Processing Loan Changes

The processes discussed in this section are for making changes for both CRC and CL4 unless indicated.

This section provides an overview of changes to originated loans and discusses how to:

Change loan dates and student grade level.

Change loan period start and end dates.

Change the student's grade level and graduation date.

Generate and view @1–07 loan adjustment information.

Process cancellations and reinstatements.

Process disbursement-level changes.

Process loan increases.

Process address, phone, and email address changes for CRC loans.

Create change transaction files.

Receive and process change application response files.

Accept change transactions manually.

The Campus Solutions system supports CommonLine change transaction processing for both versions of CommonLine, the newer Common Record CommonLine (CRC) and the older CommonLine 4 (CL 4). Changes to loan period, cancellations, reinstatements, reissues, and increases are supported. For CRC, changes to address, phone, and email are also supported. Most changes in loan eligibility result from changes to the student's award package, but changes to a loan might be required for loan period dates or anticipated graduation dates. You can make multiple changes to a single loan that generates multiple change transaction types at the same time. The loan origination process determines when changes occur and generates change transaction records to be sent to loan service providers.

When a change causes a paid disbursement to be reduced, the disbursement is suspended. Disbursed funds remain disbursed and must be reviewed, reconciled, and possibly returned to the lender. Increases in loan eligibility may result in either an increase in the existing loan award, or the creation of a new loan if the borrower's requested amount exceeds the promissory note amount.

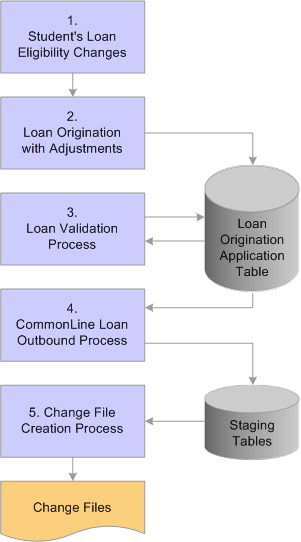

The change business processing flow for CommonLine FFELP and alternative loans using either CRC or CL 4 is as follows.

Changes are made to the student's loan eligibility.

Run the Loan Origination process with the Adjustments option selected. The system identifies the adjustments and changes the loan origination status.

When origination is complete, run the Loan Validation process to check the loan application for data discrepancies. Loans that fail validation are reprocessed in subsequent runs until validation is reached.

Run the CommonLine Loan Outbound process to process validated loans into outbound staging tables.

Run the File Creation process to create loan change files using the staging table information. CRC generates files in XML format and CL 4 uses ASCII files.

After you submit the change files to the loan servicers, they are processed and you are notified using receipt of response files for each loan processed (discussed in a previous section). After receiving the CommonLine response file from your loan servicer as an acknowledgment of the change transaction, run the CommonLine Inbound processes to inbound and process the response records.

The CommonLine 4 change process involves loan level and disbursement level changes as affected by disbursement status:

Loan level changes include:

Loan Period Change (@1-07)

Loan Cancellation/Reinstatement (@1-08)

Loan Increase (@1-24)

Disbursement level changes include:

Disbursement Cancellation/Changes (@1-09)

Disbursement Notification/Change (@1-10)

Whether disbursements have already been made to the school can also determine the change record type. An adjustment made to a borrower's loan can result in a single change record or a combination of change records. Because the loan origination program makes these decisions automatically, understanding the types of change records generated by an adjustment to a borrower's loan eligibility is useful for resolving any change record problems with your service providers.

The following illustration shows the flow of CommonLine loan change processing.

Image: The loan change outbound process.

Loan change outbound process

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Origination 2 |

SFA_CRC_LN_ORIG_FN |

|

Review and change loan start, end, certification, and scheduled disbursement dates. You can also hold loans or release loans from this page. |

|

Loan Demographic Data |

LOAN_ORIG_SEC2 |

Click the Loan Demographic link on the Loan Origination 1 page. |

Update academic level, NSLDS loan year or graduation date for student records that have been updated on the FA Term record. |

|

Loan Period Change |

CL_CHX_DTL107_SEC |

Click the Detail 1-07 link on the Change Detail 2 page. |

View 1-07 detail record information. |

|

Loan Cancellation Loan Reinstatement |

CL_CHX_DTL108_SEC |

Click the Detail 1-08 link on the Change Detail 2 page. |

View 1-08 detail record information. |

|

Disbursement Cancellation/Change |

CL_CHX_DTL109_SEC |

Click the Detail 1-09 link on the Change Detail 2 page. |

View 1-09 detail record information. |

|

Disbursement Notification/Chng |

CL_CHX_DTL110_SEC |

Click the 1-10 button on the Change Detail 2 page. |

View 1-10 detail record information. |

|

Loan Increase Detail |

CL_CHX_DTL124_SEC |

Click the 1-24 button on the Change Detail 2 page. |

View 1-24 detail record information. |

|

Trailer |

CL_CHX_TRAL4 |

|

View information contained in the trailer record for the CommonLine 4 change transaction send file. |

