Portable Waiting Periods

Waiting periods are common in the health insurance market. Different waiting periods can apply to different health care services.

When a waiting period applies for a specific service, in some occasions that waiting period is measured from the day that member was insured for an equal or better version of that service further back in the past. This check is based on the member’s plan history across funds.

To determine how one version of a service compares to the next, each service for which a member is insured has a score. This score can be specific to the member as certain benefits get better overtime.

When a member is still within a waiting period, he / she defaults to the lesser coverage. The lesser coverage is determined based on (at least) two dimensions: limits & parameters. These dimensions are applied separately so that the lesser coverage can be a combination of the current product’s copay and the previous product’s coverage limit.

This document gives examples of how a member’s plan history can support serving a member’s waiting period.

The examples are based on the use of person covered services. Person covered services hold information to determine whether wait periods have been served and whether current coverage is better / worse than previous ones.

Typically person covered services are created in OHI Enterprise Policy Administration and copied to OHI Claims Adjudication and Pricing as part of replication of person data. The examples discussed here are in line with the examples given in the dynamic logic - predefined methods chapter in the OHI Enterprise Policy Administration documentation.

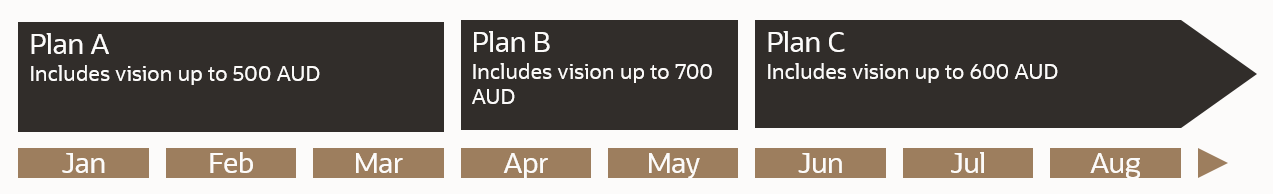

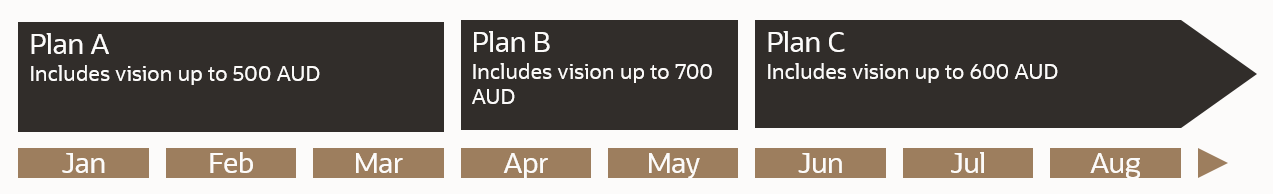

Example 1 - Better Previous Plan

Consider the Vision service being part of three different plans. In each of the three products the service has a different limit. The waiting period for all three plans is 2 months

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

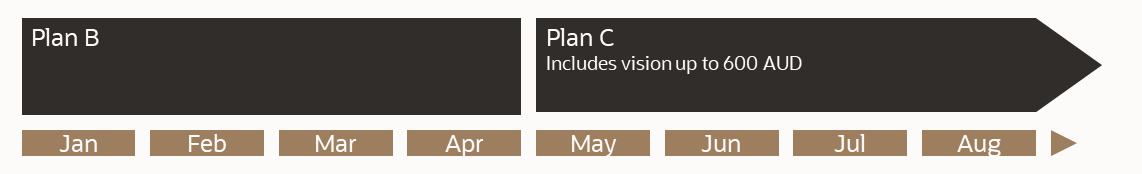

Member John Doe enrolled on Plan A from the start of January 2019 up to the end of March 2019. Then he moved to Plan B where he enrolled at the start of April 2019 until the end of May 2019. In May he moved to plan C where he enrolled as of 1 Jun 2019.

