34 Working With Service Transactions for GST (Release 9.1 Update)

This chapter discusses these topics:

-

Section 34.1, "Understanding the P2P Process for Services Applicable for GST"

-

Section 34.2, "Creating Vouchers for GST Applicable Services"

-

Section 34.3, "Specifying the GST Rule and SAC Value for Multiple Vouchers"

-

Section 34.4, "Storing Original Invoice Numbers for GST Debit Memos"

34.1 Understanding the P2P Process for Services Applicable for GST

Under the GST regime, customers are charged on the services provided to them. Service providers are responsible for issuing invoices and charging taxes to their customers. The tax components that customers pay to the service provider are CGST, SGST, and GST Cess when the service provider is from the same state, and IGST and GST Cess when the service provider is from a different state. The service provider is required to deposit the tax amount to the tax authority after collecting the tax amount from the customer. Customers can claim a credit for the tax paid on the service received after the service provider remits the tax to the government following the statutory requirements. Customers can claim a credit only when the service is used to run their businesses.

When certain categories of registered persons pay the suppliers for services received and the amount paid includes GST duty, the transactions are subject to tax deducted at source (TDS) when the total value of the supply exceeds a specific statutory limit in a financial year.

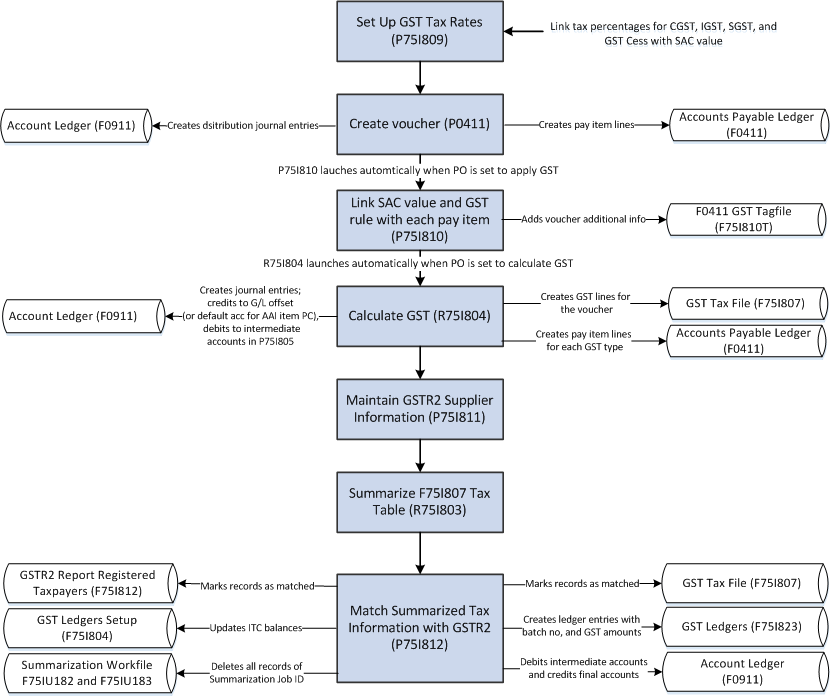

This illustration describes the procure-to-pay (P2P) process for GST applicable services in the JD Edwards EnterpriseOne system.

Figure 34-1 P2P for Services Applicable for GST

Description of ''Figure 34-1 P2P for Services Applicable for GST''

To obtain services in the GST regime:

-

Create vouchers in the A/P Standard Voucher Entry program (P0411).

After you create the vouchers, the system enables you to associate the GST SAC value and GST rule with the vouchers that you entered. The GST SAC value determines the rate of tax that applies to services. Additionally, you also enter the TDS type if TDS applies to the transaction.

-

Calculate GST using the A/P Vouchers program (R75I804).

-

If the transaction is subject to TDS, calculate the TDS using the Calculate TDS program (R75I515).

-

Maintain the GSTR2 Information provided by the government using the GSTR2 Report program (P75I811).