|

Loan Application Summary |

LOAN_ORIG_SUMM_DTL |

|

View loan summary information and use links to access more detailed loan information. |

|

Loan Origination Information |

LOAN_ORIG_SEC |

Financial Aid, Loans, View Loan Application Status. Click the Origination Status link on the Loan Application Summary page. |

Determine whether the system has created a change transaction for the loan. View the CRC status codes and the corresponding CRC staging table information for the selected loan action row. |

|

Origination Loan Disbursement |

LOAN_DISBURSEMENT |

Click the Disbursement Status link on the Loan Application Summary page. |

Determine whether the system has created a disbursement level change transaction for the loan. |

|

Loan Period Change |

LN_CL_ORIG_CHG_07 |

Click the Change link on the Loan Origination Change page. |

View 1-07 detail record information and CRC Recipient ID. This link or page is only available if a loan change has been processed in this category. |

|

Loan Cancellation/Reinstatement |

LN_CL_ORIG_CHG_08 |

Click the Change link on the Loan Origination Change page. |

View 1-08 detail record information and CRC Recipient ID. This link or page is only available if a loan change has been processed in this category. |

|

Cancel/Reinstate Loan |

LN_CL_ORIG_CHG_09 |

Click the Change link on the Loan Disbursement Change page. |

View 1-09 detail record information. This link or page is only available if a loan change has been processed in this category. |

|

Post Disbursement Change |

LN_CL_ORIG_CHG_10 |

Click the Change link on the Loan Disbursement Change page. |

View 1-10 detail record information. This link or page is only available if a loan change has been processed in this category. |

|

Loan Increase Change |

LN_CL_ORIG_CHG_24 |

Click the Change link on the Loan Origination Change page. |

View 1-24 detail record information and CRC Recipient ID. This link or page is only available if a loan change has been processed in this category. |

You send information to loan agencies regarding changes to a borrower's loan period begin and end dates, student's grade level, and student's anticipated completion date through the transmission of the CommonLine 4 Change Transaction Loan Period Change @1-07 Detail record. This is a loan level adjustment. You can submit this loan change record before or after disbursement.

If you modify information in the Originate Loan component, the loan adjustment program automatically checks for changes to the student's program complete date (graduation date) and NSLDS loan year in the FA term record. You can then run the loan origination process with the Adjustments check box selected to generate an @1-07 change transaction record that reflects the changes.

To change the student's graduation date and NSLDS loan year without changing the loan award, or if you are not making other changes to the student's loan, follow the manual change processing instructions. You can use the Financial Aid Term component to change a student's graduation date and grade level.

Changes to the loan period start and end dates occur in the Originate Loan component. To change a student's graduation date, enter the expected graduation date. You can use the NSLDS Loan Year values to change the student's grade level.

Note: Changes to FA term information may require additional processing steps, such as running FA term build and student budget assignment.

After you change the expected graduation date and grade level for the appropriate FA term record, you must use the Originate Loan component to update any affected loan records. You can also change loan period begin and end dates in the component.

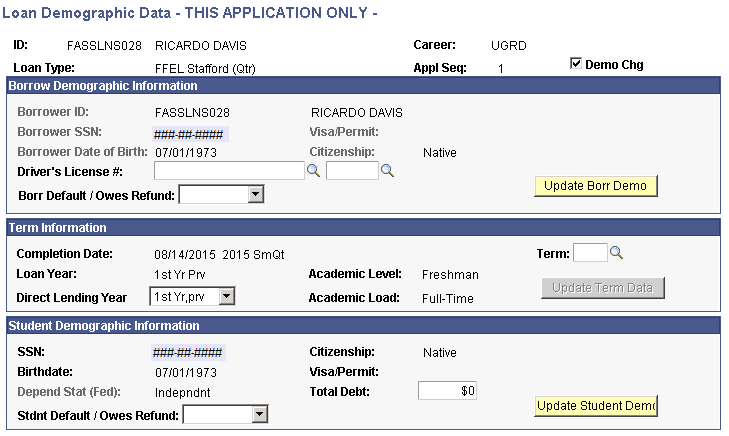

Click the Loan Demographic link to access the Loan Demographic Data page.

