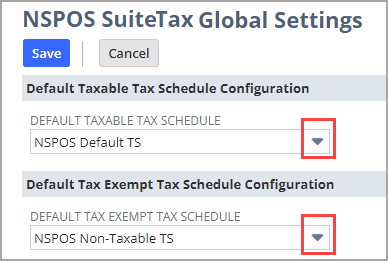

Global Settings

Use the NSPOS SuiteTax global settings to configure defaults for when a tax schedule is not available for an item. Global settings are "fall back" tax schedules to be used if the system cannot determine the tax rate based on the item, its tax schedule, or related location or subsidiary settings. Tax codes for these defaults are configured in the Tax Schedule Settings.

You can set default schedules for taxable and non-taxable items, review the tax rounding configuration, and set up codes for identifying taxes on receipts.

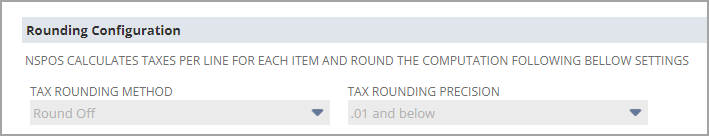

Tax Rounding

The rounding configuration section lists the tax rounding method and rounding precision used for NSPOS tax calculations. This section is for informational purposes only. You cannot adjust how NSPOS handles rounding for tax amounts.

You should configure the Nexus assigned to subsidiaries where NSPOS is used to follow this rounding configuration. Otherwise, calculation discrepancies will occur.

This rounding configuration is available only for nexuses in the United States, United Kingdom, and Canada. The configuration is not available for in Australia-related nexuses.

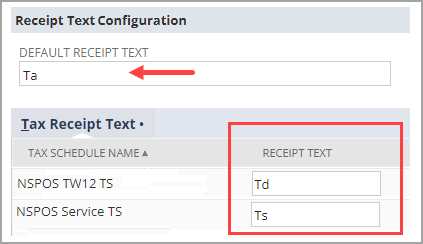

Tax Receipt Text - Default and By Tax Schedule

Use this section to enter two-character codes that represent the tax schedules that were applied to a transaction. These codes appear on receipts to the right of the item's or service's price. For example:

USB C Drive $12.50 Ta

Whole Milk 1 QT $3.50 Td

Your business determines which characters to use as receipt text codes.

The settings provide for using Default Receipt Text with the option to configure Tax Receipt Text to use for individual tax schedules. NSPOS SuiteTax uses the default text when a tax schedule does not have a receipt text entry.

The Taxable Desc (description) found on the receipt under the Sub Total line shows the receipt text and tax-amount total for each tax schedule that was applied.

Your tax schedules must be set up before configuring your global settings. See Tax Schedules.

Prerequisites Before Configuring Global Settings

Before you can select your default tax schedules and enter receipt text, you must first:

-

Create the Tax Schedules

-

Use Tax Schedule Settings to configure the tax rate for each schedule by assigning a tax code or tax group.

To configure your Global Settings:

-

Go to NSPOS > SuiteTax > Global Settings.

-

Select your Default Taxable Tax Schedule. This will be the fallback schedule for taxable items without a tax schedule assignment

-

Select your Default Tax Exempt Tax Schedule. This will be the fallback schedule for non-taxable items without a tax schedule assignment

-

Enter your Default Receipt Text. This text appears on receipts when one of the default schedules is used.

-

Enter your Tax Receipt Text. NSPOS SuiteTax uses the default text when a tax schedule does not have a receipt text entry.

-

Click Save.