Moving from plan A to plan B was an upgrade because plan B has a higher cover limit, which reflects in the higher score. Moving from plan B to plan C is a downgrade because plan C has a lower cover limit, which reflects in a lower score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

31 Mar 2019 |

5 |

Limit |

1 Jan 2019 |

Plan B |

Vision |

1 April 2019 |

31 May 2019 |

7 |

Limit |

1 April 2019 |

Plan C |

Vision |

1 Jun 2019 |

- |

6 |

Limit |

1 April 2019 |

The wait start date for plan A is the product start date. There is no previous plan. The wait start date for plan B is 1 April 2019; there is a previous product but that has a lower score therefore the method does not consider the start date of that previous plan. Plan C has a previous plan with a better score. Therefore the wait start date of the previous plan applies to plan C.

The claims flow processes a claim line for Glasses which fall under the Vision service.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Apr 2019

-

More than 2 months between 15 Jul 2019 and 1 Apr 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (600) from Plan C.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Apr 2019

-

Less than 2 months between 15 Apr 2019 and 1 Apr 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and finds person covered service for Plan A.

-

More than 2 months between 15 Apr 2019 and 1 Jan 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (500) from Plan A.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

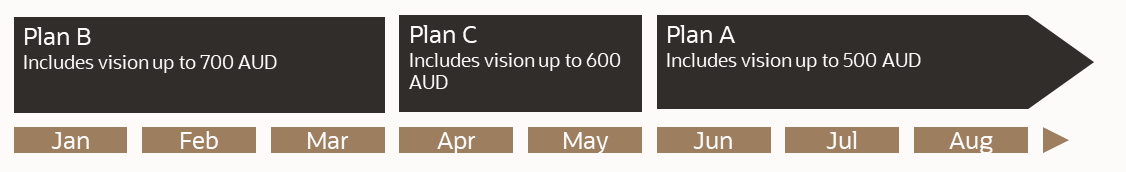

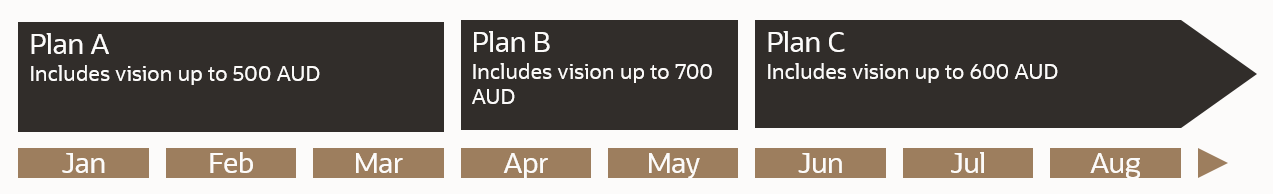

Example 2 - Chain of Better Previous Plans

The products are the same as in example 1

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

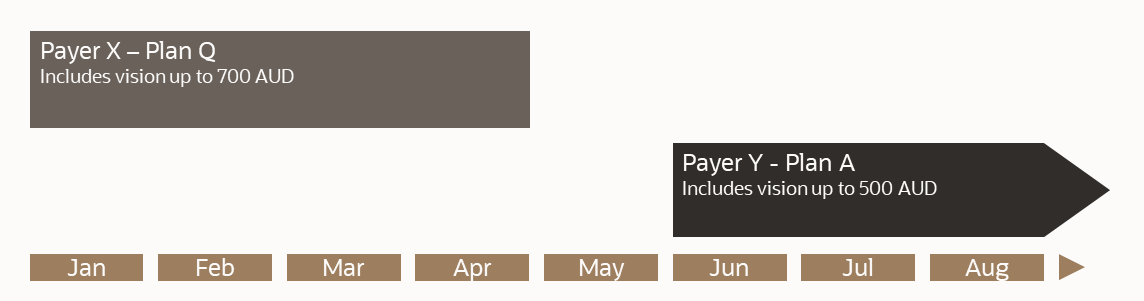

Member John Doe enrolled on Plan B from the start of January 2019 up to the end of March 2019. Then he moved to Plan C where he enrolled at the start of April 2019 until the end of May 2019. In May he moved to plan A where he enrolled as of 1 Jun 2019.

