Tax Schedules

Create SuiteTax tax schedules for specific conditions and items. You can use a tax schedule when you need a tax code that is different from the default tax codes used for most items. For example, a tax schedule is helpful when food items are taxable in most areas of a country, but are non-taxable in other areas.

NSPOS requires each item to have a tax schedule assignment. However, that assignment is not required in NetSuite ERP. If an NSPOS transaction includes an item without a tax schedule, NSPOS applies the default tax schedule from the Global Settings.

To work with SuiteTax tax schedules:

-

Go to NSPOS > SuiteTax > Tax Schedules.

-

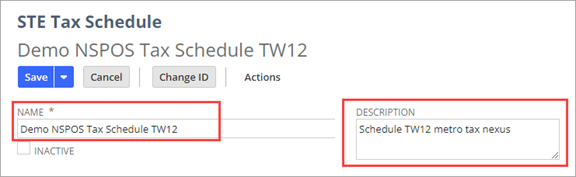

Click New.

To update an existing tax schedule, click Edit.

-

Enter a Name for the tax schedule.

For example, enter Demo City, ST Taxable.

-

Enter a Description of the tax area or tax types to be covered.

For example, enter Taxable items in the Demo City limits.

-

Click Save.

To assign a tax schedule to an item:

-

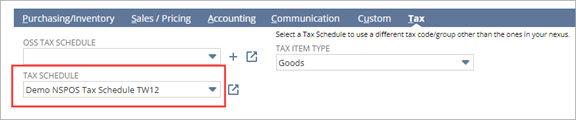

Go to Lists > Accounting > Items.

-

Click Edit for the item to update.

-

Under the Tax subtab, select the Tax Schedule.

-

Click Save.