Auto-Funding

Auto-funding lets you streamline your accounts payable workflow. You can't make any payments before you set up auto-funding.

Excess balances in the HSBC Online Account can't be used to fund payments directly. When you initiate a payment, auto-funding transfers money from the source account regardless of the current balance of the HSBC Online Account.

In a multi-subsidiary setup, you'll need to create a separate Auto-Funding setup for each onboarded subsidiary.

Auto-Funding Flow

With auto-funding, your source bank account is automatically debited, and the money is deposited in your HSBC Online Account. This process is initiated by the payment processor after NetSuite submits the payment. The payment processor is a third party that NetSuite uses to process payments. The payment processor will then check to confirm that there are sufficient funds in the HSBC Online Account before submitting ACH and check payments to HSBC.

Insufficient Funds in Your HSBC Online Account

Before initiating payments, you should ensure that your source bank account has enough balance, and allocated funds have not been withdrawn from your HSBC Online Account.

If after processing the batch payment your source bank account returns the auto funded direct debit or the funds have been withdrawn from your HSBC Online Account, you will not have sufficient funds in your HSBC Online Account, which will cause your HSBC Online Account to be overdrawn.

HSBC will contact you on the next business day to manually fund your account with a one-time ACH or wire payment sent from your source bank account. For instructions about how to make a one-time payment to fund your HSBC Online Account, see Making Money Transfers.

Funding Cycle

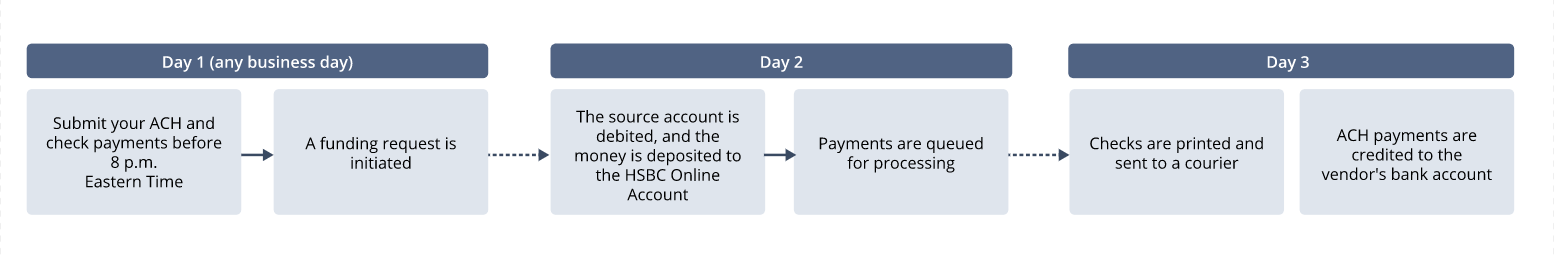

The following diagram illustrates how funds move and when transactions are settled with auto-funding.

For reprocessed payments, auto-funding will be skipped as it uses the previous funding amount. The time is quicker by one business day. For more information, see Vendor Prepayment.

Setting Up the Source Bank Account for Auto-Funding

Before you set up auto-funding, set up your source GL account that will be used to fund the HSBC Online Account. You can only have one auto-funding source account at a time. You cannot use multiple source accounts to auto-fund the HSBC Online Account at the same time.

In a multi-subsidiary setup, you need to set up a separate source bank account for auto-funding for each onboarded subsidiary. There can be only be one primary bank for each vendor at the vendor bank level.

The HSBC Bank and Credit Card GL are automatically created upon approval of the bank account. It is important not to modify the account names to prevent any potential errors during payment processing.

For instructions on creating a new account, see Creating Accounts.

To set up an existing account for Payment Automation:

-

Go to Setup > Accounting > Chart of Accounts.

-

On the line of the bank account you want to set up, click Edit.

-

Set the following fields:

-

Payment Automation Bank Name - this name will be used on the Payment Automation dashboard.

-

Payment Automation Bank Routing Number - you can use only domestic US accounts. The routing number will be validated by the system.

-

Payment Automation Bank Account Type

-

Payment Automation Bank Account

-

-

Click Save. If this is your first time setting a source account, you will be automatically redirected to the GUID setup page:

-

Provide a 16-character passphrase, which will be used to set up NACHA encryption rules for the ACH account number. The bank account number will be masked in NetSuite. This is a one-time setup. After the GUID page is set up, it will not be displayed again.

-

After you submit the GUID, you will be redirected back to GL setup. To save the record, click Save again.

-

To change an auto-funding account for Payment Automation:

-

Go to SuiteBanking> Payment Automation > Dashboard.

-

Click Bank Accounts.

-

Click View Auto-Funding Details.

-

Click Remove to remove the existing auto-funding bank account.

Note:Remove will only be enabled if there are no bill payments or vendor prepayments are in pending state.

-

To add a new auto-funding bank account, see Setting Up the Source Bank Account for Auto-Funding.

Allowing Automatic Debit of Your Source Account

For auto-funding to work, you must permit HSBC to automatically debit your source bank account. To allow funds to be transferred, contact your GL source account bank.

If there is a debit block on the source bank account held with your bank, you will be required to provide your HSBC Account Number, which is required to authorize auto debit.

To determine your HSBC Account Number:

-

Go to Setup > Accounting > Chart of Accounts.

-

On the HSBC Bank Account line, click View.

-

Write down the number in the Payment Automation Bank Account field.

If your source bank requires a HSBC ACH Company ID, refer to your Welcome Letter that was received when your HSBC application was approved. If you do not have access to your Welcome Letter or the ACH Company ID is not available on the Welcome Letter, please contact the NetSuite Support team.

If you set a maximum debit value for this authorization, align the value with your Daily Transaction Limit displayed in the Payment Automation dashboard. For more information, see Daily Transaction ACH Limit.

Setting Up Auto-Funding

You must set up your source account for auto-funding before you can start initiating payments.

After you set up auto-funding, wait at least one hour after setup before processing any payments to allow the system configuration to be completed.

If your GL source account changes, you must set up auto-funding again before initiating new payments.

Prerequisites:

-

Set up the GL source account, which will be used to fund the HSBC Online Account. For instructions, see Setting Up the Source Bank Account for Auto-Funding.

-

Permit HSBC to debit your source account automatically. For instructions, see Allowing Automatic Debit of Your Source Account.

To set up auto-funding:

-

Go to SuiteBanking > Payment Automation > Dashboard.

-

On the left-pane, click Bank Account.

-

Click Set up Auto-Funding.

-

From the Auto-Fund list, select the auto-funding source account. For more information, see Setting Up the Source Bank Account for Auto-Funding.

-

Check the boxes to certify that this account is exclusively owned for the benefit of your organization, and to authorize HSBC to automatically debit your source bank account.

-

Click Submit.

Related Topics

- Setting Up Payment Automation

- Installing the Payment Automation SuiteApp

- Applying for an HSBC Online Account

- Generating Payment Tokens

- Vendors

- Setting Up Vendor Payment Approval Routing

- Setting Up Batch Approval Routing

- Setting Up Two-Factor Authentication (2FA)

- Setting Up Roles and Permissions

- Setting up a Custom Role to Make Money Transfers

- Setting Default Department, Class, and Location Values

- Setting Email Preference

- Setting Default Bank Fees Account

- Frequently Asked Questions about Payment Automation