Moving from plan B to plan C was a downgrade because product B has a higher cover limit, which reflects in the lower score. Moving from product C to product A is also a downgrade because product C has a lower cover limit, which reflects in a lower score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan B |

Vision |

1 Jan 2019 |

31 Mar 2019 |

7 |

Limit |

1 Jan 2019 |

Plan C |

Vision |

1 April 2019 |

31 May 2019 |

6 |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

1 Jan 2019 |

The wait start date for plan B is the product start date for plan B. There is no previous plan. Plan C has a previous plan with a better score. Therefore the wait start date of the previous plan (B) applies to plan C. Plan A has a previous plan with a better score. Therefore the wait start date of the previous plan (B) applies to plan C.

The claims flow processes a claim line for Glasses which fall under the Vision service.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jan 2019

-

More than 2 months between 15 Jul 2019 and 1 Jan 2019 so waiting period is served. Apply plan A VISION limit with the limit parameter value (500) from Plan A.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Jan 2019

-

More than 2 months between 15 Apr 2019 and 1 Jan 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (600) from Plan C.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

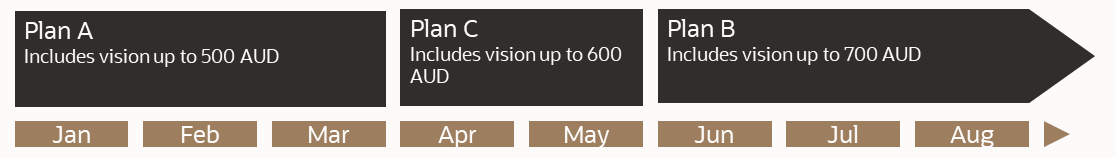

Example 3 - Previous Lesser Plan

The products are the same as in example 1

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan A from the start of January 2019 up to the end of March 2019. Then he moved to Plan C where he enrolled at the start of April 2019 until the end of May 2019. In May he moved to plan B where he enrolled as of 1 Jun 2019.

Moving from plan A to plan B was an upgrade because plan C has a higher cover limit, which reflects in the higher score. Moving from plan C to plan B is an upgrade because plan B has a higher cover limit, which reflects in a higher score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

31 Mar 2019 |

6 |

Limit |

1 Jan 2019 |

Plan C |

Vision |

1 April 2019 |

31 May 2019 |

7 |

Limit |

1 April 2019 |

Plan B |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

1 June 2019 |

The wait start date for plan A is the product start date for plan A. There is no previous plan. The wait start date for plan C is 1 April 2019; there is a previous plan but that has a lower score therefore the method does not consider the start date of that previous plan. The wait start date for plan B is 1 June 2019; there is a previous plan but that has a lower score therefore the method does not consider the start date of that previous plan.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jun 2019

-

Less than 2 months between 15 Jul 2019 and 1 Jun 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and finds person covered service for Plan C.

-

More than 2 months between 15 Jul 2019 and 1 Apr 2019 so waiting period is served. Apply plan B VISION limit with the limit parameter value (600) from Plan C.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Apr 2019

-

Less than 2 months between 15 Apr 2019 and 1 Apr 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and finds person covered service for Plan A.

-

More than 2 months between 15 Apr 2019 and 1 jan 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (500) from Plan A

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

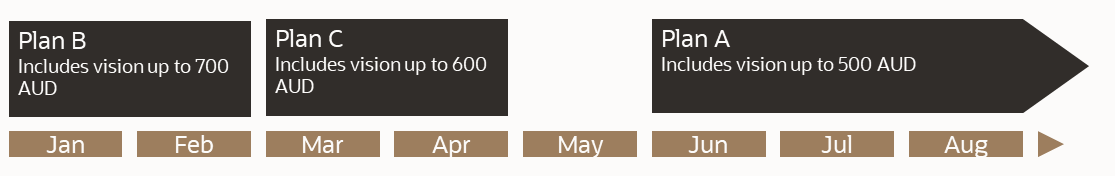

Example 4 - Enrollment Gap

The products are the same as in example 1

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan B from the start of January 2019 up to the end of February 2019. Then he moved to Plan C where he enrolled at the start of March 2019 until the end of April 2019. In May he was not enrolled. In June he enrolled on plan A as of 1 June 2019.