Select the Demo Chg (demo change) check box. Then select the changed term from the Termvalues.

Click the Update Term Data button. Note that the system displays any changes made to the FA Term record. Click OK to return to the Loan Origination I page. Save the Loan Origination 1 page.

Access the Loan Origination 2 page ().

Image: Loan Origination 2 page: Disbursements tab

This example illustrates the fields and controls on the Loan Origination 2 page: Disbursements tab. You can find definitions for the fields and controls later on this page.

You send information to loan agencies regarding changes to a borrower's loan period dates through the transmission of the CommonLine 4 Change Transaction Loan Period Change @1-07 Detail record. This is a loan level adjustment. You can submit this loan change record before or after disbursement.

After you make changes to the loan dates or disbursement dates, save the page.

|

Field or Control |

Definition |

|---|---|

| Override Loan Dates |

Select this check box to make the date fields available for editing. |

| Loan Period Start and Loan Period End |

Generated from the Valid Careers for Terms table. After changing the loan dates, save the page. |

Disbursements

Use the Disbursements tab to change disbursement dates.

|

Field or Control |

Definition |

|---|---|

| Request Date |

Change the disbursement date. |

To update the student's loan origination record to reflect the certain changes, first make the changes in the FA Term record. Before you can update the Academic Level, NSLDS Loan Year or Anticipated Completion Date fields on the loan origination record, you must first update in FA Term, then bring those changes into the student's loan origination record.

Note: Changes to FA term information can require additional processing steps, such as running FA term build and student budget assignment processes.

After updating the appropriate FA Term record, access the Loan Demographic Data page.

Image: Loan Demographic Data page

This example illustrates the fields and controls on the Loan Demographic Data page. You can find definitions for the fields and controls later on this page.

When you finish making changes to this page, save the Loan Origination 1 page.

|

Field or Control |

Definition |

|---|---|

| Demo Chg |

Select this check box to make the fields and buttons available for processing loan demographic changes. |

Term information

|

Field or Control |

Definition |

|---|---|

| Term |

Enter the term you changed in the FA Term record. This field is available when the Demo Chg check box is selected. |

| Update Term Data |

Click this button to pull in any changed information from the FA Term record into the loan origination application. |

Access the Loan Period Change page (click the Detail 1-07 link on the Change Detail 2 page) .to view the Loan Period Change (07) changes that were recognized in loan origination. A Change Status value of Ready indicates that no other action is necessary to complete the loan period change transaction.

After you have saved your loan changes, run the loan origination process using the adjustments option. The loan origination process detects the changes and displays a new loan origination action row that indicates that the loan has been adjusted.

The action code values OC (origination changed) and OX (origination cancelled) indicate adjustments have been made.

Access the Student Aid Package page (, manual award entry pages, or an award override page.

Loan cancellations and reinstatements (CommonLine Change @1-08 Detail record) are loan level adjustment changes that the system generates when you cancel or reinstate a loan before releasing the first disbursement. For reinstatements, if the lender has already processed the cancellation, the school can either fully or partially reinstate the loan. The cancellation or reinstatement change is initiated on the student's award package.

Canceling a Loan

To cancel a loan:

Click the Look Up Action button in the row of the loan that you want to cancel.

Select Cancel.

Press TAB to move out of the Action field.

Click the Validate button.

After validation is complete, click the Post button.

Reinstating a Loan

To reinstate a loan:

Click the Look Up Action button and select Offer or Offer/Accept.

Enter the amount of the loan reinstatement.

Click Validate.

After the validation is finished, click Post.

The system saves the information and updates the student award tables. The system processes a partial reinstatement if the amount is less than the original cancelled loan amount.

Note: For a loan reinstatement, you must use the same loan item type as the cancelled loan. If you add a new row and use a different loan item type, the system originates a new loan.

Generating and Viewing @1-08 Loan Change Information

After the loan changes have been made to the student's award package, run the loan origination process using the adjustments option. The loan origination process detects the changes and displays a new loan origination action row that indicates that the loan has been adjusted.

The action code values OC (origination changed) and OX (origination cancelled) indicate adjustments. A successfully reinstated loan has an action code value of OC.

Access the Loan Cancellation/Reinstatement page to view the CommonLine Change @1-08 Detail changes that were recognized in loan origination. The system populates the Reinstated Loan Amount field based on the amount of the reinstatement. A Change Status value of Ready indicates that no other action is necessary to complete the loan period change transaction.

