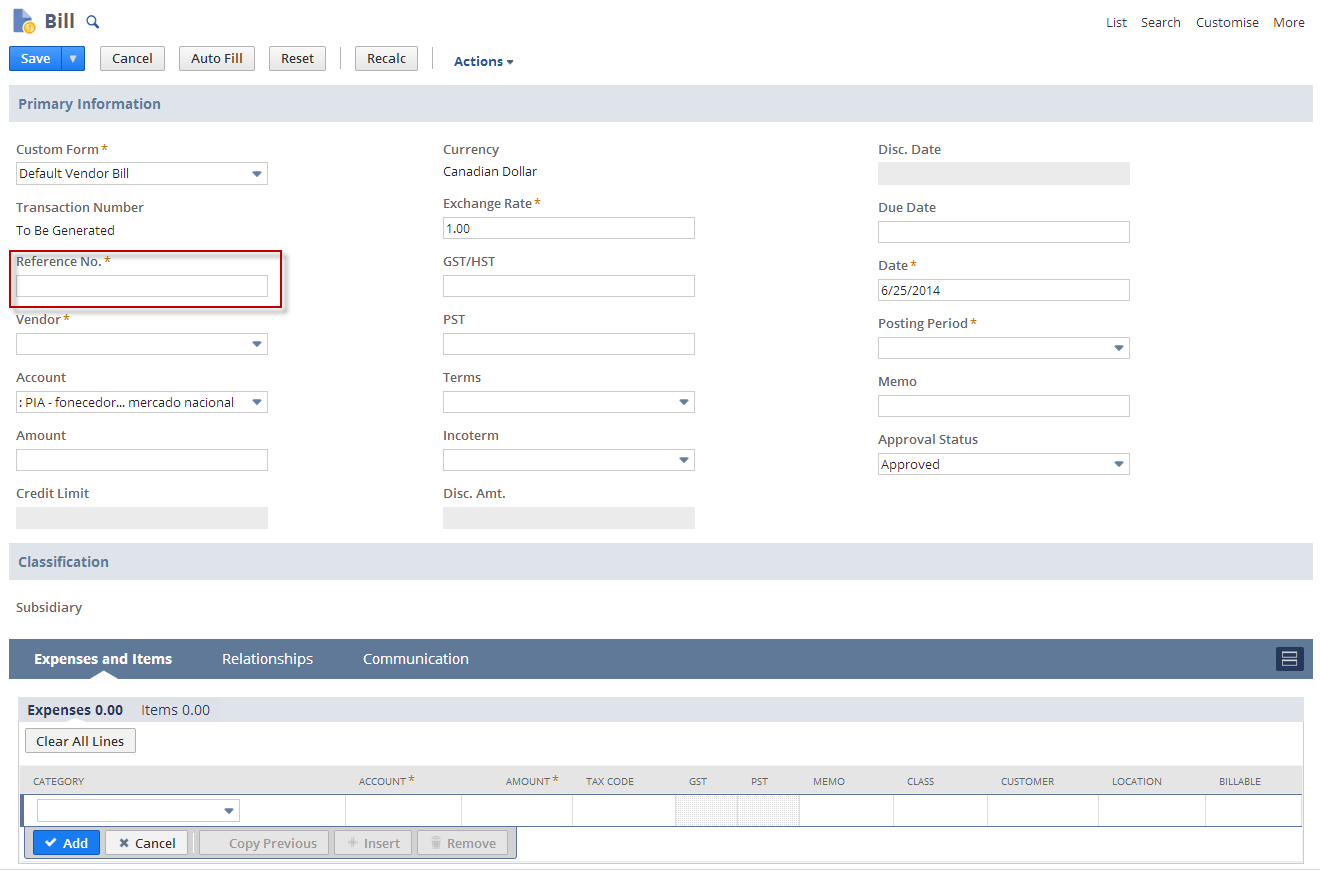

After saving the Custom Transaction Form, the custom Vendor Bill that you created now has the Reference No. field marked as required:

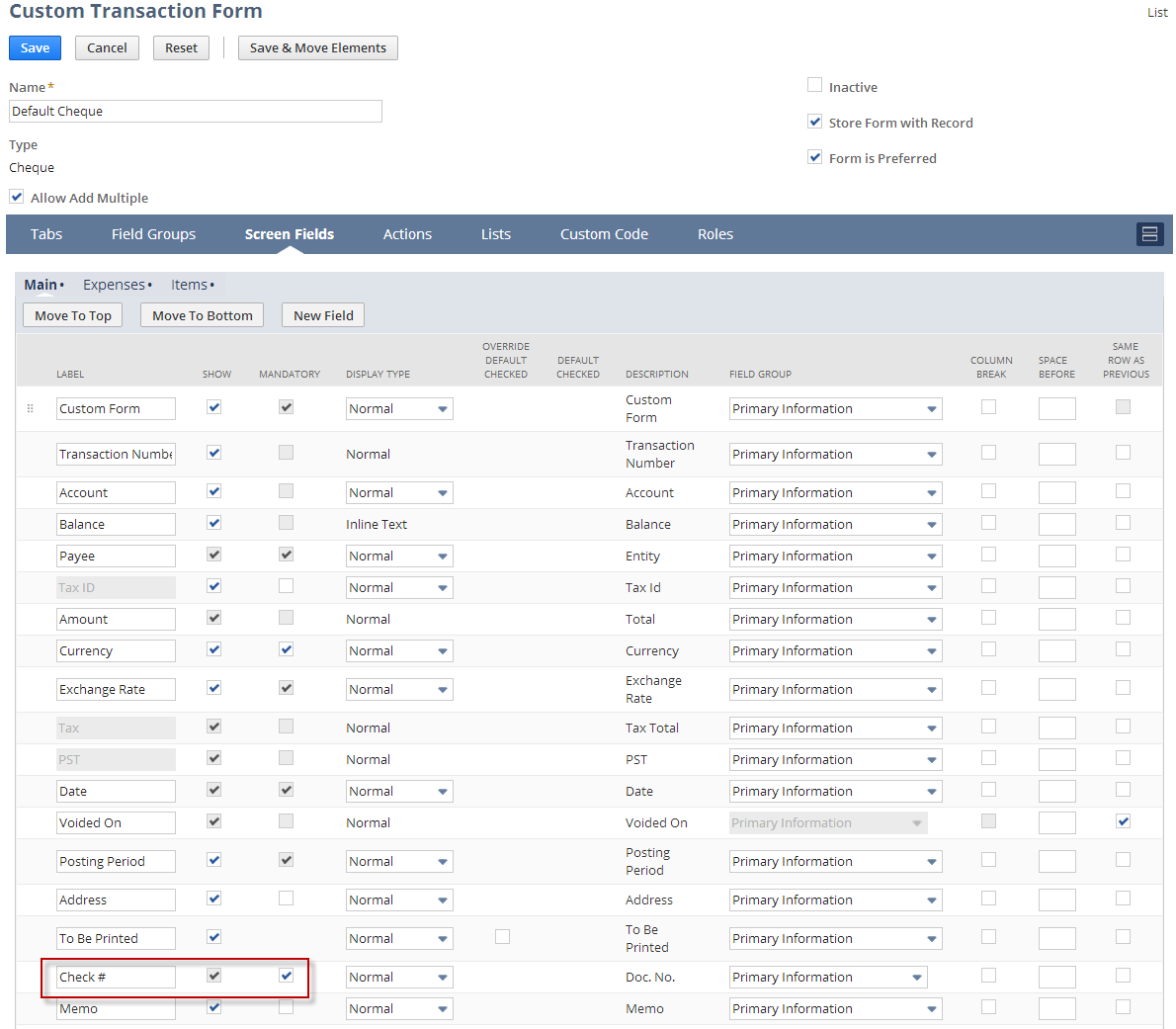

Checks

-

Create a custom check transaction form. Do one of the following to select the form to customize.

-

Go to the Transactions > Bank > Write Checks and click Customize.

-

Click Customize or Edit next to the form name at Customization > Transaction Forms. For example, click the Customize link of the Standard Check.

-

-

Enter a name for the custom form. For example, Default Check.

-

Check the Form is Preferred box o make this the default form that displays when a user creates a Write Check transaction.