Moving from plan B to plan C was a downgrade because plan C has a lower cover limit, which reflects in the lower score. Moving from plan C to plan A is also a downgrade because plan A has a lower cover limit, which reflects in a lower score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan B |

Vision |

1 Jan 2019 |

28 Feb 2019 |

7 |

Limit |

1 Jan 2019 |

Plan C |

Vision |

1 Mar 2019 |

30 April 2019 |

6 |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

1 Jun 2019 |

The wait start date for plan B is the product start date for plan B. There is no previous plan. The wait start date for plan C is 1 Jan 2019; there is a previous plan with a higher score, therefore the method picks the start date of that previous plan. Plan A has a previous plan C with a better score. However the gap between the enrollment on plan C and the enrollment on plan A restricts the use of the earlier start date.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jun 2019

-

Less than 2 months between 15 Jul 2019 and 1 Jun 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and does not find such a previous product because of the enrollment gap between Plan C and Plan A. The claim line is denied.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Jan 2019

-

More than 2 months between 15 Apr 2019 and 1 Jan 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (600) from Plan C

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

Example 5 - Previous Plan does not cover Service

The products are different form example 1. Only plan C has the service Vision.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan B from the start of January 2019 up to the end of April 2019. Then he moved to Plan C where he enrolled at the start of May 2019.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan C |

Vision |

1 May 2019 |

- |

6 |

Limit |

1 May 2019 |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 May 2019

-

More than 2 months between 15 Jul 2019 and 1 May 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (600) from Plan C

Example 6 - Previous Plan Does Not Cover Service In Between

The products are different form example 1. Only plan A and plan C have the service Vision.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan C from the start of January 2019 up to the end of March 2019. Then he moved to Plan B where he enrolled at the start of April 2019. Plan B does not cover the service Vision. Then he moved to plan A as of 1 June 2019.

As plan B does not cover Vision, the system does not create a person covered service for plan B and Vision.

- NOTE

-

The system wiil create person covered services for the other services under plan B but these are out of the context of this example.

As plan C does cover Vision the system creates a person covered service for plan C Vision.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication. There is no person covered service for Plan B Vision as Vision is not part of Plan B. Although the member was enrolled on plan C with a higher score for Vision, plan A does not inherit plan C’s wait start date because of the 'Vision-less' plan B in between.

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan C |

Vision |

1 Jan 2019 |

31 Mar 2019 |

5 |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

6 |

Limit |

1 Jun 2019 |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jun 2019

-

Less than 2 months between 15 Jul 2019 and 1 May 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and does not find such a previous product because of the enrollment gap between Plan C and Plan A. Claim line is denied

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan B is the active plan. Service Vision is not part of Plan B. Claim line is denied.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan C is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

Example 7 - Two Covered Service Types

In this example each product / service combination has a limit and a copay parameter value.

| Product | Service | Limit | Copay | Waiting period |

|---|---|---|---|---|

Plan A |

Vision |

500 |

100 |

2 Months |

Plan C |

Vision |

800 |

150 |

2 Months |

Member John Doe enrolled on Plan A from the start of January 2019 up to the end of May 2019. Then he moved to Plan B where he enrolled at the start of June 2019.