See Section 36.2, "Entering GSTR2A Information in the System"

-

Summarize the tax information in the GST Tax File table (F75I807) in a specific format using the GST Tax File Summarization program (R75I803).

See Section 36.3, "Summarizing the GST Tax File to Match with GSTR2A"

-

Match the summarized tax information with GSTR2 information to claim input tax credit (ITC) on your purchases.

See Section 36.4, "Matching the Summarized Tax Data with GSTR2A to Claim ITC"

34.2 Creating Vouchers for GST Applicable Services

To obtain services from a supplier, you must create an accounts payable voucher using the standard A/P Standard Voucher Entry program (P0411). When you create a voucher, the system checks whether the Apply GST processing option for the PO - A/P Standard Voucher Entry program (P75I0411) is set to apply GST. If the processing option is set to apply GST, the system requires you to enter the invoice number when you create the voucher. If you do not provide the invoice number, the system displays an error and you cannot proceed. The invoice number is required for claiming GST input tax credit.

At the time of voucher creation, the system enables you to link the applicable service tax rate and the GST rule to the service transaction. Additionally, you also link the TDS type if TDS applies to the transaction. You use the Voucher Entry GST Tag file program (P75I810) to link this information with the voucher.

You must generate the self-invoice for service transactions on which reverse charge is applicable. The system does not process the self-invoice for transactions for which self-invoice exists. To generate a new self-invoice for those transactions, you can use one of these methods:

-

Manually cancel the current self-invoice from the GST Tax File Information program (P75I807).

-

Set the processing option Enable Automatic Self Invoice Cancellation from the Calculate GST for AP Vouchers program (R75I804) to allow the system to automatically cancel the current self-invoice when you generate a new self-invoice.

For more information about printing self-invoice, see Section 41.8, "Printing a Self-Invoice for Reverse Charges"

You can override the Place of Supply field value from the GST Voucher Tag file program (P75I810). The system uses the Place of Supply value to update the Transaction Category value. You can update the SAC and GST rule through the Regional Info on the Row menu of the Supplier Ledger Inquiry form. However, you cannot update these values after GST is calculated for the voucher.

|

Note: If you obtain services from a service provider for your personal use, you cannot claim input tax credit (ITC) for the services received.In such a case, you must associate the voucher with a GST rule that is set up as GST non-recoverable. The system does not calculate the GST for records set up with GST as non-recoverable. |

When you create the voucher, the system updates these tables for the voucher (without tax information):

-

F0411 GST Tag file table (F75I810T) with the GST additional information for the voucher

-

F0411 Tag File - IN table (F75I411) with the TDS information for the voucher, if applicable

-

Account Ledger table (F0911) with distribution journal entries

-

Accounts Payable Ledger table (F0411) with pay item lines

You can also set the system to compute the GST after voucher creation. If you set up the system accordingly, the Calculate GST for A/P Vouchers program (R75I804) is launched after you create the voucher. The system updates the GST Tax File table (F75I807) with the transactions on which reverse charge is applied and GST Self Invoice Header File table (F75I848) with self-invoice number.

|

Note: The Calculate GST for A/P Vouchers program (R75I804) does not process those vouchers that are created by the purchase order module during the voucher match process.. |

34.2.1 Prerequisites

Before you complete the tasks in this section:

-

Set up these processing options for the PO - A/P Standard Voucher Entry (P75I0411):

-

Apply GST

The system displays the Work with GST Voucher Tag File form only when you set this processing option to apply GST.

-

Default GST Rule

If you leave this processing option blank, the system does not populate a default GST rule in the GST Rule field of the Voucher Entry GST Tag file program (P75I810).

-

Calculate GST

When you set this processing option to calculate GST, the system automatically launches the Calculate GST for A/P Vouchers program (R75I804) after you complete the G/L Distribution form.

-

Calculate GST for A/P Vouchers (R75I804) Version

-

Apply TDS

When you set this processing option to apply TDS, the system displays the TDS Type column on the Work With GST Voucher Tag file form.