-

On the Screen Fields subtab, in the Mandatory column, check the box next to Check # to mark the field as required on the custom form.

-

Click Save.

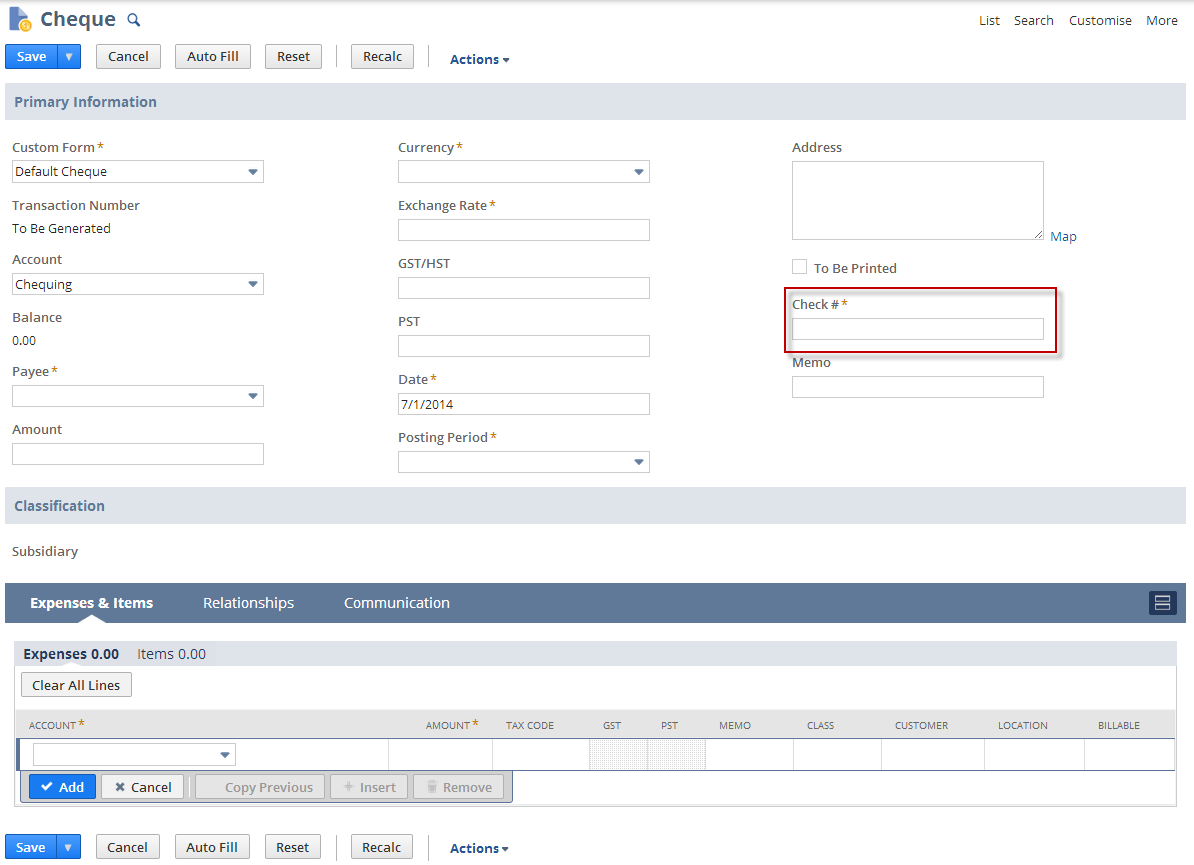

After saving the Custom Transaction Form, the custom Check that you created now has the Check # field marked as required:

For details, see Creating Custom Entry and Transaction Forms and Configuring Fields or Screens.

-

Related Topics

- Accounting for Goods and Services Tax - Singapore

- Tax Accounting Overview

- Setting Up Tax Agencies as Vendors

- Advanced Taxes

- Setting Tax Preferences

- Setting Tax Rounding Levels, Methods, and Precision Settings

- Singapore Tax Setup

- Singapore Tax Codes

- Additional Setup Requirements for Singapore

- Tracking the Unique Entity Number

- Tax Audit Files