From a limit point of view, moving from plan A to plan B is an upgrade because plan B has a higher cover limit. However, from a parameter point of view, moving from plan A to plan B is a downgrade because plan B has a higher copay.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

31 May 2019 |

5 |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jan 2019 |

31 May 2019 |

-1 |

Parameter |

1 Jan 2019 |

Plan B |

Vision |

1 Jun 2019 |

- |

7 |

Limit |

1 Jun 2019 |

Plan B |

Vision |

1 Jun 2019 |

- |

-2 |

Parameter |

1 Jan 2019 |

The wait start date for the limit of plan A is the product start date. There is no previous plan.

The wait start date for the parameter of plan A is the product start date. There is no previous plan.

The wait start date for the limit for plan B is 1 Jun 2019; there is a previous product but that has a lower score, therefore the method does not consider the start date of that previous plan.

The wait start date for the parameter for plan B is 1 Jan 2019; there is a previous product with a higher score, therefore the method applies the start date of that previous plan.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan B is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds two Person Covered Service for VISION that are active on 15 Jul 2019

-

The wait start date for Parameter (the Copay) is 1 Jan 2019.

There are more than 2 months between 15 July 2019 and 1 Jan 2019 so the wait period for the 150 Copay is served. -

The wait start date for Limit (the Copay) is 1 Jun 2019.

There is less than 2 months between 15 July 2019 and 1 Jun 2019 so the wait period for the 800 Limit is not served.

-

-

System checks if earlier policy product exists with a lower limit for Vision. It finds plan A with a wait start date 1 Jan 2019 for the Vision Limit. There is more than 2 months between 15 July 2019 and 1 Jan 2019 so the wait period for the 500 Limit is served. Apply plan B with 150 Copay and 500 limit.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan A is the active plan.

-

System finds two Person Covered Service for VISION that are active on 15 Apr 2019.

-

The wait start date for Parameter (the Copay) is 1 Jan 2019.

There are more than 2 months between 15 Apr 2019 and 1 Jan 2019 so the wait period for the 100 Copay is served. -

The wait start date for Limit is 1 Jan 2019.

There are more than 2 months between 15 Apr 2019 and 1 Jan 2019 so the wait period for the 500 limit is served. Apply plan A with 100 Copay and 500 limit.

-

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan A is the active plan.

-

System finds two Person Covered Service for VISION that are active on 15 Feb 2019.

-

The wait start date for Parameter (the Copay) is 1 Jan 2019.

There are less than 2 months between 15 Feb 2019 and 1 Jan 2019 so the wait period for the 100 Copay is not served.

-

-

System checks if earlier policy product exists with a lower parameter (Copay) for Vision. No such policy product is found. The claim line is denied. No need to check if the wait period for the limit was served.

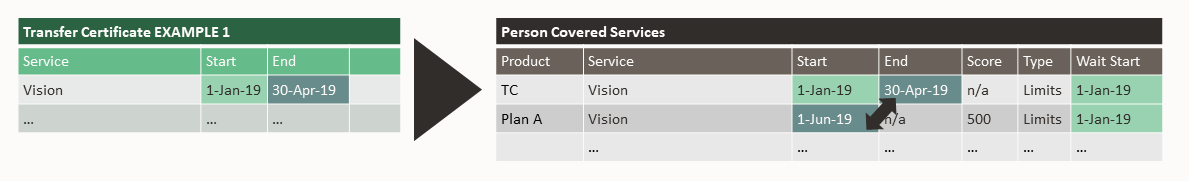

Example 8 - Transfer Certificates

In this example we only look at the Vision service for product A. Of course there could exist more services for this product.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Member John Doe enrolls on Plan A on 1 June 2019. He had been enrolled on Plan Q up to the end of April at a previous payer. The current payer received a transfer certificate for Vision covering the period from the beginning of January up to the end of April. This transfer certificate is stored in OHI Enterprise Policy Administration under the member as a person covered service for product code 'TC'.

In this example OHI Enterprise Policy Administration used a 60 days portability period. As the number of days between the end date of the transfer certificate and the start date of the enrollment on product A is less than 60 days, product A inherited the start date of the transfer certificate.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication.

