Tax Codes

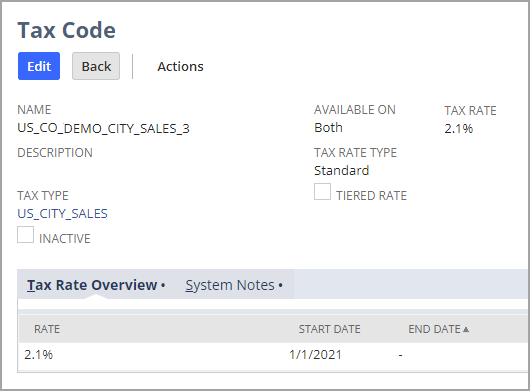

A SuiteTax tax code is set up with a name, tax type, and tax rate. You can assign tax codes to global, tax schedule, location, and other settings, or you can combine codes into tax groups.

To work with SuiteTax tax codes:

-

Go to NSPOS > SuiteTax > Tax Codes.

-

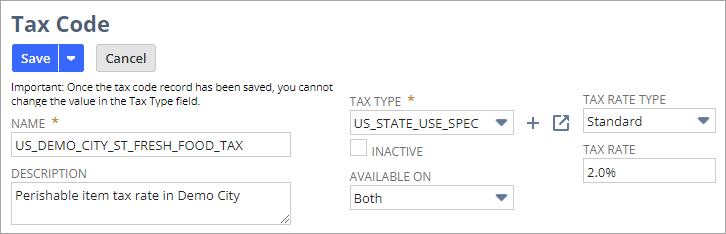

Click New.

To update an existing tax code, click Edit.

-

Enter a Name for the tax code.

For example, enter Demo City ST Taxable.

-

Enter a Description of how the code is used.

For example, enter Taxable items in the Demo City nexus.

Tip:See Tax Codes Overview for more information about tax code setup in NetSuite ERP.

-

Select the Tax Type.

-

Enter the Tax Rate.

-

Enter the Start Date. The End Date is used if a tax code should become inactive on that date.

-

Click Save.

If you will inactivate Tax Codes or Tax Groups using CSV or another mass-import method, always select to Run Server SuiteScript and Trigger Workflows. See Run Server SuiteScript and Trigger Workflows.