-

Calculate TDS

When you set this processing option to calculate TDS, the system launches the Calculate TDS Withholding program (R75I515) after GST is calculated using the R75I804 program. This processing option is applicable only when the Calculate GST processing option is set to calculate GST.

-

Calculate TDS Withholding (R75I515) Version

Note:

For prepayment vouchers, all GST-related processing options must be blank.Access the processing options for the P75I0411 program from the GST System Setup menu (G75IGST4H).

-

-

Set up the GST SAC category type for services in the GST Category Type Setup program (P75I806).

-

Set up the GST tax rates for services transactions using the GST Tax Rate Setup program (P75I809).

-

Set up the GST rules using the GST Rules Setup program (P75I802).

-

Set up the legal next number for the self-invoice using the Work With GST Self Invoice Legal Next Numbers program (P75I847).

See Section 40.3, "Setting Up Legal Next Numbers for the Self-Invoice".

34.2.2 Creating a Voucher and Linking the Voucher with an SAC Value and GST Rule

To create a voucher and link the voucher with an SAC value and a GST rule:

-

From the Accounts Payable module, click Daily Processing, Supplier and Voucher Entry (G0411) and then Standard Voucher Entry.

To create a new voucher, click Add on the Supplier Ledger Inquiry form.

-

On the Enter Voucher - Payment Information form, enter the voucher information.

For GST transactions, you must enter the invoice number.

-

Click OK on the Enter Voucher - Payment Information form.

The system displays the Work with GST Voucher Tag file form when you set the Apply GST processing option for the PO - A/P Standard Voucher Entry program (P75I0411) to apply GST.

Note:

For a copied voucher, you must open the voucher in edit mode to attach the SAC value and the GST rule. -

On the Work with GST Voucher Tag file form, enter values in these fields:

-

GST SAC Value

-

GST Rule

The system populates the GST Rule field with the default GST rule that you specified in the processing option. You can enter a different GST rule in the field.

-

TDS Type

-

-

Click OK on the Work with GST Voucher Tag file form.

The system displays the G/L Distribution form that you use to enter the GL distribution information.

-

Click OK on the G/L Distribution form.

The system launches the Calculate GST for A/P Vouchers program (R75I804) when the Calculate GST processing option for the P75I0411 is set to calculate GST. You run the R75I804 program to calculate GST for service transactions. You can run this program at a later time from the Periodic Processing menu of the GST module.

34.3 Specifying the GST Rule and SAC Value for Multiple Vouchers

You use the Additional Voucher Information program (P75I819) to enter or update the service account code (SAC value) and the GST rule for multiple transactions simultaneously before you process the transactions for GST calculation. This program enables you to review the transactions (pay items) of all accounts payable vouchers that are eligible for GST calculation. Vouchers for which GST has been calculated, but the GST amounts are not paid, posted, or matched are eligible for GST recalculation and can be reviewed using this program. After you enter or update information in this program, you can trigger the R75I804 program to calculate GST for selected transactions.

From the Additional Voucher Information program, you can also access the program to enter the original document details and reason for modification for GST modification vouchers (debit memos). Debit memos have the document type specified in the 75I/MD UDC table.

For more information on reason for modification, see Section 3.1.3.42, "Reason Modification (75I/RM)".

34.3.1 Entering the GST Rule and SAC Value for Multiple Vouchers

To enter or update the GST rule and SAC value for multiple vouchers simultaneously:

-

From the GST Module, click GST Daily Processing (G75IGST3H) and then Additional Voucher Information.

-

On the Work With Additional Voucher Information form, review accounts payable vouchers that are eligible for GST calculation.

-

Select the Without Additional Information option to filter all vouchers for which the SAC value and GST rule have not been set up.

By default, this option is not selected and the system displays all vouchers.