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

TC |

Vision |

1 Jan 2019 |

30 Apr 2019 |

- |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

1 Jan 2019 |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jan 2019

-

More than 2 months between 15 Jul 2019 and 1 Jan 2019 so waiting period is served. Apply Plan A with a limit of 500.

Claim line start date is 15 April 2019.

-

On 15 April 2019 the member has no active plan Claim line is denied.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 the member has no active plan Claim line is denied.

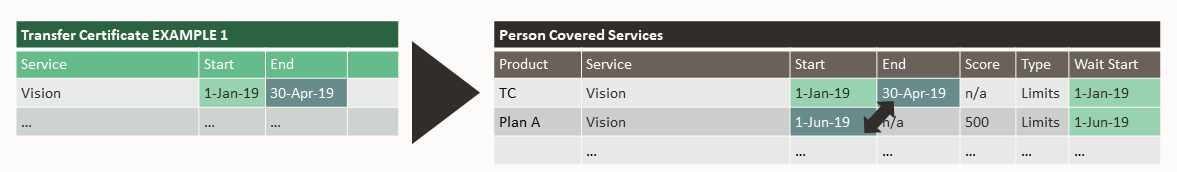

Portability Not Met

Now consider that the 'Number of Portability Days' in OHI Enterprise Policy Administration would have been set to 25 days instead of 60.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

TC |

Vision |

1 Jan 2019 |

30 Apr 2019 |

- |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

1 Jun 2019 |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Jun 2019

-

Less than 2 months between 15 Jul 2019 and 1 Jun 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower parameter (Copay) for Vision. No such policy product is found (the member was not enrolled on product TC). The claim line is denied.

Example 9 - Locked Person Covered Services

The fact that a person covered service is Locked has no impact on the results of the claims flow.

Example 10 - Locked and Waived Person Covered Services

This example explains how the Waived? indicator on the person covered service impacts the behavior of the claims flow. The fact the person covered service is locked or not does not change the behavior.

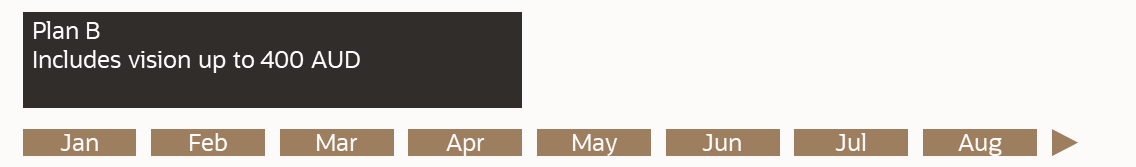

In this example we only look at the product covered service Vision for plan B.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan B |

Vision |

400 |

2 Months |

Member John Doe enrolled on Plan B from the start of January 2019 up to the end of April 2019.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date | Locked? | Waived? |

|---|---|---|---|---|---|---|---|---|

Plan B |

Vision |

1 Jan 2019 |

30 April 2019 |

4 |

Limit |

1 Jan 2019 |

Yes |

Yes |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 the member has no active plan. The claim line is denied.

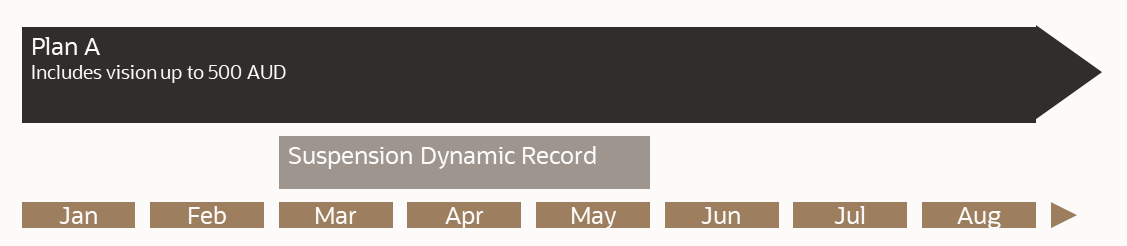

Example 11 - Suspended Enrollment

This example shows how a suspended enrollment in OHI Enterprise Policy Administration impacts the behavior of the claims flow.