Disbursement level changes occur when you make adjustments to individual disbursements of a guaranteed loan. Two types of CommonLine 4 change transaction record types communicate disbursement changes:

CommonLine Change @1-09 Detail records (Disbursement Cancellation/Change)

The system generates the Disbursement Cancellation/Change @1-09 Detail record when you submit full or partial disbursement cancellations, reinstate previously cancelled disbursements, place disbursements on hold, place disbursements from hold to release status, and reschedule disbursement dates prior to the release of funds for the disbursement.

CommonLine Change @1-10 Detail records (Disbursement Notification/Change)

The system generates the Disbursement Notification/Change @1-10 Detail record when you submit full or partial disbursement cancellations, reissue requests, and reinstatements after the release of funds for the disbursement.

The loan origination process automatically determines the type of disbursement level change transaction record based on whether the disbursement was received.

Disbursement Date Changes

Use the Loan Origination 2 page to adjust disbursement dates.

Note: You can only set disbursement dates equal to or after the current date. You cannot change a disbursement date to a past date.

Disbursement Hold and Release Changes

Use the Loan Origination 2 page to manually set individual loan disbursements to Hold or Release. You can also use the batch CommonLine Hold/Release process to automatically set the disbursement status for selected groups of disbursement records.

Note: To modify the process for setting hold/release status for your disbursements using Application Engine SQR, COBOL, and so on, set the PS_STDNT_AWARDS.OFFER_ACTIVITY_IND field to A for each employee ID that you change the PS_LOAN_DISBMNT.LN_HOLD_REL_STAT value to H (hold) or R (release). The PS_STDNT_AWARDS.OFFER_ACTIVITY_IND field is set automatically when you set the disbursement hold/release status online. It identifies a loan record as a potential change record.

Cancellations, Reinstatements, and Other Adjustments

You make disbursement date changes directly in the loan origination pages and all other disbursement changes on the awarding pages. Changes made to the student's loan disbursements on the award pages are recognized by the loan origination process and generate appropriate change transaction record types.

Changes to individual disbursements generally require changing split codes or the use of custom splits; this varies according to your institution's policies. Prior changes to a student's awards may require you to use the Award Entry/Manual or Award Override pages.

The following are examples of disbursement level changes:

Canceling disbursements due to student non-enrollment.

Reinstating previously canceled disbursements due to student re-enrollment.

Decreasing a student's loan eligibility due to new funds awarded to the student.

Increasing a student's loan eligibility due to the loss of expected financial aid awards.

Processing Post Disbursement Changes

When you reinstate a loan disbursement that has already been sent to the school by the disbursing agent, you must modify the original approved disbursement date before you can generate a post disbursement change transaction record.

The loan origination program also evaluates the status of the reinstated disbursement. If the school has already received a student's loan disbursement but has not yet applied the funds to the student's account, the system does not reinstate the disbursement until it either applies the funds to the student's account or returns them to the disbursing agent.

If either of the two conditions exists, the following error message 1021 appears in the Loan Origination message log:

The business rules established between your institution and your lending partners dictate the appropriate adjustment. To request a reissue and increase of the disbursement, adjust the disbursement date in the Originate Loan - Loan Origination 3 page before you run the loan origination process. Be sure to return the funds to the lender. Use the CommonLine Disbursement Maintenance page to document the return of funds.

Generating and Viewing @1-09 and @1-10 Loan Adjustment Information

After the loan changes have been made, run the loan origination process using the adjustments option. The loan origination process detects the changes and displays a new loan origination action row that indicates that the loan has been adjusted. The action code values of OC (origination changed) and OX (origination cancelled) indicate adjustments.

This is an example of loan change records calculated by the loan adjustment process (this example is specific to CL4).

Access If a loan disbursement is adjusted or cancelled, the system displays a disbursement action message in the Description area. If the adjustment results in a CommonLine 4 change transaction record, the Change link is active.

Click the Change link to open the Loan Disbursement Change page and view the type of CommonLine 4 change record that the system generates for the loan disbursement.

Pre-Disbursement Charges:

The system generates the Pre-Disbursement Change (09) record type if the school has not yet received the disbursement. Access the Cancel/Reinstate Loan page to view the CommonLine Change @ 1–09 Detail changes. The Change Status of Ready indicates that no other action is necessary to complete the Loan Period Change transaction.

Click the active Change link to identify changes to the loan that require the system to create the Pre Disbursement Change (09) record type.

Post-Disbursement Charges:

The system identifies the Post Disbursement Change (10) record type if the school has received the disbursement. Access the Post Disbursement Change page to view the CommonLine Change @ 1–10 Detail changes. The Change Status value of Ready indicates that no other action is necessary to complete the Loan Period Change transaction.