-

Enter or update the following fields:

-

GST SAC Value

-

GST Rule

-

34.3.2 Calculating GST for Transactions Specified in the P75I819 Program

To enter data selection values for GST calculation and to trigger the R75I804 program to calculate the GST for the selected transactions:

-

From the GST Module, click GST Daily Processing (G75IGST3H) and then Additional Voucher Information.

-

On the Work With Additional Voucher Information form, specify the company and the G/L date range (from date and thru date).

-

Click GST Calculation on the Report menu.

The system selects the vouchers for the company and the G/L date range that you specify and calculates the GST for the selected vouchers.

34.4 Storing Original Invoice Numbers for GST Debit Memos

When the supplier issues you a credit for a transaction, you create a debit memo using the standard voucher entry process. The credit is applied to open vouchers when you issue payment to the supplier.

When you create a debit memo for a GST service transaction, the system assigns the document type set up in the Modified Documents UDC table (75I/MD). You can enter and store the original invoice number and date after you create the debit memo.

The system stores the original invoice information in the Modification Transaction Details Table table (F75I825).

34.4.1 Prerequisite to Creating Debit Memos for GST

Before you create debit memo for GST, set up the document type for modification vouchers in the Modified Documents UDC table (75I/MD).

34.4.2 Creating a Debit Memo and Storing Original Invoice Number for GST

To create a debit memo for GST applicable transactions and to store the original invoice number:

-

From the Accounts Payable module, click Daily Processing, Supplier and Voucher Entry (G0411) and then Standard Voucher Entry.

To create a debit memo, click Add on the Supplier Ledger Inquiry form.

-

On the Enter Voucher - Payment Information form, enter information for the debit memo and click OK on the form.

Cancel or enter information in the forms that display before the G/L Distribution form is displayed.

-

On the G/L Distribution form, enter GL distribution information and click OK.

The system displays the Original Invoice Details - GST form when the document type of the voucher is the document type that you have set up for modification vouchers in the Modified Documents UDC table (75I/MD).

-

On the Original Invoice Details - GST form, complete the Original Document No/Type/Co and Reason - Modification Transaction fields. No refers to number and Co refers to company. The Original Document No/Type/Co should be available in the GST Tax File table (F75I807).

34.5 Calculating GST for Service Transactions

You run the Calculate GST for A/P Vouchers program (R75I804) to calculate GST for service transactions. When you run this program, the system selects the accounts payable vouchers from the Accounts Payable Ledger table (F0411) for the date range and company specified in the processing option.

The R75I804 program calculates the GST amounts for those accounts payable vouchers that are not posted and not matched. The system does not calculate the GST and prints specific error messages in the report if these conditions are not met.

You can run the R75I804 program to calculate GST for vouchers that you have paid, not paid, or partially paid the base transaction amount for the services received.

Voided vouchers that are updated are eligible for GST calculation.

You can set processing options to include both processed and unprocessed vouchers in the report. Processed vouchers are those vouchers that have already been included in an earlier report run and have GST amounts already calculated. If you edit the voucher base amount for a processed voucher, and you rerun the R75I804 program, the system recalculates the GST for the voucher based on the updated base amount.

However, processed vouchers for which you have paid or partially paid the GST amounts are not eligible to be processed again. The system prints an error in the report for the vouchers that have paid or partially paid GST amounts.

When you run the program, the system:

-

Determines the Transaction Category for all selected vouchers by using their Place of Supply values. For those vouchers that do not have Place of Supply values, the system uses the state value of the Business Unit. The system uses this information to identify the transaction as an intrastate or an interstate transaction and calculates the GST amounts accordingly.

-

Calculates the GST (CGST, SGST, IGST, and Cess) amounts for all selected vouchers and prints a report with all the processed vouchers at the voucher level detail

For those vouchers that have discounts, the system calculates the GST by deducting the discount amounts from the gross amounts.