In this example we only look at the product covered service Vision for plan A.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Member John Doe enrolled on Plan A from the start of January 2019 with no end date. He suspended his enrollment as of 1 march 2019 until the end of May.

- Note

-

For this example there is no difference in OHI Claims Adjudication and Pricing between the two ways of specifying a suspension in the examples in the OHI Enterprise Policy Administration documentation.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

28 Feb 2019 |

5 |

Limit |

1 Jan 2019 |

Plan A |

Vision |

1 Jun 2019 |

- |

5 |

Limit |

3 Apr 2019 |

OHI Claims Adjudication and Pricing receives the following policy products through the Enrollment Response IP.

| Product | Start | End | Suspended? |

|---|---|---|---|

Plan A |

1 Jan 2019 |

28 Feb 2019 |

No |

Plan A |

1 Mar 2019 |

31 May 2019 |

Yes |

Plan A |

1 Jun 2019 |

- |

No |

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 3 Apr 2019

-

More than 2 months between 15 Jul 2019 and 3 Apr 2019 so waiting period is served. Apply Plan A with a limit of 500.

Claim line start date is 15 April 2019.

-

On 15 Apr 2019 the member has no active plan. Plan A is suspended at this date. The claim line is denied.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is served. The claim line is denied.

Example 1A - Applying Limit Parameter from Previous Product

- NOTE

-

This example is the same as Example 1 except for the fact that it includes consumption (excess) on the limits.

Consider the Vision service being part of three different plans. In each of the three products the service has a different limit. The waiting period for all three plans is 2 months

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan A from the start of January 2019 up to the end of March 2019. Then he moved to Plan B where he enrolled at the start of April 2019 until the end of May 2019. In May he moved to plan C where he enrolled as of 1 Jun 2019.

Moving from plan A to plan B was an upgrade because plan B has a higher cover limit, which reflects in the higher score. Moving from plan B to plan C is a downgrade because plan C has a lower cover limit, which reflects in a lower score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

31 Mar 2019 |

5 |

Limit |

1 Jan 2019 |

Plan B |

Vision |

1 April 2019 |

31 May 2019 |

7 |

Limit |

1 April 2019 |

Plan C |

Vision |

1 Jun 2019 |

- |

6 |

Limit |

1 April 2019 |

The wait start date for plan A is the product start date. There is no previous plan. The wait start date for plan B is 1 April 2019; there is a previous product but that has a lower score therefore the method does not consider the start date of that previous plan. Plan C has a previous plan with a better score. Therefore the wait start date of the previous plan applies to plan C.

In February, in April and in June claims for Vision for an amount of 400 AUD were sent in and approved. These claims were consumed against the cover limits on Plan A, Plan B and Plan C respectively.

The claims flow processes a claim line for Glasses which fall under the Vision service.

Claim line start date is 15 July 2019.

-

On 15 Jul 2019 plan C is the active plan. Under plan C a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Jul 2019 saying the wait started on 1 Apr 2019

-

More than 2 months between 15 Jul 2019 and 1 Apr 2019 so waiting period is served. Apply plan C VISION limit with the limit parameter value (600) from Plan C.

-

As there was no need for looping back to a previous product, the 600 AUD vision limit on Plan C applies.

The existing consumption on plan C (400 AUD) plus the new claim (200 AUD) do not exceed the limit on plan C, so the claim line is fully covered. Total consumption on Plan C becomes 600 AUD.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Apr 2019

-

Less than 2 months between 15 Apr 2019 and 1 Apr 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and finds person covered service for Plan A.

-

More than 2 months between 15 Apr 2019 and 1 Jan 2019 so waiting period is served. Apply plan B VISION limit with the limit parameter value (500) from Plan A.