Click the active Change link to identify changes to the loan that require the system to create the Post Disbursement Change (10) record type

Although the loan adjustment process can calculate the amount of funds that must be returned to the lender, the school is responsible for initiating and completing the return of fund transactions. Running the CommonLine 4 EFT Reconciliation reports and the CRC EFT Discrepancy reports can identify post disbursement changes that require a return of funds. After the funds are returned to the lender or disbursing agent, update the returned amounts in the CommonLine Disbursement Maintenance page.

Loan increases, CommonLine Change @1-24 Detail records, are another type of loan level adjustment change. If the amount of the increase exceeds the borrower's promissory note requested amount, the system generates a new loan instead of an increase. You can view the promissory note requested amount on the Loan Origination 3 page in the Maintain Originated Loans component.

Increasing a Loan Amount

To increase a loan amount, access the Student Aid Package page (), manual award entry pages, or an award override page.

Click the Look Up Action button and select Offer or Offer/Accept

Enter the new increased amount of the loan

Click the Validate button.

When the validation is finished, click the Post button.

Note: Loan increase transactions are most likely to occur with alternative loans. This is due to the elimination of the loan requested amount from the FFELP promissory notes. For FFELP loans, in most cases, the system originates a new loan for additional increases in loan eligibility rather than a loan increase transaction.

Generating and Viewing @1-24 Loan Adjustment Information

After making changes to the loan awards, run the loan origination process with adjustments activated to process the changes. The loan origination process detects the changes and displays a new loan origination action row that indicates that the loan has been adjusted. The action code values of OC (origination changed) and OX (origination cancelled) indicate adjustments.

This is an example of loan change records calculated by the loan adjustment process.

Access the Loan Application Summary page ().

Click the Origination Status link on the Loan Application Summary page to view the adjusted loan (Orig Change).

The Change link is active because this is a loan level change.

Click the Change link to open the Loan Origination Change page that indicates that the system generated the Loan Increase (24) record and is ready for transmission.

Click the Change link on the Loan Origination Change page to open the Loan Increase page. The page shows the changed information that you transmitted to the loan servicer.

Note: If a message is associated with the record, the system displays a message link because the loan servicer has not received the change record. The link becomes active if the servicer rejects the change record and provides error messages.

You have the option to submit address, phone, and email address changes for CRC change transactions. This option is part of the CRC Outbound process and functions only if you made another change and have calculated a change transaction for the loan. An address, phone, or email address change by itself does not trigger the system to generate a change transaction.

To process an address or phone change:

Make an address, phone, or email address change in Campus Community.

Make a change to the loan, such as loan period start and end dates.

Run the Process CRC Outbound Records process with the Orig Change Outbound and Demographic Changes options selected.

The CRC Outbound process determines whether this loan information has changed since the last time that you submitted information to the servicer. If so, the system submits the changed information in the change transaction record.

To generate CRC change transaction files or CommonLine 4 (C004P) change transaction files, use the same outbound processes used to generate application send files, but use different run control options. As with application send records, change records must be originated and validated before you create change transaction files.

This is the change transaction outbound procedure for CommonLine FFELP and alternative loans using either CRC or CL 4:

Make changes to the student's loan.

Run the Loan Origination process, using Adjustments, to detect changes made to the student's loan and calculate new loan eligibility. The calculated information is stored on the loan origination application tables.

Run the Loan Validation process to check the loan changes for data discrepancies. Loans failing validation are reprocessed in subsequent runs until validation is reached.

Run the CommonLine Loan Outbound process to process validated loans processed into outbound staging tables. Be sure to select the appropriate Outbound Change run control options.

Run the Change File Creation process to create loan application files using the staging table information. CRC generates files in XML format while CL 4 uses ASCII files.

After you submit the change files to the loan servicers, they are processed and you are notified using receipt of response files for each loan change processed.

After sending the loan change files to your loan servicers, you receive response files from the servicers to acknowledge the receipt of your changes and to report the status of each loan change record sent.

This is the inbound business processing flow for CommonLine FFELP and alternative loans using either CRC or CL 4:

School receives inbound loan files from loan servicers.

Run an inbound process to read the information from the files into the CommonLine staging tables.

When the information is in the staging tables, run the CommonLine loan inbound process.

This process takes information from the external loan record and updates the originated loan records in the database.

To accept change transactions manually if your guarantor does not send a response record to update the system, use the CommonLine Loan Origination Transmission page (Financial Aid, Loans, CommonLine Management, Override Loan Status). It is important to ensure that your change transactions are resolved in the system to allow subsequent change transactions to take place automatically if the student's eligibility changes further.