-

Creates GST lines (CGST, SGST, IGST, and Cess as applicable) for the voucher in the GST Tax File table (F75I807)

-

Creates journal entries for the posted transactions and updates the Account Ledger table (F0911)

The system debits the ITC intermediate accounts that you have set up in the GST Account Master Setup program (P75I805). The system credits the (PC) AAI accounts that are retrieved using the G/L offset for each applicable GST type specified in the processing options for the R75I804 program. If the processing option for R75I804 program is not specified, the system uses the G/L offset from the GST GL Offset Setup table (F75I835).

Note:

If the GST rule for the GST unit is set as nonrecoverable in the P75I805 program, the system updates the nonrecoverable accounts and does not affect the intermediate accounts.For transactions where reverse charge is applicable, the system creates journal entries with the GST amounts that the receiver must pay to the service provider. This is the amount that the system calculates using the provider's percentage set up in the GST Rules Setup program (P75I802).

-

Creates pay item lines in the F0411 table for each tax sub category

|

Note: The system does not allow you to edit the GST transaction lines in the A/P Standard Voucher Entry program (P0411) after GST is calculated. |

34.5.1 Determining the GST Type (SGST, IGST, CGST, Cess) to be Calculated

Using the address information from the Address by Date table (F0116) and the F0411 GST Tag file table (F75I810T), the system determines whether to calculate SGST, IGST, or CGST for the transactions based on these transaction types:

-

Interstate: In an interstate transaction, the state of the supplier and the ship to business unit/place of supply are different. The system calculates IGST and Cess for interstate transactions.

-

Intrastate: In an intrastate transaction, the state of the supplier and the ship to business unit/place of supply are the same. The system calculates CGST, SGST, and Cess for intrastate transactions.

-

Import: In an import transaction, the country of the supplier is different from country of the ship to business unit. The system calculates IGST and Cess for import transactions.

34.5.2 Prerequisites

Before you complete the task in this section:

-

Define the GL offset codes for the tax types (CGST, SGST, IGST, and GST Cess) using the GST GL Offset Setup program (P75I835).

-

Set up the intermediate debit accounts for the GST unit for all GST types using the GST Account Master Setup program (P75I805).

-

Specify the state and country of the supplier and ship to business unit in the Address Book Revisions program (P01012).

The system uses this information to identify whether the transaction is an interstate, intrastate, or an import transaction.

-

Set up the processing options for the Calculate GST for AP Vouchers program (R75I804).

You must set up these processing options on the Select tab, otherwise the system displays specific errors in the report:

-

Document Company

-

Date From

-

Date Thru

The Date From must be an earlier date to the Date Thru.

Optionally you can use the Include Processed Vouchers processing option to include only those vouchers that are not processed.

On the Default tab, you specify:

-

A/P Standard Voucher Entry (P0411) Version

-

Payment Terms Code

-

Payment Instrument

-

G/L Offset For CGST

-

G/L Offset For SGST

-

G/L Offset For IGST

-

G/L Offset For CESS

-

34.6 Calculating TDS on GST Applicable Services

Run the Calculate TDS Withholding program (R75I515) to calculate the TDS on vouchers that are defined for withholding a percentage of the invoice amount with GST. You must run this program only after you calculate the GST for these vouchers.

The R75I515 program automatically generates the Calculate TDS Withholding report at the time of voucher creation if you set the Calculate TDS processing option for the PO - A/P Standard Voucher Entry (P75I0411) to calculate TDS. The system calculates TDS on the basis of the value of supply (gross amount) + GST on the gross amount.

The system prints the GST amounts in the Calculate TDS Withholding report.

To understand how the system processes records to calculate TDS, see Section 28.2, "Calculating TDS and WCT".

34.6.1 Prerequisites

Before you complete the task in this section:

-

Set up the system for calculating TDS.

-

Set up the processing option for the R75I515 program to include GST amounts when calculating TDS for the vouchers.

Additionally, set up the other processing options for the R75I515 program as applicable.

See Section 28.2.2, "Setting Processing Options to Calculate TDS (R75I515)".