Tax Groups

Use a SuiteTax tax group to combine several tax codes into one calculated rate. For example, if a store is subject to tax codes from four sources - city tax, transit tax, county tax, and state tax - you can combine all codes into a more manageable group.

For example, the group "Jurisdiction Name" has a total rate of 9%.

|

Tax Code |

Rate |

|---|---|

|

City |

5% |

|

Transit |

1% |

|

County |

1% |

|

State |

2% |

|

Tax Group |

Rate |

|

Jurisdiction Name |

9% |

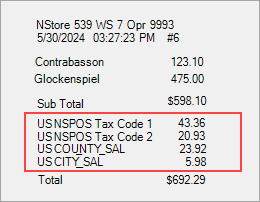

When NSPOS SuiteTax applies a tax group to a purchase, each tax code from the group is included on the receipt in a list.

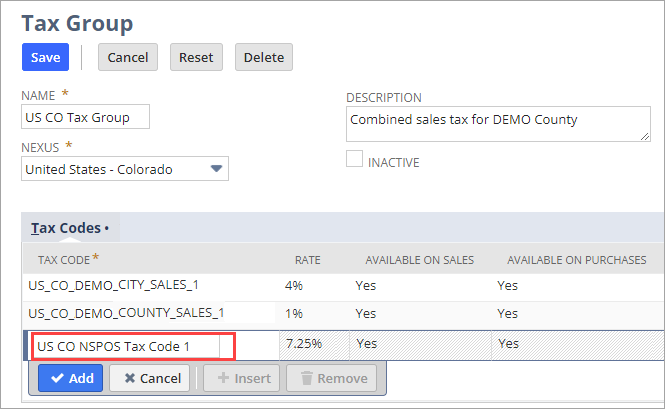

To work with SuiteTax tax groups:

-

Go to NSPOS > SuiteTax > Tax Groups.

-

Click New Tax Group to create a new collection of tax codes.

To update an existing tax group, click Edit.

-

Enter a Name for the tax group.

For example, enter a name that describes the tax area.

-

Select the Nexus in which the grouped tax codes will apply.

The term nexus describes a tax jurisdiction or geographic area that has its own tax regulations.

-

Enter a Description of the tax group.

-

To add Tax Codes to the group, start entering a Tax Code name and select it when you see it in the list.

-

Click Add.

-

Continue until all tax codes to be in the group are added.

-

Click Save.

Tip:To delete a tax code from the group, select the code and click Remove.

If a tax group should no longer be in effect, check the Inactive box and click Save. The group will not be used for transactions covered by the grouped tax codes.