The existing consumption on plan B (400 AUD) plus the new claim (200 AUD) do exceed the limit parameter value from Plan A (500). Although the limit (700) and the consumption (400) on Plan B would allow full cover of the 200 AUD claim line, the claim line is not fully covered. Only 100 AUD is covered, total consumption on Plan B becomes 500 AUD. Allowing for an additional claim of 200 AUD on Plan B as-of the date that the waiting period for Plan B is served.

Claim line start date is 15 Feb 2019.

-

On 15 Feb 2019 plan A is the active plan. Under plan A a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Feb 2019 saying the wait started on 1 Jan 2019

-

Less than 2 months between 15 Feb 2019 and 1 Jan 2019 so waiting period is not served. Claim line is denied.

Example 1B - Applying Limit Parameter from Previous Product

- NOTE

-

This example is the same as Example 1X except for the fact that the limit on Plan A is a Policy level Limit and the Limits on Plan B and Plan C are member level limits.

Consider the Vision service being part of three different plans. In Plan A the service has a policy level limit, in Plan B and Plan C the limit is at the member level.

The waiting period for all three plans is 2 months.

| Product | Service | Limit | Waiting period |

|---|---|---|---|

Plan A |

Vision |

500 |

2 Months |

Plan B |

Vision |

700 |

2 Months |

Plan C |

Vision |

600 |

2 Months |

Member John Doe enrolled on Plan A from the start of January 2019 up to the end of March 2019. Then he moved to Plan B where he enrolled at the start of April 2019 until the end of May 2019. In May he moved to plan C where he enrolled as of 1 Jun 2019.

Moving from plan A to plan B was an upgrade because plan B has a higher cover limit, which reflects in the higher score. Moving from plan B to plan C is a downgrade because plan C has a lower cover limit, which reflects in a lower score.

OHI Claims Adjudication and Pricing receives the following person covered services through the Person Replication

| Product | Service | Start | End | Score | Type | Wait Start Date |

|---|---|---|---|---|---|---|

Plan A |

Vision |

1 Jan 2019 |

31 Mar 2019 |

5 |

Limit |

1 Jan 2019 |

Plan B |

Vision |

1 April 2019 |

31 May 2019 |

7 |

Limit |

1 April 2019 |

Plan C |

Vision |

1 Jun 2019 |

- |

6 |

Limit |

1 April 2019 |

On 1 February 400 AUD was consumed on the policy limit on Plan A. When moving to Plan B On 1st April, the policy level consumption on Plan A is recorded against member level consumption for John Doe for Plan B.

On 15 April the claims flow processes another 200 AUD claim line for John Doe for Glasses which fall under the Vision service.

Claim line start date is 15 April 2019.

-

On 15 April 2019 plan B is the active plan. Under plan B a 2 month waiting period for VISION applies

-

System finds the Person Covered Service for VISION that is active on 15 Apr 2019 saying the wait started on 1 Apr 2019

-

Less than 2 months between 15 Apr 2019 and 1 Apr 2019 so waiting period is not served.

-

System checks if earlier policy product exists with a lower cover and finds person covered service for Plan A.

-

More than 2 months between 15 Apr 2019 and 1 Jan 2019 so waiting period is served. Apply plan B VISION limit with the limit parameter value (500) from Plan A.

Now it depends on the benefit specification parameter definition what will happen.

If the benefit specification in Plan A has a parameter with the same alias as the benefit specification in Plan B, it will apply the limit value of Plan A (in this case 500 AUD).

If the benefit specification in Plan A does not have a parameter with the same alias as the benefit specification in Plan B, the system will continue searching for a limit value within the current (Plan B) context. That means it will search for a value in the Product Limit, in the Count Towards Limit and in the Limit. If no values are found there, no limit is applied.

The above behavior is based on an upgrade scenario. Vision Limit within Plan B has a higher score than Vision Limit within Plan A. If the Vision Limit within Plan B has a lower score than Vision Limit within Plan A, this would have been a downgrade scenario. In that case the wait start date for the Vision Limit within Plan B would have been 1 Januari 2019, there would have been no loopback and the parameter limit value from Plan B would have been applied to Plan B.